Solana — From FTX Bankruptcy to Solana Summer 2.0

What Does not Kill Solana Makes Solana Stronger

Solana emerged with the goal of being an 'Ethereum killer' as a Layer 1 blockchain focusing on scalability and efficiency. It boasts cheaper transaction fees and faster speeds than other blockchains by integrating Proof of Stake (PoS) and Proof of History (PoH) technologies.

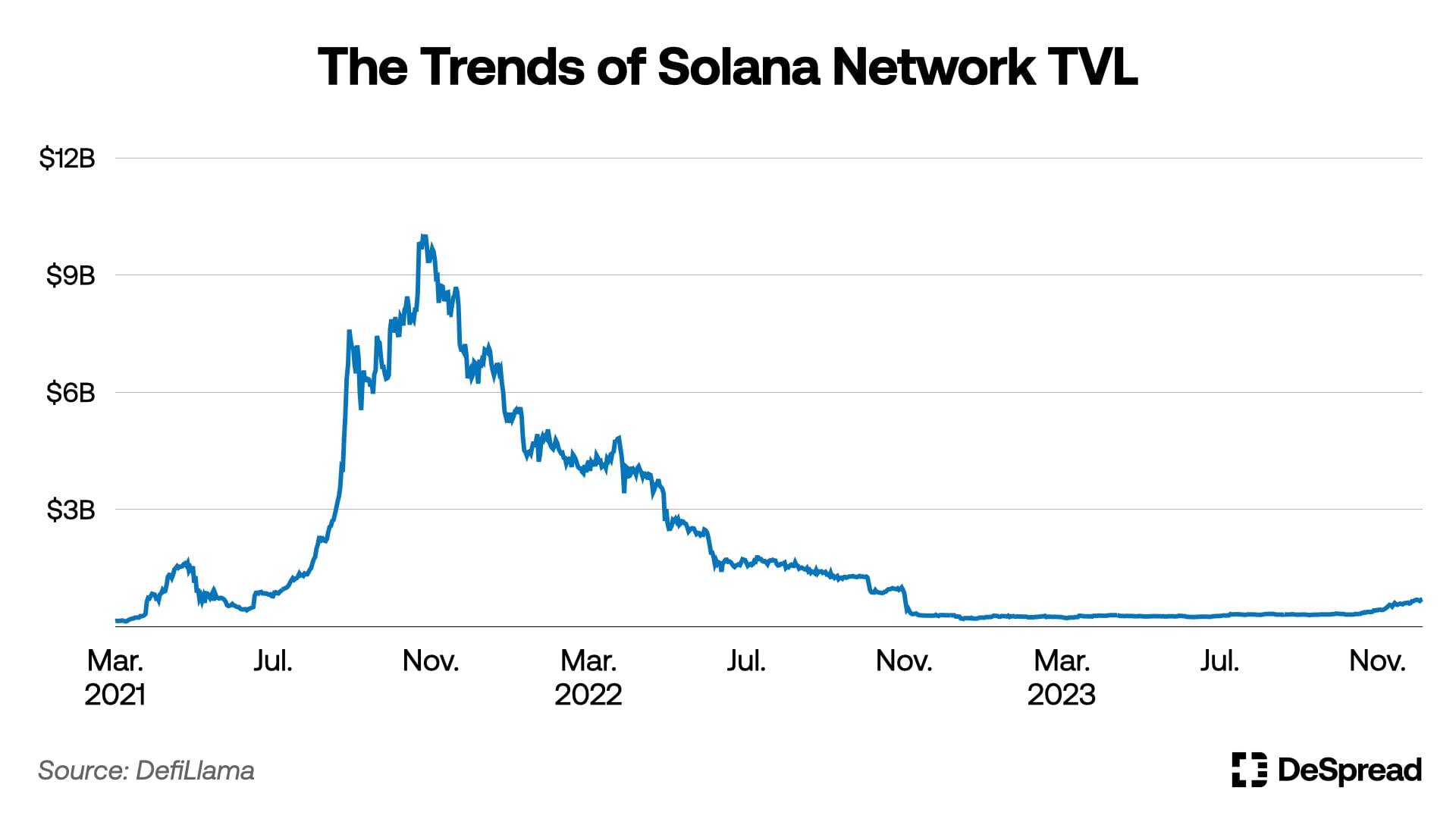

Solana launched its mainnet in March 2020 and achieved rapid growth in 2021, leaving a strong impression on many users. With the emergence of various projects like launchpads, lending protocols, decentralized exchanges (DEXs), and yield protocols, its Total Value Locked (TVL) increased rapidly. In tandem with these developments, the price of its $SOL token significantly rose, at one point reaching the fourth-largest market capitalization in the entire cryptocurrency market, seemingly setting a new standard for Layer 1 projects.

However, as liquidity exited the market, the scale of the Solana ecosystem began to rapidly decrease. The downfall of Alameda Research and the FTX exchange, which had significantly influenced the ecosystem's growth, caused many projects to face difficulties, leading to a natural decrease in ecosystem participants.

Subsequently, as Ethereum-based Layer 2 projects began to emphasize their low transaction fees and high speed, and with the emergence of new Layer 1 blockchains like Aptos and Sui, Solana's position seemed to be increasingly diminishing.

Amid these grim circumstances, Solana experienced a downturn. The network struggled to draw market attention for about a year after its TVL significantly declined in mid-November 2022. However, the Solana ecosystem has recently witnessed a rapid increase in TVL. This resurgence is due to OG projects that continued to build, aligning with the broader market recovery trend. Additionally, the ecosystem is seeing a steady emergence of new projects.

In this article, we will delve into the events that occurred in the Solana ecosystem before and after the FTX bankruptcy and will look into the OG projects dreaming of Solana Summer 2.0, as well as the newly emerging projects that are garnering attention.

1. What has happened so far?

The FTX bankruptcy in November 2022 impacted many areas. Numerous projects lost their operational funds, and it triggered events like the bankruptcy of CeFi platforms in South Korea such as Haru and Delio. The Solana ecosystem, in particular, suffered significant damage due to its relatively close relationship with FTX.

