Perpetual DEX Part 1: The Significance of Decentralized Perpetual Futures Contracts

The Significance of Decentralized Perpetual Futures Contracts

1. Decentralized Perpetual Futures Contract

The decentralized perpetual futures exchange (Perpetual DEX) built on the blockchain has a long history leading up to its inception.

Forward contract -> Futures contract -> Perpetual futures contract -> Decentralized perpetual futures contract

Since ancient times, humans have produced food through agriculture and livestock, and in the face of the vastness of nature, we have been powerless to predict the future of the food to be produced. Therefore, producers and consumers decided to eliminate the uncertainty of the future by entering into a “Forward Contract”, which fixes the price of the future trade at the present time.

Forward Contract: Elimination of uncertainty in the future

While the risk of unforeseen disasters was eliminated, there remained the risk of the counterparty defaulting on the contract or running away with the goods. To eliminate this risk, a reliable intermediary (clearing house) was necessary, and forward contracts between buyers and sellers under the rules of the intermediary developed into futures contracts.

Futures contract: Elimination of uncertainty in the future, counterparty risk

Since then, futures contracts have become primarily a means of trading price fluctuations of assets held by hedgers who want to hedge against price risk, speculators who want to bet on the price of a particular asset, and market makers who facilitate smooth trading between these two parties. None of these three parties enter into a futures contract to actually buy or sell goods. However, due to the nature of futures contracts, which were created to facilitate trading at a predetermined price at a future specific point in time, there has always been an expiration date in the contract and it has always been necessary to settle the contract in cash at each expiration and then re-contract (rollover) thereafter.

Motivated by the desire to eliminate the inconvenience of rollover for those who have no intention of exchanging the underlying asset at maturity, BitMex, a cryptocurrency trading intermediary, launched Perpetual Futures Contracts in 2016. The difference in the price of the underlying futures, which may not converge due to the absence of expiration, is resolved through the funding rate. This type of contract is a new form that has not been attempted in traditional finance, and is uniquely utilized in the crypto market.

Perpetual futures contract: Elimination of uncertainty in the future, counterparty risk, rollover risk

So far, the problems solved by perpetual futures contracts are (1) uncertainty in the future, (2) counterparty risk, and (3) rollover.

And now, we expect to be able to further solve three problems through the use of distributed ledger technology and smart contracts: (4) intermediary risk, (5) intermediary costs, and (6) unbanked.

1.1. Intermediary Risk

Throughout history, humans have experienced numerous financial crises and economic recessions due to the asymmetry of information, with financial institutions using excessive leverage under the pretext of capital efficiency, resulting in bankruptcy or accounting fraud. Even though regulatory institutions try to limit the risk of asymmetry of information through capital ratio regulations and disclosure obligations, the shield eventually collapses due to new challenges. This has been seen countless times in the past. Even the recent CeFi bankruptcies and exchange accounting frauds in the crypto market are ultimately caused by the asymmetry of information of centralized entities.

One of the risks that can arise from information asymmetry is the risk of intermediaries (exchanges) intervening in the trades of users. Currently, traders using centralized exchanges have no idea what is happening in the order book managed by the intermediaries. It is impossible to know whether the liquidity existing in the order book is contributed by other traders or market makers according to market principles, or whether the intermediaries are displaying false liquidity at will. In addition, it is not possible for traders to know whether they are indirectly incurring losses due to front running by intermediaries in their trades.

On the blockchain, all transactions are recorded in blocks without any omission, and once a block is generated, it cannot be modified. Anyone can check the contents of the transactions that occurred in that block. Therefore, all transactions are conducted transparently, minimizing information asymmetry.

In other words, if we use smart contracts that cannot be revoked on the blockchain, we can perform transactions without the risk of counterparties, as long as the trader stores their own funds and there is no third-party intermediary.

1.2. Intermediary cost

The use of decentralized ledger technology and smart contracts enables safe transactions without intermediaries, resulting in no intermediary costs. This technology also minimizes the number of people involved in the process, reducing inefficiencies due to technological development and creating added value.

Of course, as digitalization of futures contracts has progressed in the 21st century, the reduction of intermediary costs in futures contracts may be minimal compared to other financial services such as decentralized borrow & lending. However, compared to the traditional model where transaction fees are entirely attributed to intermediaries, decentralized application models that classify transaction users as contributors to the protocol and grant them ownership of protocol benefits can maximize cost reduction effects.

