What Institutional Custody Means in the Crypto

Institutional Custodians Which Brought Trust to the Crypto

1. Introduction

Over the past few years, the crypto industry has seen rapid development and is now a major industry sector that governments and institutions are paying attention to. In September 2021, a survey of more than 1,000 institutional investors in Europe, Asia, and the United States conducted by Fidelity Investments found that more than 81% of institutions believe that crypto should be included in their portfolios. Especially during the pandemic, quantitative easing by the U.S. federal government injected liquidity into the market, leading to an influx of capital into the crypto space. This surge highlighted the need for custody, a service that safeguards client assets. As a result, institutional custodians with expertise in security, operations, and legal matters have risen to prominence.

However, custody - the act of entrusting one's assets to a third party - has historically been viewed negatively in the crypto industry. This stems from challenges like immature industry regulation, a history of numerous exchange and institution hacks, and fundamentally, the contradiction it presents to the web3 principle of self-custody: the belief in individual sovereignty through decentralization. Given these concerns, institutional custodians venturing into the crypto space needed a new approach. Custodians that provide tailored crypto custody services now play a pivotal role in the industry.

2. What is Institutional Custodian?

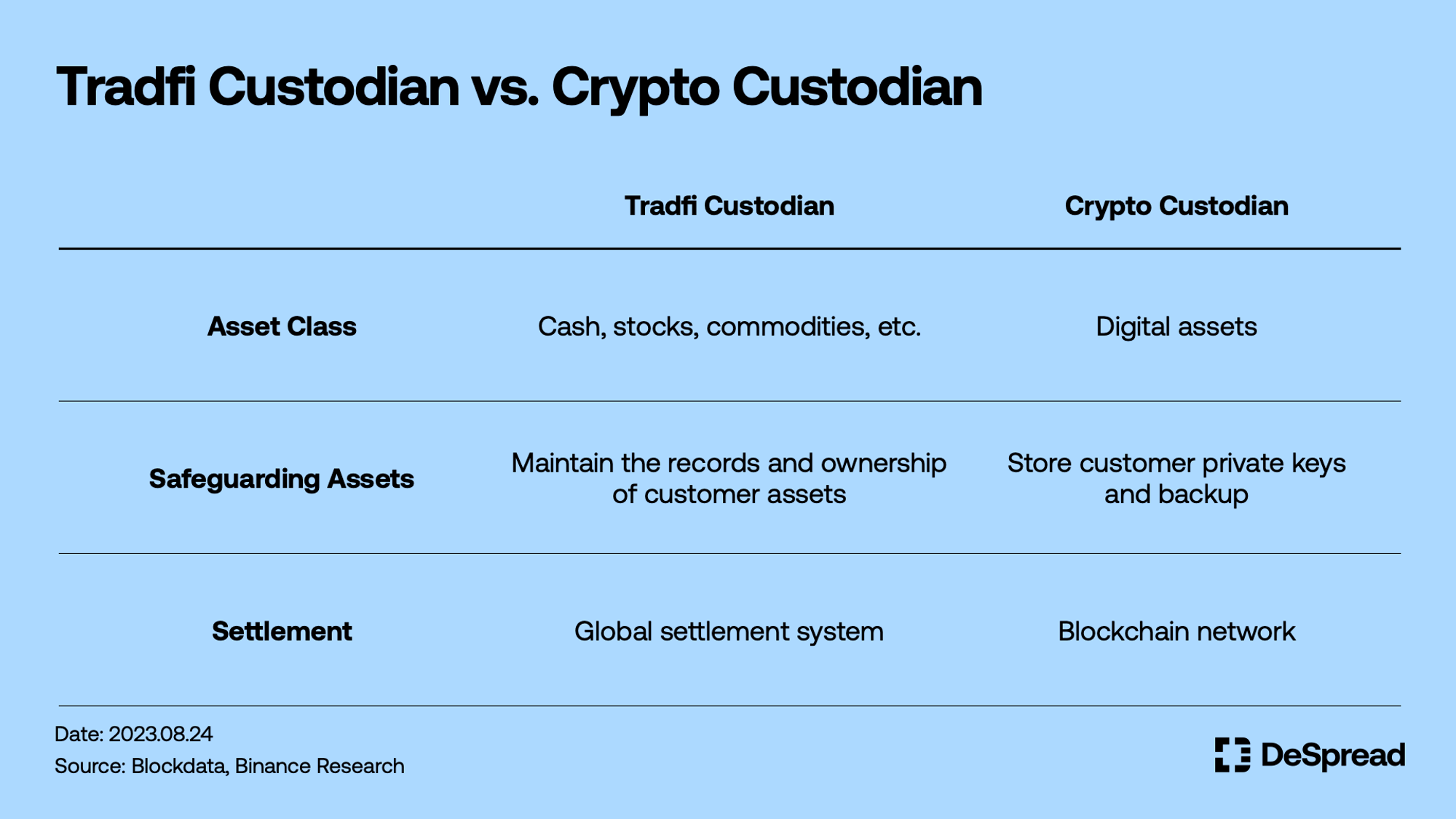

In the tradfi, custody refers to a service provided by a financial institution(usually a bank) to safeguard a client's assets. However, in the crypto industry, custody is used in a slightly different sense, where the custodian does not directly hold the client's assets but rather protects the client's private keys that enable access to those assets. As such, institutional custodians interact directly with brokers, dealers, and exchanges to trade their clients' funds, acting as the entity that holds the client's private keys and authorizes transactions on their behalf.

2.1. The Rationale Behind Institutional Custodians in Crypto

Institutional custodians help to mitigate the risks that institutions that move large amounts of money inevitably take on when entering the crypto industry. These risks can be categorized into security, operational, and regulatory risks, and institutional investors who are managing their clients' funds are increasingly relying on institutional custodians due to the limitations of self-custody in managing all of their funds. According to a report published in January 2022 by data provider Blockdata, the amount of crypto assets under custody increased nearly sevenfold from January 2019 to January 2022, from $32 billion to $223 billion.

- Security Risk: This includes threats such as private key theft and unauthorized system access.

- Operational Risk: Areas of concern involve compromised private key backups and non-secure fund transfers.

- Regulatory Risk: Major pitfalls here are the absence of damage insurance coverage and lack of rigorous audits.

