Disclaimer: The authors of this report did not purchase or sell any of the relevant tokens using material non-public information during the research or drafting of this report. The contents of each report reflect the opinions of the respective authors and are provided for informational purposes only and are not intended to be a recommendation to buy or sell any token or use any protocol. Nothing contained in this report is investment advice and should not be construed as such

Introduction

Part 1 Recap

In the first part, we explored the process and current status of cryptocurrency regulations in Japan, particularly those related to security tokens. Japan was one of the world's earliest and most active countries for cryptocurrency investment but was devastated by a series of large-scale exchange hacks, including Mt.Gox and Coincheck. Realizing the need for a regulatory overhaul of the cryptocurrency industry and investor protection measures, the Japanese government announced the first amendment in 2016 and the second amendment in 2019. The second amendment, especially, stipulated the definition and requirements of security tokens through amendments to the Financial Instruments and Exchange Act, marking the beginning of the security token market in Japan. Since then, the market has been created by practitioners centered on the Japan Security Token Offering Association(JSTOA), a self-regulatory organization established by major securities firms in Japan. Today, not limited to securities firms, companies in various industries such as startups, law firms, and fintech companies are participating to build a security token ecosystem.

A Prelude to the Korean Security Token Market

On the 5th of last month, the Financial Services Commission(FSC) announced the guidelines for the issuance and distribution of security tokens, signaling the beginning of a regulatory overhaul of the security token market in Korea. Although there have been cases of fractional investments in illiquid assets such as real estate through the designation of a financial regulatory sandbox(Innovative Financial Services) in May 2019, these were only pilot cases that were exempted from the current regulations. Therefore, the FSC’s proposal to amend the current law can be seen as a move to officially accept security tokens at the government level, and its significance is not small. In this article, we will take a look at the state of the Korean security token market, focusing on the issuance and distribution structure and related laws.

Main Content

Issuance and Distribution Structure of Securities

What are securities?

Before we look at the issuance and distribution structure of security tokens, let’s understand what securities are and how they are issued and distributed. To begin with, the dictionary definition of security is “a document that represents a private right with property value and facilitates the circulation and utilization of property rights.” More intuitively, security is a document with property value, such as stocks or bonds. Countries, institutions, companies, etc. issue various securities mainly to raise funds, and the market where these securities are traded is what we call the securities market.

Primary Market

Securities markets can be broadly divided into primary and secondary markets. The primary market is where securities are traded for the first time, most notably in Initial Public Offering(IPO). The primary market consists of issuers, intermediaries, and investors. The roles of each are as follows:

- Issuer: An entity that issues securities in need of funds, such as a country, public organization, or company.

- Intermediary: A broker that acquires securities from the issuer and sells them to investors such as securities firms, banks, investment trust firms

- Investor: The entity that purchased the security and provided funding for it such as individual investors, institutional investors

Secondary Market

A secondary market is a market where securities that have already been issued through the primary market are freely traded among investors. Secondary markets are markets most investors are familiar with, including the Korean Securities Exchange(KSE) and KOSDAQ in Korea and the New York Stock Exchange NYSE) and NASDAQ overseas. On the surface, the secondary market appears to be a multilateral transaction between investors and investors, but in reality, it is composed of various parties directly or indirectly, including securities firms, and the roles of each party are as follows:

- Investor: The entity that buys and sells securities and entrusts the purchase and sale to securities firms.

- Securities Firm: The entity licensed for financial investment business, entering buy and sell orders from investors into the exchange.

- Exchange: The entity that creates a market for safe investment by listing, buying, selling, clearing, settlement, disclosure, and market monitoring of securities ex) KRX, NYSE

- Securities Depository: The entity that deposits and settles securities through accounts opened by investors or financial investment companies under the electronic securities system.

- Financial Supervisory Service: A special corporation under the Financial Services Commission that conducts inspections and supervision of financial companies.

- Securities and Futures Commission: Under the Financial Services Commission, it investigates unfair transactions in the market and preliminarily deliberates on major matters related to the management and supervision of the market.

- Financial Services Commission: A government agency that oversees financial affairs in South Korea

Both markets are important because the former raises new funds, while the latter provides liquidity for already issued securities and provides a barometer of the security’s performance. While there are many ways to organize primary and secondary markets, including direct issuance, indirect issuance, and gross underwriting, depending on the type of security being issued and the amount of underwriting costs incurred by the issuer, this article focuses on the issuance and distribution structure of security tokens, the explanation of the structure of the securities market would end here with a general understanding.

Korean Security Token Issuance and Distribution Structure

As of early March 2023, when this article was written, no official legislation has been enacted regarding the structure of security token issuance and distribution in South Korea, so this article is based on the “Security Token Issuance and Distribution Regulatory System Improvement Plan” announced by the Financial Services Commission on February 5, 2023.