1.3. Unbanked

“Unbanked” refers to people who are either restricted in their access to bank accounts or do not have them at all. There are still more than two billion unbanked people in the world, and the majority of them are simply unable to access various financial services due to a lack of infrastructure in their countries. This lack of infrastructure is also caused by intermediaries and information asymmetry issues.

Decentralized financial services based on distributed ledger technology and smart contracts do not require such infrastructure. They are open and accessible to everyone, making them available to unbanked individuals as well.

Until now, we have described the history of decentralized perpetual futures contracts, which were developed to solve various problems starting from forward contracts. This is not a random, demand-free expansion.

By concluding decentralized perpetual futures contracts using distributed ledger technology and smart contracts, we can build an infrastructure that minimizes various inefficiencies and risks. And the platform that provides this infrastructure is a decentralized perpetual futures exchange (Perpetual DEX).

Of course, it is not yet possible to trade completely risk-free on DEX. There are still a small number of market participants in the early market, and various forms of wrongdoing, such as code abuse and hacking, may occur.

To fully utilize the advantages of transparently disclosing all information using blockchain and smart contracts in decentralized applications, it is necessary not only to enhance the security of the code, but also to onboard more market participants and establish a system for maintaining order in the market.

2. Current state and challenges of Perpetual DEX

In 2022, before awareness of the risks of intermediaries in the crypto market increased, centralized exchanges (CEX) were the main places for trading spot and futures. Based on user interfaces such as order books, which could be seen in the traditional stock market, CEXs were the first to solve liquidity and utility problems in the crypto market.

Crypto market participants did not feel attracted to the transparency of the blockchain or the intermediary-free services. Instead, centralized exchanges were perceived as centralized entities that were regulated by the state and were expected to take responsibility for problems such as hacking or misdeposits. Therefore, market participants chose the stability of centralized exchanges and entrusted their cryptocurrency to trade.

And when problems actually occurred, FTX not only refused to take responsibility for the trust, but also used the users’ funds at will and threw them away. Currently, users are in a very unclear state as to whether they can receive protection under the boundaries of laws and regulations.

As a result, the recent Flight to On-Chain phenomenon has been observed among many individual and institutional investors, and non-custodial wallets and DEXs are receiving more attention than CEXs.