Projects like Star Atlas and Mercurial Finance (now Meteora) that were incubated through FTX IEOs had received high expectations within the Solana ecosystem. Alameda Research, an affiliate of FTX, invested in various Solana projects such as Step Finance, Solstarter, and Only1, playing a pivotal role in discovering and nurturing numerous initiatives within the ecosystem.

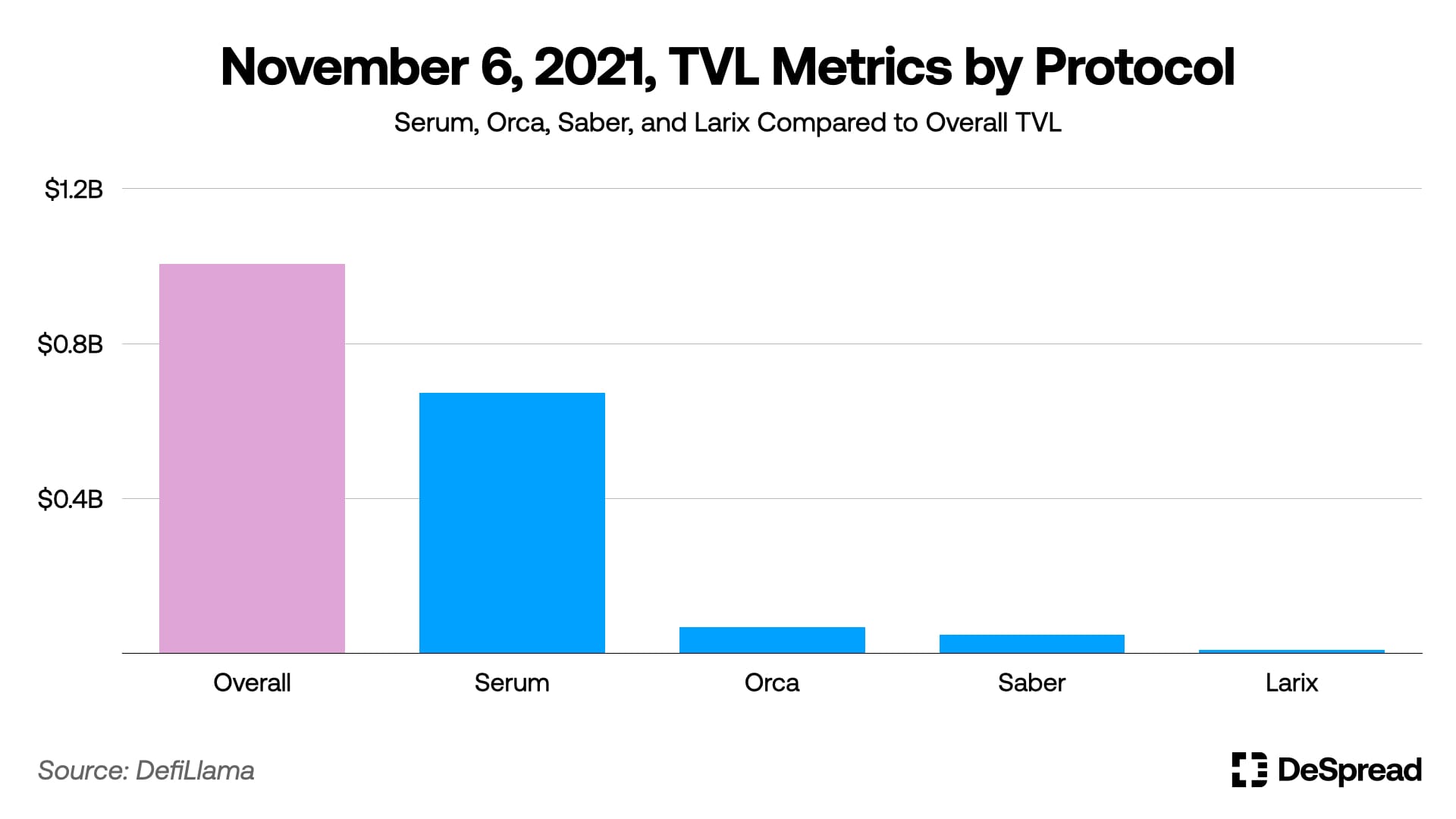

Notably, after the launch of the Solana mainnet in 2020, during a period when no DApps existed, the Serum protocol developed under the leadership of FTX CEO Sam Bankman-Fried became a key liquidity layer for Solana. It accounted for most of the TVL in the Solana ecosystem.

