TL;DR

1. After the Tornado Cash incident, Rune announced the Endgame plan through which it aims to create DAI as an unbiased world currency that is not affected by any external changes.

2. The true decentralization of DAI means breaking the 1:1 peg with USD and establishing a free float, for which the change in DAI’s collateral structure and the introduction of Negative Target Rate are necessary.

3. The journey towards a free float for DAI consists of three stages: Pigeon, Eagle, and Phoenix. Each stage is characterized by different parameters, which are adjusted to achieve the true decentralization of DAI.

1. Introduction

1.1. Endgame’s Second Goal: The Complete Decentralization of DAI

The ultimate goal of Endgame is to create the Endgame State, a self-sustaining, self-recoverable state that minimizes the impact of external environments and maintains its own viability in any situation, for MakerDAO. The roadmap for this is the introduction of MetaDAO in the first part of the Endgame plan, which aims to improve the profitability and decentralization of the Maker ecosystem.

Rune, the co-founders of MakerDAO, proposes the complete decentralization of DAI, the native stablecoin of the Maker protocol, as the second goal of Endgame. He aims to ultimately create DAI as an unbiased world currency that is not affected by any external changes, based on the Endgame State. In this article, we will see why he wants to decentralize DAI and how he will achieve it through certain changes.

1.2. What is DAI?

DAI is a decentralized stablecoin based on Ethereum that maintains a 1:1 peg with USD. All currently circulating DAI is created by the Maker protocol. Users can create a certain amount of DAI proportional to the value of their collateral assets, such as ETH and wBTC, deposited in the Maker protocol’s vaults by a certain Min Coll. Ratio(MCR) assigned to each vault. MCR refers to the ratio of the value of the collateral assets to the value of the debt, or the value of the issued DAI(collateral assets/debt value). For example, if the MCR of the first vault in the following picture is 170%, and a user deposits $170 worth of ETH, they can issue DAI up to $100 in value. The user can choose which vault to use to create DAI and which asset to use as collateral based on the stability fee, MCR, liquidity, and other factors of each vault according to their preference.

One of the most distinctive features of DAI is that it is decentralized, unlike Fiat-collateralized stablecoins such as USDT, USDC, and BUSD, which only accept USD legal tender as collateral and have centralized token issuers.

For example, to issue USDT, users must provide KYC(Know Your Customer) to the issuer of USDT, Tether. After KYC is completed, the user creates a wallet with Tether and deposits USD as collateral in the wallet address to receive USDT from Tether in a centralized structure. Similarly, Circle and Paxos issue USDC and BUSD, respectively, in exchange for users depositing USD as collateral.

1.3. The Need for True Decentralization in DAI

After the incident with Tornado Cash, Rune has warned about the potential regulatory risks that MakerDAO may face. He mentioned the “post-9/11 paradigm” in which the crypto industry must decide whether to comply with the government in extreme cases or be considered terrorists for resisting, and considered what direction MakerDAO should take. Rune argues that in this trend, MakerDAO must choose true decentralization, or more specifically, has no choice but to choose it, for the following two reasons:

- The Nature of DAI

Due to the nature of DAI, which was engineered from the beginning to be incapable of complying with the government, there is no choice for DAI to comply. DAI handles various cryptocurrencies as collateral through the Multi-Collateral DAI system, rather than legal tender issued by the government. In addition, DAI is generated based on the Vault system using smart contracts, which means that the issuance process cannot be controlled by a centralized entity. Through this, DAI has been able to secure its position as a decentralized stablecoin that is not swayed by one asset or entity in terms of collateral composition and issuance. Rune believes that due to the nature of DAI, it has no choice but to choose decentralization and must continue to develop in that direction.

2. Potential Regulatory Risks

The potential regulatory risks faced by MakerDAO serve as the second reason for promoting decentralization in DAI. The incident with Tornado Cash in August served as a precedent. The fact that the US Treasury placed the smart contract itself on a blacklist and prohibited transactions through Tornado Cash raised concerns that if the government determines that a particular protocol is engaged in illicit activities, it can easily impose sanctions, even if the target is not a person or company. Therefore, the Maker protocol, which issues DAI through smart contracts, is also not free from government control.

