1. Introduction

The previous episode discussed what options are and why we need to pay attention to the options market in the crypto world, and introduced Ribbon Finance and Squeeth, the two popular protocols built on Ethereum.

In this episode, among many option protocols that exist outside the Ethereum chain, let’s have a look at DeFi Option Vault (DOV) protocol in more detail.

DOV is about automatically implementing an options strategy just by depositing collateral into a vault, just like Ribbon Finance introduced in the previous episode. Vault protocol automatically sets optimal values for various factors including implied volatility/maturity/exercise price that should be considered for options trading. The service lowers a barrier for investors to enter positions with options, addresses concerns about Fat Finger and completely removes “rollover”, an extra effort to be taken and gas fee upon maturity.

Also, DOV protocol can create its own APR from various structured products using options to consistently provide yield, which is a good enough narrative for DeFi market participants to focus on the DOV platform.

2. Options background knowledge: Greeks

Before diving into various DOV protocols, let’s have a brief look at Option Greeks.

Greeks are the parameters that represent the consensus of the option marketplace to express the characteristics of positions into values, and understanding the Greeks are essential to have an accurate understanding of the position in options.

δ Delta: the extent that the position value changes when the underlying asset value has increased

γ Gamma: the extent that the position δ changes when the underlying asset value has increased

θ Theta: the extent the position’s time value changes after one day

ν Vega: the extent the position value changes when the implied volatility of underlying asset has increased

ρ Rho: the extent that the position value changes when an interest rate has increased on

2.1. Case Study

For instance, let’s say Greeks of an options that has $ETH as underlying assets are as below

Delta = 0.5

Gamma = 0.01

Vega = 0.2

Theta = -5

Let’s assume that an ETH call option with a price of $100 and implied volatility of 50% has been bought. Then let’s say one day after the purchase, the price of $ETH has increased by $10 and the implied volatility to 60%.

- As the underlying asset price has increased by $10, due to Gamma, the options delta increases by 0.1. The underlying asset price changes and the Delta rises from 0.5 to 0.6, meaning the delta takes an average value of 0.55.

- As the value of underlying asset has increased by $10, the options price changes by $5.5 by Delta.

- Because the implied volatility of the underlying asset has changed by 20%, the option price changes by $4 by Vega.

- A day has passed, so the price changes by -$5 by Theta.

Therefore, after one day, the price of options goes as $100 + $5.5 + $4 - $5 = $104.5

2.2. Greeks of call options and put options

Long position of call and put options always have positive Vega. It is because as the expected volatility increase, the option price goes up and option holders, compared with the long spot position, always earns when there are large price movements of underlying assets.

When long position makes money, the short position loses money, which shows that short options has negative Vega.

Next, let’s think about Greeks with following charts.

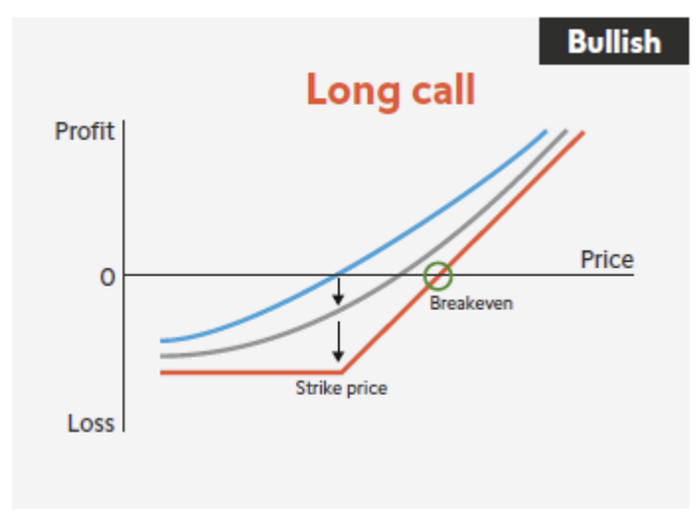

1. Long call position

- The position will have more gains as the underlying increases => Long Delta

- As the underlying increases, the slope of the curve rises + as the underlying falls, the slope of the curve decreases => Long Gamma

