Trader Joe — The New Dark Horse in the Arbitrum DEX Ecosystem

Focusing on Joe V2’s new AMM Liquidity Book

1. Introduction

1.1. Arbitrum in the Center of Attention

The hottest topic in crypto over the past few weeks has been the launch of Arbitrum’s $ARB token. Leading the Ethereum optimistic rollup ecosystem alongside Optimism, Arbitrum’s native token airdrop was one of the main events of Q1 2023 and put Arbitrum front and center in the market.

The airdrop of $ARB brought a lot of liquidity to the market. According to the official Arbitrum website, 12.75% of the initial supply of $10B was allocated for the airdrop, which will be divided into 11.62% and 1.13% to be distributed to users and Decentralized Autonomous Organizations (DAOs) on Arbitrum, respectively. Converting this to the current (23.03.29) value, about $1.35B was distributed to users, and about $131M of $ARB will be distributed to DAOs.

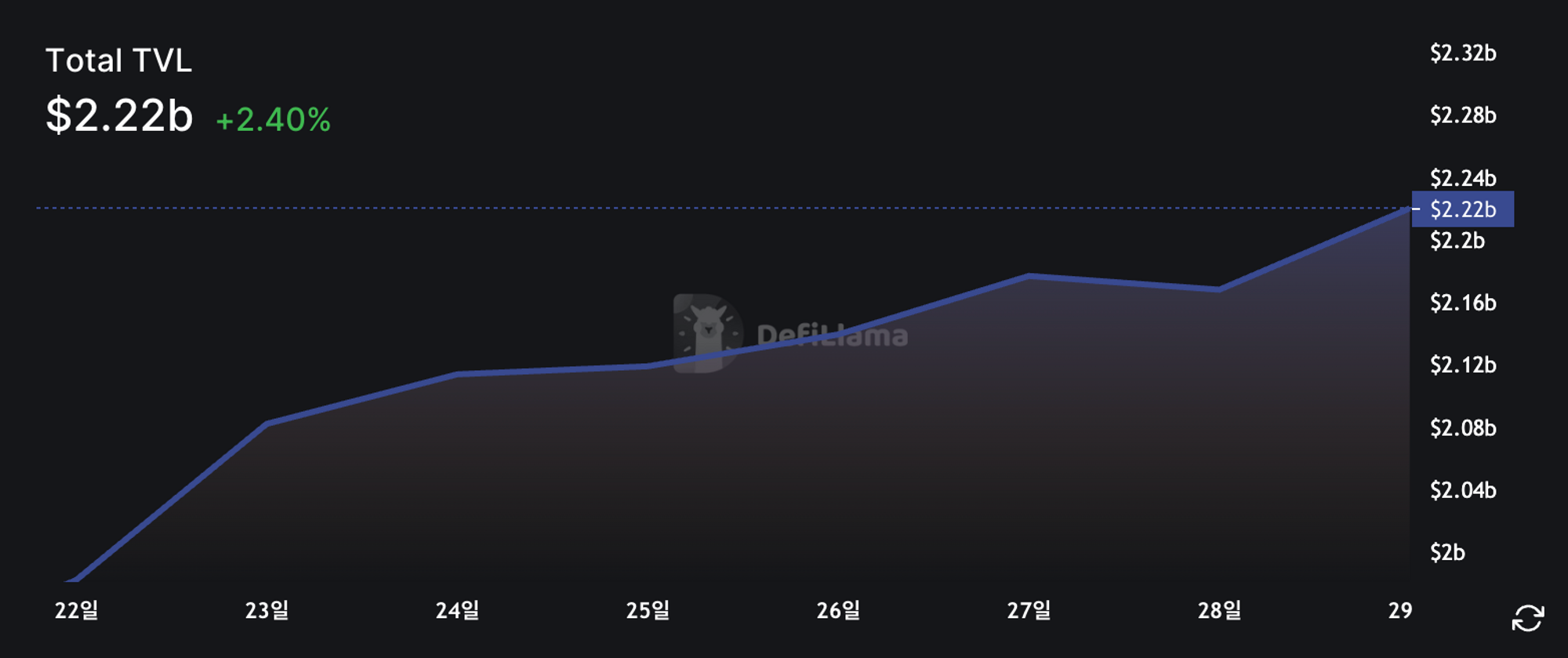

The airdrop absorbed market liquidity into $ARB, resulting in a steep growth in Arbitrum’s total value locked (TVL). Out of the five networks with over $1B in TVL (Ethereum, Tron, BSC, Arbitrum, and Polygon), Arbitrum has the highest TVL growth on a weekly and monthly basis, and is ranked 4th in TVL among all networks (source: DefiLlama). Additionally, during the week since the airdrop, there have been no major outflows of funds from DeFi protocols on Arbitrum, confirming that the Arbitrum ecosystem is growing.

