Market Commentary | 11.15.

Trends in Top 5 Korean CEXs, the rapid growth of the memecoin sector, and Beam Chain

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the November 15 edition, we examine trends in Top 5 Korean CEXs, the rapid growth of the memecoin sector, and Ethereum 3.0.

1. Korean Crypto Market on Fire Following Trump’s Election

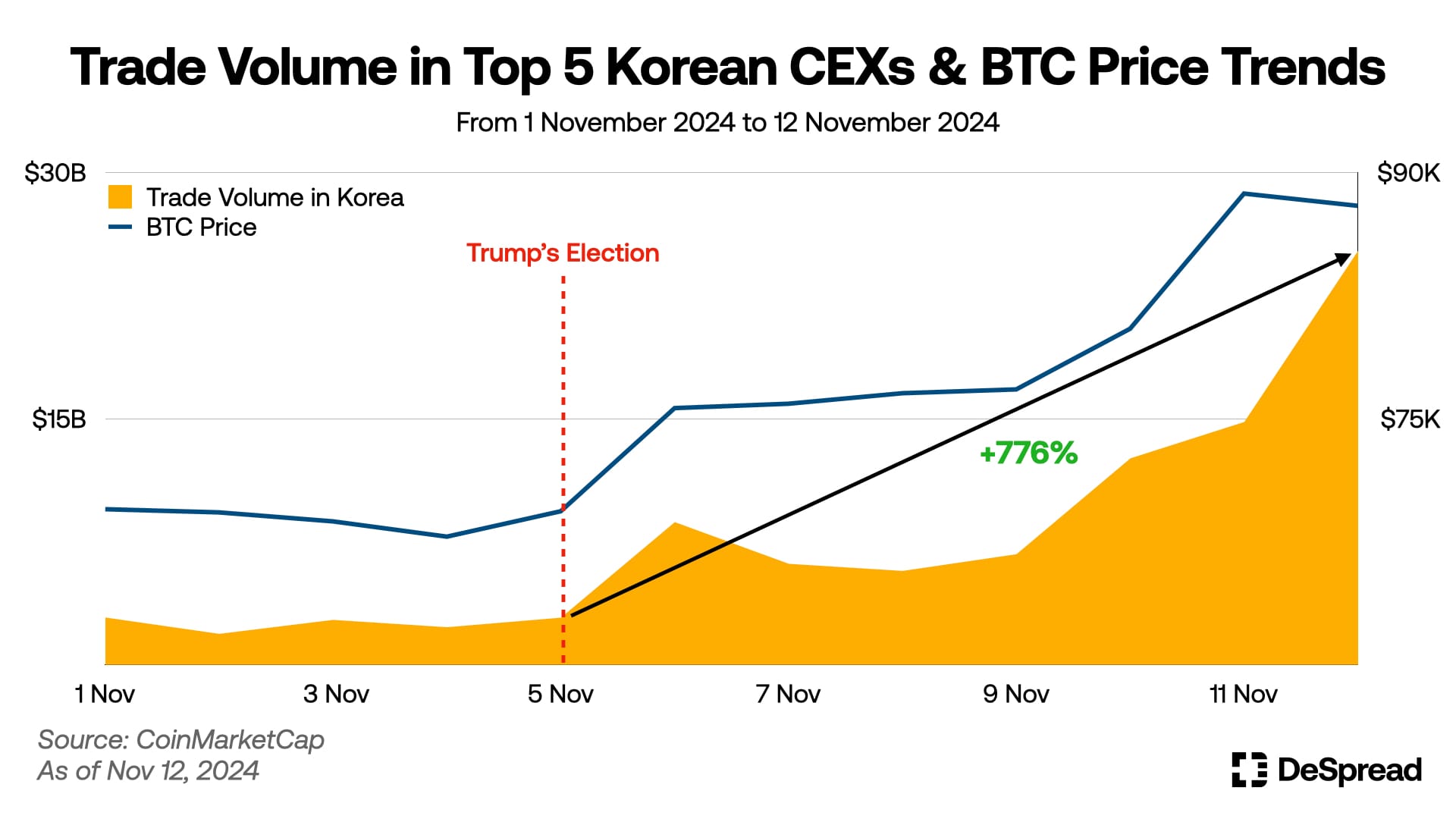

Since Trump’s election, Bitcoin's price has skyrocketed from $68K to $90K within a week, driving a surge in interest toward the cryptocurrency market. According to the chart illustrating the total spot trading volume on Korea's top five exchanges (Upbit, Bithumb, Coinone, Korbit, and Gopax) and Bitcoin price trends from November 1 to November 12, 2024, the total trading volume in Korea increased approximately 8.75 times during the week following Trump’s election, jumping from around $2.88B to $25.22B.

A report highlighted that Upbit’s daily trading volume reached about KRW 22T, surpassing the combined daily trading volume of Korea’s KOSPI (KRW 10.86T) and KOSDAQ (KRW 6.87T) markets the previous day. This shift reflects heightened investor focus on the cryptocurrency market amid rising exchange rates and declining Korean stock markets following Trump’s election.

