Story — Reflecting on a Year of Programmable IP Blockchain

Reflecting on Story Protocol's Year

1. The Beginning of Story

PIP Labs, co-founded by S.Y. Lee, Jason Zhao, and Jason Levy, was established to address the complexities of intellectual property (IP) management and monetization using blockchain technology. S.Y. Lee previously founded Radish, an English-language mobile web novel platform, which he sold to Kakao Entertainment for approximately $500 million, while Jason Zhao is an AI/ML expert from DeepMind. Through Story, they envisioned a system that transforms IP into programmable assets on the blockchain and automates the entire process from registration to licensing and royalty distribution.

Story completed a $29.3 million seed round led by a16z crypto in May 2023, followed four months later by a $25 million Series A round led by the same investor in September 2023. Subsequently, in August 2024, Story raised $80 million in a Series B round led by a16z crypto, achieving a valuation of $2.25 billion. Chris Dixon, managing partner at a16z crypto, noted that "the proliferation of AI is fundamentally reshaping the economic contract of the internet where content creators provide supply and distributors provide demand," emphasizing Story's importance in the future internet economy.

2. Testnets

Story operated two testnets to validate the protocol ahead of mainnet launch. The first testnet, 'Iliad', launched in August 2024, ran for approximately three months and processed over 247 million transactions. The testnet saw more than 1 million IP assets registered, including diverse forms of IP such as digital art, music, text, and code. Developers were able to test the entire process of IP registration, licensing terms configuration, derivative creation, and automatic royalty distribution through the testnet.

The second testnet, 'Odyssey', launched in November 2024, ran for approximately three months and focused on economic system validation, including validator ecosystem development, staking mechanism testing, and token economics verification. Users who completed activities such as IP registration, staking, and ecosystem project usage received badges in the form of Soulbound Tokens. Over 2 million badges were issued, and after testing through Iliad and Odyssey, Story completed its mainnet launch on February 13, 2025.

3. Mainnet Launch and Technology Roadmap

We envisioned a world where innovation is limitless, intellectual property is the engine of progress, and collaboration fuels a vibrant global economy powered by blockchain and AI.

- Excerpt from Story blog, "Story's Public Mainnet is Live!"

On February 13, 2025, Story's mainnet 'Homer', named after the author of the Iliad and Odyssey, was officially launched with the following core technology stack:

- Proof of Creativity (PoC): A mechanism for registering IP as blockchain-based assets. When creators register their work, an ERC-721-based IP Asset (IPA) is issued, and the creation time and originality are permanently recorded through on-chain timestamps.

- Programmable IP License (PIL): A hybrid licensing framework that connects on-chain smart contracts with off-chain legal contracts, enabling immediate IP licensing and remixing.

- IP Finance (IPFi): Implements an economic ecosystem by tokenizing IP. Creators can control how their work is used in AI model training and ensure fair revenue distribution.

The Programmable IP License is designed based on US copyright law, inspired by the Berne Convention, ensuring legal validity in over 180 countries worldwide. When a creator sets PIL conditions such as "commercial use allowed, derivative works permitted, 10% royalty," this is recorded as a smart contract on the blockchain while simultaneously becoming an enforceable contract in court. Through ERC-6551 Token Bound Account, each IP asset possesses its own smart contract account, which can automatically receive royalties, issue licenses for derivative works, and initiate arbitration processes in case of disputes.

