DI - 02: SuperWalk

A Data-driven Analysis of Superwalk's Growth

1. Introduction

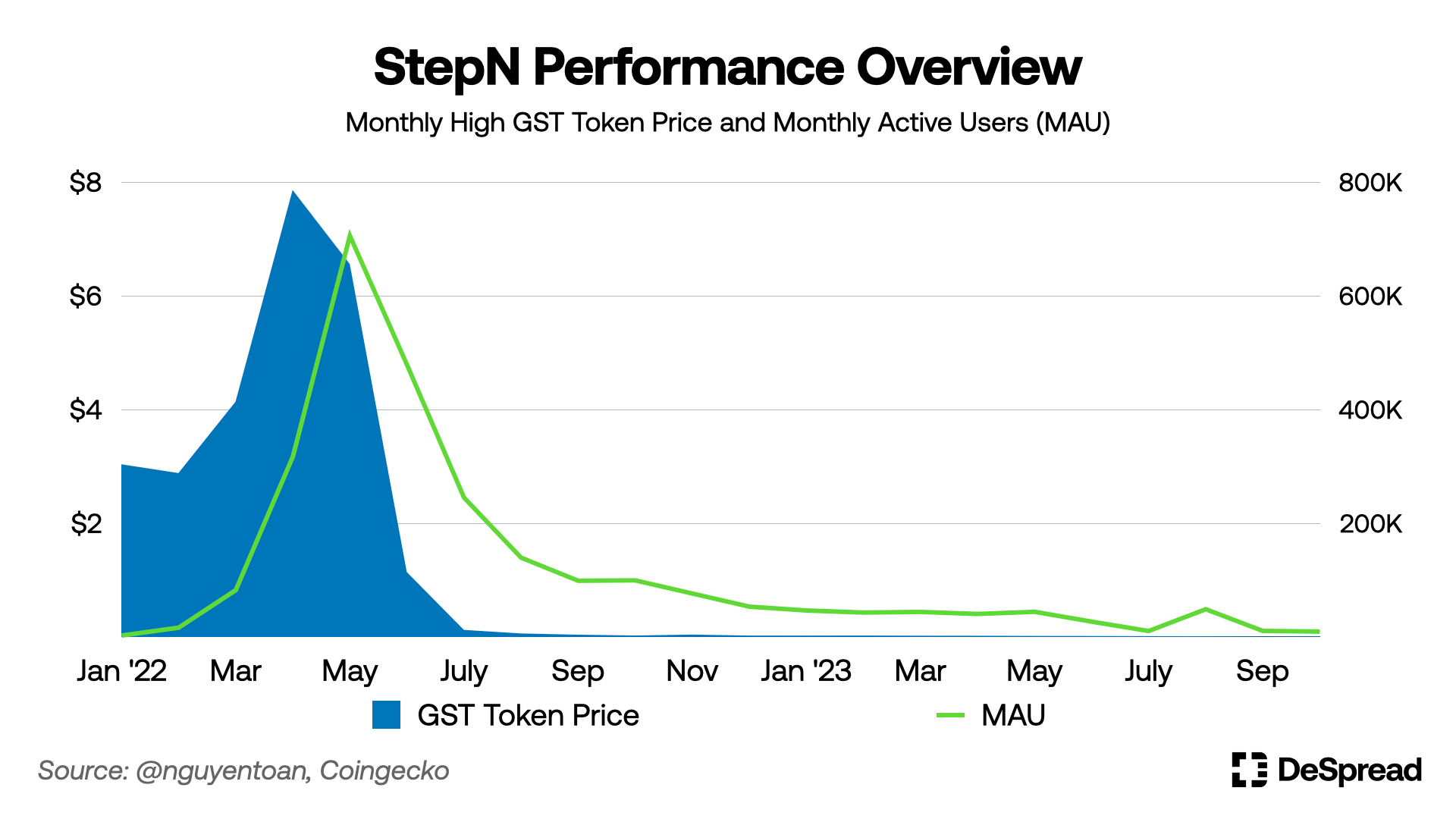

In the rapidly evolving world of crypto, Data Insight is dedicated to demystify and unravel trends through data analysis. A prime example of such a trend is the M2E craze, initially sparked by StepN. This phenomenon has led to the rise of many projects, mirroring StepN's model. However, many of these initiatives face challenges similar to StepN, particularly in achieving long-term sustainability due to their tokenomics. This, combined with unfavorable market conditions, has resulted in falling token prices and challenges in maintaining user engagement.

Several projects have emerged in Korea as well, but like their global counterparts, they too have faced challenging operational dynamics. However, since the first half of 2023, one Korean M2E project has stood out, showing significant progress compared to others: SuperWalk.

In the following sections, we will explore SuperWalk's data to understand how the project has grown. Our analysis, primarily focused on on-chain metrics up until October 2023, reveals key insights. Given the nature of the project, which operates partially off-chain, some of our analysis is based on data provided by the SuperWalk team.

2. SuperWalk

SuperWalk, launched in July 2022, is a M2E project similar to StepN. It is a decentralized app (dApp) where users record their walking or running activities to earn token rewards. The game's ecosystem revolves around three key assets: Shoe NFTs, WALK, and GRND tokens, each serving distinct purposes:

- Shoe (Shoes) NFT

- Token rewards vary based on the number and attributes of NFTs owned by the user.

- Shoe attributes can be upgraded using WALK tokens.

- WALK

- A utility token that rewards users in proportion to their activity levels.

- Used for purchasing various in-game items or for upgrading and repairing Shoe NFTs.

- GRND

- A governance token planned for future integration in staking and governance features.

- Also used as a reward for event participation.

Through engaging with these assets in the dApp, users generate valuable data that offers a window into the overall health and progress of the SuperWalk project.

3. Rising Popularity and Community Growth

- Our analysis of five major crypto Telegram channels, not linked to any specific project, shows a steady rise in SuperWalk mentions from the fourth quarter of 2022. The quarterly growth rate in mentions was substantial, ranging between 30-50%.

- Q1 2023 growth rate compared to the previous quarter: 56%

- Q2 2023 growth rate compared to the previous quarter: 47%

- Q3 2023 growth rate compared to the previous quarter: 35%

- Although these channels not being project-specific, the increasing trend of mentions suggests a growing external interest in SuperWalk.

