Berachain — The Convergence of a Strong Community and Experimental Endeavors

Focusing on the History and Core Structure of Berachain

1. Introduction

Recently, modular stacks such as Arbitrum Orbit and OP stack for rollups, along with DA layers represented by Celestia, have been announcing their release one by one, gradually making the layer construction process more accessible. Due to the widespread adoption of this modular approach, numerous layers, regardless of being L1 or L2, are being launched.

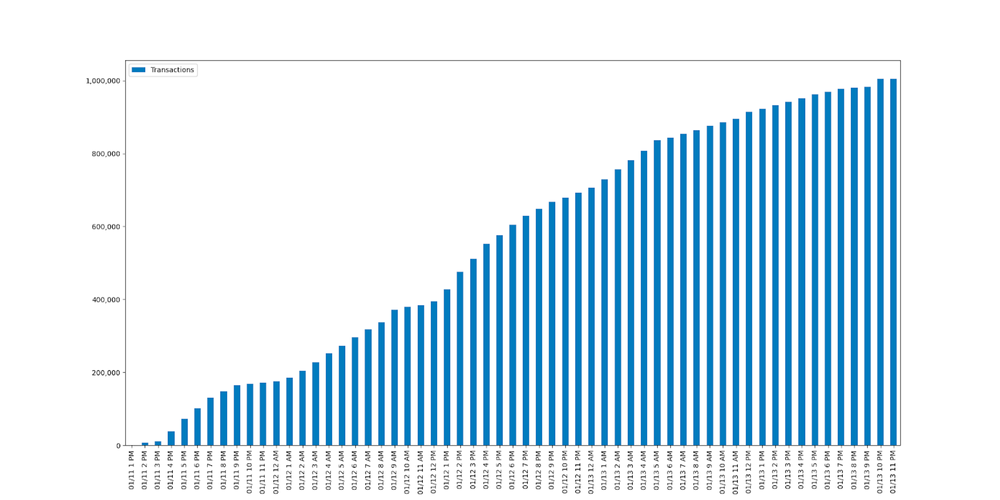

Among all the launches, a promising project has shown remarkable growth by surpassing Ethereum's annual transaction volume in just 6 hours after its testnet launch and achieving one million active wallets in just 7.5 days. The name is Berachain. In the following, we will introduce and go over the background of Berachain, including the testnet guidelines.

2. Berachain 🐻?

Berachain is a Tendermint-based EVM-compatible Layer 1 blockchain that introduced the concept of "Proof of Liquidity."

For sure it is not an easy topic to tackle as it is a novel concept. Understanding Berachain can be challenging beyond its technical aspects, primarily due to the context in which it is discussed on its official Twitter account and by Twitter users, many of whom use bear profile pictures. This creates a higher barrier to entry for comprehending the project.

