Crypto Regulation in South Korea: An Overview

Clarifying Regulatory Uncertainties

1. Introduction

As cryptocurrencies are distinctly different from traditional assets in terms of issuance and market structures, existing regulations such as the Electronic Financial Transactions Act and the Capital Markets Act have shown their limitations in being able to fully regulate crypto crises. In particular, the depegging of UST and the bankruptcy of FTX in 2022 caused enormous damage to the global crypto industry and increased calls for regulation to build a safe and reliable system, not limited to a specific country. As a result, not only countries such as the United States, the European Union (EU), and Japan, which have been preparing to revise their laws, but also new entrants such as Taiwan and Hong Kong have recently accelerated to establish cryptocurrency regulations for investor protection.

In South Korea, the framework for regulating virtual assets began to take shape starting in 2021, with its contours becoming more evident in the following years. It's essential to examine three key regulations related to virtual assets that were disclosed in 2023:

- Security Token Guidelines (February 5)

- Mandatory Virtual Asset Declaration For High-ranking Officials (05.25)

- Act on the Protection of Virtual Asset Users (Virtual Asset Law) (June 30):

This article aims to understand the trends in South Korea's virtual asset regulations in 2023 by introducing the background, contents of the legislation, and the current status of each of the three aforementioned regulations. Additionally, based on the discussions currently underway by the authorities, the article will explore the domestic virtual asset industry regulations that warrant attention in the upcoming year 2024.

2. Security Token Guidelines (February 5)

On February 5, the Financial Services Commission (FSC) issued guidelines for regulating the issuance and circulation of security tokens, with the goal of implementing them before the second half of 2024.

2.1. Background

As information and communication technology advanced, voices rose emphasizing the need to prevent existing regulations from hindering the growth of new financial industries like fintech and blockchain. In response, the Financial Services Commission of Korea implemented the Financial Regulatory Sandbox system starting April 2019, under the Financial Innovation Support Special Act. This allowed for the provision of new financial services before official amendments were made. Under this legislation, services enabling fractional investment in illiquid assets, including real estate, were designated as sandbox projects. Companies such as Kasa, Lucentblock, and Funble were among those included. This led to the gradual formation of a market that facilitated the issuance and trading of unconventional securities, including investment contract securities and non-monetary trust beneficiary securities, in small amounts.

However, the sandbox regulation, serving only as a temporary exception, faced limitations in accommodating the increasing demand for the tokenization of unconventional securities. The current system specifies that securities must be issued and circulated in a dematerialized format, meaning that they exist only as electronic records in a ledger and their rights are transferred through ledger entries, without the issuance of physical certificates. This dematerialization requirement, allowing transactions exclusively through securities firms, renders the issuance of tokenized securities using distributed ledger technology unfeasible.

*Dematerialization: A process where the rights to securities are not represented by physical certificates but exist solely as electronic records in a book-entry system, with rights being transferred through ledger entries.

In addition, under the current Capital Markets Act, the absence of a system for the distribution of unconventional securities, the increasing attempts by related businesses to enter the regulated market, and the inadequacy of the existing listed markets that trade conventional securities such as stocks have all highlighted the need for regulatory reforms concerning unconventional securities. Consequently, the FSC has announced this security token guideline to minimize the uncertainty in determining the status of securities and to reorganize the system for issuing and distributing unconventional securities.

2.2. Contents

2.2.1. Definition

Security Tokens are defined as "digitalized securities under the Capital Markets Act using distributed ledger technology." This analogy likens securities to food and their issuance format to a container, emphasizing that the essence of securities remains unchanged, despite the new “container” or form of tokens. Consequently, alongside physical securities noted on certificates and electronic securities registered in centralized accounts, security tokens recorded on distributed ledgers will also be regulated under the Capital Markets Act.

2.2.2 Primary Market

A notable aspect in the security token primary market is the introduction of an "Issuer Account Manager," which can simultaneously handle the issuance and registration of securities. Under current law, when an issuer releases securities, they are registered by account managers like securities firms and banks at the Depository. However, with token securities, the intermediary step is eliminated by enabling issuer account managers to perform both issuance and registration, aiming to streamline the securities issuance process.

To become an Issuer Account Manager, one must meet the criteria set by the FSC. Issuers who fail to meet these criteria will follow the traditional securities issuance structure, where only issuance is handled by them, and registration is done through account managers.

