HAVAH — The Next Generation of NFT Interchain Platform

The Next Generation of NFT Interchain Platform

Part 1: Challenges Affecting the Current NFT Market and HVH's Remedial Strategy

1. Persistent infrastructure challenges hinder the progress of evolving NFTs

What exactly do NFTs represent? Initially, they embodied a straightforward concept: unique digital artworks with verifiable origins. However, the NFT landscape has experienced significant transformations since then. Today, NFTs encompass a wide array of offerings, ranging from profile picture tokens (PFPs) that also serve as avatars to in-game assets like Axie Infinity. There are even utility-driven NFTs that grant tangible real-world benefits to their owners, as well as AI-linked NFTs that dynamically change based on user behavior. Clearly, NFTs are evolving at a rapid pace. Nevertheless, amidst this progress, a persistent issue remains unresolved.

The heart of the matter lies in the selection of the blockchain for NFT issuance. Once an NFT is minted on a particular blockchain, migrating it to another blockchain becomes an exceedingly challenging process. This issue is not only fraught with technical complexities but also encompasses economic considerations, such as the blockchain’s user base and liquidity. Consequently, the project team is burdened with the arduous task of meticulously weighing the choice of blockchain, giving it as much deliberation as they dedicate to the actual design of the project, all in an effort to address what we shall refer to as the “chain dependency” problem.

2. Chain Dependencies Expose a Cascade of Challenges

Amidst the events of 2022, a series of incidents unfurled on Klaytn, sparking a mass departure of users and compelling numerous NFT projects to sever their ties with the platform. Driven by the aspiration to rebrand and broaden their global reach, these projects boldly embarked on the "De-klaytn" path. MetaKongz, once hailed as Klaytn's premier NFT, daringly migrated to Ethereum, while Klaycity sought solace in Polygon. However, these transitions came at a significant cost.

To compound the situation, a catastrophic event ensued—the collapse of the mainnet itself. The Terra-Luna crash last summer shook the very bedrock of the ecosystem, bringing Terra-based projects to a grinding halt, regardless of their chosen trajectory. Derby Stars, a highly promising Play-to-Earn (P2E) venture on Terra, found itself compelled to postpone its launch and pivot operations to Polygon. Meanwhile, other projects teetering on the brink of success were ruthlessly compelled to close their doors. The inherent dependencies on chains within the NFT realm have not only resulted in project devaluation but have also delivered a fatal blow, jeopardizing their very survival.

3. Unveiling New Mainnet Launches and User Experience Challenges

In the ever-evolving landscape of blockchain technology, a slew of new mainnets has surfaced, each boasting its unique strengths. Among them are Aptos and Sui, powered by Move; specialized gaming blockchains like Oasys, Wemix, and Xpla; as well as Optimism and Arbitrum, part of the Optimism L2 family. Additionally, promising projects such as LayerZero, Scroll, Base, and Finschia loom on the horizon.

However, alongside these new mainnet launches, the user experience has steadily deteriorated. End-users now find themselves burdened with a multitude of challenges. Not only must they install separate wallets for each mainnet and manage their seed phrases, but they must also ensure they possess fiat currency for each chain in order to acquire NFTs. Moreover, even if they successfully purchase NFTs, the inherent chain dependencies confine these assets to their respective blockchains, greatly complicating the management of NFT portfolios across multiple chains. This growing complexity poses a significant obstacle for new users seeking entry into the space. The potential churn of users due to subpar user experience poses a pressing challenge for these emerging chains. Consequently, addressing the issue of NFT chain dependency is an urgent imperative that demands attention.

