Berachain: The Journey of Honey to the Bear

Examining the factors that influence Berachain's incentive distribution methods and scale

This article does not cover the basic content about Berachain, so for those who are new to Berachain, it is recommended to read the following articles first before reading this one.

- Berachain — The Bear that Captures Both Liquidity and Security

- Berachain — Bera Village Tour

- Growth 0 to 1: Berachain

- Surviving in Berachain

1. Introduction

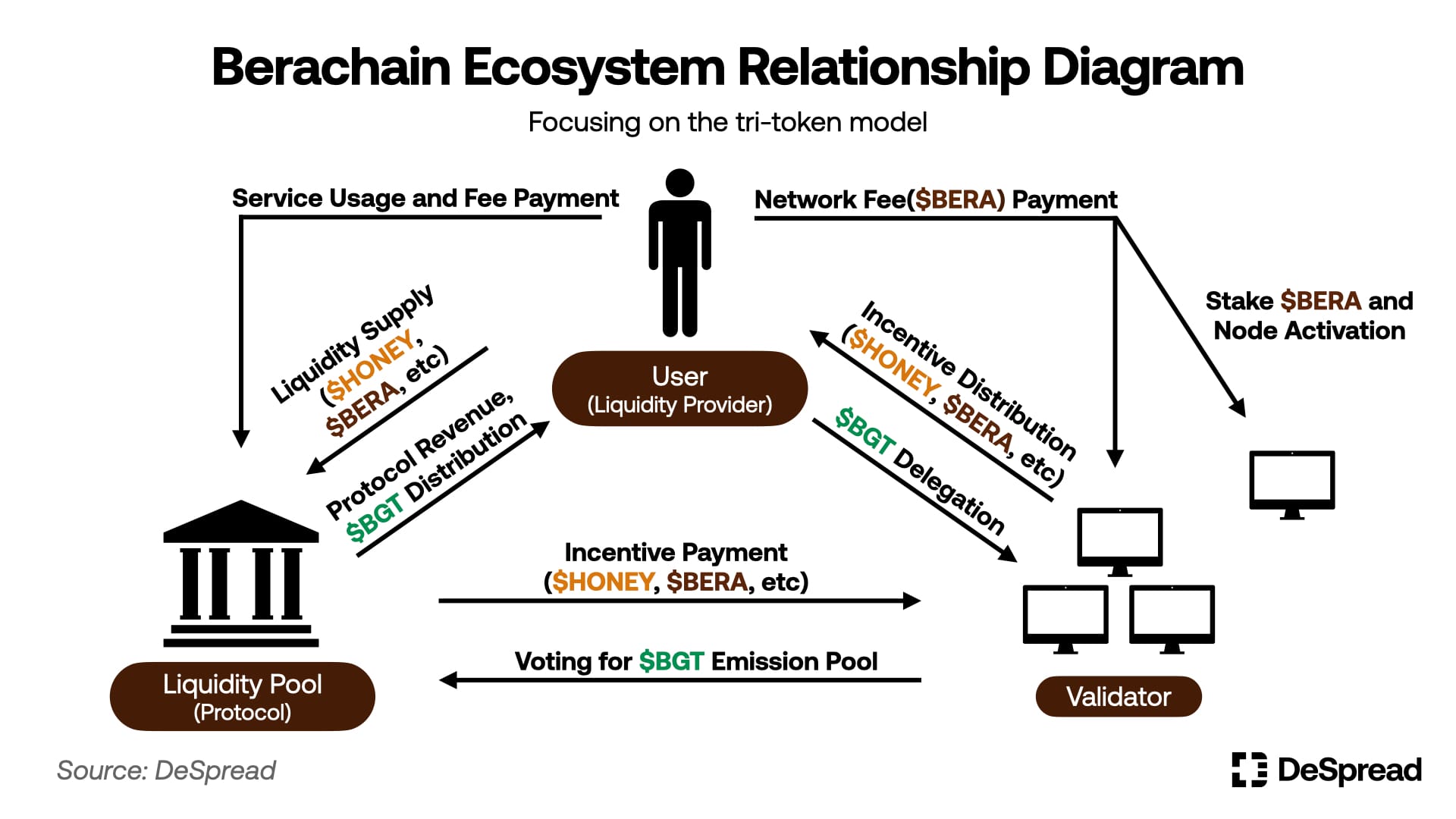

In Berachain's PoL (Proof of Liquidity) structure, validators decide which liquidity pools will receive $BGT token emissions.

