TL;DR

- Rune, co-founder of MakerDAO, proposed the Endgame Plan, a plan for reforming the MakerDAO ecosystem, to address the internal and external issues facing MakerDAO.

- The goal of the Endgame Plan is to transform the protocol, governance structure, and collateral structure of DAI to achieve what is known as the Endgame State, a sustainable equilibrium state for the MakerDAO ecosystem.

- One of the key elements of the Endgame Plan is MetaDAO, which contributes to improving the profitability of the MakerDAO ecosystem through its autonomous ecosystem and tokenomics.

1. Introduction

1.1. Background

MakerDAO is a decentralized autonomous organization(DAO) founded in 2014 based on Ethereum. It is well known for its Maker protocol and the Multi Collateral DAI(MCD) system, which leads the decentralized finance(DeFi) market.

The Maker protocol allows users to deposit collateral assets such as ETH and generate stablecoins(DAI) proportional to the value of the collateral. Because volatile virtual assets can be used as collateral to issue stablecoins, users of the Maker protocol can leverage high leverage effects. For example, if ETH is deposited in the Maker protocol and DAI is issued, the investor can not only invest in ETH, but also use the new liquidity as collateral. In addition, the Maker protocol also implements a feature that allows DAI holders to automatically receive a deposit reward simply by depositing DAI in the Dai Savings Rate(DSR) contract.

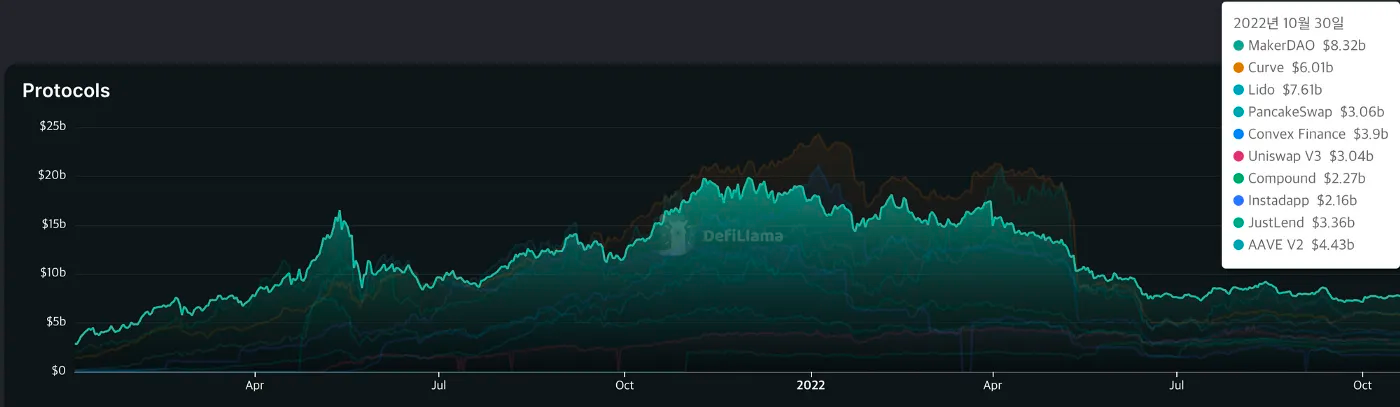

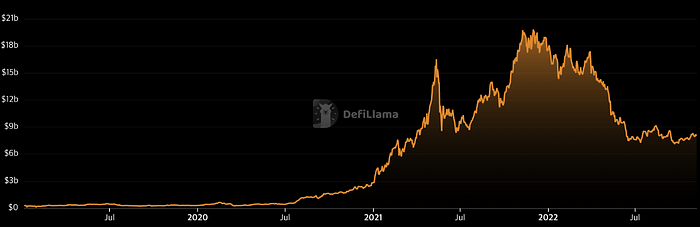

Since the adoption of the Maker protocol, MakerDAO has emerged as one of the biggest beneficiaries of the crypto bull market in 2021. According to the Total Value Locked(TVL), a commonly used success indicator for DeFi, MakerDAO consistently ranked within the top 3 since 2021 and has maintained the top spot since May 13, 2022.

1.2. Problems with MakerDAO Revealed in Bear Market

After the explosive bull market of 2021, the cumulative TVL of the DeFi area has plummeted due to consecutive adverse events such as the Terra-Luna incident and the Celcius incident in May of this year. Compared to the ATH(All Time High) of $180b recorded last year, the TVL of approximately $52b recorded in June of this year has decreased by more than 70%. MakerDAO was also unable to avoid this market situation, and its TVL, which reached a peak of around $20b, is currently showing a decrease of around 60% to around $8b, and its financial situation is also not good, with its profits continuing to decrease.

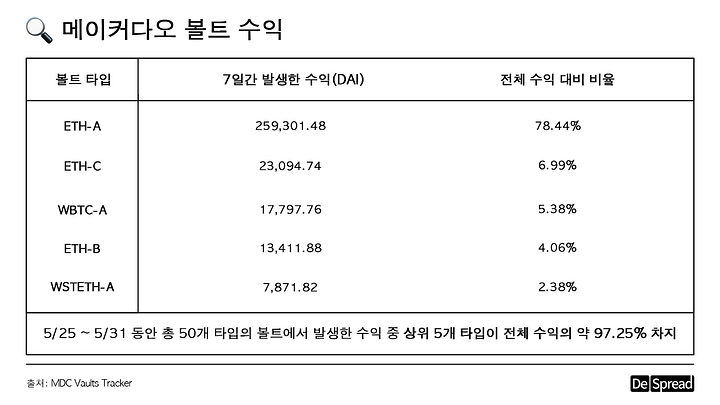

MakerDAO has exposed two main problems, the first of which is in terms of profitability. These profits are largely generated from two sources:

- Vault: A place where users deposit collateral to generate DAI, and there are various types depending on the type of collateral asset.

- Peg Stability Module(PSM): A device that swaps collateral and DAI at a fixed ratio. PSM users do not have to pay a loan interest(stability fee) on DAI in exchange for relinquishing ownership of the asset being exchanged.

The ideal profit structure of MakerDAO can be completed when users are evenly distributed across multiple Vaults to minimize the risk of liquidation due to price fluctuations of specific assets. However, as shown in the picture below, it can be seen that there is a revenue sources’ bias that just 5 Vaults and PSM are responsible for most of the MakerDAO’s profits.

The second issue is the value of MKR tokens. Due to their limited utility, MKR holders are not able to properly benefit from the growth of the protocol. MKR tokens have the following utilities:

- Governance: MKR holders deposit their MKR in the Maker protocol and participate in governance voting.

- Surplus auctions: When the fees paid by Maker protocol users exceed a certain level and surplus DAI accumulates, MKR is purchased through surplus auctions(Surplus Auction) and then burned.

- Capital redistribution: If the value of the collateral deposited by the user drops significantly, MKR is issued to compensate for the loss.

