1. Introduction

In Endgame Series ① and ②, we examined the background and purpose of the Endgame Plan presented by Rune, co-founder of MakerDAO, and the key contents for achieving the ‘Endgame State,’ which he believes to be MakerDAO’s ultimate goal. In particular, we focused on the introduction of a new governance structure called MetaDAO and the true decentralization of DAI through free float, and were able to confirm Rune’s determination to make the MakerDAO ecosystem completely free from external influences.

However, radical reform always coexists with expectations and concerns. While there are those who advocate the Endgame Plan, citing the need to solve the limited income sources of the Maker Protocol and the value issue of MKR tokens, as well as the possibility of becoming free from potential government regulation, there are also opposing opinions that argue that a reform that overturns the entire ecosystem could actually be a hindrance to the development of the system.

In the midst of this debate, on October 24th, the Endgame Plan passed the voting(opinion survey) stage in the MakerDAO governance. As a result of this vote, a social consensus among the current members of MakerDAO to ‘change the structure through the Endgame Plan’ has been secured, and MakerDAO has entered the Pregame, which is the stage before the launch of the Endgame Plan, where products are prepared for the launch of Endgame.

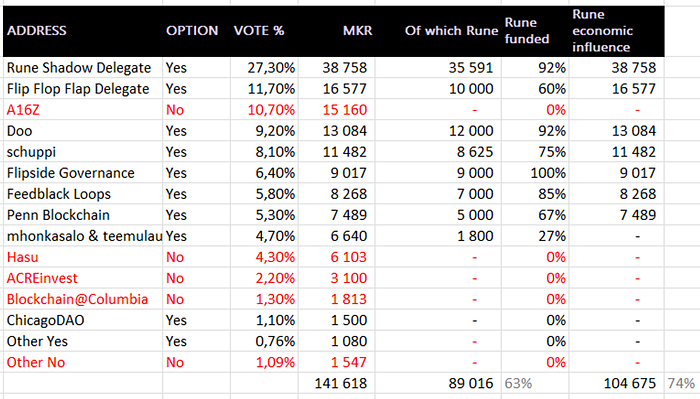

The Endgame, proposed by Rune, has passed the MakerDAO governance vote. While 122 persons have voted, only one matters as he represent 63% of the turnover and 74% if we use influence.#decentralization

— Sébastien Derivaux (@SebVentures) October 25, 2022

1/n 🧵 pic.twitter.com/lbF8sO8pGU

2. A16z’s statement

While A16z recognizes that the Endgame Plan includes various innovative ideas, they also point out that these ideas are intertwined and too complex to be integrated into the system. A16z says that in order to address regulatory and legal uncertainties, especially those related to their own stablecoin DAI, Endgame focuses on the following three main points.

- Optimal organization: Governance structure reform using MetaDAO

- Long-term growth strategy: Increase long-term profitability through MDAO token and DAI’s free float

- Framework to inject innovation and vitality into the MakerDAO ecosystem: Independent ecosystem and BM construction for each MetaDAO

Then they say that these three goals are all connected to one fundamental question:

How can we optimize MakerDAO’s long-term growth while achieving true decentralization?

A16z divides decentralization into three categories and evaluates how the Endgame Plan can positively impact each of them, focusing on MakerDAO’s decentralization while the Endgame Plan focuses on MakerDAO’s decentralization:

- Legal Decentralization

- Technical Decentralization

- Economic Decentralization

2.1. Legal Decentralization : MakerDAO Core Units

Legal decentralization refers to a state where the opinions of ecosystem participants are reflected without bias in governance stages, and this requires the absence of information asymmetry and dependence on the opinions of a few.

A16z claims that MakerDAO is already legally decentralized due to the role of MakerDAO Core Units in overseeing the overall operation of the MakerDAO ecosystem. They argue that the introduction of MetaDAOs as proposed in the Endgame Plan not only fails to enhance the legal decentralization already possessed by MakerDAO, but actually increases the overall complexity of the MakerDAO ecosystem.

