The Great Curve War (aka. Convex War)

Flywheel between Curve Finance and Convex Finance for shared growth

1. Introduction

Last July, I introduced the Curve war. Through the Curve war, each DeFi protocol attempted to maximize the profits with the Curve’s boost function. After all, each DeFi protocol locked up the CRV to obtain as much veCRV as possible.

At that time, the TVL(Total Value Locked) of the Curve was $9.8 billion based on Defilama, while that of Convex Finance was $4.2 billion. Six months later, the TVL of the Curve and Convex Finance have grown to $24 billion and $20 billion, respectively.

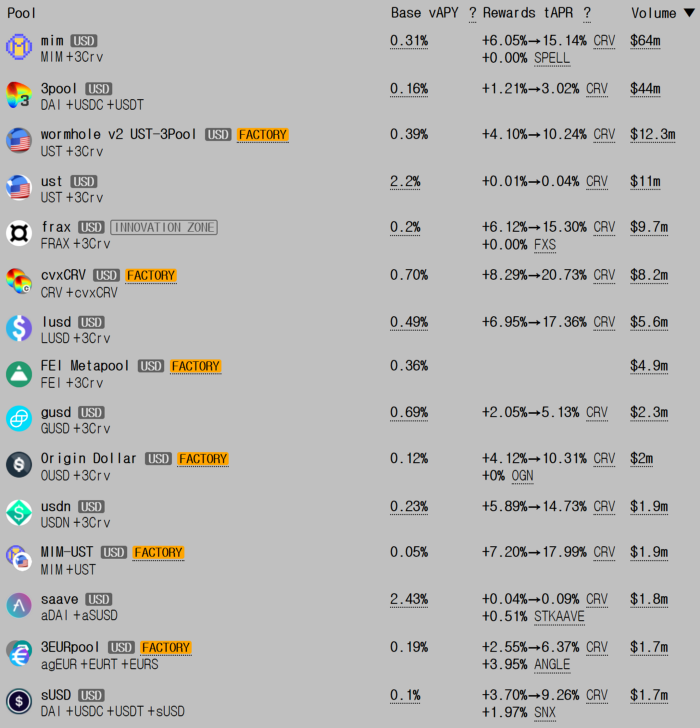

Since then, each DeFi protocol has not only incentivized the CRV deposits to obtain governance voting power in Curve Finance to raise the returns, but has also begun to incentivize the governance voting rewards such as Bribe.crv and the Votium incentives. In addition, as stablecoins such as Olympus DAO, Abracadabra, Frax, and REDACTED have recently garnered attention, the Curve war has further intensified to induce rewards for their liquidity pools.

2. Not Curve War, But Convex War

As various DeFi protocols, including Convex Finance and Yearn Finance, competed against each other to secure the governance right of Curve Finance, the protocol which secured the most veCRV, referring to the governance voting power of Curve Finance, is Convex Finance, which holds approximately 42% of the total amount in circulation.

This means that Convex Finance has the most voting power in the governance of Curve Finance, which ultimately means that Convex Finance will be able to decide which liquidity pool to apply to the Curve Finance’s gauge weights (reward boost).

Users can earn cvxCRV by locking up CRV on Convex Finance, and in doing so, since the CRV will be locked during such a period, it is highly beneficial for users to earn cvxCRV that can be liquefied. The cvxCRV/CRV pairing will allow you to freely change positions.

If you obtain cvxCRV, you will certainly lose the direct governance voting power on Curve Finance since it is not veCRV, but you can obtain all of the following: 1) Swap fees earned from Curve Finance, 2) Convex Finance’s operation fees, and 3) Convex Finance’s CVX tokens. In the end, users can earn greater yields instead of giving up the direct governance right of Curve Finance.

By locking up CVX on Convex Finance for 4 months (16 weeks), users can participate in the vote to determine the gauge weights of Curve Finance.

As explained earlier, since Convex Finance holds the most veCRV, the gauge weights of Curve Finance are, in reality, determined by the governance of Convex Finance. Therefore, the ‘Convex War’ is ongoing for various DeFi protocols and users to secure the CVX of the governance tokens of Convex Finance.

While the demand for CXV is high, since users need to stake CRV and cxvCRV on Convex or purchase them on exchanges to earn CXV, the circulating supply is extremely low.

In addition, the inflation of CVX is designed to issue less as more CRV is locked up.

A growing amount of CVX is being locked up, leading to approximately 41% of the current total in circulation being locked up.

As a result, the price of CVX has continued to rise since the beginning of the Curve wars.

There are 170 million CRV and 33 million CVX locked up on Convex. This demonstrates that 5.2 CRV tokens match up to each locked-up CVX. As of January 6th, the CRV price is $5.4 and the CVX price is $41.8, which is traded in the market at the 7.7-fold price.