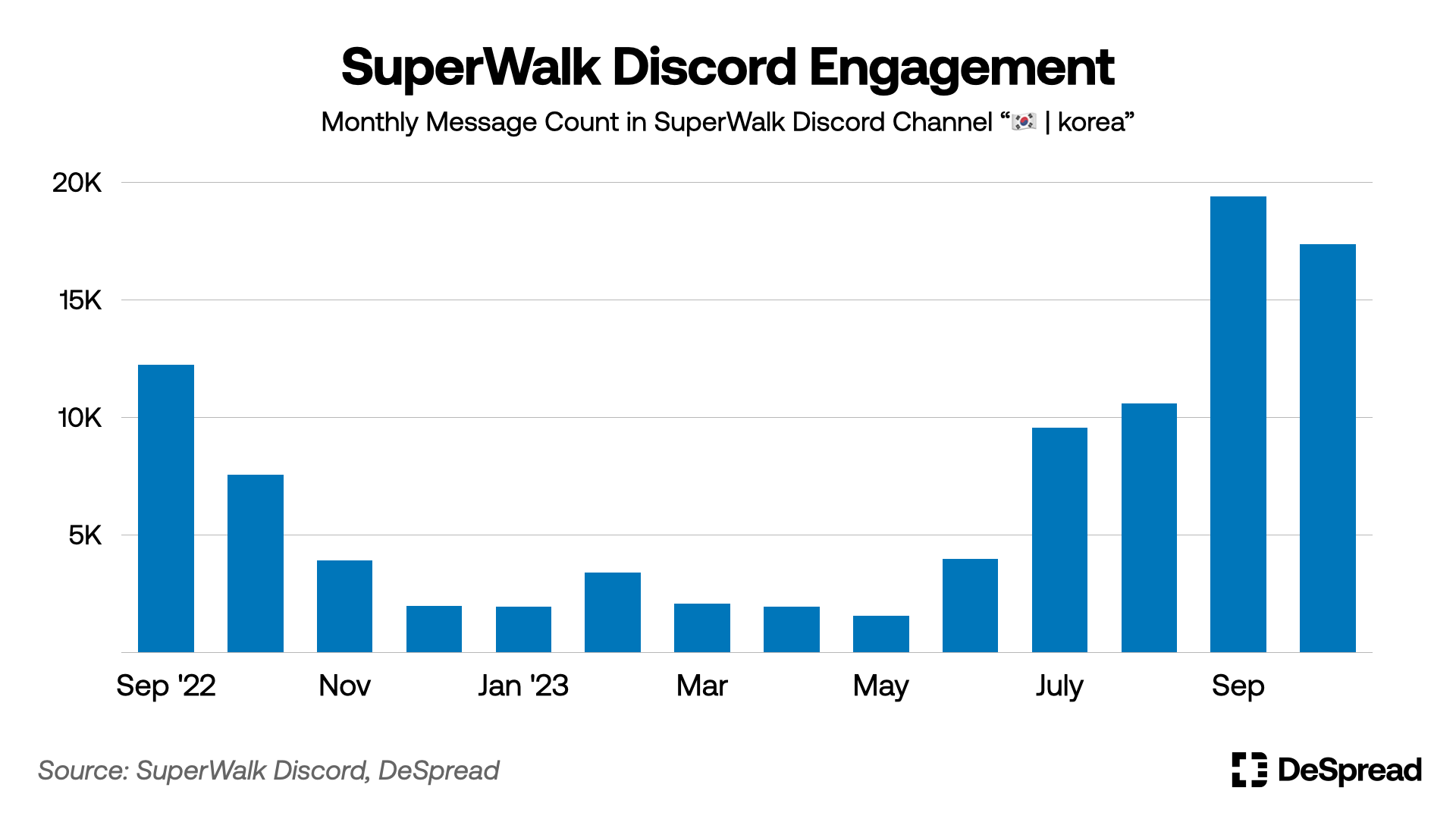

- User engagement analysis was conducted by sampling data from the SuperWalk Discord.

- Post-launch, the Korean Discord channel saw a consistent decline in conversation volume but witnessed an uptrend from June 2023. September saw a conversation surge of about 83%, nearing 20,000 messages.

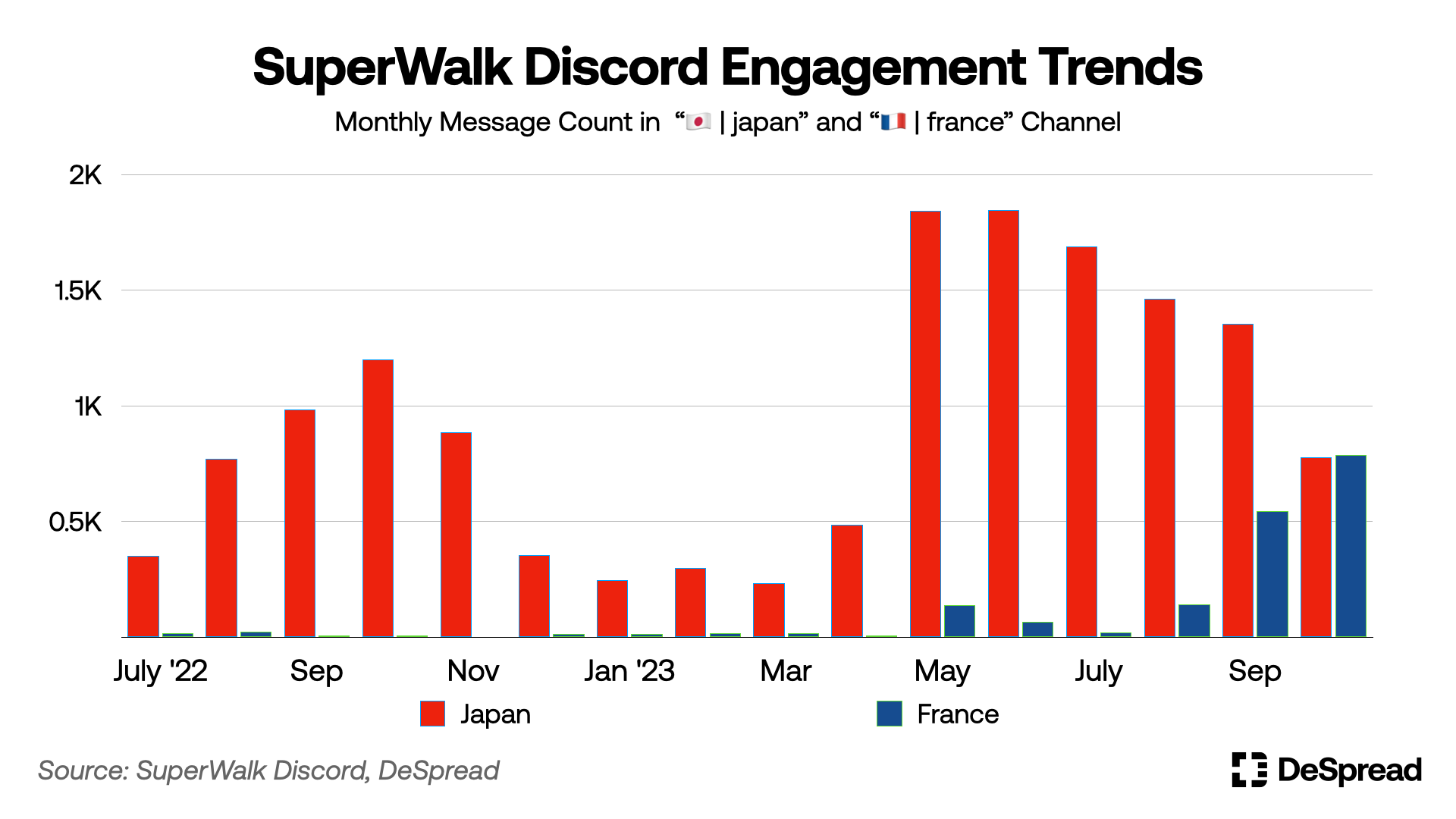

- Global community activity has grown as well. The Japanese community, initially active after the launch, experienced a decline in engagement but revived to nearly 2,000 messages by May 2023.

- The French community saw a significant conversation increase in September 2023, recording around 500 messages and aligning with the Japanese channel's activity levels by October 2023.