If it is assumed that there are legal decentralization issues with the current MakerDAO core unit, rather than resolving them with a ready-to-implement method that enhances the performance of the existing system, the Endgame plan presents a reform proposal that targets the entire Endgame system, which may take some time and may have unexpected side effects. A16z has doubts about this.

A16z’s evaluation of the Endgame plan on the legal decentralization aspect can be summarized as follows:

The current system is sufficiently legally decentralized and, if improvements are needed, they can be addressed through ready-to-implement methods that improve the system’s capabilities without taking on the additional risk of restructuring through MetaDAO.

2.2. Technical Decentralization : Issuance of DAI

Technological decentralization refers to the extent to which users of the Maker protocol can adequately reflect their individual identities in the process of issuing Maker’s own stablecoin, DAI. A16z claims that the current process of issuing DAI is already decentralized through the open-source smart contract app Oasis, and that further decentralization can be achieved by increasing the utility of DAI within the DeFi ecosystem through governance efforts on the side of utility.

A16z believes that the Endgame’s plan for each metadao to build its own frontend and to independently determine the vault assets for the creation of DAI could increase the risk that DAI may not fully receive its value due to the “commoditization effect”.

The commoditization effect refers to the phenomenon where a previously limited product or service becomes widely available as supply becomes more smooth. As a result, suppliers who have previously enjoyed a relative advantage lose their exclusive position, and because anyone can participate in supply competition, the product cannot have any qualitative differences in the market and can only compete in terms of price.

According to the Endgame Plan, in the long term, each meta-DAO will be able to decide for itself which assets it can use as collateral to create DAI, and will compete with each other through the frontend to attract more users as their collateral. This is where the commoditization effect comes in.

If we view DAI issuance as a single market, the subjects that make it up are as follows:

- Product: DAI

- Supplier: Each MetaDAO Vault’s adopted DAI collateral assets

- Consumer: Users who want to issue DAI

A16z has used the term “commoditization effect” to indicate that the value of DAI is being threatened by the indiscriminate increase in the types of collateral assets that can issue DAI. After the endgame plan, considering the high degree of governance autonomy that will exist within the MakerDAO ecosystem, each MetaDAO will adopt a wider variety of cryptocurrencies as collateral in order to satisfy the needs of more users and achieve higher profits. At this time, each MetaDAO may risk adopting assets with higher volatility as collateral assets to issue DAI, rather than relatively stable mainstream cryptocurrencies such as ETH or wBTC. If this vicious cycle repeats, the proportion of DAI issued with collateral with high liquidation risks will increase, ultimately resulting in the instability of the value of DAI. A16z claims that guidelines for the candidate collateral asset pool that MetaDAOs can accept must be presented in order to fully achieve the self-introduced vaults for technical decentralization proposed in the endgame plan.

If such competition becomes overheated, assets with higher volatility may be chosen as collateral assets that support the value of DAI, and ultimately the product of DAI issuance proposed by each MetaDAO is at risk of experiencing a commoditization effect where only price competition is overheated. A16z claims that guidelines for the candidate collateral asset pool that MetaDAOs can accept must be presented in order to fully achieve the self-introduced vaults for technical decentralization proposed in the Endgame Plan.

The Endgame Plan evaluated by A16z from the perspective of technical decentralization can be summarized as follows:

The current system is sufficiently technically decentralized, and the independent DAI collateral asset decision for each MetaDAO proposed by the endgame plan can actually make DAI unstable by bringing about a commoditization effect.

2.3. Economic Decentralization : Ensuring the value of DAI

Economic decentralization means that the collateral that ensures the value of DAI is at low risk of being seized or frozen by external parties. In the endgame plan, it is proposed to divide the collateral structure of DAI into decentralized collateral assets and RWA collateral assets to achieve economic decentralization. In order to truly decentralize DAI, it is argued that it should gradually pass through the Pigeon, Eagle, and Phoenix stances, reducing the impact it receives from the external environment.

