1. Introduction

The first episode explored options, the reasons to pay attention to the options market, and RibbonFinance and Squeeth, the two prominent option protocols.

In the second episode, we discussed the Greeks of options and some of the prominent DOV (DeFi Option Vault) platforms based on a layer built on an ecosystem other than the Ethereum.

Lastly, in this episode, we will have a look at the decentralized options exchange (hereinafter DOX). DOX is different from DOV, and it is where people can directly trade options.

There are several methods of incorporating certain assets into your position including holding a spot and using various contracts and structured products.

Spot

The method to hold a spot is the most simple. You can either purchase a spot on a centralized exchange, use DEX aggregators such as Uniswap’s AMM, 1inch, Matcha, and Cowswap on-chain, or trade spots on an order book-based decentralized spot exchange such as ZigZag.

Futures

Futures can also be incorporated in the form of a perpetual future on a centralized exchange. There are various decentralized perpetual future exchanges on-chain including the order book-based Dydx, Injective, Mango Market, Perpetual Protocol, a virtual AMM, and Drift Protocol, a dynamic virtual AMM.

Swap

Swapping in the crypto platform means exchanging spots. However, swap, in the traditional finance market, is also used but means something different. It is a method called interest rate swap which is about fixing a yield rate by exchanging a volatile interest position with a fixed rate position or equity swap that exchanged securities yields with the stock yields, which can be applied in the crypto market.

Option

Options are mainly traded by institutional investors on some centralized exchanges, and on-chain DOX include Dopex, Lyra, Premia, and Hegic which operate on an AMM-based model which will be introduced in this episode, and an order book-based ZetaMarket, PsyOption, etc.

2. Background knowledge: Option price (premium)

In the DOV protocol that was discussed in the second episode, when assets are deposited, Vault makes an options trading, meaning the users are not interested in whether the options are currently over/underpriced.

However, to trade options directly on DOX, a user should make a decision on his own whether the pricing of an option to be traded is correctly established.

Therefore, in this episode, as background knowledge, we will have a look at what the option price (premium) is and how the price is set.

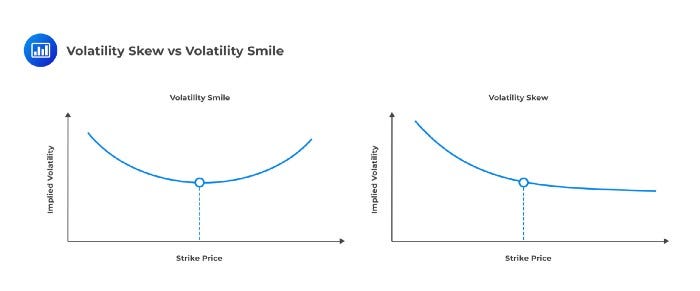

There are four variants that affect an option price.

(1) Price of an underlying asset

(2) Option exercise price

(3) Option expiration date

(4) Underlying asset’s expected future volatility (implied volatility)

(1) The price of an underlying asset, if the asset has volatility, can be easily checked from the exchange. The (2) exercise price and (3) expiration of the option are determined by the option trader. Lastly, (4) expected volatility is a subjective value.

2.1. Case Study

(1) The current price of ETH is $3000

(2) Exercise price $3200

(3) Reaches expiry in one week

Let’s assume that the price of a single ETH call option is $100.

The variants of (1) ~ (3) are obvious. So the options trader should relate the remaining factor (4) underlying asset’s expected volatility with $100, the option price.

The ETH spot can be purchased at $3000 in the market now. And the price of a single call option with an exercise price of $3200 is $100. If the price of ETH becomes $3300 or higher, or $2900 or lower, purchasing a call option is more profitable than purchasing a spot $ETH now. Then, after one week, how higher or lower the $ETH could fluctuate?

That is, there is a single question to ask for making a decision.

Based on the current price of the underlying asset, the given exercise price, and the expiry of the option, is the expected volatility by the option trader and the pricing are reasonable?

Therefore, the expected volatility (=implied volatility) is the option price. When the trader deems the option is priced low compared with the expected volatility, the trader buys it, and when the trader thinks the option is priced too high compared with the expected future volatility, he sells it.

As a result, the option price is a market trade price determined by the demand/supply in the options market, and the options trader who participates in the market connects the adequacy of the pricing with the implied volatility of the underlying asset, which is used for making a decision to buy and sell.

Below is in-depth content about the option price and implied volatility.

