Redacted Cartel — The Hidden Hand of the DeFi World

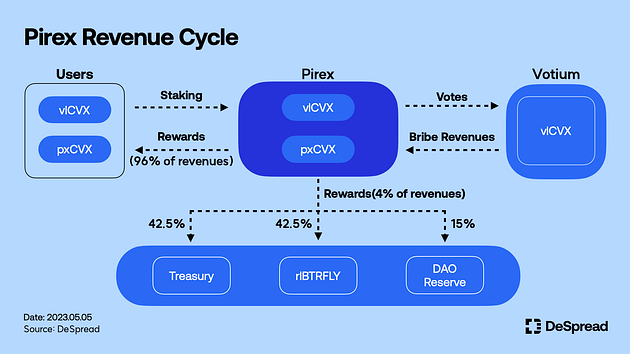

Focusing on the product revenue cycle

1. Redacted Dreaming of a DeFi Kingdom

Redacted Cartel (Redacted) is an official fork project of Olympus DAO, making its debut in December 2021. Redacted v1 embarked on its journey with the objective of establishing a prominent position within Curve Finance’s gauge weight voting system, employing a Protocol Owned Liquidity (POL) methodology akin to Olympus DAO. The project’s inception aimed to optimize the token supply within the Curve ecosystem, encompassing CRV, CVX, and Curve LP tokens, to enhance liquidity for the Curve governance system and augment its influence in receiving incentives. Following its launch, Redacted witnessed significant market interest and successfully raised approximately $73.2 million through a token issuance auction, unveiling their native token, BTRFLY.

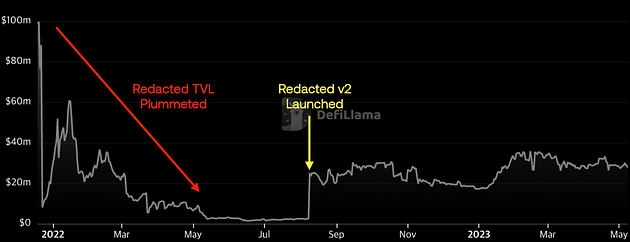

However, as 2022 began, the DeFi market started to crash, and Redacted was not spared from the impact. The price of BTRFLY, which had previously been above $3,400, plummeted to less than $400 in January 2022 alone, representing a staggering 90% decrease. At the same time, the Redacted protocol witnessed a significant decline in Total Value Locked (TVL), dropping from approximately $1 million in December 2021 to less than a quarter of that in January 2022. Subsequently, the TVL further decreased to $2 million by July.

To get out of the doldrums, Redacted announced the “Redacted v2” update, which aims to promote the sustainability of the protocol and provide a ‘real yield’ to users through a complete overhaul of BTRFLY tokenomics.

