Surviving in Berachain

Looking at the structure and risks of Berachain's flywheel

This article does not cover the basic content about Berachain, so for those who are new to Berachain, it is recommended to read the following articles first before reading this one.

- Berachain — The Bear that Captures Both Liquidity and Security

- Berachain — Bera Village Tour

- Growth 0 to 1: Berachain

1. Introduction

Recently, as the memecoin market has subsided, there has been an increasing interest in DeFi (Decentralized Finance) in the market. Amid this trend, many new users are flowing into Berachain, which offers high yields based on tokens with lower volatility compared to memecoins.

From the Berachain mainnet launch on February 6, 2025, to the date of writing on March 4, Berachain's network TVL (Total Value Locked) has steadily increased to reach $3.2B, achieving the milestone of settling at 6th place in the overall TVL ranking, overtaking Base.

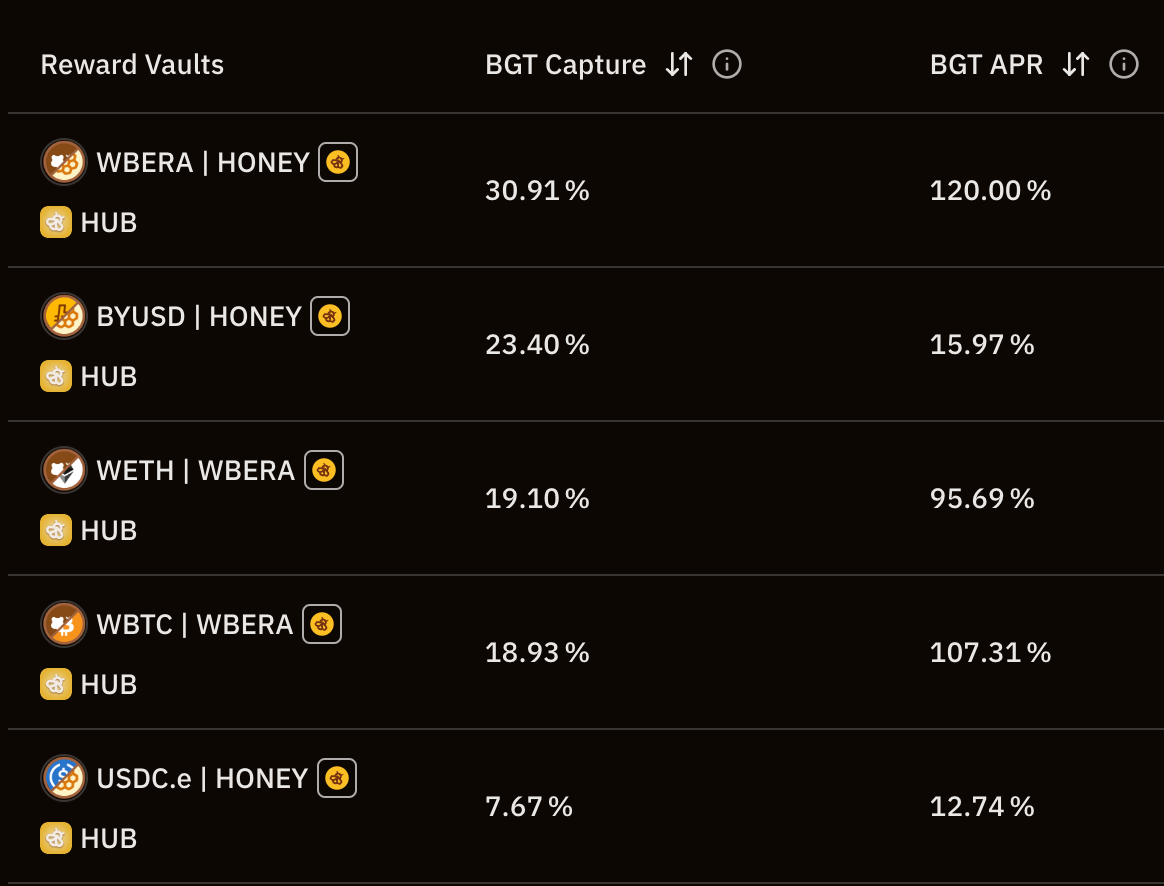

Core projects such as Kodiak, Yeet, and Ramen Finance, which have been preparing to launch on Berachain since the testnet era, are being released sequentially on the Berachain mainnet. However, these ecosystem protocols have not yet been registered in reward vaults that emit $BGT, and $BGT can only be acquired by providing liquidity to five liquidity pools within BeraSwap.

Users can supply funds to BeraSwap liquidity pools, receive LP tokens, deposit them in Liquid $BGT protocols such as Infrared and Stride, receive liquid $BGT tokens, and utilize them in other DeFi protocols. Additionally, they can deposit the same LP tokens in the liquidity farming aggregator Beradrome to farm Beradrome's native token $BERO, stake it, and receive incentives collected by Beradrome, enabling various ecosystem activities.