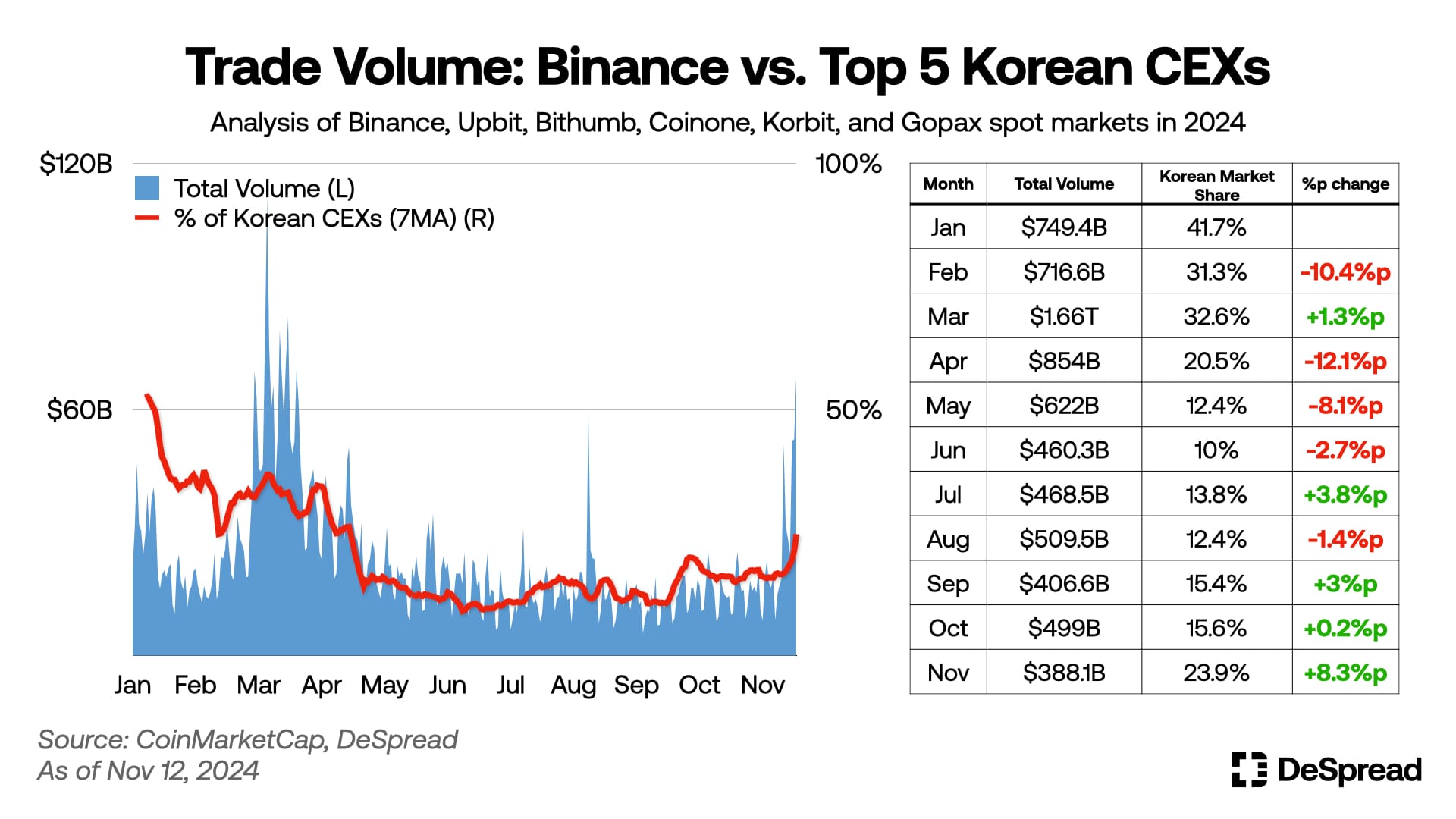

The chart above illustrates the trends in spot trading volumes for Binance and Korea's top five exchanges, as well as the market share of these Korean exchanges (7-day moving average) from January 1 to November 12, 2024. As of November 12, the total trading volume for November reached $388.1B, with the market share of Korean exchanges increasing by 8.3 percentage points from the previous month to 23.9%, marking the highest level since April.

Over the past month, the Fear and Greed Index has remained in the 'Greed' to 'Extreme Greed' range, and cryptocurrency-related applications have dominated the top ranks in Korea's iOS finance app category. This has led to concerns about an overheated investment sentiment in Korea's cryptocurrency market. However, the absolute total trading volume and the market share of Korean exchanges still fall short of the levels observed in March.

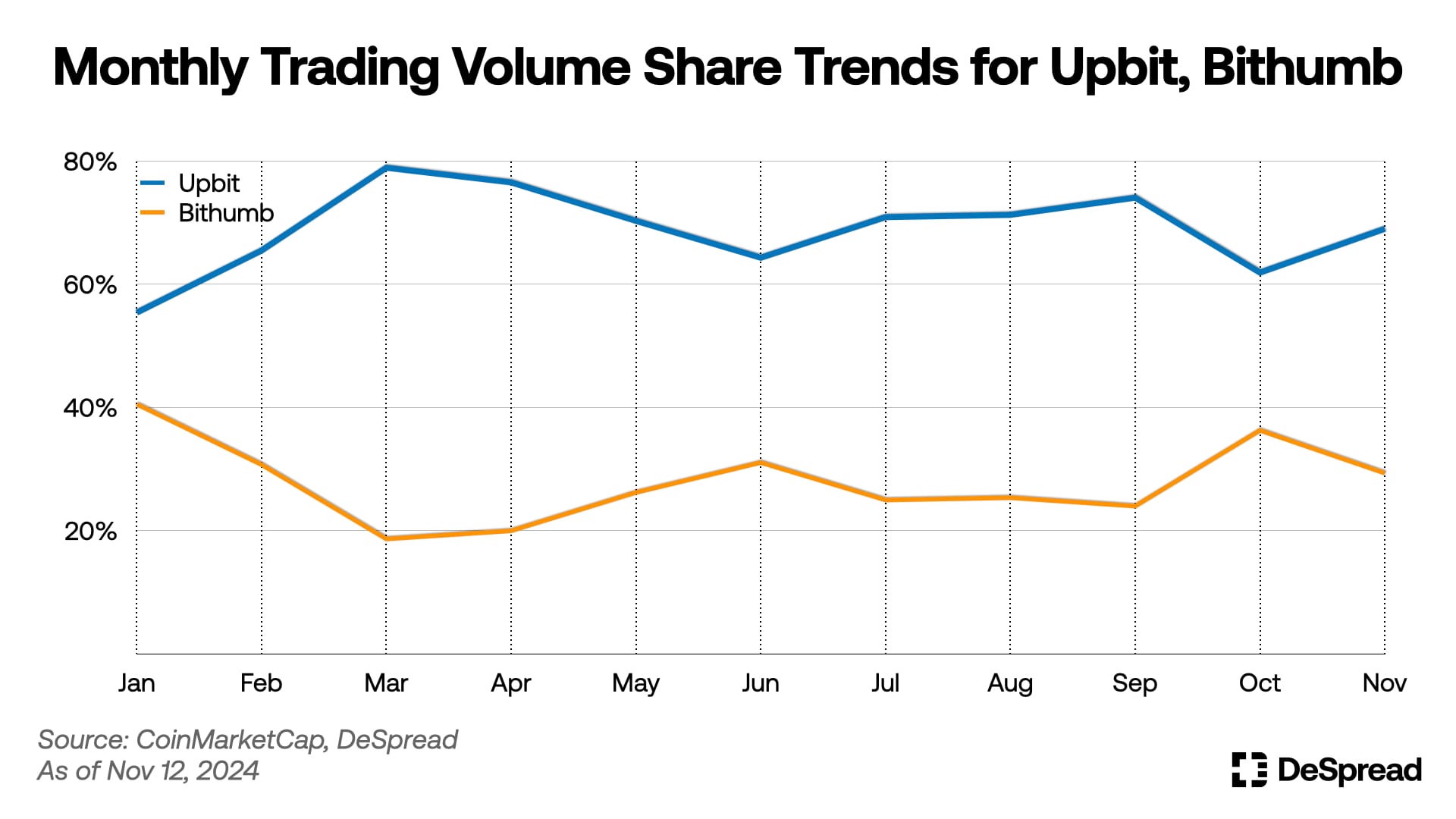

This year, a consistent trend has been observed where the gap in market share between Upbit and Bithumb widens during bullish markets and narrows during corrections or bearish markets. Bithumb has actively pursued user acquisition through strategies such as fee-free policies, aggressive listings, and marketing collaborations with various companies. As a result, it achieved an average monthly market share of 36.28% in October, successfully narrowing the gap with Upbit to 25.62%.

