Digital Asset Treasury Company Status Report — September 2025

Focusing on Capital Raising, Premiums, and Digital Asset Holdings

1. Introduction

The success of Strategy, which transformed from a software company into a pioneer of Digital Asset Treasury (DAT) enterprises by incorporating Bitcoin as a strategic asset in August 2020, has demonstrated to companies worldwide the new possibilities of making digital asset strategic acquisition and management their core business model. This innovative business model has now become a key trend connecting traditional financial markets with digital asset markets as of September 2025, serving as a catalyst accelerating institutional investors' adoption of digital assets.

If 2024's representative keyword for the integration of digital assets and traditional finance was 'spot ETF', then 2025 can be called the year of DAT companies. Initially, BTC DATs like Strategy and Metaplanet dominated, but recently they are diversifying into ETH DATs, SOL DATs, and even altcoin DATs that incorporate native tokens of relatively newer protocols like Hyperliquid, Story Protocol, and Ethena as strategic assets.

DeSpread published an in-depth analysis report in July 2025 covering DAT companies' value appreciation flywheel mechanisms, potential risk factors, and strategic recommendations for maintaining NAV premiums. This report serves as a follow-up, comprehensively examining the specific current status of various DAT companies as of September 2025. From BTC DATs led by Strategy to various altcoin DATs including Ethereum, Solana, and Hyperliquid, this report analyzes in detail each company's capital raise status, stock price and premium trends, digital asset holdings, and asset management strategies.

2. BTC DAT

2.1. Strategy

Strategy (NASDAQ: MSTR) was originally a listed company developing enterprise software, but since August 2020, it began large-scale Bitcoin purchases as part of strategic asset allocation, evolving from a software company into the prototype of DAT enterprises. As of September 10, 2025, Strategy holds 638,460 Bitcoins with a market capitalization of approximately $93.6B, reflecting a premium of about 30% above the Net Asset Value (NAV) of its Bitcoin holdings.

Capital Raise Status

Strategy raises capital from traditional financial markets through convertible bonds, ATM (At-The-Market) stock issuances, and perpetual preferred shares to accumulate Bitcoin.

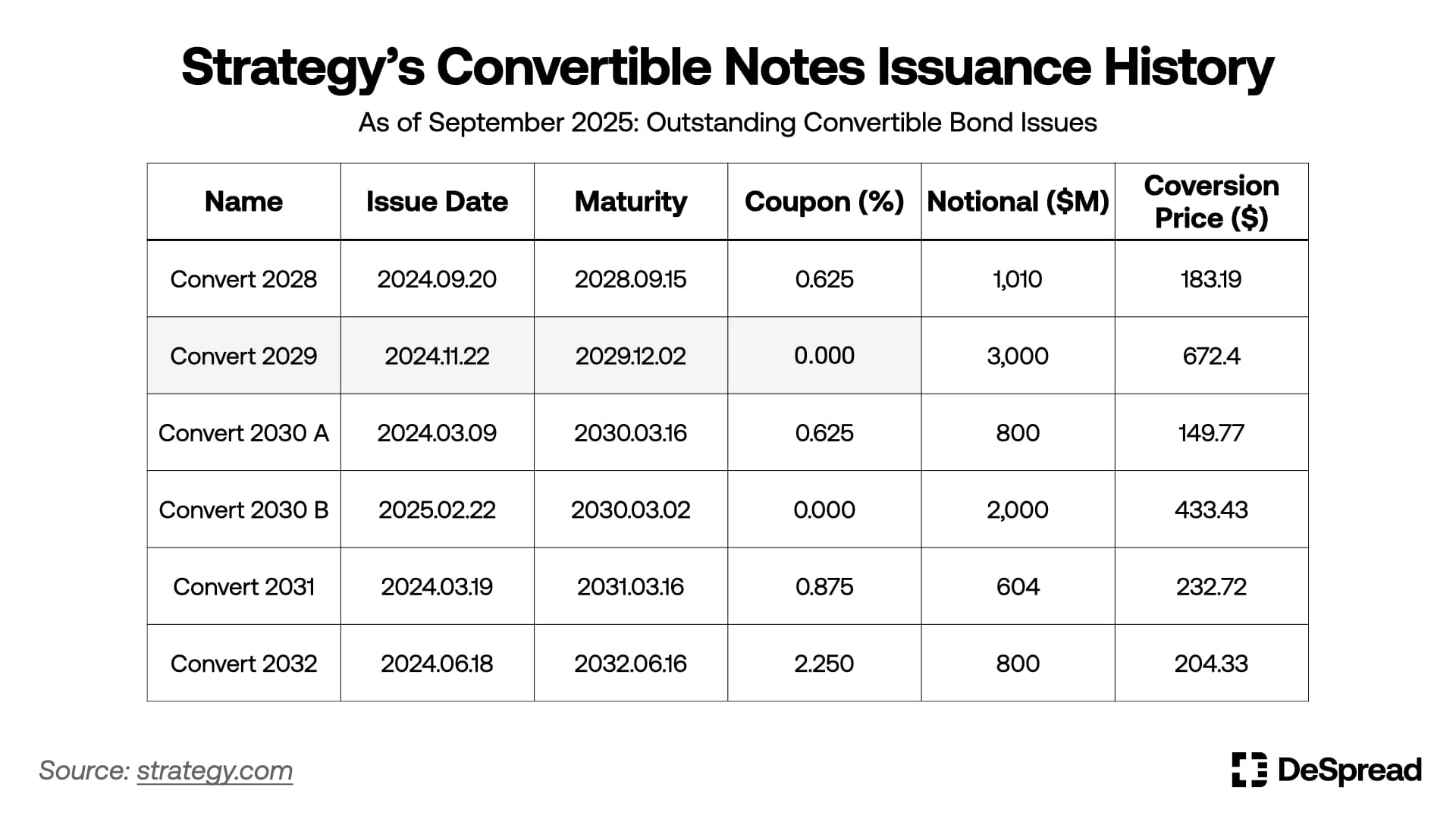

Strategy has issued convertible bonds more than 8 times since 2020, most with near-0% low interest rates. Each convertible bond's conversion price is set at a 30%~50% premium above the stock price at the time.

Strategy has also raised funds through ATM stock issuances whenever NAV premiums were high. ATM refers to continuously selling stocks at market prices in the open market within pre-disclosed ranges to the SEC. DAT companies prefer ATM as it allows them to raise funds for digital asset purchases with equity capital without additional debt issuance, minimizing premium dilution.

Strategy announced the "21/21 Plan" last October, aiming to raise a total of $42B over 3 years through $21B in ATM and $21B in bond issuance. However, achieving ATM targets faster than expected, Strategy expanded from the existing "21/21 Plan" to the "42/42 Plan" in May 2025 by announcing an additional $21B MSTR ATM.

Furthermore, Strategy recently launched various preferred stock products (STRD, STRK, STRC, STRF) and diversified funding methods through ATM sales. Each preferred stock's characteristics are as follows:

- STRK: Launched February 2025, 8% fixed annual dividend, convertible to common stock at 10:1 ratio

- STRF: Launched March 2025, 10% fixed annual dividend, not convertible to common stock

- STRD: Launched June 2025, 10% fixed annual dividend, not convertible to common stock

- STRC: Launched July 2025, maintains $100 par value through variable dividends, BTC 5:1 over-collateralized, not convertible to common stock

Particularly during March-June 2025 when ATM issuance was suspended due to low NAV premiums, perpetual preferred shares served as flexible alternatives for fundraising. This provides advantages of expanding the fixed-income investor base and enabling premium monetization even during low market volatility periods. However, cash flow burden from fixed dividends and uncertain market acceptance remain risk factors, with funding effectiveness varying based on actual investor demand. Consequently, this forms part of Strategy's strategy to monetize NAV premiums in various ways, complementing convertible bonds and ATM issuances.

Stock Price and Premium Trends

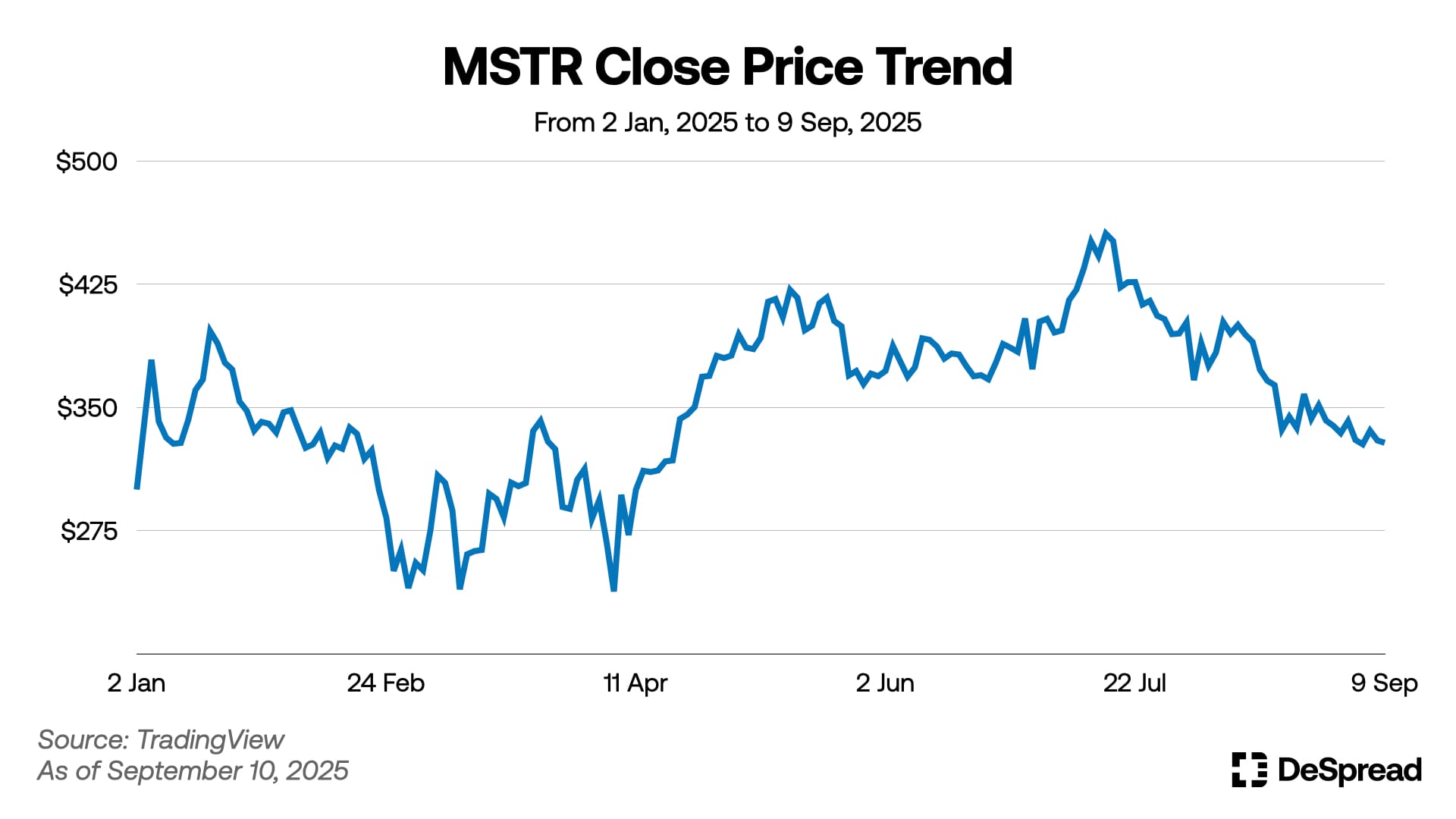

The above graph shows MSTR's closing price trends from January 2, 2025, to September 9, 2025. MSTR has generally tracked Bitcoin price movements while showing higher volatility as a structured Bitcoin leverage product accessible to institutions in traditional financial markets. When Bitcoin plummeted to approximately $76,329 in early April, MSTR's price also recorded its yearly low at $272.34. During Bitcoin's price recovery in July, it reached its highest price of $455.9. Currently, as Bitcoin has hit all-time highs but subsequently declined and moved sideways, MSTR has also fallen and remains around $330.