2.2. Black–Scholes equation

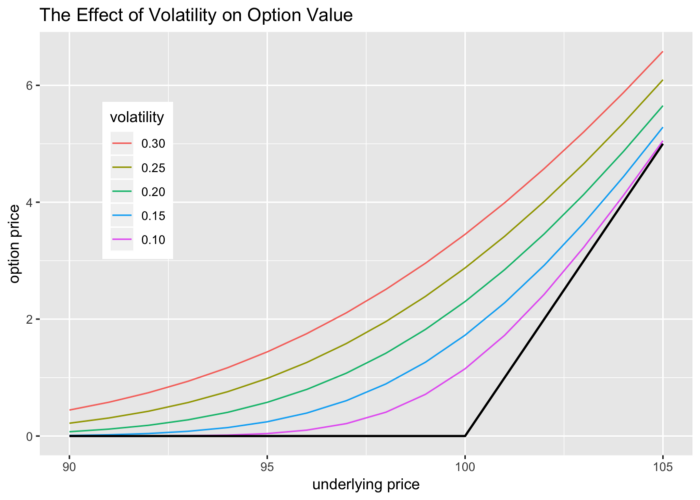

The relation between the option price and the implied volatility can be quantified into a theoretical value using an equation called the Black-Sholes option pricing model.

Using this equation, the X% is the expected volatility, and the adequate option price $Y can be calculated. Also, with $X, the market price of a certain option, it is possible to reverse calculate the market’s expected underlying asset volatility of Y%.

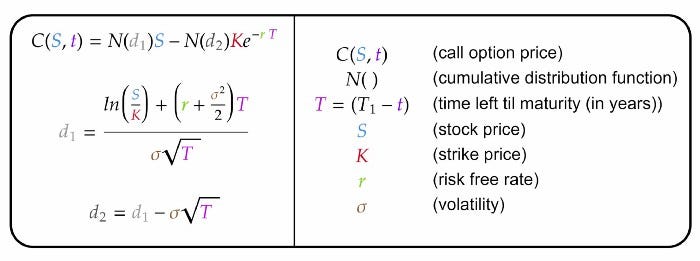

However, in the real options market, there are price pairs of volatility/option that do not correspond with the equation, in this case, one can use Volatility Surface, Volatility Smile, and Volatility Skew to quantify the relation between the volatility and the option price nearer to the actual movement in the options market.

2.3. Volatility Surface

When using the Black-Scholes equation, the Volatility Surface should be flat. However, in the real market, as in the graph above, even as the underlying asset is the same, when (1) the expiration date is near, (2) when the option is in the Deep OTM/ITM, the implied volatility is measured as high (=meaning the option is priced higher).

2.4. Volatility Skew/Volatility Smile

It is a graph that has removed an option maturity axis in the volatility surface graph and only shows the relation between the option’s OTM/ITM/ATM. As in the left image, when the market price of OTM and ITM options are priced higher than ATM for both a call option and a put option, it is called a volatility smile. And as in the right photo, when the market price of an OTM put option alone is set higher, it is called volatility skew. In particular, the case of volatility skew frequently takes place as there is a tendency to buy OTM put option for downward hedging, leading it to be valued higher than other options. The case indicates that the market moves to prepare for a bear market.

By combining the tendency of volatility surface, volatility smile/skew situation with the Black-Scholes Equation, it will be possible to draw the relation between implied volatility and option price in an actual market and quantify them.

The above description helps understand which mechanism DOX uses to set an option price and determine whether the price suggested by DOX is adequate.

3. Decentralized Option Exchange

Going back to the main business, let us have a detailed look at the DOX that provides infrastructure for direct options trading on-chain.

DOX can be largely divided into two types.

- AMM-based DOX

- Order book-based DOX

All transactions require a counterparty who will take an opposite position. However, as can be seen from TradiFi’s options market, pro options traders are the only market makers based on an order book who can correctly set the option’s price, perfectly perform a hedge for the option position and pursue yield only with the Bid-Ask spread. Therefore, at the moment, the transaction on the order book-based DOX will go through smoothly due to highly scarce liquidity, and very high slippage.

However, the AMM-based DOX can supply liquidity just by depositing assets, meaning it has a lower entry barrier for the liquidity provider (Market Maker). Instead of looking for an appropriate offer targeting an order book in an on-chain option trading environment with insufficient liquidity, it might be better to use an AMM-based DOX that offers relatively rich liquidity, to reduce the slippage.

However, the AMM-based model is less flexible compared with the order book-based one. The AMM-based DOX can trade options with conditions (underlying assets, exercise price, expiration date) designated by the protocol as it should execute automated market making with the deposited asset provided. The option price (implied volatility) should be determined by the protocol, and the data of underlying assets implied volatility, the equation to calculate the price and the calculation that has applied the volatility surface should be performed accurately.