Meanwhile, Governance Phase 1, which begins requests for ecosystem protocol reward vault registrations, started on February 26. As these requests are reflected and protocol incentives are paid to validators, Berachain's ecosystem playbook is expected to become more diverse and complex. In this process, the role of $BGT, which has the authority to receive incentives and distribute network rewards, will become increasingly important, and the flywheel based on PoL (Proof of Liquidity) structure will be activated, leading to the influx of more users and liquidity into Berachain.

In this article, we will examine the flywheel structure of Berachain in detail to help new users manage risks, and discuss the risks inherent in Berachain's flywheel and how to prevent them.

2. Understanding the Flywheel

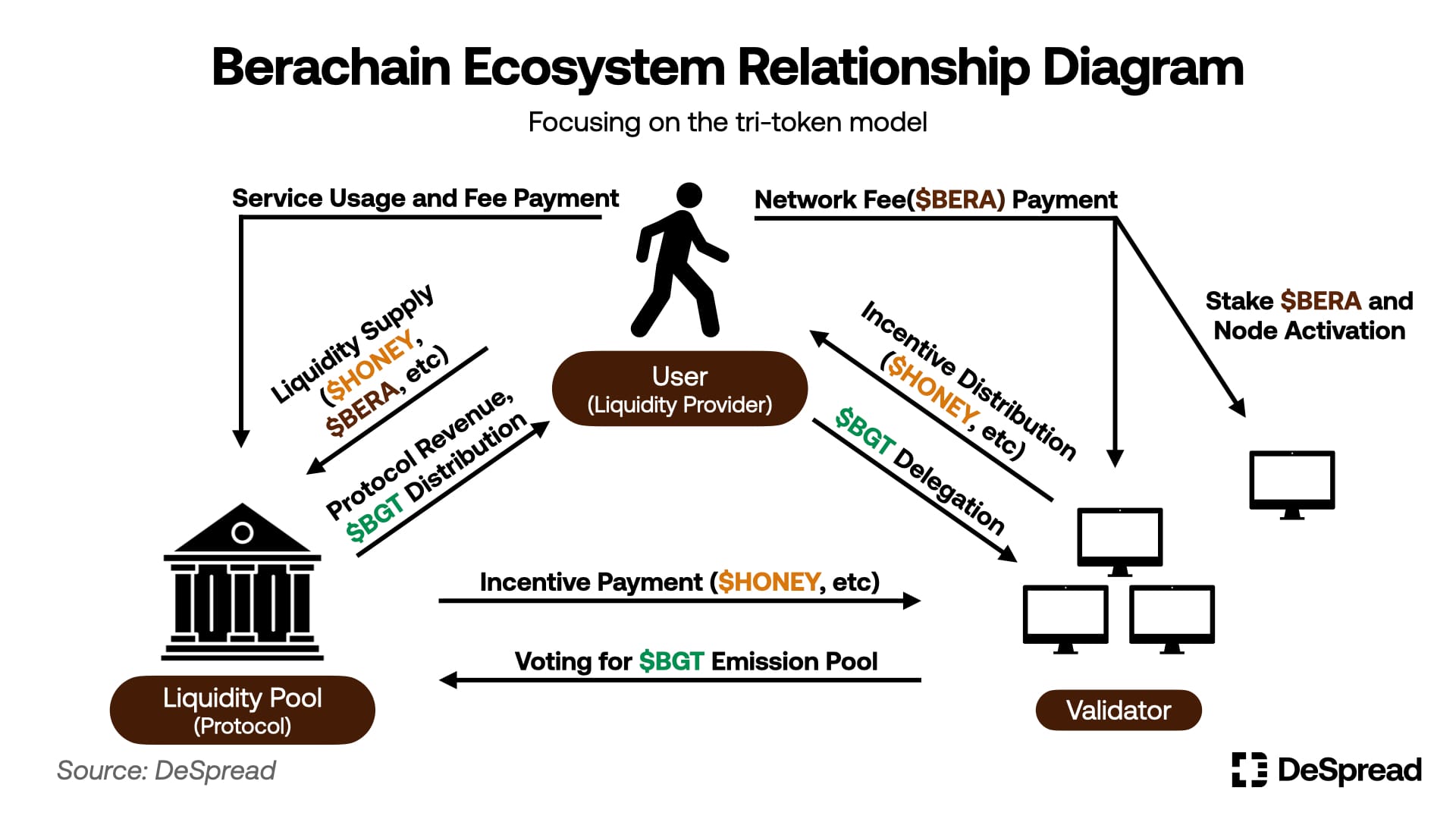

Berachain has adopted a PoL structure where the network participants—validators, ecosystem protocols, and liquidity providers—must propose and provide value to each other.