2.2.3. Secondary Market

The secondary market can be divided into on-exchange and OTC (Over-The-Counter) markets.

- On-exchange: Introduction of a digital securities market in the Korea Exchange (KRX) for trading unconventional securities.

- OTC: Establishment of OTC brokers allowing multilateral counter trading for retail investors.

Particularly noteworthy is the Financial Services Commission's announcement of plans to differentiate authorization requirements for becoming an over-the-counter (OTC) intermediary based on the type of securities. This includes exemptions from sales disclosures and market surveillance, effectively encouraging small-scale investments by new entrants. This move demonstrates a proactive approach towards revitalizing unconventional securities trading, which previously fell outside the purview of existing distribution systems and market management.

2.3. Current Status

During the "Electronic Securities and Capital Markets Act Legislative Public Hearing" held on July 13, Representative Chang-Hyun Yoon of the People Power Party revealed a regulatory amendment for security tokens. This amendment, proposed on July 28, is scheduled to be finalized after reviews by the government committee and the Legal Affairs Committee, and a vote in the plenary session of the National Assembly. However, as it's not officially enacted yet, details may change after further discussions. The current amendment was submitted to the Political Affairs Committee on November 15 and has been passed to the subcommittee for bills.

For the formal legalization of security token guideline, substantial amendments to both the Electronic Securities Act and the Capital Markets Act are necessary. The industry is extensively discussing these two laws to foster the rapid and safe growth of the Korean security token industry.

The crux of the Electronic Securities Act amendment is to recognize the blockchain electronic registry as a method of entry in an official ledger, giving it the same presumptive right of ownership transfer as the centralized electronic registry. Hence, defining the range of securities that can be registered using a distributed ledger, the specific requirements for the distributed ledger to be used as a method of entry, and the management of personal information recorded on the distributed ledger are considered urgent tasks.

The amendment of the Capital Markets Act aims to expand investors' options by allowing the circulation of unconventional securities, which was previously impossible due to investor protection issues. Therefore, discussions are actively ongoing regarding the authorization requirements for OTC brokers, their operating methods, and investment limits for general investors.

With the guideline released in February and the amendment proposed in July, anticipation for the Korean security token market is growing. The securities industry in Korea is forming various security token consortia to gain a first-mover advantage. These consortia are voluntary organizations comprising securities firms, banks, and innovative financial services (sandbox), aiming to create a security token ecosystem by specializing in areas like customer fund management and trading platform support.

The KRX has also applied for the security token on-exchange market to be designated as a sandbox by the FSC. If approved by the main committee meeting at the end of December, the final designation approval will be decided in January 2024. Il-Chan Ahn, the Head of Digital Business at the Korea Exchange, expects that for listed security tokens worth over 3 billion won, investors will be able to freely trade them through securities firms without needing a separate dedicated account, just like existing stocks. However, even after the on-exchange market is established, it will take about six months for trading to commence, as it needs to go through the same process as the current listed securities market, including preliminary review, submission of securities reports, and public offering procedures.

3. Mandatory Virtual Asset Declaration For High-ranking Officials (05.25)

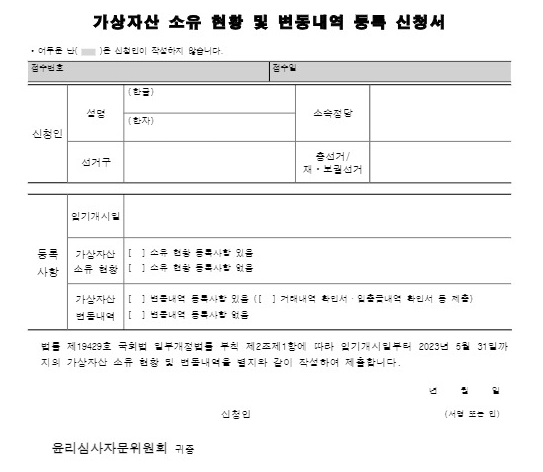

The bill known as "Mandatory Virtual Assets Declarartion For High-ranking Officials (informally referred to as the Nam-Kuk Kim Prevention Law)" was passed in the National Assembly on May 25 and came into effect on December 14 of the same year. Consequently, high-ranking officials are now obliged to report any virtual assets held by themselves, their spouses, and their direct family members.

