Market Commentary | 10.18.

Weekly Crypto Market Trends and Insights

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the October 18 edition, the following topics are covered: the announcement of the Hyperliquid token launch, shifts in Japan's interest rate hike stance under the Shigeru Ishiba Cabinet, trends in the Q3 listings on Korean top five exchanges, and the U.S. presidential election polling trends.

1. Hyperliquid Launched Its Native Token, $HYPE

On October 15, Hyperliquid announced the launch of its native token, $HYPE. Hyperliquid is a decentralized perpetual futures exchange (Perpetual DEX) with features typically associated with centralized exchanges, such as an order book system, leverage, and low trading fees. According to DeFiLlama, Hyperliquid ranks second in total value locked (TVL) among derivatives protocols, following Solana's Jupiter, and holds the top spot for daily trading volume among perpetual DEXs.

Through its official Twitter account, the Hyperliquid Foundation stated that $HYPE will play a crucial role in the team's future roadmap, including HyperBFT, the network's proof of stake (PoS) consensus algorithm, and the new Layer 1, HyperEVM, which will expand the Hyperliquid network into the Ethereum Virtual Machine (EVM) ecosystem. Additionally, users ranked within the top 5,000 in Hyperliquid points can choose to receive both the $HYPE token and the Hypurr NFT. Further details on the $HYPE tokenomics, Hypurr NFT utility, and airdrop specifics will be revealed at a later date.