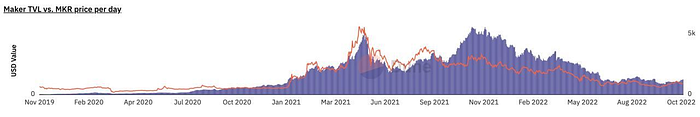

The utilities of surplus auctions and capital redistribution are designed with the aim of reflecting the value of the protocol in MKR tokens. However, these two utilities have not had a meaningful impact on MKR tokens, and the circulation of MKR tokens has remained at the level of 900,000 for a long time.

This can be seen through the graph below, which shows the trend of MakerDAO’s TVL and the price of MKR tokens. Since October last year, the TVL of MakerDAO has increased, but the price of MKR has declined, showing a decoupling phenomenon. This suggests that the utility of MKR tokens is actually concentrated on the governance side, and that the increase in MakerDAO’s TVL has little impact on the price increase of MKR tokens.

Although MKR tokens have not fully reflected the increase in profits of MakerDAO, if we look at the period after November last year, we can see that the decline in MakerDAO’s TVL is coupled with the decline in the value of MKR tokens. This is because MKR tokens represent MakerDAO and, as the losses of MakerDAO continue, the selling pressure of MKR by market participants becomes strong. Therefore, MKR holders were unable to benefit from the increase in MakerDAO’s TVL, but suffered losses when the TVL decreased, which has led to ongoing dissatisfaction with the value and profitability of MKR.

1.3. Potential regulatory risks

In addition to the profitability issues mentioned above, the potential regulatory risk triggered by the “Tornado Cash sanctions” incident has also approached as another reason for the transformation of MakerDAO. In August, the US Department of Finance listed the cryptocurrency mixing protocol, Tornado Cash, on the blacklist for use in money laundering by criminal organizations, making it impossible for any financial transactions occurring in the US to use it. The fact that the US government blacklisted a smart contract, i.e. code, rather than an individual or company, caused a huge stir and marked a turning point for the global regulatory risk for the cryptocurrency industry.

MakerDAO is currently handling not only virtual assets such as ETH as collateral for issuing DAI, but also Real World Assets(RWA) that tokenize real-world assets, so it cannot be completely free from the risk of government regulation. In a extreme scenario, if the US government were to introduce regulation of RWA through which all RWA collateral assets of MakerDAO were seized, the value of not only DAI and MKR, but also the protocol itself could be at risk. As this regulatory risk emerges, it has become necessary for the protocol to devise countermeasures.

1.4. The appearance of “The Endgame Plan”

Against the background of the above, Rune Christensen, co-founder of MakerDAO, presents the Endgame Plan. The Endgame Plan describes the reform direction that MakerDAO needs to take in terms of functionality and structure as a solution to the above problems.

Rune says that the current domestic and international situation is the optimal time to announce the Endgame Plan, explaining as follows.

• Market downturn: Strong upper projects like MakerDAO can easily draw market attention

• Transition to Ethereum 2.0: After the “The Merge” update announcing Ethereum’s switch to Proof of Stake, Ethereum’s network effect is expected to strengthen, and the likelihood of MakerDAO’s influence being maximized is high as it interacts with many DApps on the network

In this environment, Rune, co-founder of MakerDAO, believes that innovation is necessary for MakerDAO to firmly hold onto the number one spot and beat out competing projects like Aave and Uniswap, and he presented The Endgame Plan based on this thought.

2. The Endgame Plan

The Endgame Plan has been a hot potato in the MakerDAO governance since May of this year. The ultimate goal of this reform plan is to minimize the impact of external environments on MakerDAO and maintain the protocol’s self-recoverability by creating a self-sustainable ecosystem. This means developing the Maker Protocol, governance structure, and ecosystem as a whole to reach a state of equilibrium known as the “Endgame State,” where the core ecosystem is stable. Additionally, the goal of the reform plan is to make DAI an Unbiased World Currency, a decentralized global currency, based on this ecosystem.

To achieve these goals, the following implementation plans were proposed:

• Improving the profitability of MakerDAO

• Change in governance structure

• Revision of the collateral composition of DAI

Among the above implementation plans, the concept of “MetaDAO” is the most crucial. Below, we will discuss MetaDAO.

3. MetaDAO

MetaDAO can be considered a subset within the MakerDAO ecosystem, with its own distinct area of focus. All of the plans and functions of Endgame revolve around MetaDAO, allowing Rune to achieve a decentralized governance system and a diversified revenue distribution structure.

MetaDAO can be thought of in two aspects: ‘meta’ and ‘DAO’. The meaning of ‘meta’ in relation to something refers to all the various activities derived from that subject. In order to achieve the goal of Endgame, which is a sustainable and decentralized balance, ‘Positive meta’ must be consistently generated. Positive meta is basically meta that contributes to the development of the protocol, and during this time, there must be a continuous sharing of concepts about the definition and direction of Positive meta among the community members who generate the meta. Because of this characteristic, Positive meta is also known as ‘Self-aware meta’.

Currently, the governance of MakerDAO is structured around the core concept of Maker Core, which is closely aligned with a single governance structure and therefore suffers from centralization and lack of transparency issues. At this point, MetaDAO can form a more diverse governance system compared to the existing system that follows Maker Core, because each MetaDAO develops in a specific direction according to the meta shared by its members, due to its nature as a set of meta that follows different meta.

In addition to having its own governance structure, MetaDAO also holds its own native token, the MetaDAO Token(MDAO). Each MetaDAO can use MDAO tokens to build its own revenue structure, which will be further discussed in relation to Metanomics later.

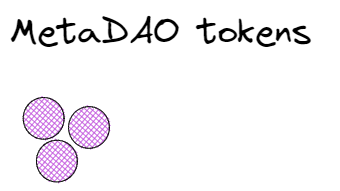

The initial six MetaDAOs are created directly by the Decentralized Workforce of MakerDAO, which refers to all the personnel who perform various functions to enable the operation of MakerDAO. From the seventh MetaDAO onwards, they are automatically generated through an Incubator smart contract, without any human intervention. The Incubator determines which class the newly created MetaDAO belongs to based on an algorithm, and the classes are Governor, Creator, and Protector. Each class can be described as follows:

- Governor: A MetaDAO that is responsible for the Decentralized Workforce of MakerDAO, and manages governance participation and the expansion of MakerDAO ecosystem functions, such as Council, Core Unit, and Tribunal operations.

- Creator: A MetaDAO that, in its basic form, drives innovation and development in the MakerDAO ecosystem by performing various roles.

- Protector: A MetaDAO that acts as a mediator in financial and legal issues that arise between the MakerDAO ecosystem and the real world, primarily protecting the MakerDAO ecosystem from regulatory risks related to RWA collateral allocation and RWA collateral regulation.