However, following Trump’s election, as Bitcoin prices rose and cryptocurrency trading volumes increased, the average market shares of Upbit and Bithumb in November (up to November 12) were 69.01% and 29.33%, respectively, widening the gap between the two exchanges back to 39.68%. This underscores Upbit’s strong position during bullish markets and suggests that as investor inflows increase, the gap in market share between the two exchanges is likely to grow even further.

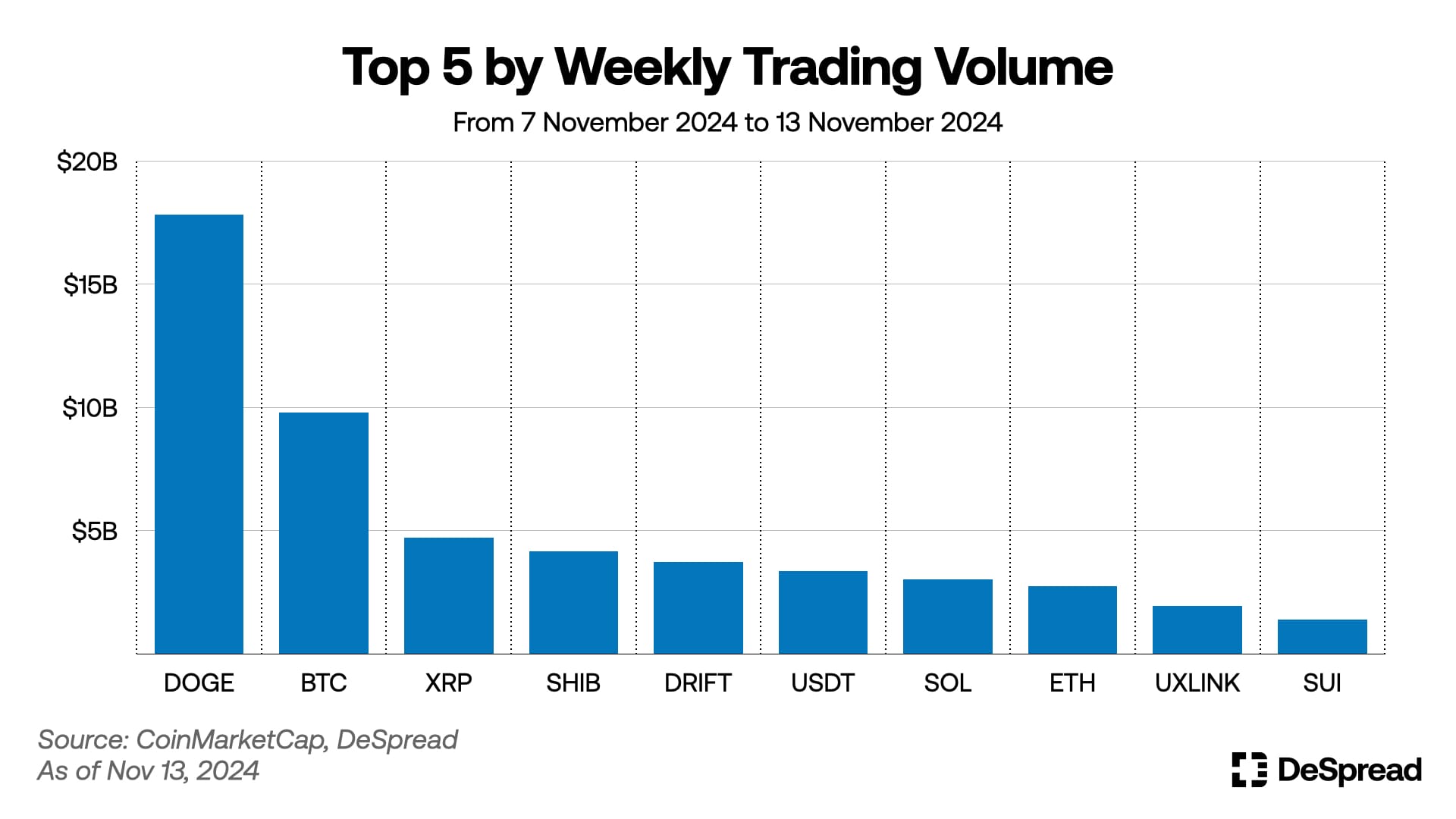

Between November 7 and 13, 2024, an analysis of the top 10 cryptocurrencies by trading volume across Korea's five major exchanges revealed that Dogecoin ($DOGE) led with approximately $17.82B in trading volume. This surge in interest is likely due to Dogecoin's status as the first and largest memecoin, coupled with its strong association with Elon Musk, who is being highlighted as a key figure in Trump's cabinet. Following Dogecoin, Bitcoin ($BTC), Ripple (4XRP)—a long-standing favorite among Korean investors—Shiba Inu ($SHIB), the second-largest memecoin by market capitalization, and Drift ($DRIFT), which was recently listed on Upbit's KRW market, ranked from second to fifth in trading volumes.

1.1. DeSpread’s Comments

Trump's election has been a pivotal moment for reigniting activity in Korea's cryptocurrency market. On November 6, the day Trump’s victory was confirmed, the total trading volume across Korea's top five cryptocurrency exchanges soared to $8.7B, a nearly threefold increase from $2.9B on the previous day. Notably, Upbit, Korea's leading exchange, saw its trading volume skyrocket from $1.66B on November 5 to $17.82B over the eight days leading up to November 12—an extraordinary 10.73-fold increase.