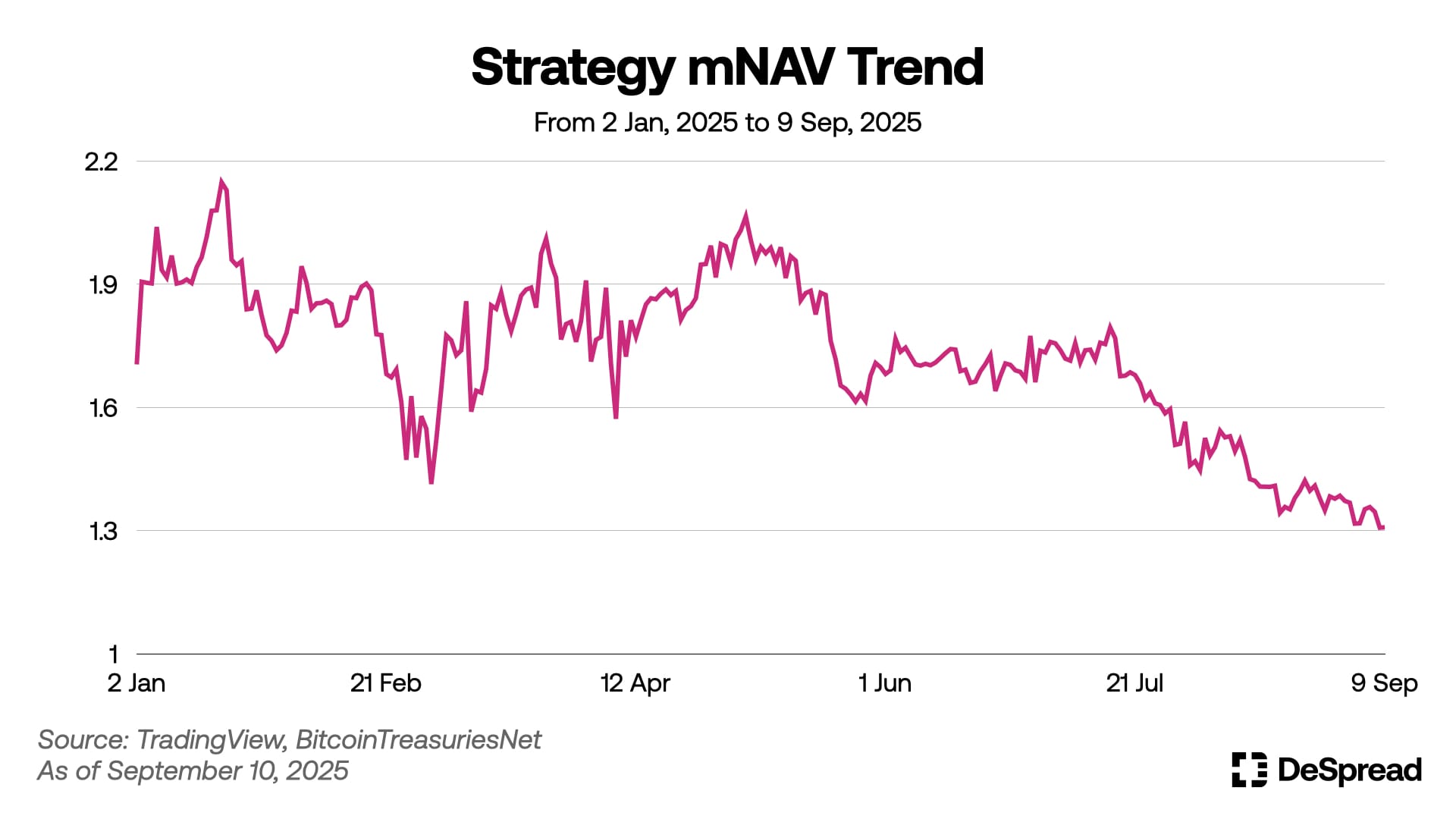

The above graph shows the premium trend (mNAV) of Strategy's market capitalization relative to its Bitcoin holdings value from January 2, 2025, to September 9, 2025. NAV premium is a key element for activating the value appreciation *flywheel not only for Strategy but for all DATs, with all companies pursuing various strategies to maintain premiums above 1.0.

*DAT Company Value Appreciation Flywheel: Asset Holdings → NAV Premium Formation → High-valued Stock Issuance → Additional Digital Asset Purchases → Asset Growth → Premium Maintenance

Strategy maintained premiums between 1.5 and 2.5 until July 2025, but from August onwards, it has failed to maintain the long-held premium level of 1.5. Currently, Strategy's mNAV continues to decline, staying at the 1.3 level as of September 10.

Digital Asset Holdings

Strategy has positioned itself as the world's largest DAT company by accumulating Bitcoin since August 2020, currently holding 638,460 Bitcoins as of September 2025. Holding over 3% of Bitcoin's total supply of 21 million, Strategy has reportedly never sold Bitcoin since starting accumulation. Notably, on July 29 this year, it purchased 21,021 Bitcoins, the largest quantity since 22,048 BTC on March 31.

This large-scale accumulation has further highlighted Strategy's presence in both digital asset and traditional financial markets, leading institutional investors' digital asset adoption trends. As of September 10, 2025, Strategy's average Bitcoin purchase price is $73,880, recording over 56% unrealized profits and leading the DAT trend.

Asset Management Strategy

As emphasized in previous DAT reports, for DAT companies to maintain value consistently even during market downturns, they need to efficiently manage their digital assets and develop sustainable business models. Recent Ethereum and Solana on-chain DAT companies have been creating additional revenue through staking and DeFi utilization of their digital assets, sharing this trend.

However, for Bitcoin, since the ecosystem and technical development haven't reached levels enabling smooth on-chain utilization at institutional scales, BTC DAT companies including Strategy are creating additional revenue using traditional financial mechanisms with their Bitcoin holdings.

A representative example is Strategy's CEO Michael Saylor publicly stating his consideration of financial products using Bitcoin as real estate mortgage collateral in discussions with the Federal Housing Finance Agency (FHFA) director. As Bitcoin is now recognized as a legitimate alternative investment asset in traditional financial markets, this indicates intentions to pioneer new revenue sources as institutionalized financial products rather than developing on-chain ecosystems that carry numerous technical risks.

2.2. Metaplanet

Metaplanet (TSE: 3350), listed on the Tokyo Stock Exchange, abandoned its existing music production and hotel management businesses to transform into a Bitcoin DAT company. As of September 10, 2025, Metaplanet holds 20,136 Bitcoins with a market capitalization of approximately $5B, reflecting a premium of about 40% above its Bitcoin NAV.

Capital Raise Status

Rather than utilizing internal reserves, Metaplanet adopted an approach of attracting external capital from the start to purchase Bitcoin. EVO Fund, which has secured a dominant position in PIPE (Private Investment in Public Equity) for Japanese small and mid-cap stocks, participates as Metaplanet's key partner. EVO Fund has functioned as a structural designer for Metaplanet's current position, beyond being a simple capital provider.

The main funding structure uses MS Warrants (Moving Strike Warrants) exclusively acquired by EVO Fund. All warrants are exclusively acquired by EVO Fund, configured as private deals enabling rapid capital execution regardless of market reaction. This structure provides clear competitive advantages to Metaplanet in terms of funding speed and consistency. Particularly in Bitcoin's high volatility environment, the ability to raise tens of billions of Japanese yen within days provides strategic execution advantages over competitors. In fact, on June 6, Metaplanet announced a $5.3B funding plan through EVO Fund, representing Japan's largest stock warrant issuance in history.

Stock Price and Premium Trends

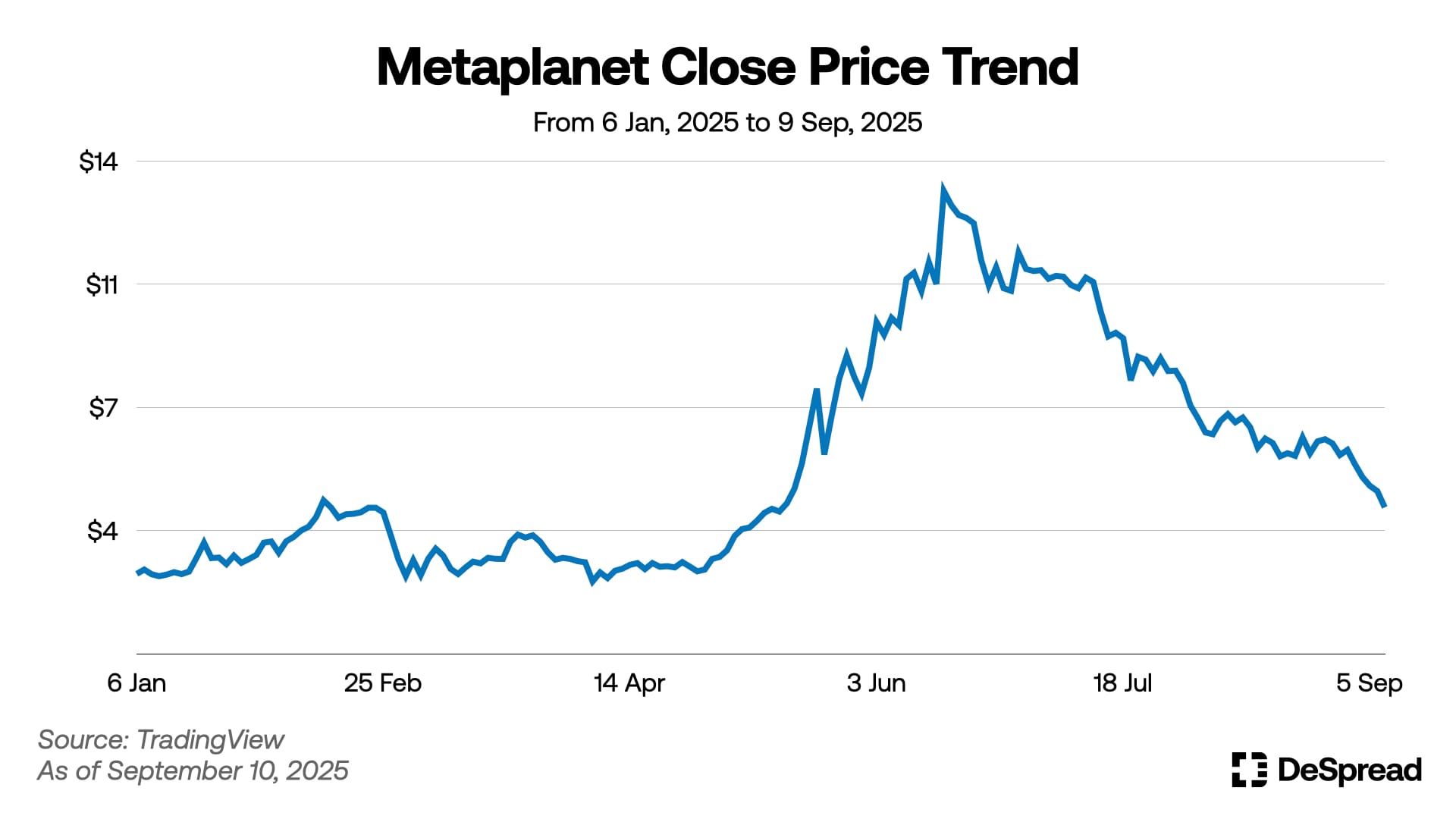

The above graph shows Metaplanet's dollar-based closing price trends from January 2, 2025, to September 9, 2025. After officially initiating its Bitcoin accumulation strategy in April 2024, Metaplanet's stock price recorded overwhelming growth of over 96 times from approximately 20 JPY in early 2024 to a maximum of 1,930 JPY in June 2025. During times when DAT companies were not as diverse as today, Metaplanet was able to rapidly elevate its corporate value through branding as "Japan's Strategy" and fast-paced Bitcoin accumulation. As of September 2025, Metaplanet's price is recording around 580 JPY (approximately $4).

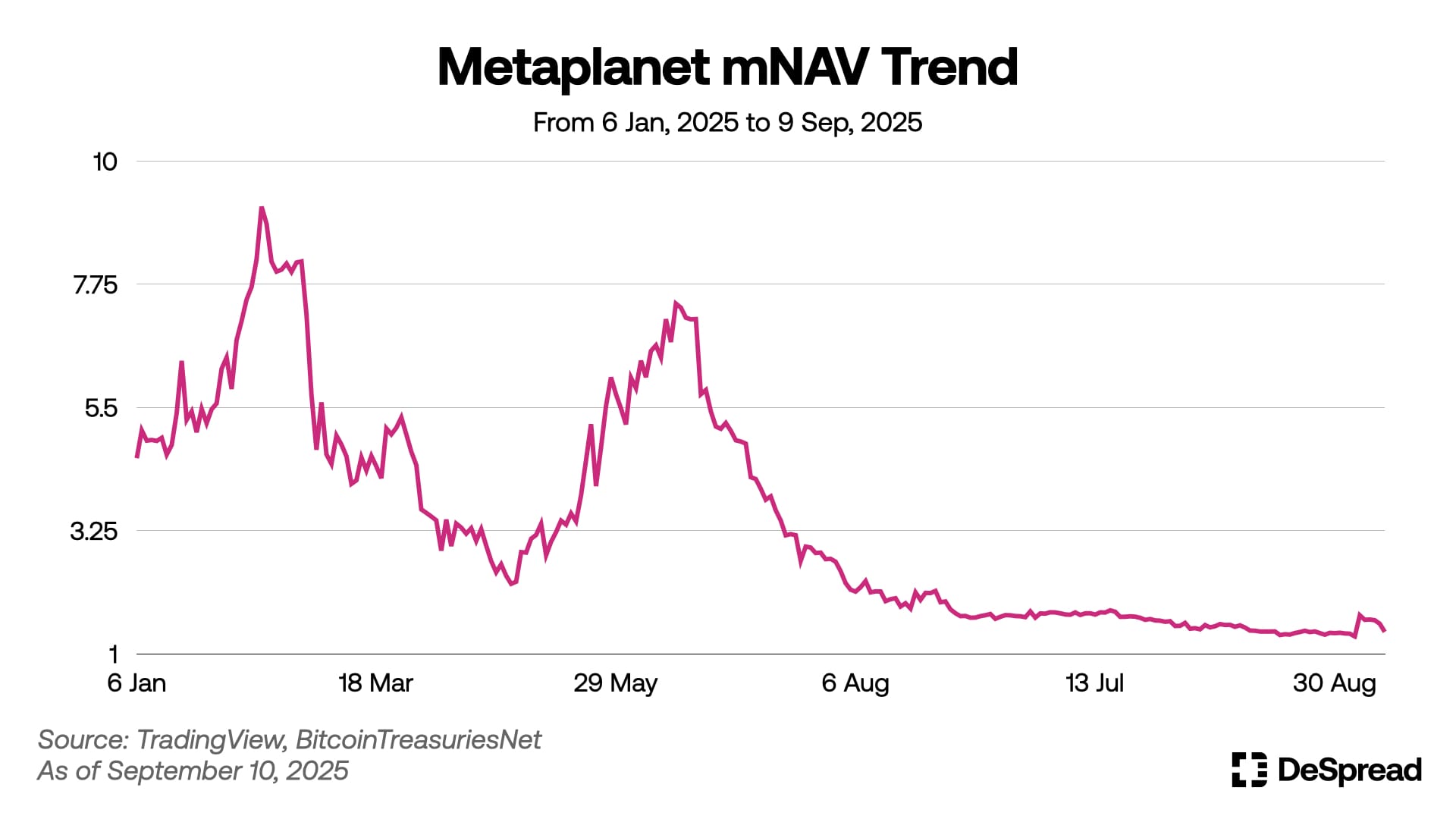

The above graph shows Metaplanet's market capitalization premium (mNAV) relative to its Bitcoin holdings value from January 6 to September 9, 2025. Metaplanet's mNAV showed dramatic fluctuations alongside its stock price, recording a maximum of 9.17 in February 2025. Since June 2025, as Metaplanet's stock price declined, mNAV has also continuously fallen from 7.4 to the current 1.4.