3.1. Technology Roadmap Announcement

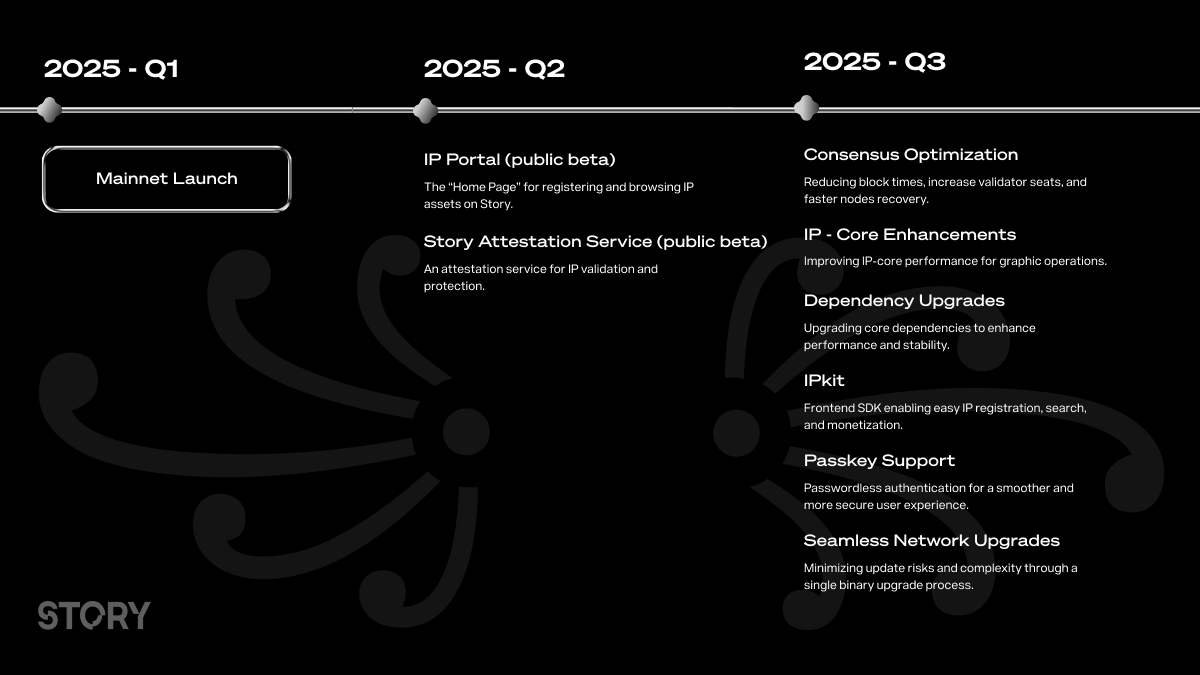

One week after mainnet launch, on February 20, Story announced its first technology roadmap update.

The roadmap was structured quarterly. The first phase, Q1, focused on mainnet performance and stability. Plans included shortening block generation time through consensus optimization and increasing the number of validators by 10-20%. Additionally, they announced plans to add state snapshot functionality for faster node recovery and synchronization, optimize IP-Core to improve IP-related task performance across the IP graph, and update base dependencies such as CometBFT and EVM. They emphasized that these changes would proceed with "minimal modifications" to ensure a seamless experience for all users.

Q2 and Q3 concentrated on simplifying IP onboarding. Q2 scheduled the public beta launch of IP Portal and Story Attestation Service. IP Portal enables simple IP registration on Story without code, and is a service that allows visual confirmation of all IP registered on Story. Story Attestation Service is a service that proves the validity of all IP assets on Story through social identity verification, IP infringement and similarity verification.

IP Portal and Story Attestation Service function as core infrastructure that can automatically detect attempts to register others' work without permission and issue warnings. Q3 planned to launch IPKit, a frontend application SDK, which they explained would include UI components to facilitate IP registration, search, and monetization across any application. Story's technology roadmap demonstrated high adherence in terms of actual implementation.

4. Story Protocol Ecosystem Development

Ecosystem projects emerged rapidly immediately after mainnet launch.