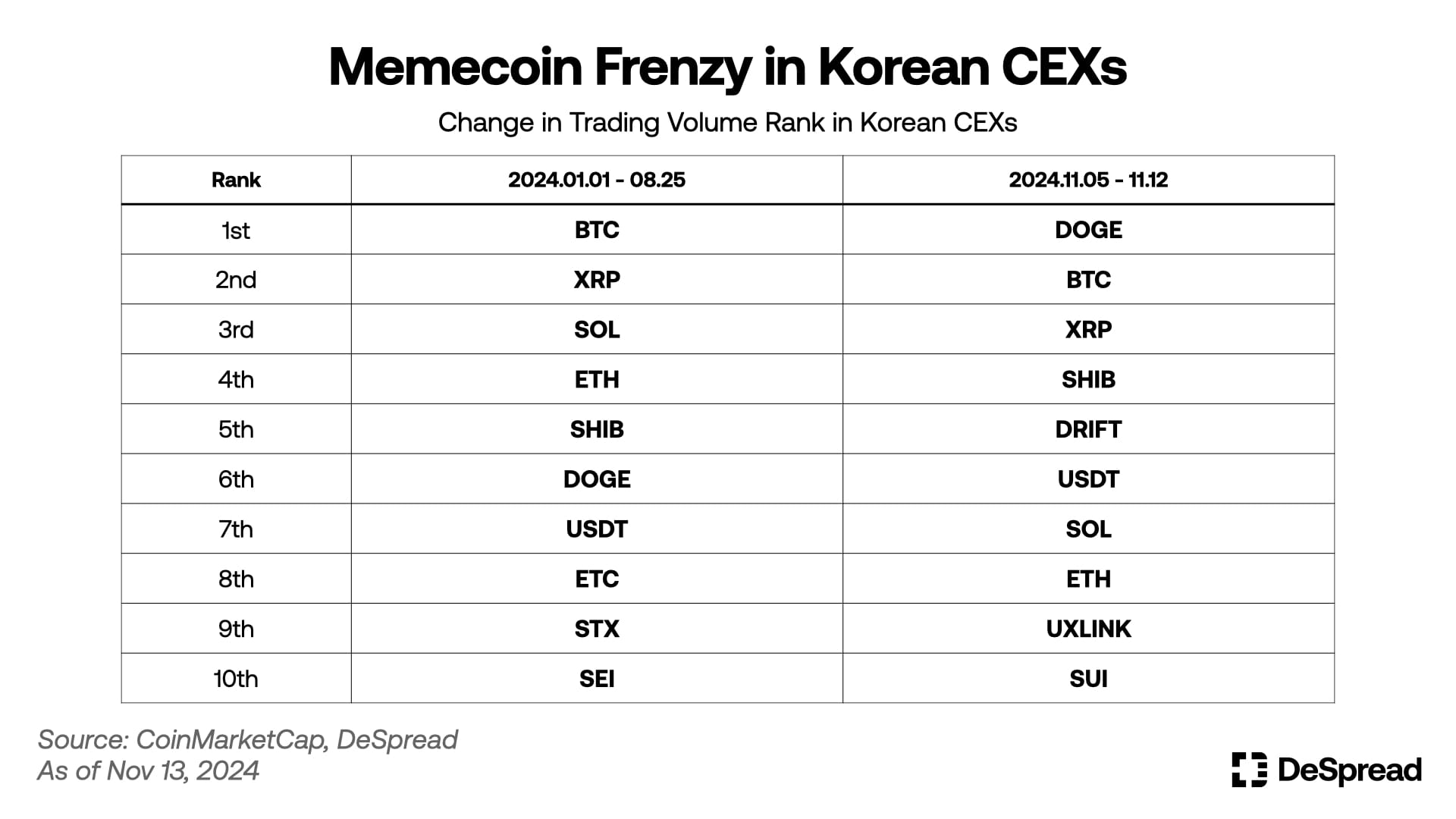

Beyond trading volume, there has been a notable shift in the sectors favored by Korean investors. According to a September 20 market commentary, the top 10 cryptocurrencies by daily average trading volume listed on Korean exchanges between January 1 and August 25 included Bitcoin ($BTC), Ripple ($XRP), Solana ($SOL), Ethereum ($ETH), Shiba Inu ($SHIB), Dogecoin ($DOGE), USDT, Ethereum Classic ($ETC), Stacks ($STX), and Sei ($SEI). At the time, Bitcoin led the rankings, followed by other high-market-cap altcoins occupying the top four spots, while memecoins ($DOGE and $SHIB) placed fifth and sixth, respectively.

However, over the past week, Dogecoin has emerged as the most traded cryptocurrency in Korea, surpassing Bitcoin by approximately 1.82 times. Similarly, Shiba Inu ranked fourth, trailing Bitcoin and Ripple, demonstrating a significant increase in interest in memecoins among Korean investors.