[Yield maximized the higher the underlying asset price goes up + loss minimized the lower the underlying asset goes down: a convex graph formed => Long Convexity] - As time goes by, the graph goes down (loss) => Short Theta

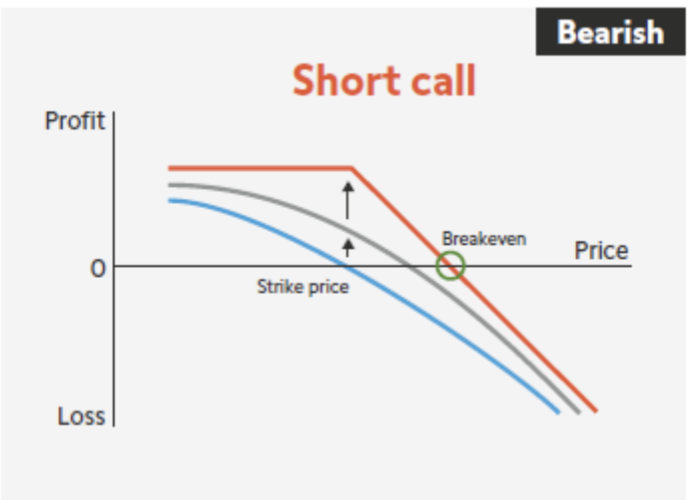

2. Short call position

- The position will have more losses as the underlying increases => Short delta

- The higher the underlying goes up, the less steep the graph’s curve becomes => Short Gamma => Short convexity

- As time goes by, the graph goes up (yield) => Long Theta

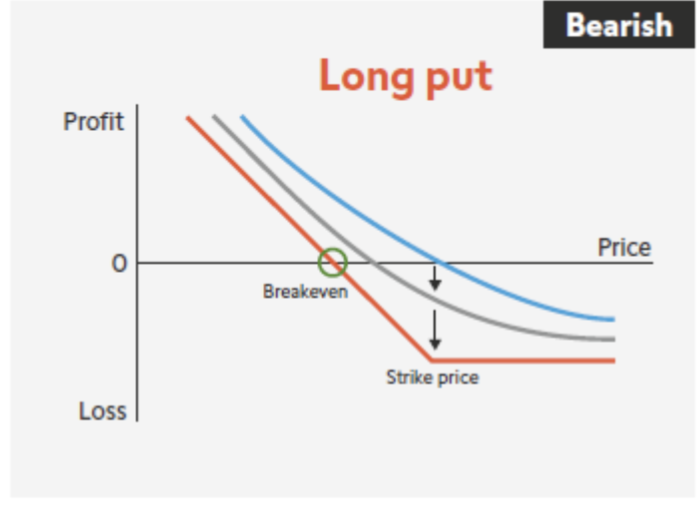

3. Long put position

- The position will have more losses as the underlying increases => Short delta

- The higher the underlying goes up, the steeper the graph’s curve becomes => Long Gamma => Long convexity