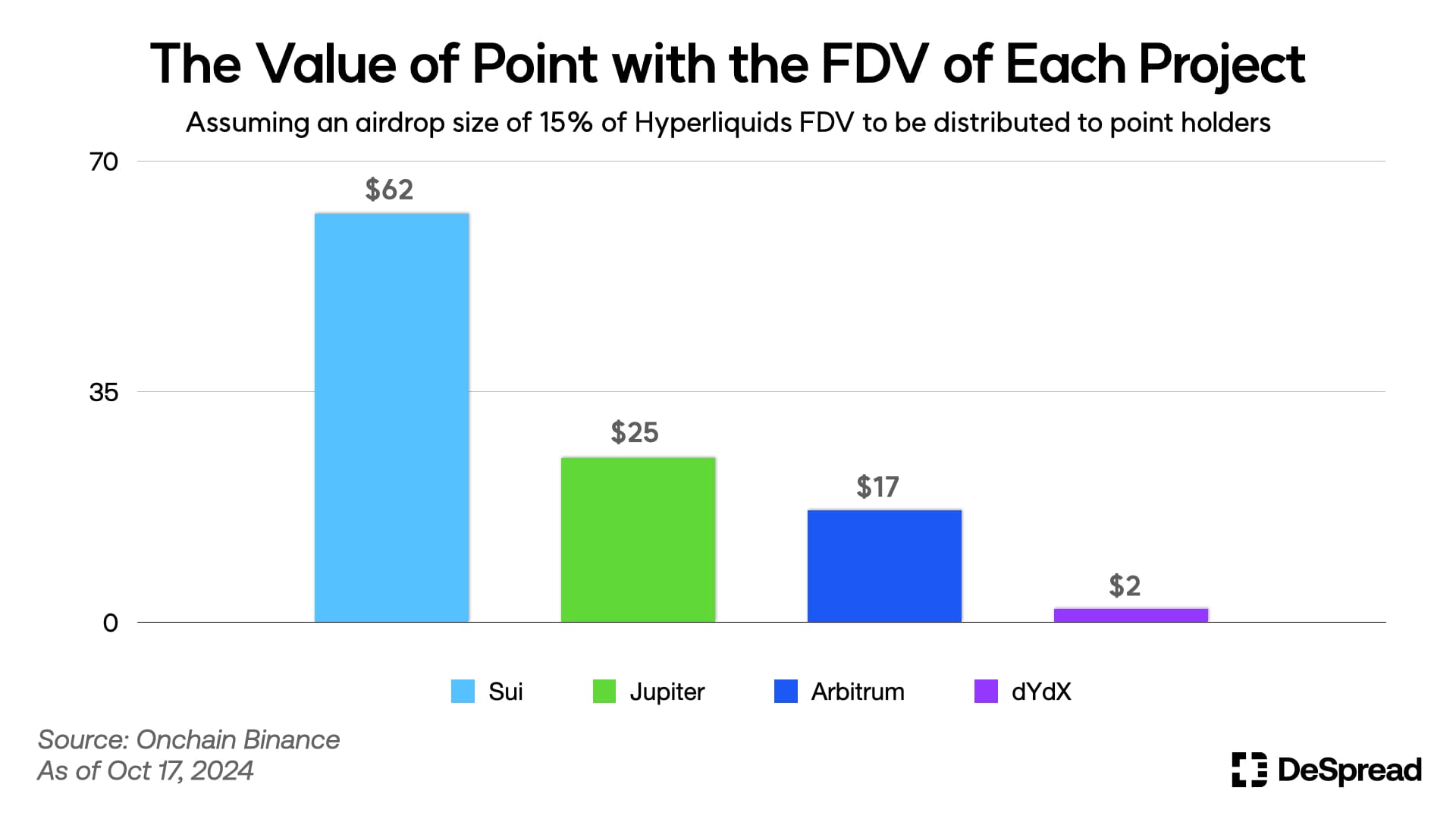

The graph above assumes the airdrop amount will be 15% of Hyperliquid's fully diluted value (FDV), and it shows the price per Hyperliquid point based on the FDV of other projects. Given that an estimated 51 million Hyperliquid points have been distributed so far, if Hyperliquid's FDV were similar to Sui's at $21 billion, the price per point would be approximately $62.

On October 16, Gate.io launched a Pre-Market OTC for Hyperliquid points, where they are currently trading at approximately $0.013 per point, based on a total token supply of 100 billion. However, it appears that the points in this market are not actual Hyperliquid points but rather points defined by Gate.io (HYP Points). Once the total supply of $HYPE and the conversion ratio between points and tokens are officially announced, the Pre-Market OTC for points will transition to an OTC market for tokens.