A16z also mentioned that it is important to have an appropriate distribution between assets with seizure risks and decentralized assets in order to achieve economic decentralization, and expressed agreement with the Endgame Plan in terms of economic decentralization, which is different from legal and technical decentralization. The three options presented by A16z for the long-term growth of the maker protocol are similar to Rune’s claim in that they set boundaries for centralized assets with seizure risks.

- Only assets that are “sufficiently decentralized” such as ETH or certain derivatives are accepted as collateral.

- USDC, wBTC, and other centralized assets are accepted as collateral, but the proportion is gradually reduced.

- There is a limit on the proportion of centralized collateral assets that can be accepted, and when that limit is reached, the collateral assets must be guaranteed in value by the same amount of DAI in the Surplus Buffer.

Option 3 in this list proposes that in order to prevent the value of DAI from becoming unstable due to the seizure or freezing of central assets used as collateral, the same amount of DAI should be secured in a surplus buffer through central assets issued as collateral. This is a new suggestion in A16z’s argument.

A16z evaluated the Endgame Plan from an economic decentralization perspective as follows:

We agree with the Endgame Plan’s proposal to reduce the proportion of collateral assets that are vulnerable to external influences, but suggest that the surplus buffer should support these collaterals in case of emergencies.

3. Concerns about the Endgame Plan

A16z, who evaluated the Endgame plan from three perspectives, including decentralization, voted against the Endgame plan in an opinion survey on October 24th. The MakerDAO governance allows for one person, one vote, but also allows for one person, multiple votes. In the Endgame opinion survey held on October 24th, A16z voted against with 15,160 MKR, which is the largest amount of MKR among the voters on the opposing side, as shown in the table above. Although A16z agrees with certain aspects of the Endgame Plan, as previously discussed in the introduction in terms of economic decentralization, the Endgame Plan’s proposed reforms are not necessarily necessary for the MakerDAO ecosystem at this time and may even be detrimental.