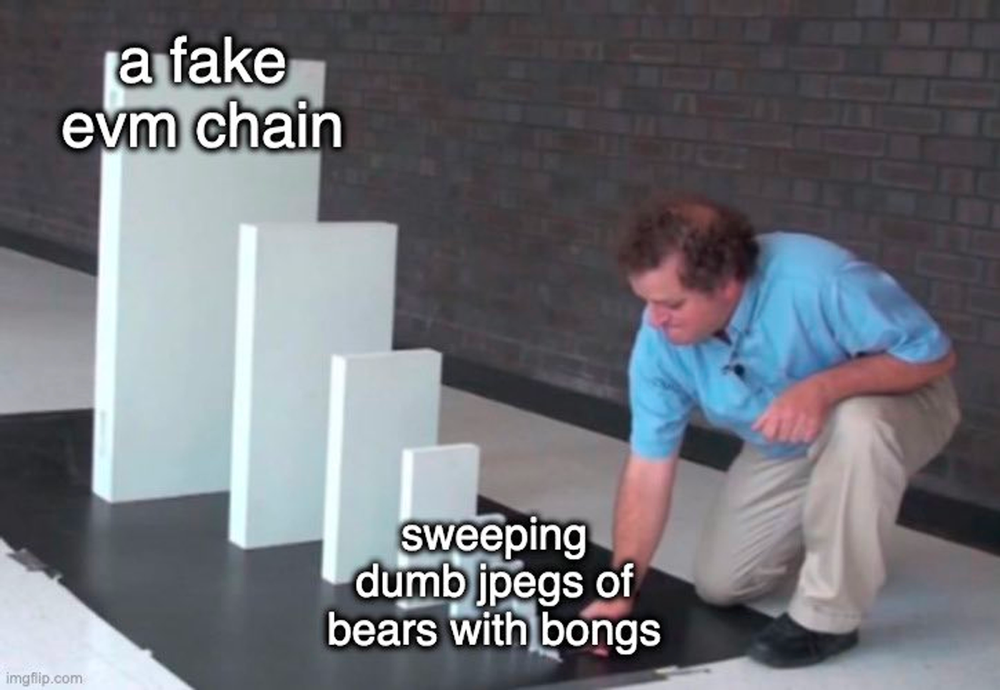

Unlike layer 1 projects that begin with significant investments from well-known venture capitalists, Berachain started differently. It is a layer 1 project with an established community layer, originating from an NFT collection known as Bong Bears. Now let's delve into the formation of Berachain’s community.

3. The Inception of Berachain, Bong Bears

The significance of community in Web3 cannot be understated, especially for Layer 1 and 2 protocols, where the role of the community becomes even more critical.

While each protocol emphasizes its technological distinctiveness, the creation of products on these protocols ultimately requires people. When these people come together, a community is formed, and through this process, a distinct culture emerges, giving each protocol its unique identity. Protocols strive to build their own communities by leveraging memes, symbols (e.g., Avalanche's 🔺), and narratives. These concepts are elaborated in more detail in writings by TZEDONN.

In the case of Berachain, the journey began with the NFT collection Bong Bears, created by @itsdevbear and @smokeythebera (the founder of Berachain) in August 2021. In addition, through "rebasing" to issue sub-collections, they gradually expanded the community's size.

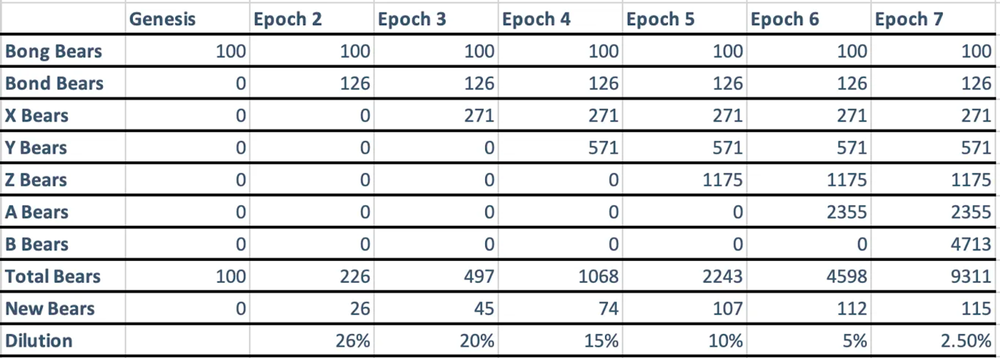

Rebasing, a term used in DeFi, refers to the adjustment of a token's total supply according to a predefined procedure to ensure its price converges towards a target value. For the Bong Bears NFTs, rebasing is employed as a strategy to encourage long-term holding of NFTs by determining the supply of new collections based on the formula [existing collection quantity + Dilution * existing collection quantity], with a dilution rate that halves with each new collection issuance. This method also involves airdropping to existing NFT holders as a way to incentivize them.

Through this process, the strategy went beyond merely increasing the quantity of NFT collections. It turned Berachain itself into a meme and, by involving the community in the development process, strengthened community cohesion. Starting with the genesis collection, Bong Bears, and successfully launching a total of five additional collections—The Bond Bears, The Boo Bears, The Baby Bears, The Band Bears, and finally the Bit Bears—Berachain has established high floor prices for these collections. As of January 25, the floor price for the Bit Bears, the lowest collection in the hierarchy, stands at 3.866 ETH.

If the strategy had been simply to expand the NFT collection, it would have been challenging to achieve both a high floor price and a solid community foundation. The journey from Bong Bears to Berachain was marked by a series of key events along a timeline.