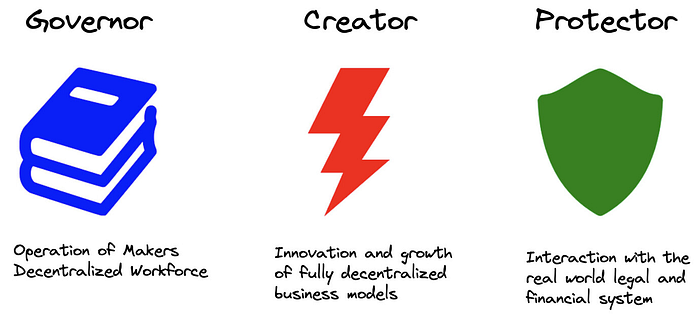

It is difficult to perfectly describe the relationship between Maker Core and MetaDAO, but it can be intuitively compared to the relationship between L1 and L2. Maker Core, which has a rich infrastructure and security, but is slow, can be likened to L1, while MetaDAO, which derives from Maker Core and has its own functions, can be likened to L2. MetaDAO initially shares core functions with Maker Core while being managed by it, but later evolves into an organization that performs independent functions in order to achieve its original purpose, establishing a symbiotic relationship with Maker Core. In other words, MetaDAO, which started as a derivative of Maker Core, gradually establishes its own governance structure, tokenomics, and products over time and grows into a self-sustaining ecosystem. This can be likened to a specialized cell that initially receives DNA and essential elements from a mother cell, but later establishes a symbiotic relationship with the mother cell in order to best achieve a specific purpose.