In contrast, the order book-based DOX freely sets options conditions (underlying assets, exercise price, expiration date) and can trade with the counterparty. As for the price of the option, the maker’s order can be submitted as wanted and the implied volatility is calculated in the price dependently, which is displayed on an order book.

3.1. AMM-based DOX

3.1.1. DOPEX

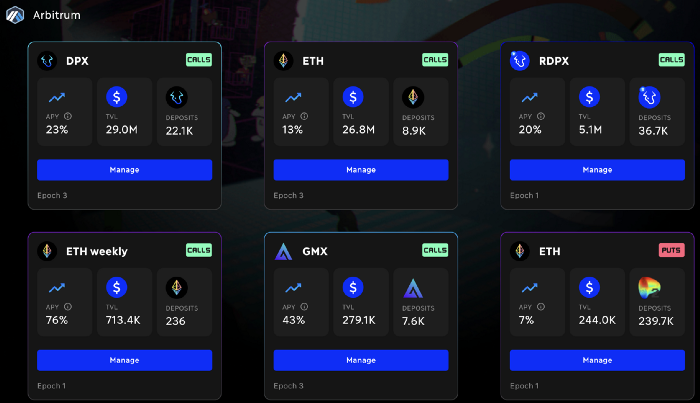

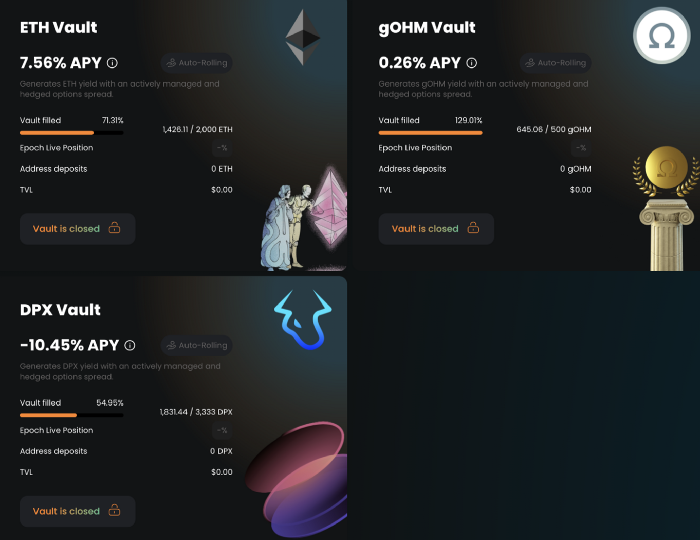

DOPEX is an AMM DOX based on Arbiturm, and its TVL as of May 13, 2022 is $34.15m. It is a protocol that has already issued governance token $DPX and a secondary token $rDPX and has commenced a two-year liquidity mining program since November 2021.

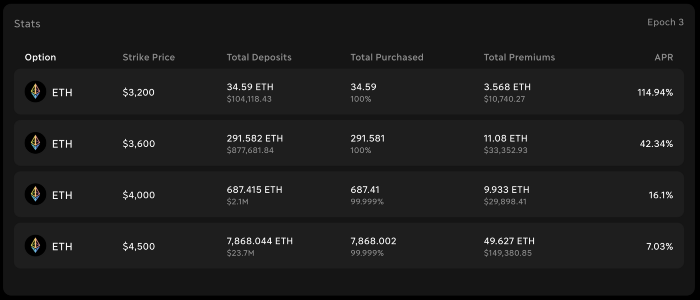

Apart from the product like ETH weekly on which the option expiry is separately marked, the expiration date is set based on one epoch (around one month) and as a new month begins, starts a new epoch. The exercise price is provided in four options, and in proportion to the underlying asset price as of the end of the month, which is the end of Epoch, the four exercise price options for the next epoch are determined.

There are three types of users on DOPEX,

1. Depositor (Liquidity Provider): A position that deposits underlying assets in case of a call, 2CRV (USDC/USDT) in the case of putting to provide liquidity for options, and obtains a premium by taking an opposite position of the option buyer.

It is the same as a covered call and a cash-secured put position as it deposits underlying assets and takes an option selling position. Withdrawal is possible only after the epoch ends (end of the month) for liquidity preservation.

Please see the relevant article for the details of a covered call and a cash-secured put.

This position itself is the same as what the current DOV provides (covered call, cash-secured put), but the difference is that it has more exercise prices and the trader can select expiration date.