4. Havah: Solving the NFT Chain Dependency Predicament

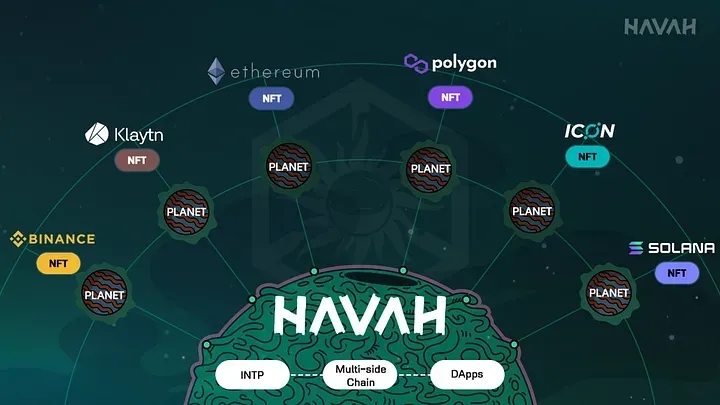

Havah aims to alleviate the problem of chain dependencies and allow NFT projects to focus on their core business. By using BTP technology (*Blockchain Transmission Protocol, a trustless, interoperable protocol that enables data and message exchange between disparate chains) developed by IconLoop, Havah bridges NFTs by validating messages sent to relayers through smart contracts without the need to share specific SDKs or architectures. This means that NFTs can be transferred between disparate chains, regardless of chain size or communication protocol standards. In particular, BTP utilizes a relay method that transmits transaction results and proofs so that transactions that occurred on the source chain can be directly verified on the target chain without an intermediary. As a result, BTP offers enhanced security when compared to the notary method, which carries the potential risk associated with intermediaries.

Currently, Havah provides support for bridging NFTs on various chains such as BNB Chain, Klaytn, Polygon, and its own mainnet Havah through their bridging service called Havah Mitter. Additionally, Havah has future plans to establish the required infrastructure to enable interchain bridging services for smaller chains. By undertaking these initiatives, Havah aspires to become a comprehensive "multi-sidechain" solution, facilitating smooth transfers of NFTs across different mainnets.

5. Addressing Key Challenges: Havah's Solutions

Havah unlocks a new realm of possibilities for NFT projects, granting them unparalleled freedom. First and foremost, the platform relieves projects of the burdensome task of selecting an initial chain. In the event of migration needs arising from issues with the existing mainnet, the process of migration becomes resource-intensive when undertaken solely by individual projects. However, Havah Mitter streamlines this process, significantly reducing resource costs for individual projects.

An illustrative example is the successful migration of the Bellygom NFT project, which is based on a well-known IP. Leveraging Havah Mitter, Daehong Communication, the project operator, seamlessly migrated Bellygom to the Polygon chain. They created a dedicated migration page and offered convenient services such as a 1 MATIC fee for holders who migrated within a week, ensuring a low-cost and highly efficient migration experience. This instance highlights how Havah Mitter not only bridges individual NFTs but also addresses the demand for cross-chain migration on a project-by-project basis.

Furthermore, Havah can strategically assist new projects in launching their chains and services. By initially minting on established platforms like Ethereum or Polygon, which are familiar to existing users, these projects can lower the barrier to entry. Subsequently, they can encourage users to migrate their NFTs to their own chain, thereby attracting new users. If this process becomes standardized, future projects planning to launch new mainnets or appchains can rely on Havah to help them attract users and capital to their respective networks, fostering growth and development.

6. Pioneering New Growth Engines: Havah's Vision

Moreover, Havah paves the way for the convergence of NFTs from diverse chains onto a particular mainnet, giving rise to unprecedented services and opportunities. Building upon the examples mentioned above, we have witnessed a surge in metaverse platforms aiming to expand the utility of NFTs by incorporating esteemed blue-chip NFTs and integrating them as playable characters. Havah's suite of services acts as a catalyst for this burgeoning trend. Imagine a metaverse that seamlessly integrates PFP NFTs from various chains, bringing them together in a unified space. Alternatively, envision a scenario where all your individual NFTs from different chains converge onto a single chain, creating a captivating exhibition. These possibilities exemplify the transformative potential that Havah unleashes, opening doors to uncharted territory and limitless innovation.

