The case of negative kimchi

The Kimchi Premium #5: Recap of Korean crypto community trends for week 3 in October

The Kimchi Premium is a weekly series that looks back at the hottest topics in the Korean crypto community

Bitcoin just hit 69,420 and the election rally is yet to come. Polls are mostly favorable to Trump but still many refuse to believe it. Guess who else is in disbelief? Bingo, Koreans.

Known as the “Kimchi Premium,” it is a metric that shows how much BTC is being traded compared to foreign exchanges. Yes, this newsletter was also named named after it.

If the Kimchi Premium is positive, that means BTC is being traded more expensive on Korean exchanges. The Kimchi Premium shoots up to 30% at times. Now imagine if you could trade this with size. You would be filthy rich. And we all know one guy who was execute this strategy:

Bankman-Fried had tried to crack that trade, at one point calculating whether it made sense to get an airplane, fill it with people, and fly to Seoul to all buy bitcoin in person. Instead, he settled for Japan. It was still complex (or “quite annoying,” in his words) to execute at scale, but Bankman-Fried and some friends, with whom he had founded a trading firm in Berkeley called Alameda Research, cobbled together a chain of intermediaries, including obscure banks in rural Japan, to take advantage of the monthlong price discrepancy. They moved up to $25 million a day.

Since the Korean government banned foreigners to trade on Korean exchanges and institutional accounts are not allowed, this phenomenon became a feature to Korean traders. Allegedly Korean exchanges are 100% retail, but I am also 100% sure that is not true. But that discussion is for another day.