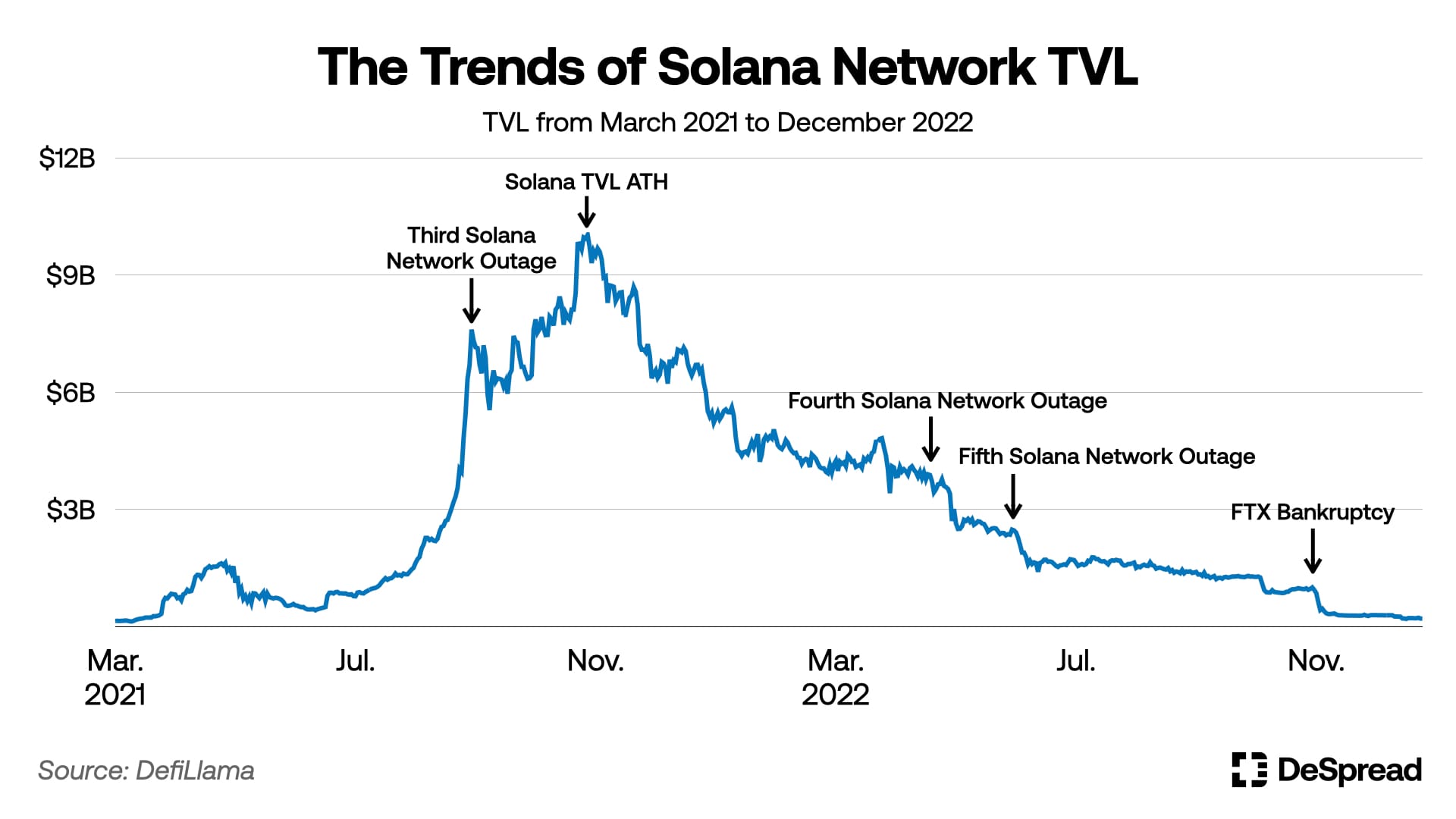

The Solana ecosystem, which had been continuously growing, reached a peak in November 2021 with a TVL of approximately $10 billion. However, several issues began to emerge thereafter.

- Protocol tokens, which were used for liquidity bootstrapping, experienced a significant drop as they couldn't withstand the inflation and decreased liquidity.

- After trading in the Serum order book, users needed to undergo a “settle” process to move assets to their wallets. This process was not smooth, leading to many users unable to find their assets and this issue occurred in all DApps using the Serum protocol, caused significant inconvenience.

- In 2022, an increase in transactions and bugs in the Solana network led to multiple network outages, severely undermining user trust.

Due to these issues and the downturn in the cryptocurrency market, the TVL in the Solana ecosystem began to decline. However, the situation worsened significantly after the FTX bankruptcy when it was revealed that FTX held complete administrative control over the Serum protocol. This revelation caused panic among users, leading to a rapid withdrawal of assets and exacerbating problems within the Solana ecosystem.

- September 14, 2021: The third outage of the Solana network.

- November 6, 2021: Solana reached its all-time high TVL.

- April 30, 2022: The network experienced its fourth outage.

- June 1, 2022: The fifth halt of the Solana network.

- November 13, 2022: FTX declared bankruptcy.

Despite maintaining a TVL of around $1 billion during its downturn, the Solana ecosystem saw its TVL plummet to about $200 million in less than a week following the FTX bankruptcy. On-chain liquidity dried up almost instantly, leading to a series of events signaling a dark era for Solana. Users were unable to withdraw their deposits from lending protocols, and trading became impossible on derivative DEXs.

After enduring these consecutive events, Solana's TVL stagnated between $200 million and $300 million, struggling to show growth and indicating a period of darkness. However, even in this bleak period, the Solana ecosystem didn't collapse, thanks to the steadfast presence of original Solana OG projects and the emergence of new promising projects. As the market began to recover, these assets and the overall TVL of the Solana ecosystem started to rise again.