- As time goes by, the graph goes down (loss) => Short Theta

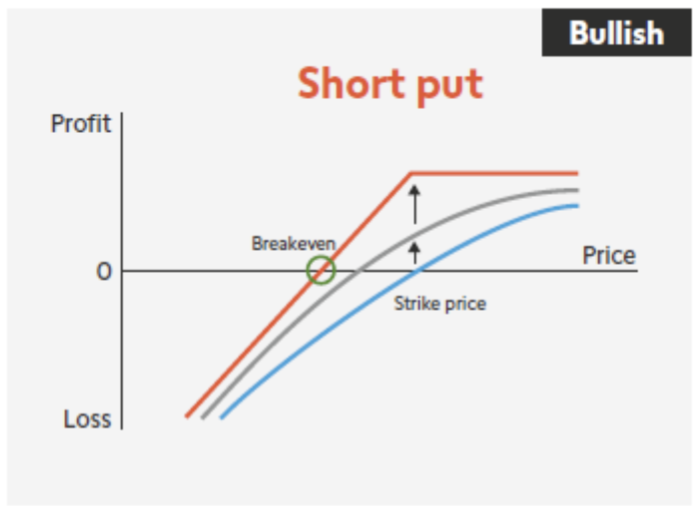

4. Short put position

- The position will have more gains as the underlying increases => Long Delta

- The higher the underlying goes up, the less steep the graph’s curve becomes => Short Gamma => Short convexity

- As time goes by, the graph goes up (Yield) => Long Theta

2.3. Summary

- Long option is always constructed by having long Gamma + long Vega + short Theta

- Short option is always structured by having short Gamma + short Vega + long Theta

- Because Delta refers to the sensitivity to the price movement of the underlying asset, the Delta is positive for call options and negative for put options.

cf. There is an exception where long Deep ITM put option has a positive Theta value.

3. Various DeFi Options Vault (DOV) Protocols

Getting to the main content, let’s have a look at various DOV protocols based on layers other than on Ethereum (Ribbon Finance).

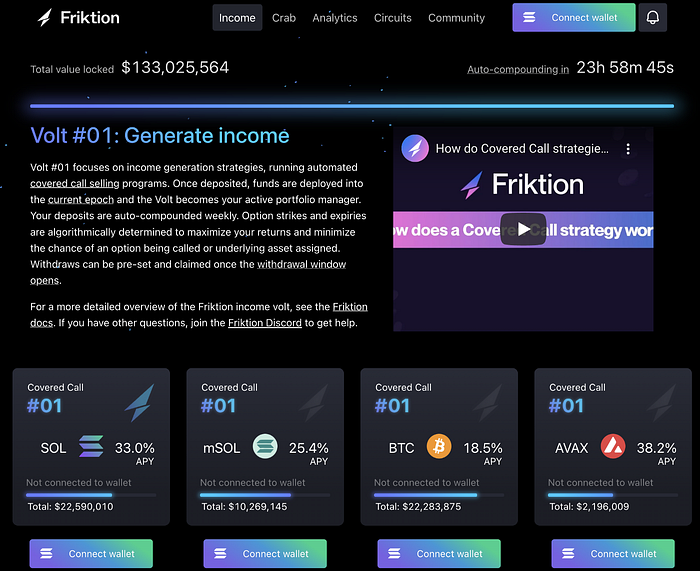

3.1. Friktion

Friktion is the first that has launched a DOV service in the Solana ecosystem.

As of April 2022, compared with the TVL ($298m) of the first generation DOV Ribbon Finance built on Ethereum, the TVL of Friktion is $133 and it is the most advanced DOV protocol among those built on layers other than Ethereum.

Friktion uses Channel RFQ based on serum and runs options trading to operate DOV in the form of auction.

Friktion currently offers positions using four options.

3.1.1. Vault #01: Income Generation

Covered call vault. The reason why we can call this vault “Income Generation” is that you can earn a call premium while having the desired underlying spot asset and selling the OTM call option of the same underlying asset. As long as the price of underlying asset does not exceed the exercise price of the call option sold, you can consistently earn call premiums at every option expiry and get additional yield. However, when the underlying asset price exceeds the exercise price, options will be exercised and you will lose the underlying assets, but the risk is limited as you already own underlying spot asset.

The covered call in Friktion can choose Low Voltage and High Voltage. Low Voltage minimizes the risk from option exercise by selling OTM call option with lower probability of exercise, while High Voltage increases the expected return by selling OTM call option with higher probability of being exercised, but it takes on increased risk.

3.1.2. Vault #02: Sustainable Stables

It is a cash secured put vault by depositing stable coins as collaterals and selling put options of certain assets. The P&L graph is the same as that of the covered call, but there is a difference between using stable coins or underlying assets as deposit assets (collateral). Both low and high voltage can be selected, and the risk/return profile resulting from the difference in the exercise prices of the put option to be sold can be selected according to one’s own tolerance level.