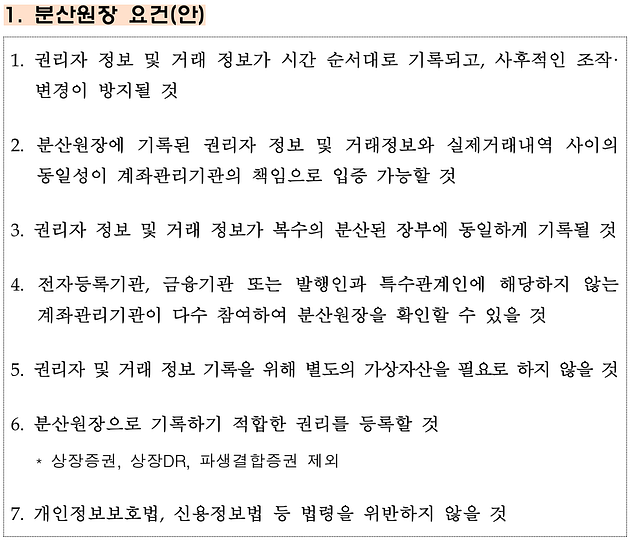

First of all, in Korea, a security token is defined as “digitized securities under the Capital Markets Act using distributed ledger technology”. The distributed ledger technology referred to here is basically the characteristics of blockchain that we are familiar with, and additional requirements are required to be included in the regulation, which is detailed below.

Among these requirements, paragraph 4 is particularly noteworthy. Paragraph 4 refers to the requirements of the network nodes in the security token issuance process. Given that at least 51% of the nodes must consist of other financial institutions, electronic registrars, and account custodians that are not related to the issuer, it is likely that 1. the network for the issuance of security tokens will consist of a consortium or private blockchain, and 2. measures have been taken to prevent malicious alteration of the issuer’s records within it. While some may argue that the network used for token securities is limited to a consortium or private blockchain, which is not an innovation that fully utilizes the benefits of blockchain, I would like to focus more on an attempt to formally introduce blockchain into national finance, that is, an effort to create 1 from 0. Objectively, the Korean security token market has many technical and institutional limitations, and there is no clear accountability in the event of a crime. Therefore, if we start with a stable system and set the goal of establishing and developing it in terms of scale and technology, we would be able to achieve sufficiently satisfactory results.

As mentioned earlier, the FSC wants to start the security token business on a stable footing, and this is particularly evident in their explanation of security tokens. They likened token securities to food and bowls, emphasizing that they are securities that have only changed their form of issuance(the bowl), but the essence(the food) within them remains unchanged. Also, they implied token securities, as a form of electronic securities issued under the Act on Electronic Registration, will basically follow the existing market structure of securities issuance and distribution.

The Structure of the Primary Market

The basic framework is the same as the issuance of traditional securities. When an issuer issues a security token, an account management organization electronically registers it in the Securities Depository by the Act on Electronic Registration. However, in the case of token securities, the use of a distributed ledger differs the issuance system from that of conventional securities, due to the introduction of an ‘issuer account management organization’.

As the name suggests, it is an entity that issues securities and also acts as an account custodian. Previously, electronic securities could only be registered electronically through an account management organization such as a securities firm or bank because the issuer of the security could not register directly with the depository, but an issuer account management organization can electronically register its securities directly with the depository. Therefore, the inefficient structure of going through an intermediary called an account management organization and paying various fees can be partially solved by issuing security tokens using blockchain. This innovation was possible due to the characteristics of blockchain, which can prevent post-manipulation and alteration because multiple nodes participate in verifying records. It is also significant that the government has recognized blockchain as a method of recording legal public registration(公簿).

Of course, as you can see from the diagram above, not all issuers can become an issuer account management organization, but only those that meet the requirements FSC demands. However, even if you do not meet the requirements, you can still issue security tokens. The only difference is that you have to go through an intermediary(account management organization) during the electronic registration process. From these changes that occur by introducing a new issuance form called security token using distributed ledger technology, we can expect the following two effects:

- Expanding securitization attempts of various assets and cash flows such as fractional investment businesses

- Diversification of business sectors utilizing the introduction of distributed ledger technology by existing account management institutions

The first effect can be exemplified by companies providing innovative financial services within the current sandbox, such as Kasa and Lucentblock. If a system is officially established that allows companies that do not have the safety and reliability suitable for a custodian to issue security tokens using various assets, but have outstanding innovation and technology, and register them through a custodian, it may encourage attempts to expand asset securitization practices, which are currently mainly focused on real estate, to include art, commodities, and even intangible assets.