2. The OG Projects that Have Kept the Solana Ecosystem Alive

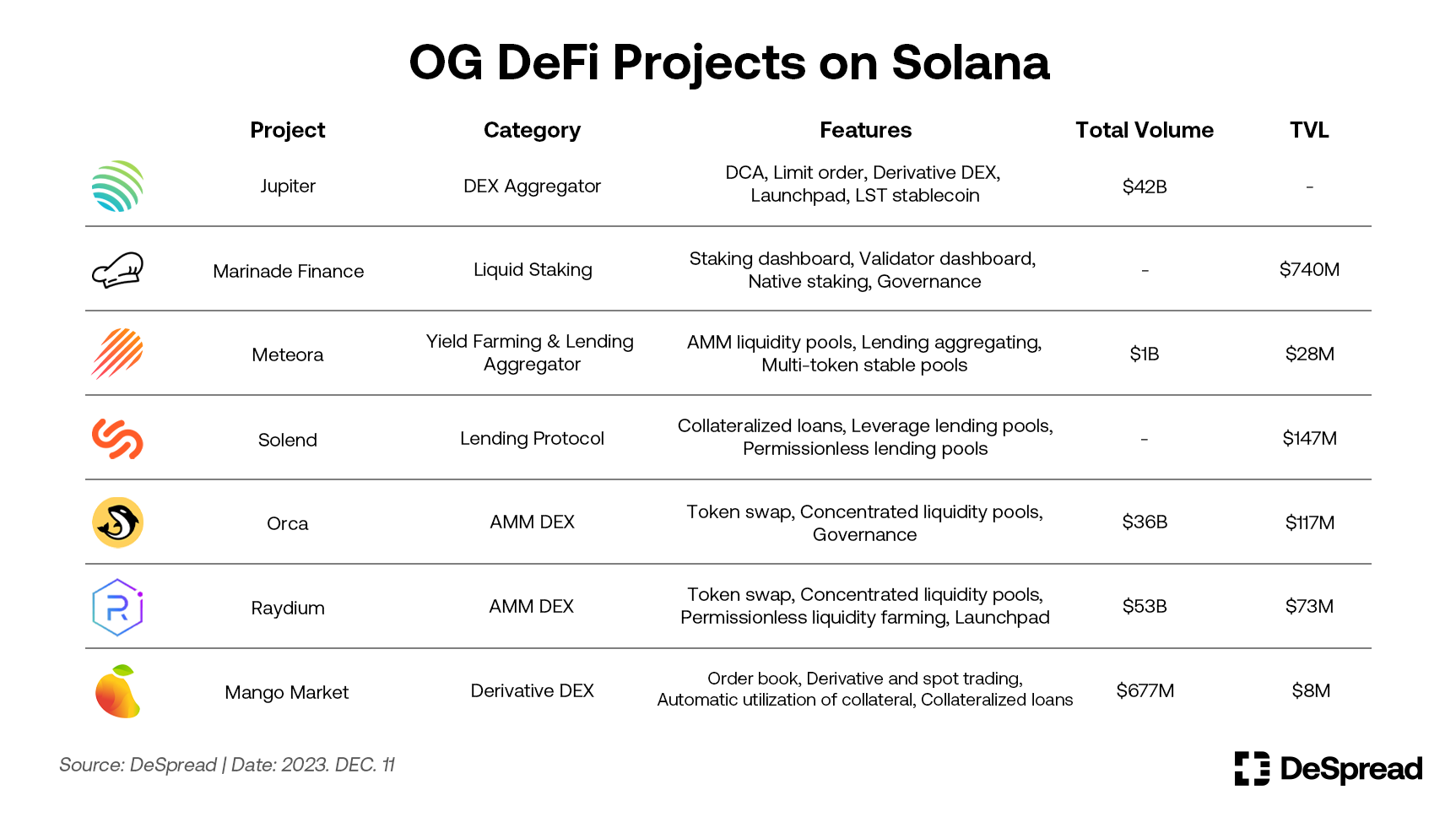

2.1 Jupiter Aggregator

Jupiter Aggregator, commonly referred to as "Jupiter," was initially planned as a program integrating Mercurial Finance and Serum through team experimentation. Targeted at stablecoin swaps, Jupiter received considerable positive response from the community, leading to its spin-off as an independent project in November 2021 to commence full-fledged development as an aggregator.

Jupiter has tackled early technical challenges in the Solana ecosystem by optimizing paths according to swap transaction size limits and integrating various mechanisms like different order book mechanics, oracles, and concentrated liquidity mechanisms applied across each DEX. Collaborating with numerous projects, Jupiter has become an indispensable member of the Solana ecosystem.

The Jupiter team continues to enhance the user experience by constantly improving their routing algorithms. The Metis algorithm, released in July 2023, represents the third major update to the platform's algorithms. It includes enhancements such as additional and combined routing paths and performance improvements.

2.1.1 $JUP, Jupiter’s Governance Token

At Solana Breakpoint 2023, the Jupiter governance token, $JUP, was announced as a token designed to invigorate the Solana ecosystem and create growth momentum. It focuses on supporting community initiatives and building a broad-based community over the long term.

Following the token launch, the Jupiter team plans to initiate two new projects: 1) Jupiter Starter and 2) Jupiter Labs.

Jupiter Starter is a launchpad focused on the success and sustainability of new projects within the Solana ecosystem. Unlike other projects primarily concentrated on increasing the value of their own platform tokens, Jupiter Starter aims to provide more active support. The team intends to impart the knowledge and technical expertise they have accumulated to onboard projects, indicating a commitment to nurturing and assisting emerging initiatives in the Solana ecosystem.

Jupiter Labs, on the other hand, aims to introduce new technologies not previously seen in DeFi, thereby innovating the Solana DeFi environment. It plans to introduce solutions like leverage-enabled liquidity pools and a Solana-based algorithmic stablecoin, sUSD and by collaborating with Jupiter DAO and the community, Jupiter Labs aims to promote the development of the Solana DeFi ecosystem.

2.2. Marinade Finance

Marinade Finance emerged during the Solana X Serum Hackathon in February 2021 as a liquid staking protocol based on Solana. It started when a team developing a liquidity staking protocol on Near Protocol collaborated with a team working on Solana RPC infrastructure. Together, they established the 'Marinade' brand, officially launching Marinade Finance.

Marinade Finance supports two types of staking. Users can participate in native staking by delegating to the Solana validator pool or engage in liquid staking using mSOL tokens. While native staking doesn't interact with smart contracts, it leverages Marinade's native features to enjoy the benefits of automatic compounding.

Liquid staking with mSOL tokens is a core feature of Marinade Finance, significantly because it allows the liquidation of on-chain assets that would otherwise be locked due to staking. This functionality is crucial as it creates a substantial difference in on-chain liquidity between blockchains that have active liquid staking and those that do not.

Marinade Finance was initially conceived from the belief that it's neither ideologically sound nor secure for certain validators in a blockchain network to hold an excessive staking ratio. By delegating staking to small, but reliable validators, Marinade Finance aims to distribute staking power and enhance user-friendliness. Its focus lies in creating convenient staking solutions to decentralize staking power and bolster the user experience.

2.3 Meteora Finance

Meteora Finance, formerly known as Mercurial Finance, emerged as a yield farming protocol with a mission to establish a liquidity layer for major assets within the Solana ecosystem.

Once a liquidity hub for stable assets alongside Saber, which had a significant TVL in the Solana ecosystem, Mercurial Finance sought to rebrand the project after the FTX bankruptcy. The goal was to minimize damages due to its existing tokenomics, eliminate unnecessary investors, and reinforce trust in Mercurial Finance and its subsequent projects.