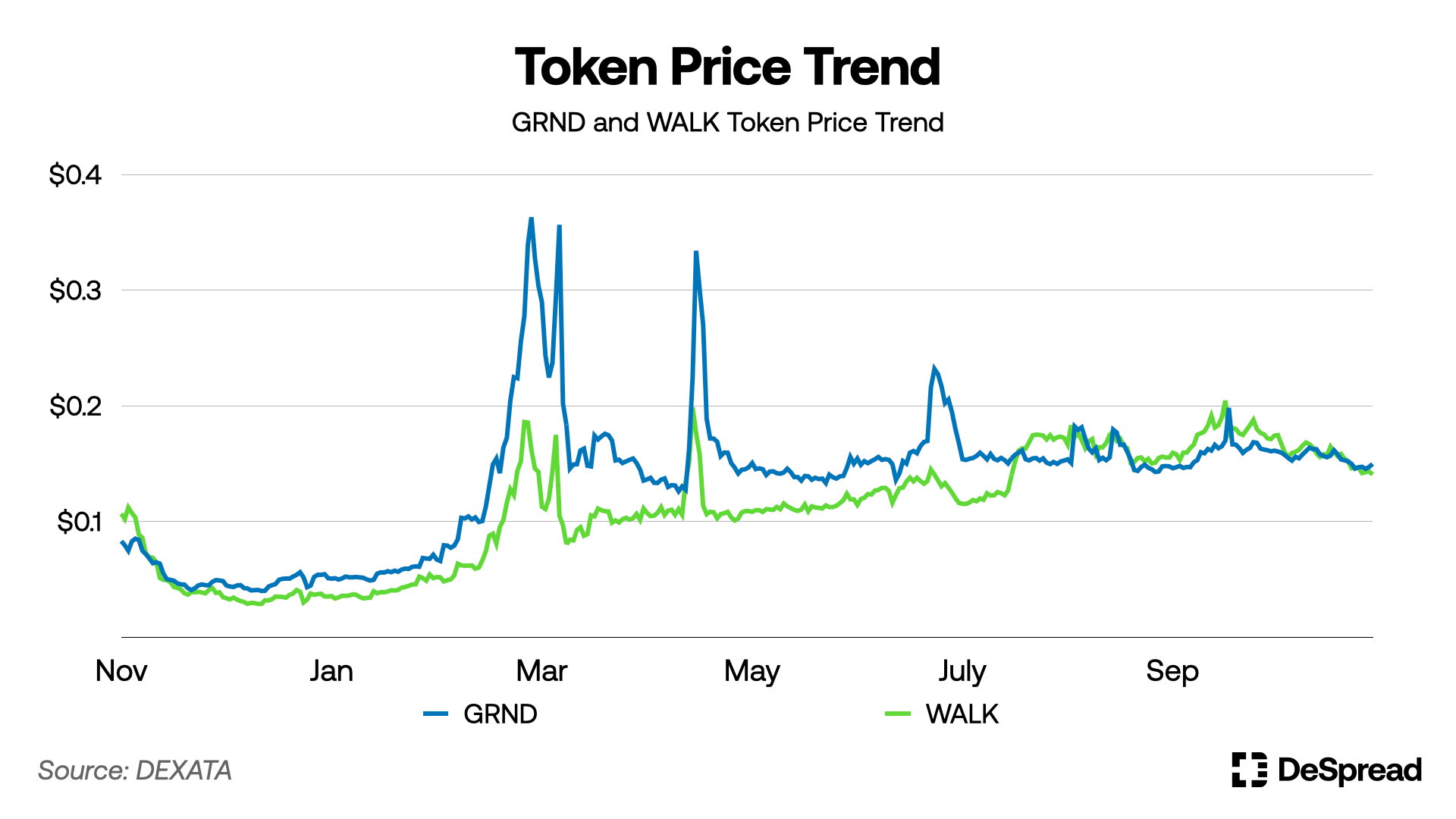

- While the token price experienced a sharp increase early in 2023, a notable rise in community engagement only followed 2-3 months later. This sequence suggests a delayed response in community growth relative to the initial token price spike.

4. User Growth

To bring their on-chain assets into the app environment, users must interact with an on-chain address known as the "Spending Wallet." Analysis of Spending Wallet addresses provide insights into the growth trends of the project.

- Users must transfer assets to the Spending Wallet for buying or selling in-app items. The frequency of these transactions acts as a vital indicator of user growth trends.

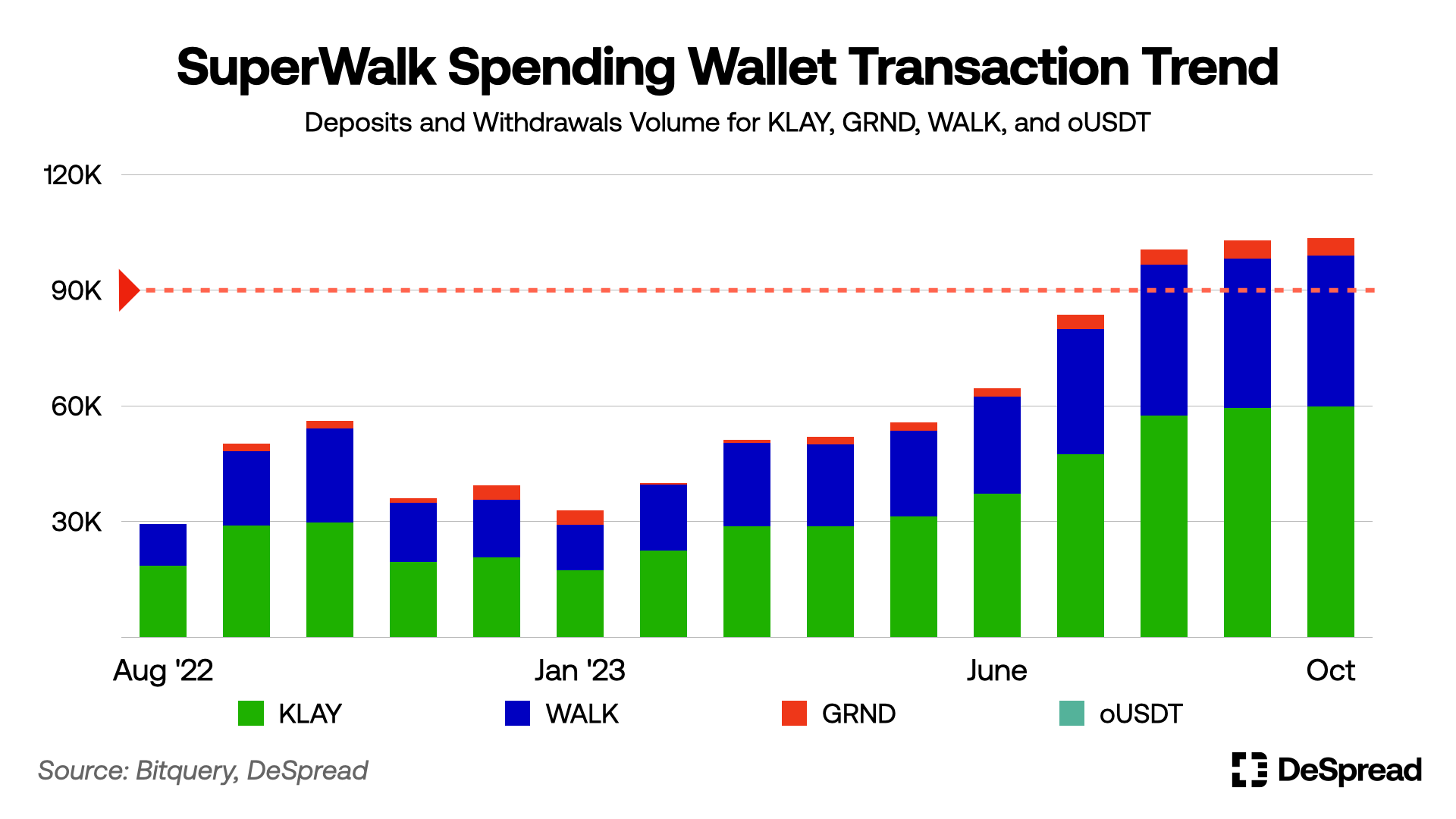

- SuperWalk's Spending Wallet manages four types of assets: KLAY, GRND, WALK, and oUSDT. It is observed that KLAY, primarily used in the in-app marketplace, and WALK, used for shoe NFT repairs and upgrades, dominate the transaction count.