Protocols provide incentives to validators using their own tokens or protocol revenues to secure more $BGT emissions for their liquidity pools. Validators then redistribute these incentives to users who have delegated $BGT to them, creating a virtuous cycle.

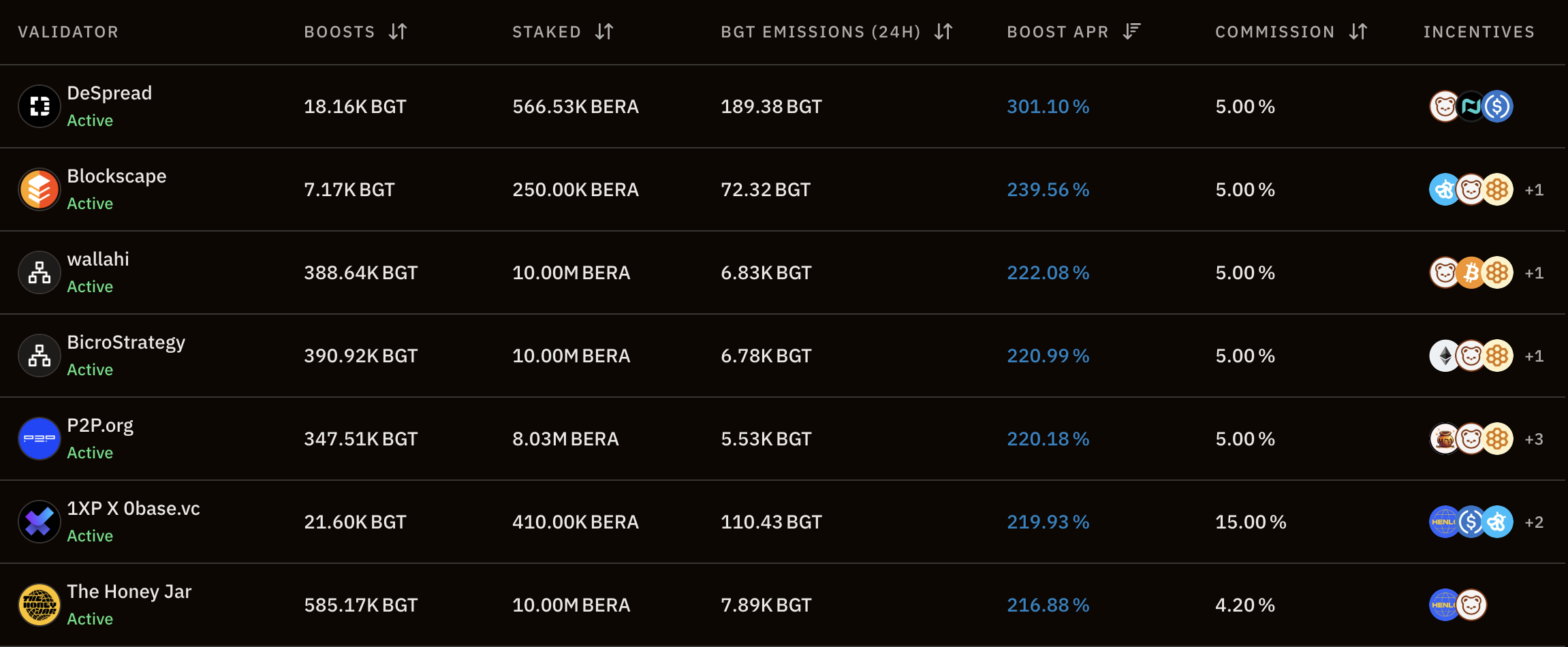

As a Berachain validator, DeSpread monitor the ecosystem in real-time and execute optimal boosting pool voting strategies to provide higher incentives to users who delegate $BGT to us.