Based on the above reasons, Rune argued that DAI must follow the path of true decentralization. The true decentralization of DAI that Rune claims is the construction of “free float”. Free float refers to the ability of DAI to break the 1:1 peg with the dollar and set its own target price, allowing it to freely flow in price.

Now, let’s look at the solutions and roadmap presented by Rune in the Endgame Plan for DAI’s Unbiased World Currency to become truly decentralized.

2. Current DAI collateral structure

The multi-collateral DAI system is known as one of the key elements contributing to the decentralization of DAI. The graph below shows the percentage of each type of collateral that makes up DAI as of November 22.

- USDC: A dollar-pegged stablecoin issued by Circle

- ETH: The native token of the Ethereum network

- USDP: A dollar-pegged stablecoin issued by Paxos

- GUNIV3DAIUSDC: A derivative product using the Uniswap V3 DAI/USDC LP token

- GUSD: A dollar-pegged stablecoin issued by Gemini

- wstETH: A token wrapping the Lido-issued stETH, an Ethereum liquidity staking token

- RWA(Real World Asset): A tokenized real-world asset

The Maker Protocol, which uses a multi-collateral system, claims to maintain its position as a decentralized stablecoin within the vault by accepting various assets such as ETH, wBTC, and USDC as collateral. However, as shown in the above graph, it can be seen that approximately 60% of the total circulated DAI is generated by stablecoins based on USD (USDC, USDP, GUSD). In the current situation where the regulation of collateralized stablecoins is continuously being discussed, if regulation becomes a reality, DAI, which relies heavily on these stablecoins as collateral, may not be free from the influence of the government. Therefore, the Endgame Plan proposes to change the DAI collateral structure in order to achieve true decentralization of DAI.

3. DAI Collateral Structure Change Plan

The journey towards true decentralization of DAI starts with changing its collateral structure. The Endgame Plan proposes dividing the collateral structure of DAI into two categories: Decentralized and RWA. The purpose of the Decentralized category is, as the name suggests, to maintain the decentralized nature of DAI, while the purpose of the RWA category is to provide liquidity and stability through real-world assets. These two categories are further divided into four subcategories to form the following collateral structure:

3.1. Decentralized Collateral Assets

ETH

Includes decentralized assets based on ETH, such as ETH, stETH, ETHD, and ETH/DAI LP tokens. The purpose of the ETH category is to increase the ETH-based token reserve, which is a representative decentralized asset among the collaterals that constitute DAI, in order to raise the decentralization level of DAI and ride on the expected strong effect of the Ethereum network after the merge. The Endgame Plan aims to secure more ETH-based assets by introducing MDAO token yield farming or Protocol Owned Vaults(POV).

Misc Decentralized

MKR can be utilized as a very useful asset that provides not only liquidity backstop as before, but also stabilization fees, governance participation, and MDAO token yield farming as collateral to generate DAI. In addition, the increase in the portion of MKR within the collateral ratio per asset can reduce the exposure of DAI to non-decentralized assets, especially RWA with seizure risk.

MDAO

MDAO tokens can also be used as collateral to generate DAI, but have the obligation to provide a backstop against risks arising within MetaDAO. Therefore, excessive use of a specific MDAO token for DAI issuance may result in undermining the stability of the relevant MetaDAO, so the extent to which DAI can be generated by one MDAO token is strictly limited.

3.2. RWA Collateral Assets

Cashlike RWA

This includes centralized stablecoins and short-term government bonds. To maximize the usefulness of DAI as a currency compared to smaller stablecoins such as USDC, it is necessary to secure assets that are stable and liquid. Therefore, DAI accepts stablecoins and low-risk short-term government bonds as collateral to fill in the liquidity and stability currently lacking in DAI. One of the main drawbacks of Cashlike RWA is that centralized assets are easily exposed to government seizure risks. Therefore, in the long term, it is necessary to reduce the proportion of DAI’s collateral composition.

Clean Money RWA

The includes renewable energy projects and sustainable agricultural assets. Like Cashlike RWA, this also carries the risk of being easily seized, but there is the advantage of creating the Clean Money brand, which considers the environment. In addition, the expected political cost and public resistance if the government tries to seize it is also one of the advantages of using Clean Money RWA.