- A detailed analysis of the Spending Wallet's transactions reveals a modest increase immediately after the project's launch, followed by a decline and then a steady increase from June 2023, with over 90,000 transactions recorded from August.

- Notably, the months of September and October saw transaction counts nearing 60,000, indirectly indicating the highest level of user activity.

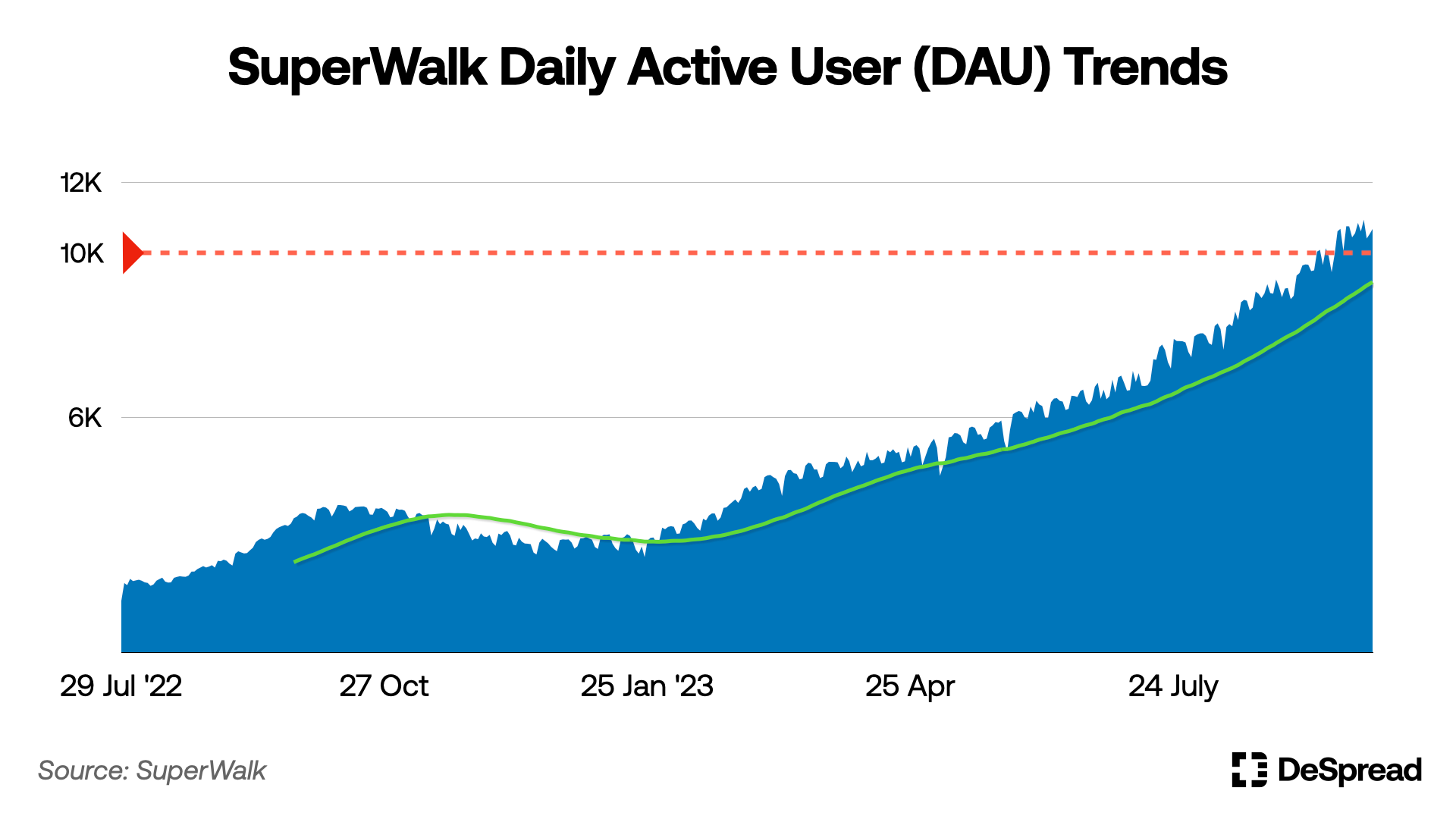

- The user growth trends identified above are further substantiated by the Daily Active Users (DAU) data provided by the SuperWalk team.

- The DAU count began to rise in June 2023, coinciding with an increase in the Spending Wallet transactions. It exceeded 6,000 and continued its upward trend, surpassing 10,000 for the first time on September 11th.