3.1. Backgrounds

The focus on this legislation intensified after it was reported on May 4 that Representative Nam-Kuk Kim (formerly of the Democratic Party) held up to 6 billion won worth of WEMIX in his personal virtual asset wallet. Subsequent scrutiny over unclear funding sources and transaction flows led to Kim's referral to the National Assembly's Ethics Committee under the Conflict of Interest Prevention Act. It was revealed that Kim owned more assets than he had previously declared. This incident fueled public demand for transparent reporting of virtual assets by high-ranking officials, leading to the passage of the bill.

3.2. Contents

According to the revised Public Service Ethics Act, all members of the 21st National Assembly must voluntarily report the status of virtual assets acquired and held from the start of their term (May 30, 2020) until May 31, 2023, including the names of the services used and transaction details. This includes transaction dates, purchase prices, selling prices, transaction costs, and counterparties. The Anti-Corruption and Civil Rights Commission (ACRC) will oversee this process, with cooperation from related departments such as the FSC and the KRX, as well as virtual asset exchanges, to ensure the integrity of officials' asset declarations.

3.3. Current Status

The period for registering the status and changes in virtual assets held by high-ranking officials began on June 15 and ended on June 30. According to the National Assembly's Ethics Advisory Committee meeting on July 21, out of the 299 members who submitted their details, 11, including Nam-Kuk Kim, had a history of holding virtual assets. However, these reports were initially limited to assets owned personally, with the disclosure of virtual assets held by immediate family members and spouses set to be mandatory from 2024.

The Nam-Kuk Kim incident has heightened awareness and accelerated the legislation of the Public Service Ethics Act. Consequently, there's been an increase in the number of suspicious transaction reports filed by virtual asset exchanges. Under the current Act on Reporting and Using Specified Financial Transaction Information, exchanges must report suspicious transactions to the Financial Intelligence Unit (FIU) of the FSC. As of September, the number of such reports for the year had already surpassed the total for 2022, indicating an increase following the implementation of the revised act.

4. Act On The Protection Of Virtual Asset Users (06.30)

On June 30, the "Act on the Protection of Virtual Asset Users (Virtual Asset Act)" was passed in the National Assembly and is set to be implemented in July 2024. This act was introduced to address the limitations of managing virtual assets solely under the Electronic Financial Transactions Act and the Capital Markets Act. In response to these limitations and particularly after the 2022 Terra incident, which highlighted the challenges in preventing unfair trading practices, the Yoon government included the construction of a digital asset infrastructure and regulatory system as one of its 120 national tasks in July 2022.

4.1. Backgrounds

As the existing Electronic Financial Transactions Act and the Capital Markets Act proved insufficient for the comprehensive management of virtual assets, the Korean government introduced a reporting system for virtual asset service providers and various regulatory measures for anti-money laundering (AML) and investor protection through the amendment of the Act on Reporting and Using Specified Financial Transaction Information in March 2021. However, this amendment, focused mainly on AML, faced difficulties in preventing unfair trading practices, a fact that was highlighted by the Terra incident in 2022.

Consequently, in July 2022, the Yoon administration included "35. Establishment of Digital Asset Infrastructure and Regulatory Framework (Financial Services Commission)" as one of the 120 national tasks and announced the creation of a "Digital Asset Basic Law (currently the Virtual Asset Act)," dedicated solely to virtual assets.

Both ruling and opposition parties in Korea agreed to establish a minimum necessary regulatory framework for virtual assets proactively, then gradually refine the details. The enactment of this Virtual Asset Act represents the first phase of this regulatory policy, focusing on the most urgent aspects: investor protection and the regulation of unfair trading practices among the various sectors of the virtual asset industry.

4.2. Contents

The Virtual Asset Act defines virtual assets and virtual asset service providers similarly to the Act on Reporting and Using Specified Financial Transaction Information but excludes the Central Bank Digital Currency (CBDC) issued by the Bank of Korea from the virtual asset category.

- Virtual Asset: An electronic certificate that can be transferred and holds economic value, excluding game money, electronic money, and electronically registered stocks.

- Virtual Asset Service Providers: Operators of virtual asset exchange, custody, wallet services, etc.

This first-phase law focuses on protecting the assets of virtual asset users, regulating unfair trade, and strengthening the supervisory authority of financial regulators.