1.1. BTRFLY v2

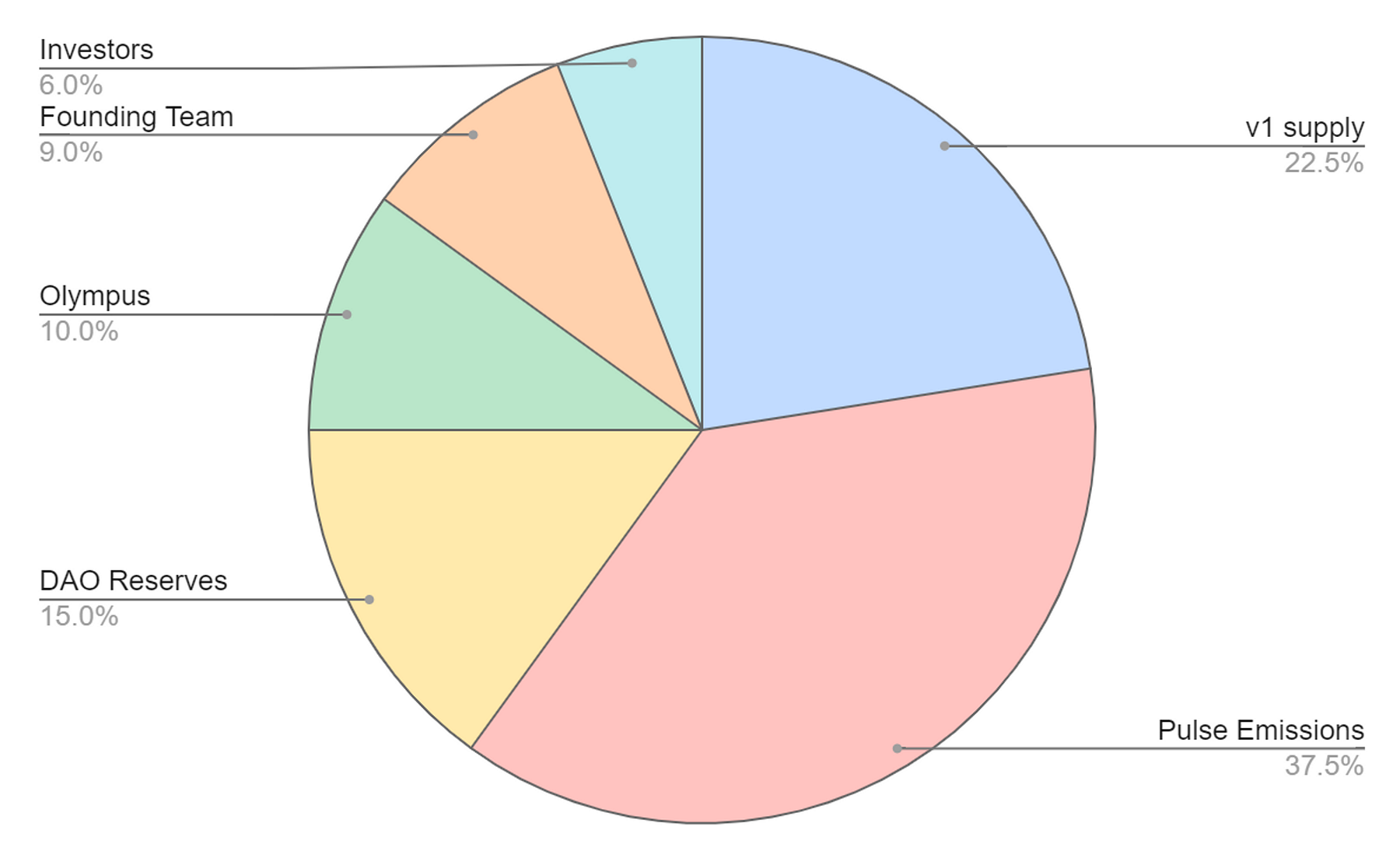

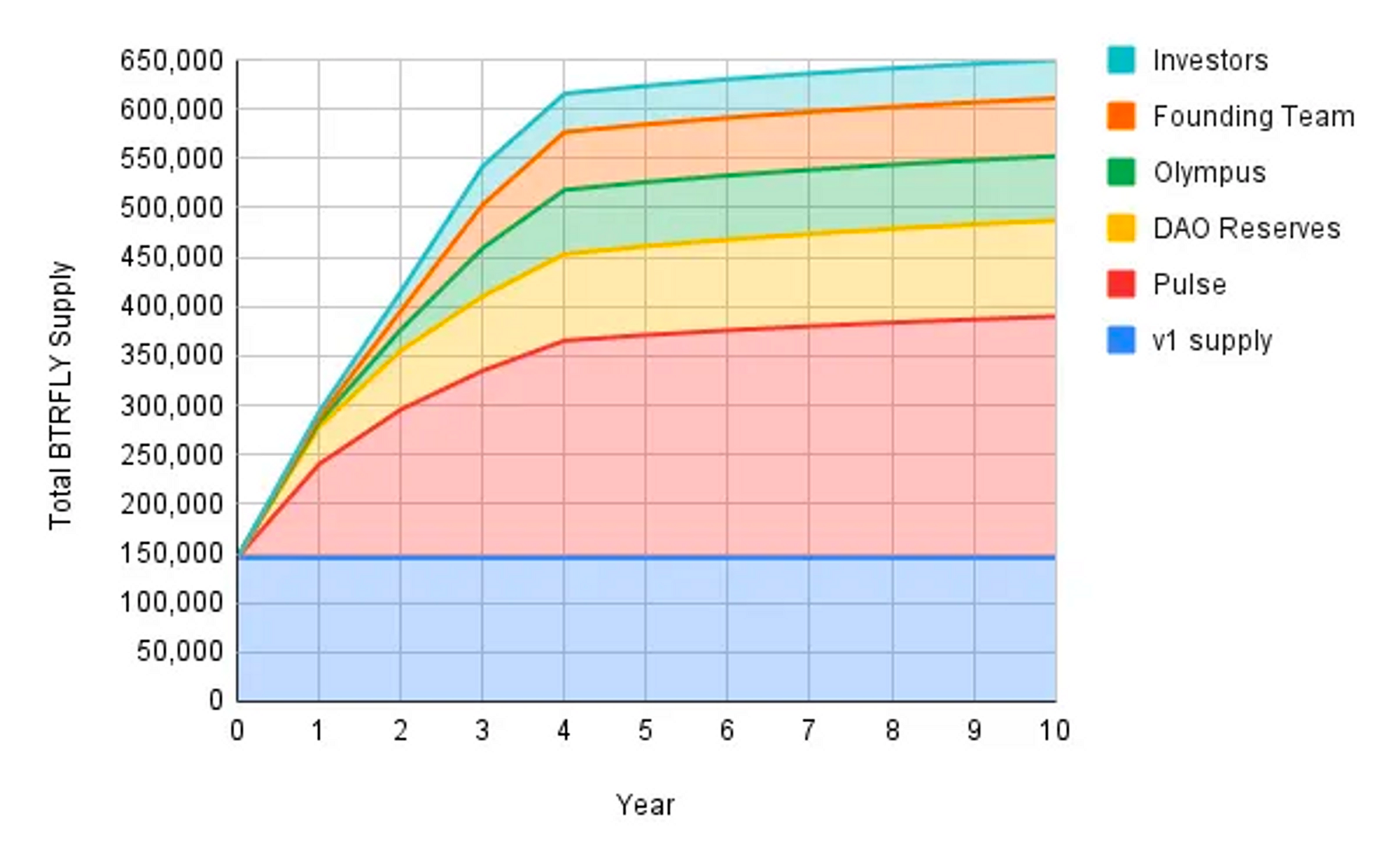

Following the implementation of Redacted v2, significant changes have been made to the tokenomics of its governance token, BTRFLY. These modifications include transitioning from an infinite total supply (as in v1) to a relatively limited quantity of 650,000 BTRFLY tokens. The accompanying graph provides a visual representation of the planned token distribution over a span of 10 years. The distribution plan focuses on initially allocating a substantial number of tokens within the first four years to facilitate protocol expansion, while adopting a more gradual distribution rate over the remaining six years to ensure a stable value for the token.

BTRFLY Distribution

- Investors: 6%(39,000 BTRFLY)

- Founding Team: 9%(58,500 BTRFLY)

- Olympus DAO: 10%(65,000 BTRFLY)

- DAO Reserve: 15%(97,500 BTRFLY)

- v1 Supply: 22.5%(146,250 BTRFLY)

- Pulse emissions: 37.5%(243,750 BTRFLY)

The focal point of BTRFLY v2’s tokenomics is the concept of pulse emissions. These emissions involve the distribution of BTRFLY tokens to different products and liquidity pools within the Redacted ecosystem, aiming to maintain ample liquidity and promote active engagement both presently and in the future. Currently, pulse emissions are exclusively allocated to rlBTRFLY generated through BTRFLY deposits. However, there are plans to extend the distribution of pulse emissions to various other products within the ecosystem, beyond rlBTRFLY, during a designated “rapid expansion period” spanning the initial four years.