Misc RWA

This includes wBTC, L1 cross-chain bridge tokens, and securities-like tokens such as Bolt. Misc RWA includes on-chain tokens that do not belong to any particular category, so it is not immediately recognized as RWA, making it difficult to prepare an appropriate response to seizure risks.

Physically Resilient RWA

This refers to RWA that cannot be easily seized in case of enforcement. As a collateral asset designed to prepare for the extreme regulatory risk of government seizure, it requires a high level of complexity both technically and legally, as it must claim ownership of the asset both technically and legally in order to claim ownership of the asset. Therefore, DAI is a key collateral asset that allows for freedom from regulatory risks in the long term, but currently it is only a theoretical concept due to technical and legal limitations.

4. DAI’s Free Float

4.1. Limitations of decentralized DAI

Earlier, we examined Rune’s argument that DAI was created to be inherently resistant to government regulation and that it would have to choose the decentralized route if government regulation were to become stricter in the future.

If we look at the aspect of the collateral assets that make up DAI in the context of DAI choosing the decentralized route, it can be interpreted as reducing exposure to RWA until it converges to 0. This is because RWA is an asset based on the real world and is generally a large collateral asset, so it cannot be free from government regulatory pressure due to its characteristics. However, if the exposure to RWA is reduced, the problem of the growth potential of the maker protocol being inevitably impaired in the long term will inevitably occur.

The graph at the top shows the asset ratios by type in MakerDAO, and it can be seen that RWA accounts for only 6.2% of the assets. The graph at the bottom shows the proportion of assets by type in MakerDAO’s profits, where RWA accounts for 36.6%. By combining these two graphs, it can be seen that RWA, as a collateral asset for DAI, is responsible for a large portion of the Maker protocol’s profits compared to its size as a collateral asset, and its influence is growing. Therefore, Rune’s argument that DAI should be completely free from the risk of government seizure ultimately leads to the abandonment of RWA, a collateral asset with high profitability in the long term.

4.2. Negative Target Rate

The proposed solution to this dilemma is Negative Target Rate.

To understand Target Rate(TR), let’s first look at Target Price(TP). TP is the price of DAI set by the Maker protocol, which continuously compares the market price with the target price to determine whether DAI is currently in a state of excess demand or the opposite.

TP, also known as the redemption price, is used to determine the amount of DAI that can be generated from the collateral deposited in a vault, based on the minimum collateralization ratio. For example, if the minimum collateralization ratio is 150% and TP is $1, and 150 ETH is deposited in an ETH vault, 100 DAI(150 ETH * 1/150% * 1/$1) can be generated. If TP increases to $1.5 in this case, approximately 66.67 DAI(150 ETH * 1/150% * 1/$1.5) would be issued, assuming all other conditions are the same.

TR refers to the percentage change in TP and is usually expressed in annual terms. In the above example, a change in TP to $1.5 could be described as a TR of +50%. The Maker Protocol has not yet introduced the parameter TR, and currently maintains a 1:1 peg with USD, so TP is currently $1 and TR is 0%.

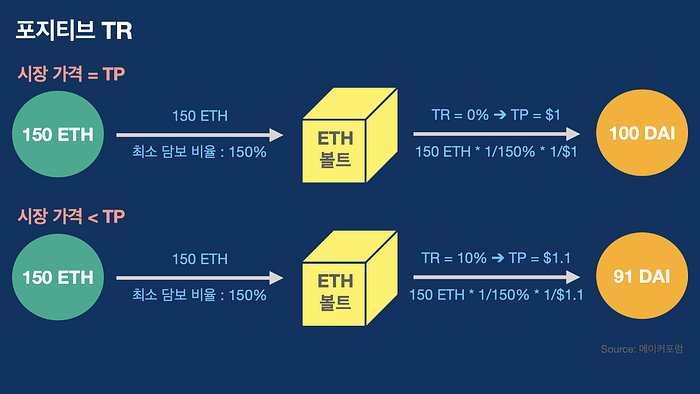

- Positive TR

Positive TR refers to a situation where TR is increased from its current value(TR = 0%). This occurs when the market price of DAI is lower than the target price, causing the Maker Protocol’s TP to increase due to the positive TR.