3.1. Key Timeline

- 08/2021: After the minting of Bong Bears, the spelling was changed from Bear to Bera, and Berachain began to be embraced as a meme.

- 10/2021: The NFT rebasing of The Bond Bears and The Boo Bears collections took place.

- 11/2021: There was notable mentions of Berachain by @itsdevbear.

- 12/2021: The NFT rebasing of The Baby Bears took place.

- 03/2022: The Olympus DAO OIP-87 proposal for Berachain seed funding was approved, featuring a $50M FDV with a $500K investment.

- The approval of this proposal led to the explosive creation and spread of key memes related to Berachain, such as “Berachain is real”, “Berachain fix this”, and “Ooga Booga.”

- 04/2022:

- The fake chain discord that evolved into Berachain's official Discord channel emerged.

- The NFT rebasing of The Band Bear NFT took place.

- Founder @smokeythebera announced the core concepts of Berachain as below.

“Berachain is not an EVM-compatible blockchain built using the Cosmos SDK and is mostly definitely not launching this summer on a brand new Proof of Liquidity consensus engine. Since Berachain isn’t real, we will not be rolling out any additional information about chain mechanics, partnerships or fundraising over the next few weeks.”

- 08/2022: The NFT rebasing of The Bit bears NFT took place.

- 04/2023: The lead of Polychain Capital announced $42M funding.

- 01/2024: Berachain Testnet was launched.

Through the timeline described above, what began as a meme in 2021 under the guise of a "Fake chain" has evolved into today's Berachain.

4. Berachain Tri-token Model

Unlike typical layer 1 projects that operate with a single token, Berachain utilizes three main tokens, each serving distinct purposes and roles within its ecosystem. This tri-token approach contributes to supporting and efficiently operating the Berachain ecosystem.

- $BERA

- A native token for paying transaction fees on the blockchain network.

- $BGT

- A token that supports the governance of Berachain. $BGT can be earned by providing liquidity or staking $BGT.

- As a non-transferable token, users must provide liquidity to earn $BGT.

- $BGT can be exchanged with $BERA at a 1:1 ratio, but $BERA → $BGT exchange is impossible.

- $HONEY

- A native stablecoin of Berachain aiming for a 1:1 peg to USDC.

But why did Berachain adopt the above token structure and separate the governance token, $BGT, from the native token, $BERA? The answer can be found by understanding the problem that "Proof of Liquidity" is trying to solve.

4.1. Proof of Liquidity

Berachain's Proof of Liquidity is designed to accomplish the following objectives:

- Systemically build Liquidity

- Solve stake centralization

- Align protocols and validators

Berachain's official documentation states that the traditional Proof of Stake (PoS) structure has the following problems:

- Staking tokens to improve the security of PoS locks funds, which negatively impacts chain activity, such as LP pool participation and reduced transaction count.

- Token rewards are distributed to staking participants, which leads to the centralization of governance.

- Protocols have little opportunity to improve the security of the chains they are building.

- Ultimately, validators have little upside to gain from the protocol.

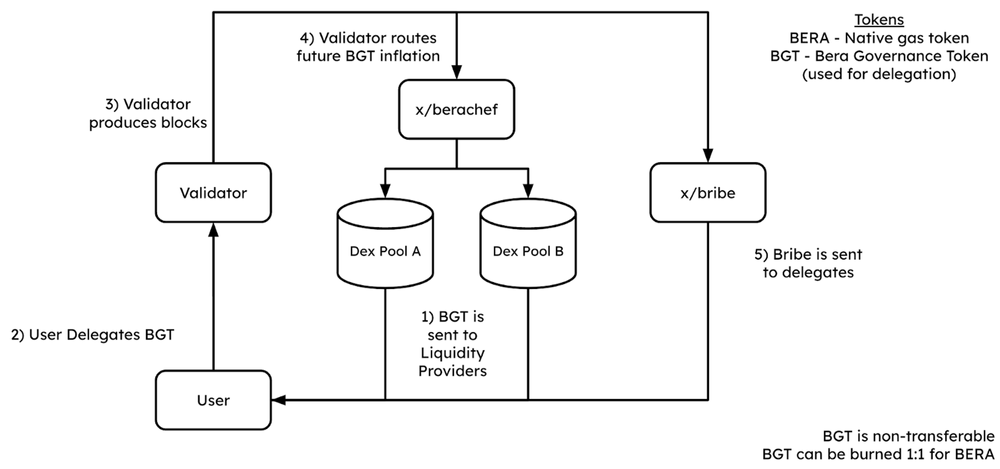

To solve these problems, the structure of Berachain’s Proof of Liquidity operates as below.