Digital Asset Holdings

Since first accumulating Bitcoin in April 2024, Metaplanet has aggressively accumulated 20,136 BTC in just 17 months. Like Strategy, it hasn't sold any Bitcoin holdings as of September and holds the 6th largest Bitcoin holdings among global public companies.

Metaplanet is currently operating the "555 Million Plan," issuing 555 million shares to raise $5.4B, aiming to secure 210,000 Bitcoins (1% of Bitcoin's total supply) by 2027. The phased targets are 30,000 BTC by end of 2025, 100,000 BTC by end of 2026, and plan completion by 2027.

Asset Management Strategy

Like Strategy, Metaplanet is exploring Bitcoin management solutions through harmony with traditional financial markets. Metaplanet's CEO Simon Gerovich expressed ambitions in a July interview with Financial Times to use Bitcoin holdings for business acquisition funding. Specifically, Simon hinted at goals to acquire digital banks in Japan to provide superior and convenient financial services to retail businesses.

This strategy connects with the aforementioned "555 Million Plan," interpreted as intentions to establish a foundation for service provision through massive Bitcoin purchases over 4-6 years, then utilize Bitcoin as legitimate collateral assets recognized by traditional financial markets to create new revenue sources.

2.3. BitPlanet (formerly SGA)

BitPlanet (formerly SGA, KOSDAQ: 049470) transformed from an information security solution specialist to a BTC DAT company on July 14, 2025, with large-scale capital increase. BitPlanet's largest shareholder is Asia Strategy Partners, led by Jason Fang, founder of Sora Ventures, widely known as a Metaplanet investor. Additionally, various qualified investors including Korean leading activist fund KCGI and Simon Gerovich, Metaplanet's representative, participated.

Capital Raise Status

BitPlanet decided to raise approximately 35 billion won (about $25M) through capital increase on July 14, 2025. The funding started on September 10 and is scheduled to complete on September 24. Following the capital increase, the number of issued shares will approximately double from 58,862,249 shares pre-increase to 117,724,498 shares. Newly issued shares are subject to one-year custody measures for stock price stability, deposited with Korea Securities Depository, making short-term sales impossible.

Additionally, the company secured additional funding through affiliate restructuring. SGA sold all SGA Solutions shares (18,851,987 shares, approximately 13.7 billion won) to SGA Holdings, securing additional DAT operating funds. This represents efficient fund management structure through intra-group fund transfers rather than external capital raising.

Stock Price Trends

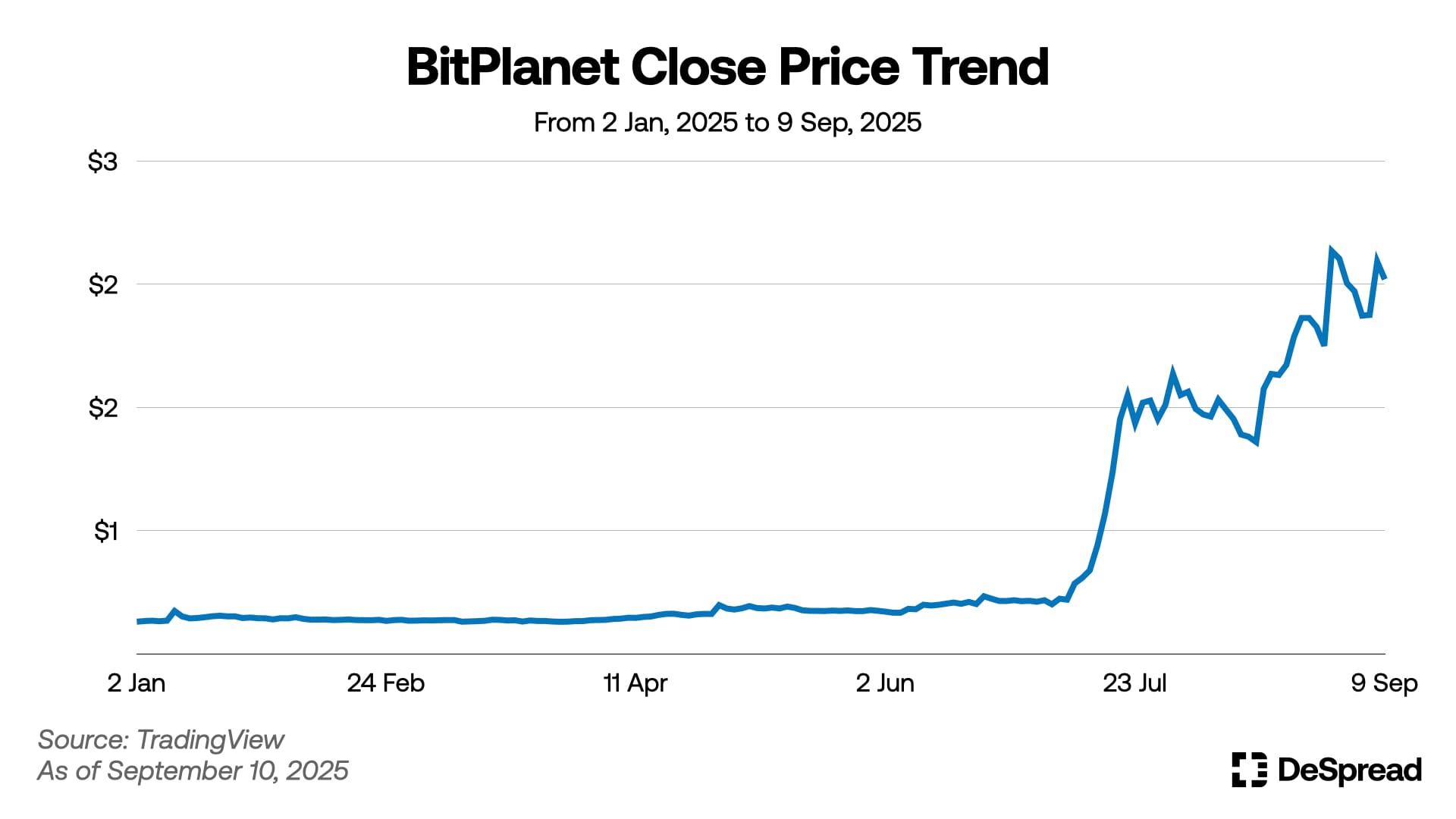

BitPlanet's stock price began surging from late June, currently recording over 11x growth compared to the beginning of the year at 3,300 KRW (approximately $2.3) as of September 10.

Since BitPlanet hasn't yet begun full-scale Bitcoin accumulation, calculating mNAV based on Bitcoin holdings like Strategy and Metaplanet presents difficulties. However, assuming all operating funds of approximately 48.2 billion won (about $35M) secured through capital increase and share sales are allocated to Bitcoin purchases, the mNAV would be approximately 4.04 as of September 12, or approximately 8.07 if new shares are issued while maintaining current stock prices.

Leading Korean DAT Company

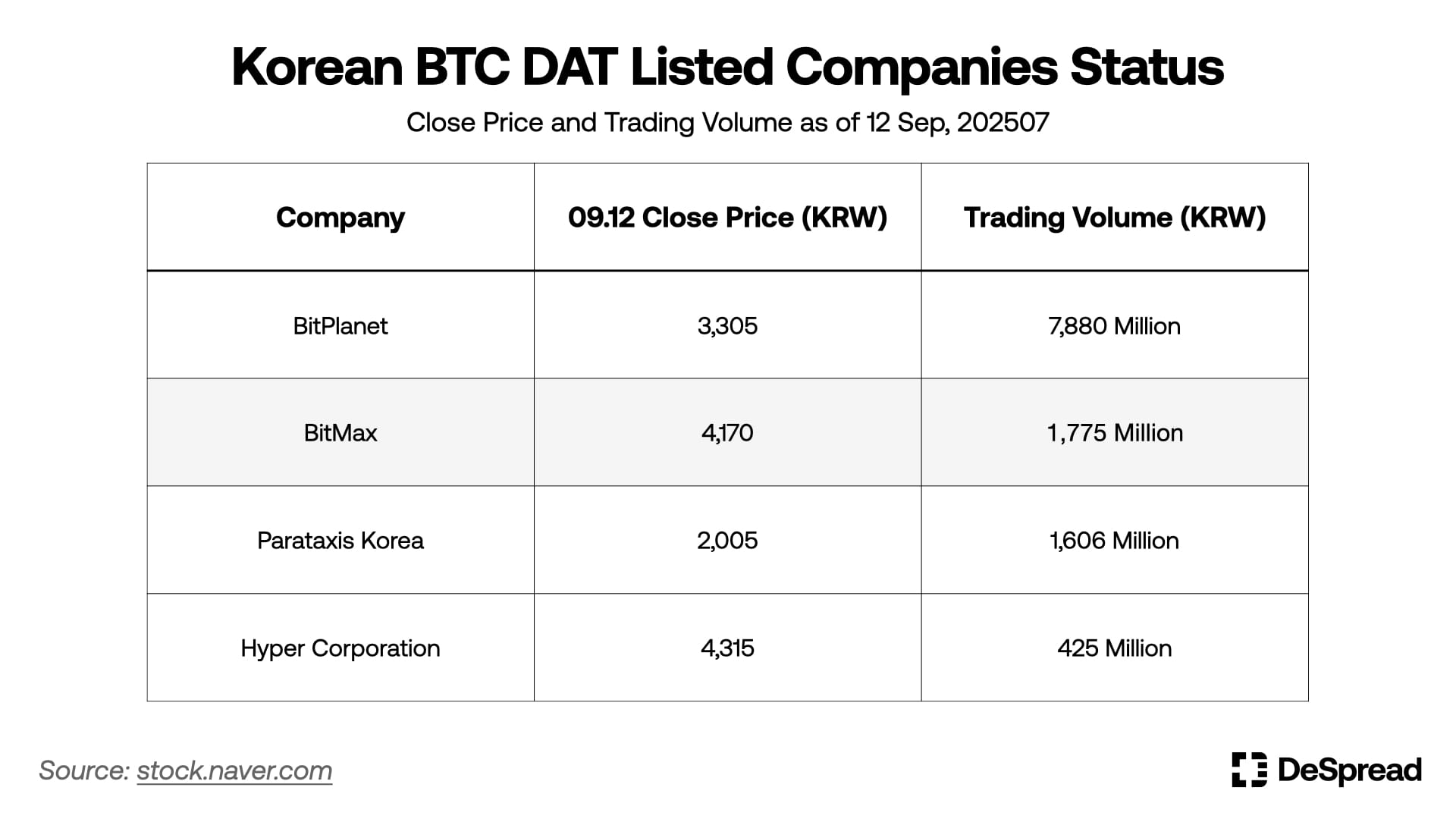

Currently, the Korean Bitcoin DAT market is an early-stage market with 4 listed companies competing. Based on September 12, 2025 stock prices and trading volumes, BitPlanet shows dominant market attention.

In terms of trading volume, BitPlanet recorded 788 billion won, significantly outpacing other competitors. This represents approximately 4.4x that of second-place BitMax (177.5 billion won), 4.9x that of third-place Parataxis Korea (160.6 billion won), and 18.5x that of fourth-place Hyper Corporation (42.5 billion won).

However, as seen in Metaplanet's case and numerous emerging DAT companies, whether BitPlanet can maintain its current upward trajectory and position while fully launching Bitcoin accumulation and operating DAT models remains uncertain.

3. ETH DAT

3.1. Bitmine Immersion Technologies

Bitmine Immersion Technologies (NYSE: BMNR) was originally a Bitcoin mining company but transformed into a DAT company focusing on Ethereum as its core asset through $250M funding on June 30, 2025. Bitmine brought on Tom Lee, co-founder of Fundstrat, as board chairman, rapidly transforming into the world's largest and fastest ETH DAT company. As of September 10, 2025, Bitmine holds over 2 million Ethereum, becoming the largest Ethereum-holding company among ETH DAT companies.

Capital Raise Status

Bitmine's strategic Ethereum accumulation funding began in earnest in June, showing a pattern of gradual expansion. Starting with an $18M public offering on June 6, by June 30, they issued a total of $250M in PIPE and pre-funded warrants. This funding was conducted through a hybrid cash and digital asset (BTC and ETH) payment method, with participation from 59 qualified investors including Peter Thiel, Pantera Capital, Kraken, and Galaxy Digital. The funding breakdown by payment method is as follows:

- Cash: 36,309,592 common shares issued at $4.50 per share

- Pre-funded warrants: 11,006,444 shares at $4.4999 each

- Digital assets: 8,804,122 common shares issued at $4.50 per share

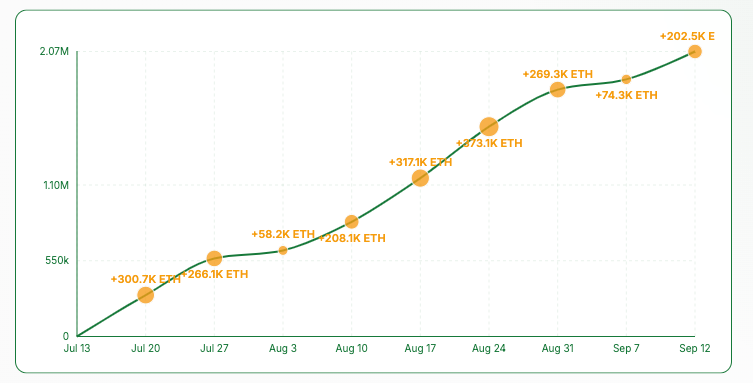

Starting July 9, they introduced ATM with an initial limit of $2B, which was rapidly increased to $4.5B on July 25, and further to $24.5B on August 12. According to Bitmine's August 12 disclosure, BMNR shares already sold total 106.58 million with total raised funds of approximately $4.5B, already reaching the maximum limit increased on July 25. Therefore, completing the planned $24.5B ATM based on BMNR's price of $58.9 could enable selling up to an additional 339.09 million shares.