A vault in the Maker Protocol with an increased TP will produce less DAI for the same collateral value than it would have before the positive TR was applied. This results in the cost of generating DAI through the vault becoming cheaper than the cost of purchasing DAI on the market, providing an incentive for users of the Maker Protocol to generate DAI through the vault instead of purchasing it on the market. The increased demand for DAI drives up the market price of DAI and ultimately brings TP back to equilibrium.

- Negative TR

Negative TR refers to a situation where TR is decreased from its current value (0%). This occurs when the market price of DAI is higher than the target price, causing the Maker Protocol’s TP to decrease due to the negative TR.

A vault in the Maker Protocol with a decreased TP will produce more DAI for the same collateral value than it would have before the negative TR was applied. This results in the cost of generating DAI through the vault becoming more expensive than the cost of purchasing DAI on the market, causing users of the Maker Protocol to prefer purchasing DAI on the market rather than generating it through the vault. As a result, demand for DAI decreases while supply increases. Ultimately, the negative TR causes the market price of DAI to decrease, bringing TP back to equilibrium.

Negative TR is significant because it allows the Maker Protocol to adjust its own supply and demand of DAI to alleviate price imbalances. Under the Endgame Plan, when demand for DAI increases and the market price rises, the Maker Protocol must use only decentralized assets in the non-collateral category(such as ETH) to meet the excess demand. If the Maker Protocol does not have sufficient decentralized assets or there is not enough additional DAI being generated by users, there may be difficulties in producing enough DAI to meet the excess demand, resulting in a supply-demand imbalance. To address this, the Maker Protocol introduces negative TR to reduce the cost of generating DAI and encourage more supply of DAI using the same ETH assets.

If Maker protocol chooses not to decentralize and continue to use RWA as collateral without any restrictions, it can sufficiently meet any excess demand through RWA assets as collateral. However, if it chooses the decentralized route, there will be limits on the use of RWA collateral, and in this case, the excess demand that arises will be met by increasing the supply through a reduction in the cost of creating DAI, also known as negative TR. As a result, the supply of DAI increases and the existing pegging of 1 USD = 1 DAI breaks down. The demand and supply of DAI will be adjusted dynamically through changes in TR to maintain a certain price in a free float setup. Therefore, the end game plans to establish a free float through negative TR in order to smoothly match the demand for DAI even if there are limits on the use of RWA collateral.

5. Preparation for successful Free Float

Rune’s suggestion to break the 1:1 peg with the US dollar that has been maintained since DAI was introduced in 2017 and to prepare for a free float has faced significant opposition from members of MakerDAO, and Rune is aware of this. In fact, Rune has said the following about this:

“Losing as many as 50% of the protocol users in a short period of time after free floating is a real possibility.” — Source : Maker Forum

Despite these concerns, Rune argues that the benefits of being free from regulatory risk and the unique position of decentralized stablecoins (compared to centralized stablecoins like USDT and USDC) as a positive meta and a true crypto ideology can outweigh short-term losses with long-term gains. He also presents two key products to successfully establish a free float for DAI.

5.1. MetaDAO and MDAO tokens

MetaDAO and MDAO tokens contribute to the free float of DAI through the following two roles:

- Providing additional income for DAI holders For users of the Maker

protocol to continue using DAI despite a decrease in value due to negative TR, there must be incentives to offset this. The Endgame plan aims to address this problem by providing secondary income through MDAO token yield farming.

MetaDAO helps to build a decentralized economic system that is free from external interference, particularly government control, enabling MDAO token yield farming to take place independently. In the long term, as the Endgame plan takes shape, this will be concretely implemented through each MetaDAO deciding on its own issuance and burn of MDAO tokens.