1.2. rlBTRFLY

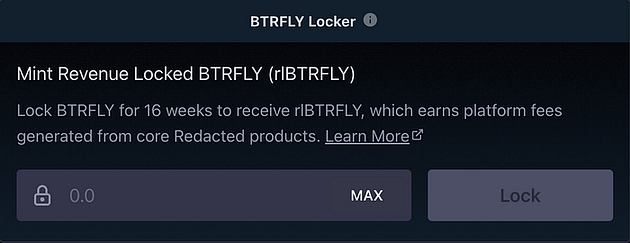

To grasp the core transformation in tokenomics, it is crucial to recall the underlying objective of BTRFLY v2, which revolves around providing tangible yield to users within the Redacted ecosystem. To comprehend this concept, we must emphasize the circulation of value generated by the Redacted ecosystem and the means by which the resulting revenue is distributed to BTRFLY holders. At the heart of this process lies rlBTRFLY (revenue-locked BTRFLY), which plays a central role in propagating the revenue to the token holders.

rlBTRFL is a token that can be obtained by locking BTRFLY for a duration of 16 weeks. Its purpose is to encourage BTRFLY holders to engage in long-term retention of their tokens by granting them a portion of the revenue generated within the Redacted ecosystem.

The revenue that rlBTRFLY holders can earn can be divided into two main categories:

- Revenue sharing from the Redacted Ecosystem (ETH)

- Pulse emissions from staking BTRFLY (BTRFLY)

The Redacted ecosystem consists of the governance marketplace Hidden Hand, the token securitization platform Pirex, and the Redacted Treasury. Redacted is offering a percentage of the revenue generated by each product as rlBTRFLY rewards, which are paid out in ETH. The revenue sharing percentage that each product provides to rlBTRFLY is as follows:

- Hidden Hand: 50% of revenue paid to Redacted

- Pirex: 42.5% of revenue paid to Redacted

- Redacted Treasury: 15% of revenue

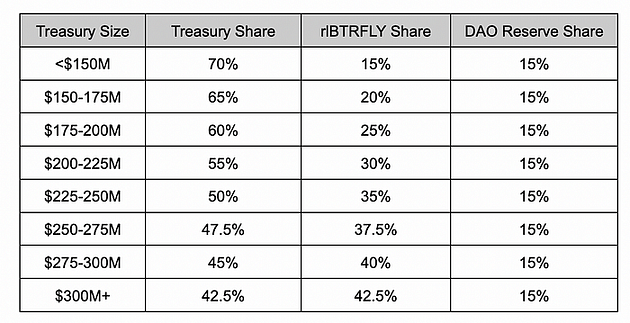

In subsequent chapters, we will delve into the Hidden Hand and Pirex examples with more depth. However, for the purpose of this chapter, our attention is directed towards the revenue flow originating from the Redacted Treasury. The Redacted Treasury serves as a repository for the revenue generated by the Redacted ecosystem, which is further capitalized through yield farming. From this yield farming activity, the Redacted Treasury receives 70% of the generated revenue, along with 35% from Hidden Hand and 42.5% from Pirex.