Stock Price and Premium Trends

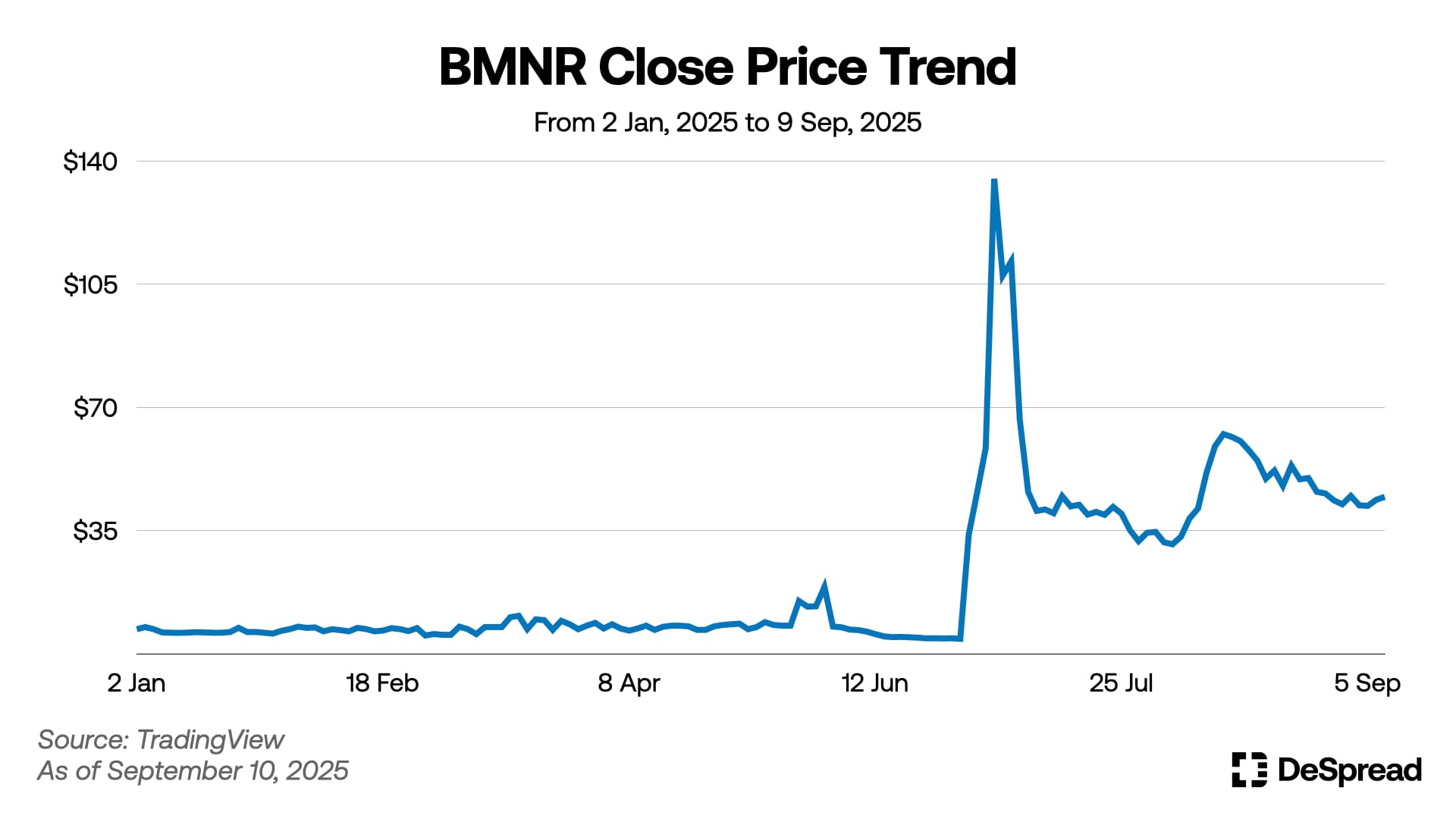

BMNR's stock price recorded dramatic growth after beginning fundraising for strategic Ethereum accumulation in late June. Following the announcement of $250M fundraising, BMNR's closing price soared from the previous day's $4.265 to $33.9 on the same day, recording nearly 8-fold growth. The stock continued its vertical climb until July 3, when the fundraising was announced, recording a high of $135.5. However, it subsequently showed extreme volatility, falling to around $31, recovering to $60 in August amid Ethereum's rise and Tom Lee's spotlight as the 'Michael Saylor of ETH DAT,' but recently experiencing a decline and staying around $44.

Trading volume has been substantial, with daily average trading volume recording $1.7B as of September 5, 2025. This ranks 30th among U.S. stocks, positioned between Bank of America (29th) and ExxonMobil (31st). Moreover, Korean individual investors net purchased $253M worth of BMNR during August, showing keen interest in ETH DAT.

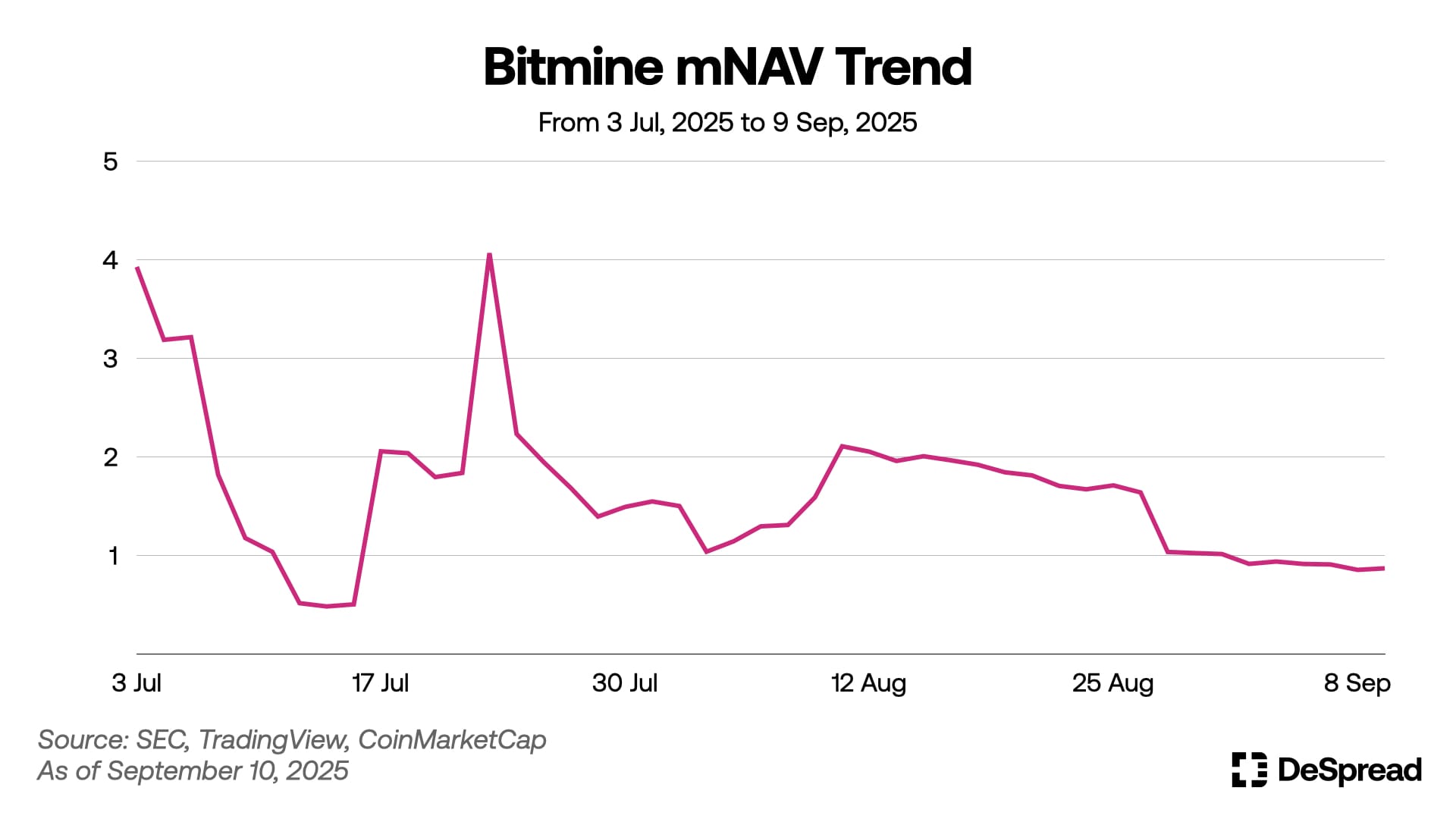

The above graph shows Bitmine's mNAV from July 3, 2025, when it announced its pivot to ETH DAT, through September 9. Here, mNAV represents the premium Bitmine's market capitalization holds considering only the value of its Ethereum holdings, excluding Bitcoin and cash.

In early July, Bitmine reached approximately 4.0 mNAV amid explosive market interest, but has repeated dramatic fluctuations due to Bitmine's large-scale Ethereum purchases, Ethereum price movements, stock issuances through ATM, and waning speculative inflows. During August, when Korean individual investors' interest concentrated, it generally maintained mNAV above 1.5 with the flywheel operating solidly, but currently has fallen to around 1.0.

Various factors contribute to this, including large-scale stock issuances and sales, extreme volatility in digital assets, but particularly NASDAQ's announcement on September 4 to strengthen regulations on reckless DAT companies appears to have had significant impact.

However, Bitmine stated its position that it is unaffected by NASDAQ's regulatory strengthening, citing three reasons: first, Bitmine is listed on the New York Stock Exchange (NYSE), not NASDAQ, so it is not subject to NASDAQ regulations; second, it has already received shareholder approval for new stock issuances for digital asset purchases; and finally, it purchases Ethereum with cash rather than issuing new shares.

Digital Asset Holdings

Bitmine aims to secure 5% of total $ETH supply under "The Alchemy of 5%" goal, accumulating Ethereum at historically fastest pace. As of September 10, 2025, Bitmine holds approximately 2.07 million Ethereum, becoming the entity holding the most Ethereum among all ETH DAT companies, exchanges, DAOs, and protocols worldwide. Besides Ethereum, it holds 192 Bitcoin and $266M in unsecured cash.

Asset Management Strategy

Bitmine operates $ETH treasury strategies for Ethereum network and its own value appreciation, entering a 10-year consulting contract with Ethereum Towers LLC on July 9. Ethereum Towers handles partner selection and operations for Ethereum trading, staking, and DeFi activities to increase Bitmine's Ethereum holdings and create continuous revenue.

Furthermore, Bitmine recently announced its "Moonshot" strategy to support innovative projects strengthening the Ethereum ecosystem. As the first initiative, Bitmine invested $20M in Eightco Holdings (NASDAQ: OCTO), a Worldcoin ($WLD) DAT company. Bitmine stated plans to invest 1% of its assets in the "Moonshot" strategy, emphasizing ETH DAT flywheel by creating pipelines connecting Ethereum ecosystem growth to Bitmine shareholder value appreciation.

3.2. Sharplink Gaming

SharpLink Gaming (NASDAQ: SBET) was originally an online sports betting platform but transformed into an ETH DAT company in May 2025, making strategic Ethereum acquisition and management its core business model. As the first ETH DAT company to emerge prominently, SharpLink holds approximately 840,000 ETH as of September 10, becoming the second-largest Ethereum-holding institution after Bitmine.

Capital Raise Status

SharpLink Gaming's first funding for Ethereum purchases was announced on May 27. The $425M PIPE involved various institutional investors including Pantera Capital, Founders Fund, Galaxy Digital, and Multicoin Capital. Of the total $425M raised, $25M was allocated for existing sports betting operations and debt servicing, with the remainder dedicated to Ethereum treasury construction and accumulation.

From June, they focused on ATM funding. SharpLink Gaming raised $529.1M through ATM stock sales from June 16 to July 13, with all proceeds used for ETH accumulation. Subsequently, the company expanded ATM limits from $1B to $6B on July 17, expressing more aggressive Ethereum accumulation ambitions.

ATM funding continues to serve as the main source for Ethereum purchases through September, raising over $1.2B since the limit increase. Additionally, on August 6, they registered a $200M Registered Direct Offering (RDO). RDO differs from ATM in that while both involve public market sales, RDO fixes share prices at discounted rates for transactions with institutional investors rather than market prices. SharpLink Gaming has raised a total of $600M through RDO in two August transactions.

Based on August 29 disclosures, current SBET issued shares total 194,067,724, with approximately 276,781,662 unissued shares available, totaling about $4.5B at current $16.3 price.