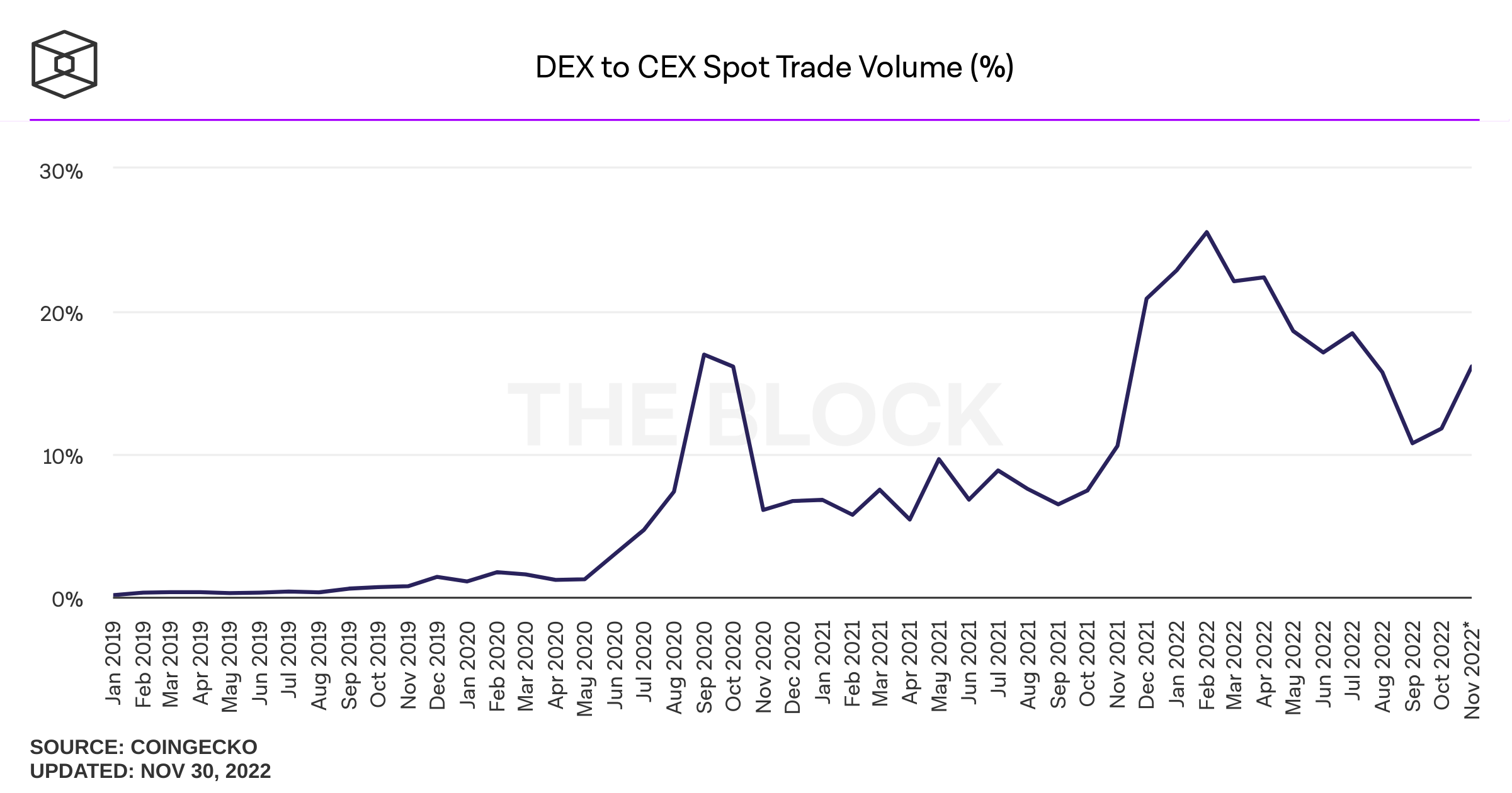

2.1. Spot Trade Volume in DEX

In the spot trading market, we can see that the market share of DEXs is steadily increasing, with Uniswap, Curve, and PancakeSwap as the main players.