After the airdrop, Arbitrum will be challenged to continue to revitalize the ecosystem with concentrated liquidity, and the many DApps on the Arbitrum network, especially DeFi protocols that enable efficient capital utilization, will play a key role in this. There are a number of DeFi protocols exist on top of Arbitrum, including Uniswap v3, Sushiswap, and Camelot, and those who will offer users greater capital efficiency, attractive returns, and superior risk management strategies will be able to rise to the top of the race.

1.2. Joe V2, dreaming of a leap in Arbitrum

In this situation, there is a protocol that has caught the market’s attention by recording a tremendous increase in TVL and a high fee reward rate. The protagonist is none other than “Joe V2,” which showed an increase in TVL from $36.8M to $58.78M, a rise of over 50% in a week since the $ARB airdrop. Joe V2 is currently ranked 18th among the DeFi protocols on the Arbitrum network by TVL, and 8th among DEXs (Decentralized Exchanges). While it may not have a top-ranked position in absolute terms, Joe V2’s explosive growth rate on the Arbitrum network has been enough to capture the market’s attention. Of the three chains Joe v2 serves (Avalanche, BSC, and Arbitrum), Arbitrum alone has seen a 272% increase, knocking Avalanche out of the top spot for TVL within the protocol. Compared to protocols with a similar TVL, Arbitrum’s rise to the top is significant.

Scaling this up to the network as a whole, we can see that from 3/23, when the airdrop occurred, to 3/29, the overall TVL increase on Arbitrum was approximately $160M, of which Joe V2 accounted for 14.11% ($22.59M). What was the reason behind Joe V2’s ability to attract so much liquidity within Arbitrum, and what advantages did it have compared to other DEXs? How has Joe V2 been able to offer high fees to liquidity providers? In this article, we will explore the characteristics of Joe V2 and the benefits it provides to users.

2. Main Content

2.1. Liquidity Book

2.1.1. The Limitations of CPMM

Liquidity Book (LB) is Joe V2’s new AMM that aims to improve the capital efficiency found in Trader Joe’s AMM (V1). V1 used a Constant Product Market Maker (CPMM), like Uniswap, which determines the price of an asset in a x*y=k formula. CPMMs allowed assets to be traded without a centralized authority, relying solely on algorithms, and helped the early DEX market take off, but over time, problems began to surface.

Due to the nature of CPMM, which uses x*y=k to determine the trading price of an asset, it was inevitable that the liquidity deposited by Liquidity Providers (LPs) into the asset pools would be evenly distributed across all prices from 0 to infinity. This eventually led to a situation where too much idle liquidity was left behind. For example, in the case of the USDC/USDT pair pool, due to the nature of stablecoins with a price pegged at $1, most swaps between the assets occurred in the $0.99 to $1.1 range, leaving liquidity outside of that range to sit idle.

The protocol was not fully utilizing the capital provided by the liquidity providers, and the liquidity providers were receiving low fees for the capital they provided, which led to the need for a solution to address this inefficient capital utilization. Trader Joe’s recognized the limitations of CPMMs and launched a new AMM last year, LB, which is an enhancement to Uniswap V3’s Concentrated Liquidity.

By utilizing CPMM, Trader Jo faced issues such as an increase in idle liquidity, inevitable impermanent loss (IL), and a discrepancy between the displayed price and the actual execution price known as slippage. Trader Joe sought to achieve three goals with LB: increase capital efficiency, reduce IL, and reduce slippage. Let’s take a look at how Joe V2 uses LB’s features to achieve these three goals.

2.1.2. Price Bin

Within LB, the liquidity of an asset pair pool is segmented into individual bins, with each price bin representing a fixed price (exchange rate between assets). For a more intuitive understanding, compare this to the previous AMM model, CPMM. In CPMM, when an LP supplies liquidity to a pair of assets, that liquidity is spread out across the entire range of possible prices from 0 to infinity. In contrast, with LB, LPs can concentrate liquidity within a specific range of prices by selecting which price bins to supply liquidity to. LB accomplishes this by allowing LPs to choose specific price ranges where they wish to supply liquidity, which are represented by discrete price bins. In other words, with price bins, LB has created a system that allows LPs to pick and choose where they want to be on an infinite price curve.

The picture above depicts the bins of a pair pool with assets X (Base Asset) and Y (Quote Asset). The Active bin in the center represents the price at which the pool is currently trading (P14) and is the only bin that has both X and Y assets. All other bins except the active bin have only one of the two assets. Therefore, if the LP wants to deposit both X and Y assets into the pool, it can only provide liquidity to the active bin that is providing the current trading price, and when depositing assets in other bins, it must deposit only one asset. The LP must consider the composition(c), the proportion of Y assets in each bin, so when adding liquidity to the active bin, the LP must deposit two assets in a proportion equal to the c of that bin, and when adding liquidity to other bins, the LP must deposit only asset X(c=1) or only asset Y(c=0). As the active bin’s liquidity is depleted for either one of the two assets, the active bin moves to the next bin with only X or Y assets, and the active price changes accordingly based on the newly designated bin price.