Stock Price and Premium Trends

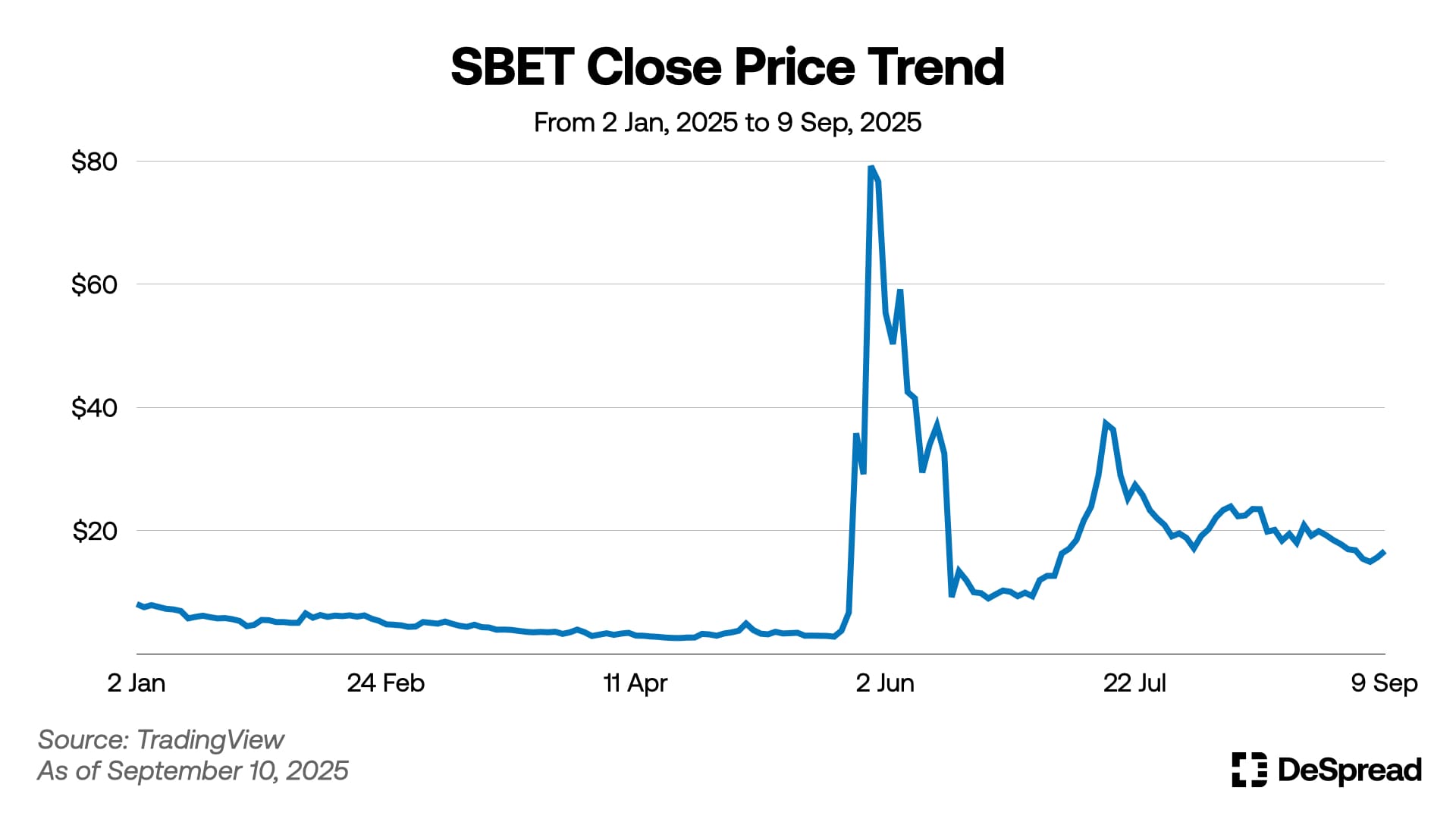

SBET's stock price rose dramatically after beginning fundraising for strategic Ethereum accumulation in late May. Following the first PIPE announcement, SBET's closing price soared from the previous day's $6.72 to $35.83, recording approximately 5.3 times growth, then reaching a high of $79.21 within just 3 days, showing extreme volatility. As of September, SBET's stock price continues to fluctuate dramatically, staying around $16.

On August 22, SharpLink Gaming announced a $1.5B share buyback program, recognizing existing shareholders' concerns about massive stock issuances through ATM and aiming to maintain SBET's continued value. The intention was to maintain NAV premium, the core driver of the DAT company flywheel, by purchasing treasury shares when SharpLink Gaming's market capitalization falls below the net asset value of its Ethereum holdings, i.e., when mNAV falls below 1. Indeed, on September 9, SharpLink executed the buyback program by purchasing 1 million SBET shares worth $15M. Along with this fact, the company emphasized that it has never issued shares when mNAV was below 1, reiterating that long-term shareholder value growth is its primary objective.

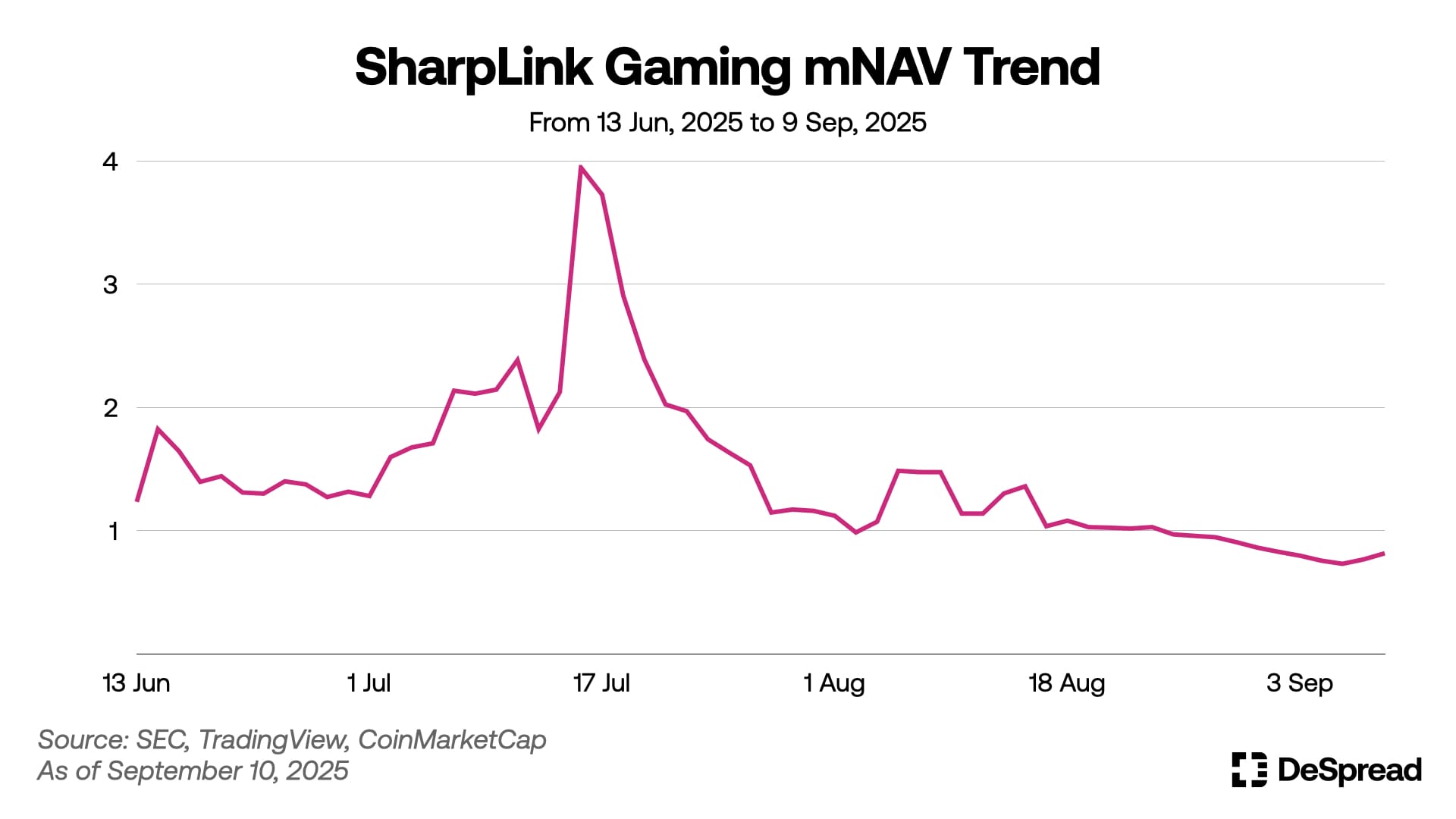

The above graph shows mNAV trends representing SharpLink Gaming's market capitalization relative to its Ethereum holdings value from June 13 to September 9, 2025. While not shown in the graph, in the very early stages when SharpLink Gaming attempted to transition to ETH DAT in early June, mNAV soared to 78. The graph shows trends after Ethereum holdings reached approximately 180,000, when mNAV became relatively stable.

By mid-July, as SBET's price broke through $37, SharpLink Gaming's mNAV approached 4. However, as speculative fervor subsequently cooled, SBET's stock price and mNAV have continuously declined, and combined with the direct impact from NASDAQ's warning about DAT companies on September 4, they have been affected. As of September 10, it has slightly recovered with mNAV exceeding 0.8, but has not yet reached 1.0, raising questions about flywheel sustainability.

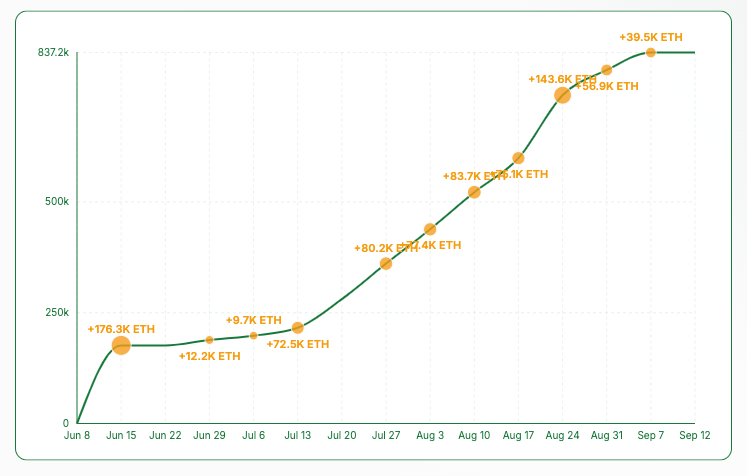

Digital Asset Holdings

SharpLink Gaming holds 837,230 Ethereum as of September 10, starting with its first Ethereum purchase on June 2. Initial Ethereum accumulation primarily used funds from the $425M PIPE raised in early June, with consistent stock sales funding since mid-June ATM launch.

SharpLink Gaming holds the second-largest Ethereum holdings globally among all ETH DAT companies, Ethereum Foundation, DAOs, and protocols, after Bitmine. However, while initially aggressively accumulating Ethereum through ATM, they've approached stock sales for Ethereum purchases more cautiously to maximize shareholder value, concerned about existing shareholders' dilution risks in connection with the share buyback program.

Asset Management Strategy

SharpLink Gaming stakes nearly 100% of its Ethereum holdings including liquid staking, continuously generating additional revenue. According to September 2 disclosures, total rewards from ETH staking from June 2 to August 31 were 2,318 ETH, with this revenue expected to increase as SharpLink Gaming continues accumulating Ethereum and increasing staking volume.

4. SOL DAT

4.1. DeFi Development Corp.

DeFi Development Corp. (NASDAQ: DFDV) changed its business model from real estate platform operations to Solana-focused digital asset finance in May. Setting strategic $SOL acquisition and management as the core business model, they brought in cryptocurrency industry experts including Joseph Onorati (CEO, former Kraken), Fei Han (CFO, former Binance), and Parker White (COO/CIO). As of September 10, they hold 2,027,817 $SOL with mNAV of 0.92.

Capital Raise Status

DeFi Development has consistently raised funds for $SOL purchases through convertible bonds, PIPE, and ELOC (Equity Line of Credit) since April. Particularly on August 28, they closed a $125M PIPE deal including common shares and pre-funded warrants, recording the largest single funding in their fundraising history. Including this deal, DeFi Development has surpassed $370M in total annual funding as of September 2025, demonstrating strong interest from traditional finance and crypto markets in SOL DAT. Major investors include Pantera Capital, Kraken, and Galaxy Digital.

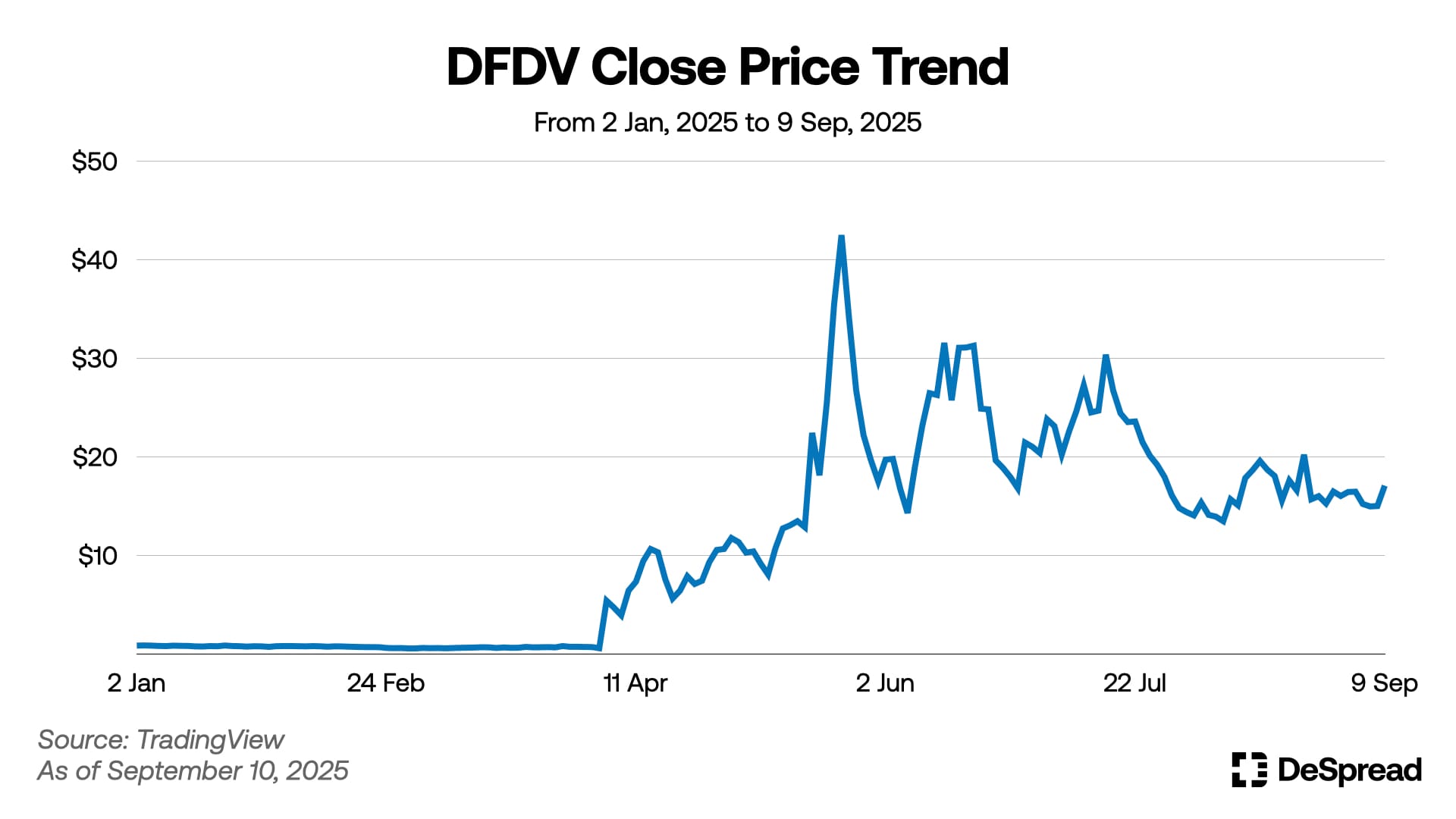

Stock Price and Premium Trends

DFDV's stock price recorded dramatic growth after beginning fundraising for strategic $SOL accumulation in April. While DFDV's closing price was $0.57 when first announcing fundraising on April 4, it reached $5.38 on April 7, showing nearly 10-fold growth. Subsequently, the stock price continued rising until early June, with June 2 closing price recording a high of $42.5. However, it later showed extreme volatility, falling to around $14, but recently DFDV's price has been surging with $SOL's uptrend.