At the moment, it employs a 100% collateral system for option selling, however, if it supports partial collateral option selling, it will be possible to build an option selling position using leverage, differentiated from a simple covered call/cash secured put.

As it is an option selling position, it receives a premium, but when the option is exercised, the loss could exceed the premium received. In this case, DOPEX distributes rDPX equivalent to 30% of the loss to provide incentives to the liquidity providers.

2. Option buyer (User): The position pays an option premium, bets on the direction (delta) and volatility (gamma) of the underlying asset or hedges a portfolio.

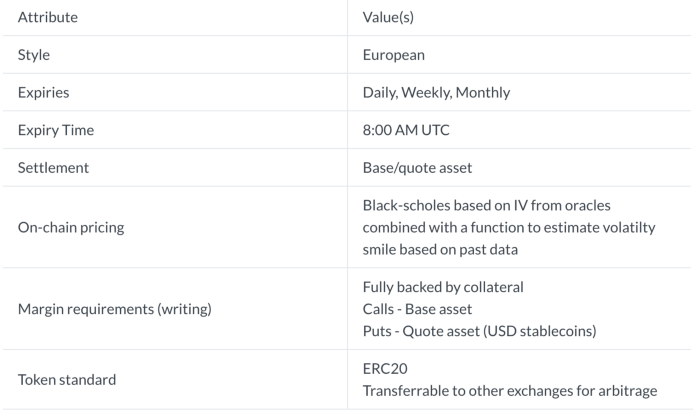

An option buyer pays the price of the option (premium) set in accordance with the exercise price selected from the four options and the remaining period until expiration (the period until the epoch ends) and takes a long option position. The price of the option, based on the underlying asset’s implied volatility data supplied from the chainlink is consistently calculated by DOPEX which applies volatility smile (powered with SVI IV params from the partnered option MMs) to the Black-Scholes Equation. The long position can enter anytime in the middle of the epoch, but when all liquidity supplied to one epoch is bought out, the option cannot be purchased anymore.

Purchasing option does not require collateral as it can enter the position just by paying the option premium, meaning it can set the leverage freely. When a trader has bought 100 $ETH call options and the $ETH price at expiry exceeds the exercise price + call premium, the call buyer can enjoy a 100-fold $ETH P&L.

DOPEX currently offers European options. Therefore, to get out of an option position in the middle of the epoch requires taking an opposite position on another exchange. To address this inconvenience, DOPEX announced that the platform will add functions to sell and buy options and to exercise options before expiry like American options.

3. $DPX, $rDPX, and liquidity token staker: It is possible to perform single staking of $DPX and $rDPX, tokens issued by DOPEX, and to get compensation. Also, the two tokens can be combined with $WETH respectively to provide liquidity tokens and get higher compensation.

$DPX: It is a governance token with a voting right related to the protocol and where the profit from the protocol belongs. 500,000 are the maximum number of issuance and the issuance schedule is as below image.

$rDPX: It is a utility token on DOPEX. It is an incentive that compensates 30% of the loss of option liquidity, providers and there is no limit on the issuance volume. This token needs a clear source of use and burning model, and in this regard, it was announced that it will have the following functions: (1) Fee payment currency in future app layer in additions to DOPEX (2) Option leverage position collaterals (3) Collaterals for the issuance of various synthetic asset that will be adopted in the DOPEX (4) Boosting for fee accrual

Not only individual and institutional investors or market makers but also the decentralized protocol itself can be the main player that uses an option transaction infrastructure of DOX. One such example is Jones DAO. Jones DAO is a type of DOV protocol based on Arbitrum and uses DOPEX as an options exchange to manage assets deposited to the Vault with an optimized option strategy.

Additionally, DOPEX has just launched very first interest rate option with MIM + 3CRV interest rate as an underlying option at May 30, 2022. This is a brand-new structured product on-chain that let users speculate or hedge interest rate volatilities. To investigate further, check the link below.

3.1.2. Lyra Finance

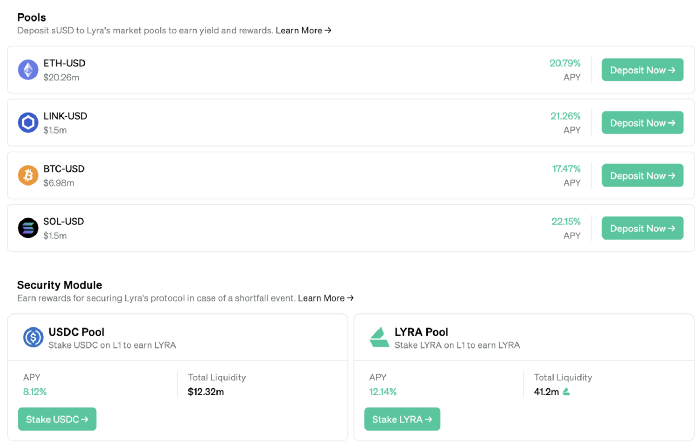

Lyra Finance is an AMM DOX based on Optimism and has $46.62m of TVL as of May 13, 2022. Lyra Finance has also issued its governance token $Lyra and the token is distributed as incentives to the liquidity and option collateral providers and as trading incentives.