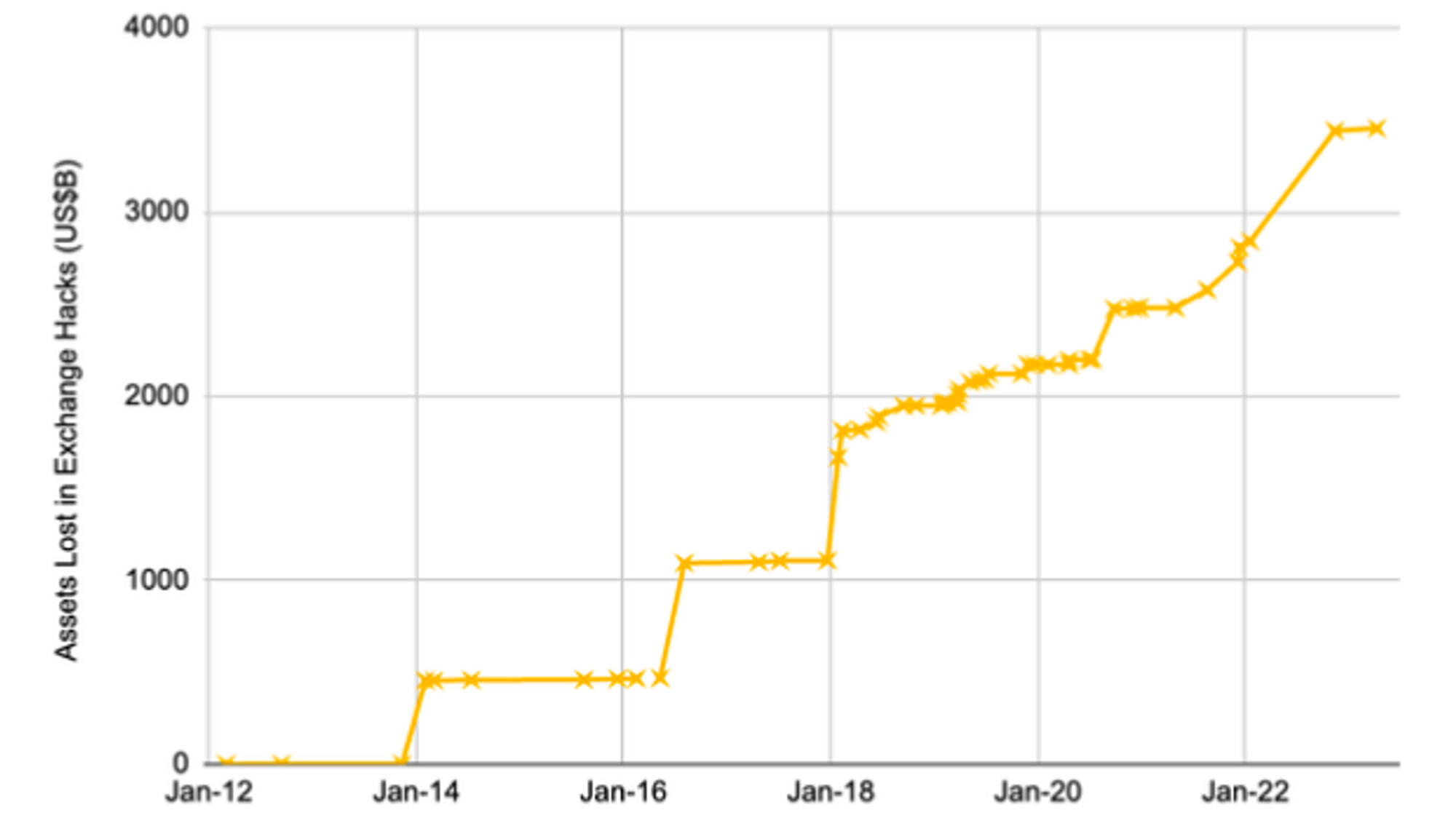

While centralized exchanges like Binance, Upbit, and others can and do play a role in protecting their clients' assets similar to that of an institutional custodian, the trend of entrusting institutional funds to exchanges has been declining as the number of exchange hacks has increased over time.

As a result, institutions that move large amounts of assets have begun to rely less on exchanges and more on institutional custodians, whose primary goal is to protect and safeguard their clients' assets, which has led to more thorough auditing and management of security. Based on these strengths, institutional custodians are now acting as a lubricant to attract institutions that do not yet have the capacity to custody funds alone into the crypto business.

3. Leading Institutional Custodians

3.1. Coinbase Custody

Coinbase Custody is a custody service launched in 2018 by Coinbase, the largest cryptocurrency exchange in the United States. The service is a part of Coinbase Prime, which offers institutionalized trading and custody. Coinbase Custody targets large financial institutions, protecting their private keys on behalf of them and generating revenue through asset custody, fee collection, and deposit management.

As a limited liability trust company licensed by the New York Department of Financial Services and regulated by the New York State Banking Law and the U.S. Securities and Exchange Commission(SEC), Coinbase Custody is relatively immune from regulatory risk. In February, when the SEC announced that it would impose more stringent regulations on custodians, Coinbase responded by stating that it could continue to provide custodial services in a compliant manner.