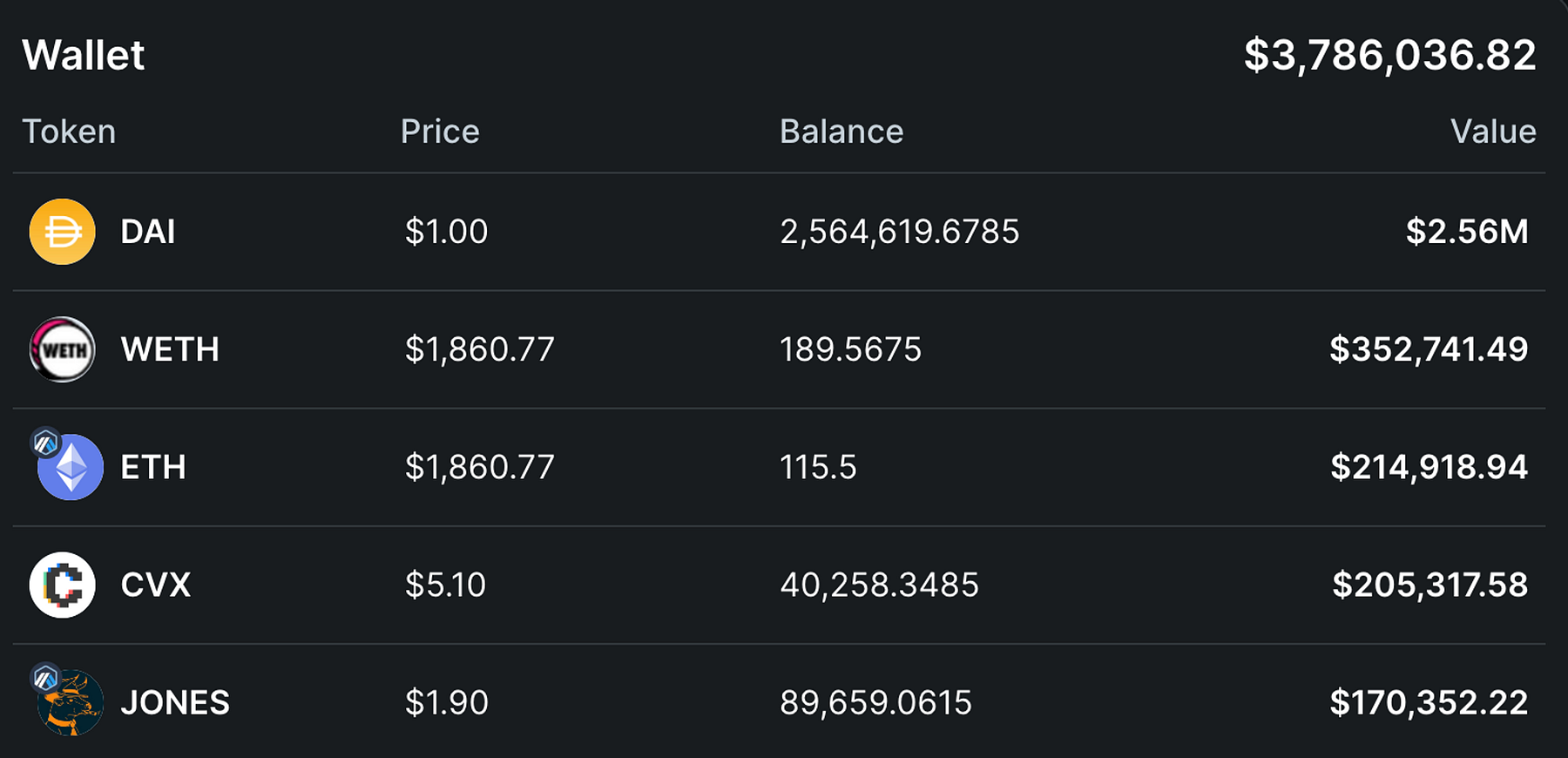

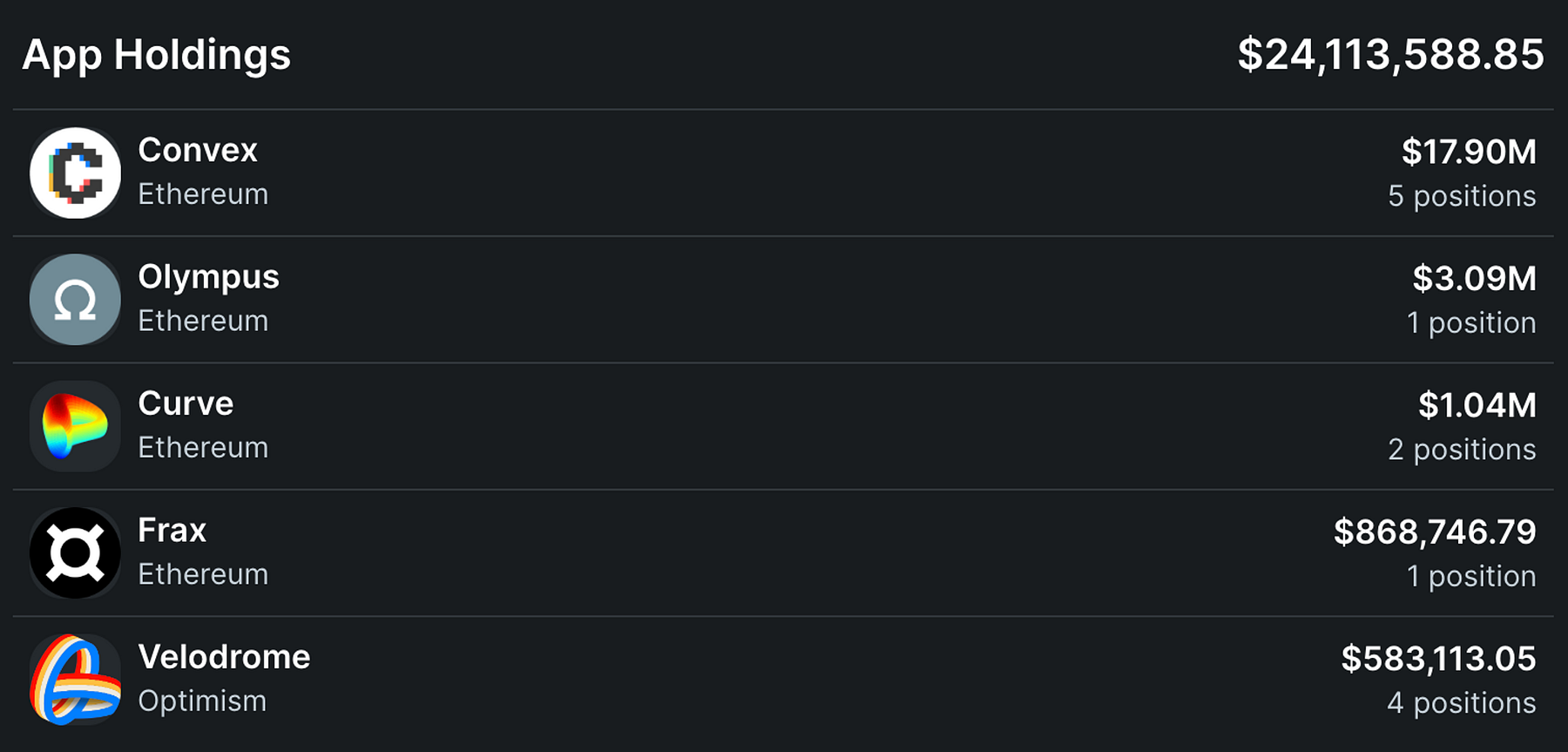

The diagram provided above depicts the current holdings of the Redacted Treasury, showcasing the assets stored in its wallet, as well as the liquidity pools in which it has made deposits for yield farming. Notably, approximately 86.4% of the treasury’s assets are allocated to liquidity pools within DeFi protocols closely affiliated with Redacted, including Convex, Olympus, and Curve. These allocations are aimed at generating yield. Moreover, a portion of the yield generated, equivalent to 15%, is distributed to rlBTRFLY. It is worth noting that this percentage increases proportionally alongside the growth of the Redacted Treasury, as outlined in the following details.

Currently, the Redacted Treasury has approximately $28M in assets, where 70% of the revenue generated by the treasury through yield farming is distributed back to the treasury, 15% to rlBTRFLY, and the remaining 15% to Dao Reserve. The share allocated to rlBTRFLY is designed to increase as the size of the treasury increases, creating a virtuous cycle between the revitalization of the Redacted ecosystem and the benefits enjoyed by rlBTRFLY holders.

Aside from the revenue obtained through treasury yield farming, holders of rlBTRFLY will also be eligible to receive BTRFLY rewards through pulse emissions. These rewards can be perceived as staking incentives for rlBTRFLY holders and differ from the aforementioned ETH rewards in that they involve the issuance of new BTRFLY tokens rather than sharing in the protocol’s generated value.

Every two weeks, both ETH and BTRFLY rewards are distributed, allowing holders to claim them promptly without any required lockup period. Moreover, it’s important to note that rlBTRFLY possesses the same voting privileges as BTRFLY. Consequently, holders are not required to segregate their earnings and voting rights as both functions can be exercised through a single token, namely rlBTRFLY.

Let’s take a closer look at the products that compose the Redacted ecosystem and how the value generated by each product flows into rlBTRFLY.