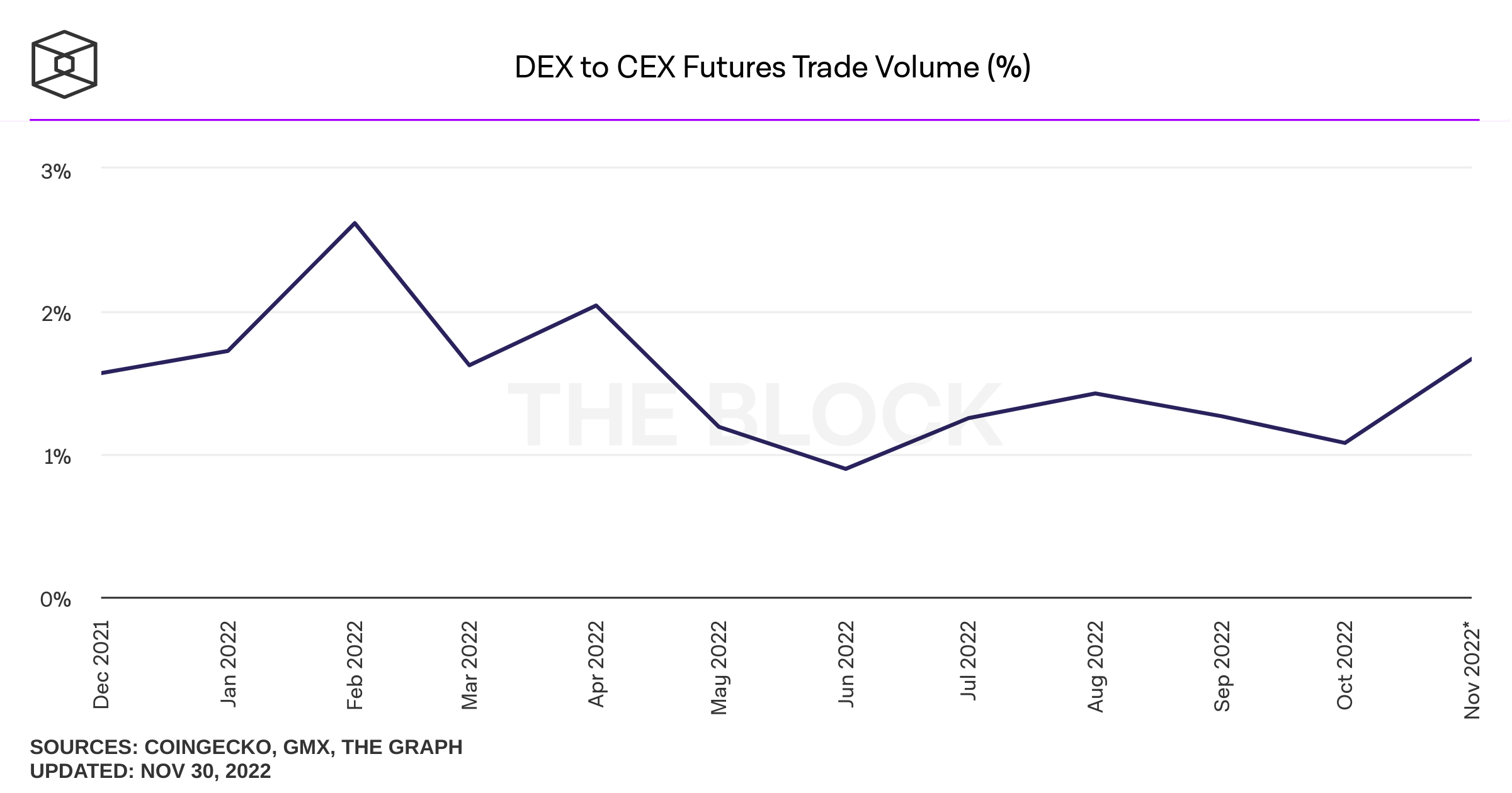

2.2. Perpetual Trade Volume in DEX

In the crypto market, futures trading has also surpassed spot trading volume, with futures leading and driving spot prices. However, the market share of DEXs in the futures market is still only around 2%, with centralized exchanges (CEXs) still dominating.

Of course, as time goes on, centralized custodial institutions like CEXs will be regulated and users’ assets will be protected. At that point, users will have to decide whether they want to be responsible for their own assets in a transparent blockchain world or whether they want to be protected by intermediaries and regulatory authorities.

In other words, the roles of CEXs and DEXs will evolve in different directions, and especially in the current situation, DEXs should take advantage of the strengths unique to DEXs and increase their market share in the futures market.

It is impossible for DEXs operating on blockchain to keep up with the speed of CEXs that use central servers. Blockchain was not designed to improve speed, and the approach of trying to compete with CEXs in speed will only result in DEXs remaining inferior to CEXs.

Therefore, assuming that centralized custodial institutions that are protected by regulation are completed, there are several areas where DEXs should focus on and outperform CEXs, in addition to transparency.

2.3. Composability

Composability refers to the leveraging of the functions of multiple projects to maximize use cases. In particular, the decentralized world, where a variety of projects based on open source are spread out, is specialized in combining forces to create new innovations using each other’s innovations. In fact, you can see many cases where a particular DeFi protocol provides financial services that leverage a specific asset or pool created by another protocol.

For example, there is Arrakis Finance, a protocol that leverages Uniswap V3, and provides an ALM (Automated Liquidity Management) service that automatically rebalances to ensure that the range of concentrated liquidity provided by Uniswap does not exceed. Furthermore, if a platform appears that allows you to deposit and lend derivative products that follow the price of Uniswap V3 LP tokens, you can sell LP tokens, which have an inherent option selling position, to provide option buying positions for various tokens, which creates a completely new service. In this way, the composability is the main feature of an on-chain environment that allows anyone to freely and easily lead unlimited potential innovation, and a perpetual DEX must also take advantage of this feature.

Some examples of composability that can currently be found on perpetual DEXs include the use of the Perpetual Protocol to leverage Uniswap V3 LP positions to build a maker position in futures trading, and recent demand to leverage GMX’s liquidity provider positions (GLPs). The extent to which such composability with various protocols is utilized will likely be a key competitive advantage that only DEXs can achieve.

2.4. Granting platform ownership to users

So far, it has been perceived as a trade mining reward for simple liquidity bootstrapping, but this concept needs to develop in the direction of being a community member who has the right to own one decentralized platform (such as governance power and protocol profit attribution rights) as well as paying fees to use the exchange. This concept is also in line with the concept of “Web3” and the idea that platform users also own the platform.

Profits generated on CEXs are taken by a limited group of CEX insiders, but profits generated on DEXs are distributed to all contributors to the DEX ecosystem, including users who use the exchange.

Of course, the profits of existing token holders may be compromised by newly issued tokens that are distributed to users as rewards. Therefore, the new issuance should be distributed to both existing holders and users in a way that does not compromise the profits of existing holders, and the token economy should be properly set in terms of (1) the distribution ratio and (2) the distribution amount in relation to protocol revenues. As a result, transaction fees may be higher than on CEXs, but a structure can be created in which ownership is distributed as compensation for the difference and existing holders do not suffer any losses.