4.1. Aria: Proven Success in Music IP Tokenization

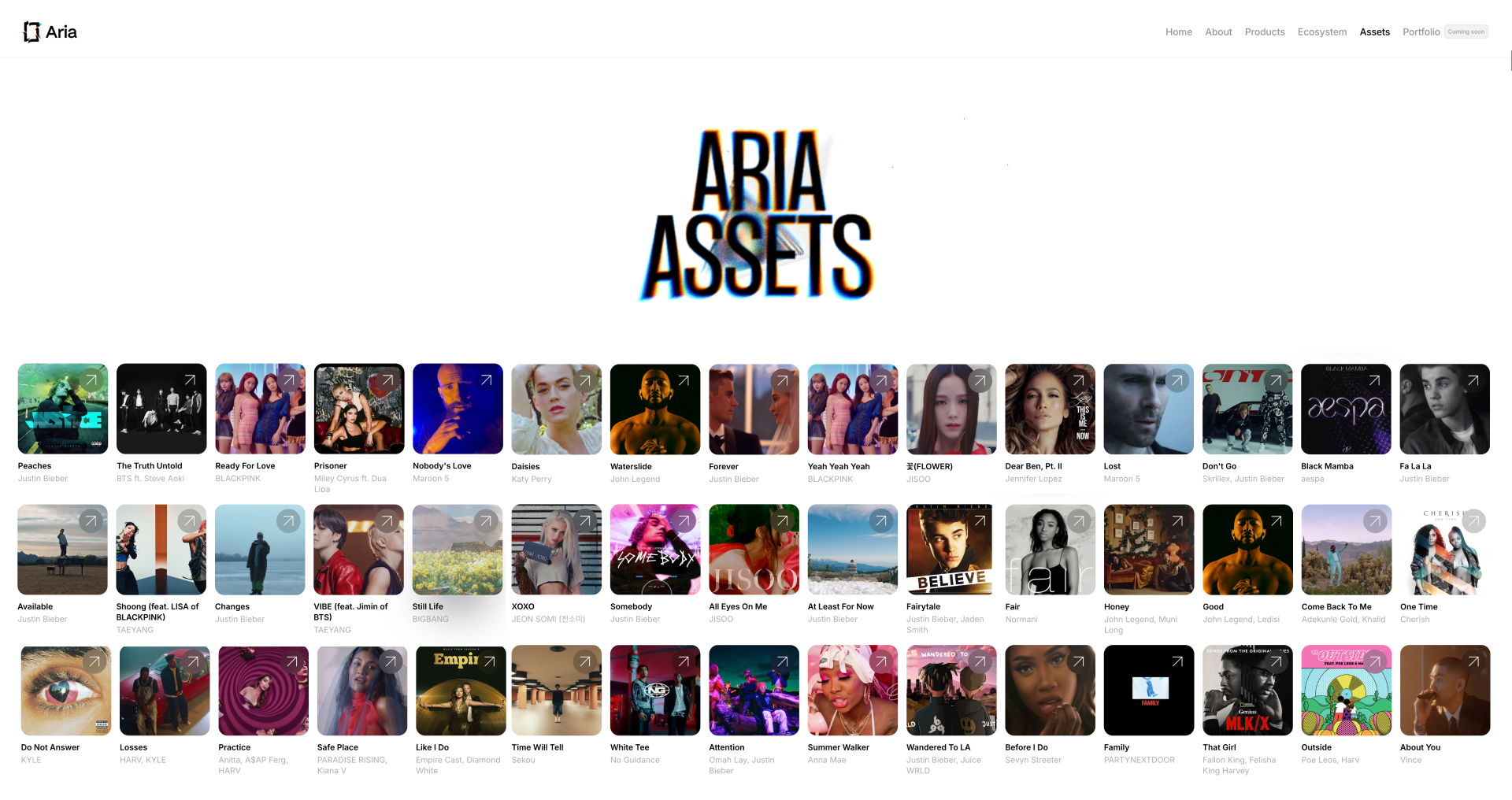

One of the most successful projects in the Story ecosystem is Aria. Aria is a platform that tokenizes music IP, allowing investors to own a portion of music catalog royalties and earn revenue. On March 28, 2025, Story introduced Aria as the ecosystem's first killer app through a blog post titled "Case Study: Aria on Story".

Aria's first IP asset, APL, launched in February 2025. It consisted of partial copyright ownership of 48 songs performed by Justin Bieber, Miley Cyrus, BLACKPINK, BTS, and Selena Gomez, with participants able to access revenue from streaming, synchronization, and performance royalties. $10.95 million was raised through StakeStone's LiquidityPad, representing the largest music IP tokenization case to date.