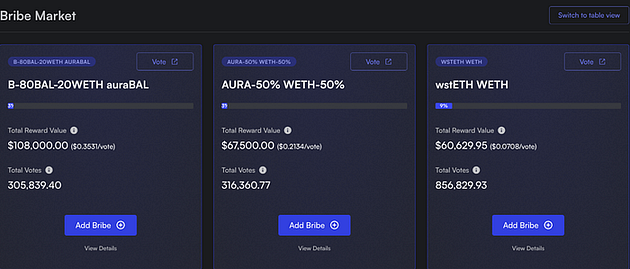

2. Governance Marketplace: Hidden Hand

Hidden Hand, as Redacted’s central offering, presents users with supplementary governance incentives, commonly referred to as “bribes,” by leveraging the liquidity bootstrapping technique of ve-tokens (vote-escrow tokens). To participate, users have the option to deposit their governance tokens into various DeFi protocols like Aura, Balancer, and Frax. Subsequently, they can delegate the ve-tokens they receive to the Hidden Hand platform. Hidden Hand serves as an aggregator, consolidating these ve-tokens and distributing them strategically to optimize the user’s rate of return, ensuring they receive the highest possible amount of bribes. As a result, users can benefit from economies of scale by utilizing the governance incentive aggregator, Hidden Hand, enabling them to obtain substantial bribes without undergoing the complex process of directly depositing and voting governance tokens across multiple protocols.

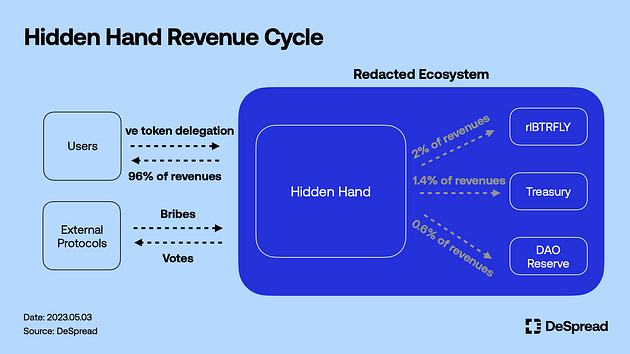

Out of the revenue generated from bribes through Hidden Hand, 96% is allocated to users who have delegated ve-tokens to the platform, while the remaining 4% is charged as a fee to the Redacted protocol. This fee undergoes further distribution, with 35% directed to the treasury, 50% to rlBTRFLY, and 15% to the Dao Reserve, as previously mentioned. To illustrate this with an example, let’s consider a hypothetical DeFi protocol called Vesta Finance that offers a $1 million bribe to Hidden Hand’s FRAX market. In this scenario, $960,000 (96%) of the bribe would be allocated to users who have delegated veFXS tokens to Hidden Hand, while the remaining $40,000 goes towards Hidden Hand’s fees. These fees would then be divided, with $14,000 allocated to the treasury, $20,000 to rlBTRFLY, and $6,000 to the Dao Reserve.

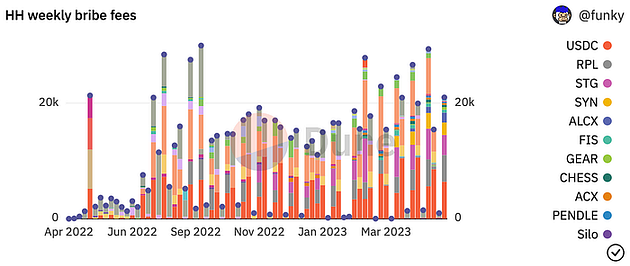

The provided graph illustrates the weekly fees generated by Hidden Hand through bribes. Considering that rlBTRFLY rewards can be obtained on a bi-weekly basis, holders of rlBTRFLY tokens receive rewards amounting to approximately $10,000 to $13,000 per epoch from Hidden Hand. It’s important to note that this figure increases when factoring in the indirect rewards that are distributed to the treasury.

Therefore, Hidden Hand not only enhances Redacted’s position in the pursuit of governance incentives within the competitive landscape of DeFi protocols but also, the revenue structure that leads to an increment in the revenues of rlBTRFLY holders when Hidden Hand is activated enables users to partake in the value generated by the product without directly engaging in Hidden Hand itself.

3. Token Securitization Platform: Pirex

Pirex is an additional fundamental component within the Redacted ecosystem. It assumes responsibility for the automatic compounding and management of yields for tokens that users deposit on the platform. Moreover, Pirex facilitates the trading of future yields and governance influence derived from these stakes through the securitization of staked tokens, thereby enhancing capital efficiency. The tokens serviced by Pirex encompass CVX, GMX, and GLP. This article will primarily concentrate on the CVX product, which exhibits a close relationship with rlBTRFLY, as we delve into the exploration of the Pirex ecosystem.

3.1. CVX Products

CVX is the governance token of Convex Finance, a platform designed to amplify the rewards provided to Liquidity Providers (LPs) and CRV stakers on Curve. Notably, CVX holds significant influence within Pirex, representing 96% of Pirex’s Total Value Locked (TVL). Pirex is actively engaged in developing an array of liquidity staking strategies that revolve around CVX, with the aim of bolstering their impact on Convex and, ultimately, Curve.

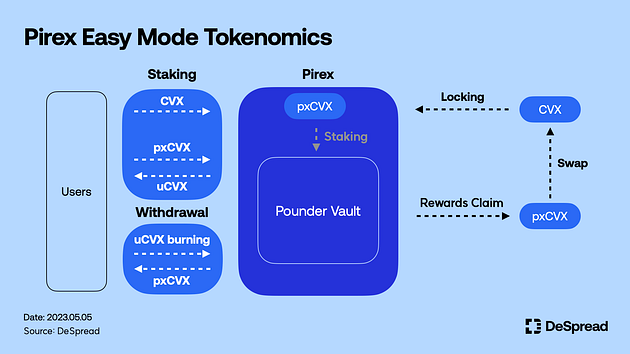

Pirex’s CVX securitization strategy starts with users depositing CVX into Pirex. Users can lock up their CVX for 16–17 weeks, at which point the locked CVX is converted to vote-locked CVX(vlCVX). As the name implies, vlCVX is a token whose original purpose is to monetize governance incentives and strengthen voting influence, and therefore cannot be traded or transferred.