After over a year of development, the successfully rebranded Meteora Finance aims to achieve the following three objectives:

- Provide a safe, optimized, and easily configurable yield layer for users and developers.

- Serve as the fundamental asset layer in Solana, efficiently offering and integrating liquidity for lending protocols.

- Build a community-centered asset layer to create an open and trustworthy system.

Following the rebranding, Mercurial tokens ($MER) have been fully migrated to $MET tokens, completely overhauling the original tokenomics in preparation for launching as Meteor's governance token. Additionally, there are long-term plans to use MET tokens as a strong incentive to concentrate liquidity on Meteora Finance.

2.4. Solend

Solend emerged as the first lending protocol based on Solana during the June 2021 Solana Hackathon. Its inception during the rapid growth of the Solana ecosystem allowed for more flexible asset management, significantly enhancing the ecosystem's liquidity.

As Solend grew, it launched isolated pools that didn't allow cross-collateralization and introduced "Turbo Solana Pools" to maximize interest rates using leverage, continually upgrading the protocol in response to community demands. Furthermore, it launched its governance token, $SLND, using it for airdrops and liquidity incentives, achieving organic growth.

However, following the FTX bankruptcy and the subsequent significant drop in Solana's price, large-scale liquidations of collateral and withdrawals of deposits occurred. This led to a sudden increase in the Loan to Value (LTV) ratio, rendering some deposits unrecoverable. In response, Solend actively used governance to repay bad debts with the community treasury and significantly increased loan interest rates to encourage repayments, successfully resolving the liquidity crisis without user asset loss.

Timeline of Solend Liquidity Depletion after FTX Bankruptcy

Gaining substantial experience from this incident, the Solend team launched Solend V2, designed to prevent liquidity depletion and create a more decentralized protocol. It introduced a deposit protection feature allowing immediate withdrawals even when LTV approaches 100% by limiting yields and upgraded to more conservative operations when loan and liquidation follow spot prices by adding oracles. These enhancements aimed to maintain user trust and optimize the protocol.

2.5. Orca

Unlike most DEXs within the Solana ecosystem that used Serum protocol's liquidity pools, Orca launched its own liquidity pools. While many protocols lost their liquidity following the FTX bankruptcy, Orca, having its proprietary liquidity pools, managed to significantly increase its market share and grow as other DApps were busy addressing their challenges and undergoing transformations.

Even as the TVL in the Solana network continued to decline, Orca solidified its position as the leading Solana DEX by improving its UI and usability. Key achievements and initiatives include:

- Launching the first concentrated liquidity pools in Solana

- Introducing permissionless pools

- Decentralizing protocol governance through a governance council

- Contributing to environmental protection through a climate fund.

Especially with the introduction of Solana's first concentrated liquidity pool on Orca, liquidity providers can earn higher returns and users can swap with lower slippage, elevating Solana on-chain swaps to the next level.

Orca didn't stop there. It revamped its website to offer a more intuitive swapping UI and introduced a smart router to minimize slippage across more than six liquidity pools. It also adopted dynamic fees for transaction priority confirmation, continually striving for a user-friendly experience.

The Orca team is actively working to diversify the use of concentrated liquidity pools. They provide user tutorials and are launching Orca Pro, which will offer more accurate yield estimations for liquidity pools and present a P2P market-making option to a broader user base. Preparations are underway for various updates, including a liquidity terminal feature that allows users to view the status of liquidity pools through charts, further enhancing the platform's offerings.

2.6 Raydium

Raydium is a DEX based on the Central Limit Order Book (CLOB) model. Unlike typical DeFi protocols that create liquidity pools for their own DApps, Raydium began by leveraging the Serum protocol to provide liquidity across the entire Solana ecosystem.

At launch, Raydium faced skepticism, especially since there were already many Serum-based DEXs in the Solana ecosystem. However, Raydium differentiated itself by introducing unique features such as token staking and accelerator programs exclusive to its platform. As the Solana ecosystem evolved and several DApps removed their swap functionalities to support the ecosystem, Raydium became a core DEX in Solana.

However, the aftermath of the FTX bankruptcy led to a significant liquidity crunch for the Serum protocol, and Raydium faced further challenges when an exploit in December of that year led to the theft of $4.4M of its assets. The incident resulted in operational difficulties and substantial community criticism.

In response, the Solana developer community forked the Serum protocol to create an OpenBook DEX, which was quickly integrated into Raydium. The stolen assets were compensated through the community treasury, allowing Raydium to resume normal operations.

Despite these challenges, Raydium continued to update and improve its protocol, showing its resilience and commitment to growth. Key updates include:

- Launching permissionless concentrated liquidity pools

- Supporting the new token standard, token2022

- Providing support for permissionless liquidity farming

Raydium enables any project within the Solana ecosystem to create token liquidity pools and set pool rewards, supporting the early ecosystem to bootstrap liquidity easily. While Orca focuses on being trader-centric, Raydium has strategically concentrated on bootstrapping for early projects. This approach has positioned Raydium as the second-largest DEX in terms of TVL in the Solana ecosystem, following Orca.

2.7. Mango Market

Mango Market is a derivatives DEX based on Solana, initially launching its protocol using the Serum protocol's liquidity pools like many others.

Unlike typical DApps that require a wallet-based service like Phantom Wallet, Mango Market adopted a system where a separate account is created within the DApp. Users deposit assets into this wallet, which are then used as collateral for trading or automatically as loan collateral, earning interest. This model drew positive early reactions, as users could earn from their deposits without actively trading.

Particularly when the Solana NFT standard wasn't well-established, Mango Market sold $MCAPS tokens using a bonding curve. As a gimmick, those who redeemed these tokens received a cap with the Mango logo, fostering a sense of community engagement.

Mango Market maintained a TVL of around $100 million without major issues until October 2022, when it was targeted by an exploit that used an oracle vulnerability. The attackers artificially inflated the price of the governance token $MNGO, then used it as collateral for abnormal loans, leading to the theft of most assets used in Mango Market.