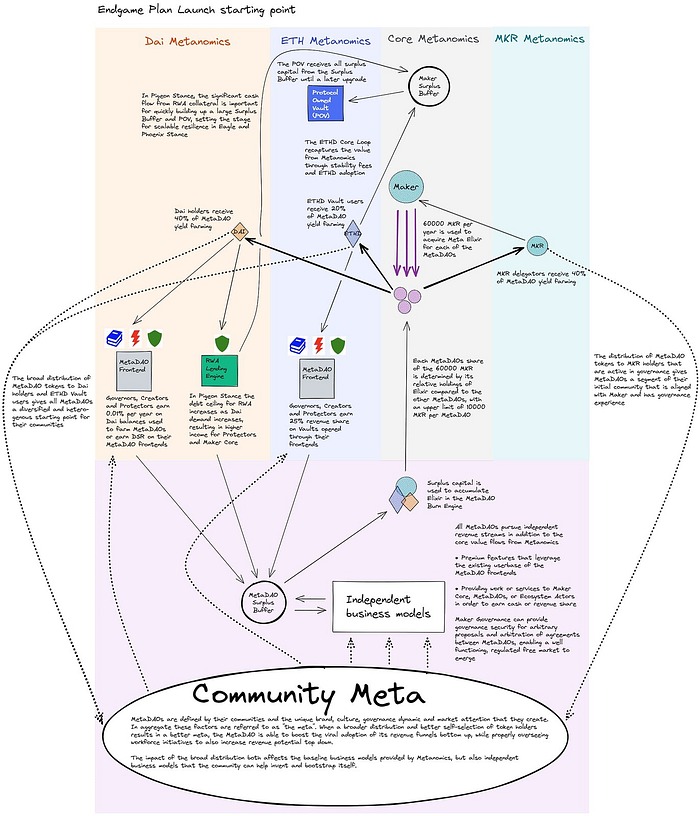

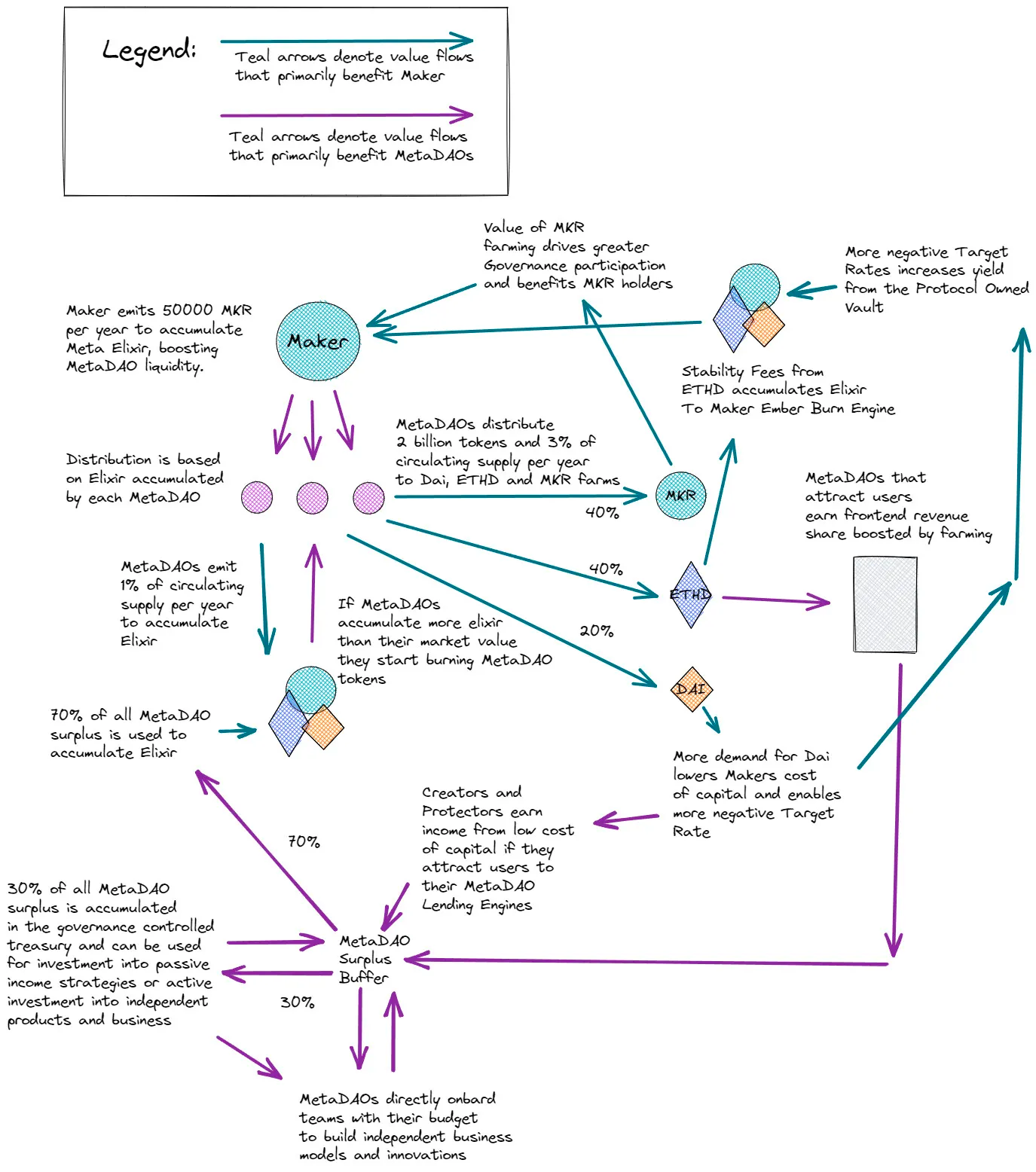

4. Metanomics diagram

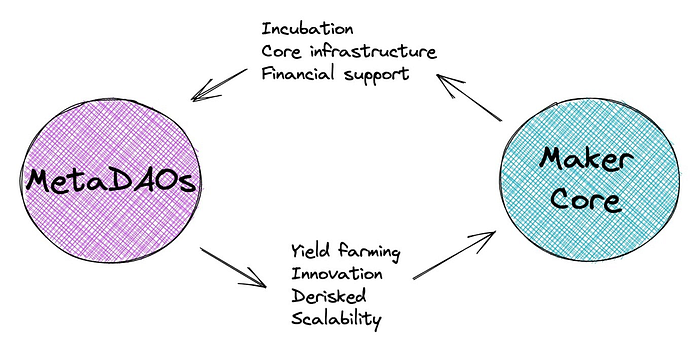

The Endgame Plan is divided into stages according to the degree of completion of the project and its functions. The above diagram shows the metanomics(Metanomics) at the point when the Endgame Plan is formally launched after completing the basic preparatory stage(Pregame) for executing the Endgame Plan. Metanomics refers to the new token distribution structure presented in the Endgame, meaning the tokenomics that make up the MakerDAO, MetaDAO, and MetaDAO ecosystems, including the MDAO token. From now on, we will look at the key contents of metanomics, focusing on how MakerDAO will solve profitability issues through metanomics at the time of the Endgame Plan launch.

4.1. Key terminologies

Before we delve into a detailed explanation of metanomics, let’s look at some key terms that appear in the Endgame Plan.

- MetaDAO: a subset of MakerDAO with its own ecosystem created for a specific purpose

- Maker Token(MKR): the native token of MakerDAO MetaDAO Token(MDAO): the native token of MetaDAO

- EtherDAI(ETHD): a synthetic asset using stETH managed by Maker Governance, created for the purpose of long-term liquidity on the Ethereum network through network effect piggybacking

- Elixir: an LP token for the long-term liquidity of DAI, ETHD, and MKR; in the initial phase, Elixir I, it exists as a Balancer pool with a composition of DAI:ETHD:MKR in a 1:1:1 ratio”

- Meta Elixir: a liquidity pool of MDAO/MKR for MDAO liquidity, existing as an MDAO/MKR pool on Uniswap in the launch phase of the endgame

- Yield Farming: the act of depositing tokens into a liquidity pool to receive a reward for the deposit

- Dai Savings Rate(DSR): a reward automatically received when DAI is deposited through a contract with the Maker Protocol

- Stability Fee: the cost of generating DAI using vault

- Maker Surplus Buffer: a location where DAI transferred as a stability fee is sent

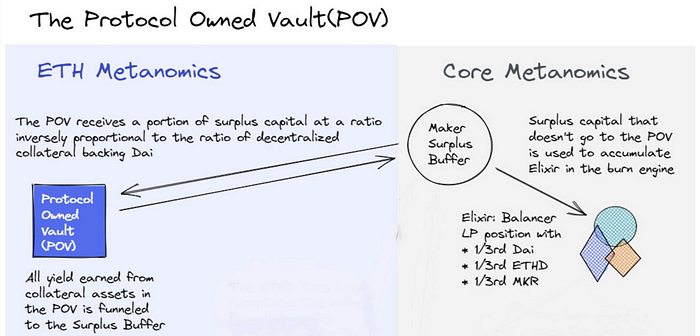

- Protocol Owned Vault(POV): a vault that can only receive ETHD as collateral and is managed by the Maker Protocol, designed to increase the decentralization of collateral for generating DAI and does not have a stability fee or liquidation

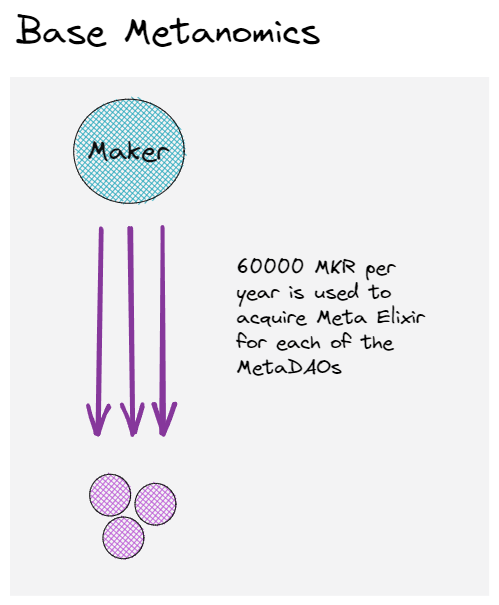

4.2. Permanent MKR issuance(Core/Base Metanomics)

One of the key challenges that Rune aims to address through the endgame is the improvement of the limited profitability of MetaDAO. Rune presents a solution to this problem by announcing a new talkonomy called ‘Metanomics’ using MDAO tokens in the endgame plan.

Metanomics begins with the permanent issuance of 60,000 MKR tokens per year. The issued MKR tokens are deposited in the MDAO/MKR liquidity pool(Meta Elixir) and the amount of MKR tokens that each MetaDAO will hold is determined based on the proportion of Elixir each MetaDAO holds within a 10,000 MKR upper limit.

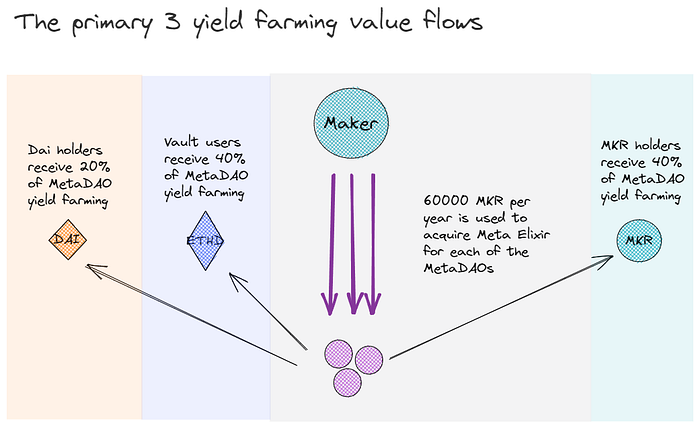

4.3. 3 Major Yield Farmings

As previously mentioned, members of MetaDAO can expect additional revenue through MDAO tokens. The following three MDAO yield farming distributions are the solution to this.

