Intelligent DeFi: AI Redesigning the Blueprint of DeFi

Exploring the Changes AI Will Bring to the DeFi Ecosystem

1. Introduction

With the advancement of the IT industry, including increased computing power and expanded availability of big data, the performance of AI (Artificial Intelligence) models has also improved dramatically. Recently, AI performance has reached or surpassed human capabilities in many areas and is being rapidly applied to various industries such as healthcare, finance, and education.

A representative example of AI commercialization is ChatGPT, a generative AI model developed by OpenAI in November 2022 that can understand and respond to human natural language. ChatGPT acquired 1 million users in just 5 days after its launch and reached 100 million monthly active users in 2 months, earning the title of the fastest-growing consumer application in history.

NVIDIA, which designs and manufactures GPUs used for training and computation of major AI platforms, has also greatly benefited from this trend. In the first quarter of 2024, NVIDIA's net profit increased by 628% year-on-year to $14.8B, and its stock price rose about 3 times compared to the previous year, recording a market capitalization of $3.2T, showing remarkable performance.

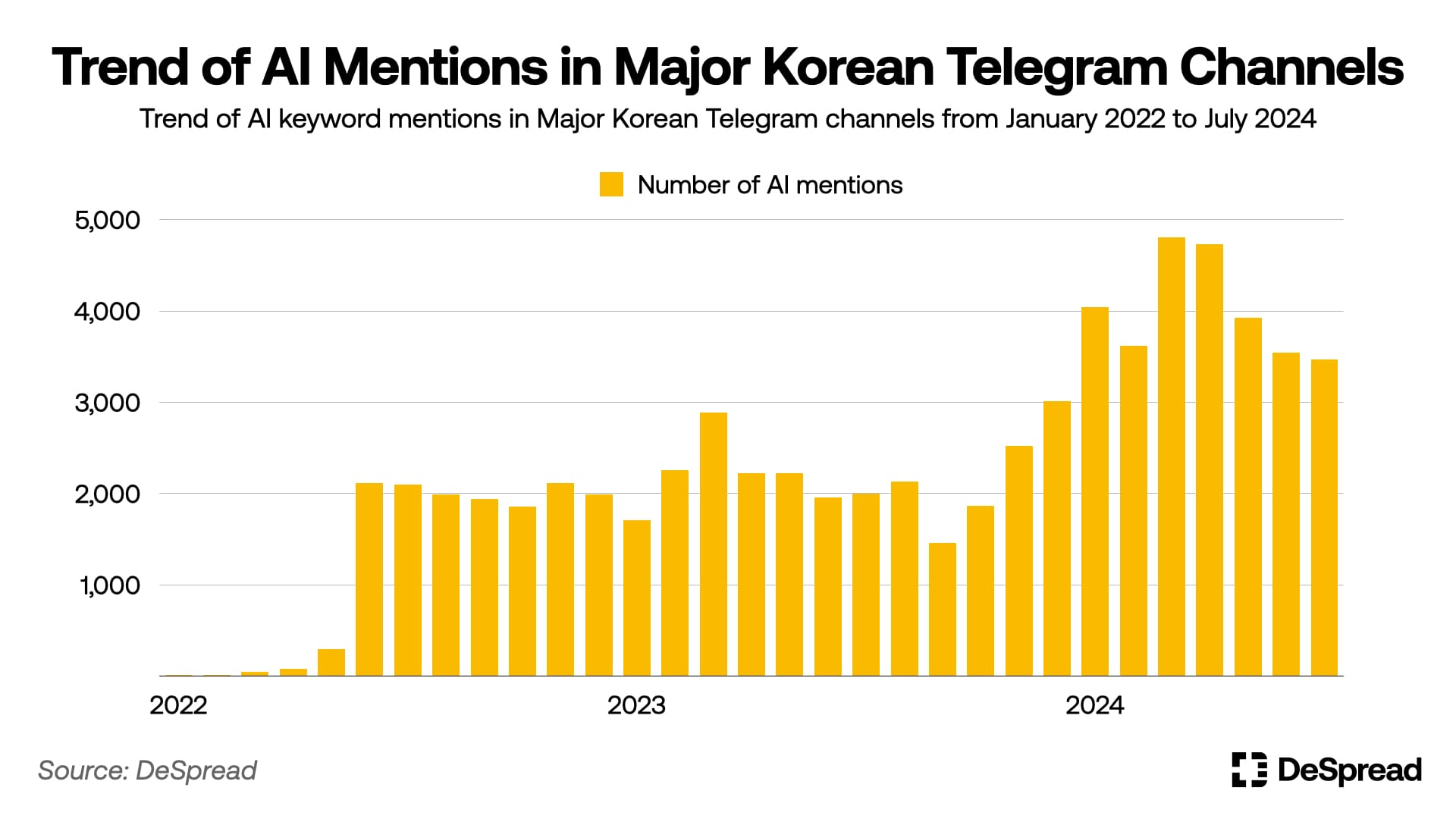

The rise of the AI sector is also having a significant impact on the crypto market. In June 2022, when NFT art projects were thriving, the release of DALL-E 2, an AI developed by OpenAI that generates high-quality images based on text, led to an 8-fold increase in AI keyword mentions in domestic crypto Telegram channels. Furthermore, from the second half of 2022, attempts to more directly link AI and blockchain began to emerge, and AI mentions increased by an additional 2 times.

The rise of the AI sector is also having a significant impact on the crypto market. In June 2022, when NFT art projects were thriving, the release of DALL-E 2, an AI developed by OpenAI that generates high-quality images based on text, led to an 8-fold increase in AI keyword mentions in major Korean crypto Telegram channels. Furthermore, from the second half of 2022, attempts to more directly link AI and blockchain began to emerge, and AI mentions increased by an additional 2 times.

This level of interest in AI from the crypto community is also reflected in investment trends in AI-related crypto projects. According to the virtual asset statistics site Coingecko, as of August 20, 2024, the total market capitalization of 277 blockchain projects classified in the AI sector has rapidly increased over the two years since projects combining AI with blockchain began to emerge in the second half of 2022, reaching $21B, which is about 25% higher than the Layer2 category.