The biggest advantage LB takes from using price bins is that it guarantees zero slippage when trades are executed in a single price bin. Slippage is the difference between the price just before a user executes a trade and the price after the trade is actually executed, and has been pointed out as an inevitable problem with traditional CPMM models. However, using x+y=k rather than CPMM’s x*y=k, each bin partially solved the slippage problem.

P_i : Fixed price of the pool

x : Amount of Asset X

y : Amount of Asset Y

The graph above represents the liquidity of each bin in LB using the x+y=k formula. In contrast to the x*y=k curve in the CPMM model, the slope in each section is represented by a straight line with a constant exchange rate. This allows users to trade assets within one bin without worrying about slippage.

2.1.3. Variable Fee

Due to the nature of DEX, where two assets are placed in a pool and trades are executed at the relative price between the assets, IL has been a long-standing challenge for DEX protocols. IL tends to increase as asset prices become more volatile, and it has often led to reduced incentives for LPs to supply liquidity in cryptocurrency markets with high levels of price volatility.

To address these issues, Joe V2’s LB introduced a system that offers liquidity providers a variable fee that is proportional to the volatility of the asset, in addition to the base fee.

- Base Fee: The minimum fee incurred on all the transactions (0.01% to 0.2% of volume)

- Variable fee: an additional fee paid to the LP based on the asset volatility

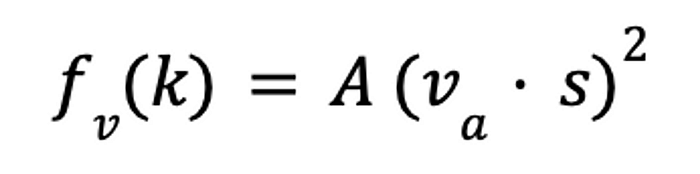

Every swap trade that occurs in Joe V2’s pool is accompanied by these two fees. What we need to focus on here is the variable fee, which Joe V2 introduced to mitigate IL experienced by liquidity providers. Variable fee is calculated by a mechanism called “Surge Pricing” that measures volatility in real-time based solely on internal transactions, without relying on external data.

- Bin step(s) : Price ratio between two consecutive bins

- Volatility Accumulator(v_a) : A mechanism to measure volatility through trading volume and frequency

Looking at the formula above, you can see that the variable fee is increasing in proportion to the square of the product of the two parameters. Let’s take a look at what each parameter means and how it affects the variable fee.

We mentioned earlier that liquidity within a pair pool is split into a number of price bins, each of which has a single fixed price. Bin step is the term for the distance between two consecutive bins, expressed in increments of 1bp (0.01%). For example, if the $ARB/$ETH pair pool has a bin step of 20bp and the price of the currently active bin is $1.3, the price of the next bin will be $1.3026, an increase of 0.2% from $1.3.

Because bin step is an important parameter that affects the determination of both base and variable fee rates, protocols set bin step based on a combination of factors, including market conditions, asset volatility, and liquidity needs. In general, bin step is set higher for asset pair pools with large price changes and lower for less volatile assets, such as stablecoin pair pools.

Volatility Accumulator(VA) is a system that measures the volatility of assets in a pair pool in real-time by tracking internal transactions without relying on an oracle. There are two factors that affect the increase/decrease in VA, which are

- How many bins were moved

- How often transactions occurred

In LB, the movement of the active bin represents the movement of a fixed price, i.e., how much price change occurred in a single transaction. VA measures the volatility in single point in terms of the number of changes in the bin, then calculates the final volatility(v_a) by taking into account the time it took for the next trade to occur. If the interval between the n+1st trade and the nth trade is less than the protocol-calculated lower time limit, VA increases; if it is greater than the upper time limit, VA decreases.

In other words, if two consecutive transactions occur with a small time gap, it means that transactions are occurring more frequently than the protocol’s standard interval, and vice versa. So you can see that it has a system that calculates higher volatility when trades are heavy and lower volatility when trades are infrequent. One important point to note is that VA takes into account the directionality of the trades when measuring volatility. For example, A sells an asset and the bin goes down by 5 bins, and then B buys it and the bin goes up by 4 bins, even though the time interval between the two trades is less than the lower bound, the total volatility will not increase by 9 bins, but will instead be recognized as the same as the volatility of 1 bin due to the directionality of the two trades canceling each other out.