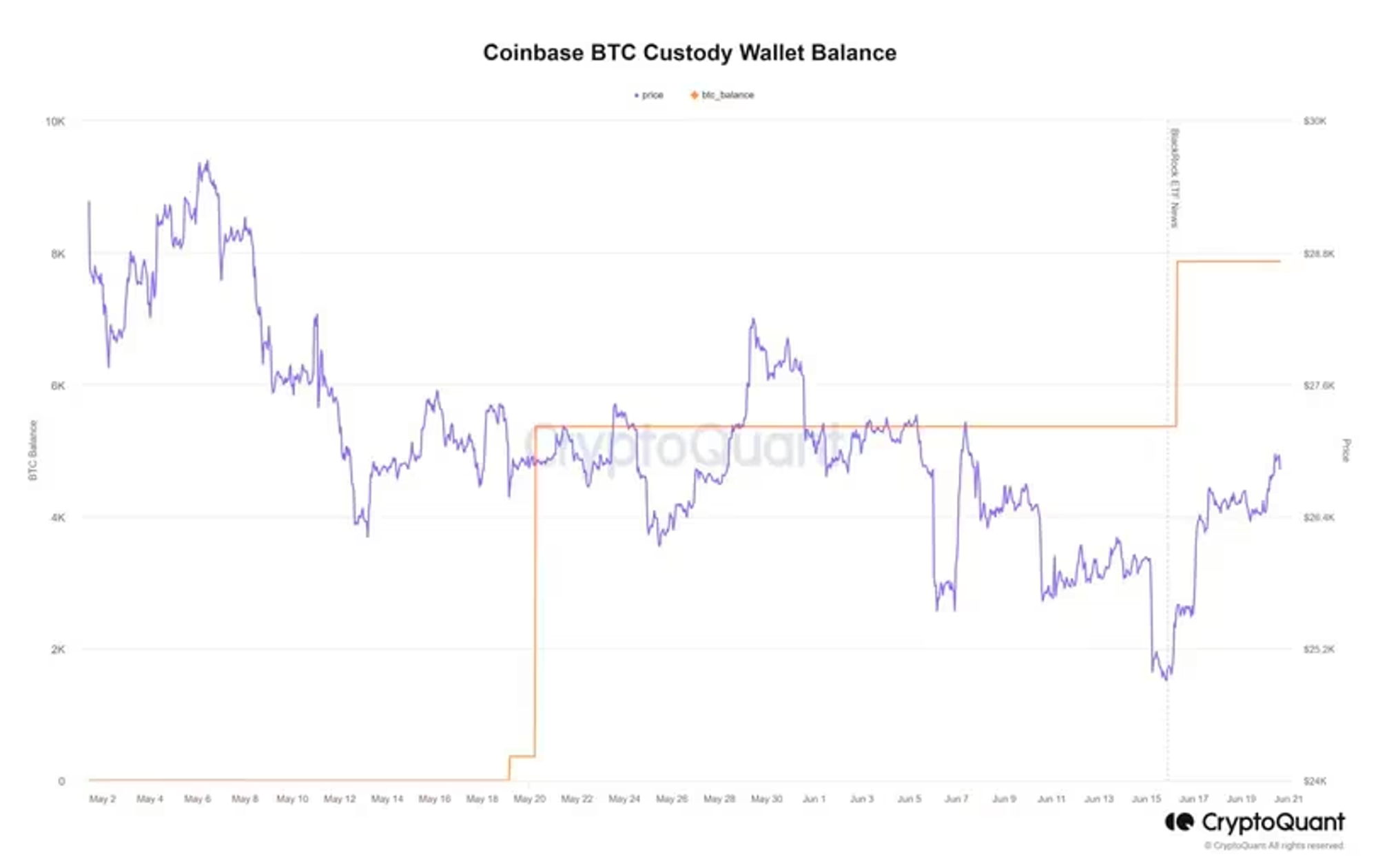

Coinbase Custody became a hot topic in June when it was selected by BlackRock, the world's largest asset manager, to be the custodian for its application for a Bitcoin spot ETF. According to data provider CryptoQunat, Bitcoin holdings in one of Coinbase Custody's wallets increased by 2,200 after BlackRock submitted its application for a Bitcoin spot ETF.

Coinbase reported net revenue of $663 million in Q2 2023, driven by the aforementioned custody agreement with BlackRock and an increase in institutional clients. While this was down about 10% from the same quarter last year, it was still above expectations and quite impressive compared to competitors such as Binance, which has struggled with regulatory issues.

