1. UST-LUNA, an Anchor protocol that led a paradigm shift

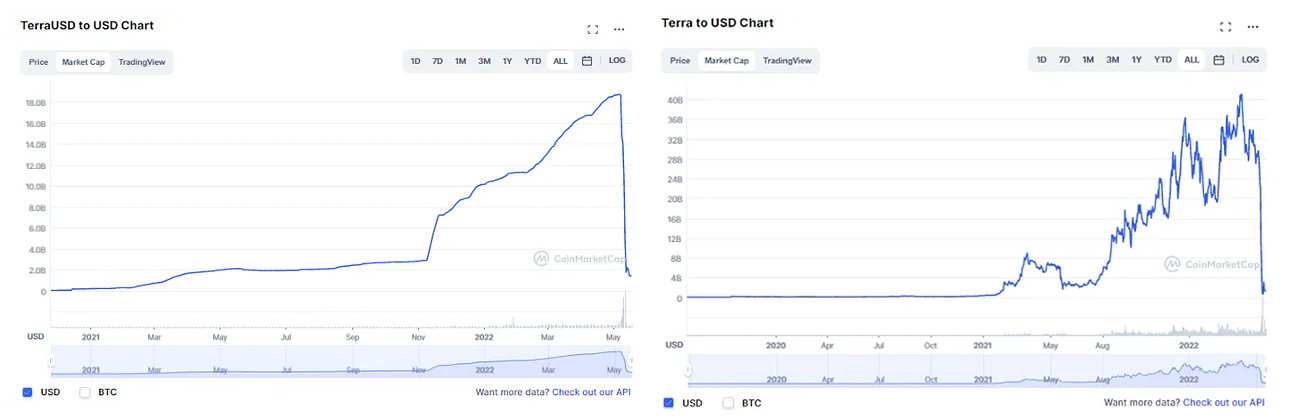

UST’s market cap was around $3B in November 2021 and reached up to around $18.7 B in May 2022 right before it plummeted, and the market cap of LUNA which was linked to UST grew from around $16 B to around $30 B during the same period. The success of UST and LUNA led to a paradigm shift towards algorithmic stablecoins in the DeFi market, making other existing algorithmic stablecoins (USDN, FRAX) re-examined while triggering the emergence of new algorithmic stablecoins (USN, USDD).

1.1. Icarus wings that fell off within just three days

UST that started to depeg on May 10, seemed to repeg, but as the market cap of LUNA, an asset linked to UST plummeted, it dropped to the price of around $0.15 on May 13. The combined market cap of around $ 50 B of UST and LUNA dropped within three days, recording around $ 2.2 B as of May 17. I would like to revisit the recent UST debacle and think about methods that can complement the causes of this crash.

2. History of UST-LUNA Crash

2.1. “By my hand, DAI will die.”

On March 22, Do Kwon, co-founder of Terra, announced its plan to introduce 4pool of Curve finance, which provides liquidity for UST, FRAX, USDC, and USDT stablecoins, and predicted the demise of DAI, a stablecoin of Maker DAO.

By my hand $DAI will die.

— Do Kwon 🌕 (@stablekwon) March 23, 2022

The real purpose of 4pool would have been to combine the FRAX and UST pools that provide the most incentives to the veCRV holders to enable easier pegging, more liquidity, and more users. But, depending on the Factory Pool creation condition of Curve finance, the pool of up to four types of tokens can be created, so DAI was likely excluded in the pool design process as its market share was lower than other USDC and USDT stablecoins.

2.2. Preparing the launch of 4pool and the breakout of a bank run

Terra(LUNA), the protocol was preparing to transfer the liquidity for Curve finance 4pool launch, and this worked as a trigger for the disaster. The history of the UST-LUNA collapse is as below.

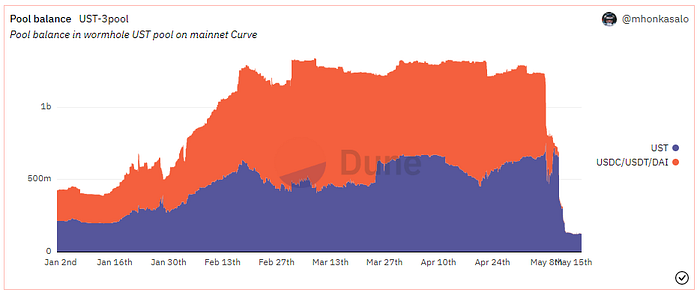

- The liquidity of UST-3pool which had a whopping $ 1.2 B plunged to around $ 800M on May 7 and 8.

- On May 8, Do Kwon tweeted the reasons for the liquidity plunging as below.

For the launch of 4pool, TerraForm Labs had withdrawn UST equivalent to around $ 150M.