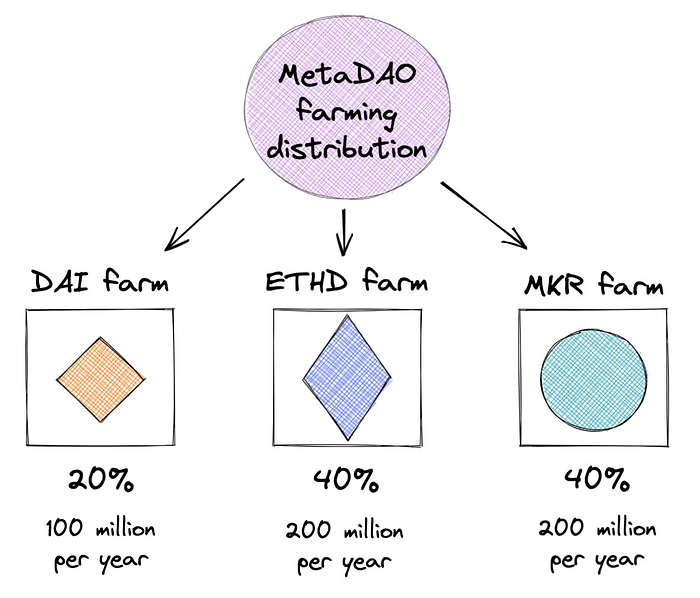

Newly created MetaDAOs receive 2 billion MDAO tokens for the purpose of using them in the 10-year genesis yield farming. At this time, all MetaDAOs distribute 3% of their total MDAO token issuance as permanent yield farming rewards to DAI holders, ETHD vault users, and MKR holders in the proportions of 20%, 40%, 40% respectively, as shown in the diagram below. Let’s take a closer look at how each token holder can benefit.

• DAI farm

20% of MDAO token yield farming is distributed to the DAI farm. DAI holders can deposit DAI into the DAI farm to participate in MDAO token yield farming. The DAI farm does not pay DSR but instead has the effect of distributing DAI farming demand, which can increase the DSR beyond its current level. Ultimately, the introduction of MDAO token-based DAI farming improves DAI farming conditions and brings more capital into the MakerDAO ecosystem.”

• ETHD farm

40% of MDAO token yield farming is paid to the ETHD farm. Users can deposit their ETHD vaults into the ETHD farm and receive MDAO yield farming based on the amount of loans they have in ETHD vaults. In other words, users have more incentive to generate DAI with more ETH as collateral, and the increased amount of ETH within DAI collateral makes DAI more decentralized.

• (Delegated) MKR farm

40% of MDAO token yield farming is paid to the MKR farm. When depositing MKR for governance participation, users can receive MDAO tokens. The two incentives of governance influence exercise and MDAO token rewards encourage governance participants to deposit more MKR tokens, ultimately helping to decentralize governance.

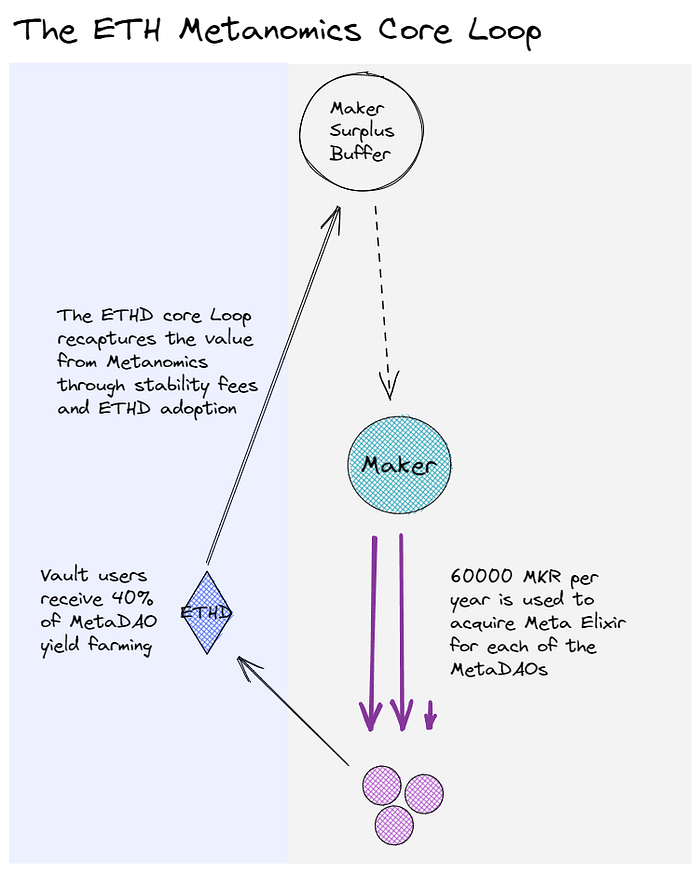

4.4. ETH-Core Metanomics Value Cycle Structure

Endgame claims that MakerDAO should maximize the Ethereum network effect. This claim is manifested in the role of tokens such as ETH, stETH, and ETHD in the Metanomics.

If participants use ETHD vault to get MDAO token yield farming rewards, they have to provide stabilization fees for DAI generation. The stabilization fees provided by ETHD vault users are transferred to the Maker surplus buffer, which is then used to issue 60,000 MKR per year by Maker.

In summary:

- Maker issues MKR tokens → MKR tokens are distributed based on the amount of ether each MetaDAO holds

- The distributed MKR tokens are deposited in the Meta Elixir and used in MDAO token yield farming

- Of the resulting MDAO tokens, 40% are distributed to ETHD vault users

- ETHD vault users pay stabilization fees, which go into the Maker surplus buffer and are used to issue MKR tokens that are distributed to the MetaDAOs.

Through this process, a circular value structure is formed and both the MetaDAOs, ETHD vault users, and the Maker protocol can all benefit. It can be represented diagrammatically as follows:

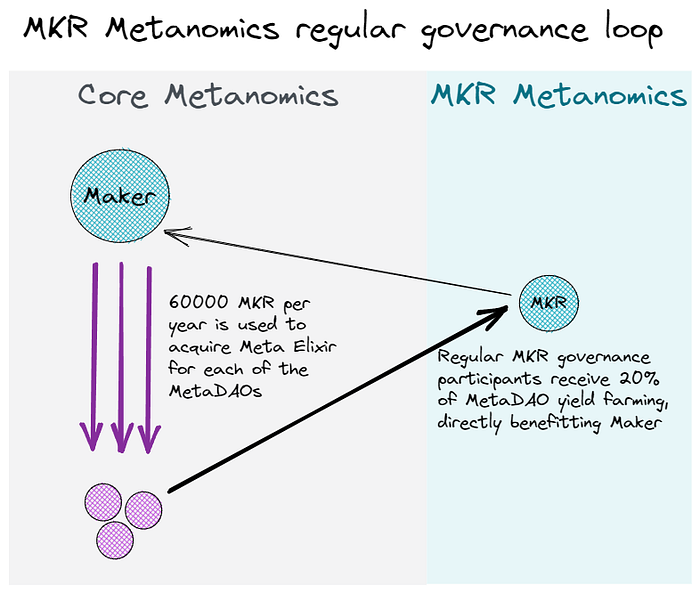

4.5. MKR-Core Metanomics Value Cycle Structure

Just as the ETH-core Metanomics value circulation structure is completed with ETHD vaults as a mediator, a circulation structure is also formed between the core Metanomics and the MKR Metanomics through the MKR farm. This circulation structure focuses on decentralizing the governance structure differently from the earlier token value flow that focused on the ETH-core Metanoimcs loop.