5. Spending Wallet Analysis

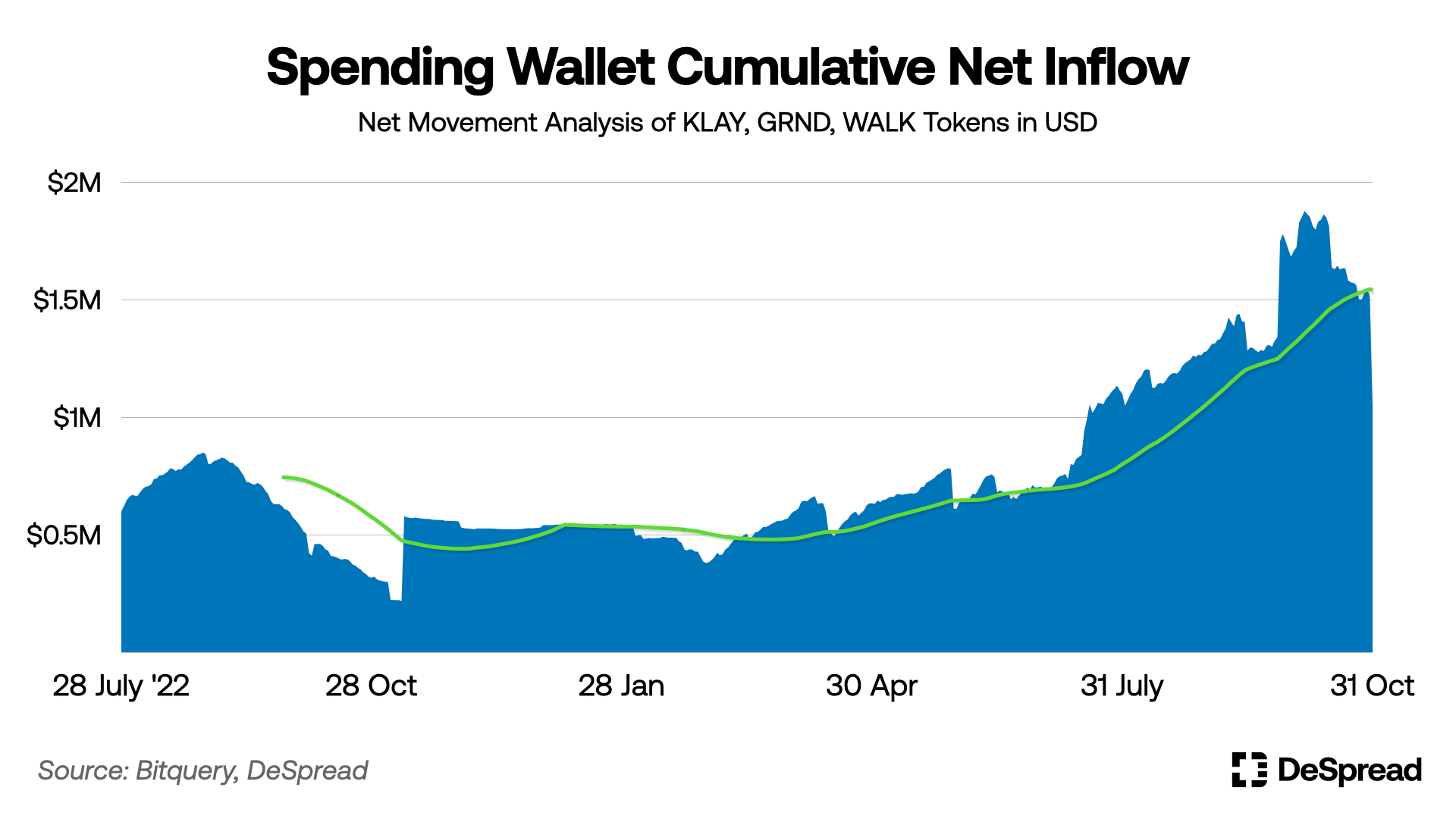

- The above chart provides an analysis of the net worth of inflows and outflows from the Spending Wallet. It uses the daily closing prices in USD for each asset, excluding transactions involving oUSDT due to their relatively minor financial impact.

- Based on the 60-day moving average, the net inflow trend for the Spending Wallet began to rise around March 2023. On October 6th, the wallet’s balance peaked at approximately $1.87 million before showing a downward trend.

- However, it’s important to note that the net inflow and outflow trends, as seen in the chart, may not fully represent user activity. This is due to potential asset movements related to project operations from team-owned wallets, complicating the assessment of the project's overall sustainability based solely on these metrics.

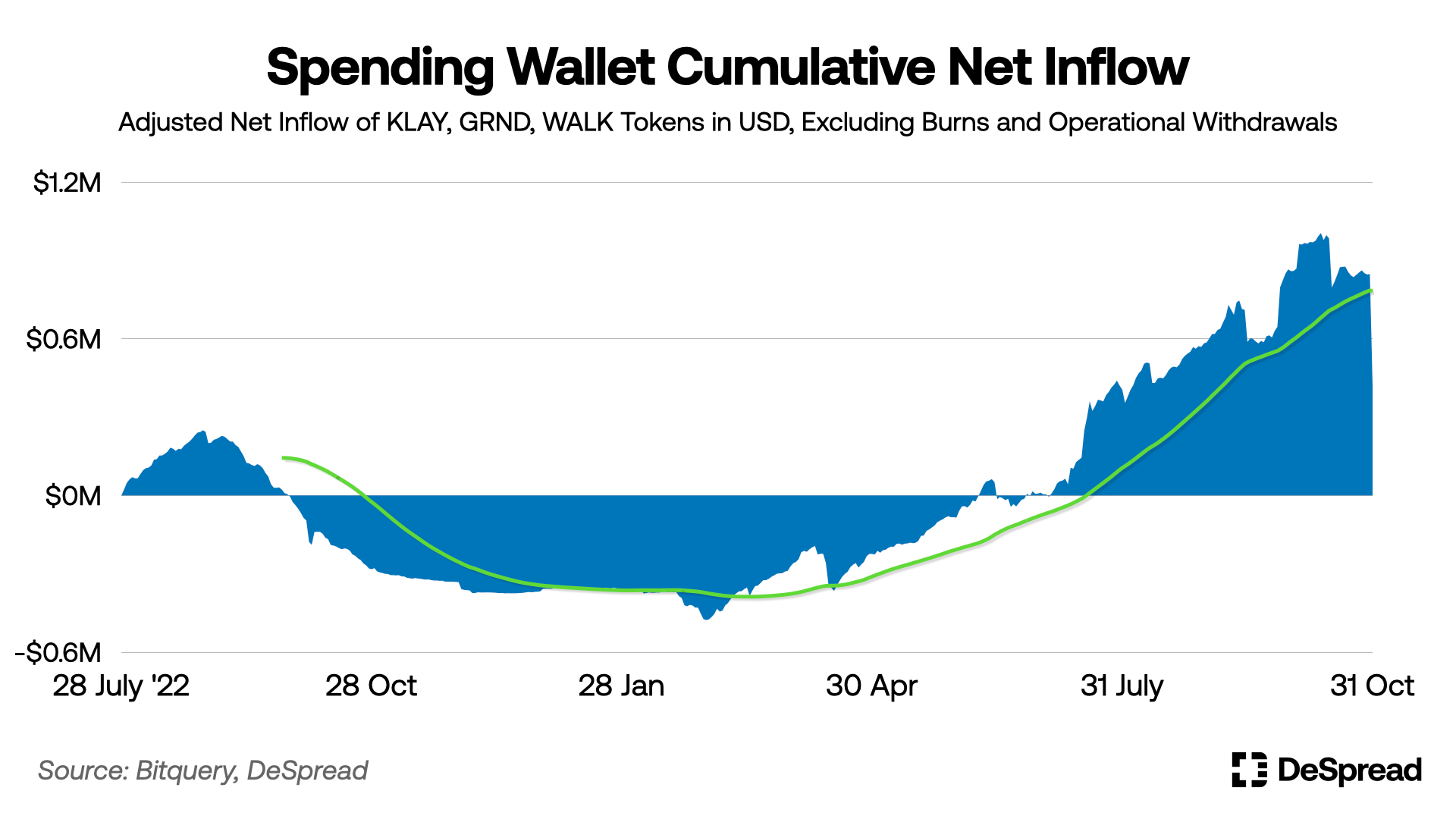

- To accurately access the scale of user asset movements in the Spending Wallet, transactions related to project operations must be excluded. The analysis excludes the following transactions, with the acknowledgment that certain influencing factors may not be fully accounted for:

- Transactions related to the withdrawal of GRND for burning purposes.

- Transactions involving WALK, suspected to be from team-owned wallets.

- Following adjustments for these transactions, the net cumulative flow in the Spending Wallet shifted to a state of net outflow beginning September 28, 2022. This trend of net outflow persisted, reaching its lowest point at approximately $477,000 on February 28, 2023.

- After a period of recovery, the wallet transitioned back to a net inflow state on July 5, 2023. The cumulative net inflow showed an increasing trend, reaching a peak of approximately $997,000 on October 14, 2023.