3.1.3. Vault #03: Crab Strategy

It is the same strategy as the [long spot ETH + short oSQTH] volatility selling offered by Squeeth introduced in the previous episode. Friktion’s Crab Strategy is about trading BTC as underlying assets and creating short volatility positions by selling BTC’s power perpetual at Entropy, a decentralized exchange, and buying spot BTC.

3.1.4. Vault #04: Hedge IL (preparation underway)

Providing a liquidity pool to AMM like UniSwap can allow you to earn swap fees as much as the amount held, but you get exposed to impermanent loss. Friktion is preparing a Market Neutral strategy that allows to hedge asset position and impermanent loss of liquidity pool and only get fee yields.

This strategy has already been introduced in Medium of the Opyn Protocol.

(1) ETH-USDC pool (long Delta, short Gamma) creation

(2) Buying oSQTH (long Delta, long Gamma) as much as Gamma that is equal to (1) position => Gamma hedge

(3) Short ETH futures (short Delta) in the same amount as Delta that is equal to (1) + (2) position => Delta hedge

As in the above, the Delta and Gamma of the underlying ETH asset is hedged to near 0 and earns fee yield regardless of the ETH price movement.

A condition to earn yield is calculated as [(fee yield + short ETH funding yield) > long oSQTH funding cost].

The above strategy is not provided as a vault service yet, but Squeeth and Friktion are the most likely to provide the said vault.

For more information about the strategy, please see the article in Opyn Protocol blog.

3.2. Katana

Katana has proudly reigned as the grand champion at the Solana Ignition Hackathon in October, 2021.

As the latecomer DOV operating on Solana, Katana’s TVL stands at $25.7m as of April 2022, and the currently available vaults are only the two types of covered call and cash secured put. Other strategies such as volatility trading and market neutral strategy are also being planned, but these are already offered by other protocols.

Katana has declared to be the layer of Yield Generation that gathers various DeFi protocol products in the Solana Ecosystem under Katana Asset Management. Given this, unless Katana provides a great risk/return profile optimized under the strategy that is similar to those provided by other protocols, it should focus on providing more diverse investment strategies and structured finance services.

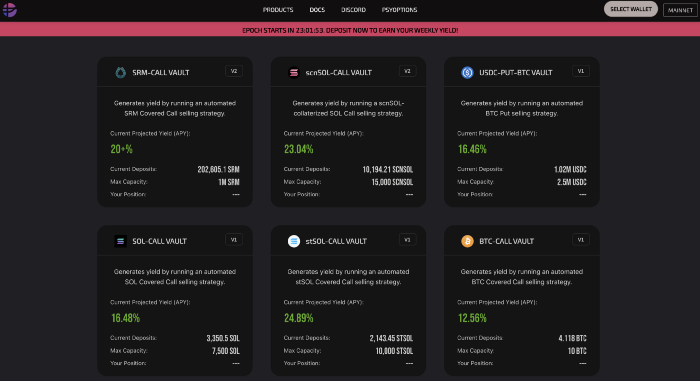

3.3. Psy Finance

It is a protocol rebranded by Tap Finance, a DOV built on Solana and which launched a mainnet in Dec. 2021. What is interesting about Tap Finance is that it used to trade options on PsyOption, a decentralized options exchange, and then was acquired by Psy Option to become Psy Finance. It is the first case of protocol-protocol acquisition that happened in the Solana Ecosystem, that led to the launch of PsyDAO that manages Psy Finance and PsyOption.

The TVL of Psy Finance is $10.42m as of April 2022, and it also offers covered call and cash secured put strategies only. The options of PsyFinance DOV are traded at the same affiliate PsyOption’s orderbook-based decentralized option exchange and Serum, and anyone can access the exchange and can take the opposite position of PsyFinane DOV.