Each participant in the network forms a state of incentive alignment where their growth and decline are directly connected to one another. When each participant has a positive impact on others, the following virtuous flywheel operates:

- As the ecosystem grows and expands, incentives paid by protocols to validators increase

- As incentives distributed to $BGT holders increase, the demand for $BGT farming through liquidity provision increases along with $BGT burn demand, and $BERA issuance decreases

- As liquidity supply increases, the ecosystem grows and expands

When this virtuous flywheel operates, the price of $BERA, TVL of ecosystem protocols, and profits from ecosystem activities all increase, benefiting all ecosystem participants. However, for the flywheel to operate smoothly, it must satisfy all three of the following conditions:

- Loss from protocol incentive expenditure < Profit gained by the protocol from spending incentives and securing liquidity

- Volatility risk exposed by buying/holding ecosystem tokens < $BGT profit gained by executing liquidity provision

- Volatility risk exposed by holding $BERA < Incentive profit gained by delegating $BGT

When all these conditions are met, the flywheel begins to operate. Once started, the flywheel has a structure where each condition positively affects the other requirements, giving it an inertial quality to keep spinning, and the robustness and intensity of the flywheel are determined by the degree to which the conditions are met.

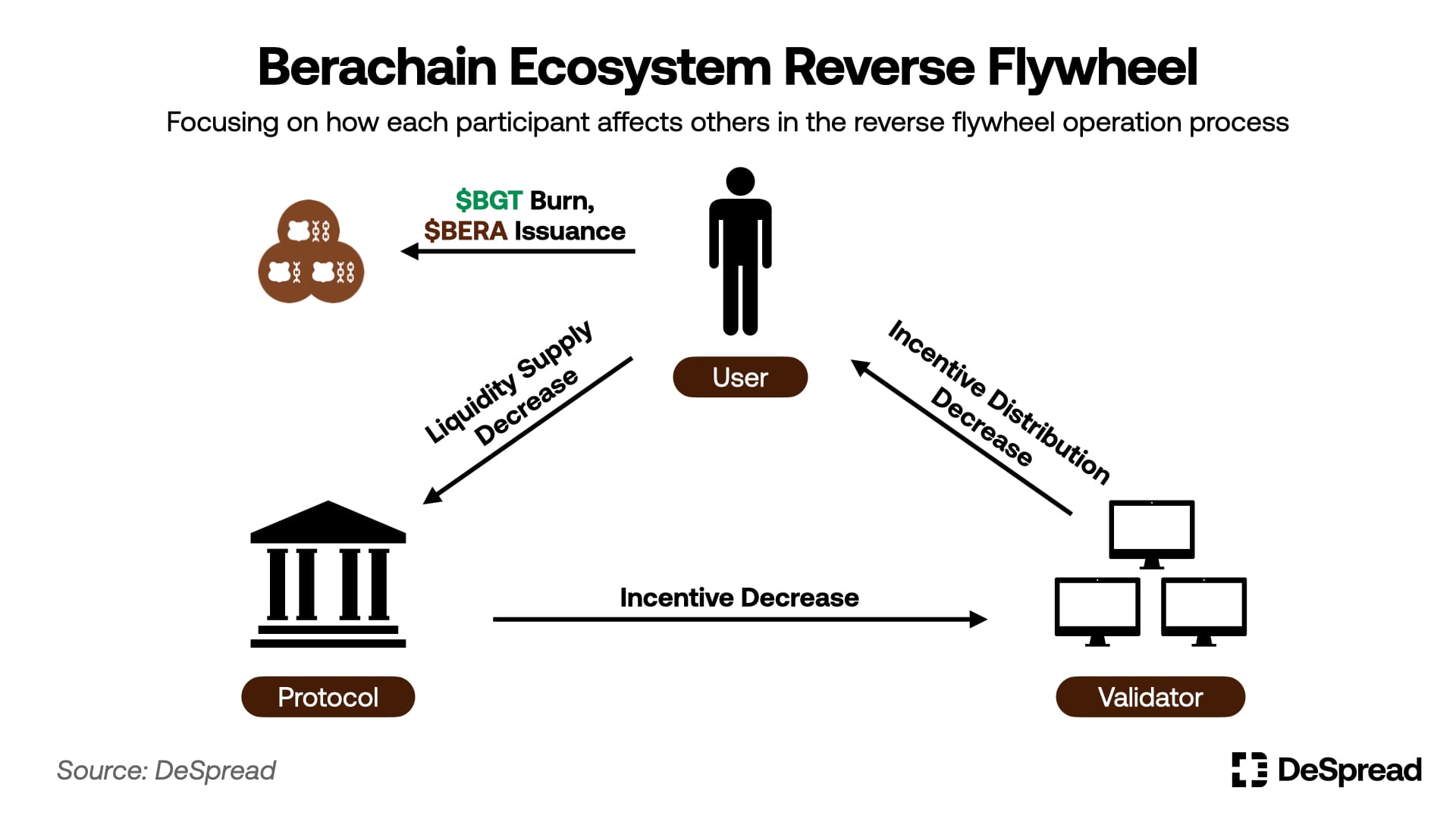

This flywheel structure of Berachain seems like a unique feature and significant advantage that cannot be found in other PoS structure networks. However, if for some reason one of the conditions is not satisfied and is not restored to its original state in the near future, the misaligned condition will negatively affect other conditions, and the flywheel will operate in the reverse direction as follows:

- As the ecosystem contracts, incentives paid by protocols to validators decrease

- As incentives distributed to $BGT holders decrease, the demand for $BGT farming through liquidity provision decreases, while both $BGT burn demand and $BERA issuance increase.