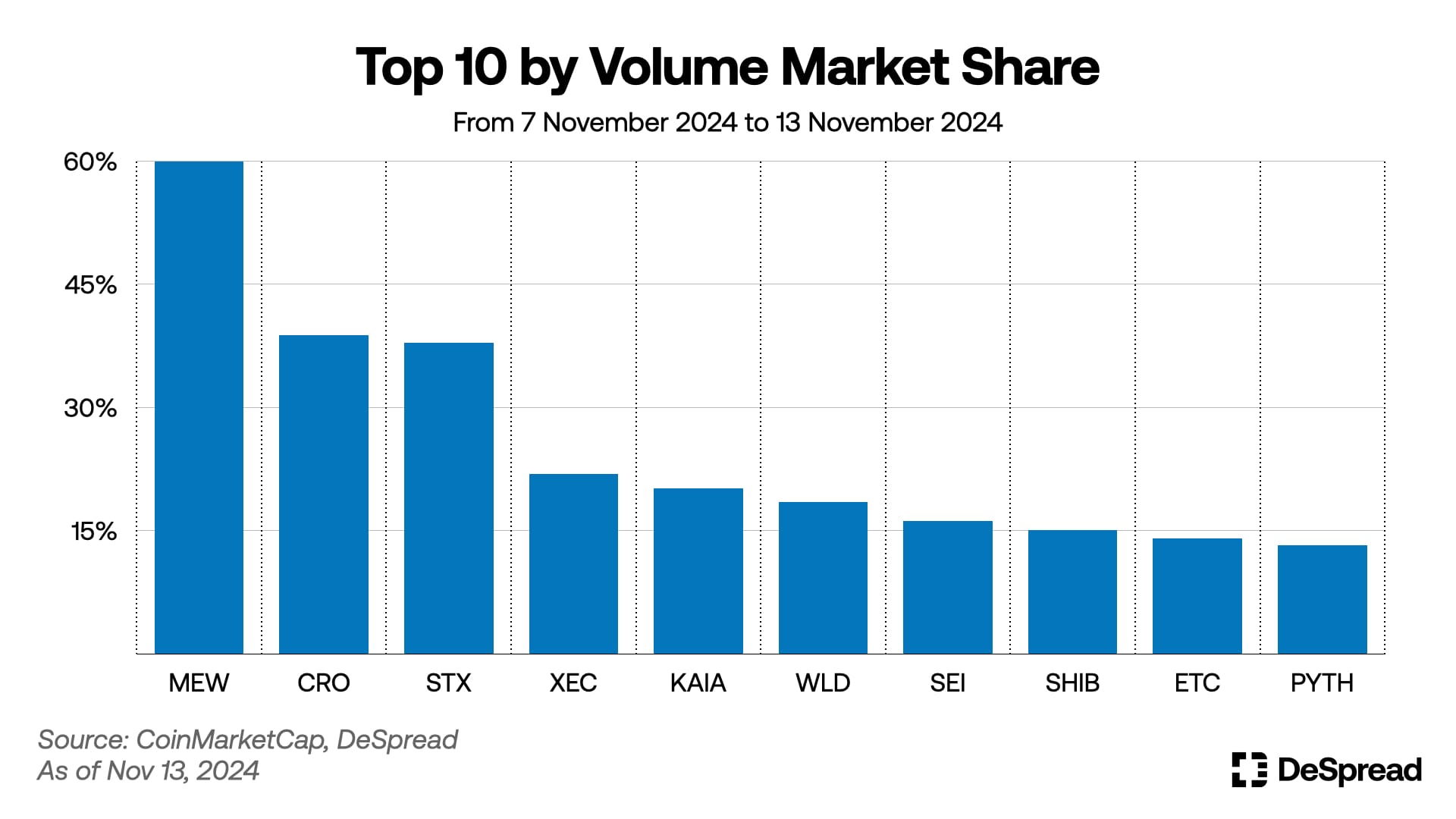

The recent trend among Korean investors favoring memecoins is evident from the proportion of global trading volumes accounted for by Korean exchanges. An analysis of the top 10 cryptocurrencies with the highest share of global trading volumes from Korean exchanges during this period reveals that the memecoin Cat in a Dog's World ($MEW), listed on both Upbit and Bithumb's KRW markets, leads the list with a dominant 60%.

Shiba Inu also ranks 8th, and while not shown in the chart, Dogecoin is positioned at 12th. This data underscores the growing preference for memecoins among Korean investors, solidifying their presence in Korea's cryptocurrency market.

Between August 20 and November 14, Upbit listed four memecoins: $BRETT, $PEPE, $MEW, and $BONK. Notably, $MEW and $PEPE began trading in the KRW market on October 21 and November 14, respectively. This proactive listing strategy indicates a growing interest in memecoins among Korean investors, expanding beyond traditional altcoins. Monitoring the future actions of Korean exchanges and investor behavior will be essential in understanding this evolving trend.

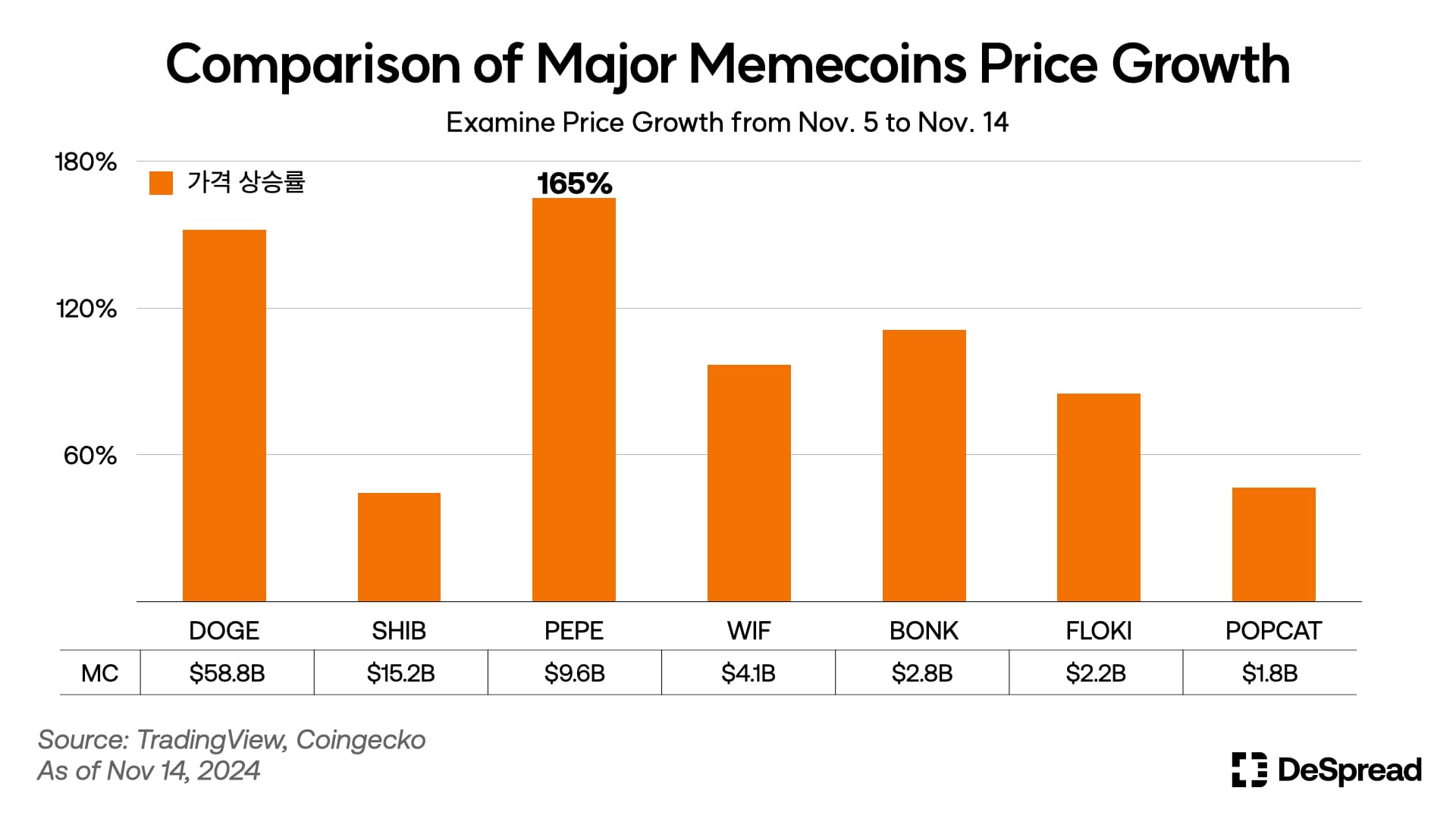

2. The Dawn of a Bull Market: Is “Memecoin Supercycle” Approaching?

The rise of the memecoin sector following Trump’s election on November 5 has been impressive. After the sharp increase in Dogecoin ($DOGE), memecoins with relatively smaller market caps compared to Dogecoin all started rallying, showing faster growth than any other sector in the virtual asset market within about ten days. From November 5 to November 14, Dogecoin rose by about 145%, signaling the start of the memecoin sector's rise. Subsequently, major memecoins such as $PEPE, $WIF, and $BONK also surged, delivering impressive performances over the week.