6. Shoe NFT Minting

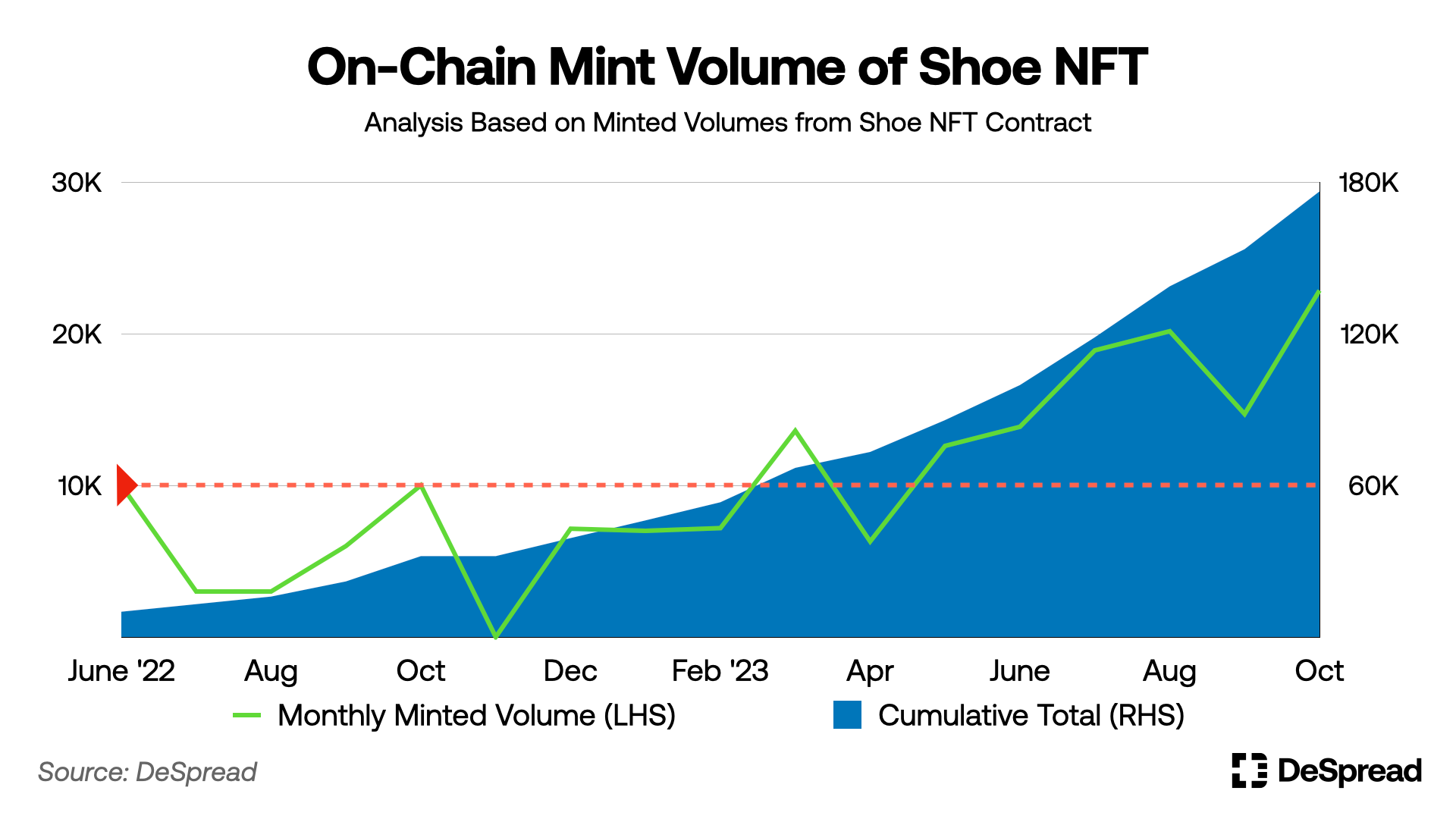

- The graph above shows that the on-chain minting volumes of Shoe NFTs remained mostly below 10,000 units per month until April 2023

- In May 2023, the monthly minting volume exceeded 10,000 units and continued to increase, reaching about 23,000 units in October 2023. This marked the project’s highest minting volume, totaling approximately 176,000 units for the year.

- There were instances like in November 2022 when no Shoe NFTs were minted. This likely stems from the minting process occurring off-chain, leading to discrepancies in on-chain data.

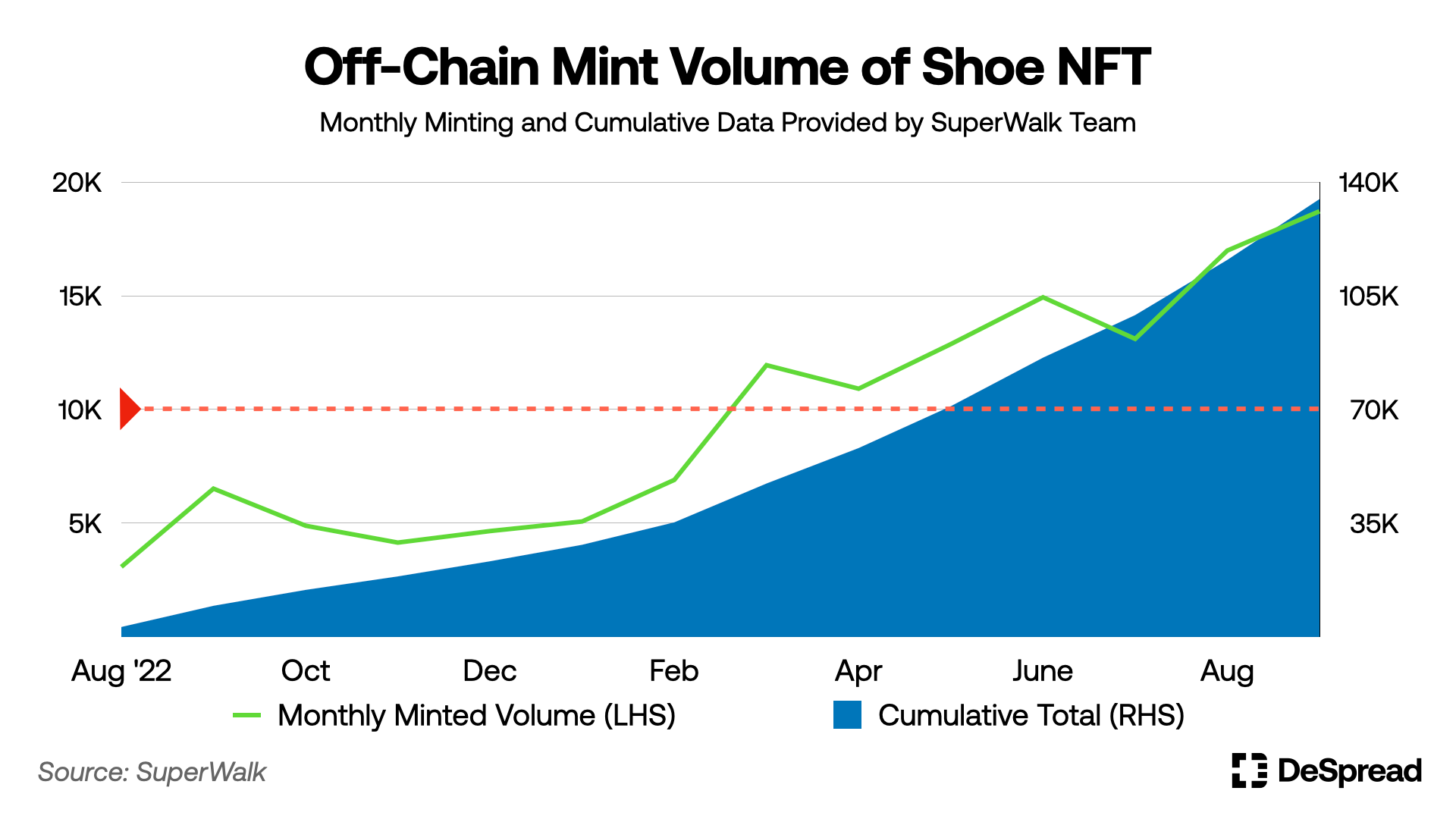

- Off-chain data from the SuperWalk team shows detailed Shoe NFT minting volumes. Until March 2023, monthly volumes were around 5,000 units, but post-March, they consistently exceeded 10,000 units.