1.1. DeSpread’s Comments

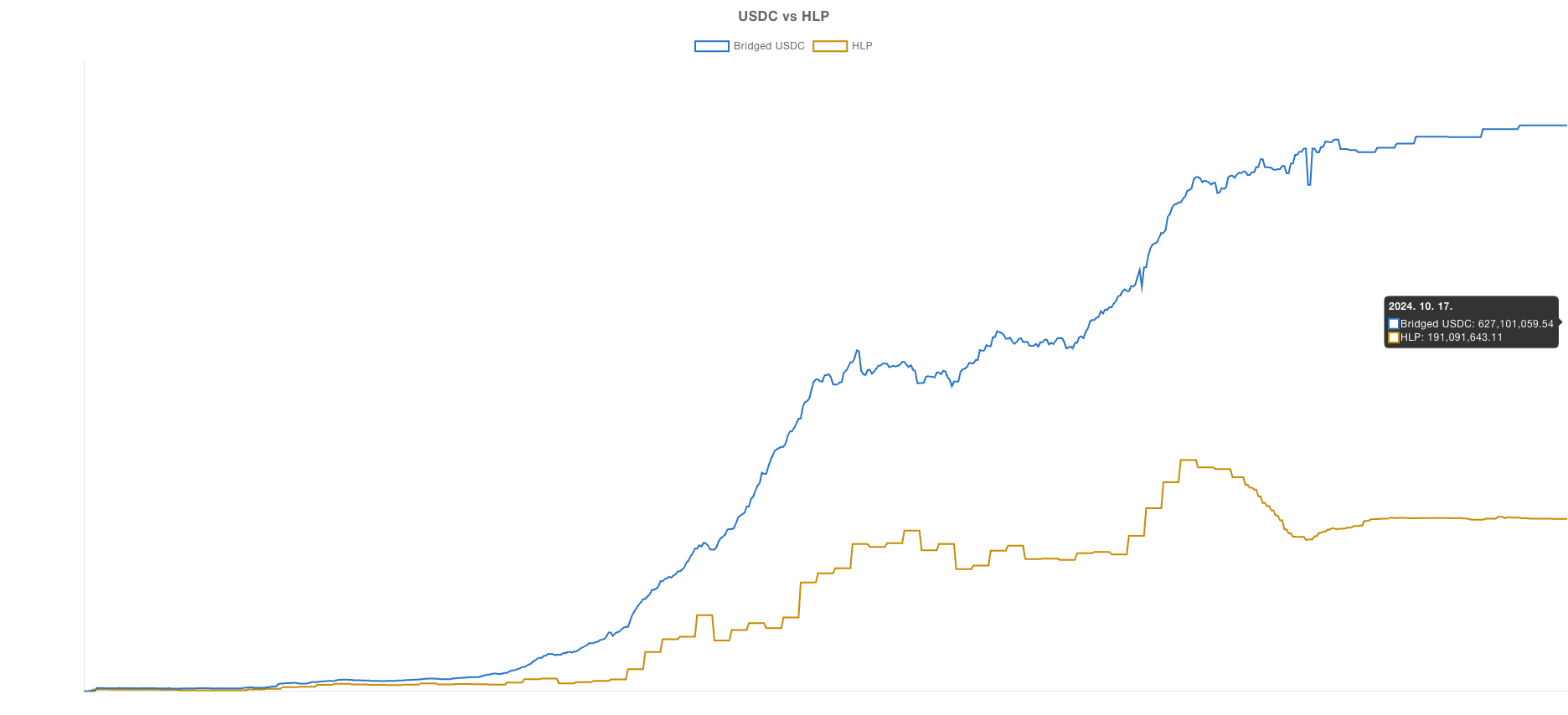

Hyperliquid has consistently demonstrated impressive performance since its launch, recording the highest trading volume among Perpetual DEXs. At one point, Arbitrum—the network used for depositing funds into Hyperliquid—gained so much popularity that a meme calling it the "Hyperliquid Bridge" emerged, due to the significant net inflows of stablecoins (USDC). This popularity has persisted even after the conclusion of Season 2 point distribution. Currently, the amount of USDC deposited on Hyperliquid has slightly increased, reaching approximately $627 million.

What’s particularly noteworthy is that despite not receiving any VC investment, Hyperliquid has maintained strong user engagement, underpinned by a solid community. In 2024, several large early-stage projects characterized by "Low MC, High FDV" received substantial private market investments, yet many fell short of expectations due to lack of demand. As these large projects delivered disappointing results, market participants grew increasingly skeptical. However, Hyperliquid is receiving positive recognition for successfully building an ecosystem without external capital.

Nevertheless, many projects have recently experienced declines in TVL, Daily Active Users (DAU), and token prices after airdrops, due to user attrition. In this context, it remains to be seen whether Hyperliquid can maintain its impressive performance post-TGE. Much attention is focused on how the follow-up incentive mechanisms will be designed and how $HYPE token’s value creation logic will be integrated into the protocol. Hyperliquid will also need to prove that it can continue to build a strong product and ecosystem without relying on large-scale investment.

2. Ishiba Cabinet Inauguration and the Shift in Interest Rate Hike Stance

On September 27, Shigeru Ishiba was elected as Japan's new Prime Minister, well-known for his long-standing opposition to Abenomics and his support for a stronger yen. Following the announcement of his election, concerns over a potential interest rate hike in Japan grew in the market, leading to a decline in the USDJPY, the Nikkei, and Bitcoin.