The liquidity effectively evaporated, leaving Mango Market in a virtually inoperative state. Although they managed to recover $60M of assets by offering the exploiter a $40M bug bounty and agreeing not to pursue legal action, regaining users' trust became nearly impossible. The situation worsened with the FTX bankruptcy in November 2022, rendering the Serum protocol unusable and leaving Mango Market in an even more precarious position.

To overcome this, the Mango Market team, as a Solana OG project, gathered a developer community to develop the Solana liquidity layer, OpenBook. Thanks to the OpenBook, DApps that used the Serum protocol could operate normally again, and the team continues to lead its development, preparing for the launch of OpenBook v2. Mango Market is looking to re-emerge as a mainstream derivatives DEX in the Solana ecosystem with the release of Mango Market v4, after integrating with the OpenBook, improving its oracles and preparing a framework for distributing protocol revenue to the community.

3. New Projects

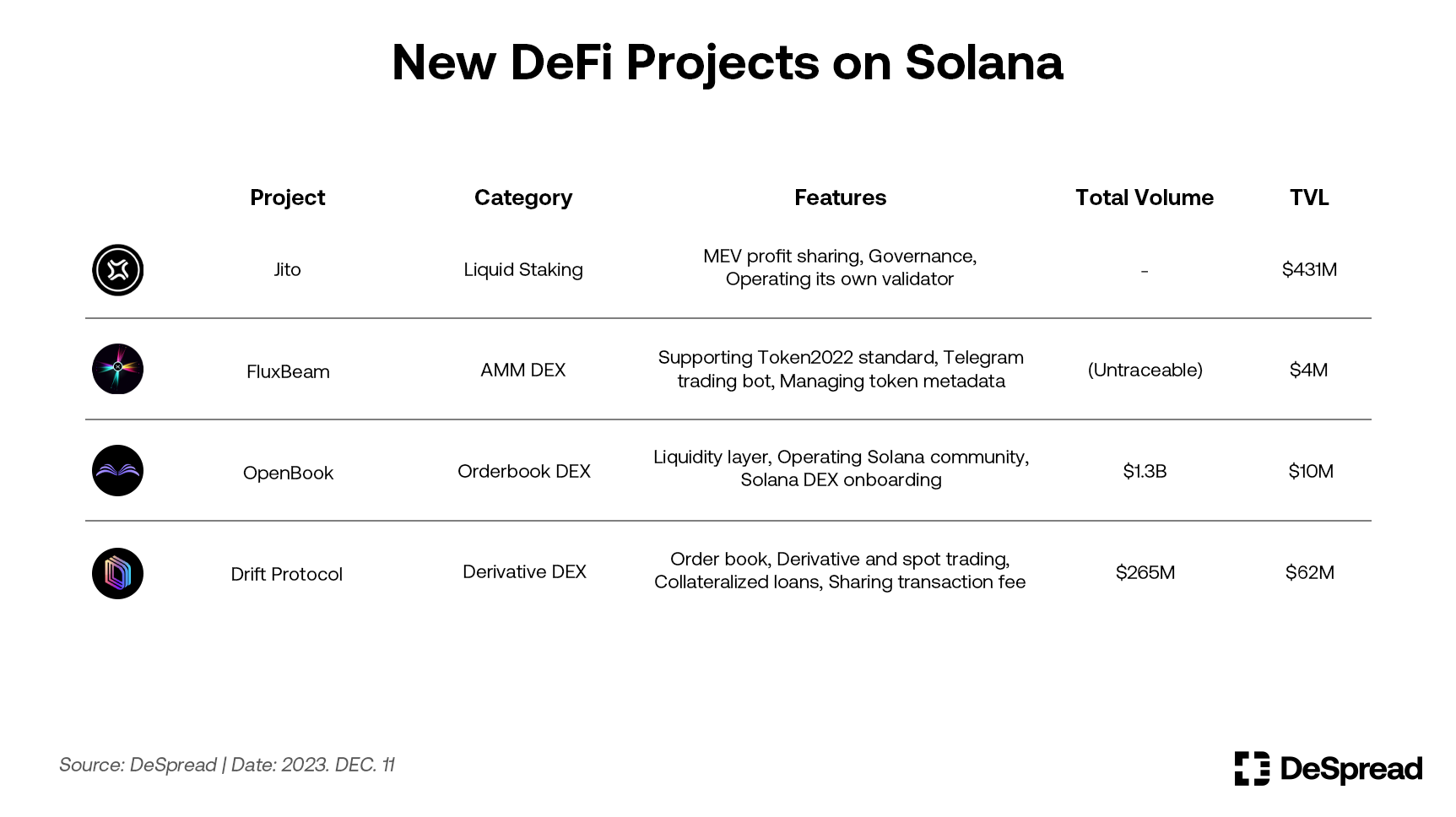

3.1. Jito

Jito is a newly emerged liquid staking protocol that distinguishes itself from other protocols by exclusively operating validators with an enhanced network performance client. This setup allows Jito to distribute Maximum Extractable Value (MEV) profits generated at the validator level to holders of its token, JitoSOL. Essentially, by holding JitoSOL, users can receive both the usual Solana staking rewards and MEV profits, while also maintaining the liquid aspect of their assets.

MEV refers to the 'Maximum Extractable Value' and represents profit opportunities arising from on-chain transactions. For example, a large swap on a specific DEX can cause token prices in the pool to fluctuate. Traders might exploit the price difference in another pool to make profits, and such arbitrage opportunities are considered MEV.

Like other liquid staking protocols, the value of JitoSOL tokens is designed to increase over time as Solana staking rewards are integrated into the token's value. Consequently, the price of JitoSOL tokens is expected to rise relative to Solana tokens.

In September, Jito introduced a point system that propelled it to the second-highest TVL in Solana. Points are distributed proportionally to JTO governance token holders, who then assume responsibilities such as setting staking pool fees, adjusting staking delegation strategies, and contributing to the improvements of the Jito protocol.

3.2. FluxBeam

FluxBeam is set to be the first project built on Solana's newly proposed token2022 standard.

Token2022 is a new token standard for Solana that allows projects to directly integrate their unique ideas into tokens while maintaining compatibility with the existing SPL token standard.