However, the AI sector blockchain projects that have emerged and gained attention so far mainly adopt the form of using blockchain to solve the limitations highlighted as the AI industry develops. The main use cases are as follows:

- Decentralized GPU Network: Projects that utilize blockchain technology to create a distributed GPU network where anyone can contribute GPU power and receive token incentives, addressing the entry barrier issue due to the enormous GPU costs required for AI model training (e.g., IO.NET, Akash Network)

- Decentralized AI Training and Model Development: Projects where multiple participants contribute to AI training and model development and receive token incentives using blockchain technology to solve the AI bias problem caused by centralized AI development environments (e.g., Bittensor)

- On-chain AI Marketplace: Decentralized AI marketplace projects that transparently evaluate and trade the performance and reliability of AI models/agents using blockchain technology in response to the demand for AI models/agents specialized for industries and functions (e.g., SingularityNET, Autonolas)

In addition to these examples, various attempts continue to emerge to overcome the challenges faced by the current AI industry by utilizing blockchain infrastructure, such as decentralized data marketplaces and IP protocols. These attempts are creating synergy effects by providing a more stable infrastructure for the AI industry while expanding the range of applications for blockchain technology.

On the other hand, integrating AI into the blockchain ecosystem also holds infinite potential for development. Particularly in DeFi services, which are built on permissionlessness, there is potential to implement various functions that were difficult to realize with existing smart contracts if the involvement of trusted third parties can be minimized through the introduction of AI.

In this article, we will look at specific examples of how AI is being used in current DeFi protocols, the challenges they face, and the future of AI in DeFi.

2. Intelligent DeFi

AI has an excellent ability to analyze vast amounts of data in real-time and draw conclusions. This capability can play a significant role in concretizing data such as yields and risks provided by DeFi protocols for user fund execution and helping with risk management. In this case, AI mainly functions on the UI of the Dapp, allowing existing DeFi protocols to utilize AI without major structural modifications.

A representative example is Yearn Finance, a yield farming aggregator. To provide users with a safer investment environment, Yearn Finance is collaborating with GIZA, an AI agent building platform, to establish a real-time strategy risk assessment system for Yearn Finance v3 vaults.