3.2. BitGo

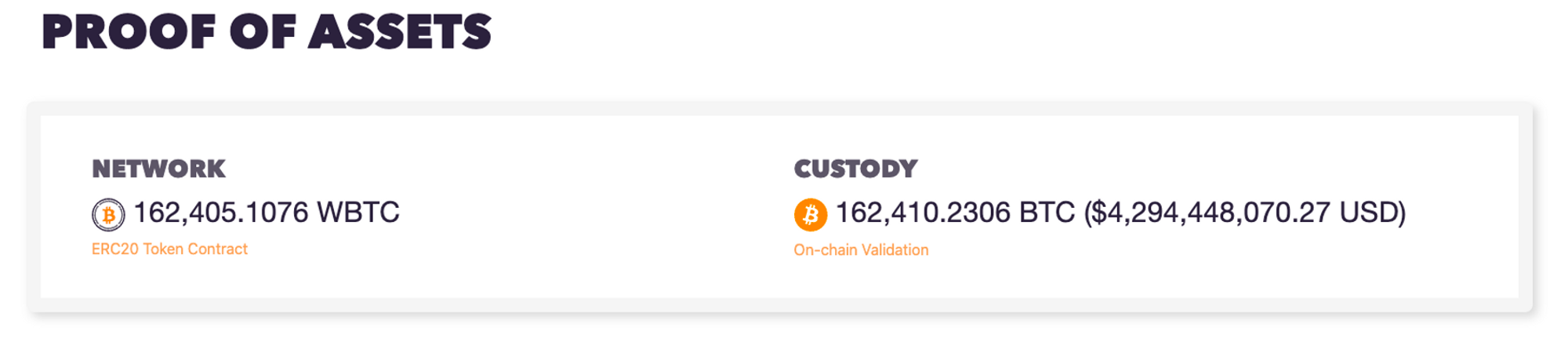

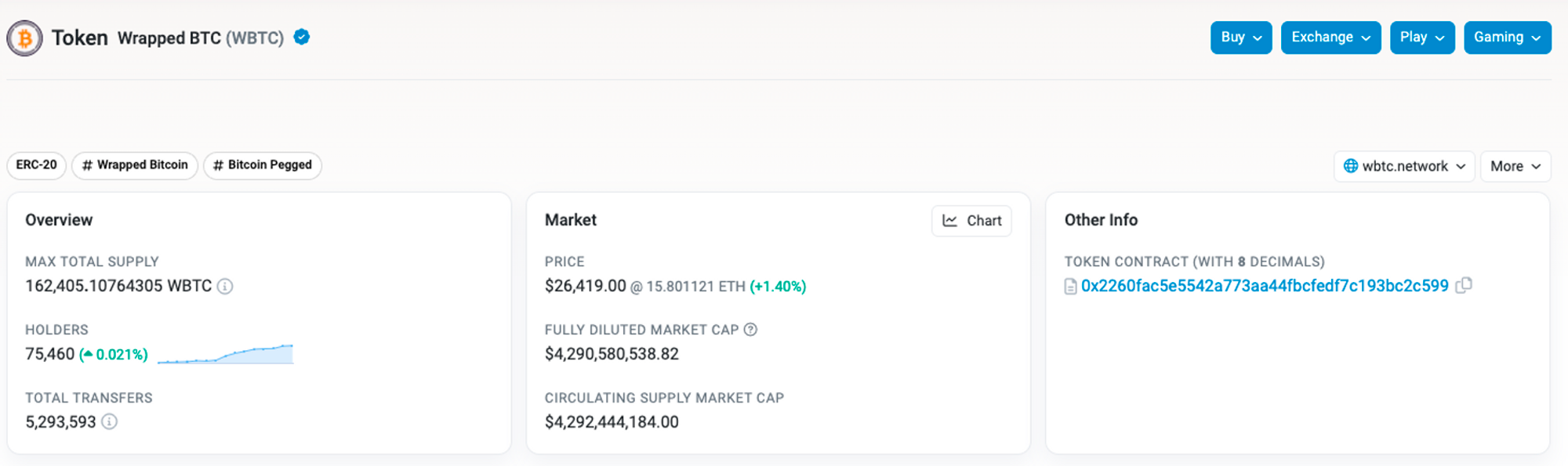

Founded in 2013, BitGo specializes in providing institutional fund custody services through its Multi-Sig Wallet and Threshold Signature Scheme(TSS). BitGo was an early partner of wBTC, BTC's ERC-20 wrapped token that can be used on the Ethereum network, and is the sole custodian of wBTC to date. Due to the structural nature of wrapped token issuance, users must trust the custodian they entrust with their underlying assets, so to reassure customers that their funds are held securely and transparently, BitGo provides a Proof of Reserve(PoR).

BitGO provides PoR through an on-chain dashboard, which allows users to see in real-time how much wBTC is in circulation, how much BTC is locked in BitGo, and more. The dashboard is also cross-validated by the Ethereum network's block explorer Etherscan, which mitigates the risk that BitGo could intentionally manipulate the dashboard.

They also make all transaction information publicly available through on-chain verification, including how much BTC is being held in which wallet, and when the BTC went in and out of that wallet. This allows users to go beyond simply comparing the total amount of wBTC and BTC and verify each transaction, giving users a more transparent way to see how BitGo is managing their funds.

Today, BitGo is a leader in the institutional custody industry, holding more than 1,500 institutional funds across more than 50 countries and offering a range of services beyond simple asset custody, including staking, DeFi security, and lending and borrowing.

4. Conclusion

With the influx of diverse institutions and large amounts of capital into the crypto industry, institutional custodians have become an integral part of the industry, providing trust, stability, and convenience. Their roles have evolved, now encompassing more than just the protection of clients' assets; they're delving into trading, insurance, escrow, staking, and research.

In addition, tradfi custodians are moving into the crypto industry as regulations for institutional custodians are being refined and client demand grows. BNY Mellon, one of the oldest banks in the United States, made headlines when it launched a crypto custody program in 2022. The competition between tradfi custodians and native crypto custodians is also something to watch in the future.

For an industry to continue to develop, trust in its infrastructure is pivotal. This holds especially true for the crypto industry, which has recorded a number of catastrophic events in its short history, Ensuring trust in the infrastructure becomes critical as the industry scales upwards. In this regard, institutional custodians are likely to become increasingly important as they can ensure safety and trust within the ecosystem.

References

- DeSpread Research, Understanding third-party assets, wrapped tokens, 2022

- Cointelegraph, Institutional crypto custody: How banks are housing digital assets, 2022

- Binance Research, Institutional Custody in Crypto, 2023