FluxBeam is progressing on two fronts: as a Solana-based trading bot called "FluxBot" and as a DEX called "FluxBeam" tailored for tokens created under the token2022 standard. The platform aims to position itself as a comprehensive infrastructure offering various tools for on-chain users in Solana.

While it's possible to trade tokens based on the token2022 standard in the existing ecosystem, many platforms do not support the creation of liquidity pools for these tokens, making integration into the broader ecosystem challenging. FluxBeam seeks to actively support tokens based on the token2022 standard, encouraging new projects to adopt this standard. Moreover, it aims to enhance user convenience, particularly for those interested in trading meme coins and new coins through its on-chain trading bot, FluxBot.

Though the token2022 standard is still under development and related infrastructure is scarce, the launch of FluxBeam is a testament to the Solana community's enthusiasm and willingness to embrace and actively engage with new models. It signifies a step forward in diversifying and enriching the Solana ecosystem with innovative token functionalities.

3.3. OpenBook

As the Serum protocol became nearly impossible to use, most DApps that relied on its liquidity faced significant challenges. In response, the Solana developer community decided to fork the Serum protocol to bring it under community ownership and develop a new on-chain liquidity layer, OpenBook, to enable its reuse in existing DApps.

Led by the Mango Market team, the Solana community collaborated to create OpenBook. It swiftly began migrating liquidity from the Serum protocol, and currently, most DApps that used Serum have completed their migration to OpenBook.

OpenBook, serving as a community-owned Solana liquidity layer, is a DEX protocol that doesn't generate profits. To reinforce its complete community ownership, OpenBook does not plan to launch its own token. Instead, it focuses on fulfilling its role as a liquidity layer dedicated to supporting Solana DApps.

Currently, OpenBook is preparing for a V2 upgrade, which aims to further enhance its performance. It's utilizing "Anchor," the latest Solana development framework, to facilitate easier integration with existing Solana projects and to enable parallel processing of all transactions.

3.4. Drift Protocol

Drift Protocol is a derivatives DEX that introduced a feature to minimize slippage even with low liquidity by implementing Drift Dynamic vAMM (DAMM), based on the PYTH oracle. This innovation established Drift as a leading derivatives DEX in the early Solana ecosystem. However, in May 2022, Drift lost most of its liquidity due to an exploit involving futures positions.

The Drift team responded swiftly by halting trades immediately after the incident but discovered inherent design flaws in the protocol. Acknowledging their responsibility, the team committed to a complete overhaul with the new Drift V2 design and updates. They also secured funds internally to fully compensate the community for their lost assets.

Moreover, having witnessed issues within the Solana DeFi ecosystem such as high volatility leading to futures/spot price disparities and the inability to trade due to Serum protocol's liquidity depletion, the team addressed these problems with the re-launch of Drift Protocol V2 in December 2022.

Drift Protocol V2 is designed to provide an efficient trading experience tailored to the size of the liquidity by utilizing various liquidity mechanisms. It doesn't rely entirely on oracles for platform protection but includes many liquidity provisions allowing market participants to voluntarily trade close to oracle prices. These mechanisms include liquidity provision through market-making vaults, Just in Time auctions with market-making priority, decentralized limit order book keepers, and Drift insurance fund stakers. This comprehensive approach aims to ensure a reliable and efficient trading experience, reflecting a significant advancement from its previous version.

4. Evolving Solana Infrastructure

4.1. token2022

While it has been possible to add new features or modify existing functionalities for Solana-based tokens and NFTs, ensuring the intended functionality across the entire ecosystem sharing a single asset on-chain was challenging. For instance, if a particular NFT marketplace wanted to enforce a trading fee, and another marketplace opposed it and removed the fee, finding a consensus was the only solution.

A new token standard compatible with the existing SPL token standard was needed to seamlessly incorporate project-specific ideas directly into tokens and ensure they work flawlessly across DApps. This led to the creation of the "token2022" standard. The features currently implemented in token2022 include:

- Anonymous transfers

- Transfer fees

- Token minting authority closure

- Promissory tokens

- NFT standards

- Permanent token leases

- Token metadata

Currently under development, token2022 is planned to be deployed extensively on the mainnet from the fourth quarter of 2024. Particularly, the anonymity feature will utilize zero-knowledge proofs and is already applied in the latest Solana clusters.

4.2. Firedancer

Firedancer is a new Solana network client currently under development by Jump Crypto. After experiencing frequent network outages between 2021 and 2022, Solana recognized the need for client diversification.

Most Solana validators currently use the validator client developed by the foundation, which means that issues with this client could jeopardize the entire network's stability. To mitigate such risks, there's an initiative to develop multiple clients so that a problem with one doesn't affect the entire network. FireDancer is one such client that's receiving significant attention.

Unlike the existing client developed in the Rust programming language, Firedancer is based on C and C++ languages. This approach aims to prevent bugs from occurring in the same components as the existing client. Additionally, Firedancer is designed to enhance parallel transaction processing performance and support sharding features, enabling horizontal scaling of the Solana blockchain.