However, what I focus more on in the fusion of the DeFi ecosystem and AI is the ability to give autonomy to DeFi protocols by utilizing AI's autonomous thinking and action capabilities.

Current DeFi protocols have a form that passively reacts to transactions generated by users. In other words, the smart contracts of the protocol operate in predefined ways according to user interactions. However, by incorporating AI into DeFi protocols, the protocol itself can analyze market conditions, make optimal decisions, and actively generate transactions. This enables the emergence of DeFi protocols that provide new forms of financial services that were difficult to implement before.

Let's look at specific examples of Intelligent DeFi protocols that utilize AI in their main operating mechanisms.

2.1. Fyde Treasury: AI Token Fund

Fyde Treasury is a protocol that provides a basket-type fund service called Liquid Vault, which operates multiple tokens together, and AI manages the portfolio. Users receive and can utilize $TRSY, a liquidity token corresponding to the assets deposited in the Liquid Vault.

2.1.1. Asset Selection and Fund Operation Method

The key task of the Liquid Vault is to increase the proportion of tokens with low volatility during a downward market trend, providing users with a lower rate of decline, thus offering a portfolio with good performance compared to other asset classes from a long-term perspective.

Fyde Treasury selects assets to be included in the Liquid Vault portfolio through the following three-step criteria:

- Evaluate whether there is abundant trading liquidity

- Examine the background of the protocol founders, protocol code audits, etc., to determine if there are any issues

- Analyze on-chain data through AI to evaluate the presence of wash trading, the degree of token centralization, organic growth trends, etc.

Tokens that pass these criteria are included in the Liquid Vault portfolio, and Fyde Treasury also utilizes AI in the asset management process of the Liquid Vault as follows:

- Market Analysis and Prediction: Analyze on-chain transaction data, market trends, news, etc., to predict future market trends

- Weight Calculation and Rebalancing: Calculate optimal token weights and execute rebalancing based on predicted market trends and recent performance and volatility of tokens in the portfolio

- Risk Management and Response: Quickly identify governance attacks, liquidity pool depletion, abnormal transactions from specific wallets, etc., for each token in the portfolio in real-time, and adjust the portfolio or isolate the relevant token from the portfolio

- Advanced Asset Management Strategy: Continuously evaluate portfolio performance, analyze strategy effectiveness, and derive data to modify and develop strategies. Then, conduct tests comparing existing strategies with newly derived strategies, measure performance, and reflect on actual operating strategies