- As liquidity supply decreases, the ecosystem contracts

In this reverse flywheel state, the price of $BERA, TVL of ecosystem protocols, and profits from ecosystem activities will all decrease until the conditions to operate the flywheel are met again.

Considering only internal ecosystem requirements in the near future, 1) it is expected that many protocols seeking to issue their own tokens as incentives will emerge, and 2) since $BGT emissions have only recently begun, the farming efficiency per $BGT is high, so there is high demand for executing liquidity provision and accumulating $BGT.

Based on these reasons, it is likely that the flywheel will operate in the early stages of the mainnet launch, but the macro market conditions and investment trends by sector according to narrative cycles also significantly influence the flywheel operation conditions, making it difficult to assert whether the flywheel will operate.

Below, assuming the flywheel operates in the near future, we will examine risk factors and scenarios that could trigger a reverse flywheel.

3. Reverse Flywheel Scenarios

3.1. $BERA Crash

$BERA plays the following key roles within the Berachain ecosystem:

- Staking for node operation

- Guaranteeing the minimum value of $BGT

- Utilized as a deposit asset in various liquidity pools

Thus, a downward trend in $BERA's value can be seen as indicating weakened network security, decreased minimum value of $BGT, and reduced ecosystem liquidity. For Berachain network participants, the price of $BERA plays a more important role than the network token price does for participants in other networks.

When the flywheel is operating smoothly, even if the price of $BERA falls to some extent, it can recover if incentive yields remain robust, creating demand for $BERA. However, conversely, a decline in $BERA's value could negatively impact ecosystem protocols, lowering incentive yields, which may induce people to burn $BGT to issue $BERA or unstake $BERA supplied to liquidity pools and sell it on the market. This can be the starting point of a reverse flywheel that causes $BERA's value to fall again.

Therefore, special attention should be paid to the following situations:

3.1.1. Large-scale $BERA Unlock

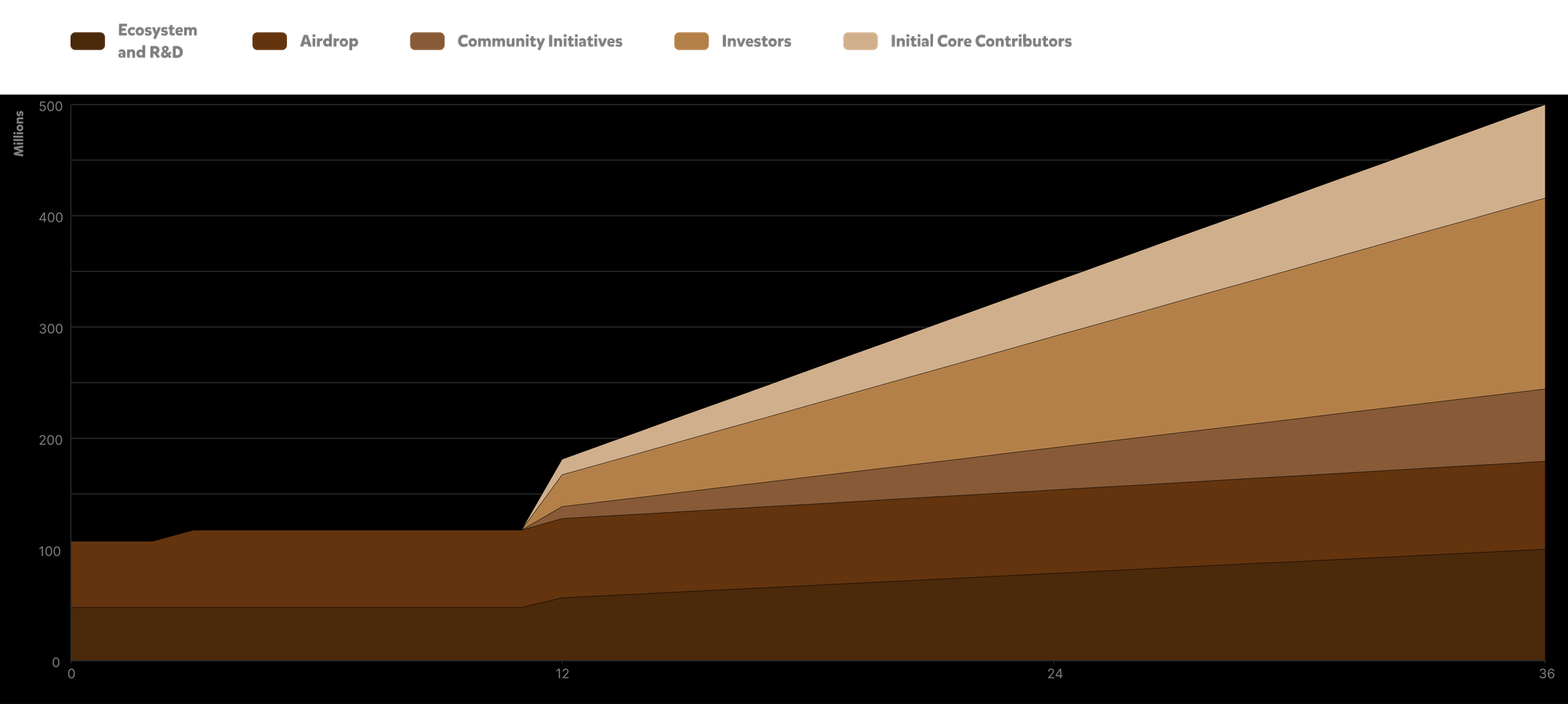

Apart from $BERA issued through $BGT burning, there is a planned $BERA issuance and distribution amount of 500M, with the following distribution schedule:

Linear vesting of investor, early core contributor, and separate community allocations is scheduled to begin in February 2026, one year after the mainnet launch. Until then, factors that could trigger market selling pressure due to increased $BERA circulation in the short term include:

- Allocations received by protocols and the community through the RFB program (about 2.04% of total issuance)

- Allocations to be distributed through the Boyco program (about 2% of total issuance)

Of these, there is a regulation that the amount distributed by protocols and the community to users through the RFB program must have a distribution period of at least 6 months, and since each protocol will distribute at different times, it is not expected to exert significant selling pressure on the market in a short period.

However, the Boyco allocation amount, which is scheduled to be distributed in about 2 months, is expected to proceed similarly to the existing airdrop claim method. In this case, $BERA equivalent to about 2% of the total issuance may be supplied to the market, potentially acting as selling pressure. Additionally, the Boyco program unlocks the deposited assets along with the $BERA airdrop, which could reduce ecosystem liquidity. This creates a favorable environment for triggering a reverse flywheel with both a decrease in $BERA price and ecosystem liquidity occurring simultaneously.

Therefore, it will be important to watch whether the ecosystem can build an attractive flywheel by the end of the Boyco program to effectively absorb the $BERA released to the market and ecosystem liquidity.

3.1.2. Large-scale Exit and Panic Selling by $BGT Holders

To secure $BGT, one must deposit liquidity in liquidity pools registered in reward vaults and invest sufficient time. However, through the Redeem function of BeraHub, one can burn $BGT delegated to validators and receive $BERA to execute a sale at any time, with only an unboosting time of about 5 hours required for the process.