For users considering active participation in the Berachain ecosystem and utilization of $BGT, this article will examine in detail the process of incentive creation and distribution to users, as well as the factors that influence the scale of incentive rewards.

2. From Reward Vault Creation to Incentive Distribution

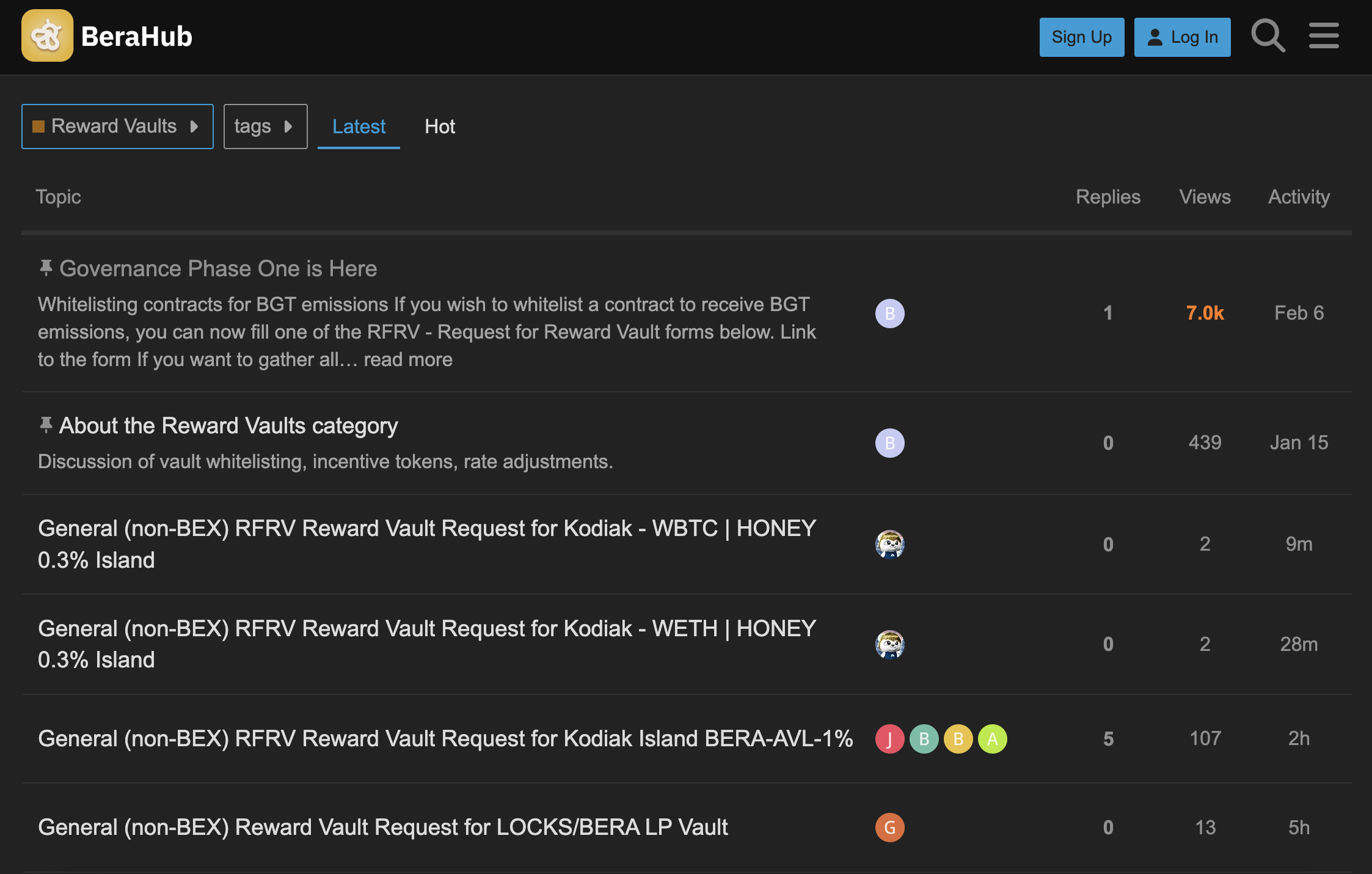

In Berachain, $BGT emissions only occur from whitelisted reward vaults. Therefore, protocols seeking $BGT emissions for their liquidity pools must first create a Reward Vault on BeraHub, then request whitelisting approval through a proposal on the forum to be approved by the five-member Governance Guardian Council.

The whitelisting proposal for a reward vault must include information about the tokens to be submitted as incentives (typically a maximum of 2 types, with additional tokens or changes requiring governance approval) and details about the incentive token manager.

Additionally, reward vaults must meet the following key conditions:

- Deposit tokens must have at least 100 holders

- No single wallet address should hold more than 40% of the total supply of the deposit token, and any address holding more than 20% must be identified by the operating entity

- Deposit tokens should have no special permissions or restrictions for holding (with exceptions for assets like RWAs), and should not be designed to become concentrated in few holders over time

- Reward vaults must maintain at least $100K in TVL (or liquidity for DEX pools)

- Deposit tokens must primarily enhance the utility and value of $BERA

- To ensure sustainable user participation, incentives must operate for at least 2 months and provide a minimum of $10K in monthly incentives

There are also various additional conditions, and the Governance Guardian Council reviews whitelisting requests weekly to determine eligibility.

Once whitelisted, reward vaults can receive emission voting from validators to distribute $BGT to liquidity providers. Incentives are distributed to validators and their $BGT delegators when $BGT emissions occur in the reward vault, based on the emission amount and each reward vault's incentive rate.