Currently, the liquidity of options that PsyFinance receives is not sufficient, meaning a Vault manager of PsyFinance team directly decides the maturity and exercise price of options, but it was announced that the process will be automated when the liquidity becomes abundant.

PsyFinance is the only DOV platform in a non-ETH ecosystem that has a governance token ($PSY, PsyDAO’s governance token), and the token has already been issued at FTX through IEO. In March 2022, PsyFinance’s official blog mentioned Liquidity Mining, therefore, anyone who would go for additional APR on the option structured product, please follow news and notice of the protocol.

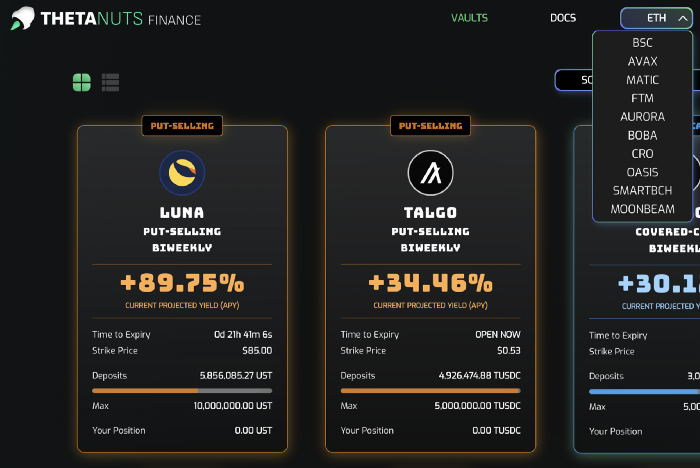

3.4. Thetanuts

Most of the option tradings of BTC and ETH are done by institutional investors at Deribit. And being skeptic about the current status, Thetanuts has launched under the motto of providing Altcoin’s option services to the fullest extent. Its TVL is around $37.24m as of April 2022, and has expanded to various chains including BSC, AVAX, MATIC, FTM, AURORA, BOBA, CRO, OASIS, SMARTBCH, and MOONBEAM and increased accessibility. From this, it has the most number of underlying assets that can create an option position, but currently there are only covered call and cash secured put strategies.

It uses auction process for option selling, and it has recently announced that it now has numerous counterparties through its collaboration with Paradigm. According to Thetanuts, Paradigm is connected with more than 700 crypto institutional investors, which allows the company to secure options trading partners that would lead to up to monthly $10b in the trading volume, for which Thetanuts speaks highly of its scalability and growth potential.

Thetanuts has announced that it would launch Theta-Index, its own options product based on options services based on Thetanuts’ numerous underlying assets and a lot of trading partners it has secured, and the company is planning a strategy to secure APR by implementing short options strategies of various underlying assets.

So far, we’ve had a look at the most renowned DOV protocols based on a layer other than Ethereum. Like Ribbon Finance, mostly the strategies that use options are covered call and cash-secured put strategies. Friktion has taken a step further to launch Crab Strategy and it is publicly planning to launch Hedged IL strategy. Even though DOV doesn’t have dozens of options positions as in TradiFi and the flexibility of extensive leverage that is unique to options, but for sure, DOV has a capability to provide more various services.

Unlike the existing DeFi model where reckless token issuance offered high APR but ended up with token price drop that led to massive churn of users, the vision of DOV protocol is that it can provide high APR based on a finance technology with options. From this, DOV is proposing a new model of sustainable DeFi protocol, and it has enough potential to get enough attention going forward.

At the moment, except for Ribbon Finance and PsyFinance, most of DOV protocols are at the early stage where the governance tokens are yet to be issued. Each protocol has its own characteristics, so by following up on the development status of the Protocol that you are interested in, you can predict a winner and a loser in the DOV market.

The first and the second episodes of this series have introduced crypto options ecosystem and focused on DOV protocols. In episode three, the last episode, I will explain decentralized options exchange, a platform that allows users to buy and sell options on-chain.