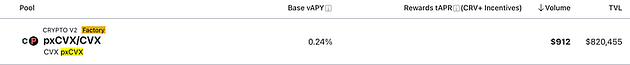

To overcome the liquidity constraints associated with vlCVX (vote-locked CVX) while preserving the governance power it holds, Pirex has introduced pirex CVX (pxCVX). pxCVX is designed to maintain a 1:1 value ratio with vlCVX. It functions as a tradable and transferable variant of vlCVX, offering users the ability to acquire pxCVX through a simple swap for CVX within Curve’s liquidity pool, in addition to staking it on Pirex.

Pirex offers a variety of securitization strategies centered around CVX, each of which is divided into three modes: Easy, Standard, and Expert, depending on the specific liquidity staking token(LST) and yield farming strategy.

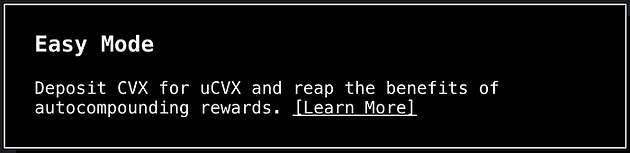

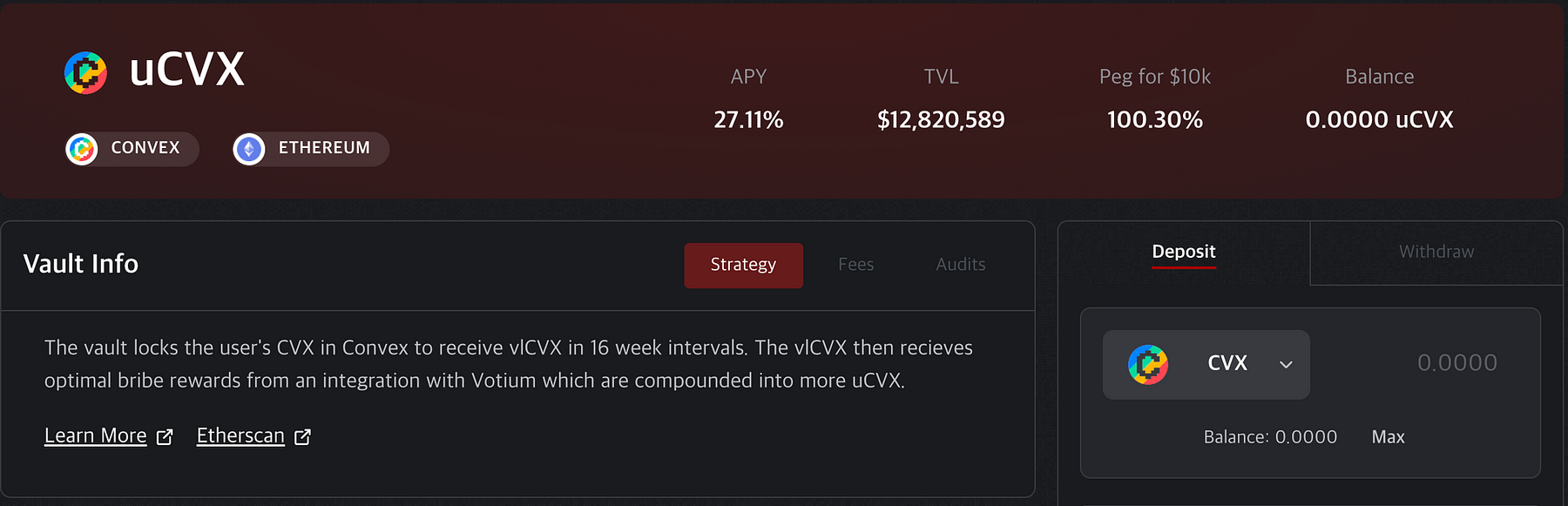

3.1.2. Easy Mode

Easy mode allows users to deposit CVX or pxCVX to obtain a union CVX(uCVX). In the process, the pxCVX is deposited into the pxCVX Pounder vault, which is jointly operated with Llama Airforce. If the user deposits a CVX, Pirex will automatically convert the CVX to pxCVX and deposit it into the Pounder Vault.

Pounder vault automatically receives rewards earned by utilizing pxCVX in their vaults, and instead of sending those pxCVX rewards directly to the Pounder vault, they convert them to CVX, lock them up, and convert them back to pxCVX. The reason for this intermediate process is to provide staking rewards to users while increasing the amount of CVX held by the Redacted ecosystem, thus strengthening its influence in Convex governance.

Once the Pounder vault claims the pxCVX rewards, these rewards are distributed to users over a period of two weeks. Users have the freedom to claim their rewards without any mandatory lockup period by burning their uCVX tokens. As the Pounder vault continuously acquires pxCVX rewards, the exchange rate of pxCVX per 1 uCVX gradually increases. Consequently, users can withdraw their investments along with additional rewards by simply burning the uCVX tokens they have already received. This approach allows for a flexible and accessible method of receiving both the principal amount and extra rewards upon withdrawal.

