Crypto Funds pitching to the community? Feat. SushiSwap

Interesting case from SushiSwap’s Strategic Investment

1. Introduction

Funding is important to the growth of any startup. Right investment can drive the company a long way. By efficient capital injection and allocating to where it is needed, a startup can find more room to grow.

Venture capitals or accelerators make investment in companies with potential and support their expansions throughout the business.

The investment market in the blockchain is not so different from that of more traditional markets. Crypto funds with strong networks and human resources in developers and analysts find startups with potential still in early stage and help them by raising funds. However, such deals are made privately beyond the closed doors, not in the open.

Of course, traditional investments are made in the same way. But what’s so different in the crypto market is that transparency and decentralization are highly held to be the industry’s core values.

It’s true that some excellent investment firms add real value by tapping into their networks and providing other useful resources while the project could wholly focus on team building, development and user acquisition.

And it is also true in the market that there definitely are horrible crypto funds which offer nothing useful and in a worst case scenario, they end up dumping the tokens to the community and retail users.

So the fact that the Sushiswap team is actively communicating with the general community about its recent strategic raise proposal ‘Sushi Phantom Troupe’ and the details being laid out by the community governance makes it a very unusual case for the field of institutional crypto investment.

The Phantom Troupe strategic raise is still being the subject of community discussion on the forum above. So far the thread received more than 300 replies and the number is ever growing.

The following is a summary of this strategic investment.

SushiSwap co-founder 0xMaki unveiled his proposal for strategic investment on July 8. The proposal was outlined as follows:

- Total raise: up to $60 million (up to $10 million for the community)

- Token Unlock Schedule: Cliff in 6 months, vesting 18 months

- Token price: From 20 to 30% discount with $SUSHI price at point of sale

- Minimum investment per investor: $250K

- List of Strategic Investors Included

Lightspeed Venture Partners(Co-Lead), Spartan Group(Co-Lead), Pantera Capital(Co-Lead), Breyer Capital, Divergence, Dragonfly Capital, Polychain, True Ventures, Blockchain.com 19, , Jump, 3AC, DeFiance, Parafi, Hashed, Zee Prime, Multicoin Capital, Blockchain Capital, Future Fund, Rockaway, Coinfund, CMS Holding

However, the Sushiswap community was strongly opposed to the discount of $SUSHI for VCs in this strategic investment. The reasons why the community objected are as follows:

- Oversized round investments

2. Invalid token price discount rate

3. Short-term Unlock Schedule

4. Too many strategic investors

5. Doubt of benefits in this strategic investment

6. Why strategic investment in this bear market

“I don’t know how 21 crypto funds can add value to sushi swap. Each fund knows each other very well and will try to maximize revenue. Too doubtful how funds will help Sushiswap. Funds also do not contribute to increasing Sushiswap users. Five to seven funds selected from the community will be great. Sushiswap is a blue chip in the DeFi project and has a constructive governance structure. It is a big mistake to proceed if this proposal is approved”, SushiSwap community criticized.

Many crypto funds, including Lightspeed, Pantera Capital, Spartan Group, Paradigm and Defiance, have expressed their opinions.

1) Some thoughts on https://t.co/wKsGOlkJ8w

— SBF (@SBF_FTX) July 16, 2021

Two notes on the Sushi sale:

— Hasu⚡️🤖 (@hasufl) July 16, 2021

1) If there's a lockup + vesting schedule, there should obviously be a discount as well. Otherwise, the funds would be strictly better off buying spot (and idd many are owners already).

Putting together the opinions of the funds is as follows.

- If the best VCs are involved in this investment, they can support Sushiswap and provide a variety of strategic assistance, including network and technical support.

- Recruitment: To build a great team, VC can connect a lot of talented people entering the cryptocurrency/DeFi industry. VC can help to recruit people in various fields such as development and business.

- Management and Connectivity: VC can connect strong partners and networks to Sushiswap and continue to communicate with the community. Also could connect partners who can help develop mutual benefits, new markets or products.

- Technology and market research: Partners need to constantly review new technologies in the fast-changing cryptocurrency industry. We’ll give the project variety of tips, including which Layer 2 will be utilized, how to build crosschain bridges and flexibility, and what new features to improve scalability/security/UX.

- Resources and Supplier Support: We work with partners in a variety of areas, including security audits, laws, market creators, and insurance. I’d like to find a supplier to help the team and connect you.

- Promotional and marketing: It will deliver news through various platforms such as media, podcasts, and newsletters and help you understand important topics and trends in the blockchain and cryptocurrency industries. It also helps the team communicate well to the general public when it launches a new product.

2. Unnecessary VCs that dump and pump can have an adverse effect on the Sushiswap ecosystem if they participate in the investment.

3. In order for superior and healthy VCs to participate, a discount on the token price is required.

4. We agree to coordinate the token unlock schedule longer.

5. First of all, we agree to attract $20 million and then the rest of the funds will be additional when the value added of VCs becomes clear.

‘strategic investment’ defined by OmakaseBar, the developer of sushi swap, is:

- Are strategic partners able to support technical and legal advice?