- In September 2023, the monthly minting volume peaked at around 19,000 units, with the cumulative total reaching about 134,000 units.

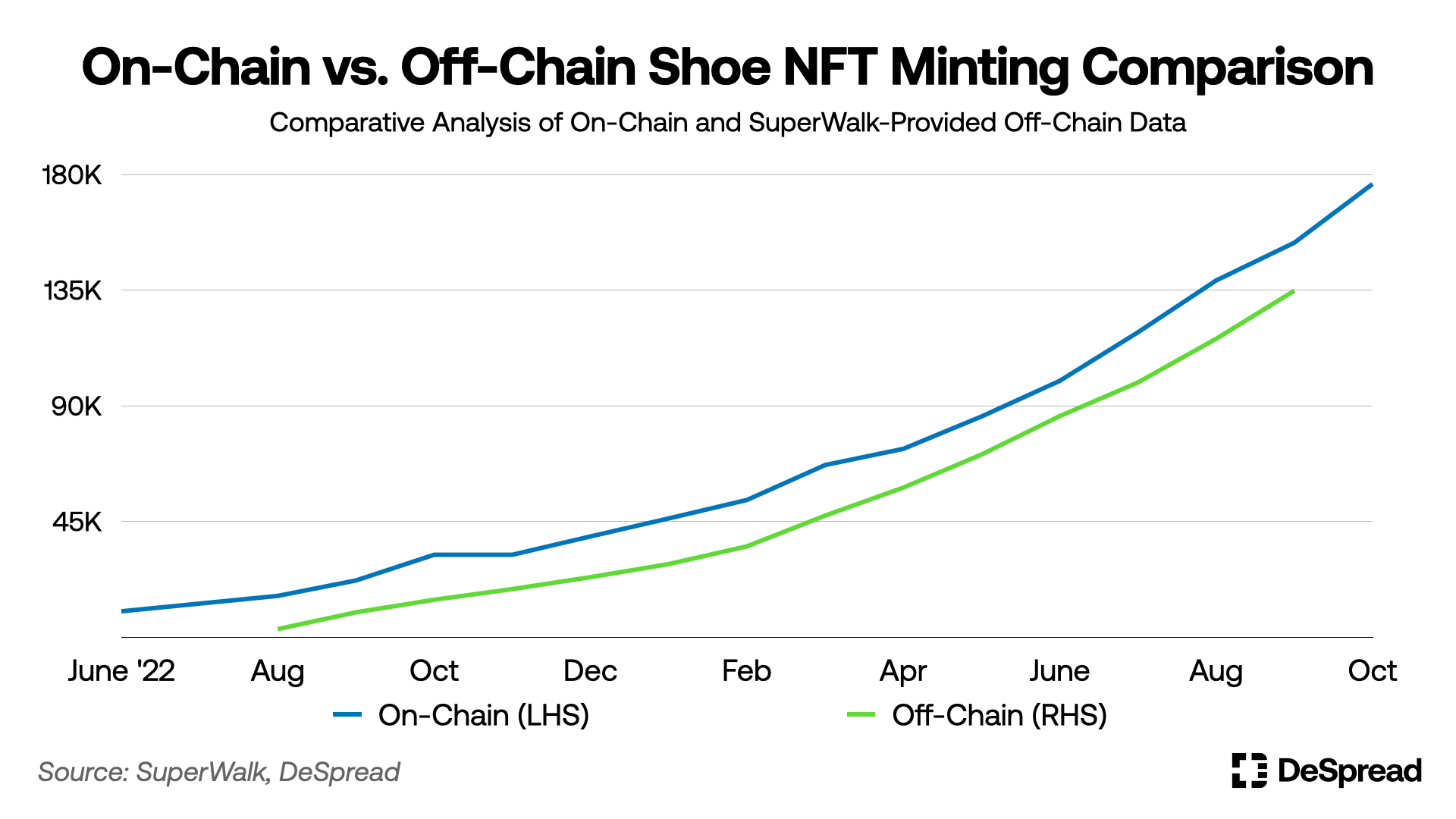

- A comparison of the cumulative minting volumes on-chain and off-chain reveals that on-chain figures are approximately 10,000 to 20,000 units higher. This suggests that on-chain minting typically precedes off-chain processes to proactively address minting requirements.

7. Shoe NFT Trade Volume

- Shoe NFT trades primarily occur in the app's marketplace, making on-chain data inaccessible. However, an analysis was conducted using data from the SuperWalk Discord “👟 | shoe-sales” channel.