4.2.1. Protection of User Assets

The law introduces specific regulations absent in the Act on Reporting and Using Specified Financial Transaction Information, such as detailed methods and measures to ensure the safety of virtual assets held. Virtual asset service providers are required to segregate users' deposited funds from their own and maintain them with a reputable institution like a bank or trust. Additionally, they must hold the same type and quantity of virtual assets as the deposited funds. Service providers are also mandated to store a certain percentage of these deposits in cold wallets, which are disconnected from the internet to protect users' assets from hacking risks. They must also take out insurance or reserve funds to prepare for incidents like hacking or system failures and retain transaction records for 15 years after the transaction is concluded.

4.2.2. Regulation of Unfair Trading Practices

The first phase of the Virtual Asset Act includes and regulates the following five types of unfair trading practices:

- Use of Undisclosed Information: Prohibiting trading activities using information that has a significant impact on investment decisions before it's disclosed to the public.

- Market Manipulation: Prohibiting all forms of trade-based market manipulation, including matched orders, rigged trades, and actual trading.

- Fraudulent and Deceptive Transactions: Prohibiting transactions that involve the false entry of significant details, false pricing, or the use of dishonest means.

- Trading of Virtual Assets Issued by Oneself or Related Parties: Prohibiting the trading of virtual assets issued by oneself or related parties, with *specific exceptions, taking lessons from incidents like the FTX case.

- Arbitrary Blocking of Deposits and Withdrawals: Prohibiting the unjust blocking of deposits and withdrawals and mandating that any unavoidable reasons for such actions be promptly notified to users and reported to the FSC.

*Specific Exceptions: Virtual assets issued as a means of payment for specific goods or services, where the virtual asset service provider provides the promised specific goods or services to the user and acquires virtual assets in return (Article 10, Paragraph 5, Subparagraph 1).

Additionally, virtual asset exchanges and other market operators must monitor and report any abnormal transactions indicating unusual changes in asset prices or volumes to protect users. Thus, by July 2024, exchanges must develop systems to monitor these transactions and have the necessary resources to perform related tasks.

4.2.3. Increase in Supervisory Authority

This act also clarifies and strengthens the supervisory authority of financial regulators, preventing unfair practices and laying the groundwork for smooth law enforcement. The FSC is now authorized to demand various documents, statements, and witness attendance from virtual asset service providers when necessary. New provisions also allow for the recommendation of dismissal, suspension of duties, or suspension of service for employees of service providers who violate these regulations.

Furthermore, the sanctions for engaging in prohibited practices have been significantly increased. Criminal penalties include imprisonment for at least one year or a fine of three to five times the profit earned from the violation. Additionally, administrative fines equivalent to double the avoided loss and provisions for class action lawsuits for damages have been introduced.

4.3. Current Status

On December 11, the FSC conducted a legislative notice for the enforcement decree and supervisory regulations detailing the content of the first phase of the Virtual Asset Act, set to be implemented on July 19, 2024. This enforcement decree is meaningful as it specifies the detailed regulatory guidelines that the current Virtual Asset Act lacks.

The enforcement decree of the Virtual Asset Act includes additional exclusions for virtual assets, establishes the ratio for cold wallet storage, and defines undisclosed information, directly affecting virtual asset service providers and investors.

Particularly, the regulation on user deposit managers stipulates that only banks will manage user deposits. It further mandates that virtual asset service providers must substantially hold the same type and quantity of virtual assets as the deposits, making it virtually impossible for third parties to manage or operate custody and operation businesses in Korea.

The Financial Supervisory Service (FSS) announced the establishment of a dedicated organization for virtual assets, signifying a commitment to enhance the reporting and inspection process for virtual asset service providers. The Digital Asset Research Team, which handles legislative support and market monitoring, will be subdivided into the 'Virtual Asset Supervision Bureau' and the 'Virtual Asset Investigation Bureau'. The Supervision Bureau will act as the general department for managing and supervising service providers, while the Investigation Bureau will be responsible for investigating unfair trading practices. The aim is to prevent money laundering through virtual assets, enhance user protection, and rigorously reorganize the review process for existing virtual asset service providers.