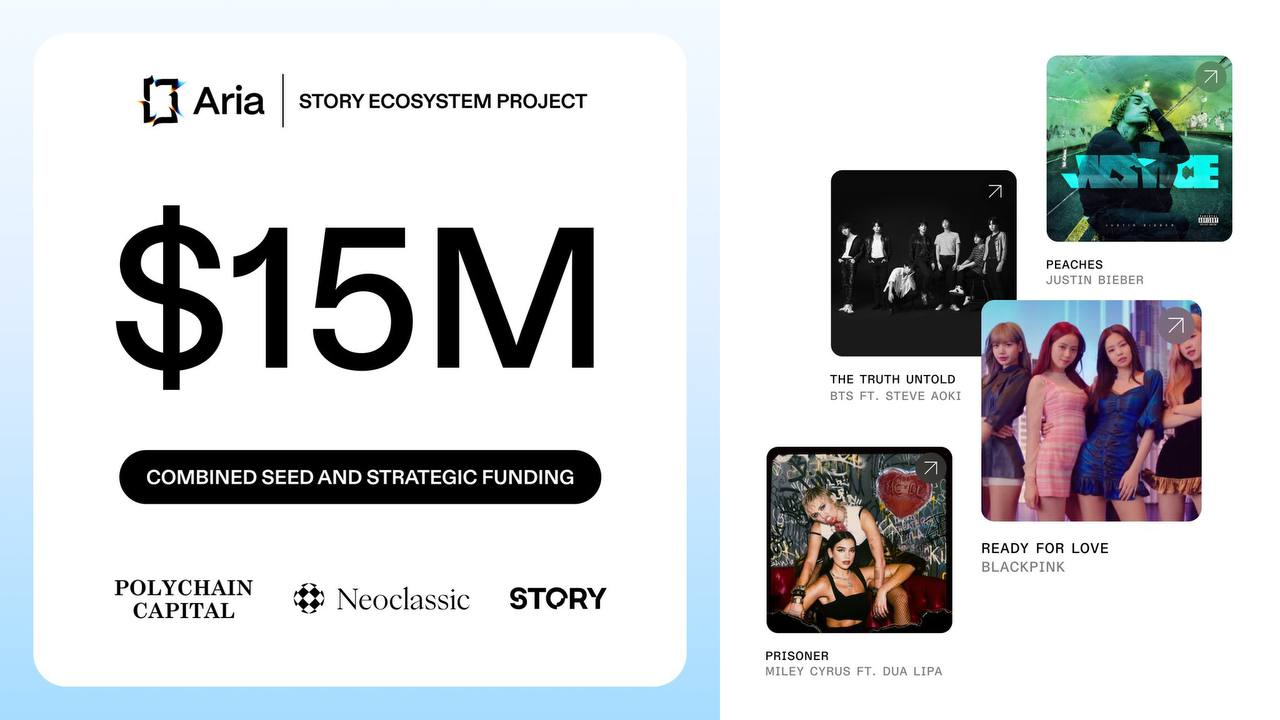

In September 2025, Aria secured $15 million in seed and strategic funding co-led by Polychain Capital and Neoclassic Capital at a $50 million valuation. The funding included participants from the Story Foundation and strategic investors in the crypto, IP, and entertainment sectors. The funding round was structured as a combination of equity and warrants, with Aria's valuation reaching $50 million.

In the same month, on September 22, Aria partnered with Story and Contents Technologies to launch Aria PRIME, tokenizing a $100 million Korean music catalog.

Aria generates revenue through origination fees for new IP tokenization launches, transaction fees on secondary trading, and management fees for IP asset management.

Aria's success holds the following significance for Story:

- It demonstrated that Story is infrastructure that enables businesses to generate actual revenue.

- It showed that blockchain-based tokenization can work in the massive and complex music IP market.

- It proved sustainability through a clear business model and revenue streams.

4.2. Verse8: Combining AI-Native Game Creation with IP Licensing

Verse8 is an AI-native game creation platform that enables anyone to build, publish, and share games using simple text prompts. On September 23, Verse8 announced its integration with Story, presenting a new paradigm combining game creation with IP licensing. Verse8 also formed a strategic partnership with Google to provide superior visual and audio quality utilizing the latest generative AI models.

The core of Verse8 is an intelligent generative agent called "Agent 8". Agent 8 automatically handles code, art, and audio, allowing users to describe game ideas in natural language and convert them into playable 2D or 3D multiplayer games within minutes.

Verse8 can generate 3D assets from a single image using proprietary technology. This was an innovation automating 3D modeling, one of the most time-consuming aspects of game development. Users could upload images of characters, environments, and items, and Verse8 would convert them into game-ready 3D assets. During the beta period, Verse8 secured thousands of creators and over 800,000 monthly active users (MAU).

In September 2025, Verse8 and Story announced their collaboration at Origin Summit in Seoul. Through this partnership, IPs from Moonbirds and Azuki were introduced into Verse8's user-generated games.

Through the integration of Verse8 and Story, creators could customize Moonbirds and Azuki characters within Verse8's AI-powered builder, integrate them into new game environments, and monetize content through in-game purchases and brand extensions. Revenue distribution was automatically handled through programmable royalties recorded on Story's blockchain.

Verse8 joined the growing ecosystem of Story-based applications alongside Aria, Poseidon, and IP Portal. This demonstrated that Story could support diverse IP forms including games, art, and film, not just music or AI data. Verse8's 800,000 MAU proved the potential to bring large-scale users into the Story ecosystem.