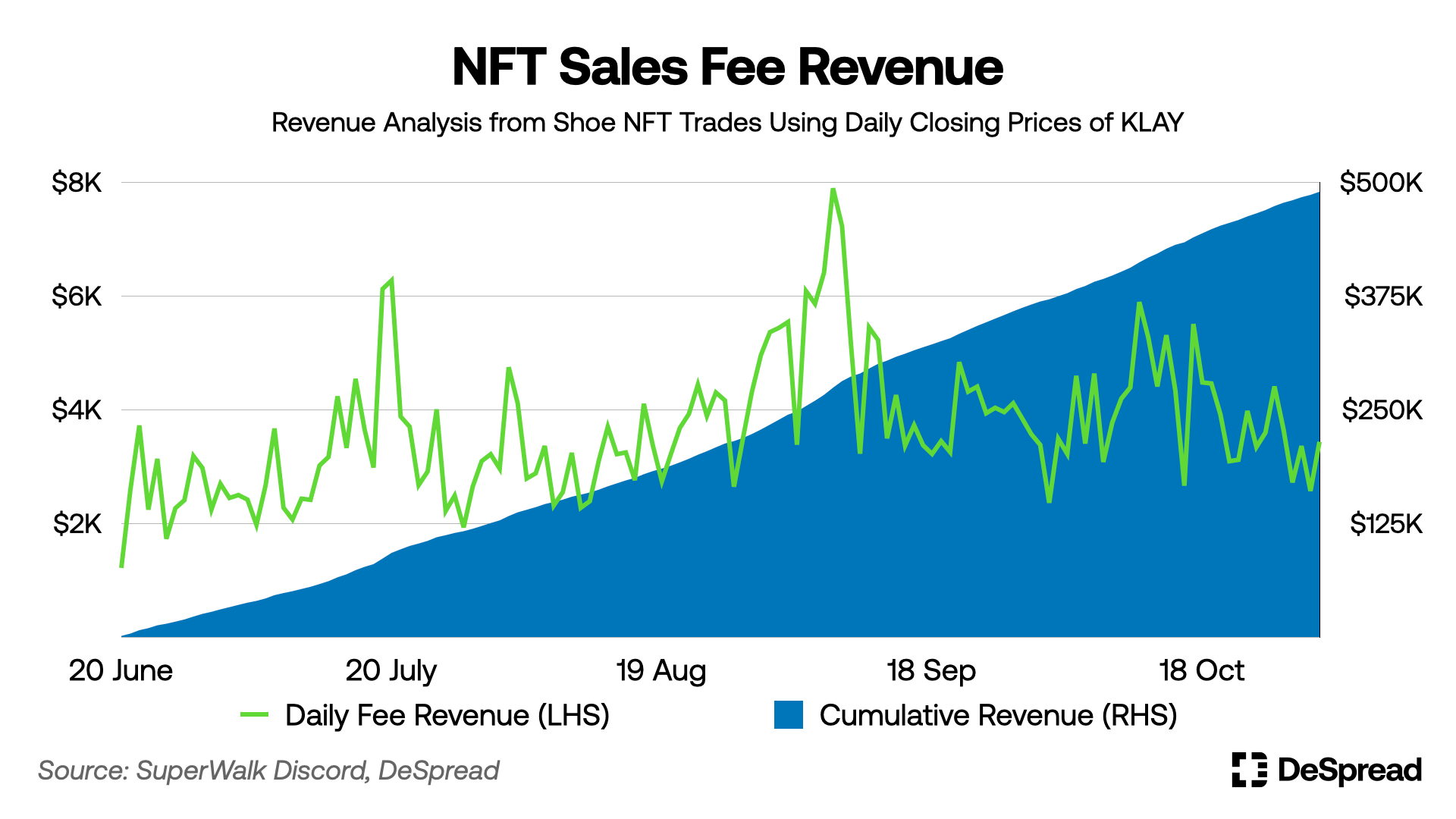

- The analysis starting from June 20, 2023 measured NFT trading volumes using daily KLAY token trades and their USD closing prices.

- In four months, average daily trades were around $60,000, with a peak of $100,000 on September 4, 2023.

- Based on the 20-day moving average, Shoe NFT trading volume rose consistently until September 2023 before showing signs of leveling off. The average daily trade volume in September was about $75,000, dropping to around $65,000 in October.

- According to SuperWalk Docs, the in-app marketplace trading fee is set at 6%. Considering the NFT trading volumes in KLAY tokens and the daily USD closing price of KLAY, the revenue trend from trading fees is as shown in the graph.

- The estimated cumulative revenue from marketplace fees over this period is about $490,000. This analysis assumes immediate conversion of daily fee revenues into USD, so actual revenues may vary.

8. Sustainability Efforts of SuperWalk

SuperWalk's progress can be attributed to its product design which addresses the sustainability issues commonly pointed out in existing M2E projects. Key design features include:

- SWEAT Required for Issuing Shoe NFT

- Users who walk or run using the app can earn SWEAT, a non-exchangeable asset.

- Issuing Shoe NFTs requires SWEAT, preventing non-app users from creating NFTs.

- WALK Tokenomics Design

- A daily reward pool exists for WALK rewards, distributed based on users' daily point rankings.

- The daily pool adjusts to include WALK used for shoe NFT repairs, creation, and leveling, ensuring sustainability.

- Raffle System for WALK Burn

- Regular raffles offer real-world items like game assets or clothing, serving as a method for WALK asset burn.

These systems help prevent excessive inflation, contributing to relative price stability and controlled inflation rates.

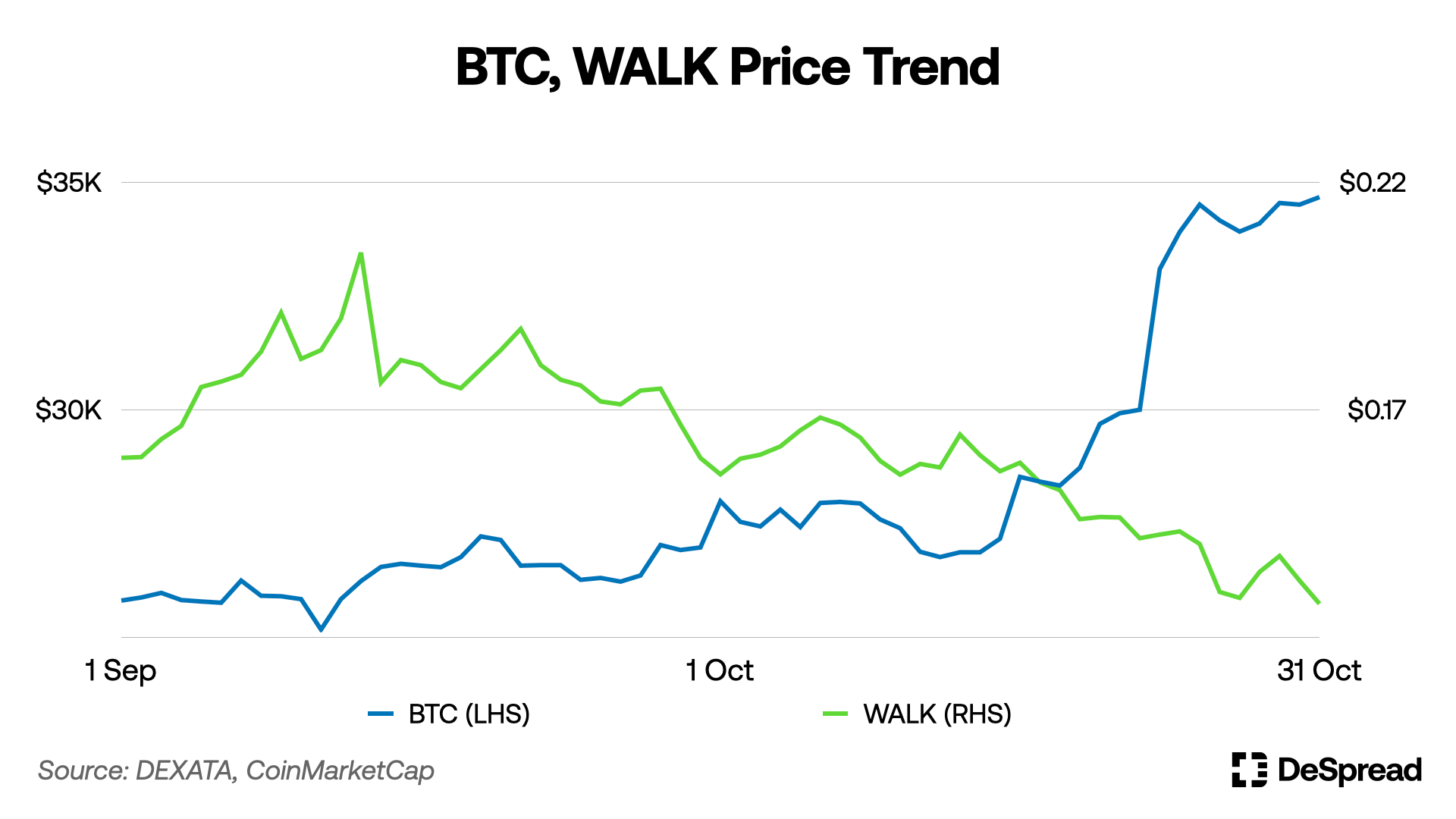

However, these measures alone may not guarantee the project's long-term sustainability. The recent downturn in WALK tokens and Shoe NFT assets, despite overall growth and improving market conditions, remains a notable concern.

The future of SuperWalk remains a subject of keen interest. Its ability to continuously attract new users while retaining existing ones, and to uphold its sustainable design principles, will be crucial in determining its long-term position in the M2E project landscape.