5. Solana Summer 2.0

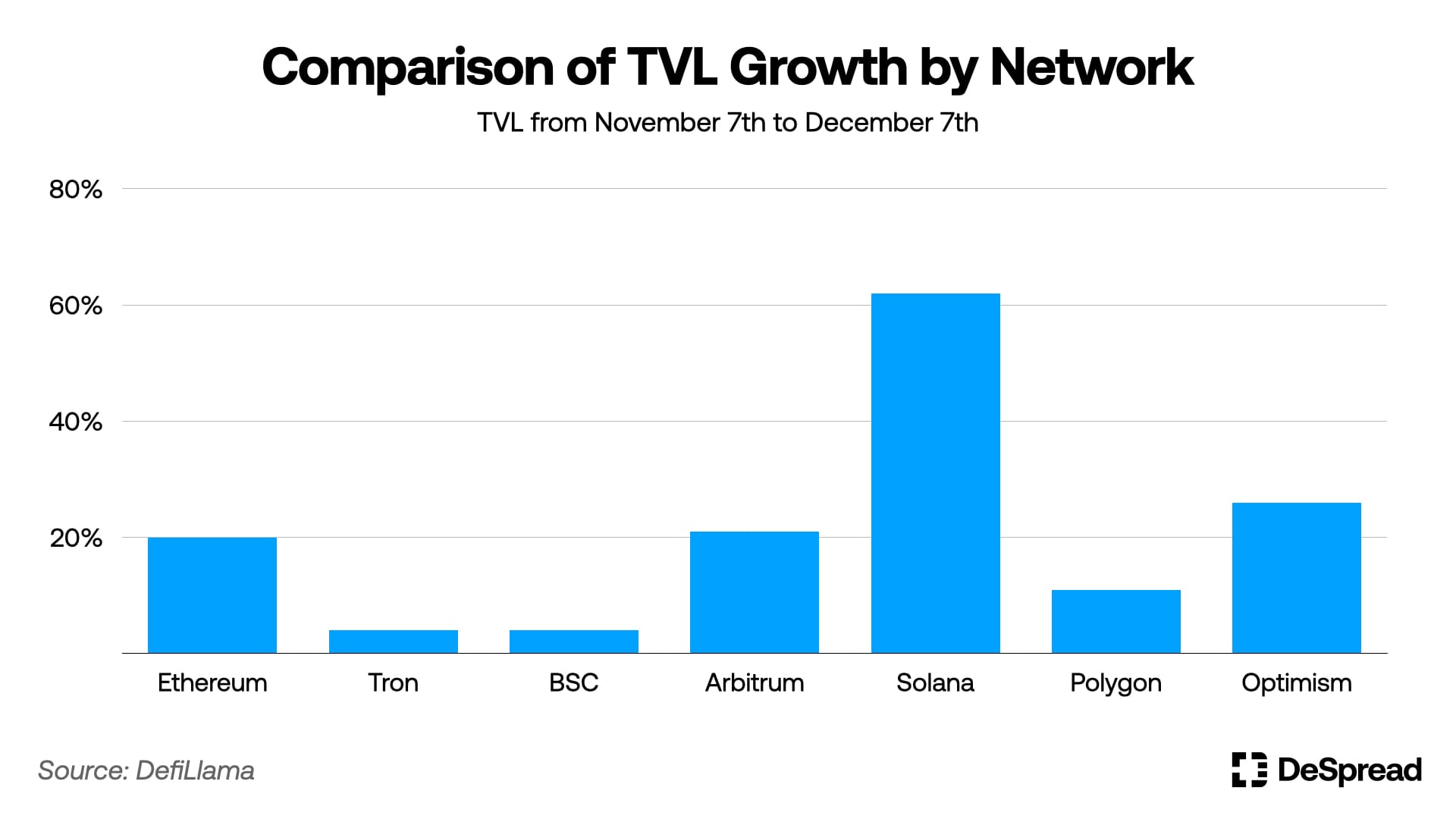

The increasing liquidity in the cryptocurrency market has led to a rise in the TVL across various blockchain ecosystems, but the growth of Solana is particularly encouraging. Despite not achieving EVM compatibility and not distributing tokens to bootstrap network liquidity like some networks, Solana has seen a significant increase in the price of its base asset, $SOL.

For dominant Solana DEXs like Orca and Raydium, even as the liquidity bootstrapping using their own tokens has nearly concluded, they continue to offer attractive interest yields in several liquidity pools. The top two liquid staking protocols in the Solana ecosystem, which hold the highest TVL, generate returns based on Solana inflation.

Unlike the previous DeFi summer dominated by issuing native tokens and relying on their inflation and price increase, Solana is achieving healthy growth through actual protocol usage fees and returns generated from Solana inflation.

However, the current TVL in the Solana ecosystem is heavily concentrated in liquid staking, leading to a significant issue: the reduced utility of liquid staking tokens. Currently, the main uses for these tokens in the ecosystem are depositing in lending protocols and supplying liquidity pools through DEXs. Yet, the returns generated from the protocols are not enough to attract users, resulting in a relatively low flow of liquidity generated through liquid staking tokens.

The liquidity tied up in liquid staking tokens has positioned them somewhat akin to real estate within the Solana ecosystem. To enable this liquidity to flow more freely across the ecosystem, protocols like Pendle Finance are needed, which utilize Solana inflation to make liquid staking tokens more organically useful.

Moreover, many projects that have already launched tokens are locked into their tokenomics due to long-term vesting schedules, making it challenging to modify their tokenomics or introduce new models.

Behind the growth trajectory of the Solana ecosystem lies difficult-to-resolve issues due to the nature of OG projects, as well as a bottleneck where the increased liquidity due to staking isn't actually flowing into other projects. For instance, Friction, which ceased operations earlier in the year, initially succeeded in securing high returns utilizing covered call mechanisms and inflation, achieving over $150 million in TVL. However, it ultimately couldn't sustain the project as the costs exceeded profits amidst a severe drop in Solana's price.

However, if protocols that can more easily liquidify Solana inflation in the form of bonds are developed and liquidity is abundantly filled across various sectors, it's conceivable that the Solana ecosystem could experience a resurgence, potentially leading to a new era that could be "Solana Summer 2.0."

References

- Solana Foundation, 9-14 Network Outage Initial Overview

- Solana Foundation, 04-30-22 Solana Mainnet Beta Outage Report and Mitigation

- Solana Foundation, 06-01-22 Solana Mainnet Beta Outage Report

- Jupiter docs

- Marinade finance docs

- Meteora docs

- Solend docs

- Solend v2 docs

- Solend, FTX’s impact on Solend

- Orca docs

- Raydium docs

- Raydium, Detailed Post-Mortem and Next Steps

- Mango markets docs

- Coindesk, Accused Mango Markets Exploiter Wants to Keep $47M in Disputed Funds: Court Filings

- Certik, Mango Market Incident Anaylsis

- Jito Foundation blog

- FluxBot docs

- OpenBook tweet

- Drift protocol docs

- Drift protocol, Drift Protocol Technical Incident Report — 2022/05/11