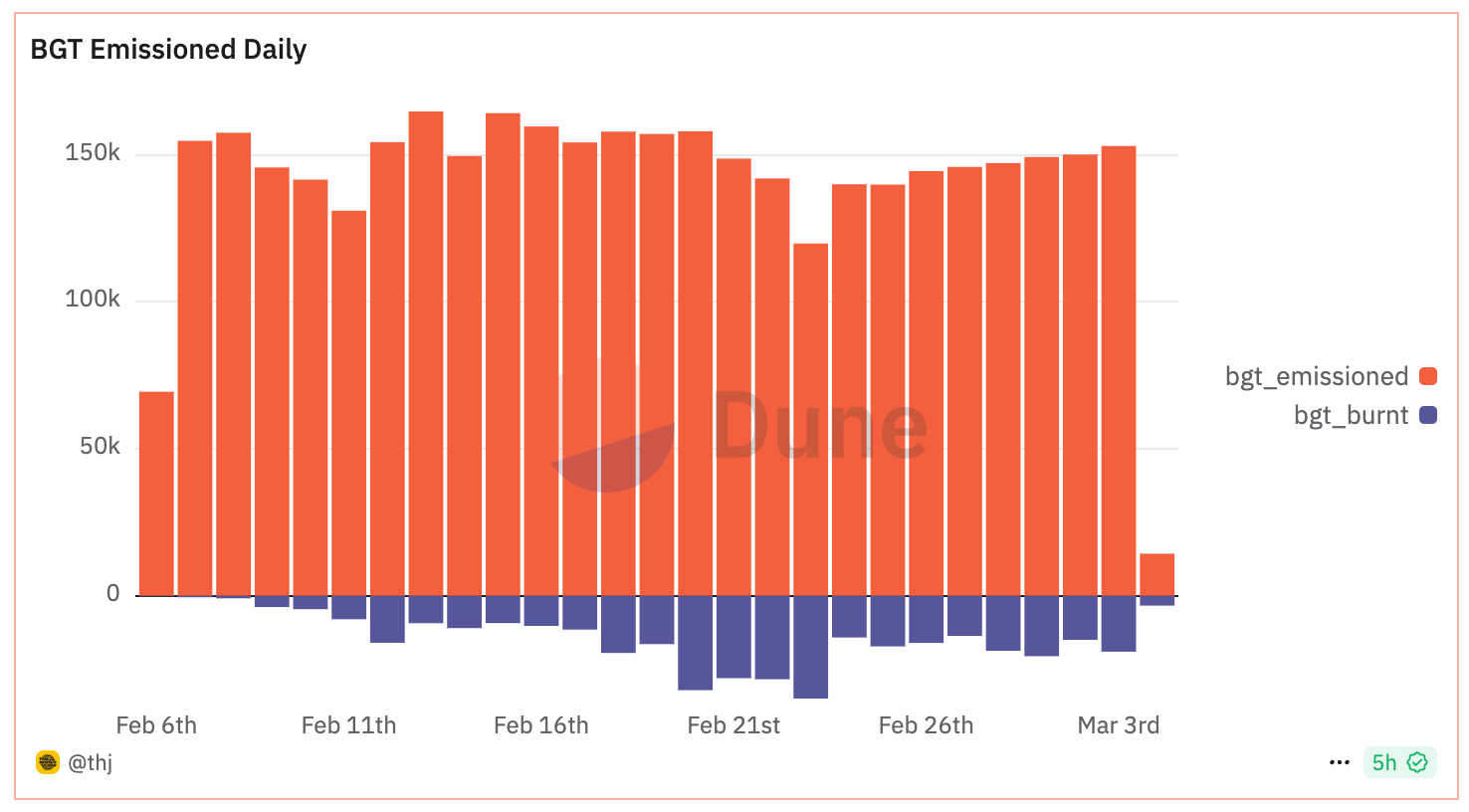

If users holding large amounts of $BGT simultaneously exit the ecosystem, the circulation of $BERA could rapidly increase, and if the price of $BERA falls significantly in a short period as a result, it could induce panic selling by other $BGT holders and users supplying liquidity with $BERA, potentially leading to a greater decline. Therefore, it is important to monitor $BGT burn volume trends to understand the current ecosystem trends.

Furthermore, the trends in incentive rates and $BGT farming rates through liquidity provision are the most crucial factors determining the demand for $BGT burning and delegation. By consistently observing each trend, one can somewhat predict the potential risk of triggering the scenario mentioned earlier and the possibility of flywheel recovery if large-scale $BGT burning actually occurs.

Meanwhile, liquid $BGT tokens have a structure where demand increases and price rises as the incentive rate increases, and demand decreases and price falls as the incentive rate decreases. Therefore, if it is difficult to grasp past data on incentive rates and $BGT farming rates, one can estimate their approximation through the trend of liquid $BGT's premium against $BERA, which reflects the intrinsic value of $BGT.

However, the price of liquid $BGT tokens is influenced not only by the intrinsic value of $BGT but also by the incentive distribution method of liquidity protocols and protocol-related issues, so these factors should also be considered together.

3.2. Inflation and Growth Slowdown

In addition to the 500M $BERA distributed to network participants over three years from the mainnet launch, Berachain has an annual inflation rate of approximately 10% for $BGT. Although there is a structure where part of the network fees submitted by users is burned, since the main activity in Berachain is depositing assets in liquidity pools and claiming interest, it is difficult to expect significant burn amounts.

This means that even if Berachain builds a positive flywheel when all $BERA is unlocked after three years, to maintain it for one year, it would need to attract external liquidity inflow at the level of the inflation rate during that period.

Meanwhile, Berachain's founder, Smokey The Bera, mentioned in an interview with Bell Curve that they are developing and will apply a dynamic inflation model that changes according to the incentive rate distributed to $BGT delegators to complement the aforementioned issue.

While this feature may help control the acceleration of the flywheel and contribute to sustainability, as long as there is a sandbag that adds force in the direction of the reverse flywheel, namely "inflation," the reverse flywheel will inevitably operate at some point, leading to a decline in $BERA's price and contraction of the ecosystem. Therefore, even from a long-term perspective, it is necessary to continuously monitor the ecosystem indicators mentioned in the upper section to diagnose the current state of the ecosystem.

Also, in Berachain, the strategy of simply holding $BERA spot in the long term without utilizing it in the ecosystem is an inefficient investment method that fails to recover value diluted through "inflation." Therefore, for users looking to build positions utilizing $BERA, it is important to actively generate interest by depositing it in ecosystem protocols.

If users want to build stable positions in the ecosystem for the long term, it might be effective to conservatively use assets that are less affected by the flywheel's price impact (such as $BTC, $ETH, stablecoins, etc.) to accumulate $BGT or to operate compound deposits.