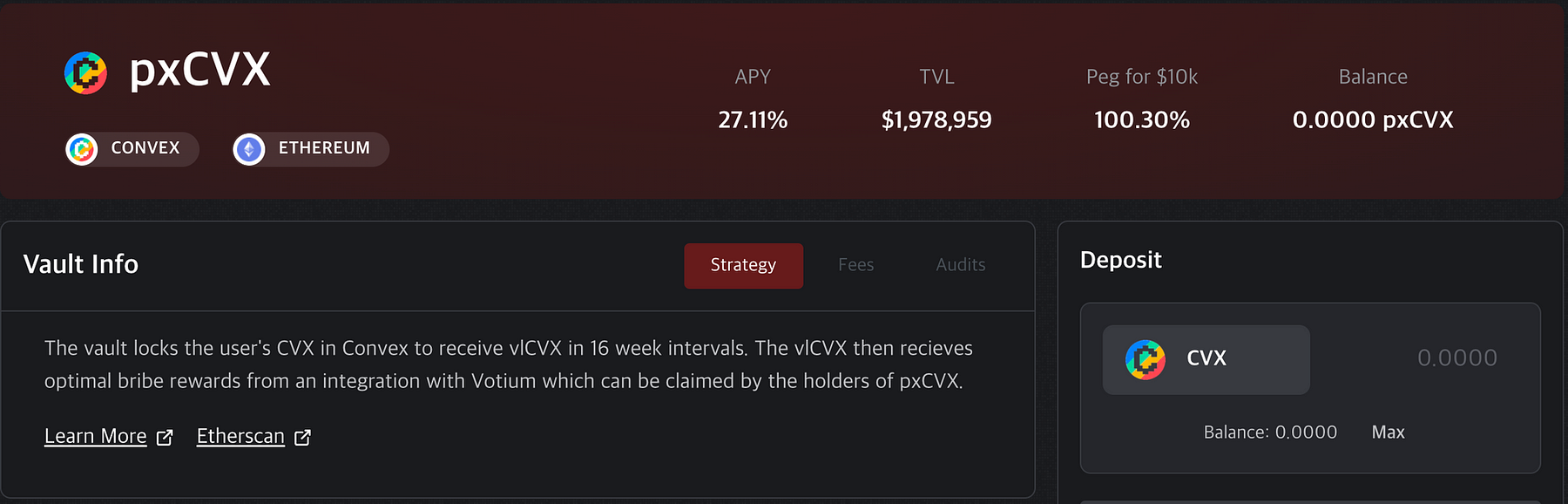

3.1.3. Standard Mode

Standard mode refers to a securitization strategy wherein users deposit CVX with Pirex to acquire pxCVX and Votium rewards. As previously stated, Pirex re-locks the CVX deposits from users into vlCVX, resulting in the creation of pxCVX tokens that maintain a value ratio of 1:1 with vlCVX. These pxCVX tokens function as a conduit for capturing all profits derived from vlCVX and subsequently distributing them to the users who originally deposited CVX.

Votium serves as a governance incentive marketplace, similar to Hidden Hand, enabling vlCVX and veCRV holders to obtain bribe revenue through direct voting or token delegation (excluding veCRV). Pirex utilizes its vlCVX holdings to receive bribes from Votium, distributing the remaining revenue, after deducting a 4% fee, to pxCVX holders every two weeks based on their token holdings at that time. To date, Pirex has received approximately $21 million in total revenue from vlCVX bribes through Votium, positioning it as the 20th largest vlCVX holder within the Votium ecosystem.

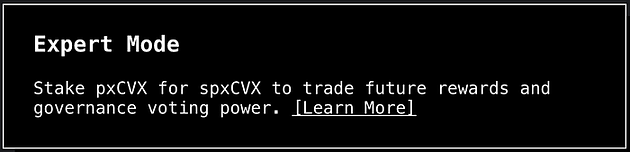

3.1.4. Expert Mode

In Expert mode, users deposit pxCVX to obtain future profits linked to those pxCVX holdings. These profits are received in the form of staked Pirex vlCVX (spxCVX) and Reward Future Note (RFN) tokens. The RFN represents a right to claim future bribe revenue, essentially tokenizing anticipated cash flow.

Pirex offers spxCVX and RFN tokens in proportion to the amount of pxCVX deposited by a user and the duration of the deposit. Let’s consider an example: User A deposits 10 pxCVX for a duration of 52 weeks (26 epochs). As a result, User A immediately receives 10 spxCVX and 10 RFN tokens, along with an additional 10 RFN tokens for each epoch, resulting in a total of 260 RFN tokens. In a similar manner to real-world bonds, where the value varies based on factors like maturity and purchase timing, the values of spxCVX and RFN tokens are influenced by factors such as the unlocking period and the specific epoch in which they are received.

3.1.5. Redemption

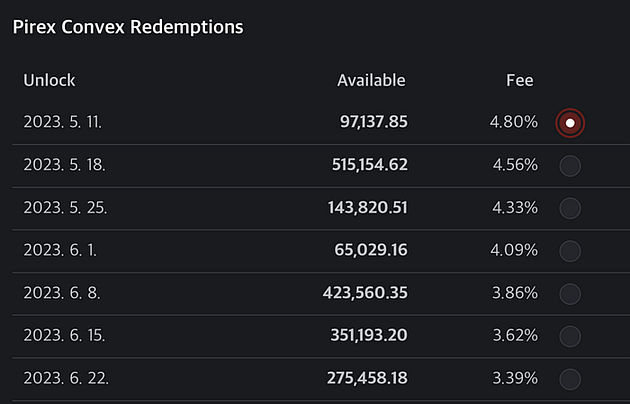

Users can unlock the pxCVX rewards they receive in each mode and convert them into CVX if they choose to do so. The unlocking of CVX depends on the unlock schedule of vlCVX since all pxCVX tokens on Pirex are valued at a 1:1 ratio with vlCVX. Therefore, the ability of a user to unlock CVX is contingent upon the unlocking schedule set for vlCVX.

The image displayed above illustrates the “Available” amount of vlCVX that can be unlocked based on the respective unlocking schedules. The unlocking fees vary, ranging from a maximum of 5% to a minimum of 1%, depending on the redemption timeline. Pirex has implemented this fee structure with the objective of discouraging users from frequently accessing and redeeming pxCVX rewards over a short period. Instead, Pirex aims to promote long-term holding by encouraging users to maintain their pxCVX rewards for extended durations.

Once a user selects a pxCVX unlock schedule, they will possess a quantity of upxCVX (unlocked pxCVX) and RFN tokens equivalent to the remaining epochs instead of holding pxCVX. The upxCVX tokens, like RFN, can be freely traded, and their value can vary based on the number of remaining epochs. It’s important to note that the same amount of upxCVX may have different values depending on the remaining epoch.