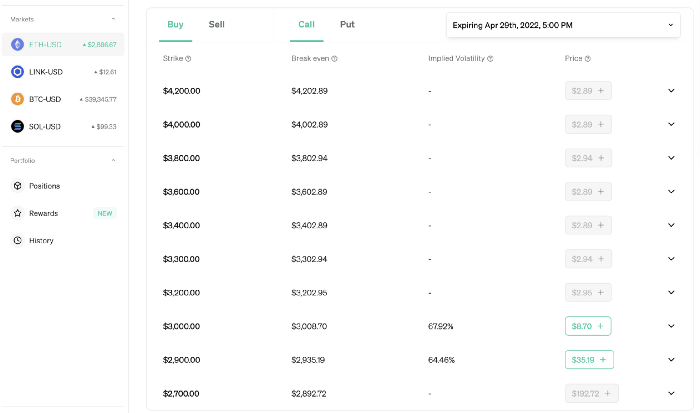

Call options and put options that have an expiry within 1~4 weeks (settlement takes place every Friday) are available for trading at Lyra Finance. Options that can be bought or sold are those with exercise prices whose delta ranges between 0.15~0.85, not so much distance from the current underlying asset price. Also, an option that has an expiry within 24 hours or less cannot be traded.

Option price setting is not about bringing oracle’s implied volatility unlike DOPEX but about directly calculating the option price by applying Black-Scholes Equation and Volatility Smile/Skew based on the implied volatility that was calculated with the market data.

As for the underlying asset price, the data is provided from Synthetix and Chainlink.

Lyra Finance also has three types of users as DOPEX but the structure to provide liquidity is different from DOPEX.

1. Option seller: A covered call/cash secured put position that deposits underlying assets in case of a call, sUSD in the case of a put to provide liquidity for options, and takes an option selling position. Lyra Finance also announced that it will support a partial collateral option selling position to provide a right to choose leverage for the selling position.

2. Option buyer: It is a position that pays an option premium and takes a long option. Just like DOPEX, it is possible to take a leverage position freely.

3. Liquidity providers: It is a position that deposits stable coins (sUSD) and provides liquidity to an options trading pool, playing a role in supplying electricity to any DeFi platform found on AMM such as Uniswap. Unlike DOPEX, Lyra Finance does not take the underlying assets as collaterals for the smart contract for options trading from the users but takes sUSD which are Synthetix-based stable coins. The protocol buys the underlying assets which will be used collaterals with the sUSD at Synthetix. Then, the protocol uses a dynamic hedge (a position that consistently maintains Delta at 0) to prevent the value of sUSD’s liquidity pool change due to the change of collateralized underlying assets’ price.

The biggest advantage of this liquidity supply method is that it can prevent the liquidity from being disseminated in various products with different exercise prices and expiry dates. The method allows anyone to use sUSD to provide liquidity to a single pool, offering it to option buyers who want various expiry dates and exercise prices.

However, despite this approach, there is an issue that the liquidity should be provided for a lockup period of one round (a month). It is because it is not possible to pull liquidity before expiry as one should become a counterparty to a buyer of an option that has up to one month of expiry. Because of this, in the first week, liquidity can be provided across a wide range of expiry between one week and four weeks, but in the last week, the liquidity can only be provided to an option with one-week expiry.

Lyra Finance has announced that it will launch Lyra Finance V2, called “Avalon”, to address these three issues of liquidity lockup, full collateral, and limited expiry of one month. Please see the announcement for more details.

In addition, there are $USDC which performs like an insurance fund that protects against when sUSD pool fails to absorb all, $Lyra, a single pool for depositing, and $Lyra-$ETH pool for $Lyra swap liquidity.

In addition, there are other AMM-based DOX including Hegic which only supports ATM options and the expiration date can be freely adjusted daily, and Premia which provides American options and has underlying assets like unique tokens including $YFI, $ALCX, and $alETH. The TVL of each protocol is not that high, at $5.7m, and $7.7m respectively.