As more MKR is deposited, more MDAO token yield farming rewards can be received, so MKR holders have an incentive to deposit more tokens. This not only helps decentralize governance but also reduces the circulation of MKR tokens and contributes to the growth of MKR token value. In other words, the introduction of the MKR farm can contribute to the activation of governance participation and the benefit of MKR holders by forming a circular structure that does both.

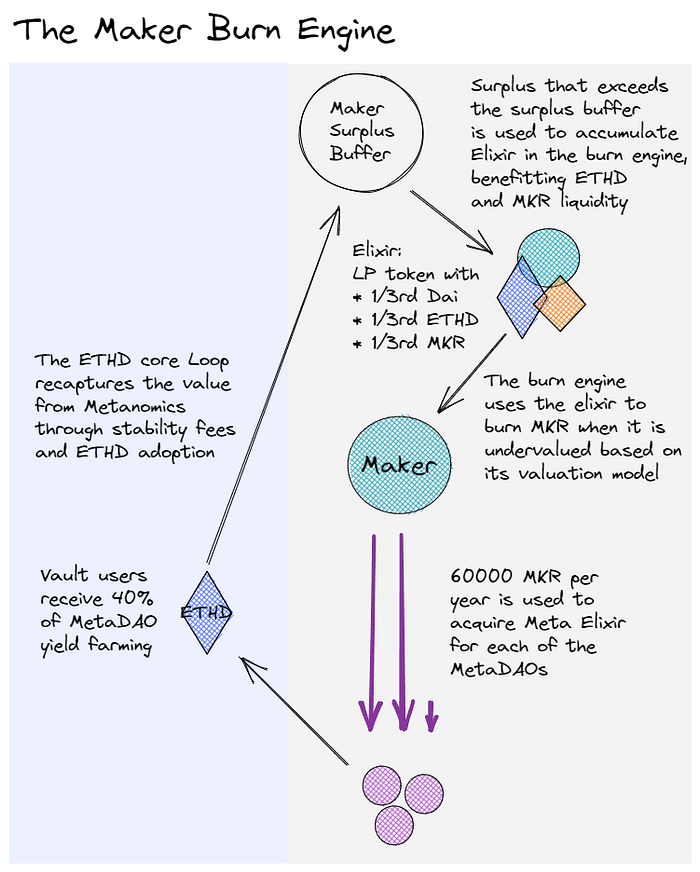

4.6. Burning structure

To understand the burning structure of Metanomics, you need to first understand its Anti Reflexivity Mechanic. This system refers to a system that allows external DEXs to buy DAI through the sale of MKR or MDAO tokens at a stepped price. In other words, the system increases the holder’s DAI balance through the sale of MKR or MDAO tokens, and this obtained DAI is converted into Elixir and accumulated in the burn engine of the Maker or each MetaDAO.

If the market price of MKR or MDAO tokens is lower than the value calculated through the self-valuation model, the burn process will take place, and Elixir within the burn engine will be used to burn MKR or MDAO tokens. When a new MetaDAO is launched, 4.5 billion MDAO tokens are issued, and 2 billion of them are accumulated as a selling reserve in the Anti Reflexivity Mechanic. Staircase selling is performed mechanically, starting with the purchase of 0.01 DAI per 1 MDAO token, and sequential specified sales are performed until it reaches a ratio of 0.109 DAI per 1 MDAO token.

4.7. POV(Protocol Owned Vault)

POV means a vault that is self-managed by the Maker Protocol. POV is a vault that can only be held in ETHD, and was created for the decentralized collateralization of DAI. POV receives funding from the Maker surplus buffer inversely proportional to the decentralization of the collateral that comprises DAI. In other words, if the decentralization of the collateral that makes up DAI is low, POV increases the amount of ETHD held in it by receiving more funding from the Maker surplus buffer.

All profits obtained from the collateral in POV are transferred to the Maker surplus buffer and used to increase the liquidity of the elixir. Therefore, POV plays a role in increasing the ratio of DAI issued by decentralized collateral in the meta-economy, and supporting the Maker Surplus Buffer with funding along with ETHD vaults. The fact that the gateways for transferring funds to the Maker Surplus Buffer are diversified means that the Maker Surplus Buffer has increased liquidity, which ultimately leads to more profits for holders of DAI, ETHD, and MKR tokens by making the value circulation structure more smoothly.

4.8. MetaDAO Surplus Buffer

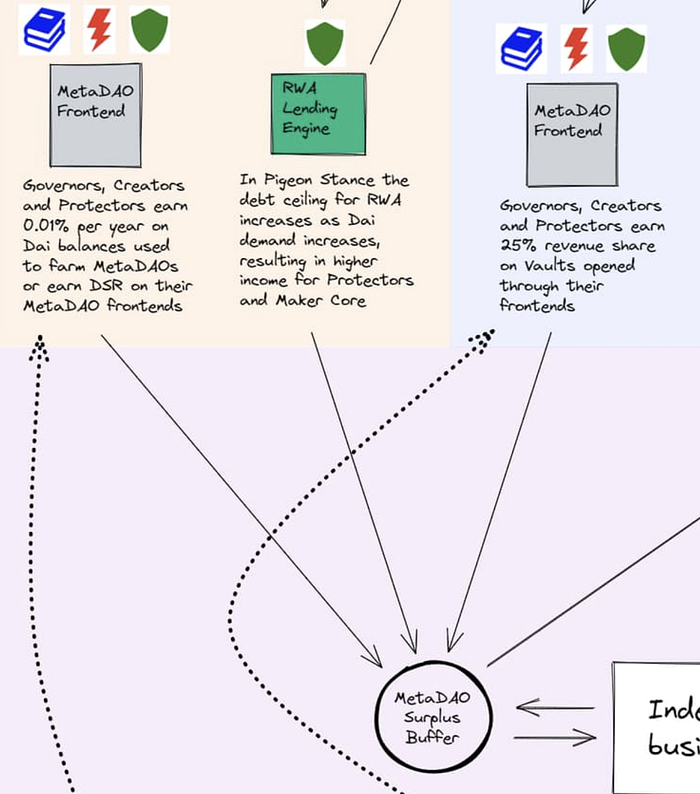

If the Maker surplus buffer affects the overall capital flow of the Maker Protocol, the MetaDAO Surplus Buffer is the surplus buffer belonging to each MetaDAO. While the Maker Surplus Buffer obtains DAI through the stability fee generated from vaults, the MetaDAO Surplus Buffer receives liquidity from the DAI obtained through the MetaDAO’s activities within the ecosystem.

The diagram above is an enlarged view of the meta-economy flow in the Endgame Plan launch stage, related to the MetaDAO Surplus Buffer. The meaning of the arrow is that DAI transferred to various MetaDAOs is accumulated in each MetaDAO’s Surplus Buffer. Before examining each arrow individually, “MetaDAO frontends” refer to spaces where various functions of MetaDAOs, including vaults, are displayed. As the place where users first interact with MetaDAOs, each MetaDAO tries to show their identity and meta.

Let’s go back to the structure where liquidity flows into the MetaDAO Surplus Buffer and look at each arrow individually.