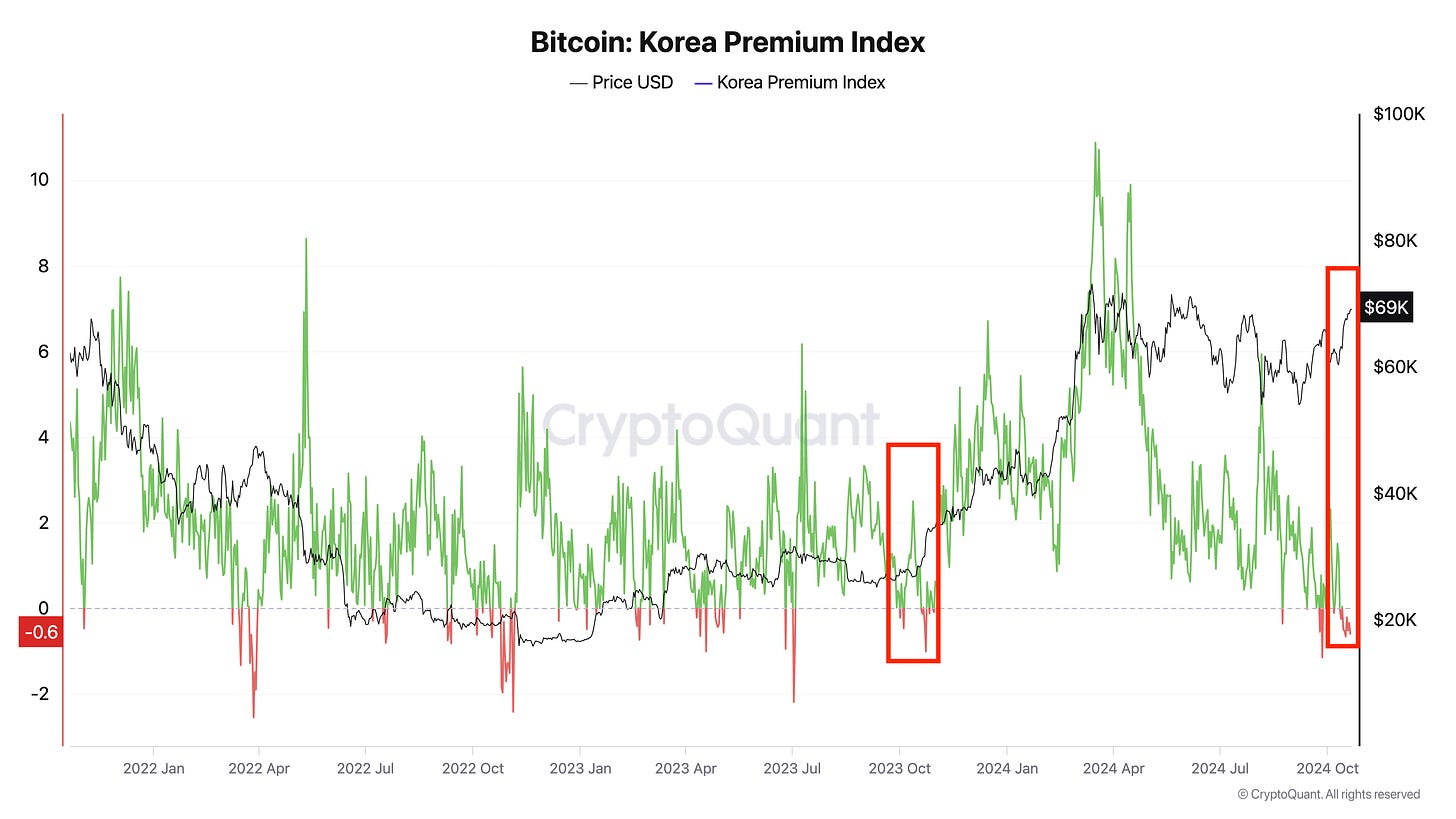

Anyways, the point I’m trying to make here is that there are signals that you can read from the Kimchi Premium like when Bitcoin started to rally last week. At the time hansolar wrote:

Coinbase premium has changed course

Also kimchi premium is at a discount(shown as positive on the chart), meaning you can buy korean BTC for cheap atm

Historically this happens during 'disbelief' rallies. Last occured in 2023 Oct. Before the price of BTC doubling over the course of six months...

Historically when Koreans are in disbelief, it’s when you buy and when the premium is too high, you sell. Of course I have never followed these rules. And maybe, I might not want to in the future because the institutions are coming. Per my last newsletter, I wrote that the Korean government is considering to allow institutional trading accounts. When we get highly sophisticated institutions playing the arbitrage game the Kimchi Premium might disappear once and for all.

Cat Enters the Chat

As of writing, Upbit just announced it will list $MEW. That means there will be only three memecoins on Upbit. $DOGE, $SHIB, and now $MEW. Korean Telegram channel sPeCuLaTiOn dAiRy came up with a convincing theory:

*I am disclosing that currently I do not hold any MEW tokens

TL;DR

- MEW is likely to see a massive green candle with insane trading volume on Upbit at some point. The timing is uncertain.

MEW was listed on Upbit today, which I consider quite significant news. Until now, Upbit only offered "DOGE" and "SHIB" as options for betting on "memes."

As you all know, these two are already the top 1 and 2 meme coins by market cap, having evolved into relatively stable mega-cap coins with valuations in the tens of billions of dollars. Naturally, people seek coins with more growth potential, gravitating towards "cheaper" options.

Now, Upbit has introduced "MEW" as an alternative. Unlike the other two, it's cat-themed and, crucially, "relatively inexpensive" compared to them.

MEW's market cap has just surpassed $1 billion, which isn't particularly huge when you consider the all-time highs of Doge and Shiba during the 2021 season.

Let's imagine a scenario where Bitcoin breaks its all-time high, ushering in a (Memecoin) supercycle.

Media coverage and word-of-mouth would likely drive many crypto newcomers to download Upbit. They'd naturally gravitate towards memecoins.

But they'd only have three options: Dogecoin, Shiba Inu, and MEW. Looking at market caps, they might think, "Hey, MEW is much cheaper than these two. How high did Dogecoin go again? Maybe I should buy some." (Surprisingly, many Upbit users exclusively use Upbit. Many don't even use Binance, let alone MetaMask.)

I still remember the insane volume of Dogecoin on Upbit during the 2021 bull run, surpassing the combined volume of KOSPI and KOSDAQ in a single day (around 20 trillion KRW, if I recall correctly). Even recently, when Shiba Inu rose 50% earlier this year, Upbit alone saw about 4 trillion KRW in trading volume. This demonstrates that Koreans' speculative power is world-class, even surpassing foreign degens.