3.3. $BGT Monopoly

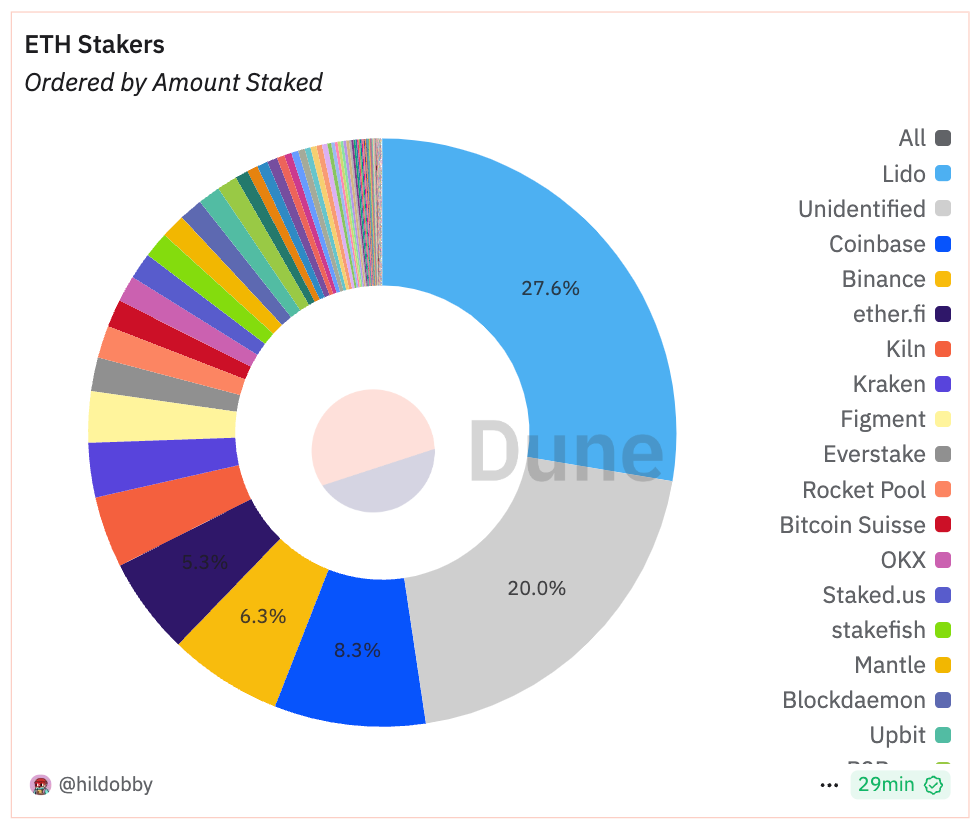

In the PoS structure adopted by most recently launched networks, entities with a larger stake receive more network incentives. This leads to the entrenchment of validators' stake ratios and poses a risk of network centralization.

Berachain, being a network created by modifying the basic PoS structure, also experiences this phenomenon. Moreover, in Berachain, validators holding a large amount of $BGT can directly intervene in the ecosystem to unilaterally design structures favorable to themselves, so $BGT monopolization leads to ecosystem monopolization, entailing a greater risk of network token monopolization than other PoS-based networks.

To prevent this issue, the team has limited the maximum amount of $BERA staking that affects block creation authority to 10M, and introduced a method where the boosting power increases inefficiently as the number of $BGT delegations determining the amount of $BGT generated per block increases. However, these limitations can be circumvented by operating multiple nodes distributed by one entity or through collusion among multiple validators.