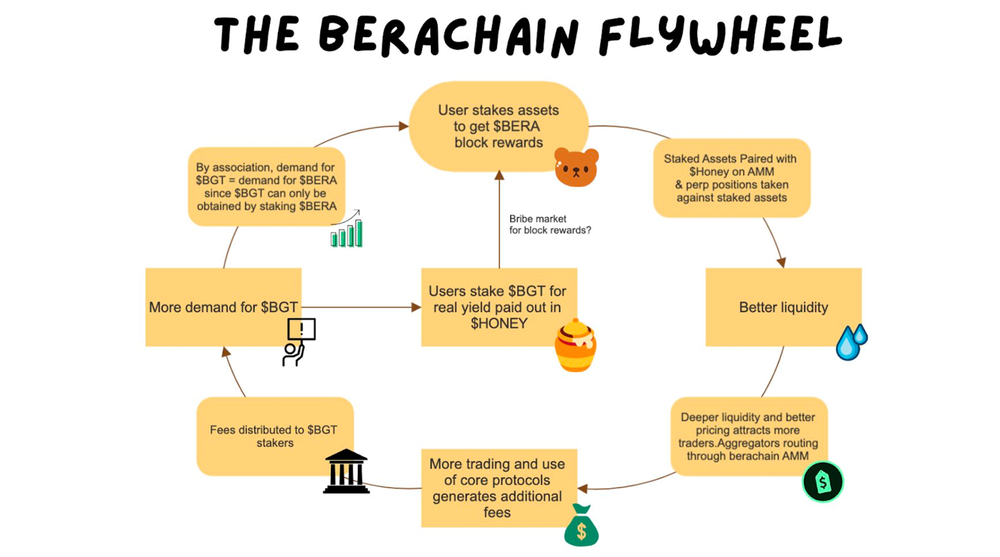

- $BGT is paid to BEX (Berachain's DEX) Liquidity Providers

- Liquidity providers delegate $BGT to Validators

- Validators create and validate blocks

- Governance determines $BGT inflation

- Delegators are rewarded with $BGT (Bribe)

The structure described addresses several issues traditionally associated with Proof of Stake (PoS) systems in innovative ways:

- The channel to obtain new issuance of $BGT is restricted to liquidity provision and the separation of the governance token ($BGT) from the native token ($BERA) increases the liquidity of the network itself with increased security.

- Providing $BGT to the liquidity providers may create a fairer distribution than if it were distributed only to governance participants.

- Finally, aligning the interests of the both protocol and validators by allowing validators to use $BGT to incentivize LP pools and delegate more $BGT through bribe.