After the withdrawal, an anonymous user dumped $84 million worth of UST

To address the liquidity imbalance after the dumping, TFL withdrew an additional UST of $100M

- Additional dumping of $350 M worth of UST took place thereafter, causing a severe imbalance to the UST-3pool liquidity (The ratio between UST to USDT/USDC/DAI became around 7 to 3)

- Deposits on the Anchor protocol plunged fast from $14 billion during the same period

May 6~8: Loss of around $ 2.2B

~ May 9: Lost around 1B

~ May 10: Lost around 4.4B

~ May 11: Lost around 2B

- From May 7 to 11, deposits on Anchor Protocol plunged to $4.5 billion from $14 billion, and the Curve finance UST-3pool had a severe imbalance where the ratio between UST and USDC/UST/DAI exceeded 9 to 1.

- UST depegging exacerbated, LUNA price dropped, the market cap between UST and LUNA reversed, which worsened the Death Spiral, and the market cap that was around $50 B plunged to around $2.2B.

3. What has caused all this?

There are various factors being discussed that have caused this crash, but the key factors are the limitation of arbitrage transactions, and a tool to mitigate the shock from the large-scale asset transfer.

3.1. Cause 1: Limitation of arbitrage mechanism with volatile asset

UST and LUNA are linked to each other and issuance of 1 UST burns LUNA worth $ 1, and returning 1 UST issues $1 LUNA. Based on this mechanism, when the price of UST is set higher than $1 due to high demand for UST in the market, the market participants use LUNA worth $1 to issue UST and sell it, thereby yielding a profit. In contrast, when the price is set lower than $1 due to a demand decrease, the participants buy UST at low prices in the market and exchange each UST with LUNA worth $1, yielding a profit from the arbitrage transaction.

However, this mechanism is valid only when there is an expectation in the market that LUNA prices won’t change or go up. When people expect that the price of LUNA will drop due to a bad market situation or the prospect of the Terra ecosystem is not so bright, the risk of holding LUNA increases, and people return UST when it is lower than $1 as they prefer selling UST than holding LUNA, and even as they are in the middle of arbitrage transaction, they tend to immediately sell new LUNAs in the market, causing LUNA to have a sudden drop in its value. In particular, as UST and LUNA were closely linked to each other, the value drop of LUNA caused UST and LUNA holders to sell other assets, which caused the serial price drop of the two assets, and this led to a high risk of so-called “Death Spiral”.

During this incident, the mechanism between UST-LUNA had no change, but due to the UST depegging and fast decrease of UST deposits on Anchor collapsed trust on UST and LUNA, leading to an unprecedented bank run that led to the crash of the two assets.

3.2. Cause 2: The shock from the large-scale asset transfer was overlooked

The crypto market is still an extremely small part of the global financial market. As Tascha, a web3 researcher says, out of 1,000 trillion assets in the world, crypto-only accounts for 0.15%. Considering this, any protocol is exposed to an attack by bigger capital from outside, and as it does not have a right to unlimited issue tokens as central banks in the real world, it faces the difficulty of not being able to become the lender of the last resort.

In this environment, most of the UST issuance for UST-LUNA was concentrated on Curve finance and Anchor protocols, and it had an issue of a single point of failure which means that an attack on these two protocols or Curve finance to be more accurate would break the confidence on UST pegging, leading to the demise of the entire Terra protocol. As a result, the TFL’s large money movement to form a 4 pool of curve finance caused this single point of failure with UST dumping approximately $350M, and the loss of protocol confidence by UST depegging led to the downfall, triggering UST-LUNA’s Death Spiral.

4. Could have it been complimented on a protocol level?

4.1. Need to use assets that are less relevant with stablecoins as collaterals: PSM of MakerDAO

Tascha pointed out that there should be a demand for collateral assets backing stablecoins rather than securing demand for themselves. George Soro’s betting against the British pound in 1992, which is mentioned as a case comparable to the UST clash, led to the devaluation of the currency by max. 25% because of the non-speculative demand for the legal currency.

However, non-speculative demand for reserve assets or stablecoins in crypto is hard to expect. Except for USDC, USDT, etc. stablecoins that are issued based on legal currency, I think it is not realistically possible to issue a stablecoin that perfectly meets the condition mentioned by Tascha. In fact, since the emergence of algorithmic stablecoins, securing utility has been discussed as an ultimate task, but no stablecoin model, even UST which was the biggest in scale has not yet achieved this task.