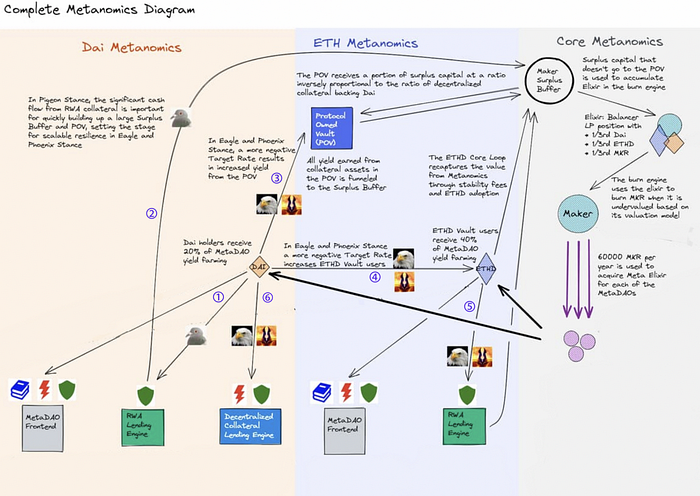

The diagram above shows the distribution structure of MDAO token yield farming that was discussed in the previous part. The left side of the diagram shows the scene where DAI holders receive additional income through MDAO token yield farming. By receiving 20% of the MDAO token yield farming distributed in the DAI farm, DAI holders can offset the decrease in value of DAI due to negative TR.

- Decentralized DAI supply increase

In addition to providing additional income to DAI holders, MDAO yield farming also contributes to the increase in decentralized DAI supply. 40% of MDAO yield farming is sent to the ETHD farm and distributed to ETHD vault users. At this time, the MDAO yield farming distributed to vault users is proportional to the amount of decentralized collateral assets (ETHD) that each user has deposited in the ETHD vault. As a result, users are incentivized to create more DAI by depositing more ETHD as collateral, which ultimately increases the amount of ETH assets in the DAI collateral and allows negative TR to work more smoothly.

Rune’s argument is that in this way, DAI holders can maintain the free float system by continually using DAI, as they can earn secondary income through MDAO token yields, which are not subject to government regulation even in a situation where the value of DAI declines due to negative TR.

5.2. POV(Protocol Owned Vault)

Another key product is POV. POV refers to the vault managed directly by MakerDAO, which treats decentralized assets such as ETHD as collateral (refer to the first article for more details). POV is a product that creates negative TR and synergy, offering two benefits.

First is the increase in profitability. Because POV accepts ETHD, a synthetic asset using stETH, as collateral, it can earn a 7% APR in Ethereum staking profits as of November 22nd. In addition, you can also indirectly benefit from the decline in DAI value due to negative TR.

The Maker Protocol can be thought of as taking collateral and lending out DAI, so DAI is considered debt from the perspective of the Maker Protocol. If the value of DAI declines due to negative TR, the value of the debt decreases from the perspective of the Maker Protocol, so it can be said that the Maker Protocol earns a profit. Therefore, through POV, the Maker Protocol can earn additional income not only through stETH staking yields (APR 7%), but also through the decline in debt value due to negative TR.

Second, the liquidity of the abundant decentralized assets deposited in POV can help the Maker Protocol operate negative TR more smoothly. Negative TR reduces the cost of generating DAI in decentralized asset vaults and increases the supply of DAI.

If there is excess demand for DAI, the Maker Protocol introduces negative TR in order to balance demand and supply. The key to the effective operation of negative TR is the size of the decentralized collateral deposited in POV. If there is enough decentralized collateral deposited in POV, the Maker Protocol can use it to increase the supply of DAI as much as it wants, but if there is not enough collateral stored in POV, it depends on additional collateral deposits from external users, which may not allow it to increase the supply of DAI as much as desired.

Therefore, the Endgame Plan seeks to solve the problems that may arise during DAI’s free float through two powerful products, MDAO token yields and POV, and even looks for ways to use them to further develop the ecosystem.

6. Three Steps for Unbiased World Currency

The Endgame Plan has divided the roadmap for DAI to become an unbiased world currency into three stages. The stages are divided according to the proportion of RWA used as collateral, and are respectively the pigeon, hawk, and owl stages. The key to the entire roadmap is as follows.

- DAI maintains 1:1 peg with USD for at least 3 years

- Scheduling for free float may be delayed if there is no regulatory risk

- If decentralized assets make up more than 75% of DAI’s collateral, the 1:1 USD peg is extended indefinitely

- During the first 3 years, as much ETH as possible is accumulated to halve the proportion of RWA

As the process progresses, the proportion of DAI that depends on RWA decreases, and the free float of DAI becomes more robust. In addition, each stage has automatic targeting rules (ATR), which automatically check the collateral composition ratio through smart contracts, and adjust the incentive levers such as DSR, SFBR, and TR according to the situation. The key points of each stage are as follows:

6.1. Pigeon Stance

There is no limit on exposure to RWA, and DAI maintains a 1:1 peg to USD.