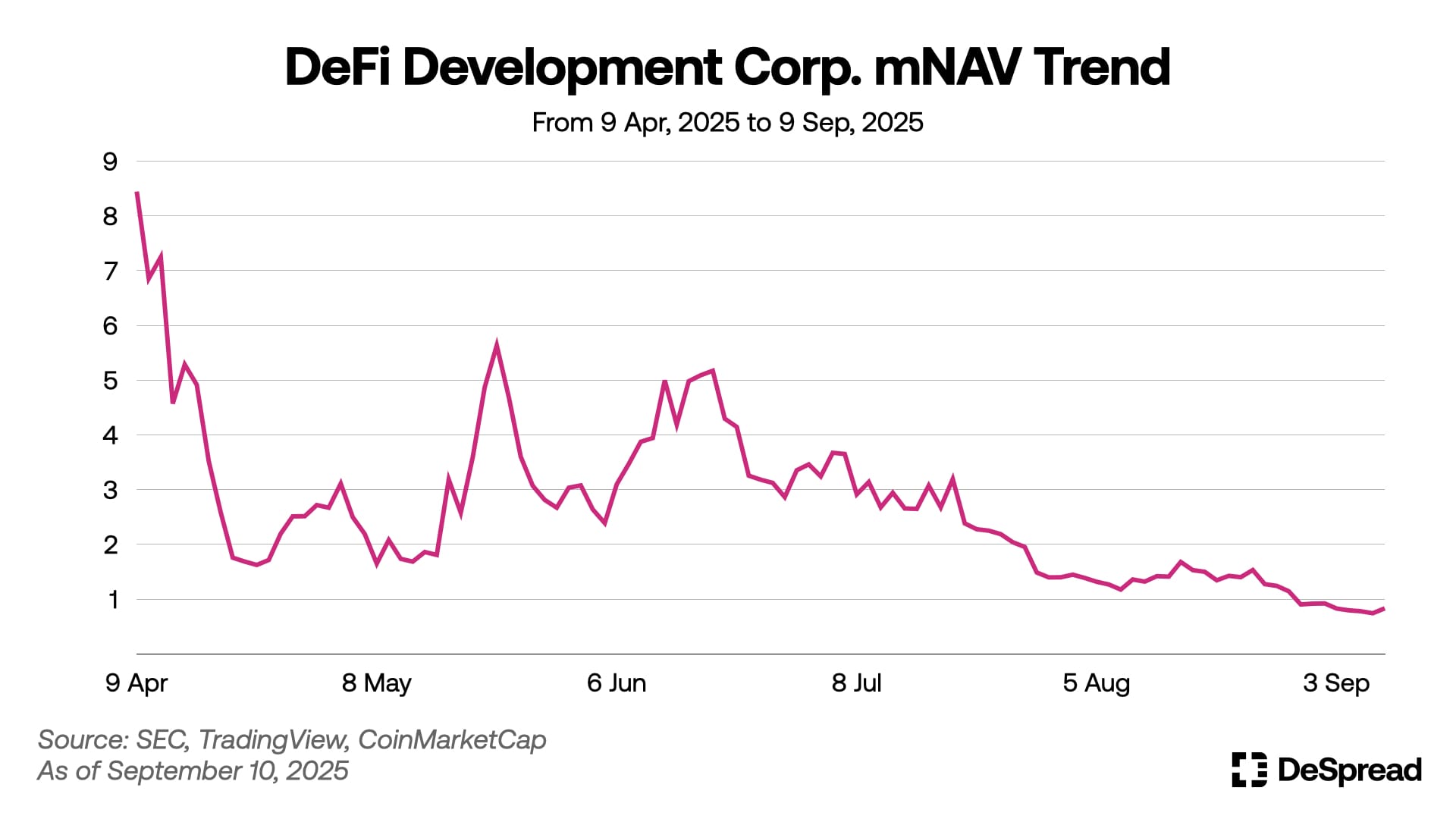

The above graph shows mNAV trends representing DeFi Development's market capitalization relative to its Solana holdings value from April 9 to September 9, 2025. When transitioning to SOL DAT in April, DeFi Development reached mNAV of 8.44 amid high market interest, but has generally declined since, currently positioned at 0.83, below 1.0.

Multiple factors contribute to this including large-scale stock issuances from fundraising, numerous DAT company launches, and extreme volatility in cryptocurrency markets, interpreted as DAT company value moving away from speculative interest in DeFi Development toward evaluation based on substantial business value at a transition point.

Digital Asset Holdings

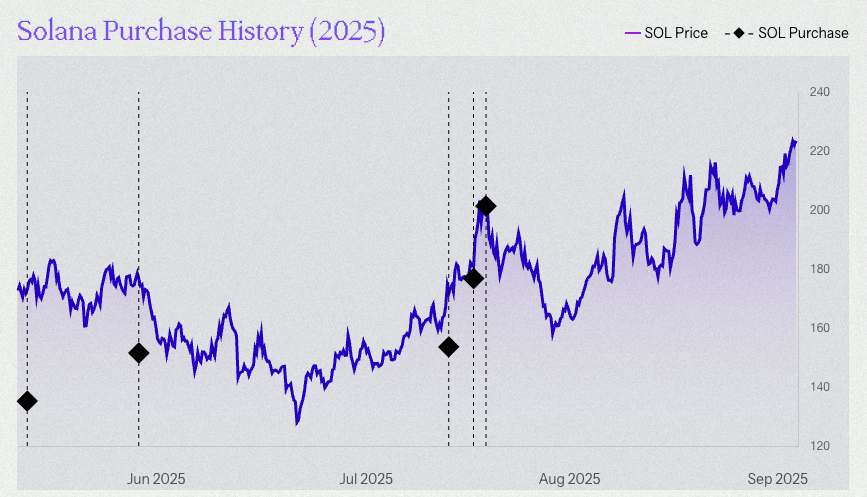

DeFi Development's Solana holdings continue increasing. Starting with first purchases on April 8, 2025, they recently purchased 196,141 $SOL on September 3 including staking rewards, with total holdings exceeding 2 million $SOL.

$SOL purchase funding sources varied by period. April used convertible bond and warrant funds, May primarily used PIPE and pre-warrant funds, and July onwards used convertible bond and ELOC funds as main purchase sources. Particularly on August 28, they purchased 407,247 $SOL at once. The PIPE raised on August 28 is expected to be the main purchase source in the near future.

Asset Management Strategy

DeFi Development's asset management strategy goes beyond simple $SOL holding to construct diversified revenue generation models. In basic staking strategy, they stake $SOL holdings in their own validator infrastructure while accepting third-party delegated staking to generate additional revenue. As increasing $SOL quantities through native yield generation is the core goal, DeFi Development introduced Annual Validator Reward Rate (AVRR) as a new metric to measure staking returns.

Furthermore, they actively pursue integration strategies with the Solana DeFi ecosystem. They launched dfdvSOL through Solana LST protocol Sanctum, integrating with various DeFi protocols including Orca, Kamino, Drift, Exponent, and RateX. In these protocols, dfdvSOL is used diversely as loan collateral, trading assets, and liquidity pool assets.

Additionally, DeFi Development entered a loan agreement with BitGO HongKong in July for efficient capital utilization of $SOL holdings. This structure involves borrowing additional $SOL using held $SOL as collateral, with the first loan borrowing 75,000 SOL at 12.5% annual interest for 4 months.

DeFi Development's Solana ecosystem expansion isn't limited to on-chain activities. The 'DFDV Treasury Accelerator' announced July 17 is a franchise model for DeFi Development's global expansion, establishing SOL DAT companies by region worldwide with DeFi Development providing operational know-how and infrastructure while holding equity stakes. DeFi Development provides operational infrastructure, strategic guidance, technical infrastructure, and brand connectivity to franchise partners, gaining regional company equity ownership, board participation, staking revenue through validator delegation, and shared infrastructure synergies. Global consortium partners including Kraken, Pantera Capital, Arrington Capital, RK Capital, and Borderless Capital are participating, currently developing in 5 regions including the UK.

4.2. Upexi

Upexi (NASDAQ: UPXI) joined DFDV as a leading NASDAQ SOL DAT company, beginning earnest Solana-focused portfolio construction from late April. As of September 10, 2025, Upexi holds 2,000,518 Solana with mNAV of 0.75 based on market cap.

Capital Raise Status

Upexi has raised funds for strategic Solana reserves three times from April 21, 2025 to present. The first funding, Primary PIPE, was announced April 21, 2025, with GSR as lead investor raising $100M total. Major investors included Delphi Ventures, Maelstrom, and Arthur Hayes. Of the $100M, approximately $5.3M was planned for company working capital and debt servicing, with remaining funds allocated to Solana purchases.

The second funding on July 11 consisted of $50M PIPE and $150M convertible bonds. For specifics, the PIPE issued 12,457,186 common shares at $4.00 per share ($4.94 per share for management participation), while convertible bonds were issued with 2.0% quarterly interest rate, $4.25 fixed conversion price, and 24-month maturity. The second funding also allocated only $3M of stock issuance proceeds for existing business operations, with remaining $47M used for Solana purchases, while convertible bond proceeds involved a structure where collateral physical $SOL and locked SOL are incorporated into Upexi's treasury.

The most recent funding was the $500M ATM program announced in late July. Upexi plans to sell $500M or less than 19.99% of UPXI issued shares through ATM over one year.

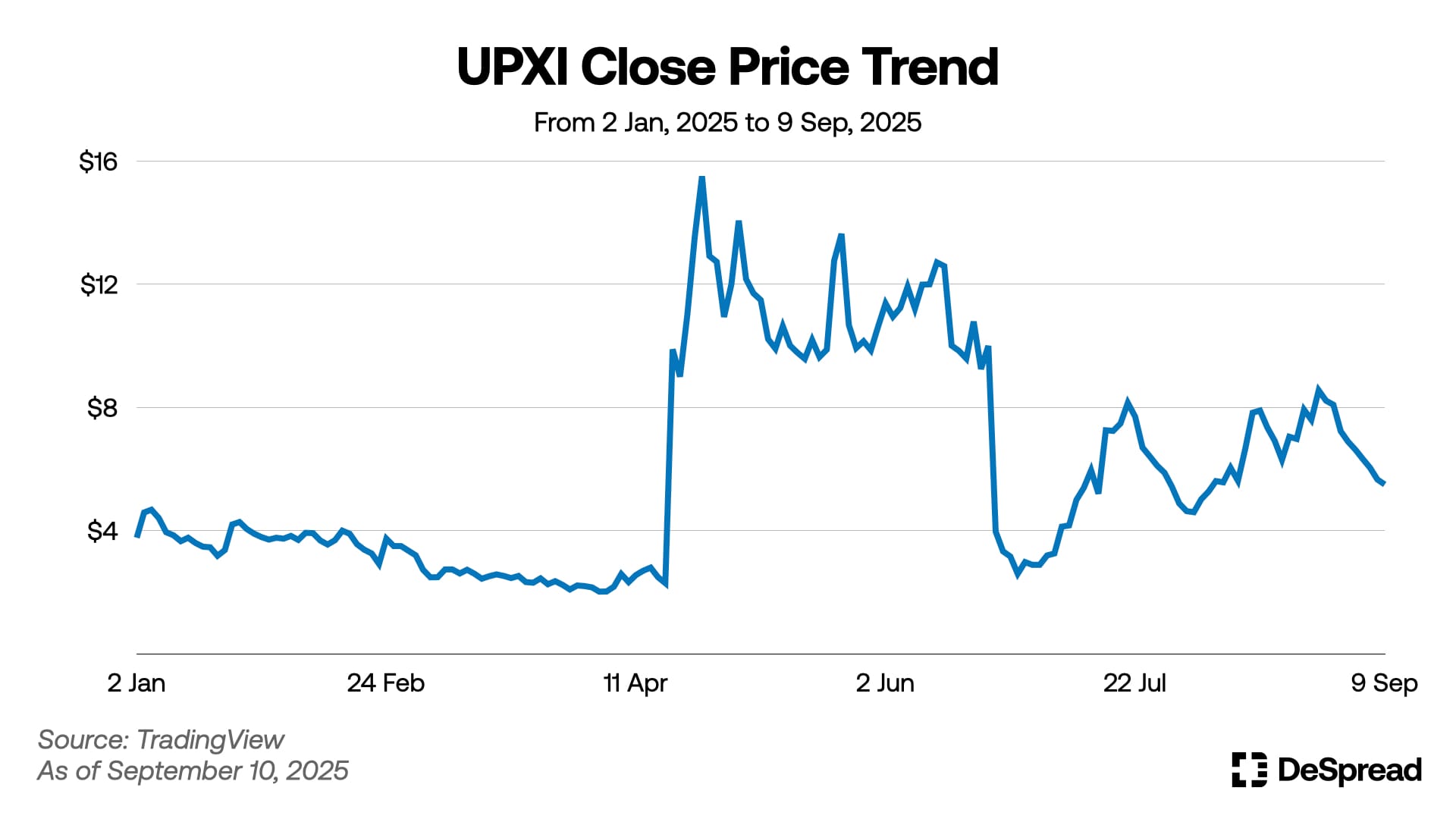

Stock Price and Premium Trends

UPXI's stock price surged after announcing its first fundraising for Solana purchases on April 21, recording $9.89, approximately 4.3 times higher than the previous day's closing price ($2.295). After reaching its high of $15.51 on April 25, it showed high volatility, falling sharply to a minimum of $2.89 in early July. It has since continued showing high volatility with repeated price fluctuations, currently staying at $5.5 as of September 10.