- Can strategic partners inform the general public of Sushiswap and bring users in?

- Can Sushiswap be integrated into being a new strategic partner?

- Can the partners share long-term strategic vision and advice through research and analysis?

- Can strategic partners actively participate in governance and exercise their right to vote?

There was a long discussion between the community and crypto funds, and 0xMaki voted to get opinions from the community.

Meanwhile, the Spartan Group’s Darren Lau voted on what the community thought of each crypto fund. Of course, that figure does not mean the capabilities and values of certain crypto funds, but could have simply been a popularity vote for the community. Darren Lau pointed out that a model is needed to accurately compare and evaluate crypto funds considering various capabilities such as network, technology, and support.

As a result, the UMA team recommended Sushiswap to use Range Token to strategically sell SUSHI tokens. The UMA team launched Range Tokens last June, similar to a convertible bond. It is a method of adjusting the number of tokens that can be received at the time of execution by setting a certain range of token prices by combining put and call options. Detailed information on the range token can be found at the link below.

2. uLABS: Range Tokens in Detail

2.1. How To Build A Range Token

medium.com

Using range tokens has following advantages:

- Effectively attracting funds and pre-determining the price when selling tokens six months later

- Attract investment without risk of liquidation with tokens as collateral.

- Establishing investment conditions between investors and projects through smart contracts

- Token can be sold at higher value as protocol grows

Also, Cynneamhain Ventures partner Adam Cochran used UMA and Yearn for his proposal ‘Smaug’

The team issues a Sbond with SUSHI token as collateral, and set various parameters such as deposit, expiration date, and annual interest rate through Yearn. This issue of SBond will be able to be traded in AMM of SushiSwap. This can be a fairer approach because it can be purchased by community DAO members, not only for crypto funds.

After about two weeks of lengthy discussion, OmakaseBar, the developer of SushiSwap, released a revised investment proposal by putting together opinions from the community.

- Total investment target: $20 million (10 million for 3 to 5 strategic investors, $10 million for the community)

- Token Price: No Discount

- Lockup and Unlock Period: 2-years

- Call Option: Twice the price of the event token, 2 years due

- Duration: 2 years lock-up, 2 years vesting/ No lock-up or vesting for communities (which may change in the future)

- Call Option: Strike price is twice the current token price (which may change in the future) Expiration 2-year, 2-year vesting

3. New ways of investing by the community

To summarize the above, the SushiSwap team actively reflected the opinions of the community. In fact, the SushiSwap team could have attracted private investment from the crypto funds, but it didn’t and publicly announced it to respect the community’s opinion.

The sushi-swap community demanded to demonstrate what added value and benefits the crypto funds could offer, and the crypto funds pitched their strengths and abilities to be chosen by the community.

The community also argued that crypto funds should not simply receive tokens at a discount and coordinate token distribution schedules, but rather receive investment that could bear results and show capabilities of crypto funds.

In SushiSwap’s strategic investment case, as introduced earlier, there are funding methods that include various conditions such as token securitization and call options. As the DAO(Decentralized Autonomous Organization) driven by the community draws more attention in the future, the cryptocurrency investment market is expected to become more mature and transparent along with various ways of investing.

4. (Extra) Trident

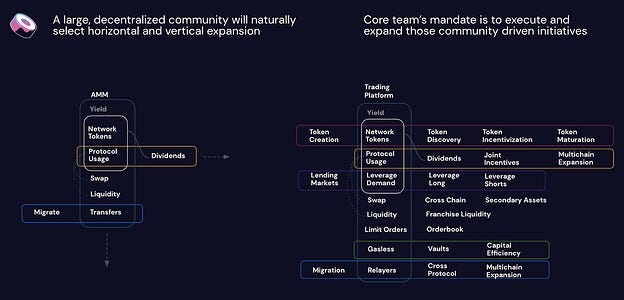

Meanwhile, SushiSwap launched Trident, a new type of automatic market maker (AMM), at an ETHCC event in France on the Jul 21st.

Trident is built on the Bento Box of SushiSwap. The tokens deposited in the Bento Box are allowed to be leveraged for multiple strategies and create new liquidity pools.

1. Existing liquidity pool

2. Hybrid Pool: Pool with efficient exchange between stable assets (similar to Curve V1)

3. Weighted Pool: Supports 8 tokens simultaneously (similar to Balancer V2)

4. Liquid concentrated pool (similar to Uniswap V3)

By supporting these diverse types of pools, users of SushiSwap can use pools that are optimal for their goals. It’s an AMM platform that integrates each liquidity pool.

SushiSwap also developed a new price matching engine ‘Tines’, to reduce market risk and price volatility. Users can identify efficient gas costs and prices among various pools and swap them at optimized prices.

Trident’s characteristic is the originality in the development which means it’s not just a forked code from the existing Defi project. Trident and Tines’ code, in particular, were released as an open source, unlike Uniswap.

“We are not faking some crypto anarchy. We trust in keeping DeFi open source.” — Joseph Delong