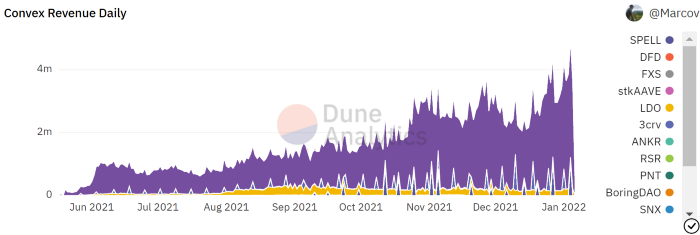

In addition, Convex Finance’s protocol income continues to rise.

2.1. Bribe.crv

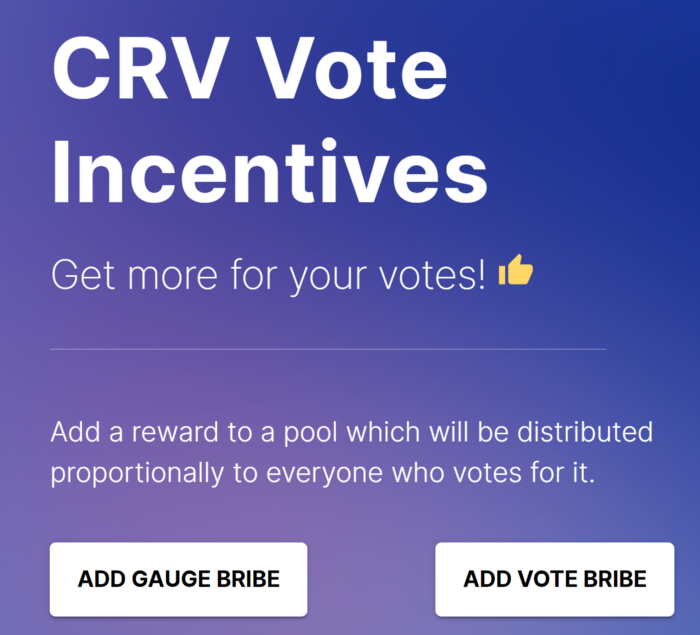

Bribe.crv is a platform developed by Andre Cronje of Yearn Finance, and it seeks to obtain governance rights on Curve Finance by paying bribes to veCRV holders. This is why users seek to increase the gauge of the boost functions of Curve Finance to maximize the yield of Yearn Finance.

2.2. Votium

Votium is a platform where users who want greater voting power on Convex Finance are delegated with the voting power from the CVX stakers (vlCVX, vote locked CVX) and pay rewards. At the beginning of each epoch, a snapshot is created, and users who have difficulty exercising their voting power can delegate vlCVX through Votium and receive rewards.

If users delegate vlCVX to Votium, they can automatically participate in the votes on Convex Finance and receive additional rewards. Therefore, Votium carries significant strength as it offers more flexible options for users compared to bribe.crv.

As Convex Finance holds an overwhelming amount of veCRX, the DeFi protocol chose to utilize Convex Finance’s governance participants (vlCVX) instead of earning veCRV.

96% of the rewards go to vlCVX, while the remaining 4% is allocated to Votium. As a result, Votium has earned USD 46 million in total so far.

If a user currently pays USD 1 to obtain the voting power on Votium, he/she can obtain CRV and CVX worth USD 2.59 depending on the gauge weights. Therefore, the user who wants the voting power on Convex Finance will actively utilize Votium. (For the time being, Votium does not offer its governance token.)

2.3. UST

Terraform Labs also purchased CVX over-the-counter (OTC) to secure high rewards for the UST liquidity pool. Additionally, they are increasing rewards for the UST-3CRV pool through Votium.

2.4. FRAX, MIM

FRAX and MIM pay a large amount of rewards on Votium and receive high gauge weights from Curve Finance.

2.5. REDACTED

REDACTED is a fork project of Olympus DAO that has recently drawn attention. The sale of BTRFLY, its governance token, was carried out through the bond issuance by Olympus DAO, and it has 3 pairs of OHM, CRV, and CVX.

REDACTED has chosen CRV and CVX in addition to OHM to improve the OHM’s utility and maximize the boost function of Curve Finance, thereby earning higher yields.

2.6. Badger DAO

Badger has deposited 78% of the protocol to Convex Finance. Badger seeks to earn CRV and CVX on Convex Finance.

3. Curve Finance’s Flywheel

Curve Finance and Convex Finance interacted to build a flywheel for shared growth. Convex Finance has not only experienced growth using Curve Finance, but since the protocol with the largest voting power on Curve Finance has fully established itself, the race for CVX, rather than CRV, has also begun. However, just as the demand for CVX has grown to be higher than CRV, we cannot rule out the possibility of the emergence of another Convex.

In the same way the stablecoin projects related to DeFi 2.0, as new and fresh ideas are on the rise, the stablecoin market will see further growth. Since Curve Finance and Convex Finance are at the center stage to maintain the price stability among stablecoins and provide swaps with high liquidity, they will continue to take on added significance.