3.2. Order book-based DOX

As described earlier, pro options traders are the only market makers that can take an opposite position in the options trading in the order book. The demand and market markers for on-chain order book options trading are seriously undersupplied, and most of the market share is taken by Deribit, a centralized option exchange.

To address this, it is important to secure an order book-based decentralized option trading infrastructure in advance, use retroactive airdrop, liquidity mining, etc. like Dydx in the past to achieve the early bootstrapping and give an impression that the order book provides a pleasant environment for trading to the traders.

Currently, the decentralized option market is being shaped around AMM DOX which has a low entry barrier in liquidity supply and options trading. However, an order book is essential to trade options that have various variants including expiration date/exercise price/implied volatility in a way that is the most flexible, meaning there is no doubt that an order book DOX market will grow substantially in the future.

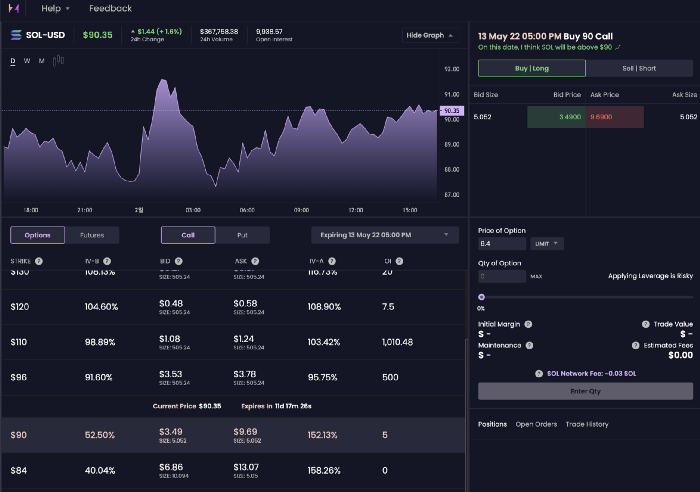

3.2.1. Zeta Market

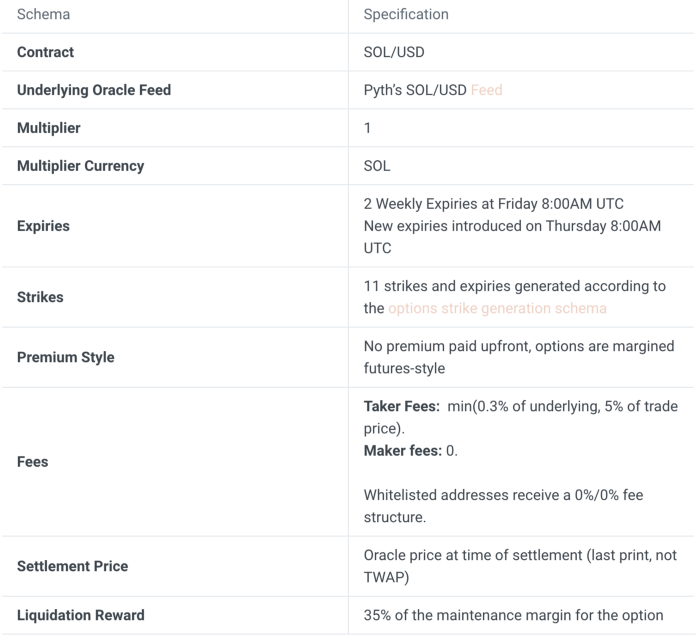

It is an order book DOX built on Solana. $SOL is the only underlying asset available for trading and the 24-hour trading volume stands at around $350k as of May 2. It is well below $8.44 m which is a 24-hour trading volume of $SOL perpetual swap of Drift protocol, a decentralized future exchange on Solana.

Actually, in TradiFi securities market in the United States, the trading volume in the options market is ~50 times larger than in the futures market. This shows that the order book DOX is at the extremely early stage meaning it has huge growth potential.

In Zeta Market, one can deposit USDC to one’s account from the SPL wallet, and use the USDC as collateral for partial leverage to freely trade options. It is not about paying or receiving an option premium when transaction, but depending on the movement of the price of an option, the P&L that has reflected the leverage deducts USDC at an account level. Like Dydx, Perpetual Protocol, GMX, Drift protocols which are decentralized exchanges for perpetual futures, Zeta trades derivatives using USDC as collaterals to get or lose as much as P&L, but the tool for trading is not perpetual swaps but options (Zeta serves $SOL-PERP as well though).

So, this platform which allows partial collateral trading to freely use leverage is advantageous to ensuring liquidity and trading volume due to high capital efficiency as just a small amount of money enables to trade a large value with a small amount of money. However, critical errors, such as incorrect liquidation from incorrect option prices due to oracle failures, can threaten the project’s survival, and the infrastructure should be built very tightly to prevent that from happening.