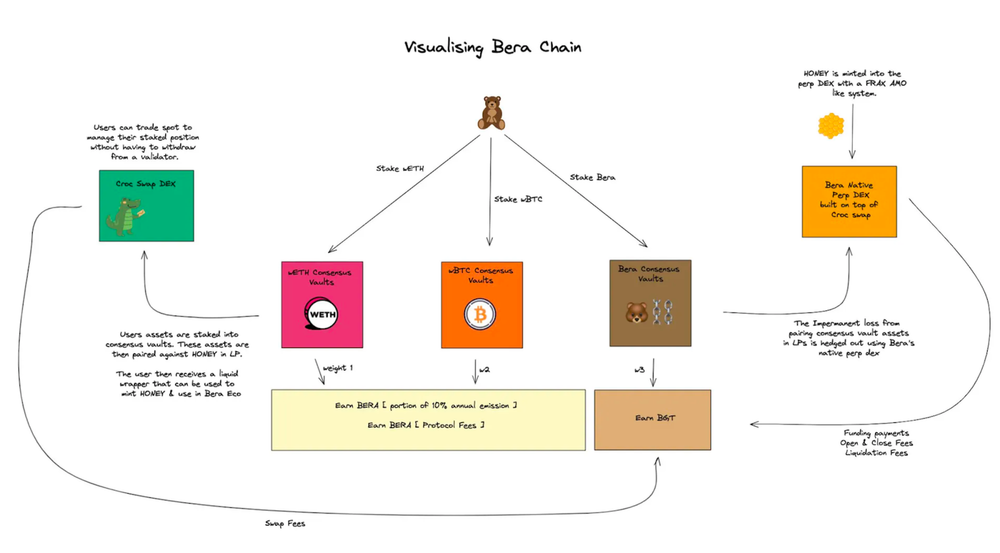

Although not mentioned in the official documents, according to @burstingbagel and The Honey Jar blog, Berachain's Proof of Liquidity supports staking of external assets such as $BTC, $ETH, DeFi blue chips, and stablecoins as targets for liquidity supply, which serves as a gateway to acquire $BGT. What's interesting is that it has a structure where $BERA is rewarded in return for this contribution.

To elaborate further, Berachain rewards external liquidity supply by paying out $BGT or $BERA emissions, and at the protocol level, it supplies liquidity in DEXs by pairing these assets with $HONEY. Additionally, users who stake their assets receive liquid wrapper tokens, which can be used to mint $HONEY, thereby facilitating its use within the ecosystem and enhancing the network’s own liquidity.

However, staked assets deposited in LP pools are exposed to impermanent loss. To hedge against this, a long position is taken in a perpetual DEX to offset the impermanent loss. Various fees generated in the process of utilizing staked assets for liquidity and offsetting impermanent loss (e.g., Swap fee, Funding Fee, Liquidation fee, etc.) are distributed to the stakers in the form of $BGT.

Furthermore, the process of adjusting emissions for each staked asset can effectively utilize bribe, providing opportunities for active governance engagement.

5. The Governance of Berachain

Berachain is not limited to an ecosystem running solely on its native tokens, it also envisions a structure that pays $BERA emissions to users who supply liquidity using external assets.

Therefore, Berachain's governance includes additional roles on how to manage and utilize external assets at the protocol level, beyond general decision-making issues:

- Text Proposals: Proposals that do not automatically apply to the protocol upon approval (e.g., budget requests).

- Gauge Proposals: Proposals for whitelisting new liquidity providers to receive $BGT emissions, allowing validators to select them.

- Collateral Proposal: Proposals for whitelisting new tokens to be traded on BEX through mapping with $HONEY.

- Market Proposal: Proposals to allow trading of wrapped tokens on BEX.

Furthermore, the process of adjusting asset-specific emission weights can utilize bribe, potentially enhancing dynamic governance and increasing demand for $BGT. In this context, Berachain announced a partnership with Redacted Cartel, which supports the Frax bribe market, indicating its intention to support a Bribe Market at the protocol level.

6. A Guideline for Berachain Artio Testnet

On January 11th, the Berachain Artio testnet was launched, allowing users to experience the seven core products that form the foundation of Berachain's ecosystem, without the involvement of external assets.

[Core Products]

- Faucet: A faucet that can receive testnet $BERA every 8 hours

- BEX: Berachain native DEX to swap assets or provide liquidity

- BGT Station: Act as a governance forum to participate in governance by staking $BGT, or convert to $BERA

- Honey: Able to mint the Berachain native stablecoin $HONEY. Currently supports swaps with $stgUSDC, but will support minting utilizing diverse stablecoins in the future

- BEND: Berachain native lending protocol. Currently you can get $HONEY loans based on $BTC, $ETH. Lending between the same asset is impossible ($HONEY ↔ $HONEY)

- Beratrail: An blockchain explorer like Etherscan

- BERPS: A Berachain Perp that supports perpetual contract leveraged trading of $BTC, $ETH, $ATOM, $TIA (up to 100x)

[How to add testnet]

Before participating in the testnet, you need to add the Berachain Artio testnet to your metamask.

- Network name: Berachain Artio

- RPC URL: https://artio.rpc.berachain.com

- Chain ID: 80085

- Currency symbol: BERA

- Block explorer URL: https://artio.beratrail.io

[Activites]

After adding the testnet, users can engage in the following activities.