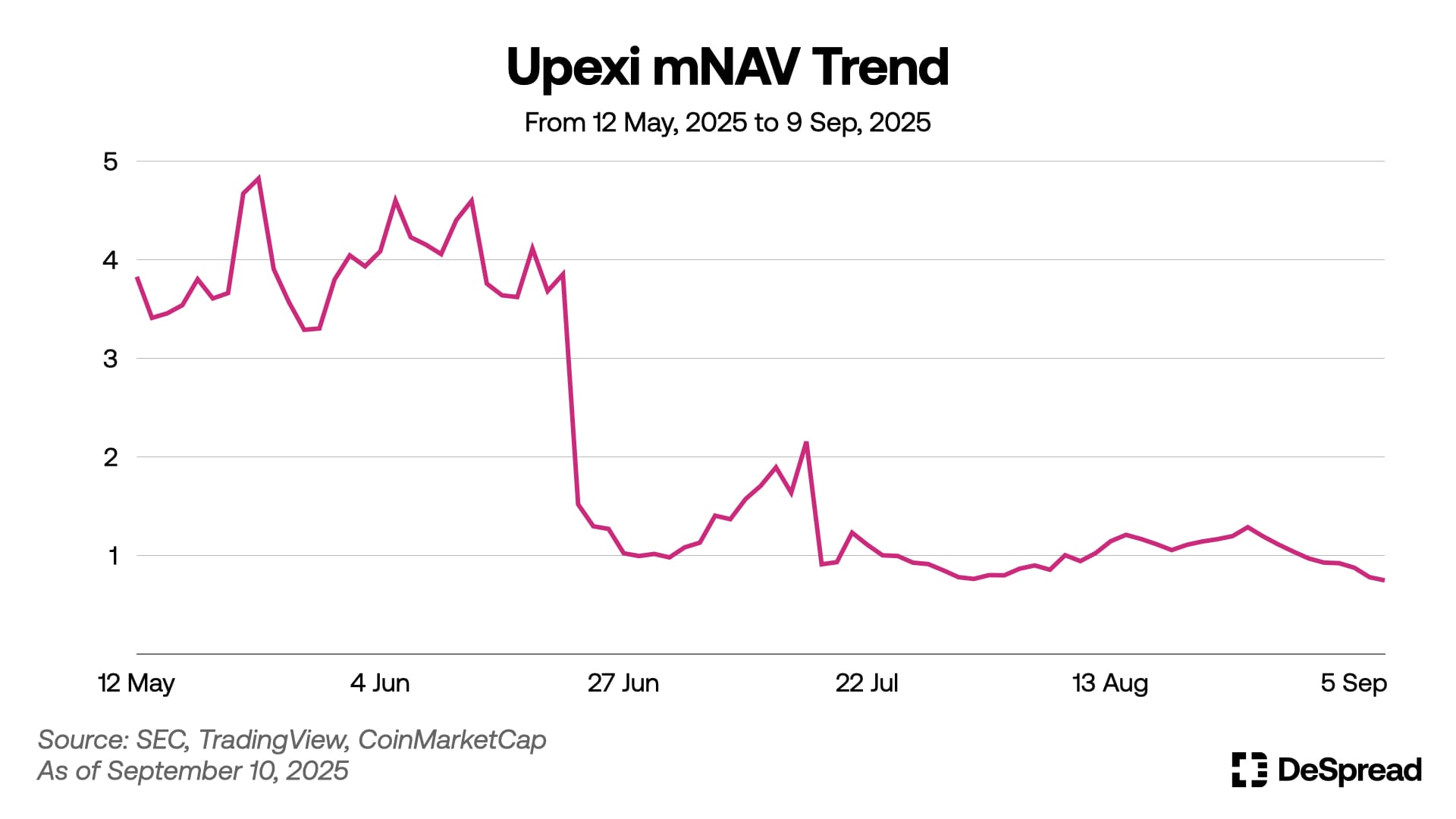

The above graph shows mNAV trends representing Upexi's market capitalization relative to its Solana holdings value from May 12 to September 9, 2025. While not shown in the graph, in the very early stages when Upexi attempted SOL DAT transition in late April, mNAV soared to 71. The graph shows trends after Solana holdings reached approximately 600,000, when mNAV became relatively stable.

Upexi's mNAV recorded 4.82 on May 22 before plummeting, then recovering to 2.15 during Solana's July rally, but has remained below mNAV of 1.0 since September 2, losing its premium. Similar to DFDV's case, large-scale stock issuances from fundraising and the emergence of numerous DAT companies appear to be major causes of premium loss, requiring observation of whether Upexi's future Solana management strategies will be effective in overcoming this.

Digital Asset Holdings

Upexi's Solana holdings continue increasing. Starting with first purchases equivalent to 45,733 $SOL on April 29, 2025, they currently hold 2,000,518 Solana including purchases up to August 4. Particularly during July alone, they increased Solana count by approximately one million, very rapidly increasing Solana holdings and per-share Solana metrics.

Additionally, Upexi holds approximately 57% of its Solana as locked $SOL purchased at approximately mid-10% discounts to spot prices, with most of these being staked.

Asset Management Strategy

According to August disclosures, Upexi stakes approximately 95% of its current Solana holdings, recording approximately 8% annual returns and daily profits of about $65,000. Upexi employs multi-validator strategies to reduce single validator risks and maximize overall staking returns. Validator selection uses due diligence programs, initially allocating small Solana amounts to verify performance and returns, then adjusting monthly Solana allocations based on evaluation results.

Furthermore, Upexi is pursuing various business initiatives including UPXI options trading on NASDAQ, pursuing share on-chain conversion through partnerships with SEC-registered transfer agent Superstate, joining Webull's Corporate Connect Service platform, and recruiting Arthur Hayes as the first member of their advisory board.

5. Other Altcoin DATs

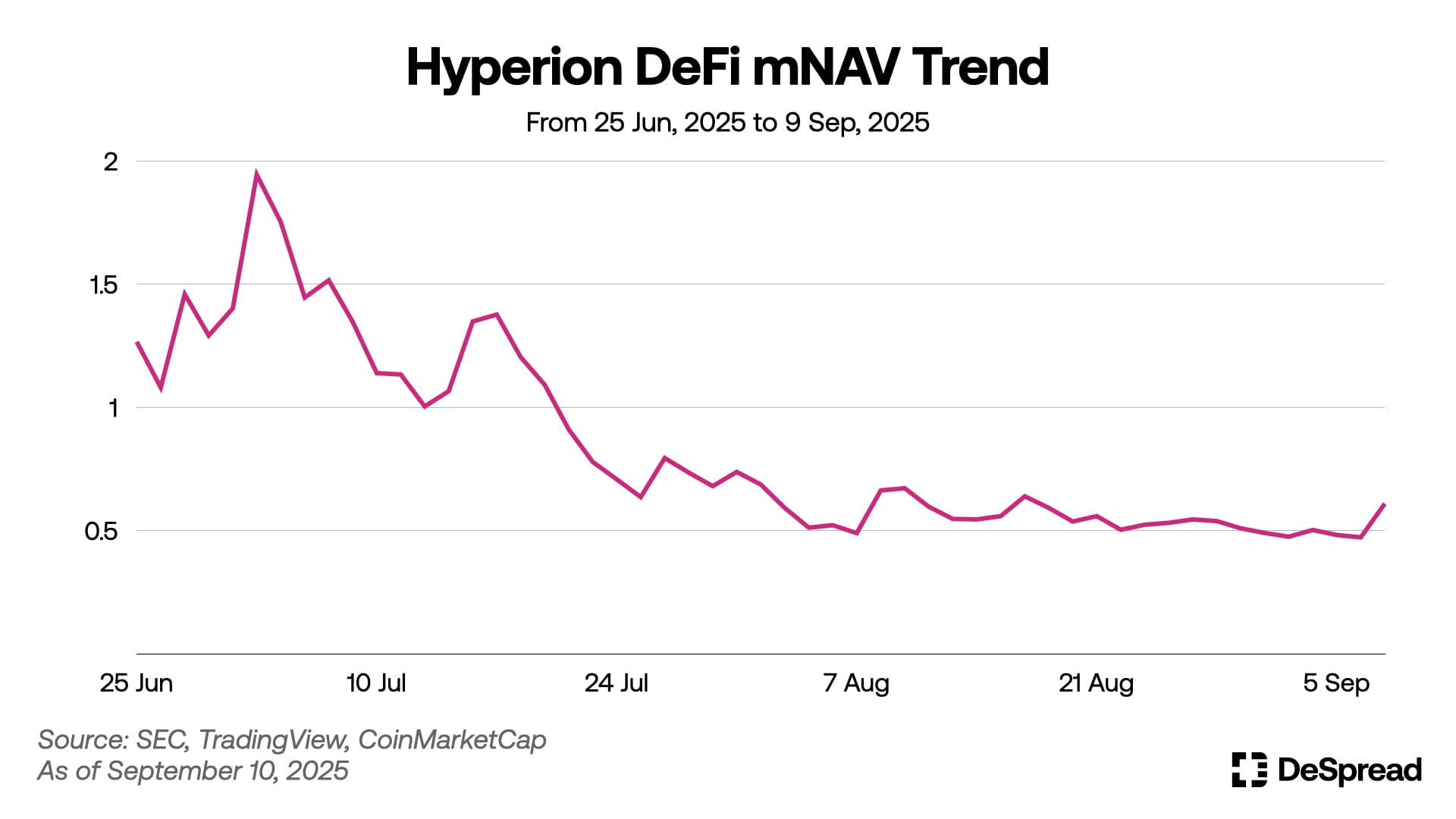

5.1. Hyperion DeFi - $HYPE

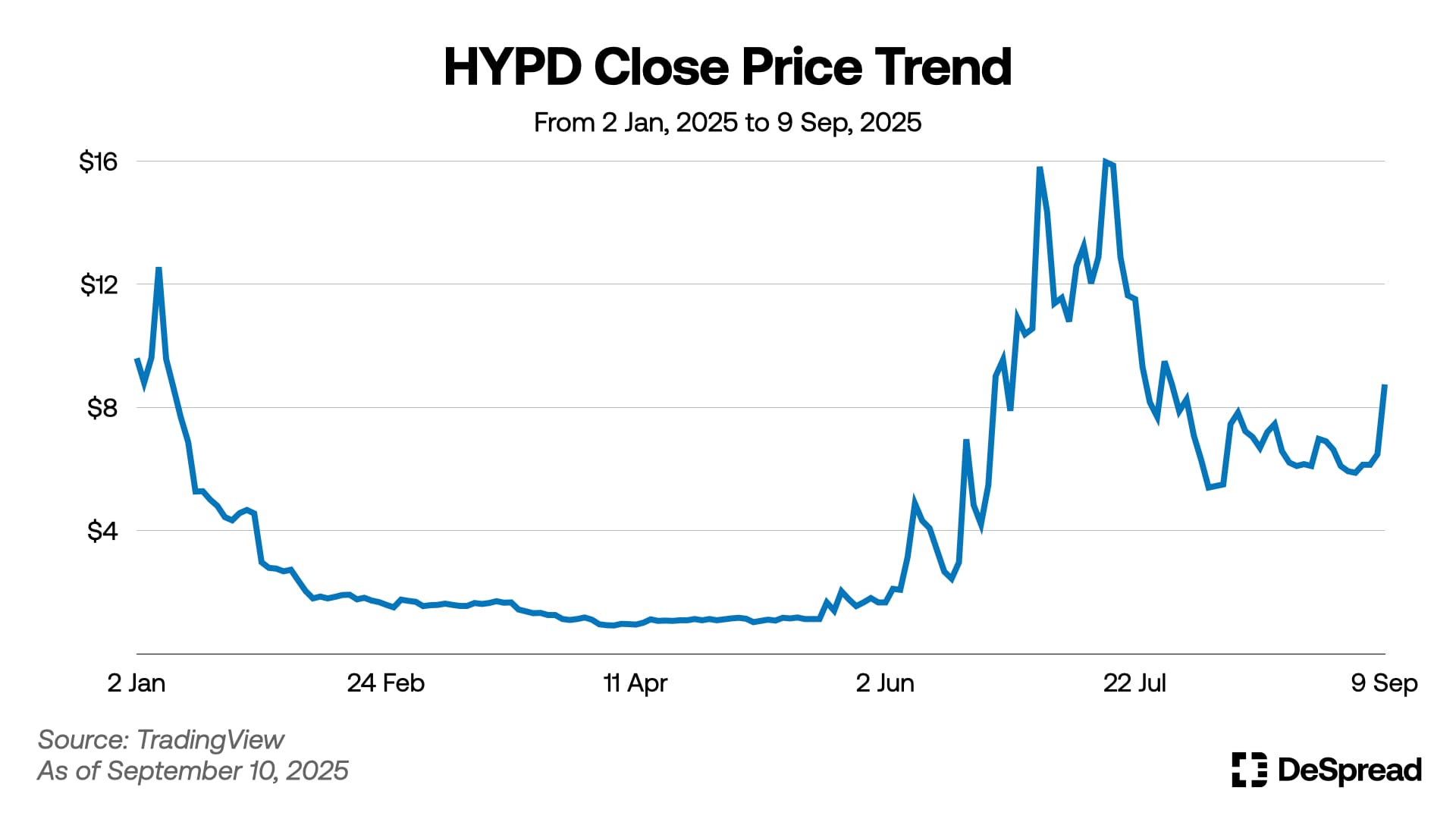

Hyperion DeFi Inc. (NASDAQ: HYPD) was originally Eyenovia, an ophthalmology medical device company, but announced HYPE DAT business expansion in June 2025. Hyperion DeFi changed its ticker from 'EYEN' to 'HYPD' on July 3 and became a leading NASDAQ-listed company incorporating Hyperliquid's native token $HYPE as strategic financial assets. As of September 10, 2025, Hyperion DeFi holds approximately 1.54 million $HYPE with a market cap of about $60 million, trading at approximately 30% discount to its $HYPE NAV.