Therefore, before forming non-speculative demand on collateral assets, it is necessary to first use an asset that is less relevant with stablecoins as a collateral asset and to design it in a way that enables arbitrage with stablecoins. In addition, the expected profit in arbitrage should be determined so that smooth arbitrage can be induced under any circumstances. In the cryptocurrency market, the only asset that meets these requirements is the legal currency-based stablecoin, so the algorithm stablecoin should be treated as collateral even in part (because it indirectly benefits from the non-speculative demand formed for legal currency)

The case that supports my argument is from the trajectory of MakerDAO. DAI which are stablecoins that MakerDAO issues using cryptocurrency as collateral have been under chronic shortage in supply from the date of launch to late 2020 since they are issued at a high collateral rate. Therefore, over pegging, which is about a price set above $1 easily instead of $1 pegging being maintained, was frequently observed. To address this, in Dec. 2020, MakerDAO adopted PSM (Peg Stabilization Module) using USDC. PSM makes the issuance ratio of 1 USDC = 1 DAI mandatory in the MakerDAO’s smart contract to address DAI supply shortage and enable smooth arbitrage. After PSM adopted, the pegging of DAI seemed to be stabilized.

4.2. Applying Time-weighted concept: TWAMM of Frax finance

Looking at the crash from the asset management perspective, a large amount of capital moved without limitation and blew a significant shock on the market, leading to a decrease in market participants’ confidence. As a method to mitigate large-scale asset management’s shock on the market, the time-weighted concept can be introduced. The most prominent example is TWAMM(Time-Weighted Automated Market Maker) which is provided at Fraxswap, a DEX recently launched by Frax Finance.

TWAMM is about breaking a single large-scale transaction into many small transactions to implement, and it is a way to address liquidity depletion, and sudden price change when trading a large amount of capital. It was designed to help protocols that own direct liquidity such as OlympusDAO to manage assets more easily and smoothly, and as a way to mitigate market shock caused by large-scale capital trading in the market. At the moment, Fraxswap offers trading between broken-down assets for 6 hours minimum and 1095 days maximum.

At present, it is one of the services that one can select when trading capital. However, on protocols that play a critical role in stablecoin pegging such as Curve finance, TWAMM may become mandatory when trading assets above a certain amount to mitigate market shock and help protocols have some time to prepare against the shock from the capital attack.

4.3. P2P(Protocol-to-Protocol) insurance service required: Insurance protocols

In the real financial world, there are measures including central banks’ acting as lenders of last resort and the depositor protection system to keep the financial system properly functioning. In the crypto world, protocols that issue stablecoins are not able to act as lenders of the last resort as they do not have the right to issue as central banks, but the depositor protection system seems to be feasible to be introduced in the DeFi world to some extent.

The Depositor Protection System or the Depositor Protection Act refers to the government’s guarantee of deposits within a certain amount of money when financial companies are unable to pay customers’ deposits due to bankruptcy or other reasons. Under the current Korean depositor protection law, depositors can be guaranteed up to 50 million won per person if they cannot pay their deposits due to the bankruptcy of financial institutions. These systems have the effect of limiting bank runs by suppressing people’s fears in the event of a market shock.

According to the tweet thread of CryptoCondom, during this UST-LUNA crash, Unslashed Finance, InsurAce, Risk Harbor which is the DeFi insurance protocols have provided coverage for the UST depegging, and InsurAce has paid USDT of $12 M in total and Risk Harbor an amount of up to around $2.5M. Currently, a market participant directly joins the insurance protocol, but when protocols such as Curve finance, Anchor protocol, etc. that are related to the stablecoin pegging directly engage with the insurance protocols and join an insurance system that provides coverage for liquidity loss regarding a large-scale liquidity pool, it would help mitigate market shock. In addition, it appears that the overall consensus in the market on the need to have DeFi insurance products should be established first.

DeFi 🦺 is of paramount importance when trading or farming with funds.

— CryptoCondom (@crypto_condom) May 15, 2022

Given the recent $LUNA implosion, depeg insurance has become a hot topic of conversation. Let’s see how the 4 protocols that offered $UST depeg have done since the recent debacle.

👇🧵 pic.twitter.com/ahlX6tqAxw

5. The Show Must Go On

Tascha said that for the survival of crypto markets and market participants, we need to be able to produce regulations ourselves rather than wait for the regulators to impose them. Considering the clash this time, supplementary measures for protocols that issue stablecoins should be discussed and adopted in some way, even if not in the same way as mentioned above. Also, I think it is worth paying attention to how DAI and FRAX, which have shown how well they can be pegged despite the sudden clash in the market, will implement innovations and improve their business models.

The collapse of UST-LUNA has deepened the downturn in the cryptocurrency market, and this has led to a more prejudiced view of cryptocurrency from outside the market. The harsh time that the crypto market is going through may be much longer than we think, but I would rather be patient to wait and see when no one is paying attention, whether we can learn from what’s happening and create another innovation to bring back another time of hope.