- Acquire testnet $BERA from the Faucet (additional $BERA can be obtained from the 0xhoneyjay faucet)

- Convert $stgUSDC on BEX and mint $HONEY on Honey

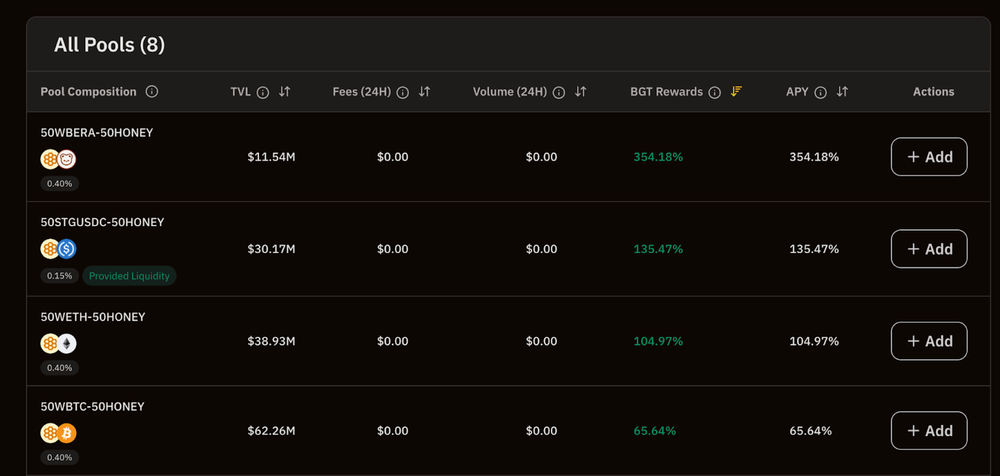

- Supply $HONEY LP on BEX

- Deposit $HONEY, $BTC, $ETH on BEND, where $BTC and $ETH collateral are required to borrow $HONEY

- Deposit $HONEY in $bHONEY on BERPS

- Delegate the mined $BGT or convert it to $BERA at the BGT Station

There are four limited ways to acquire $BGT in the process above.

- Supply $HONEY LP on BEX - Although there are a total of 8 pools operating, only 4 pools provide $BGT rewards.

- Deposit $HONEY on BEND

- Deposit $HONEY in the $bHONEY vault on BERPS

- Delegate the $BGT acquired through methods 1, 2, and 3 to a validator at the BGT Station

Through a partnership with Galxe, a Web3 Credential platform, missions are provided, suggesting that using the testnet would be a great opportunity to experience Berachain's concept of Proof of Liquidity and experience the overall branding that embodies Berachain's unique culture.

6.1. Early Ecosystem Bootstrapping through Build a Bera

On January 17th, Berachain officially announced its incubating program, Build a Bera. This initiative aims to attract startups from various sectors, including DeFi, gaming, social-fi, and DePIN to the ecosystem at a team level. The first batch will unveil five projects, which will be supported through seed funding, mentoring, and networking to ensure successful onboarding into the ecosystem.

Berachain believes that governance activities, such as whitelisting specific assets or obtaining emission rights, will be crucial. It is anticipated that these projects will highly benefit, directly or indirectly, especially in the early stages where the core team's decision-making power is strong.

7. Conclusion

Leveraging Berachain’s solid community base, there are projects that are either gearing up for launch or have already launched on other chains. As these dispersed communities converge on a single chain, Berachain believes it can grow rapidly compared to other protocols.

Berachain, with its playful website design that scrolls upwards as if wishing for its native token, $BERA, to go "Up Only," is experimenting with a novel concept called Proof of Liquidity alongside its strong community. The future of Berachain, receiving significant attention for its testnet launch, promises to be intriguing. It is recommended to keep a close eye on their progress.

Ooga Booga! 🐻

References

- Berachain docs

- Bong Bears, Introducing Bonga Bera Pro

- moyed, [Research] 베라체인을 소개합니다.

- The Honey Jar, Berachain, Cults and the Dawn of The Honey Jar

- kedi.eth (⛓️,🐻,🐈⬛), Bullish on Berachain Part I: The Future of MemeFi

- The Honey Jar, Bonga Bera 101

- Sooper, Wait, It's Real? What is Berachain?