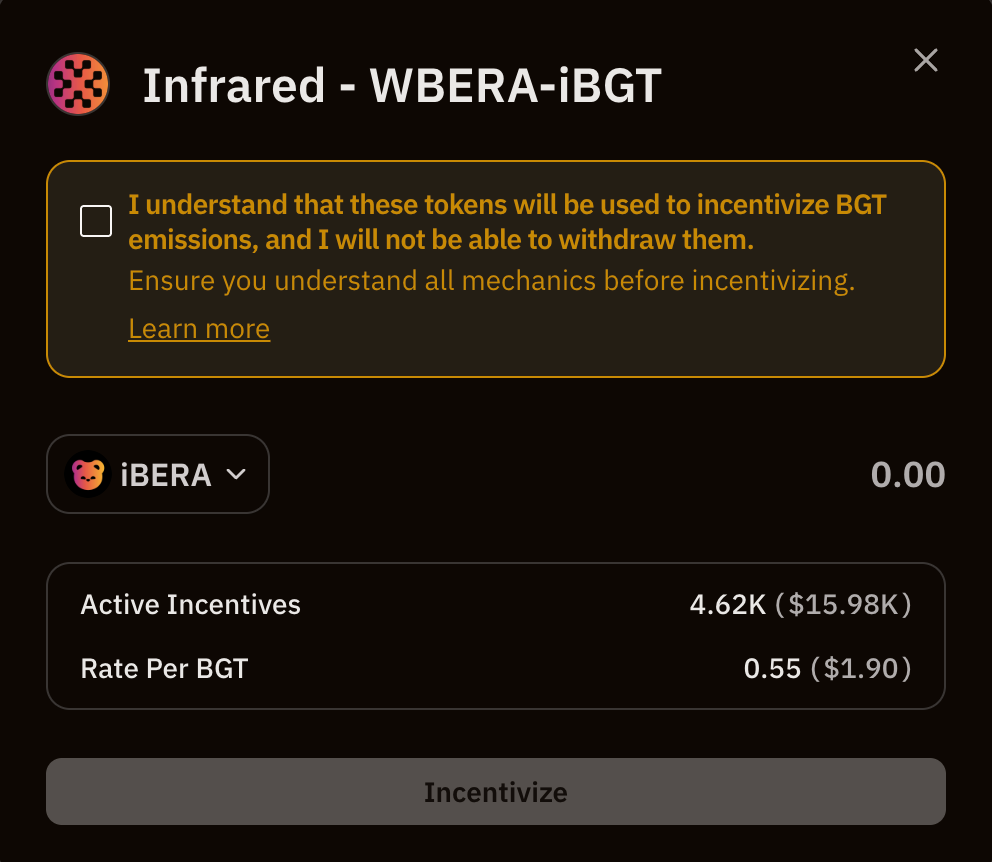

Anyone can deposit tokens into a reward vault to be used as incentives, and once deposited, these incentives cannot be withdrawn. However, since there's little reason for unrelated third parties to provide incentives, protocols typically fund their own reward vaults.

Each reward vault's incentive rate can only be set by the incentive token manager, and once set, the rate can only be increased until the incentive pool is depleted. Berachain implements this structure to prevent reward vaults from attracting boost voting with high incentive rates and then immediately lowering them to deceive validators.

3. Factors Affecting Boost APR

Validators strive to secure $BGT as more delegations enable them to exert greater influence in the ecosystem and receive more rewards.

From a $BGT holder's perspective, there are two motivations for delegating $BGT to validators:

- Having assets deposited in reward vaults where a specific validator consistently votes

- A specific validator offering high $BGT delegation rewards (displayed as Boost APR on BeraHub)

However, for a validator to consistently vote for a specific reward vault, either the protocol must run its own node or establish a partnership with a validator. Since such cases are rare, most validators currently attract $BGT delegations by pursuing strategies to increase boost APR.

Let's examine the factors that influence validators' boost APR in more detail.

3.1. Validator's $BGT Emission

Incentives are generated corresponding to $BGT emissions from reward vaults and are shared between validators and $BGT delegators. Therefore, boost APR increases when the validator's $BGT emission amount relative to delegated $BGT is higher. Additionally, the amount of $BERA a validator has staked influences their block production frequency, allowing validators with higher $BERA staking shares to secure higher boost APR.

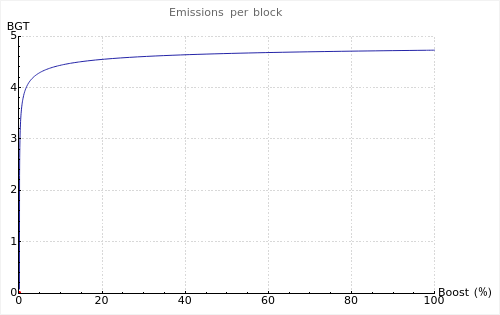

However, Berachain has implemented a structure where emission efficiency decreases as the proportion of $BGT delegated to a validator increases, promoting delegation decentralization. Consequently, running multiple nodes with $BGT delegations distributed among them yields higher boost APR than running a single node with concentrated delegations.