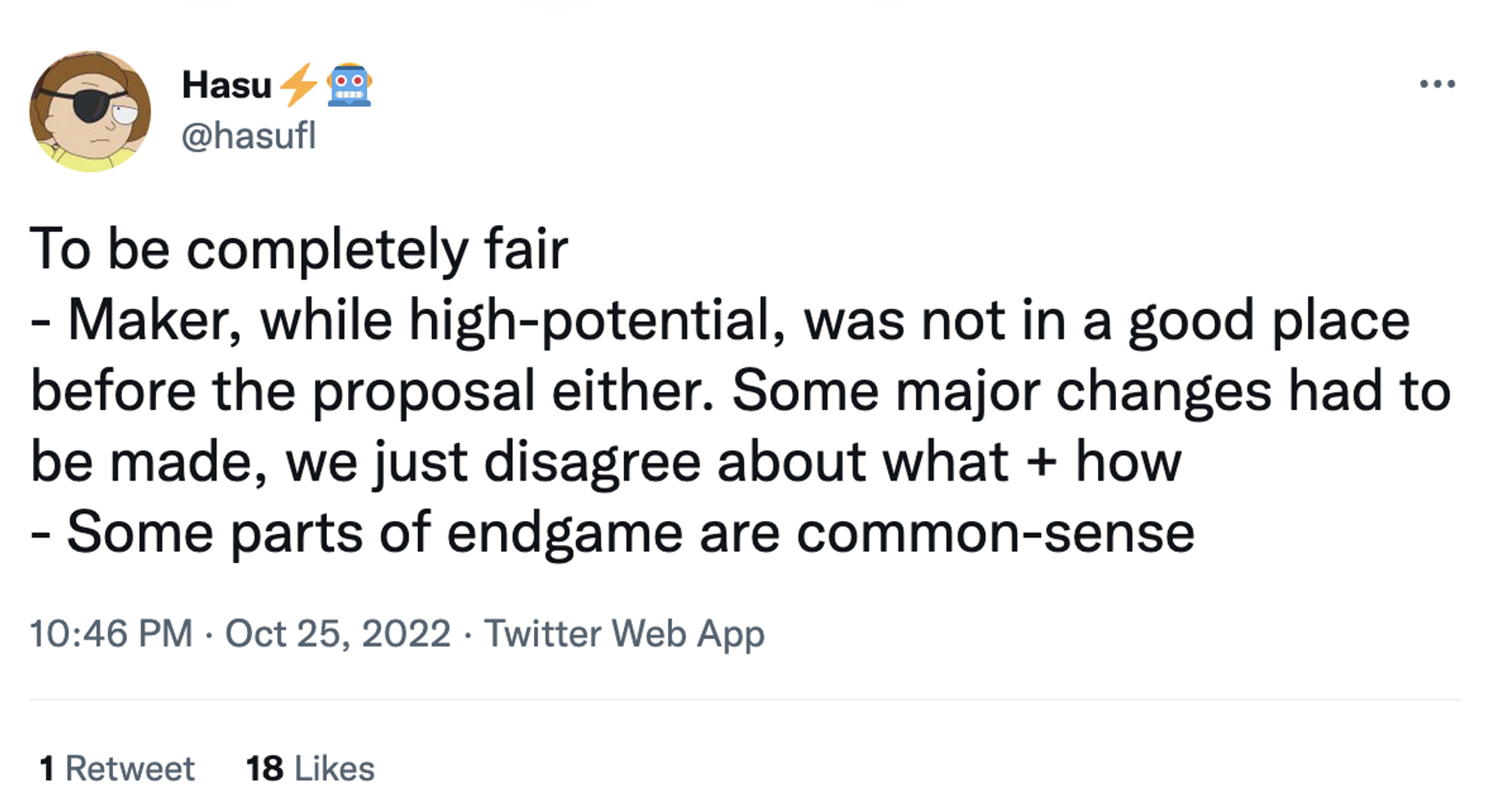

Flashbot’s Head of Strategy, Hasu, also cast a vote against the endgame plan with 6,103 MKR. While he also expressed agreement that some of the changes proposed in the endgame plan could solve problems currently facing MakerDAO, he pointed out that the overall change would have a wider impact on the ecosystem, and should not be included as a single MIP vote.

4. Expectations about the Endgame Plan

Centrifuge is a platform that specializes in on-boarding Real World Assets (RWA) onto DeFi. They currently manage four out of the seven RWA vaults used by MakerDAO, including ConsolFreight, FortunaFi, Harbor Trade Credit, and New Silver, and play a crucial role in enabling Maker Protocol to access the real world.

Centrifuge is one of the main proponents of the changes that the Endgame Plan will bring, and claims that the adoption of the MetaDAO will allow for more transparent and efficient on-chain finance. In particular, they envision the Protector, one of the types of MetaDAO, to increase the utility of DAI in the real world in the long term, and say that the adoption of the Endgame plan could bring springtime for Maker.

1. With @MakerDAO's Endgame Plan up for vote, we've been working hard to define the future of real-world assets and DAI.

— Centrifuge (@centrifuge) October 18, 2022

We're excited to share the first step of this path. Alongside our partner @Blocktower, we're forming the Spring Protector Cluster.

→https://t.co/WAwwn6JVK8 pic.twitter.com/ftr7lBCn64

5. DeSpread’s Statement

MakerDAO is currently expanding its business to real world asset-based financial services through Real World Assets(RWA). The introduction of new features increases the complexity of the ecosystem, highlighting the need for functional independence and specialization of the Maker protocol. This follows the proposal and voting of the Endgame Plan, which represents the first fundamental change in MakerDAO since the release of its whitepaper.

DeSpread recognizes that change is necessary for MakerDAO to progress, but, like A16z and Hasu, they believe that there are problems with the proposed approach of the Endgame plan. The Endgame plan proposes a comprehensive overhaul of the entire system rather than just a technical change, and DeSpread is concerned that such a significant decision could be made with just one vote.