5. Travel Rule

5.1. Backgrounds and Contents

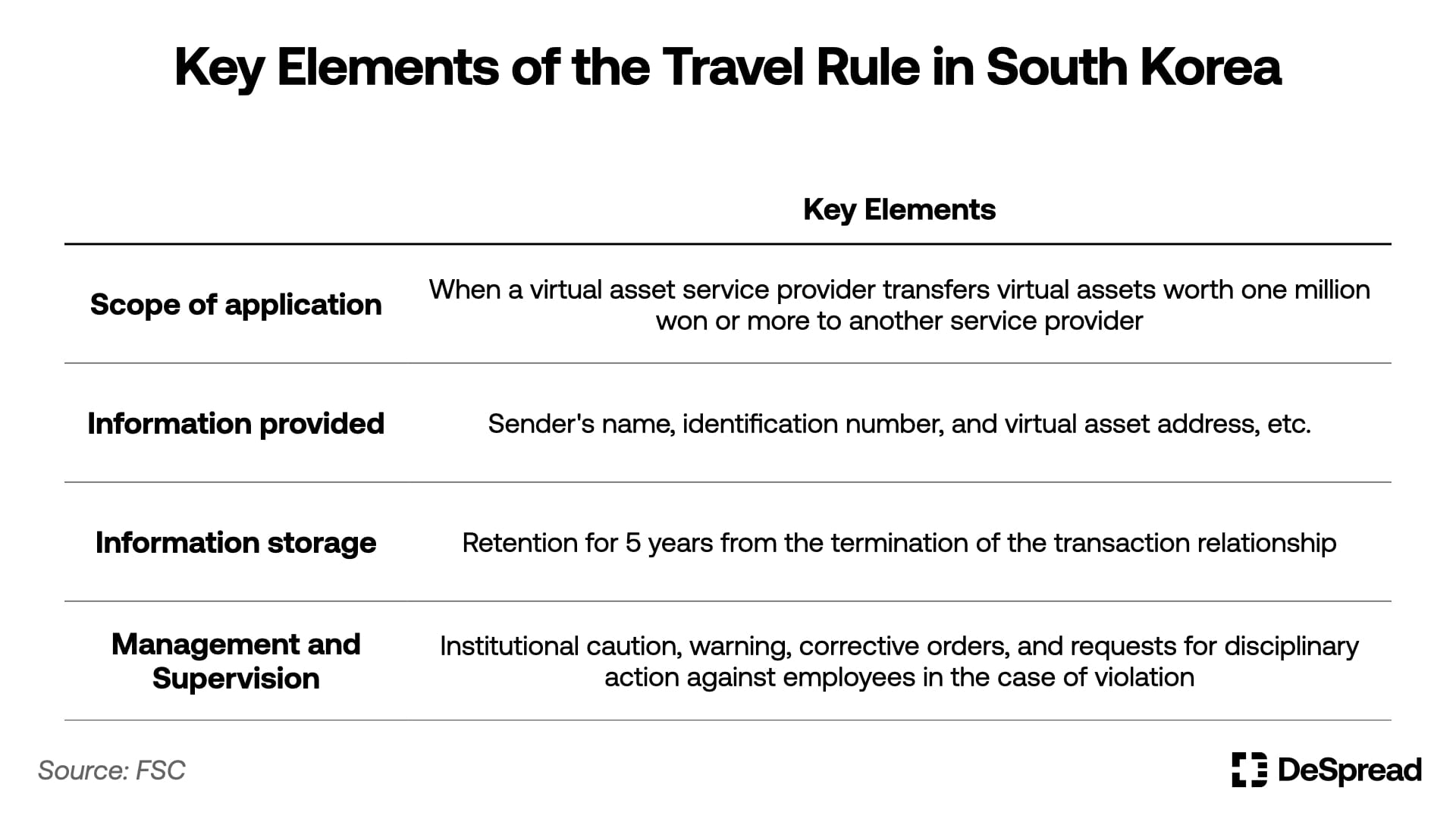

The Travel Rule originally refers to the regulation that financial institutions must record the sender's information when making international transfers, following the format required by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). However, with the rise of virtual assets as a global issue in money laundering, the Financial Action Task Force (FATF) proposed in 2019 to extend the Travel Rule's application to virtual assets, urging countries worldwide to apply it to their virtual asset service providers.

South Korea became the first country to implement the Travel Rule in virtual asset transactions on March 25, 2022, under the Act on Reporting and Using Specified Financial Transaction Information. This regulation mandates that when virtual asset service providers transfer virtual assets worth over 1 million won, the sending service provider must provide and store relevant information to the recipient.