The logic above, which takes into account the distance between prices, the change in price, and the frequency of trades, allows Joe V2’s liquidity providers to earn a larger variable fee the more volatile the asset, offsetting much of their inevitable impermanent losses.

2.1.4. Flexible Asset Management

The nature of LB, which allows LPs to pick and choose the specific bin in which they want to deposit their funds, rather than simply setting a range to provide liquidity, allows LPs to choose different asset deposit strategies based on market conditions, asset volatility, investment appetite, etc. Currently, there are four deposit strategies in total offered by Joe V2, with the advantages and disadvantages of each strategy described below.

- Spot: a strategy to concentrate liquidity around an active bin

- Pros: Earn large commissions from low volatility assets with small price movements

- Cons: Increased IL when trades occur outside the liquidity concentration zone - Curve: a strategy that distributes liquidity evenly around the active bin

- Pros: Average returns

- Cons: Not suitable for profit maximization and increased exposure to IL - Bid-Ask: A strategy that deposits the smallest amount of liquidity in the active bin and increases the amount as it moves outward.

- Pros: Higher returns in volatile market conditions

- Cons: Increased risk - Wide: Deposit liquidity evenly across all bins (same as CPMM)

- Pros : Passive return strategy that takes a fixed fee no matter what.

- Disadvantages : Lower capital efficiency

Thanks to these diverse options, LPs can create different strategies for different assets and different market conditions, such as a spot strategy for stablecoin pair pools where trades trade in a relatively flat range, and a bid-ask strategy for more volatile markets, allowing LPs to take on more risk and earn higher returns.

In addition, LB provided ERC-1155 compliant LP tokens to enable flexible asset management for liquidity providers. On the Dex Protocol side, when a LP deposits assets into a pair pool, he receives LP tokens proportional to the amount deposited to prove his position. LB also provides LP tokens to LPs, but unlike the LP tokens of other DEXs that follow ERC-721, LB provides tokens that follow ERC-1155. Unlike ERC-721 tokens, which are recognized as NFTs (Non-Fungible Tokens), ERC-1155 tokens are recognized as FTs (Fungible Tokens), allowing LPs to burn a portion of their LP tokens when they want to bring back the liquidity they provided, instead of having to burn the entirety.

3. Conclusion

So far, we’ve covered a number of features of the Liquidity Book: it solves the slippage problem within a single bin using price bins and x+y=k, mitigates impermanent losses by introducing a variable fee that increases with asset volatility, and enables flexible asset management with multiple liquidity strategies and individually burnable ERC-1155 LP tokens. With LBs that benefit both LPs and traders, Joe V2 is poised to become one of the leading exchanges in the Arbitrum ecosystem.

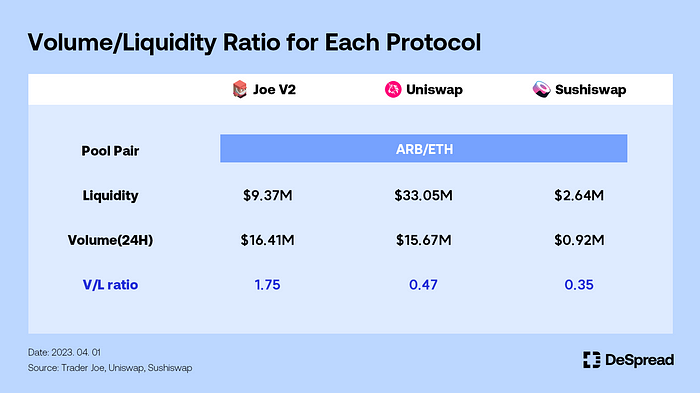

Joe V2 on Arbitrum is gaining popularity among liquidity providers due to its high yield. The volume/liquidity ratio is an important metric that indicates the level of asset utilization by measuring the ratio of transaction volume to liquidity provided. A high volume/liquidity ratio suggests that LPs can earn high fees with relatively small amounts of capital in a low competition environment. For instance, in the largest ARB-ETH pool across DEX protocols on Arbitrum, Uniswap and SushiSwap have volume/liquidity ratios of 47% and 35%, respectively, whereas Joe V2 has a ratio of almost 175%, which is significantly higher.

While Joe V2’s absolute TVL still lags far behind major DEX protocols like Uniswap and SushiSwap, the rapid growth rate it’s recording with Liquidity Book has enough reasons to keep an eye on Joe V2 as a protocol that will be at the forefront of the DEX race on Arbitrum.

References

- Trader Joe, Liquidity Book Whitepaper, 2022

- Joe Content, Introducing: Liquidity Book, 2022

- Joe Content, Surge Pricing: improving swaps and protecting liquidity providers, 2022

- Trader Joe, Liquidity Strategies, 2023