Part 2. Havah Tokenomics

1. Analyzing the Pros and Cons of Node-Participatory Tokenomics

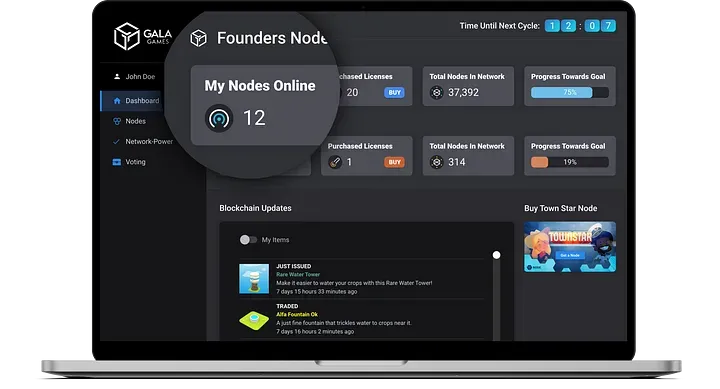

The remarkable success of Gala Games has sparked a wave of game projects embracing node-participatory tokenomics. However, it is important to carefully consider the advantages and disadvantages inherent in this approach.

1.1. Advantages

Projects that embrace the node system enjoy numerous advantages. In the short term, the proceeds generated from node sales can provide a stable source of funding for future project development and operations. In the long run, the mainnet can achieve decentralization. Additionally, as node buyers receive project tokens as an incentive, their interests align with those of the project. As a result, node buyers become essential users within the ecosystem, actively engaging with dApps on the platform at an early stage. They also become a supportive force, sharing the project's long-term vision and playing a significant role in major governance decisions, thus greatly contributing to the project's growth.

1.2. Disadvantages

The main challenge lies in the imbalance between supply and demand. Once nodes are sold and tokens are distributed as rewards for node operation, it becomes challenging to control the tokens, particularly if the ecosystem is not yet developed to accommodate the released tokens. Restoring balance becomes increasingly difficult. When the token price decreases due to an excess supply compared to demand, the motivation to invest in and operate nodes, as well as participate in the ecosystem, diminishes. Consequently, attracting new users becomes more challenging as the incentives lose their appeal. As the supply of tokens continues to increase through node operations, the longer it takes to find buyers, the quicker the project's tokens lose their attractiveness, subsequently impacting the project's overall appeal and making future operations problematic. How does Havah intend to address this issue?

2. Havah Tokenomics

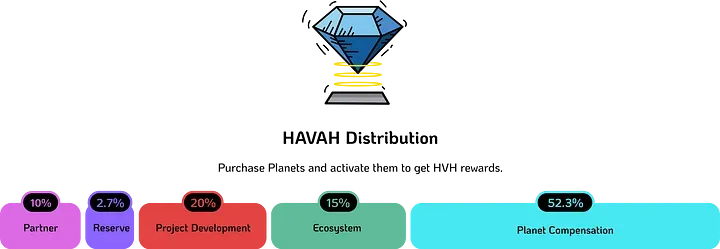

Havah's tokenomics revolve around the concept of "Planet" nodes, with a pre-allocation of 47.7% and node-driven rewards accounting for the remaining 52.3%. These Planet nodes function as off-chain nodes on the Havah chain, responsible for transmitting data from a source chain to a target chain. In exchange for their service of 6 hours per day, they receive HVH, the native token of the Havah chain. Furthermore, Planet node operators have the opportunity to actively participate in key governance decisions concerning the Havah blockchain. The total supply of HVH is set at 10 billion, to be distributed over a span of 15 years. Here are the details:

1) Pre-allocation (47.7% total)

- Partners: 10% of the total supply, subject to a cliff period of 1 year, followed by linear distribution over the subsequent 24 months.

- Reserve: 2.7% of the total supply, subject to a cliff period of 1 year, followed by linear distribution over the subsequent 12 months.

- Developers: 20% of the total supply, subject to a cliff period of 1 year, followed by linear distribution over the subsequent 36 months.

- Ecosystem: 15% of the total supply, subject to a cliff period of 1 year, followed by linear distribution over the subsequent 36 months.