However, the current Travel Rule only applies to transfers between domestic virtual asset service providers. The four major exchanges in Korea (Upbit, Bithumb, Coinone, Korbit) are using solutions like VerifyVASP (Upbit) and Code (Bithumb, Coinone, Korbit) to comply with the rule. But transfers between domestic exchanges and foreign exchanges or personal wallets are not covered by the regulation. Therefore, exchanges are following the FSC's guidelines and adopting a whitelist approach on their own. As of 2023, there have been no significant changes in the Travel Rule, but there's an international movement expected in 2024 to extend its scope to include personal wallets

5.2. Travel Rule in 2024

On June 27, the FATF published a report titled "Virtual Assets: Targeted Update on Implementation of the FATF Standards on Virtual Assets and Virtual Asset Service Providers," announcing the continuous monitoring of criminal activities related to DeFi and private wallets as part of the FATF roadmap. Additionally, the EU's regulation on virtual assets, MiCA (Markets in Crypto-Assets), has been applying regulations to personal wallets since June 2022, regardless of whether the transfers are domestic or international.

Since South Korea was the first to implement the Travel Rule globally, the current Act on Reporting and Using Specified Financial Transaction Information did not reflect the revised recommendations of the FATF's Travel Rule. This has led to identified issues such as the limited application of the rule to domestic exchanges (article) and the lack of alignment with international regulations, which limits transaction transparency (article). Continuous amendments in line with the international trend of the Travel Rule have been called for, particularly as the "Sunrise Issue" — the regulatory disparities between countries — is more pronounced in the virtual asset industry due to its less confined nature by national borders. By 2024, there's a growing need to expand the regulatory scope to include not only transfers between exchanges but also personal wallets, and the industry is accelerating its efforts to respond to this need.

For example, on November 29, multi-chain infrastructure provider PiLab (operator of Bifrost), Korea Information Certificate Authority (KICA), and the Travel Rule solution provider CODE signed an MOU for the development and deployment of a Web3 KYC service. Bifrost, which has been developing a personal wallet KYC solution in collaboration with KICA since October 2022, plans to expand the current scope of Travel Rule KYC applications conducted by virtual asset service providers to personal wallets. This collaboration signifies an intent to create a reliable investment environment in Korea that aligns with global regulatory trends.

6. Conclusion

In 2023, the South Korean virtual asset industry laid a foundation for flexibility in the capital market through the implementation of security token guidelines, established trust and integrity in the market through the mandatory reporting of virtual assets by high-ranking officials, and prepared a solid foundation for the industry to become a legitimate sector with the enactment of the Virtual Asset Act, aiming to enhance investor protection. Additionally, the plan to introduce virtual asset-related accounting guidelines, although not mentioned above, was announced to address the accounting uncertainties faced by companies holding virtual assets.

With the growing recognition of the need for comprehensive national regulation of virtual assets since 2022, 2023 marked the year where the foundation for such regulations was laid out. It's anticipated that 2024 will see the full implementation of these foundational measures. Particularly in South Korea, there's an intensified focus on regulation due to the scheduled enforcement of critical legislative developments, notably the first phase of the Virtual Asset Act and the amendment of security tokens. The latter is especially significant as it's expected to provide a conduit for traditional financial institutions like securities firms and banks to enter the virtual asset industry, marking a significant integration of conventional finance with the emerging virtual asset sector. As these regulations are set to be implemented in a phased manner, there's a keen interest in how they will balance the dual objectives of preserving the innovative spirit of the domestic virtual asset industry while also instilling a sense of trust and efficiency within the sector.

References

- FSC, FSC Unveils Measures to Overhaul Regulations to Permit Issuance and Circulation of Security Tokens, 2023

- Declan Kim, STO Series Part 2: A Prelude to the Korean Security Token Market, 2023

- Bill Information System, Resolution on Self-Declaration and Investigation of Virtual Assets by Members of Parliament (Committee Bill), 2023

- FSC, Government to Ensure Virtual Asset User Protection, Transaction Transparency and Market Discipline, 2023

- Shin & Kim, Act On Reporting And Using Specified Financial Transaction Information, 2023

- Kim & Chang, Highlights of the Act On Reporting And Using Specified Financial Transaction Information, 2023

- FSC, FSC Proposes Rules on the Protection of Virtual Asset Users, 2023

- KB Financial Holdings, Significance of Applying Travel Rules and Trends in the Domestic Virtual Asset Industry, 2022

- CODE, 1 Year of Virtual Asset Travel Rules, Present and Future, 2023