However, during a meeting with Bank of Japan (BoJ) Governor Kazuo Ueda on October 2, Prime Minister Ishiba took a cautious stance, signaling that the current monetary easing policy would remain in place. This sparked widespread speculation that there would be no additional rate hikes during the two remaining monetary policy meetings this year. Governor Ueda also echoed a similar sentiment during the meeting, stating that any decisions on monetary policy would only come after the 2% inflation target is consistently maintained.

Furthermore, on October 16, BoJ Board Member Seiji Adachi emphasized the need to carefully manage the gradual interest rate hike process, stating that "What we need to be careful of, in a gradual rate hike process, is that we raise it extremely gradually while keeping financial conditions accommodative” until the price trend gets to 2% (source)". This statement further pushed market expectations of an additional BoJ rate hike into next year.

2.1. DeSpread’s Comments

In July, the sudden interest rate hike by the Bank of Japan (BoJ) triggered a large-scale unwinding of yen carry trade positions, drawing continued attention to Japan's interest rate decisions. The yen is considered one of the major global safe-haven assets, and since Japan's interest rate decisions directly impact the yen's value, they play a critical role in predicting the movements of risk assets that are vulnerable to macroeconomic shifts. At this point, the strengthening of the yen could signal potential tightening of global liquidity.

Prime Minister Shigeru Ishiba has mentioned the need for rate hikes but has expressed caution, stating, "We don't think we are in an environment where further rate hikes are necessary," and "We expect the economy to continue developing while maintaining the current easing stance" (source). This cautious stance reflects the view that Japan's current economic situation is not conducive to pursuing yen appreciation and price stability through aggressive rate hikes.

In November 2023, the Japanese government announced a comprehensive economic package aimed at achieving full recovery from deflation, which includes support for low-income households and local governments, wage increases, and income tax cuts. The financial foundation for this package largely relies on the issuance of additional government bonds. In this context, a hasty rate hike could not only increase the government's debt servicing costs but also raise costs for companies, exerting downward pressure on wages. It also poses the risk of accelerating the current decline in Japan's household spending.

The key point moving forward will be whether Japan, with its primary focus on escaping deflation, can establish a virtuous cycle of economic growth by boosting household income and consumption through wage increases and employment improvement. Therefore, close attention should be paid to the direction of Japan's Core CPI, which is expected to heavily influence the interest rate decision on October 30, as well as the trends in real wages, which were highlighted in the BoJ's July 2024 outlook report.