Despite Korean exchanges like Upbit only offering spot trading, they generate such incredible volume that foreign projects are desperate to get listed there.

While there's no guarantee of seeing such volumes again, MEW now has the opportunity to benefit from Upbit's crazy volume potential. Unless other meme coins get listed, MEW now holds the title of "the cheapest meme coin on Upbit" and "the only meme coin available besides Doge and Shiba" (considering KRW pairs).

Given all this, I believe MEW will likely show a massive green candle with insane trading volume on Upbit at some point, though the timing is uncertain.*

Imagine all the Korean hedge funds bidding on a cat coin to be dumped on brainrot schizo sol shitter trench bois. That is a world I choose to live in.

But Why

However, I have detected some discontent on this matter, as $MEW is “only a memecoin” and the token distribution is pretty uneven compared to other major memecoins on Solana. But I am not the one to judge whether $MEW should be listed or not.

Let’s just consider the fact that Upbit actually listed a memecoin. Upbit is supposed to be very conservative with its listings because they are always under the radar. The suits are waiting to give them a beating any second. But… this memecoin? Out of nowhere?

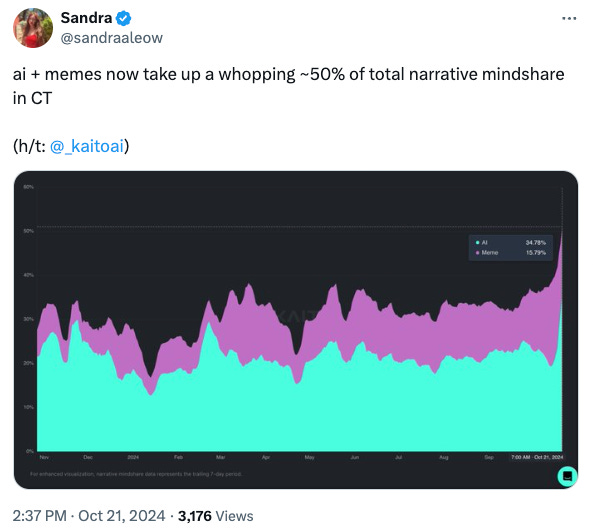

We can see the tides are turning in realtime. Now Korean exchanges are catching up with the meme meta because apparently, memes and AI are responsible for around 50% mindshare according to Kaito. Memes are an inevitable force.

During my podcast, I said that crypto culture is “a culture of money”: If crypto is a culture of money, and memes will make you most money, then the whole industry will be steered to that direction.

With market participants becoming more sophisticated and acknowledge this fact to the degree to ditch these so-called VC-backed tokens and gravitate to memes, exchanges will need to adjust accordingly. We are already seeing signs from major exchanges as they have already listed a good amount of memes.

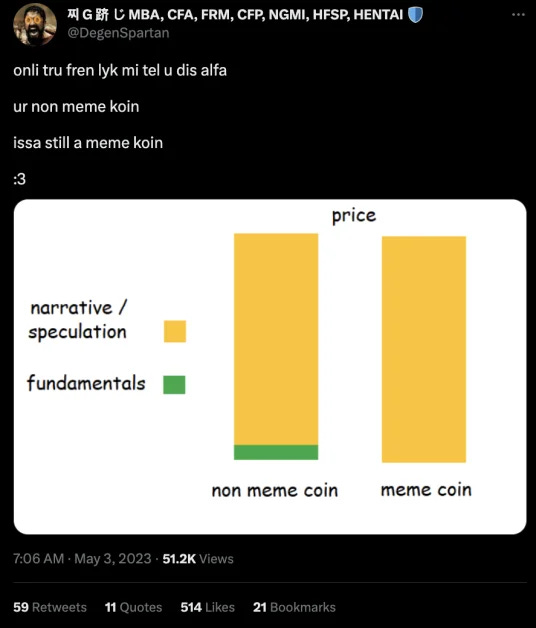

This trend will become more true if utility tokens cannot find its place in legislation. Without a token being able to carry inherent value, like stocks that give out dividends or other tangible assets, then it is no different from a meme. Like DegenSpartan said, currently the value of a token is either 95% speculation or 100% speculation.

Supercycle (real)