- Metadao Frontends(DAI Metanomics)

DAI held in a MetaDAO’s frontends or 0.01% used in yield farming by Governers, Creators, and Protectors is transferred to the MetaDAO’s Surplus Buffer as DSR rewards. In other words, all MetaDAOs can earn larger rewards by using and depositing more DAI, regardless of their class.

- RWA Lending Engine

The middle shows a case where Protectors can earn profits using the RWA Lending Engine. As demand for DAI increases, Protectors and Maker Cores can earn more profits as the limit for lending DAI using RWA increases. RWA refers to assets that have been tokenized on a blockchain network by tokenizing real-world assets, and Pigeon Stance refers to the first step of the three steps(Pigeon, Eagle, Phoenix) towards complete decentralization of DAI. The three steps of RWA and DAI decentralization will be discussed in more detail in a later article

• MetaDAO Frontend(ETH Metanomics)

Finally, on the right, we can see that all three classes of MetaDao can earn 25% of the profits generated through ETHD vault through their frontend.

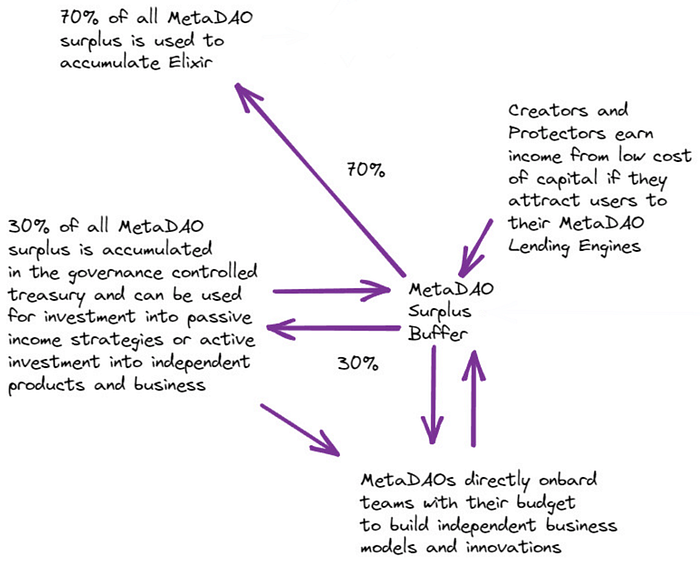

In summary, the more capital that is pooled into MetaDAO, the greater the network effect of generating profits. As more people deposit DAI into MetaDAO, more people use the ETHD vault, and more people use the lending engine, the amount of DAI that MetaDAO receives will increase and the MetaDAO Surplus Buffer will have greater liquidity. And of this liquidity accumulating in the MetaDAO surplus buffer, 30% is used for MetaDAO’s independent business model or product, while the remaining 70% is accumulated in the Elixir and used to defend the value of MKR and MDAO tokens.

To summarize the value circulation structure so far, MKR tokens issued by Makers are used for MDAO token yield farming and the resulting profits are distributed to DAI holders, ETHD vault users, and MKR holders. Some of the MDAO token yield farming profits distributed to ETHD vault users are converted into DAI token form as stability fees and accumulated in the Maker Surplus Buffer to be used for MKR token issuance. In addition, the MDAO tokens distributed to DAI, ETHD, and MKR farm are redistributed to each MetaDAO in the form of DAI and used to fill the MetaDAO Surplus Buffer.”

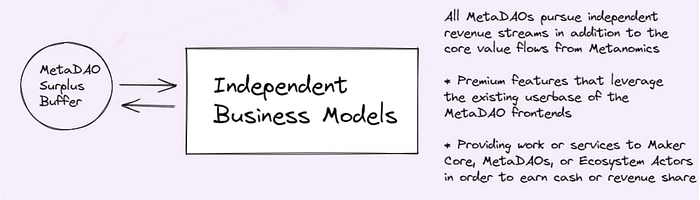

5. Unique Business Model

So far, we have seen how MetaDAO can change the profit structure of the Maker ecosystem centered on Metanomics. The ultimate goal of MetaDAO is to have a unique business model based on the core Metanomics mentioned above to maximize their profits. The possibilities for MetaDAO to grow are limitless, and they are encouraged to freely consider and execute any new products and functions that can bring the maximum benefit to their users. Just as various L2 solutions launch their own products on Ethereum, Maker(L1) provides the core tokenomics and infrastructure, while MetaDAO(L2) focuses on building their own unique business models on top of the infrastructure provided by Maker to gain more users and profits

6. The Current Status of Endgame

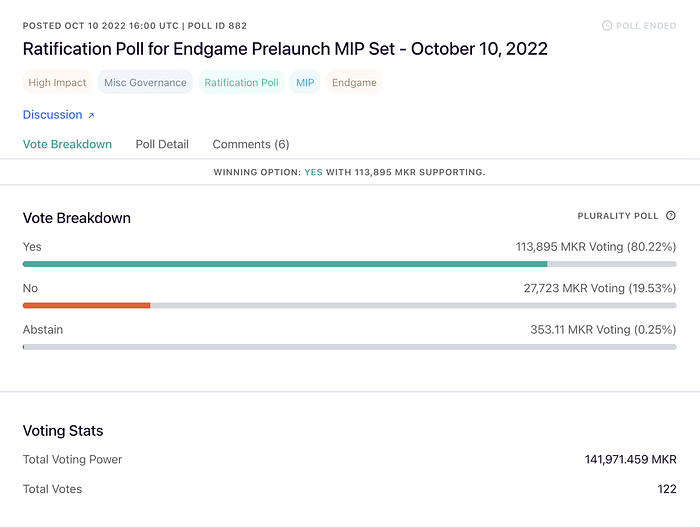

In the vote held on October 24, 80% of MakerDAO community members voted in favor of executing the Endgame plan. Rune has submitted basic rules called Maker Improvement Proposals(MIPs) for the launch of the Endgame Plan since early October and has gained the consent of many MakerDAO participants. Lucas Vogelsang, the founder of Centrifuge, a member of MakerDAO and a tokenized RWA company, said, ‘If you want to do something different, you have to create something new, not evolve the system you already have. And that’s exactly what we’re trying to do through MakerDAO — it’s a sea change.’ He explained the background that MakerDAO members accepted the somewhat radical change of the endgame.