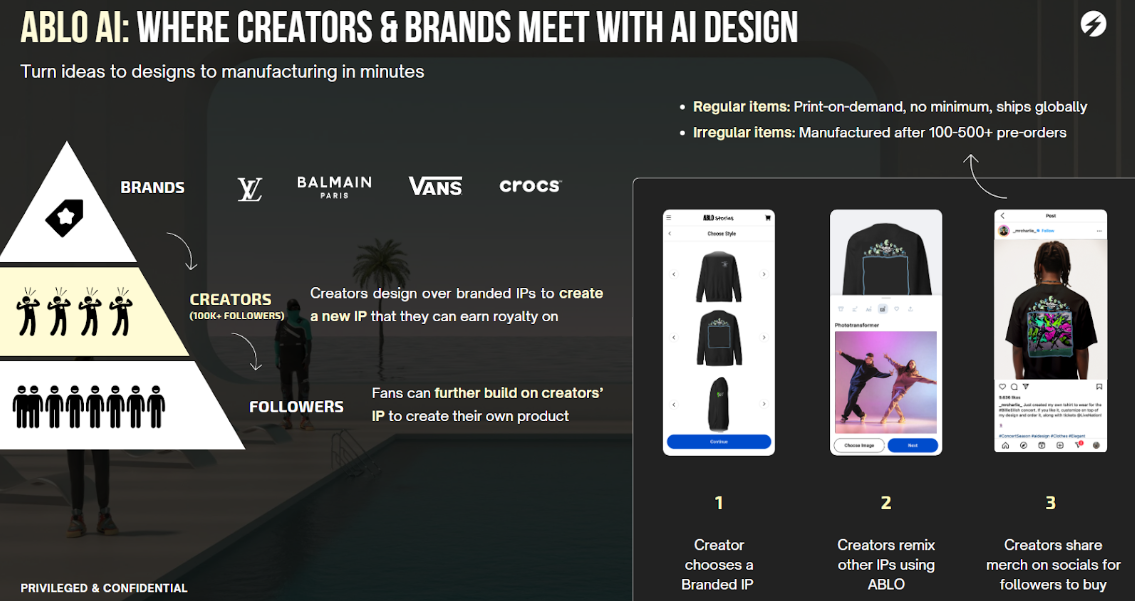

4.3. Ablo: AI-Powered Fashion Co-Creation Platform

Ablo is an AI-powered fashion design platform developed by Space Runners that presents a new business model enabling consumers to directly co-create with major brands. Through integration with Story, Ablo built infrastructure that automates creator attribution, IP registration, and royalty distribution.

Ablo established partnerships with major fashion brands including Crocs, Adidas, Champion, Balmain, Smiley, Pangaia, and Dolce & Gabbana. Each brand integrated Ablo's technology into their websites, enabling customers to design products while purchasing them.

Ablo provides both B2B and B2C services:

- B2B Service: Enables brands to integrate Ablo's technology into their platforms, leveraging customer creativity and expanding product lines.

- B2C Service: Ablo Stories allows individual consumers to generate designs for use on clothing and order them as actual products.

In early 2025, Ablo conducted a product event utilizing IP through collaboration with Crocs. Consumers uploaded photos or text prompts and selected various art styles to generate custom Jibbitz designs. Generated designs were converted into purchasable products on the Crocs website within minutes. Story's Layer-1 blockchain recorded licensing terms and provenance, enabling seamless collaboration and revenue distribution.

Ablo demonstrated the possibility of transforming the fashion industry's traditional one-way model into a bidirectional co-creation model. AI technology removed barriers to design capability, Story automated IP management complexity, and partnerships with major brands secured business scalability.

5. Crisis and Metric Deterioration

Story's on-chain metrics underwent sharp adjustment following TGE. Daily active users (DAU) decreased by over 80% from 13,000 in August to 1,600 in November, and TVL also declined from a September peak of $45.12 million to $12.42 million in November, with approximately 72% capital outflow. However, cumulative transactions (IP activity) showing ecosystem health exceeded 1.85 million, and actual registered IP assets (IPA) reached 307,825. This suggests that despite speculative user departure, substantive developers focused on IP registration and utilization remain in the ecosystem.