The second effect is the opposite of the first one, where a securities firm that was previously a broker becomes an issuer account custodian that issues and registers security tokens directly. Since securities firms already met the requirements of an account management organization, they can become an issuer account management organization as long as they meet the requirements of a distributed ledger. This can be an opportunity for them to diversify their business by issuing securities instead of being limited to brokerage. There is a case where Shinhan Investment & Securities directly participated in the establishment of a fintech company called ‘APND’, which was designated as an innovative financial service by establishing its own STO platform. When the official legal reform is implemented, we can expect more securities firms to directly participate in the establishment of token securities platforms, such as the Japanese case of ‘Progmat’.

The Structure of the Secondary Market

The core of the secondary market is the establishment of an on-exchange and OTC(Over-The-Counter) market where atypical securities (non-monetary trust beneficiary certificates and investment contract securities) can be actively traded. Looking at the on-exchange market first, the FSC announced plans to establish a digital securities market on the Korea Exchange(KRX) for trading beneficiary certificates and investment contract securities by applying listing requirements for investor protection such as issuer soundness and issue size, and disclosure of material information, but relaxing them compared to the existing listed market. This implies the intention to settle atypical securities in the on-exchange market through the existing proven system, but when registering security tokens in the on-exchange market, it seems inevitable to convert the issuance form to electronic securities for stable trading due to technical limitations such as limited processing speed of distributed ledger technology compared to the electronic securities system.

In the case of the OTC market, the government has announced plans to establish an OTC broker and allow multilateral counterparty brokerage business for retail investors. This means that a market will be formed where retail investors can freely trade security tokens through the order book method, and due to the nature of security tokens that use innovative technologies and use previously illiquid assets as underlying assets, active trading in the OTC market seems to be the key to the security token business rather than the structured and high hurdles of the on-exchange market.

In particular, FSC has been active in promoting security tokens in the OTC market by announcing a plan to encourage small investments by new businesses, such as exempting them from revenue disclosure and not applying market surveillance, by separating the licensing requirements for becoming an OTC broker by security type. In response, various fintech companies such as crypto bank ‘Delio’ have expressed their ambitions to acquire OTC broker licenses, and if the trading in the OTC market slowly settles and grows, we can expect to see the scale of the OTC market grows beyond the currently scheduled investment limit with the active involvement of various fintech companies, not limited to existing securities firms.

Conclusion

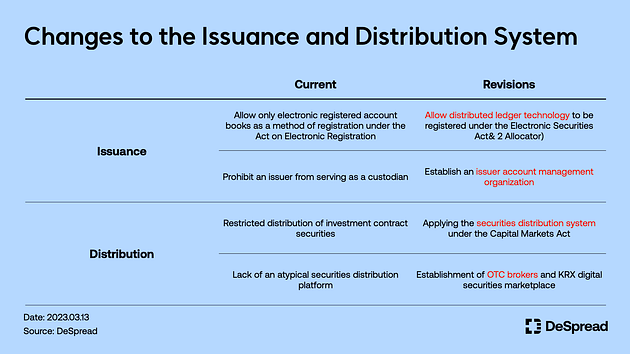

The areas that will be changed compared to the current system after the guidelines described in this section are shown in the diagram above. Changes in the Korean security token market are expected to occur slowly and gradually. Amendments to the Capital Markets Act and the Act on Electronic Registration, which are related to security tokens, are expected to be submitted to the National Assembly in the first half of this year. Also, the actual implementation of the amendments is expected by the end of next year at the earliest. However, even before formal institutionalization, FSC has stated that the current financial sandbox system will continue to operate and has announced plans to continue testing the feasibility of security tokens. However, for innovative financial services implemented before the amendment, token securities will be issued to match existing electronic securities on a 1:1 basis and will be subject to the same securities issuance screening and total volume management by the KRX as under the current law.

The new financial market of security tokens is expected to be an opportunity for existing financial market players, such as securities firms, banks, and listed companies, to diversify their businesses, and a springboard for new players, such as fintech companies and startups. The race to be at the forefront of the new market started before the guidelines were released and accelerated after the guidelines were released. Especially, I am paying attention to the transformation of securities firms, and I expect that business agreements with startups that have outstanding technologies, development of their own security token distribution platforms, preoccupancy of consortium blockchain nodes, and possession of various assets and intellectual property(IP) will be key competitive points to be at the forefront of the upcoming security token market.

Firsts are always significant. If this attempt to introduce the revolutionary technology of blockchain to the financial market, which has been considered somewhat closed, at the national level comes to be successful and develops, we can look forward to introducing this innovation beyond finance to key areas of national operations such as administration, legislation, and politics. Furthermore, we believe that the transition from a top-down approach where the state determines the direction of development of the industry to a bottom-up approach where the industry influences the direction of development of the state can be more actively implemented. In the next article, I will analyze the security token market in Japan, which is currently making practical use of security tokens through legal reforms years ahead of Korea.

<References>

- FSC, Security Tokens Issuance and Distribution Regulatory System, 2023

- FSC, Additional QA on Security Tokens Issuance and Distribution Regulatory System, 2023

- TechM, Seminar Presentations, 2023