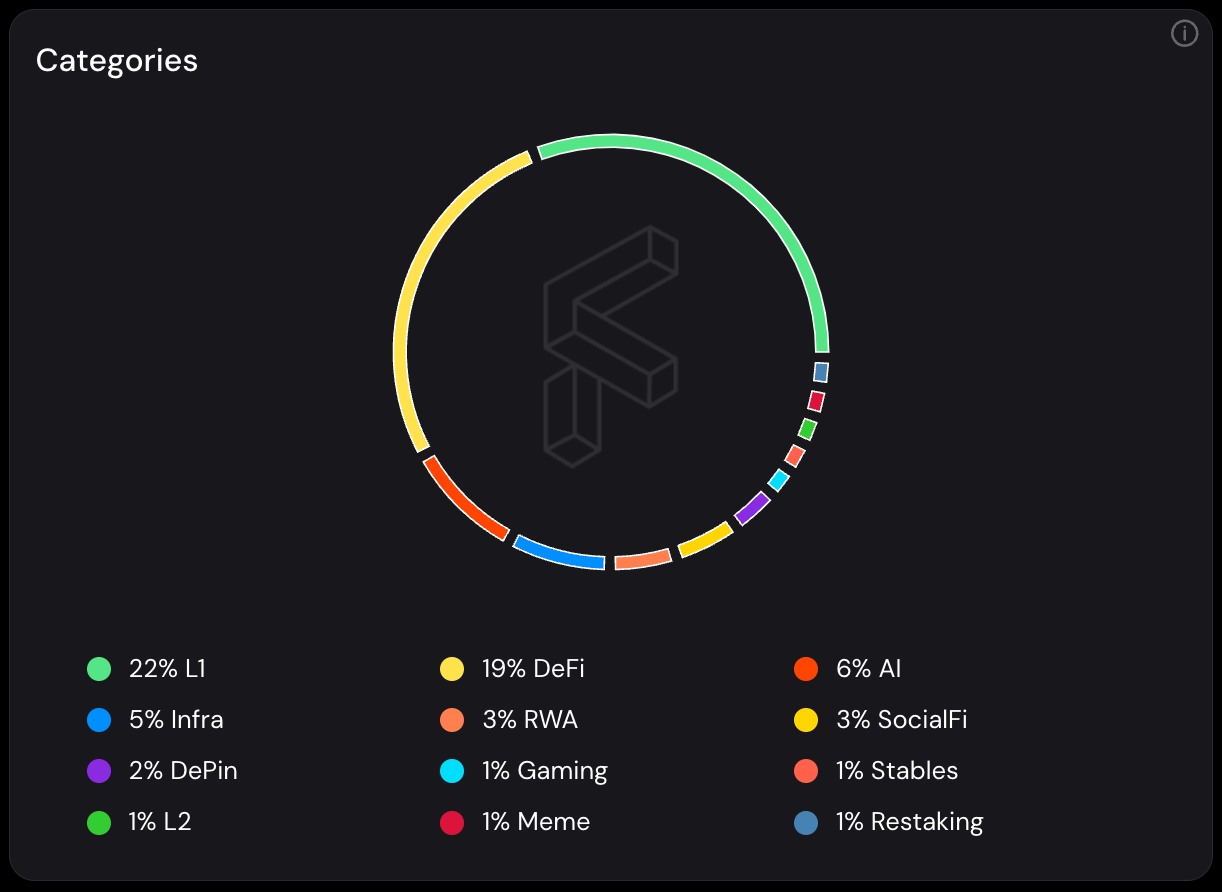

As of August 23, the writing date, there are a total of 29 tokens included in the Liquid Vault portfolio, consisting of various sector tokens based on the Ethereum network.

Additionally, Fyde Treasury provides a feature that allows users who deposit specific protocol governance tokens in the Liquid Vault to maintain their governance voting rights by providing liquidity tokens for those tokens. The governance tokens deposited by users in the Liquid Vault are sent to the depositor's wallet in the form of $gTRSY-token, which can be used to execute governance voting for the respective protocol in Fyde Treasury's governance tab.

However, voting rights are affected by the token weights in the portfolio, so voting rights may change each time the portfolio is adjusted.

2.1.2. Liquidity Mining Campaign

Fyde Treasury is awarding Fyde points to liquidity providers who improve the market liquidity of $TRSY, the Liquid Vault liquidity token, and promises to distribute $FYDE, Fyde Treasury's governance token, based on these points in the future.

Unlike other projects that typically conduct liquidity mining campaigns where users have to directly deposit pairs on decentralized exchanges and receive tokens or points, Fyde Treasury accepts users' $FYDE deposits into the protocol's internal liquidity mining contract and directly executes liquidity provision to Uniswap v3, a decentralized exchange that allows setting the supply range when providing liquidity.

In the process of providing liquidity to Uniswap v3, it calculates and executes the optimal exchange path for converting some of the $FYDE deposited in the liquidity mining contract to $ETH through an AI-based simulation environment. Additionally, depending on market conditions, AI also manages and optimizes the liquidity provision deposit range on Uniswap v3 in real-time, achieving about 4 times the capital efficiency compared to providing liquidity to a general decentralized exchange with the same capital.

In this way, Fyde Treasury is building a basket fund that minimizes human judgment and prevents various risks existing in the market in real-time by utilizing AI for assets deposited by users in the protocol.