In particular, $PEPE experienced a rise of up to 165% by November 14, after being listed on Coinbase and Upbit. Following the listing of $PEPE, the crypto community shared lists of memecoins that could potentially be listed on major centralized exchanges, reflecting ongoing expectations for the growth and price increases in the memecoin sector.

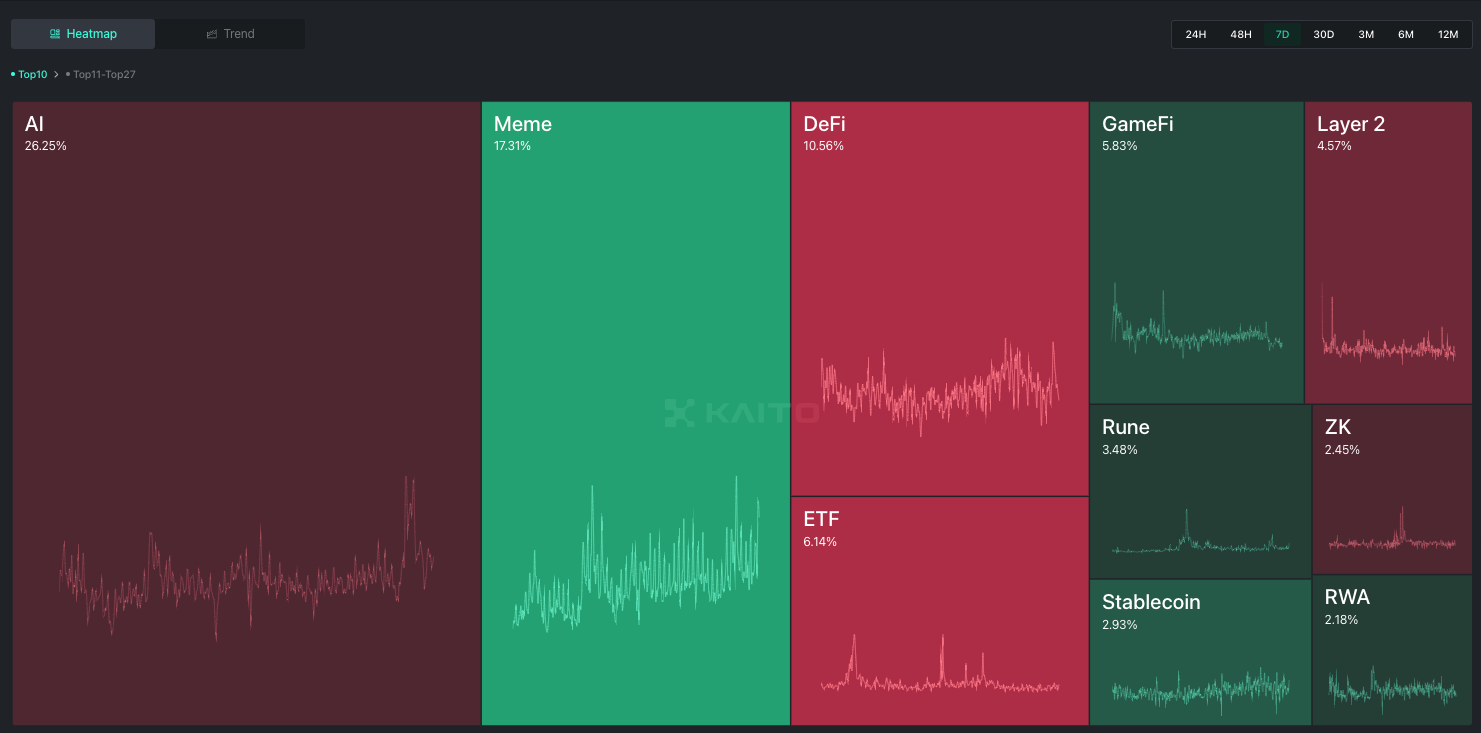

According to narrative mindshare data provided by Kaito AI, the most-discussed narratives in the crypto community over the past week were, in order: AI, memes, and DeFi. Considering the recent buzz surrounding AI agents like $GOAT in the memecoin sector, it would not be unreasonable to include the AI narrative within the broader memecoin narrative.

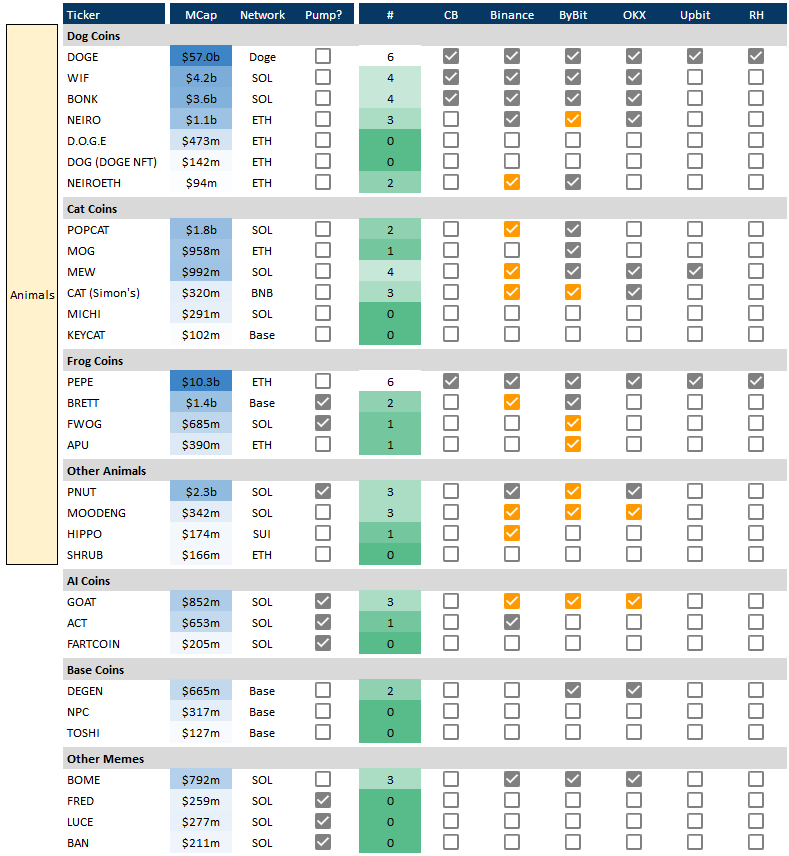

In addition to the rise of the aforementioned major memecoins, the sector continues to see remarkable growth. For example, the sharp rise in $D.O.G.E (Department of Government Efficiency) following Trump’s announcement on government efficiency, as well as $PNUT’s surge to a peak market cap of $2.4 billion alongside its Binance listing, underscores the ongoing impressive performance of memecoins.