Meanwhile, on August 16, 2025, the Story community learned that co-founder and Chief Product Officer (CPO) Jason Zhao stepped back from operational frontlines to transition to strategic advisor. This raised concerns in the community about project continuity. The official announcement stated that Jason Zhao would continue to collaborate with Story as a strategic advisor, with Andrea appointed as the new CPO and Sandeep Chinchali, a Stanford PhD and former University of Texas at Austin professor, brought on as Chief AI Officer.

6. Chapter 2: Transition to the AI Era

In Chapter 1, Story built a dedicated Layer 1 blockchain running an IP-Native protocol providing hundreds of thousands of IPs protected on-chain. Through Aria, they tokenized music from Justin Bieber, BLACKPINK, and BTS, and through Ablo, major brands like Crocs and Adidas.

At this point, signs of strategic pivot were detected. In recent months, major AI partners began requesting IP-cleared assets from Story. These were datasets with embedded provenance, permissions, and royalty logic that automatically tracked and updated when data was remixed, reused, or integrated into AI workflows. Story's focus was shifting from a platform where "creators register and license their work" to infrastructure where "AI companies secure training data".

In July 2025, Story published a strategy document titled "Story's Chapter 2: AI-Native Infrastructure for the $80T IP Economy". Just five months after mainnet launch, Story declared it would fundamentally expand its vision.

6.1. Three Core Directions of Chapter 2

Story outlined its vision in the strategy document as follows:

- Data Layer for Physical AI Models: From robots cleaning messy living rooms to cars driving in rain and fog to smart assistants responding to various languages and accents, Story presented the goal of becoming a licensing layer for high-value real-world AI training data that cannot be crawled through DePIN and infrastructure.

- Bringing World's IP On-Chain: The plan was to dramatically expand IP tokenization beyond music and fashion to enter massive and untapped sectors like sports, DeSci, and entertainment. This was an extension of Chapter 1, but on a much larger scale.

- Unlocking the $80T IP Market: Story raised its market size estimate from the previous $61 trillion to $80 trillion. Traditional IP frameworks were not built for a world generating billions of new content iterations daily. The analysis concluded that this resulted in an $80 trillion IP market that is mostly illiquid, undervalued, and urgently needs new infrastructure.

Chapter 2 particularly emphasized the importance of real-world data. The next leap in AI depends on unlocking and scaling this $80 trillion IP market, especially the subcategory of real-world data. Real-world data refers to sensor-generated content captured by cameras, microphones, LIDAR, radar, etc., providing unique and valuable snapshots of the physical world in specific spatiotemporal contexts.