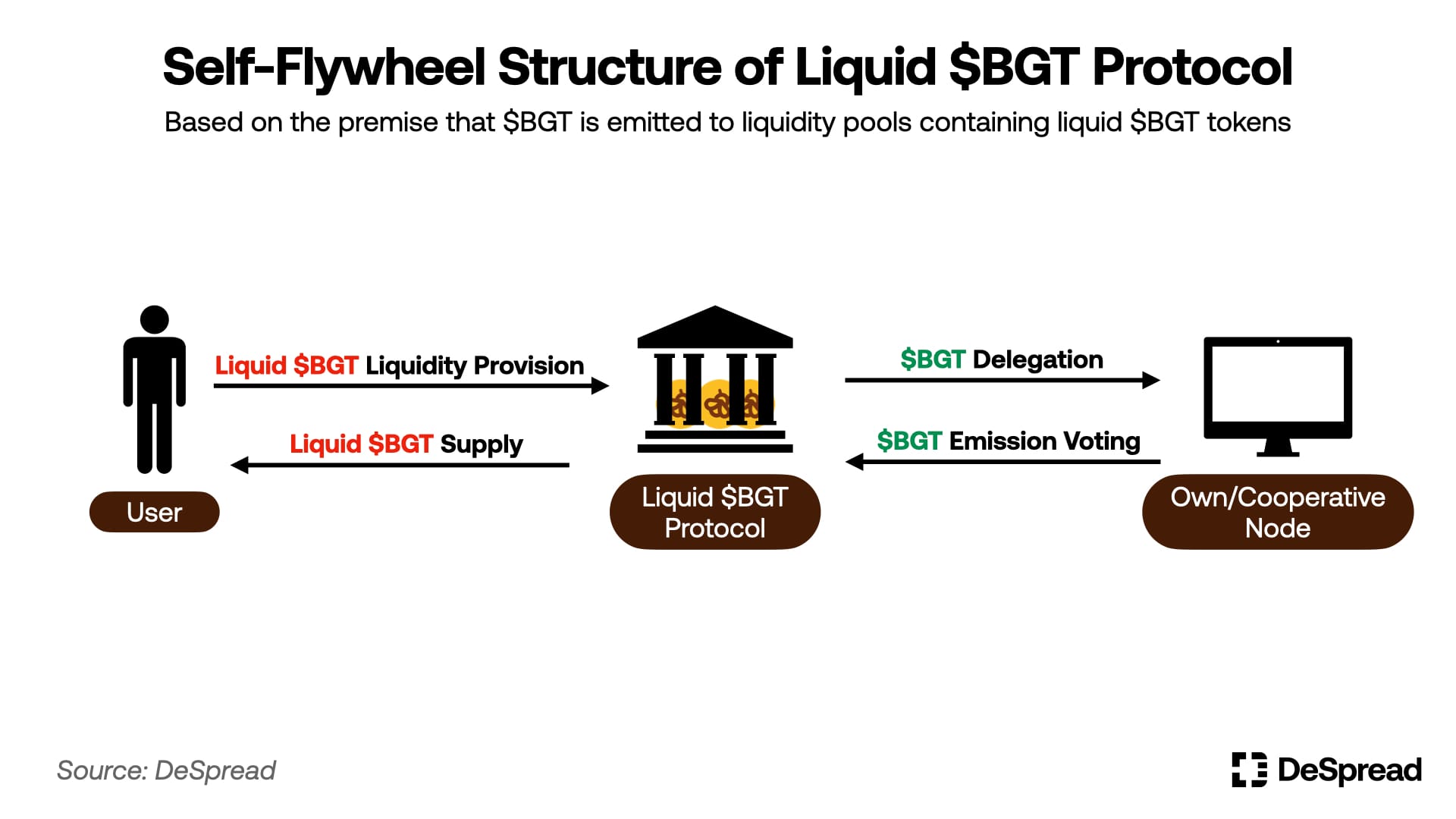

In particular, Liquid $BGT Protocols are advantageous for attracting liquidity used in reward vaults in Berachain, where the potential value of "liquidity" is high, and can directly accumulate $BGT by depositing liquidity received from users into reward vaults on their behalf. Furthermore, by delegating that $BGT back to nodes they operate or collaborate with, they can secure significant $BGT emission voting authority without negotiating with other ecosystem entities.

If they use this collected voting authority to additionally emit $BGT to liquidity pools containing liquid $BGT tokens, Liquid $BGT Protocols can build their own independent flywheel that can increase demand for liquidity provision to the protocol without paying separate incentives.

In this case, the Liquid $BGT Protocol's own flywheel becomes as large and robust as the ratio of $BGT held by the Liquid $BGT Protocol compared to the total $BGT issued. If multiple Liquid $BGT Protocols acquire large amounts of $BGT in the above manner and continuously pursue a direction that only increases the demand for liquidity provision for their own liquid $BGT tokens, they may inhibit the liquidity boosting of other protocols, hindering the launch and growth of new protocols, which can lead to a weakening of ecosystem diversity. This ultimately drives the contraction of the ecosystem size, triggering a reverse flywheel.

As mentioned earlier, structural constraints on $BGT monopolization can be imposed through protocol operation mechanisms, but it is difficult to completely block it. Therefore, the most certain way to prevent monopolization of the ecosystem by specific entities is consensus among network participants considering ecosystem sustainability before the monopoly structure solidifies, and reaching such a consensus requires the continuous interest and effort of the community.

4. Conclusion

So far, we have examined how Berachain's flywheel operates, its operating conditions, and reverse flywheel scenarios. In addition to the scenarios introduced in this article, a reverse flywheel can operate if the three conditions that drive the flywheel are not met for any reason, so it is important to continuously monitor network and ecosystem indicators to assess the operating status of the flywheel.

Also, the unfamiliar PoL mechanism and various forms of DeFi protocols utilizing it are combining to create complex derivative products and synthetic assets that are difficult to understand intuitively. Therefore, individuals need to actively understand their position structure and be aware of overlapping structural and security risks in advance.

From a long-term perspective, Berachain faces the challenge of formulating a strategy to increase network fees along with continuous ecosystem expansion to respond to the reverse flywheel caused by inflation. It is necessary to closely watch whether consumer applications such as perpetual DEXs or on-chain games can settle in the ecosystem to generate real user traffic beyond "simple deposits."

Hope this article helps you navigate the Berachain ecosystem wisely and successfully overcome the reverse flywheel if it arrives.