2.1. DeSpread’s Comments

At TOKEN2049 held in Singapore this September, Murad's lecture on the "Memecoin Supercycle" gained significant attention from the industry and market participants. In his talk, Murad argued that the cryptocurrency market is shifting toward a memecoin-centric ecosystem. He explained that internally, the overproduction of new tokens and excessive initial valuations, and externally, inflation and wealth inequality are driving people toward speculative assets like memecoins. He also asserted that the essence of the cryptocurrency industry lies in tokenized communities, emphasizing that memecoins' simplicity and fun make them more appealing to investors compared to overly complex alternative coins.

As the memecoin sector continues its strong performance following Trump’s election, the industry is closely watching whether the memecoin supercycle is indeed coming to fruition. Murad predicted that as memecoins’ market dominance grows, the total market capitalization of the memecoin sector could surpass $1 trillion, with major memecoins reaching individual valuations of over $100 billion. According to CoinGecko, the current total market capitalization of the memecoin sector is approximately $120 billion, indicating that a nearly 9x price increase would be required for Murad’s projection to materialize.

Can the recent success of memecoins positively influence the development of the industry? Debates surrounding the impact of memecoin trading on the cryptocurrency sector have been ongoing since memecoins began gaining traction. Dispread Research also addressed this topic in its article, "Memecoins: Rediscovered Potential Through the Attention Economy". The discussion generally centers on how memecoins provide market participants with simplicity and entertainment, fostering strong communities. However, concerns persist regarding their speculative nature, high volatility, and lack of fundamental value, which may hinder the industry’s long-term growth.

Personally, I see the rise of memecoins as a natural phenomenon. Following Trump’s election, positive expectations for the cryptocurrency industry and Bitcoin emerged. However, blockchain technologies and products that can be immediately integrated into traditional finance or daily life have yet to materialize. It is also expected to take time for public perception of this market and technology to shift positively. Thus, it seems inevitable that memecoins, which represent attention itself, and Bitcoin, which represents the market as a whole, would garner the spotlight before technology-driven tokens.

Of course, it is undeniable that in some cases, the extreme volatility and speculative approaches within the market lead to scenes that are difficult to comprehend from a conventional perspective. However, this style of participation by market participants could perhaps represent a new standard, the so-called “New Normal.” Rather than taking an unconditionally critical stance, I believe there needs to be continuous effort to address these phenomena positively, whether through regulatory measures or voluntary initiatives.

3. Ethereum's New Roadmap: Beam Chain

On November 12th, amid the bullish market sentiment, the annual Ethereum Foundation conference, Devcon, was held in Bangkok, Thailand. Devcon is an event where builders in the Ethereum ecosystem gather to share and exchange information about the latest technologies and projects they're developing. It's also a venue where one can learn about Ethereum's present state and future roadmap through speeches from key figures in the Ethereum ecosystem.

Justin Drake, a prominent figure in the Ethereum Foundation, generated significant market interest before the event by announcing on his X account the day before, stating he would "reveal the most ambitious plan I've ever prepared on tomorrow's Devcon main stage." He teased a proposal for a new form of Ethereum consensus layer roadmap.

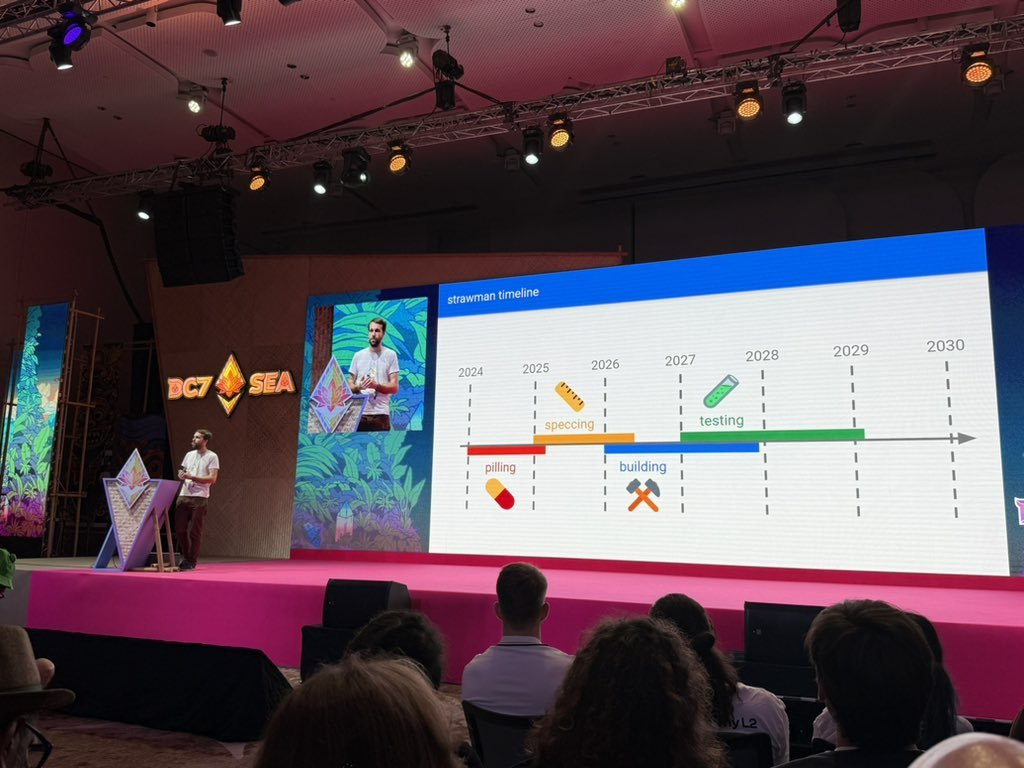

On the day of the event, Justin Drake proposed upgrading the Beacon Chain—which has been operating as Ethereum's consensus layer for the past five years—to a new form of consensus layer called the Beam Chain, incorporating advanced technologies that have emerged since the Beacon Chain's introduction.

Justin Drake's Beam Chain proposal includes the following detailed improvements:

- Strengthening censorship resistance and decentralization by separating block production and block selection roles

- Reducing the required ETH for network staking from 32 to 1

- Shortening the slot time (block generation time) from 12 seconds to 4 seconds, and achieving block finality within 3 slots

- Enhancing security against quantum computing by introducing hash-based signatures and zk-SNARK technology

While Drake's proposal contains groundbreaking content that strengthens the security of Ethereum's consensus layer while improving the network's overall efficiency, it also included a lengthy development period of approximately 5 years from detailed design to development, testing, and actual implementation. This long-term roadmap has failed to generate positive market reactions.