One of the things to be most careful about is that the value of newly issued tokens may exceed the revenue generated by the platform. There are examples where the value of newly issued tokens from the perpetual DEX, dYdX has accumulated long-term losses for token holders by exceeding the protocol revenues. Of course, every business experiences a J-curve of recording losses for initial bootstrapping, but the problem of who will bear the cost at any given time can lead to a death spiral between users, existing holders, and the platform, in which no one wants the token at that time. This situation should be avoided.

3. Classification of Perpetual DEX

Perpetual DEXs can be classified into three categories based on their price discovery mechanism.

3.1. AMM Model

It is a market making system where asset prices are automatically determined by the x*y=k formula as a price discovery mechanism that has developed independently in the cryptocurrency market and created use cases. It is easy to create a trading market without specialized market makers, making it most advantageous for bootstrapping new trading assets.

However, unlike Uniswap’s spot AMM, in the case of perpetual trading, a virtual AMM is used that is based on the assumption that the nominal amount was traded in the AMM, not because the spot is exchanged.

In the initial model, it aimed to achieve extreme capital efficiency in futures trading by using a fully virtual AMM curve that only required collateral for the trade, without LP. However, as AMM futures exchanges are not market leaders in shaping market prices, it has struggled to set a virtual K (market depth) that follows market prices, ultimately incurring incentive costs that surpass the benefits of capital efficiency by having to pay for profit-taking traders. Over the years, AMM has tried various solutions to this problem and found that one of the ultimate solution is Real liquidity, not Virtual liquidity.

Therefore, it has begun to introduce LP as network participants to receive actual liquidity from the outside, partially sacrificing the capital efficiency of the initial model, and are attempting to solve the problem using virtual AMM in a form that leverages real liquidity.

Currently, the main perpetual DEXs based on AMM are the Perpetual Protocol and the Drift Protocol, and emerging projects include SynFutures and Rage Trade.

3.2. Oracle Model

This is a model that leverages the price data of market leaders, who determine the market price based on high trading volume, to provide an futures trading service without having a price discovery mechanism of its own. Therefore, there is no cost to narrow the gap between the price on DEX and the market price, and even all positions are settled at the Oracle price at the time of trade, which presents an attractive zero slippage to takers.

However, the maker must bear the risk of zero slippage given to the taker. For example, there is a risk of exploit in which someone manipulates the Oracle on an external exchange while trading with zero slippage on an Oracle-based perpetual DEX, and it is difficult to on-board liquid long-tail assets from this. Therefore, a suitable reward must be provided to the maker to compensate for this risk, and the reward pool is created based on the trading volume, so the hurdle of the chicken and egg problem (liquidity and trading volume problem) is relatively high.

Additionally, because prices discovered from external sources are used for the trading, this Oracle-based perpetual DEX cannot theoretically be a market leader in leading market prices due to this limitation.

It is a project that is closer to a margin trading DEX rather than a perpetual DEX, but GMX is currently a representative project that provides leverage trading based on the Oracle model. GMX is known for overcoming the chicken and egg problem by providing a taker-friendly zero slippage experience and sufficient rewards for makers produced by high trading volume, and showing organic growth.

3.3. Orderbook Model

This is a model that uses the orderbook that is most familiar to all existing capital market participants as is. Therefore, it has maintained the highest trading volume market share in the perpetual DEX market for a long time, and is also maker-friendly as market making is possible at the desired price for favorable prices, while also being liquidity-rich due to institutional funds seeking to create alpha through professional market making.

However, due to the nature of the blockchain, where transactions are settled in blocks, it is not possible to perfectly capture all maker orders that come and go on the order book on the on-chain. Therefore, there are currently no projects that support a completely transparent “decentralized orderbook”. Thus, the orderbook itself work on the off-chain and only on-chain supports the execution and settlement of trades are supported on the on-chain.

Each model, such as AMM, Oracle, and Orderbook, has its own strengths and limitations, as well as a roadmap for solving problems. It is currently unknown which model and protocol will emerge as the winner. It is even possible that there will be no winner. However, observing how the still-emerging derivative product DEX industry develops and studying the history together while trying to identify the winner has enough value, and there may also be hints about Alpha.

For the next part, we will delve into the each models and the projects that represent the model.