2.1.3. Protocol Performance

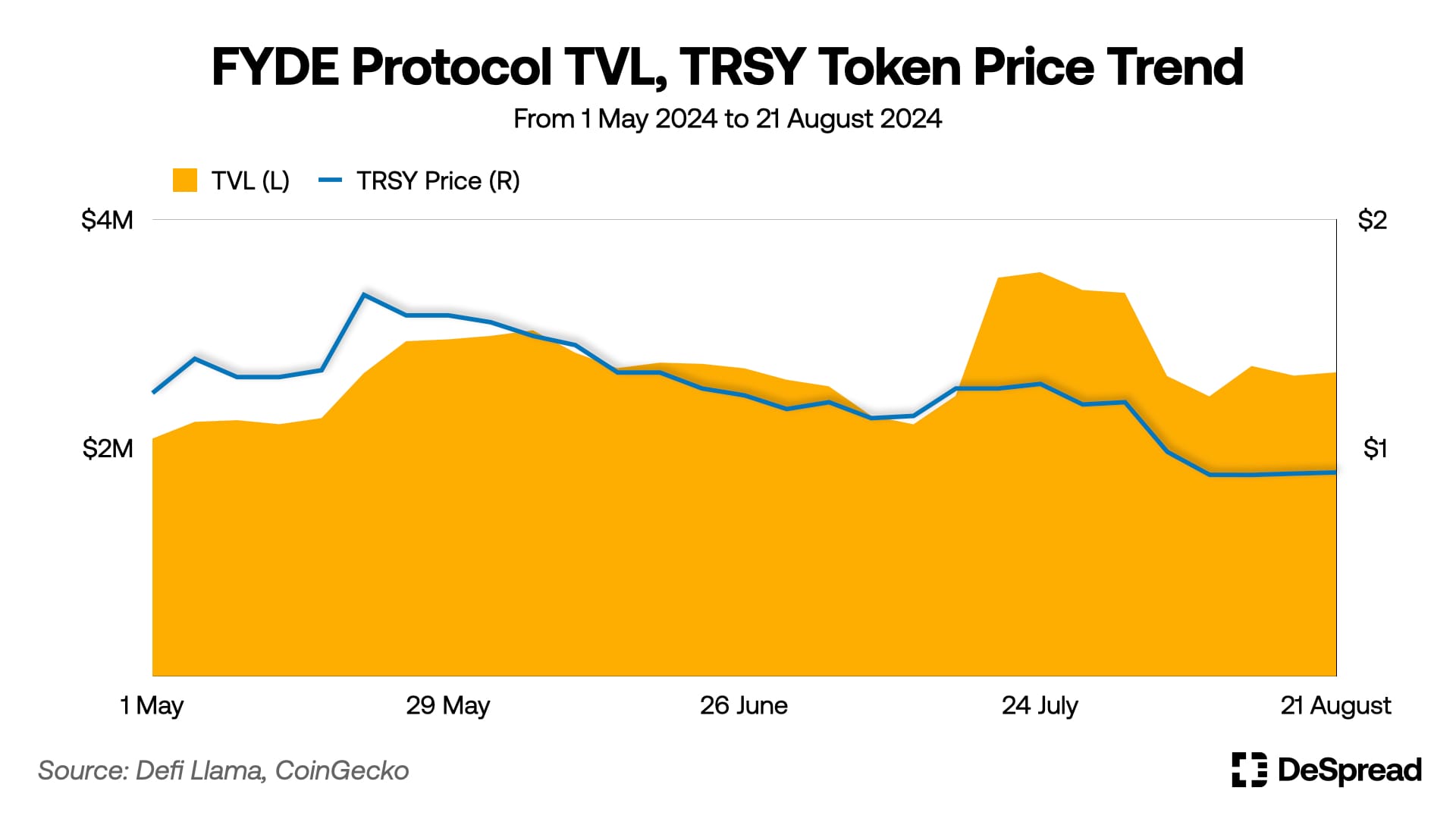

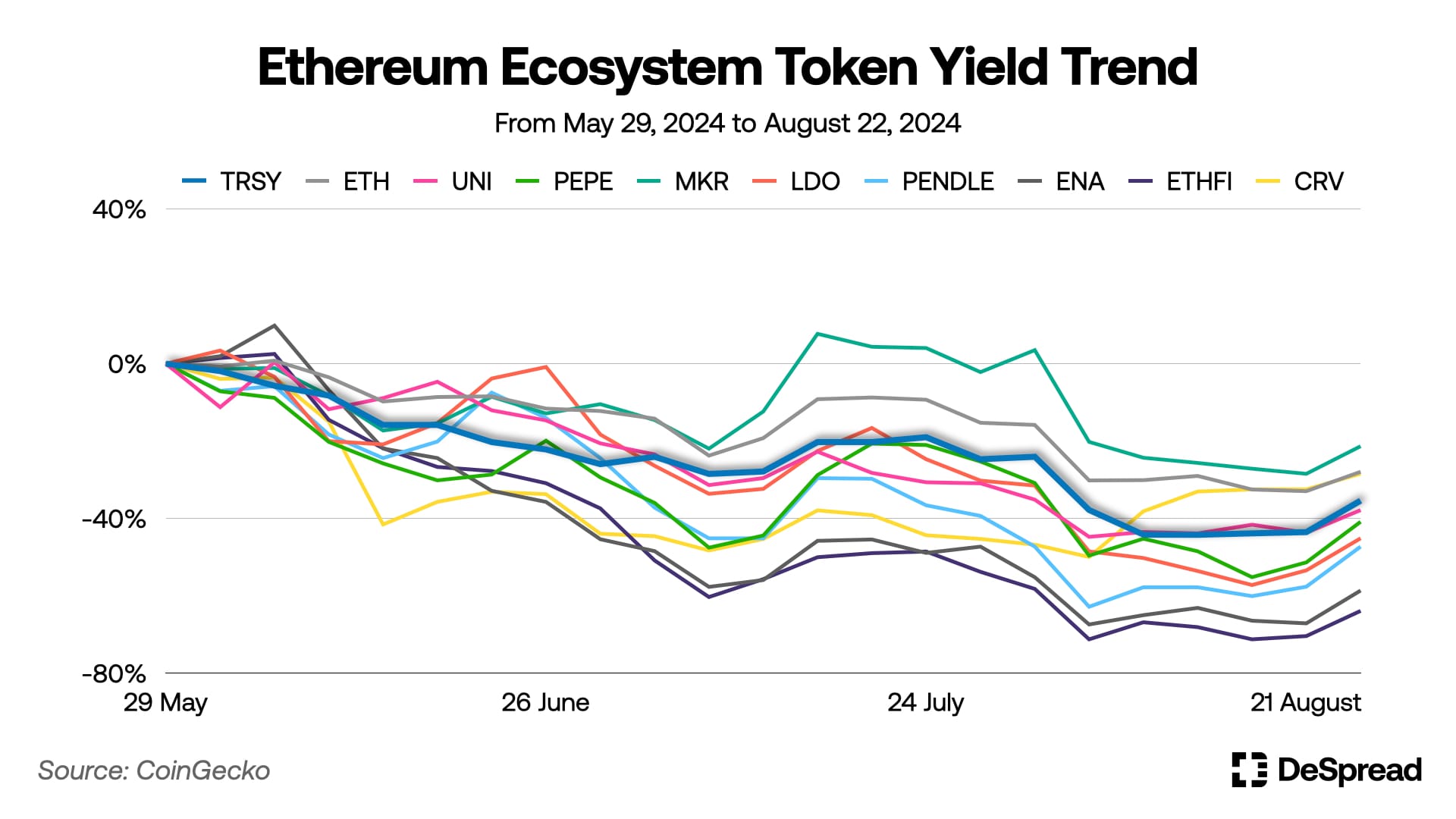

Fyde Treasury's TVL has steadily increased since its launch in January 2024, reaching $2M and maintaining around $2M TVL consistently until now. On the other hand, the value of the $TRSY token has shown a -35% return over the past three months due to the continued market weakness since late May.

However, when comparing the returns of $TRSY with other major tokens in the Ethereum ecosystem, we can see that the $TRSY token is showing a smaller decline based on relatively stable price volatility.

Fyde Treasury has been launched for less than a year, and Fyde's AI model continues to learn and develop through market data. Therefore, as AI learning accumulates and optimizes, there is a possibility of showing better performance in the future, so it is necessary to pay attention to Fyde Treasury's future development direction and performance.

2.2. Mozaic Finance: AI Yield Optimizer

Mozaic Finance is a yield optimizer protocol that optimizes yield farming strategies using specific DeFi protocols through AI. Mozaic Finance provides users with various DeFi ecosystem asset management strategies in the form of vaults and utilizes the following two types of AI for strategy optimization:

- Conon: Analyzes on-chain data in real-time to predict market conditions and changes in APY of yield farming strategies

- Archimedes: Calculates the optimal investment strategy and executes fund allocation based on the prediction data derived by Conon

Thus, in Mozaic Finance, AI agents Conon, acting as an 'analyst', and Archimedes, acting as a 'strategist', collaborate to manage assets deposited by users.