3.2. Pirex and rlBTRFLY

Pirex allocates the 4% of its revenue generated from Votium’s vlCVX governance incentive as follows: 42.5% to the Redacted Treasury, 42.5% to rlBTRFLY holders, and 15% to the Dao Reserve. The majority of Pirex’s revenue, accounting for 96%, is distributed to users who deposit CVX, while the remaining 4% is directed to the Redacted protocol. Users can optimize their returns by depositing both CVX and BTRFLY on Redacted, as they can benefit from this distribution. Redacted itself follows a similar strategy, aiming to enhance its CVX reserves through Pirex while simultaneously providing real yield to participants within the ecosystem.

3.2.1. Pirex v2

Redacted made an announcement on May 5 about the release of Pirex v2, which includes a redesigned user interface. With this update, users no longer need to select between Easy, Standard, and Expert modes. Instead, they can simply deposit tokens into the relevant vault to receive rewards. It’s important to note that although the mode selection process has been eliminated, the underlying contracts in each mode remain unchanged. This means that the actual token flow remains the same as when utilizing the Easy, Standard, and Expert modes mentioned earlier.

The above images depict the CVX vaults offered by Pirex v2. By selecting the uCVX vault, users can continue utilizing the service in Easy mode, which enables withdrawals only. On the other hand, the pxCVX vault supports both Standard and Expert modes, allowing users to engage in staking and redemption activities.

In addition to the UI overhaul, a key change in Pirex v2 is the introduction of pirex BTRFLY(pxBTRFLY).

When users deposit BTRFLY into either the pxBTRFLY or apxBTRFLY vaults, they will be able to earn rlBTRFLY rewards, just like when they deposit into the Redacted protocol, with a 16-week deposit period. Moreover, Pirex offers additional incentives for those who deposit BTRFLY into these vaults. In the case of pxBTRFLY, users receive ETH as rlBTRFLY rewards. On the other hand, with apxBTRFLY, the received ETH rewards are converted to BTRFLY and reinvested in the vault, leading to increased staking rewards.

Although pxBTRFLY has recently been launched and currently has low total value locked (TVL) and unconfirmed rewards, its introduction is generating excitement as it has the potential to foster engagement and lively token circulation within the Redacted ecosystem, with a focus on rlBTRFLY.Blockspace Market, Dinero

4. Blockspace Market: Dinero

Dinero is the issuance platform for the upcoming stablecoin DINERO, which aims to launch an Ethereum liquidity staking service and access to the Ethereum network blockspace through DINERO. On April 7, Dinero released its litepaper on the official Twitter account, and the protocol consists of the following three elements:

- pxETH(pirex ETH): Dinero’s Ethereum liquidity staking token

- DINERO: Dinero’s decentralized, overcollateralized stablecoin

- Redacted Relayer: a relayer that enables meta-transactions through pxETH and DINERO.

4.1. pxETH

pxETH is a liquid staking token (LST) that users can acquire by staking their ETH on Dinero. The majority of the staked ETH is utilized to meet Dinero validators’ validation needs, while the remaining ETH is allocated for covering transaction gas fees on the Redacted Relayers (details to be discussed later). This participation positions Redacted in a competitive landscape for liquidity staking, which has become more intense since the Shanghai upgrade. Redacted has expressed its commitment to leveraging its governance influence to establish an ETH/pxETH pool on Curve, thus enhancing the liquidity of pxETH and ensuring its success.

4.2. DINERO

DINERO, a decentralized stablecoin created by Dinero, utilizes ETH and pxETH as collateral for its issuance. In essence, DINERO follows a similar approach to MakerDAO’s DAI stablecoin when it comes to its issuance mechanism, peg maintenance system, and liquidation process. It encompasses the typical characteristics of decentralized stablecoins, including the generation of stablecoins through Collateralized Debt Positions (CDPs), the implementation of a Peg Stability Module (PSM) to uphold the peg, and the utilization of Dutch Auctions for liquidation purposes. However, DINERO distinguishes itself significantly from other stablecoins in terms of its utility, which will be further discussed in the upcoming section on Redacted Relayers.

4.3. Redacted Relayer

Redacted Relayers serve as the central component of Dinero, enabling users to submit transactions to the Ethereum network using meta-transactions without the need to pay ETH for gas fees.

Relayer: An entity that forwards transactions to the blockchain network on behalf of a user. Users can benefit from relayers in terms of UX, such as reduced gas costs and faster transaction processing.

Rather than using ETH to pay for transaction fees, users provide DINERO as tips to the relayers. The received DINERO is subsequently burned, serving both to maintain the value of DINERO and to cover the expenses associated with the ETH gas required for executing the transaction.

Through the interconnectedness of pxETH, DINERO, and Redacted Relayers, Dinero has devised a mechanism to gain a competitive edge in the liquid staking derivative (LSD) race and secure a prominent position in Ethereum blockspace utilization. By elevating the utility of DINERO as a vital medium for accessing Ethereum blockspace, a positive feedback loop has been established, generating increased demand for DINERO and amplifying the influence of Redacted Relayers. This exemplifies the commitment of the Redacted Protocol to expand its operations beyond the application layer as an Ethereum dapp and extend its reach to the consensus layer.

5. Redacted Ecosystem Revenue Cycle

Thus far, we have delved into the individual components of the Redacted ecosystem, including Redacted Protocol, Hidden Hand, Pirex, and the upcoming Dinero, to examine how the value created within each ecosystem is integrated into rlBTRFLY. It is evident that a substantial portion of the revenue generated by Redacted’s primary products, Hidden Hand and Pirex, is directed towards the users, while a significant proportion of the remaining revenue is allocated to rlBTRFLY. In the subsequent article, we will explore the tokenomics of the Redacted ecosystem to assess the long-term viability and sustainability of rlBTRFLY.

References

- Redacted Cartel, Redacted docs, 2023

- Redacted Cartel, Dinero Protocol, a litepaper, 2023

- Redacted Cartel, Pirex V2: pxBTRFLY and New UI, 2023

- TokenomicsDAO, Tokenomics 101: Redacted Cartel ($BTRFLY), 2022

- Do Dive, 올림푸스 다오를 등에 업은 [REDACTED] BTRFLY, 커브 파이낸스의 권력자가 될 수 있을까?, 2021