2) Node-powered rewards (52.3% total)

During the first year, a daily distribution of 4.3 million HVH tokens will be evenly allocated among Planet node runners. Subsequently, the reward will decrease by 30% each year, culminating in a total of 15 years of HVH distribution.

3. Supply side: Compensates for the shortcomings of the existing node operating model

Havah has strategically addressed the limitations of the existing node operating model by implementing a supply-side solution. One noteworthy decision they made was to deliberately extend the cliff point for pre-allocated tokens by one year. This strategic move was aimed at instilling confidence in potential buyers who may have been hesitant to invest in nodes due to the lack of a well-established ecosystem. By assuring them that "for the next year, no additional tokens will be introduced to the market apart from node-driven rewards," Havah created an economic incentive for early adopters to take the risk and acquire nodes.

Moreover, Havah carefully managed the token supply to ensure that no additional tokens entered the market outside of the rewards earned through node participation. This precautionary measure effectively mitigated the risk of a significant supply-demand collapse before the ecosystem had fully matured. During this critical period, Havah focused on strengthening the ecosystem by launching its core project, Crypto Gears, and introducing its own NFT platform called HAVAH Friends. These strategic initiatives were designed to generate sufficient demand for HVH tokens when the cliff point was eventually reached.

By implementing these measures, Havah demonstrated its proactive approach in compensating for the shortcomings of the existing node operating model. This deliberate strategy not only instilled confidence in potential buyers but also laid the groundwork for a robust and sustainable ecosystem as Havah continued to expand its offerings.