One of the key factors that could determine the success or failure of the Endgame plan is the free float of DAI. While Reflexer Finance’s RAI failed to escape from the 1:1 hard pegging approach, DAI may be able to maintain or expand mass adoption based on its competitive strengths, such as DSR, multi-collateral DAI, and a large community, after the implementation of free float. Attention is being paid to whether DAI can maintain or expand mass adoption after the implementation of free float.

The vote on the Endgame plan for MakerDAO has sparked much debate, and while many agree that change is necessary for MakerDAO to progress, there are concerns about the way in which the Endgame plan proposes to overhaul the entire system, rather than just proposing a technical change. One clear outcome is that the success or failure of the Endgame plan will be a test case for other blockchain protocols, including DAOs, to see how effective and stable decision-making can be within a DAO system and how much complexity it can handle. If community members continue to actively participate and contribute to the decision-making process in a way that is faithful to the mission of a DAO, then it is expected that not only will MakerDAO, but also the overall development of DAOs within the blockchain ecosystem will be realized.

6. Key points to consider at the upcoming governance

The Endgame Plan, which proposes a complete overhaul of the existing MakerDAO governance, DAI collateral structure, and business model through the introduction of MetaDAO, has generated both hope and concern among some. To confirm whether the Endgame Plan is a truly transformative proposal that will be supported by the members of MakerDAO, we should pay attention to the following two points in the future:

- Technical MIP details

- Maker governance participation rate

6.1. Technical MIP details

The Endgame Plan, which passed a poll and gained social consensus, is currently in the pregame phase where no specific technical changes have been decided yet. MIPs that will directly affect the Maker ecosystem will be detailed in terms of the changes they bring to the Maker protocol smart contract through executive votes. Therefore, in the upcoming executive votes, Maker community members will decide their position based on how much each MIP reflects and accompanies the Endgame Plan announced by Rune and the direction in which Maker will develop can be specifically identified.

6.2. Maker governance participation rate

The Endgame vote has sparked debate and raised concerns among some as it proposes significant changes to MakerDAO’s governance, collateral structure, and business model. It is important to pay attention to the details of the technical MIPs (Maker Improvement Proposals) and whether the limitations of Maker governance, which were pointed out as a problem during the Endgame poll, will be addressed. It was noted that 63% of the 122 addresses that participated in the vote were influenced by Rune and the MKR used in the poll only made up 15% of the total circulating supply. It is important to ensure that the technical MIPs accurately reflect the Endgame Plan and that the concerns about Maker governance are addressed in order for MakerDAO to move forward and continue to develop.

As the Endgame Plan is a reform that will change the entire MakerDAO ecosystem, it requires the attention of all members of MakerDAO. Therefore, it is important to pay attention to whether the participation rate of governance in the upcoming Endgame executive vote improves, and it can be said that the Endgame Plan reflects the will of all members fully when the vote is held by a sufficient number of members.

7. Conclusion

So far, we have looked at the background of the Endgame series, the purpose and key content of Endgame, and the various expectations and concerns surrounding Endgame. As there are no substantive changes in the system that Endgame will bring to MakerDAO, I would like to step back and consider the significance of the Endgame Plan for MakerDAO and other DAOs.

Someone may think that Endgame is just a hollow spectacle, but I believe that the fact that it presents innovative ideas that challenge the status quo is truly meaningful. The sight of the person who founded MakerDAO actively proposing innovative ideas for the future of MakerDAO and passionately discussing them with the members shows that MakerDAO is not content to stay in place and is determined to move forward, instilling that determination in its members. Whether or not one agrees with Rune’s opinion, the sight of people expressing their opinions through the Maker Forum and Twitter and proposing what they believe is the true direction of development is exactly what a DAO, a decentralized autonomous organization, should truly value. I hope that the roadmap presented by the Endgame plan will be decided in a direction that is realistically helpful to Makerdao through the upcoming executive vote, and I will conclude the Endgame series.

<References>

- Porter Smith, A16z Endgame Thoughts

- Centrifuge, Spring Cluster Introduction and Proposal

- Investopedia, What Is Commoditization?