Though it is an order book-based DOX, the liquidity is not enough so it is limited in terms of setting expiration date and exercise price. Therefore, only options that will expire after one and two weeks and options with up to 11 exercise prices can be traded, but the more it is away from ATM, the bigger the Bid-Ask spread gets exponentially.

Zeta Market receives price feed of underlying assets from a Solana-based DeFi oracle solution Pyth network, and the implied volatility posted on an order book is calculated via Zeta market’s own formula based on the Bid/Ask prices proposed by makers.

However, Mark Price, the liquidation basis, is calculated by adjusting the implied volatility where the actual trading occurred to the implied volatility calculated directly by the Zeta Market from the volatility surface based on the historical volatility. We believe this is because the transaction volume on the platform is small, so using the transaction price as the base price for liquidation is vulnerable to outliers, and there is no oracle that supplies index implied volatility yet in the Solana ecosystem.

The price of the underlying asset used for settlement uses Oracle’s price at the moment of settlement, not TWAP. It is important to take full advantage of the fact that real-time data update is possible based on Solana, but it should fully prepare against tail risks as it can be vulnerable to them in the event of a disruption in data supply.

Ribbon Finance and Katana are the most well-known protocols that use Zeta Market to trade options with $SOL as underlying assets. Zeta Market also operates Zeta Flex, which mints options in the form of tokens and conducts auctions in the Solana ecosystem like Ethereum’s Opyn Protocol does and provides the infrastructure for options trading for the Solana ecosystem’s on-chain protocols.

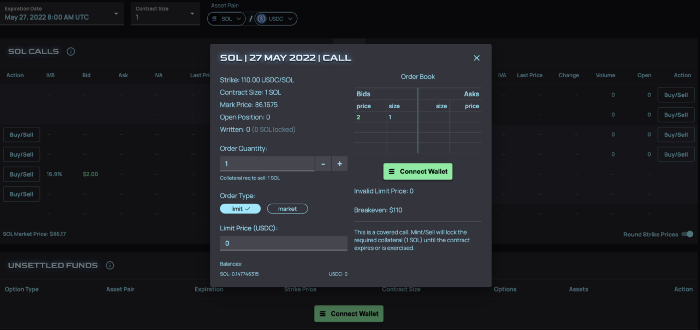

3.2.2. PsyOption

This is an order book-based DOX selected as First Place Winners at the Solana x Serum DeFi Hackathon in March 2021. Uniquely, Psy Option introduced the American option that features Full Collateral and Physical Delivery Settlement as its first product, and the European Option which provides Partial Collateral and Cash Settlement is currently under development.

The latter option is a partial collateral-cash settlement-European option that we are familiar with. By signing a transaction of future underlying assets by exchanging premium only, the leverage is characterized by (partial collateral), the exercise of the option is only due (European) and the difference is exchanged in cash (cash settlement) when the option is exercised.

The American Option is an option that can be exercised at any time without reaching an expiry, and the option is priced higher because the option can be exercised to benefit from the price of the underlying asset at any time before expiry (early exercise premium). But in reality, there are not many reasons to exercise options that are not due. There is a time value in the option because if you exercise an option that has a time value left because it is not due, it will blow the time value away. Rather than exercising, selling the option or getting out of the opposite position is a good way to get compensated for the time value.

Therefore, it is reasonable to think American Option should be more expensive in the case of the Deep ITM put option where Theta is the only positive number. Or, in the case of Physical Delivery Settlement American Option, the American Option’s existence would be valid only when the physical delivery takes place before the expiry so that holding the physical asset itself can be profitable (ex. stock dividends, voting rights, commodities, etc.).

For this reason, PsyOption has linked American Option with the Physical Delivery Settlement and therefore, an option seller who is obliged should place the asset to be delivered on a smart contract meaning the seller should trade on full collateral.

- Call option seller: Uses underlying assets as collaterals as he bears an obligation to hand over the underlying asset when an option is exercised (same as a covered call)

- Put option seller: Uses USDC as collaterals as he bears an obligation to acquire underlying assets when an option is exercised (same as cash-secured put)

The option buyer, who is the right holder, only needs to pay a premium, so there is no need for collateral, and the buyer can freely use the leverage.

Currently, there are two ways to use PsyOption.