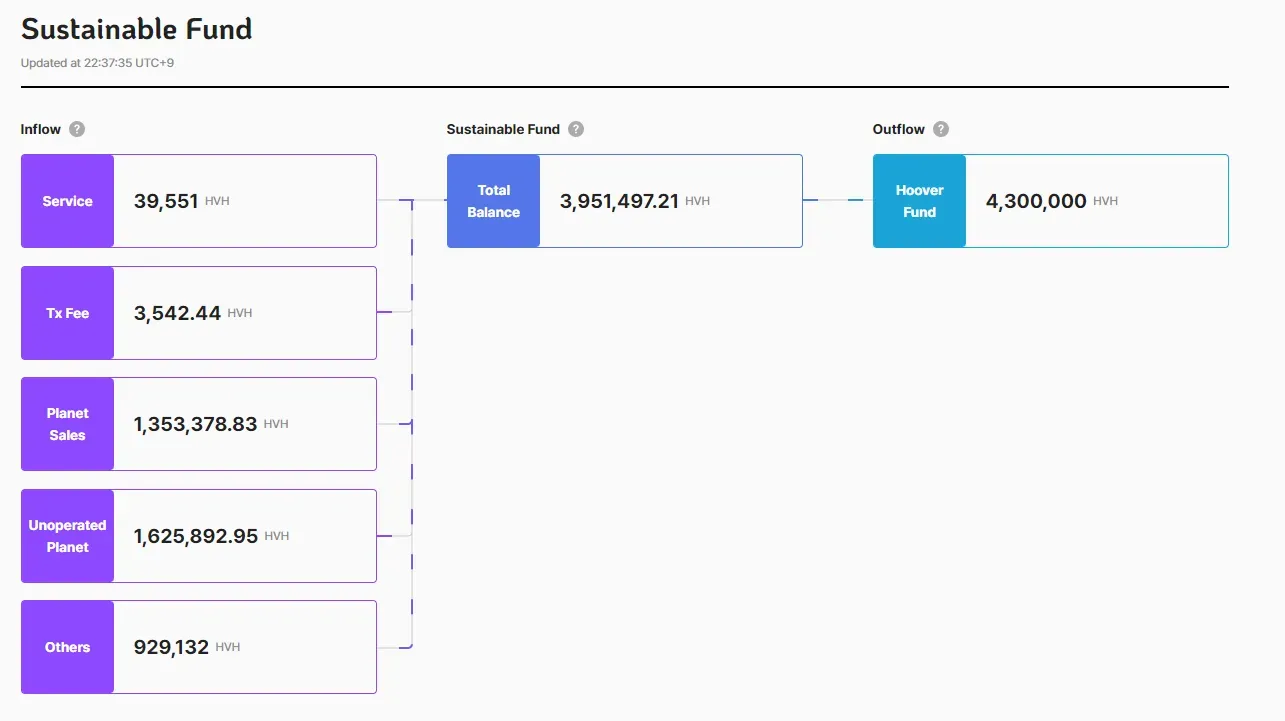

3.1. Sustainable Fund

Havah has implemented a deflationary tokenomics model designed for long-term sustainability. As the Havah ecosystem gains momentum and the demand for HVH tokens rises, the total amount of HVH locked up from various sources such as service fees, transaction fees, and planet node sales will increase proportionally. This deflationary mechanism involves moving a certain portion of HVH tokens to the Sustainable Fund whenever ecosystem activities occur, effectively reducing the circulating supply in the market.

The Sustainable Fund is allocated HVH tokens based on specific criteria, including:

- Service: 80% of service fees collected on the platform are locked up.

- Transaction fee: 80% of the transaction fees generated on the Havah Mainnet are locked up.

- Planet Sale: 60% of the revenue generated from the sale of planet nodes is locked up in the Sustainable Fund.

- Unpowered Planet Reward: HVH tokens are locked up for nodes that fail to meet the daily power condition.

- Etc: The remaining token supply is locked up after conducting airdrops or community events. The significant contributors to the Sustainable Fund are the Unpowered Planet Reward and Planet Sale.

However, the introduction of services like Havah Earth and Havah Swap has alleviated the burden of node operation, leading to an anticipated decrease in the lockup amount due to unpowering in the future. On the other hand, as the Havah ecosystem gains further traction, the performance of Planet Node Sale is expected to improve, resulting in a substantial amount of HVH tokens being locked up.

Havah's deflationary tokenomics model ensures a controlled supply of HVH tokens, contributing to the long-term sustainability and growth of the ecosystem.

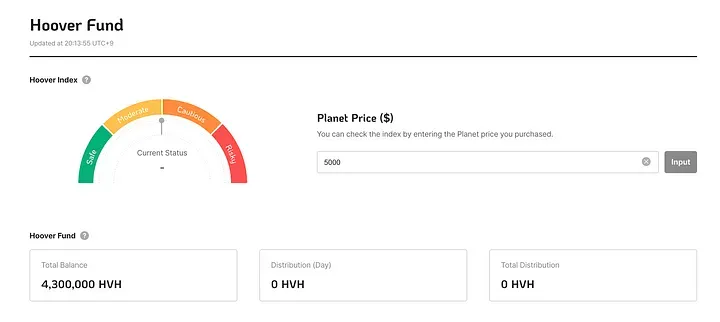

3.2. Hoover Fund

There is a potential scenario where the funds locked in the Sustainable Fund could be released. While the Sustainable Fund typically serves as a lockup mechanism, Havah has provisions in place to address extended periods of reduced interest from new Planet buyers due to unfavorable market conditions. In such cases, Havah may redirect HVH tokens locked in the Sustainable Fund to the Hoover Fund, aiming to alleviate the financial burden on new and prospective Planet noders. This strategic measure guarantees that Havah has implemented minimal precautionary measures to attract new Planet noders, even during times of market uncertainty.

4. Demand side: projecting the value of the network

Limiting the supply is an add-on, not an inherent feature. At the end of the day, tokenomics is all about how to keep the demand for a token higher than the supply. HVH is used in the following ways.

4.1. Transaction and NFT bridging fees

HVH is utilized as a fee for transactions on the Havah mainnet. When bridging NFTs from one chain to another using Havah Mitter, the fees incurred by the destination chain are covered by the source chain. However, the demand for HVH as a fee is somewhat limited due to the low cost of using the Havah Mainnet.