Pigeon stance is the first to be implemented when the endgame plan is launched, assuming a situation where government regulation of the Maker Protocol is not severe. The main feature is that it maintains a 1:1 peg with USD for a minimum of 3 years, like the current situation, and does not impose any restrictions on the proportion of RWA assets held as collateral.

The reason why there are no restrictions on the exposure ratio to RWA in the Pigeon stance is because the top priority of the Maker Protocol at this stage is to accumulate as many ETH assets as possible in the POV, in order to increase its mass. These accumulated ETH assets can be used as reserves for potential risks that may arise in the long term. In other words, the Pigeon stance can be seen as a time when DAI focuses on accumulating as many decentralized assets as possible before actively reducing its dependence on RWA, similar to how animals consume a large amount of food before winter sleep.

According to the plan, the Pigeon stance will be maintained for 2.5 years (about 30 months) and will automatically transition to the Eagle stance thereafter. However, if the regulatory environment remains lenient and external risks are low after 2.5 years, the Pigeon stance maintenance period will be extended to allow for the accumulation of even more ETH assets in the POV.

The table above shows the ATR applied during the Pigeon stance. While physical limits on the collateral ratio for RWA are not imposed through conditions 1 to 4, it is possible to see that the protocol is preventing excessive dependence on RWA by changing its parameters. For example, by examining condition 4, it can be seen that if the total ratio of all RWA collaterals exceeds 1/4 of the total DAI collateral, 90% of the surplus funds of the Maker Protocol will be accumulated in the POV as ETHD. In other words, by increasing the ratio of decentralized asset accumulation as the dependence on RWA increases, it can be seen that the Maker Protocol is preparing for the risk of potential regulation.

6.2. Eagle Stance

Eagle stance, according to the plan, will start 2.5 years after the implementation of Pigeon stance, but if it appears that DAI is not at risk of regulation or, conversely, that breaking the 1:1 peg with the USD is a clear benefit to the Maker protocol, the activation of the Eagle stance may be delayed or brought forward.

In Eagle stance, the proportion of RWA, excluding Physically Resilient RWA, which can be restricted, must not exceed 25%. If necessary, the deflation of DAI can be activated for this purpose. In short, Eagle stance can be seen as the point of balance between growth and resistance.

After Eagle stance is implemented, we will review the situation with a limit of -5% on the decrease in TR for the following 6 months. After 6 months, there will be no limit on the decrease in TR. By examining the ATR applied in the hawk stage, it can be understood that if RWA exceeds 25%, TR will be decreased to increase the supply of DAI, and if RWA is below 25%, TR will be increased to decrease the supply of DAI.

6.3. Phoenix Stance

Phoenix stance is the final stage of the Endgame Plan, in which the DAI achieves a sustainable equilibrium state that is unaffected by any changes in the external environment. Phoenix stance is only activated in the event of strong government regulation or a global economic crisis that makes it impossible to use RWA collateral any longer.

The key to Phoenix stance is that no RWA with a risk of being restricted is allowed. Therefore, the collateral that DAI can hold is limited to decentralized collateral assets such as ETH and MKR, and Physically Resilient RWA. This means that the maker protocol’s Peg Stability Module (PSM), which exchanges stablecoins and DAI that belong to the Cashlike RWA category, can no longer be used.

All types of RWA except for Physically Resilient RWA are converted to ETHD and sent to the POV. In addition, the weight of 0.5 applied to Physically Resilient RWA in Pigeon and Eagle stances disappears, because only Physically Resilient RWA is allowed as collateral in Phoenix stance.

Physically Resilient RWA is currently not possible to implement with current technology, but it is essential collateral for the ultimate goal of the Endgame Plan, The Endgame State. Therefore, the maker protocol requires continuous efforts to develop Physically Resilient RWA while reducing the proportion of RWA in the collateral of DAI to increase the free float of DAI.

6.4. Metanomics step by step

The diagram above shows part of the final metanomics that will be established after the endgame plan is fully in place. Let’s see how the Metanomics will be completed as it evolves through Pigeon, Eagle, and Phoenix stances.

6.4.1. Pigeon Stance

The key to Pigeon stance is the creation of profits through the use of RWA vaults.