Capital Raise Status

Hyperion DeFi's DAT conversion began with $50M funding closed on June 17, 2025. Chardan Capital managed this with participation from various investors including Chardan Investments, Ask Venture, Michael Bucella, and VA Consulting & Advisory.

The transaction issued 5,128,205 Series A non-voting preferred shares convertible to 15,384,615 common shares at 1:3 ratio. Simultaneously, 30,769,230 warrants were issued, exercisable at $3.25 per share for 5 years starting 6 months after transaction completion.

While actual issued common shares at transaction completion were 5,104,335, full preferred conversion and warrant exercise could increase issued shares to maximum 54,027,429, potentially creating dilution risks for existing shareholders.

Additionally, on July 7, Hyperion DeFi's market float value increased to $82.9M, exceeding SEC's $75M threshold. This removed previous restrictions limiting stock issuance to 1/3 of market float over 12 months, enabling Hyperion DeFi to issue desired amounts of stock to raise $HYPE purchase funding.

Stock Price Trends

Hyperion DeFi's stock price showed impressive performance after announcing its HYPE DAT transition on June 17, recording $6.97, a 135% increase from the previous day's closing price ($2.97). It continued rising through early July before experiencing declines until early September. Currently, aided by $HYPE's new highs, HYPD has also shown recovery, reaching $8.75 levels.

Digital Asset Holdings

According to Hyperliquid explorer HypurrScan, Hyperion DeFi deposited $17.5M USDC to Hyperliquid exchange from June 19-22, beginning with 1,040,584.5 $HYPE purchases on June 25 and continuing steady accumulation. Based on on-chain $HYPE holdings including Hyperliquid exchange, native staking, and Kinetiq staking, Hyperion DeFi's mNAV trends are as follows.

Asset Management Strategy

HYPD goes beyond simply holding $HYPE to actively manage holdings in crypto-native markets. On June 18, Hyperion DeFi recruited Maximilian Fiege from German digital asset investment firm Merenti Capital as HYPE Treasury Strategy Advisor, signaling aggressive entry into the $HYPE ecosystem.

Currently, Hyperion DeFi collaborates with Kinetiq, the largest LST protocol in the Hyperliquid ecosystem, operating Hyperliquid network validators while staking significant $HYPE holdings to contribute to network stability and secure continuous additional revenue. This validator operation is handled by infrastructure specialist Pier Two with SOC 2 Type I/II and ISO27001:2022 certifications, while $HYPE custody is managed by Anchorage Digital.

5.2. StablecoinX - $ENA

StablecoinX (NASDAQ: USDE) is an ENA DAT company announced July 21, 2025. The company has a two-stage merger structure where TLGY Acquisition Corporation and StablecoinX Assets combine to become StablecoinX subsidiaries.

Upon merger completion, StablecoinX will issue two types of shares:

- Class A common shares: No voting rights, economic rights only, exchange-listed and freely transferable

- Class B common shares: 1 vote per share, no economic rights, non-listed and transfer restricted

StablecoinX maintains close relationships with Ethena Foundation, which contributed $60M worth of $ENA at 30% discount to market value at contract signing before the merger, receiving voting Class B common shares and effectively controlling majority voting rights of StablecoinX shares.

Capital Raise Status

StablecoinX successfully completed two large-scale PIPEs. The first funding occurred with company announcement on July 21, totaling $363M. This included $262M in cash investments (legal tender, USDT, USDC) and $101M in $ENA tokens, including $60M $ENA contribution from Ethena Foundation, with cash investments $262M entirely allocated to locked $ENA purchases.

Major first funding investors included Polychain Capital, Pantera Capital, DragonFly, and Galaxy Ventures - leading crypto venture capitals driving current DAT trends.

The second funding on September 6 totaled $530M, bringing total cumulative funding to $893M. Second PIPE funds will also be entirely used for locked $ENA purchases from Ethena Foundation. This funding included existing investors DragonFly and Pantera Capital alongside new institutional investors including Yzi Labs, Breven Howard Digital, and Susquehanna Crypto.

Digital Asset Holdings

As an ENA DAT, StablecoinX systematically secures $ENA circulation through PIPE. The first funding secured 7.3% of $ENA circulation over 6 weeks, with the second funding adding 13% for total planned holdings of 20% of $ENA circulation.

StablecoinX's $ENA purchases occur through 'Token Purchase Agreements' buying locked $ENA from Ethena Foundation at 30% discount to market value at contract signing. Locked $ENA holdings are stored in custody accounts managed by Anchorage Digital Bank under Ethena Foundation oversight. 25% of locked $ENA unlocks after 12 months, with remaining 75% distributed equally over subsequent 36 months.

Ethena Foundation's Influence

Through 'Contribution Agreements,' Ethena Foundation effectively holds majority voting rights in StablecoinX shares, maintaining very close strategic partnerships. This relationship extends deeply beyond simple token transactions into StablecoinX governance structures and overall business operations.

Particularly, an investment committee within StablecoinX has authority over capital allocation decisions including $ENA purchase timing, scale, pricing and frequency, and major borrowing and other transactions outside StablecoinX's normal business course. Additionally, Ethena Foundation holds veto power over StablecoinX's $ENA sales, preventing reckless asset sales and enabling long-term value preservation strategies.

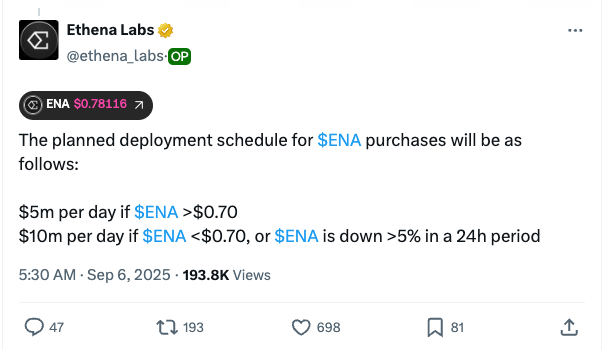

Ethena Foundation's Buyback Program

A key feature distinguishing StablecoinX from typical altcoin DATs is the existence of aggressive and explicit buyback programs by the foundation. Ethena Foundation began a 6-week buyback program starting July 21 when StablecoinX announced ENA DAT. The foundation announced daily $5M third-party market maker purchases in public markets for 6 weeks totaling $210M in $ENA, generating significant market interest.

The second buyback program evolved to be more sophisticated and market-friendly. Running for 6-8 weeks from September 6 totaling $310M, it introduced mechanisms adjusting buyback speed based on $ENA prices. In stable conditions with $ENA above $0.7, it proceeds at daily $5M pace, but when $ENA falls below $0.7 or experiences daily declines exceeding 5%, buyback volume doubles to $10M. This indicates intentions to actively establish $0.7 psychological support levels even in unstable market conditions.

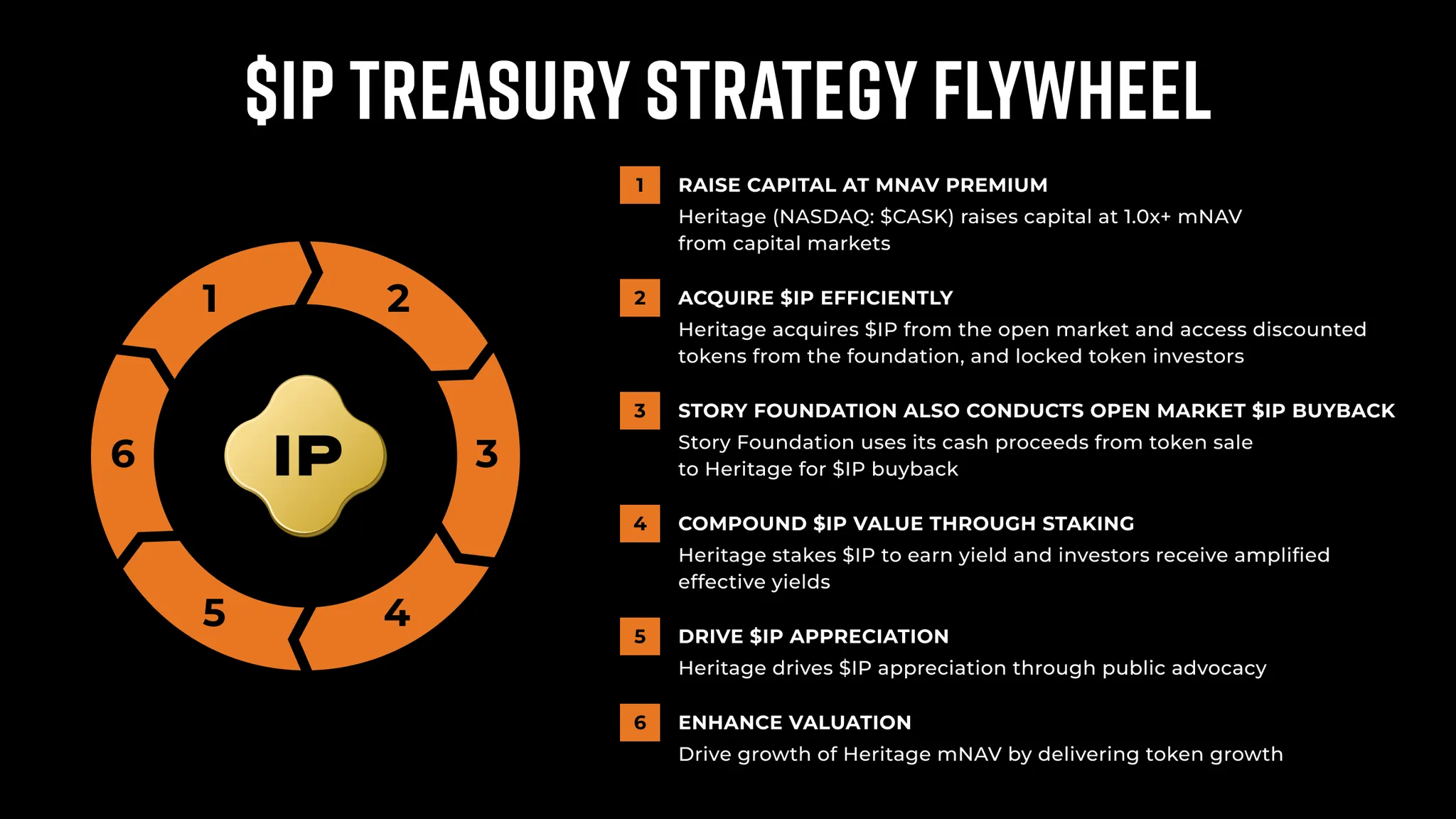

5.3. Heritage Distilling - $IP

Heritage Distilling (NASDAQ: CASK) attempted business diversification in August from distillery operations to a DAT company treating Story Protocol's native token $IP as core assets. Heritage Distilling's ultimate goal is constructing the '$IP Treasury Strategy Flywheel' through strategic partnerships with the Story ecosystem. This strategy encompasses comprehensive DAT management including capital raising leveraging mNAV premiums, efficient $IP acquisition, Story Foundation buyback support, compound effects through staking, public advocacy for $IP value appreciation, and ultimately corporate value enhancement through token growth.

Capital Raise Status

Heritage Distilling successfully completed $223.8M PIPE funding on August 15, 2025. All proceeds were structured as pre-funded warrants, issuing 370,378,890 warrants at $0.6042 each. Considering approximately 26 million issued shares as of August 15, warrant exercise would increase issued shares by approximately 1,400%, raising unavoidable dilution risks for existing shareholders.

Examining funding composition, cash comprised $35.5M (16%), USDC $59.5M (27%), and $IP $128.8M (57%). In investor composition, Story Foundation holds 107,781,820 warrants, securing approximately 30% equity upon future exercise. Additionally, Heritage Distilling CEO Justin Stiefel holds 3,309,615 warrants and director Andrew Varga holds 300,000 warrants. Furthermore, 49 accredited investors including a16z, Hashed, Arrington Capital, and Amber Group participated.

Heritage Distilling stated intentions to use at least $80M of raised funds for $IP purchases, acquiring from Story Foundation at $3.4 each. Additionally, $4M goes toward general corporate purposes, up to $7.6M for existing working capital obligations, and $7M for debt servicing.

As of August 25 disclosures, Heritage Distilling holds 53.2 million $IP, worth approximately $532M at September 10 $IP prices.

Story Foundation's Buyback Program

Story Foundation's buyback program was announced alongside Heritage Distilling's IP DAT conversion on August 11. The foundation announced plans to use entire $IP sales proceeds to Heritage Distilling for $IP buybacks in public markets. The program runs for 90 days from August 15 to November 16, totaling $82M.

Indeed, on August 31, Story Foundation announced completion of approximately $3M in $IP buybacks over the past 24 hours through official Twitter. Story Foundation's buyback program serves as a core component of the $IP Treasury Strategy Flywheel, evaluated as driving force for $IP and Heritage Distilling value appreciation.

6. Conclusion

As of September 2025, the DAT ecosystem stands at an inflection point where maturity and challenges coexist. The Bitcoin-focused DAT model pioneered by Strategy has now expanded to various digital assets, building new financial paradigms. However, growing pains are simultaneously evident, including NAV premium declines, large-scale stock dilution, and extreme volatility. Particularly, as many DAT companies have fallen below mNAV 1.0, fundamental questions about flywheel mechanism sustainability are being raised.

This phenomenon signifies not merely results of market downturns but rather that the DAT ecosystem must transition from quantitative growth to qualitative maturity. Rather than reckless digital asset accumulation through stock issuances, efficient management of held assets and sustainable revenue model development are becoming crucial. Companies demonstrating innovative management strategies through on-chain revenue generation via staking, DeFi utilization, and validator operations, or collateral utilization in traditional financial markets, are expected to gain long-term advantages.

The DAT ecosystem remains in early stages and will require numerous trials and improvements going forward. However, its fundamental value as a bridge connecting traditional finance with digital assets and as a catalyst accelerating institutional investors' digital asset adoption is expected to remain unchanged. Whether the current DAT trend will remain as one of many short-term speculative trends or serve as a gateway accelerating traditional companies' digital asset adoption remains to be observed.