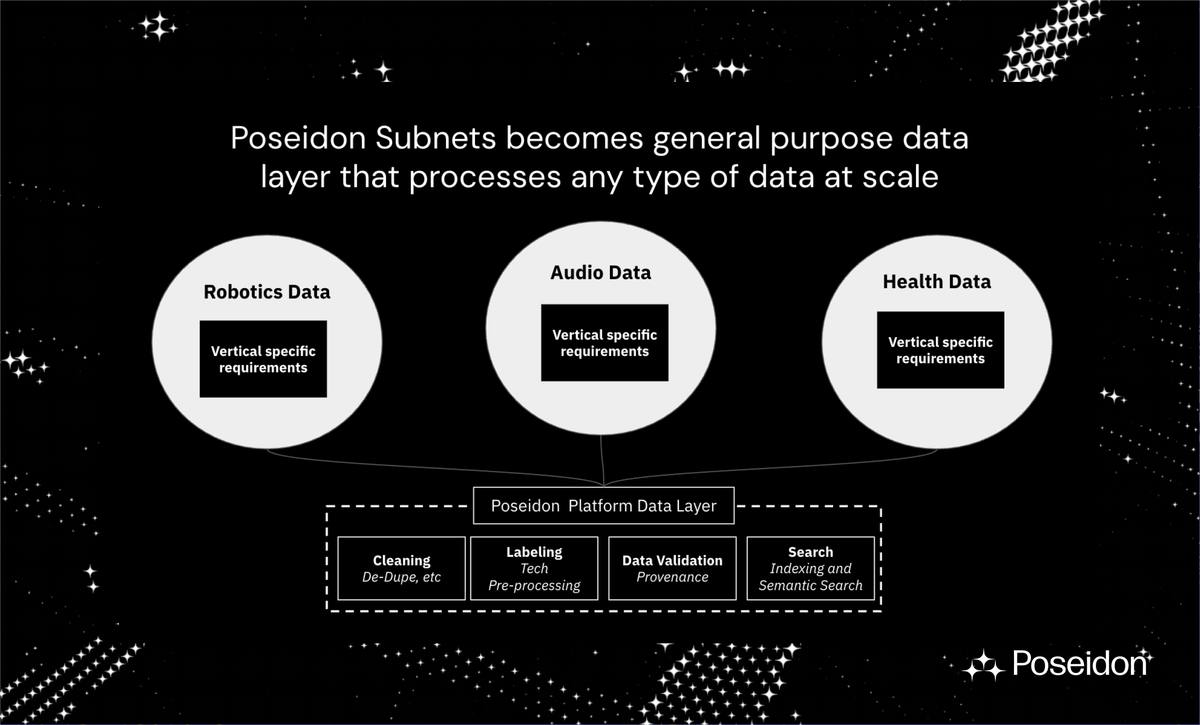

AI foundation models have already exhausted the most easily accessible training data. To advance further, they needed long-tail data. Such data cannot be crawled from the internet and must be collected directly from the real world. Poseidon aimed to provide the entire infrastructure for collecting, labeling, licensing, and compensating contributors for such data.

7. Poseidon: Strategic Expansion into AI Data Layer

In July 2025, Story unveiled Poseidon, which it had incubated. Poseidon was the core project executing Story's Chapter 2 vision, infrastructure handling training data—the new form of IP in the AI era.

The Story team captured fundamental changes in the AI industry. AI was rapidly evolving from simple chatbots to physical agents operating in the real world. However, data that could be scraped from the web had already reached a plateau, and AI models desperately needed high-quality data. Most importantly, the bottleneck for AI advancement had completely shifted from computing power or model architecture to data and rights issues.

Poseidon's core value proposition was providing the long-tail data needed for AI foundation models to advance further. Real-world data that cannot be crawled from the internet, such as POV (Point of View) videos, biometric audio, multilingual voice, and sensor data collected from robots and edge devices. Such data was the core resource powering physical AI like humanoid robots, autonomous vehicles, and voice interfaces. Story's architecture was uniquely suited to bring such data on-chain through transparent provenance, programmable rights, and native licensing rails.

"What NVIDIA is to compute and OpenAI is to models, Story and Poseidon will be to IP and data.”

- S.Y. Lee, Story Co-founder & Poseidon Chairman

Like Story, Poseidon secured a $15 million seed round led by a16z crypto. Chris Dixon of a16z crypto assessed that "Poseidon's decentralized data layer seeks to establish a new economic foundation for the internet, rewarding creators and suppliers who provide the diverse inputs that next-generation intelligent systems require." Poseidon's emergence demonstrated Story's strategic expansion. It signified Story was expanding beyond existing IP registration into AI data infrastructure.

In August 2025, the Poseidon team launched a crypto-incentivized audio data collection application, enabling users to contribute voice samples in various accents, background noises, and acoustic environments and receive immediate rewards. In just two weeks, they secured non-English audio/voice datasets exponentially surpassing major big tech companies' low-resource language datasets like Meta's VoxPopuli and MLS, and Alphabet's Fleurs, specifically collecting over 34,000 hours of audio data from over 405,000 contributors worldwide. They also built an initial version of a training data marketplace for AI data, enabling AI companies to purchase high-quality data with legally clear provenance.

Subsequently, they developed the v1 architecture of data subnets—systems handling the entire process of data collection, verification, licensing, and distribution in a decentralized manner—and released a litepaper, conducted cutting-edge research in audio deepfake detection and low-resource language fine-tuning, and initiated data licensing contract processes with Frontier AI Labs, proving business model feasibility.

Audio/voice data was becoming increasingly important as the user interface for humanoid robots. Physical AI agents that people would interact with in the future required natural voice interfaces, which demanded large-scale training data collected in various languages, accents, background noises, and acoustic environments. Poseidon's emergence signified Story's strategic expansion to address data infrastructure demands in the physical AI era.

8. DAT, K-Culture, and Continuous Development

On August 11, 2025, Nasdaq-listed Heritage Distilling announced it would change its name to 'IP Strategy (ticker: IPST)' and raise $223.8 million in PIPE funding to fully enter the Story ecosystem. Heritage was originally a traditional beverage company producing premium whiskey and spirits in Washington State, but management determined the company's future was not limited to the beverage industry.