- ①: The DAI farm, which receives 20% of the MDAO token yield, sends DAI to the RWA Lending Engine (RWA vault).

- ②: The profits(stability fee) generated by the RWA vault are sent to the Maker Surplus Buffer and the POV, contributing to the expansion of the maker protocol, which is the key to Pigeon Stance.

6.4.2. Eagle Stance & Phoenix Stance

The key to Eagle and Phoenix stances is the negative TR, which enables the free float of DAI. Negative TR reduces the cost of creating DAI and increases the supply of DAI, enabling more people to deposit decentralized assets in the vault.

- ③: The number of POV users who deposit decentralized assets such as ETHD increases due to negative TR.

- ④: The number of ETHD vault users increases due to negative TR.

- ③ & ④: The decentralized assets deposited in the POV and ETHD vault are transferred to the Maker Surplus Buffer, contributing to the profitability of the entire Maker Protocol.

- ⑤: ETHD farm, which receives 40% of MDAO token yield farming, sends ETHD to the RWA vault, increasing the proportion of decentralized collateral assets within the vault.

- ⑥: DAI farm, which receives 20% of MDAO token yield farming, sends DAI to the Decentralized Collateral Lending Engine, contributing to the profitability of each MetaDAO.

7. Benefits of DAI’s Decentralization

When DAI secures its position as a fully decentralized, sovereign world currency free from external pressures, the benefits will include:

- Building an ecosystem that is independent from external environments

- Return to the true ideals of crypto

7.1. Building an ecosystem that is independent from external environments

Currently, although DAI is fully decentralized in terms of its issuance, it still relies on centralized sources for its collateral and revenue streams. The Endgame Plan aims to address this by seeking to capture both rabbits of building a regulatory-free ecosystem and an independent revenue structure through the aforementioned reform.

The risk of government regulation will be addressed by decreasing exposure to RWA collateral assets and increasing the ratio of decentralized collateral assets such as ETH. The decrease in the RWA ratio will be compensated for through negative TR, MDAO token yield farming, and POV through the free float of DAI. Ultimately, in the event of a global economic crisis where external capital becomes scarce and government regulation becomes strict, we have planned to maintain the functioning of the maker ecosystem through the self-built Metanomics, in which we can no longer use RWA.

7.2. Return to the true ideals of crypto

Rune states that in addition to building an independent ecosystem, the Endgame Plan can also bring back the fundamental ideals of crypto. When Maker and DAI achieve complete decentralization, they will be able to return to their fundamental ideals, and even more so, the industry itself can return to the true spirit of crypto that resists censorship and regulation. He claims that the Endgame Plan’s decentralization of DAI can provide an opportunity to reverse the centralized movements that MakerDAO has pursued until now, such as excessive dependence on USDC, and contribute to becoming the protocol that best represents the spirit of crypto. Therefore, in situations where external confusion is weighing heavily, the self-sustaining ecosystem of MakerDAO can paradoxically become more attention-worthy and be a source of nourishment for the growth of the system, leading to the participation of ecosystem participants who share the spirit of crypto, according to Rune.

We have looked at the reasons why the true decentralization of DAI is necessary, the roadmap for the Endgame Plan to achieve this, and the benefits that can be obtained when DAI becomes a fully unbiased global currency.

Regardless of the feasibility, Rune’s proposal to break away from the tradition of 1:1 peg with USD, which is considered a virtue for stablecoins, can be considered innovative. His suggestion to build an independent subset called MetaDAO and complete the decentralization of the entire ecosystem through the free float of DAI makes us think again about our position in the current situation where the risk of regulation is becoming increasingly real. In addition, his thought process of considering the fundamental ideals of crypto, such as resistance to censorship, makes me and other crypto industry participants think about the appeal, vision, and goals that motivated us to enter this market for the first time.

In the current context where the argument that the crypto industry must necessarily be regulated due to the FTX incident is gaining strength, Rune’s argument prompts us to consider what direction the industry we are currently in should truly take. I think his argument that we should build a completely independent ecosystem from the government through the endgame plan could potentially bring about a new prosperity for the crypto industry, or it could be nothing more than an unrealistic illusion that is disconnected from reality. It is worth considering the value of paying attention to whether the endgame plan can bring about innovation that will bring new prosperity to the crypto industry, or if it is merely an illusion.