3. Trends in Q3 2024 Listings on Korean Exchanges

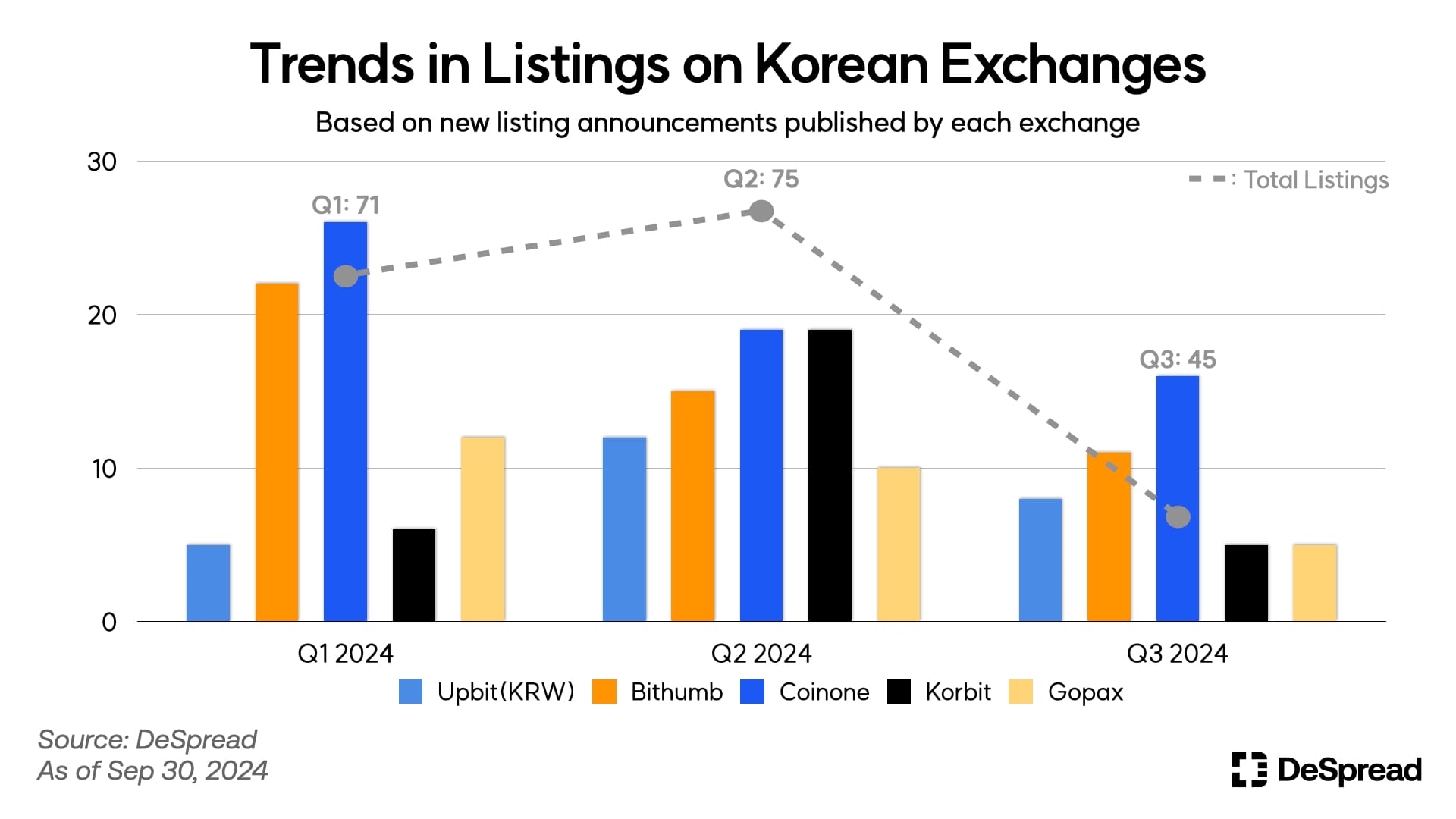

The total number of listings across Korea's top five exchanges recorded 71, 75, and 45 listings per quarter, respectively (for Upbit, the number of KRW market listings, showing a sharp decline in the third quarter.

This decrease was particularly pronounced on Korbit and Gopax, with Korbit having no new listings from July 12 through October. The change in listing trends is largely attributed to the implementation of the Act on the Protection of Virtual Asset Users (hereafter the Act on Virtual Asset), which came into effect on July 19.

With the introduction of joint listing review guidelines under this law, exchanges like Coinone, Korbit, and Gopax, which had previously relied on independent listing policies, faced significant challenges. In fact, following the regulatory changes, Coinone listed only 8 assets, Korbit listed none, and Gopax listed 2, with only Coinone maintaining a similar level of listings to Upbit and Bithumb in the third quarter.

Not only these three exchanges, but all five major exchanges in Korea have seen a decline in quarterly listing numbers, and this trend is expected to continue for the foreseeable future.

3.1. DeSpread’s Comments

Following the implementation of the Act on Virtual Asset, it was anticipated that there would be an increasing concentration of users and trading volume on Upbit and Bithumb. In reality, the Korean trading volume share of these two exchanges steadily increased, with Upbit and Bithumb holding a combined market share of 95.88% in July, 96.63% in August, and 98.05% in September. Notably, Bithumb, which had maintained a market share of around 24–25% during Q3, saw a sharp rise to over 40% in October. This growth is largely attributed to Bithumb's fee-free policy implemented since October last year, along with new promotions and an aggressive marketing strategy involving various collaborations.