1. Option token minting (option contract generation)

It stakes underlying assets to the protocol as collaterals and mints American Options in the form of SPL tokens to create an option contract itself. Two types of tokens which are “Option Token” and “Writer Token” are minted to the contract generator and the said tokens are traded at OTC, Serum market, and other SPL markets to conclude an option contract. Option Token holder is the same as an option long position, writer token holder as an option short position.

During the option token minting process, fees are paid to the PsyOption, and the fees are the source of revenue for the protocol. The protocol has announced that it will create complex positions that use various options such as Spread, Straddle, Condor, etc. in the form of tokens as there are more diverse demands for options positions.

The method of option token minting is detailed in PsyOptions Docs, but it is not yet a platform for individual investors. Currently, it serves as a protocol-to-protocol function, such as mediating the sale of DOV options on PsyFinance.

In addition to providing an option position to the DOV protocol, PsyOption can be used to offer an airdrop which protocols offers to early users as an option. An example of this is Jungle DeFi’s offering an airdrop with American Option tokens that have physical delivery having the governance token $JFI as underlying assets.

To sell said tokens by airdropping the physical delivery option without giving the governance token directly, one first has to exercise the option to buy the underlying asset at the exercise price and get the physical delivery. This helps to control reckless selling trends, and even though a user has a clear intention to sell by exercising an option, the option token is minted and the cost of physical purchase is reverted to the protocol that holds the writer token so the protocol can earn yields.

2. PsyMarket (marketplace)

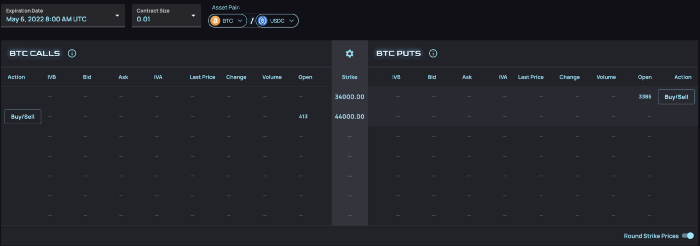

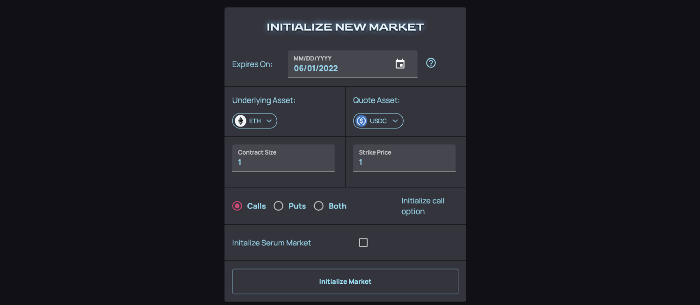

This is the recently updated European Options Marketplace. Partial collateral is not yet supported, liquidity is currently extremely scarce and trading volume is very low.

However, as shown in the image above, there is an interface where anyone can create a market by setting any underlying asset/exercise price/expiration date/contract unit. Currently, there are few users, but it is important to solidify the infrastructure so that it will get attention as an option marketplace with the highest level of freedom when the decentralized option market is in the spotlight in the future.

Today, cryptocurrency trading volume is concentrated on centralized exchanges, both in spot/future/option. However, we can observe the rapid increase in the trading volume at decentralized exchanges, led by Ethereum-based first-generation AMM Uniswap and perpetual futures protocol Dydx.

Transparent transactions are possible at decentralized exchanges as there is no conflict of interests between traders and exchanges, and there is no need to worry about intentional control that often occurs in centralized exchanges. It can be said as contradictory that most of the trading of cryptocurrency which strives to be decentralized takes place in the centralized exchanges. In 2021, the trading volume on the centralized exchange was close to $14 Trillion, but only about $1 Trillion was made on the decentralized exchange. If you’re an investor who’s joined this market because you saw the future from decentralized assets and protocols, you can’t ignore the growth of a decentralized exchange, one of the infrastructures that are the foundation of that market. Furthermore, if one can predict that on-chain transactions will continue to advance and therefore consistently bring market share, a huge upside can also be expected.

4. Lastly

So far, we’ve covered different decentralized structured financial instruments using options and decentralized option exchanges in three episodes.

DeFi service that started from a simple deposit/borrowing/trading platform has evolved continuously until now and in the future, all structured financial products that exist in TradiFi will be made available on the decentralized platform.

TradiFi option market is a huge market that has a trading volume of 50 times the futures market. As such, there is no doubt that there exist substantial demands to use options to build various positions and manage portfolio risks, and that the options market will grow substantially as the market becomes more mature with various and more investors coming in.

Why don’t you follow the protocol related to various options, which are not yet spotlighted but have big growth potential, and discover the hidden alpha?