4.2. Purchase of a Planet Node

By using HVH instead of USDT to purchase a planet node on the market, buyers can enjoy a 5% discount (subject to change). The process of purchasing HVH from the market by Planet Buyers contributes to the initial increase in HVH value. Furthermore, 60% of the purchase cost is locked up in the Sustainable Fund, contributing to the subsequent increase in HVH value. During the early stage of Planet Node sales, the unit price of a node remains relatively high (around $5,300), and as sales increase in the future, the price of a Planet is expected to rise proportionally. Consequently, a significant amount of HVH is likely to be locked up as a result of Planet sales. However, it is important to note that there is a clear cause and effect relationship between the increased demand for HVH due to the purchase of Planet nodes. While an increase in HVH price may drive the demand for purchasing Planet Nodes to acquire HVH, it is unlikely that nodes would be sold first, leading to a reduction in HVH supply and an increase in its value. In other words, nodes can only accelerate the price increase of HVH, rather than proactively enhance its value.

4.3. Role of the ecosystem's reserve currency

As the ongoing debate surrounding the valuation of mainnet tokens continues, market dynamics have shown a clear correlation between the level of activity and liquidity on a mainnet and the price of its corresponding tokens. In light of this observation, the intrinsic value of HVH can be enhanced by fostering a robust and functional ecosystem on the Havah chain, while simultaneously attracting users and capital. With this objective in mind, Havah has devised a series of projects aimed at nurturing and expanding its ecosystem. By focusing on these initiatives, Havah seeks to solidify HVH's position as the reserve currency within its ecosystem, thereby bolstering its long-term viability and attractiveness to stakeholders.

5. Building Havah’s Ecosystem

Rather than adopting a passive approach of persuading other projects to join Havah, the company has opted for an active strategy of first developing its own ecosystem of decentralized applications (dApps) and then driving adoption from the others. One notable project in the pipeline is Crypto Gear, sci-fi strategy game slated for launch later this year. With the involvement of over 50 seasoned game developers, Crypto Gear aims to deliver a unique gaming experience by integrating NFTs from external chains onto the Havah chain. By doing so, players will enjoy benefits such as enhanced combat capabilities and access to additional in-game resources when their NFTs are connected to in-game robots.

Another exciting dApp under development by Havah is the PFP To Card (P2C) project, which introduces a card game that transforms PFP NFTs into playable cards within the game. Essentially, P2C enhances the value of PFP NFTs by providing them with functional utility beyond their aesthetic and community-building aspects. Through these innovative services, Havah seeks to unlock the full potential value of NFTs and propel the industry forward. In addition,

- NFTs: Havah Friends, SPQ(coming soon)

- DEX and NFT marketplace: Havah Swap

- Wallet: Havah Wallet

- Havah Explorer

As the platform's basic infrastructure is already in place, Havah plans to utilize the HVH tokens allocated to the ecosystem upon service launch to bootstrap its own offerings and ignite the ecosystem's growth. Throughout this process, Havah aims to bridge as many NFTs as possible onto the Havah Chain, cementing its position as a thriving hub for NFT activity and innovation.

Part 3: Final thoughts

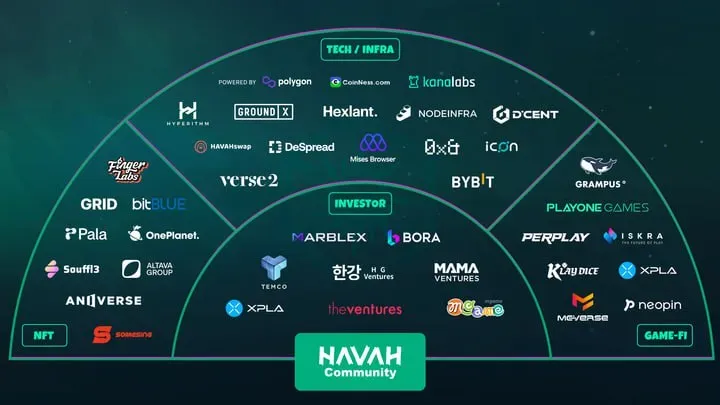

Havah's overarching goal is to unlock additional value within the market by disrupting the existing paradigm, enabling NFTs to transcend chain limitations and move freely. This vision has garnered support from various players in the space, including prominent Play-to-Earn (P2E) projects like Neopin, Marblex, XPLA, Meverse, and Perplay, as well as NFT-focused initiatives such as Altava, Pala, and Aniverse.