Meanwhile, the joint listing review guidelines introduced under the new law include requirements such as the reliability of the issuer, user protection measures, technical security, and legal compliance. This led to predictions that memecoins without clear issuers or utility would face difficulties being listed on Korean exchanges. Contrary to these expectations, however, Upbit listed three memecoins—$MEW, $BRETT, and $PEPE—on its USDT market after the guideline’s implementation.

Although the guidelines allow for a more relaxed review process for assets without a specified issuer if they have been traded on eligible overseas markets for at least two years, none of the three meme coins listed by Upbit met this condition. Despite this, the listings were likely approved due to factors such as the presence of explorers confirming the total and circulating supply of each coin, the availability of official white papers, and the absence of security incidents over the past three years.

Regarding the reliability of the issuer, there were concerns that the lack of a clear circulation plan or business roadmap could be problematic. However, Upbit's disclosure documents for these assets suggest that even without an official issuer or business roadmap, the existence of an ecosystem (e.g., in DeFi) where the memecoin is utilized, along with a sizable community (on platforms like Telegram, Twitter, and offline communities), may suffice to meet the business plan requirements.

Another point worth noting is that all three memecoins listed by Upbit had already been listed on Bithumb. Upbit's decision to list these memecoins can be interpreted as a strategic move to strengthen its competitive position in the Korean market.