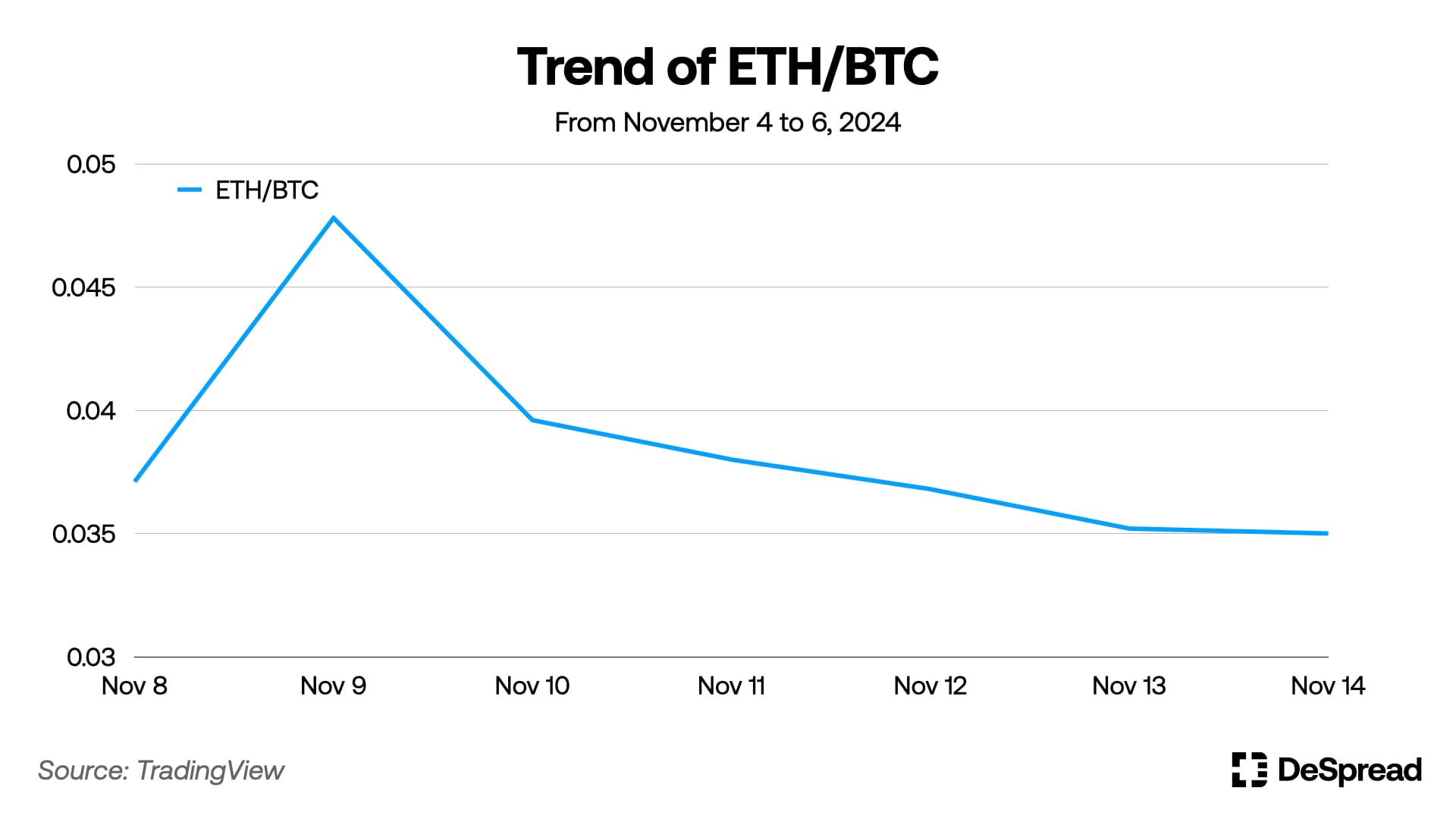

After the Beam Chain announcement, criticisms of the Ethereum Foundation emerged, such as "By the time Beam Chain is implemented, its technology will be outdated, and another consensus layer will be needed" and "The Ethereum Foundation should also know how to make Ethereum's vision more appealing." On the day of the announcement, while BTC's price showed strength with a 2.7% increase, ETH's price actually declined by approximately 1.7%.

3.1. DeSpread's Comments

As discussed in our previous commentary, the cryptocurrency market entered a bullish phase following Trump's victory in the U.S. election, with Ethereum and Ethereum-based ecosystem tokens showing significant rebounds. However, the bull market centered around Ethereum and Ethereum-based tokens didn't last long due to the rise of networks like Solana and Sui, and the anticipation of a memecoin supercycle as discussed above.

The Beam Chain proposed by Justin Drake contained improvements that largely aligned with Vitalik Buterin's previously proposed roadmap, including increased block generation speed, strengthened censorship resistance, reduced staking requirements, and the introduction of 3-slot block finality. However, in the midst of highly volatile bull market conditions, it was inevitable that ETH holders who had been waiting for Justin Drake's announcement since the day before Devcon would express disappointment at the proposed 5-year development period.

Meanwhile, there were also voices supporting Ethereum's approach. AbstractChain developer Cyggar (@cyggar_) defended the Ethereum Foundation's stance through his X account, using the analogy that "Ethereum is like an airplane full of passengers," suggesting that while development time could be shortened by halting the chain or starting over, Ethereum cannot do so.

It would be much easier to make these changes if the chain could be down or restarted from scratch (plane landing), but you can't do that because there are so many people/applications that depend on ethereum working as it always has..

this is why it takes a long time for changes to go live - they happen mid-flight and they need to be incredibly battle tested to prevent catastrophic issues.

Excerpt from Cyggar's tweet about Beam Chain

The DeSpread Research also highly values how Ethereum has developed its network while maintaining maximum security and decentralization, and partially agrees with Cyggar's opinion. However, we believe that Ethereum and the Ethereum Foundation's approach of excessively prioritizing "security" and "decentralization" needs some improvement going forward. This is because token price is not only the most important indicator in the current crypto market community, but ETH price appreciation is also closely related to the security of networks with PoS (Proof of Stake) structure, beyond just investors' aspirations.

References

- Declan, DI - 07: Market Commentary | 09. 20., DeSpread Research

- Declan, Memecoins and Attention Economy, DeSpread Research

- @0xRamenUmai tweet

- Devcon SEA | Mainstage - Day 1