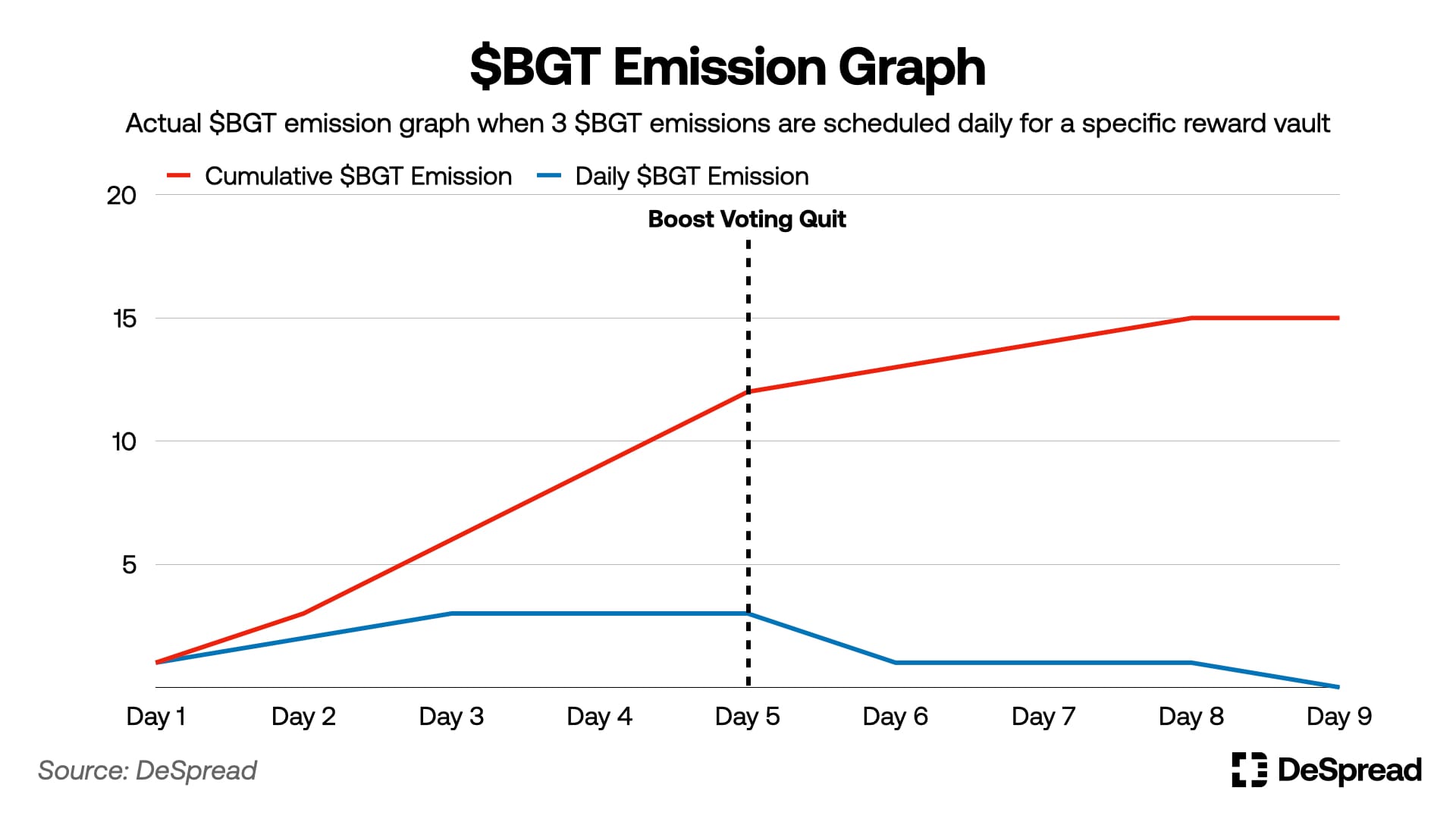

Furthermore, to minimize sharp fluctuations in reward vaults' $BGT APR, Berachain employs a ramp structure where $BGT emissions from successful block production are gradually distributed over three days rather than immediately.

Incentives distributed to validators and $BGT delegators are also affected by this emission structure, being distributed over three days. Therefore, new validators, even with substantial $BGT delegations, cannot immediately achieve high boost APR but must wait three days to reach normal levels.