4. U.S. Presidential Election Approaching, Trump Leads Amid DeFi Project Controversy

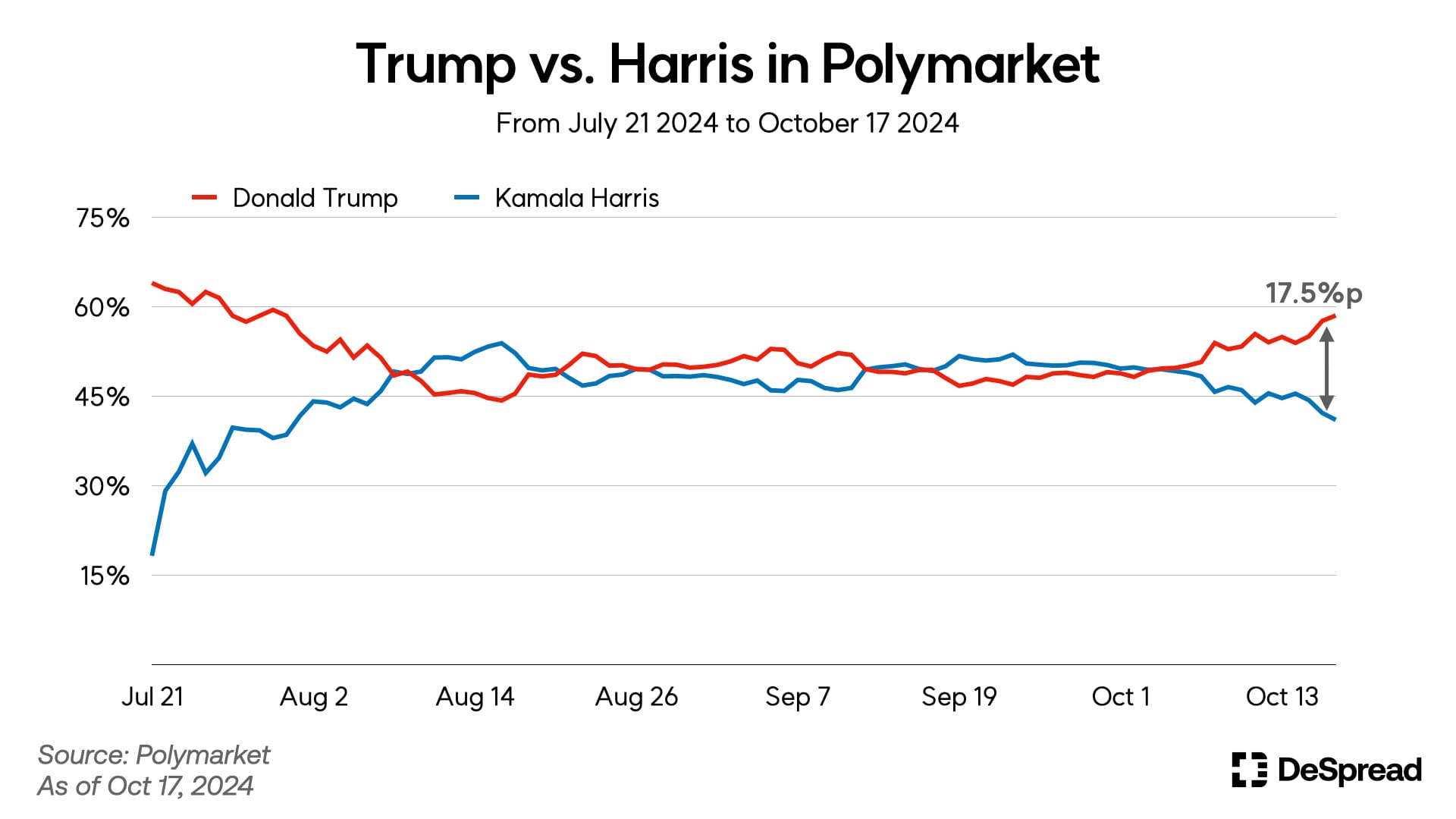

With just three weeks remaining until the U.S. presidential election, prediction market platform Polymarket shows Donald Trump's chances of winning steadily rising, reaching 58.55% as of midnight on October 17. In contrast, Kamala Harris's chances stand at 41.05%, with Trump leading by 17.5 percentage points.

According to recent polls by RealClearPolitics (RCP), Trump is also leading in key swing states such as Pennsylvania, Michigan, and Nevada. Considering that polls in both the 2016 and 2020 elections predicted a Democratic lead, yet the results were either close or favored Trump, analysts are increasingly confident in Trump's growing chances of winning this election.

Meanwhile, on October 16, the DeFi platform World Liberty Financial (WLF), reportedly linked to Trump, began selling its native token, $WLFI. Although 20 billion tokens were initially made available, only about 840 million tokens (4.2% of the total) had been sold after the first day. The project's token sale terms specify that $WLFI will have a one-year lockup period after purchase, can only be used as a governance token, does not confer economic rights, and cannot be transferred to other addresses.

Controversy has also arisen regarding whether the Trump family is directly involved in the project. World Liberty Financial's official website and gold paper state that no member of the Trump family is an official team member, with titles such as Chief Crypto Advocate or Web3 Ambassador being honorary positions. Also further scrutiny has revealed that DT Marks DeFi, LLC, reportedly owned by the Trump family, holds the rights to 75% of the project’s profits and 22.5 billion $WLFI tokens, fueling ongoing controversy.

4.1. DeSpread’s Comments

Since Biden’s withdrawal, the race between Trump and Harris has been consistently close, but recent polling shows a significant increase in support for Trump. However, polling results, especially in key swing states, remain within the margin of error, leaving the outcome of the election uncertain.

Amidst this, there is growing recognition that cryptocurrency, particularly memecoins, has become a central component of the attention economy. As the election approaches, it will be important to monitor the trends of assets associated with the candidates. Examples include betting markets like Polymarket and various Trump-related memecoins, as well as $DOGE (Department of Government Efficiency).

Trump has long been considered a pro-crypto candidate, and many market participants are hopeful that his potential election could lead to regulatory easing in the cryptocurrency industry. A key focus now is whether Trump will secure victory, and if he does, how his leadership might reshape the crypto industry.