Unlike MicroStrategy's strategy of exclusively purchasing Bitcoin, IPST's strategy adopted a Digital Asset Treasury (DAT) model supporting the entire Story ecosystem. In practice, IPST strategically purchased not only $IP but also Aria's governance token $ARIAIP and $APL linked to actual music royalty revenue. IPST's portfolio strategy is directly linked to Story ecosystem growth. By holding $IP tokens, it invests in the overall network value appreciation while simultaneously generating stable revenue through validator node operation and directly participating in the success of specific vertical sectors (music IP, game IP, etc.) through ecosystem project token purchases.

In September 2025, Story signed a three-year exclusive contract with Korea's Seoul Exchange. Seoul Exchange is one of the unlisted stock trading platforms licensed by Korea's Financial Services Commission, providing regulated infrastructure for token security trading. The partnership's goal was to build a platform for tokenizing and trading K-pop royalties, K-drama rights, webtoon intellectual property, game IP, and patents. Specifically, global hit content like BTS, Blackpink, Psy, and Baby Shark were mentioned as tokenization targets.

Story's technical development also continued. The IP Portal beta version launched in Q2 2025 was designed as "GitHub for IP", enabling general creators without coding knowledge to easily register and manage IP. Uploading files via drag-and-drop in the web interface automatically extracted metadata and registered it on the blockchain. Licensing terms could also be selected from templates or customized. Attestation Service was a service that brought off-chain data on-chain to verify IP credibility, with creator identities proven on-chain when they connected their social media accounts. The most important feature was plagiarism detection—when someone attempted to register another's work as their own, Attestation Service would crawl the internet to find the original and issue warnings.

The IPKit SDK was launched in Q3 2025. This was a frontend toolkit enabling developers to easily integrate IP functionality into existing apps, supporting all major JavaScript frameworks including React, Vue, Angular, and Svelte, with Python and Rust SDKs also in preparation. Using IPKit, IP registration, licensing, and royalty distribution features could be added to apps with just a few lines of code. Passkey support was also under development, which would enable users to log into wallets with biometric authentication without passwords or private keys.

Network performance also continuously improved. Block generation time shortened from initial 6 seconds to 4 seconds, and the number of validators expanded from 64 to 75, strengthening network decentralization. Transaction throughput increased from initial 500 TPS to 1,200 TPS, and transaction fees remained at an average of $0.01, making small-scale IP transactions economically feasible. After vulnerabilities were discovered in the BitsLab audit, security became the top priority, with quarterly third-party audits mandated and security verification strengthened through strategic partnerships with traditional leaders like Trail of Bits and CertiK as well as security specialist platform Cantina. The bug bounty program was also significantly enhanced, offering rewards up to $1 million for discovery of critical vulnerabilities.

9. Future Outlook and Challenges

Story's first year revealed the gap between ambitious vision and practical achievements. It achieved levels of success that most blockchain projects fail to reach—over $200 million in investment led by a16z crypto, a Nasdaq-listed company's $360 million IP reserve construction, and an exclusive partnership with Korea's Seoul Exchange. Original technologies like Proof of Creativity, Programmable IP License, and Agent TCP/IP actually worked, and over 1.85 million IPs were registered. Ecosystem projects like Aria's music IP tokenization and Poseidon's AI data layer continued to grow.

However, 88% DAU decrease, 72% TVL decline, co-founder role change, and limited protocol revenue suggest the project has not yet achieved Product-Market Fit. A gap was observed between strategic partnership achievements and actual user adoption rates. While B2B achievements like Heritage IPST and Seoul Exchange are important, for the protocol to be sustainable long-term, it must become infrastructure that general creators use daily. The $2.2 billion valuation is interpreted as an assessment based on future growth potential rather than current revenue.

If core metrics are achieved—Aria's active users surpassing hundreds of thousands, K-pop IP token trading launching in earnest on Seoul Exchange, and Poseidon forming partnerships with major AI companies—Story will be recorded as a leading case of real-world asset tokenization in the Web3 industry. If this leads to large-scale creator influx through IP Portal and meaningful protocol fee growth, emergence of killer apps based on IPKit SDK, and actual validation of Agent TCP/IP, Story will establish itself as a core layer of internet infrastructure.

Conversely, if current low activity persists, killer apps fail to emerge, and the business model remains unvalidated, this will remain a case that failed to achieve market adoption despite excellent technology and strong partnerships.