And the use cases for Havah's solutions are continually expanding. Numerous individual NFTs have successfully crossed over through the NFT bridging service offered by Havah Mitter already. Notably, there have been instances of projects migrating to Havah, such as the Bellygom case, showcasing the real-world implementation of project-level migration facilitated by Havah's services.

As Havah continues to forge ahead, its commitment to disrupting the market and unlocking the full potential of NFTs remains steadfast. By fostering seamless interoperability and driving the adoption of innovative solutions, Havah is poised to shape the future of the NFT ecosystem.

However, the market that Havah aims to capture is far more expansive. Merely serving as an interchain bridge for NFTs would only bring fleeting satisfaction to NFT projects, leaving Havah with little to showcase. Therefore, while Havah may initially be perceived as an NFT bridging service, its ultimate goal is to establish itself as a comprehensive multi-sidechain platform that accommodates all types of NFTs. To achieve this, Havah must secure a substantial number of NFTs that will remain on the Havah chain long-term and cultivate an ecosystem where Havah becomes the primary chain for NFT activities.

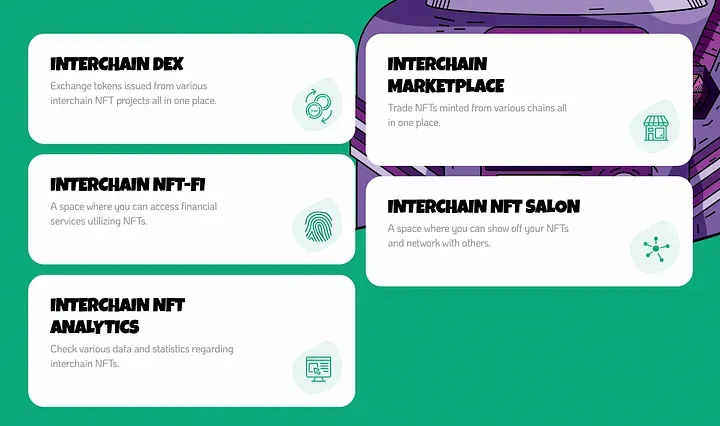

The initial step entails onboarding small and medium-sized NFT projects from various chains that seek to leverage the enhanced liquidity provided by the Havah chain. Once the infrastructure is robustly established and NFTs from diverse mainnets begin to flow into Havah, the platform will be well-positioned to offer differentiated services based on this influx. Beyond the aforementioned NFT-linked gaming services, Havah can explore the implementation of interchain NFT-fi, allowing users to lend their NFTs as in-game items for a predetermined period in exchange for HVH tokens or enable NFT collateralization to enhance capital efficiency. Additionally, Havah needs to develop an NFT marketplace and decentralized exchange(DEX) where these NFTs and capital can be freely traded, effectively positioning HVH as the core currency within this ecosystem.

Once the organic ecosystem is firmly established, Havah must ensure that its services are appealing to the market in order to attract large-scale NFT projects to the Havah chain. To entice prominent NFTs, Havah needs to highlight the additional value of being part of the Havah ecosystem, demonstrating that they can serve a broader purpose beyond simple ownership. This could involve offering benefits such as increased lending limits, lending rewards, or enhanced in-game attributes when utilized within gaming environments. By showcasing these advantages, Havah can incentivize major ecosystem participants like Ethereum, Binance Smart Chain, and Solana to migrate their NFTs from their respective mainnets to Havah. As a result, Havah can transform itself into an "NFT-specific hub" rather than just a bridging service, establishing itself as a vital player within the NFT market.