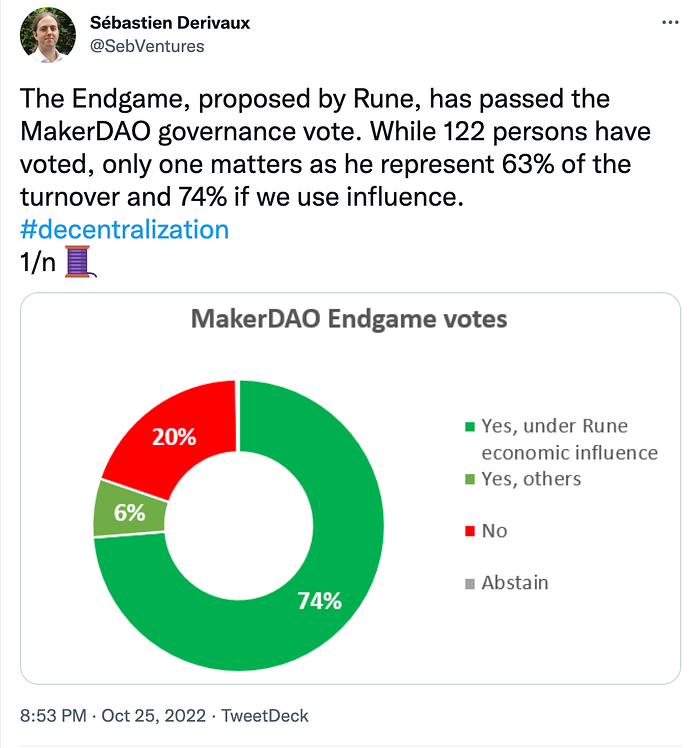

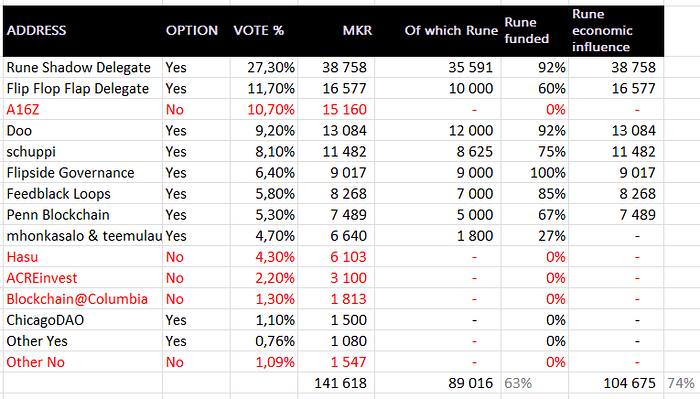

However, there are also voices of criticism on this matter. According to Sébastien Derivaux, the asset-liability manager of MakerDAO, 63% of the 122 addresses that participated in the vote were influenced by Rune. Derivaux claims that only 6% of the votes in favor were from votes unrelated to Rune, and that the endgame vote was highly centralized. In addition, a16z, a major MKR holder, also expressed concern about the endgame voting pattern.

Endgame is not yet an official position of MakerDAO and has not been confirmed for release. Additionally, the Endgame Plan is currently a draft version that is continuously being revised, rather than a completed roadmap. In fact, the original plan for a yearly issuance of 50,000 MKR has been modified to 65,000 due to the high level of centralization in token distribution.

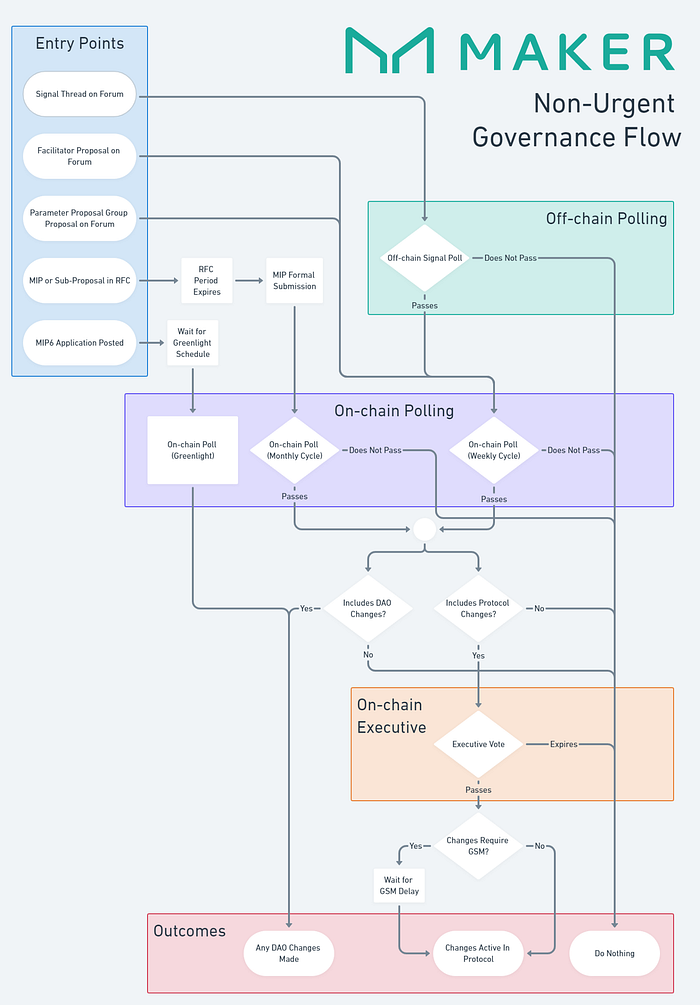

Currently, in order for a proposal to be approved and officially implemented by MakerDAO, it must go through the following process: entry points, off-chain polling, on-chain polling, and on-chain executive. The Endgame has passed the on-chain polling stage, but has not yet gone through executive voting, so it is not certain at this time whether it will be implemented.

Entry Points: The process of presenting opinions freely in the Maker forum.

• Off-Chain Polling: Polling that takes place off-chain, such as a discussion or informal vote, rather than a vote on the blockchain.

• On-Chain Polling: Polling in which MKR token holders participate, similar to a poll.

• On-Chain Executive: A vote in which the proposed changes to the Maker protocol that the proposal will bring are recorded in detail.

• Outcomes: A vote that has been approved and officially implemented by Maker governance.

7. Conclusion

So far, we have looked at the background of the Endgame plan, what the core of Endgame, MetaDAO, is, and how the Endgame plan will change the MakerDAO ecosystem. In particular, the main focus of this article has been the Endgame Plan’s proposals for improving the profitability of MakerDAO, which can be summarized as follows:

- Compensation for MDAO yield farming to holders of DAI, ETHD, and MKR.

- Value defense of MKR and MDAO tokens through a value cycle structure and a structure for growing demand for DAI through ETHD.

- Establishing an independent business model for each MetaDAO using the MetaDAO Surplus Buffer.

Although the official implementation of the Endgame Plan has not yet been confirmed and there are opinions that it does not represent the opinions of all members of MakerDAO, I believe that the innovative restructuring plans contained in the Endgame plan have sufficient value to be used as a reference for preparing the next generation of protocols, including DeFi protocols.

In the next article, we will take a closer look at another key aspect of the Endgame plan, the decentralization of DAI. We will examine why Rune argues that DAI must break away from its 1:1 value peg with the US dollar and become a currency that is not affected by external conditions, and how the changes in the composition of the DAI collateral proposed by Rune will be implemented. We will conclude this article with these remarks.

<References>

- Rune, Endgame Metanomics diagrams

- Rune, Endgame Plan v3 complete overview

- Rune, The Endgame Plan parts 1&2

- MakerDAO Community Portal, Learn

- MakerDAO, Maker Operational Manual