3.2. Reward Vault's Incentive Rate

Once a validator's $BGT emission amount is determined through the above methods, validators and their $BGT delegators receive incentives according to the incentive settings of each reward vault where the validator votes. Voting for reward vaults with higher incentive rates can secure higher boost APR.

Currently in PoL, validators cannot allocate more than 30% weight to a single reward vault, requiring them to distribute votes across at least four vaults. To maintain high boost APR, validators must concentrate votes on the top four reward vaults offering high incentive rates while continuously monitoring potential depletion or changes in these rates to adjust their voting accordingly.

However, there's a one-hour waiting period when changing votes, so if a reward vault's incentives are depleted within an hour after a vote change, it could actually reduce boost APR. Therefore, validators must also consider the total amount of incentives in each reward vault.

Validators must continuously monitor all reward vaults and adjust voting strategies to secure high boost APR, which is the most active measure they can take to improve boost APR. Our validator at DeSpread also executes voting optimization considering these factors to maintain high boost APR.

3.3. Validator's Commission Rate

Incentives generated from a validator's $BGT emissions and reward vault voting are distributed between the validator and $BGT delegators. Delegators receive incentives proportional to their delegation amount within the validator's total delegated $BGT, minus the validator's commission rate. Therefore, lower validator commission rates result in higher boost APR for delegators.

Currently, Infrared collaborative validators who directly hold liquidity to secure their own $BGT have set their commission rate at 100% as they don't need to attract additional $BGT delegations, while other validators have commission rates ranging from 0% to 15%.

4. Conclusion

In Berachain's PoL structure, validators actively participate in the ecosystem by constantly observing and voting on reward vaults, while liquidity providers must consider protocol incentives and validator voting when supplying liquidity and delegating BGT.

This structure gives Berachain an advantage over traditional PoS-based networks where validators and ecosystem protocols compete for limited liquidity. Instead, Berachain forms an ecosystem with abundant liquidity and high activity based on aligned incentives among participants.

However, amid the crypto market weakness following Trump's tariff policy, Berachain faces the following structural limitations in its incentive distribution method:

4.1. Challenge: Incentive Depletion Problem

Currently in Berachain, validator votes are concentrated on reward vaults that spend incentives at high rates. This phenomenon encourages protocols to set high incentive rates despite having insufficient resources to sustain them, resulting in rapid depletion of incentives for reward vaults with high rates.

This has led to the following issues:

- Small protocols setting appropriate incentive rates with sustainability in mind fail to secure $BGT emissions

- Speculative trends are promoted for low-cap tokens in small protocol reward vaults with excessively high incentive rates

- Validators must frequently adjust votes, often resulting in inefficient voting

- Protocol incentive spending only temporarily increases demand for liquid $BGT tokens without contributing to Berachain's virtuous cycle flywheel

To address this issue, the Berachain Foundation plans to extend the current three-day ramp period to seven days, effectively doubling both the $BGT emission period and incentive distribution period. However, even with a seven-day ramp, the fundamental problem of small protocols with appropriate incentive rates failing to receive votes will likely persist, as votes will still concentrate on high incentive rates.

In the long term, mechanisms are needed to fundamentally resolve these issues. Among ecosystem participants, ideas such as introducing mechanisms that allow protocols to control $BGT emission rates have been proposed as solutions.

Until clearer solutions are implemented, we expect to see small protocols securing BGT through Protocol Owned Liquidity structures and forming partnerships with smaller, delegation-efficient validators to delegate their $BGT and secure $BGT boosts for their pools.

As the PoL mechanism is a novel incentive structure first introduced by Berachain, such issues requiring adjustment may continue to arise. Therefore, it's important to closely observe whether the Berachain Foundation and community can effectively resolve future challenges.

If Berachain effectively addresses these challenges, it is expected to serve as a paradigm shifter offering a new alternative in the current crypto market dominated by centralized, airdrop-centered incentive distribution.