2.2.1. Types of Vaults

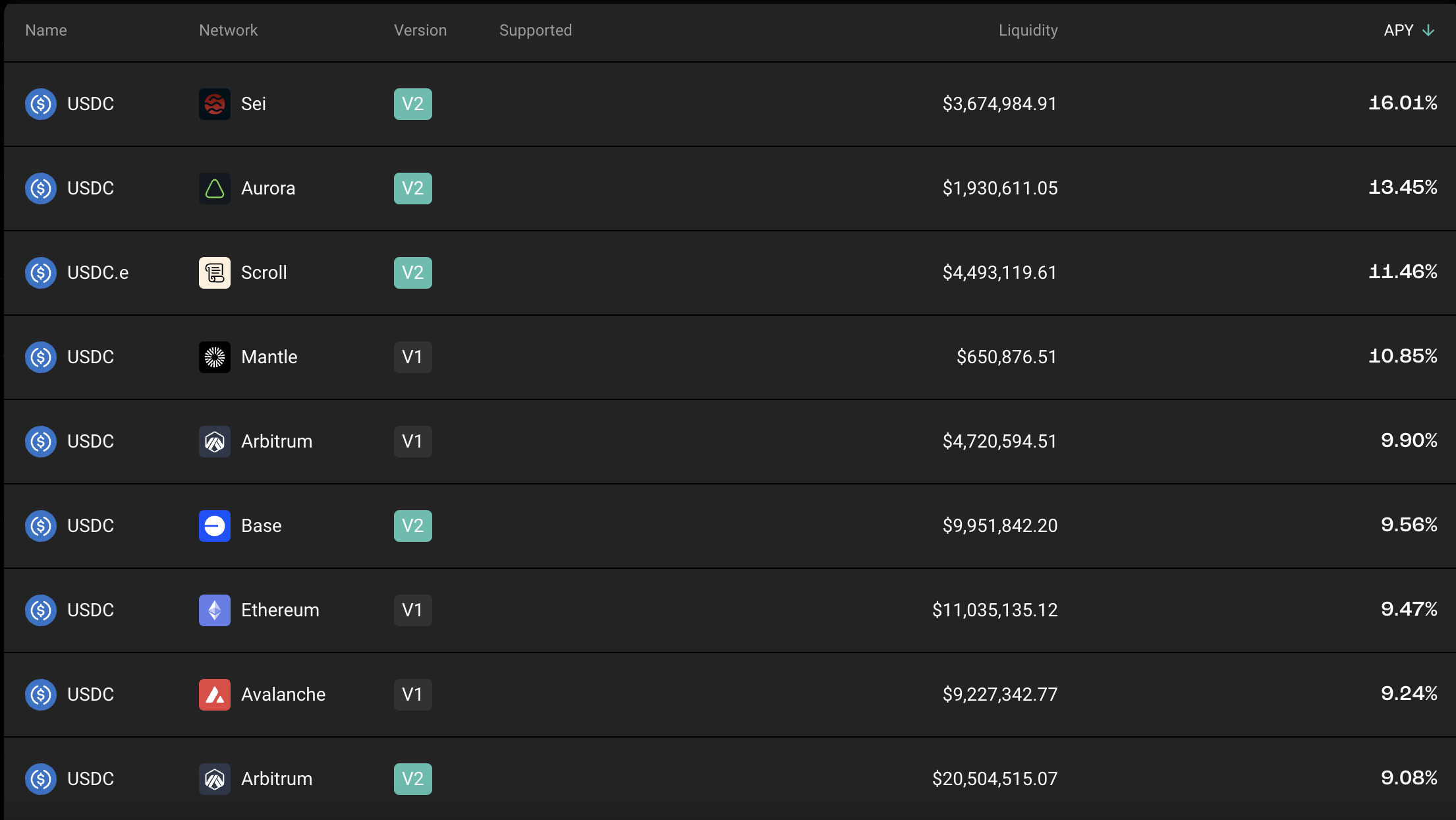

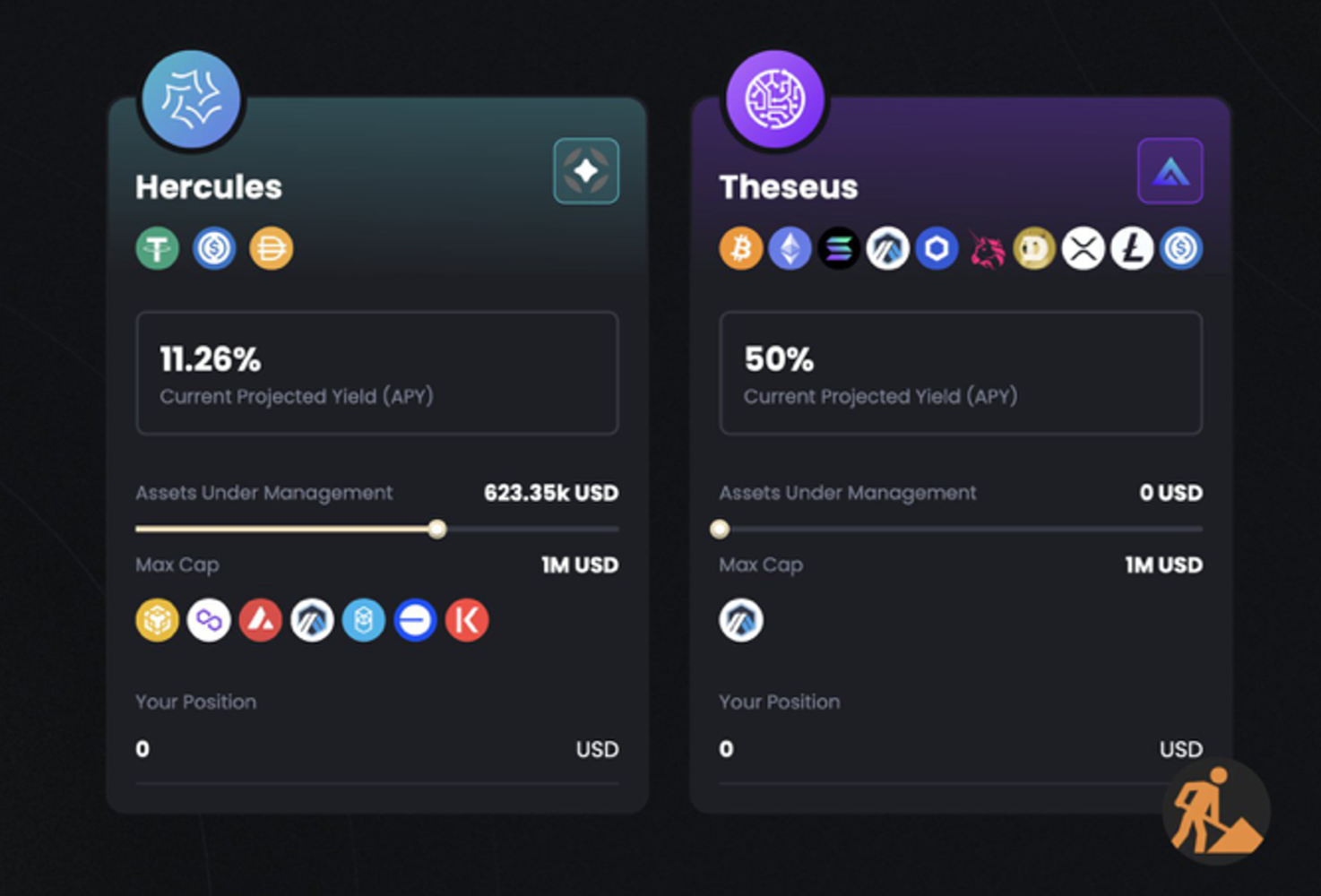

- Hercules: A vault that can execute yield farming using stablecoins, and depositors are issued MOZ-HER-LP tokens as liquidity tokens

- The assets deposited by users in the vault are supplied as liquidity to the bridge protocol Stargate to generate yield. AI bridges and rebalances vault assets to liquidity pools with higher yields in real-time, utilizing Stargate's characteristic where APY is set differently for each network depending on the degree of liquidity, even for the same asset

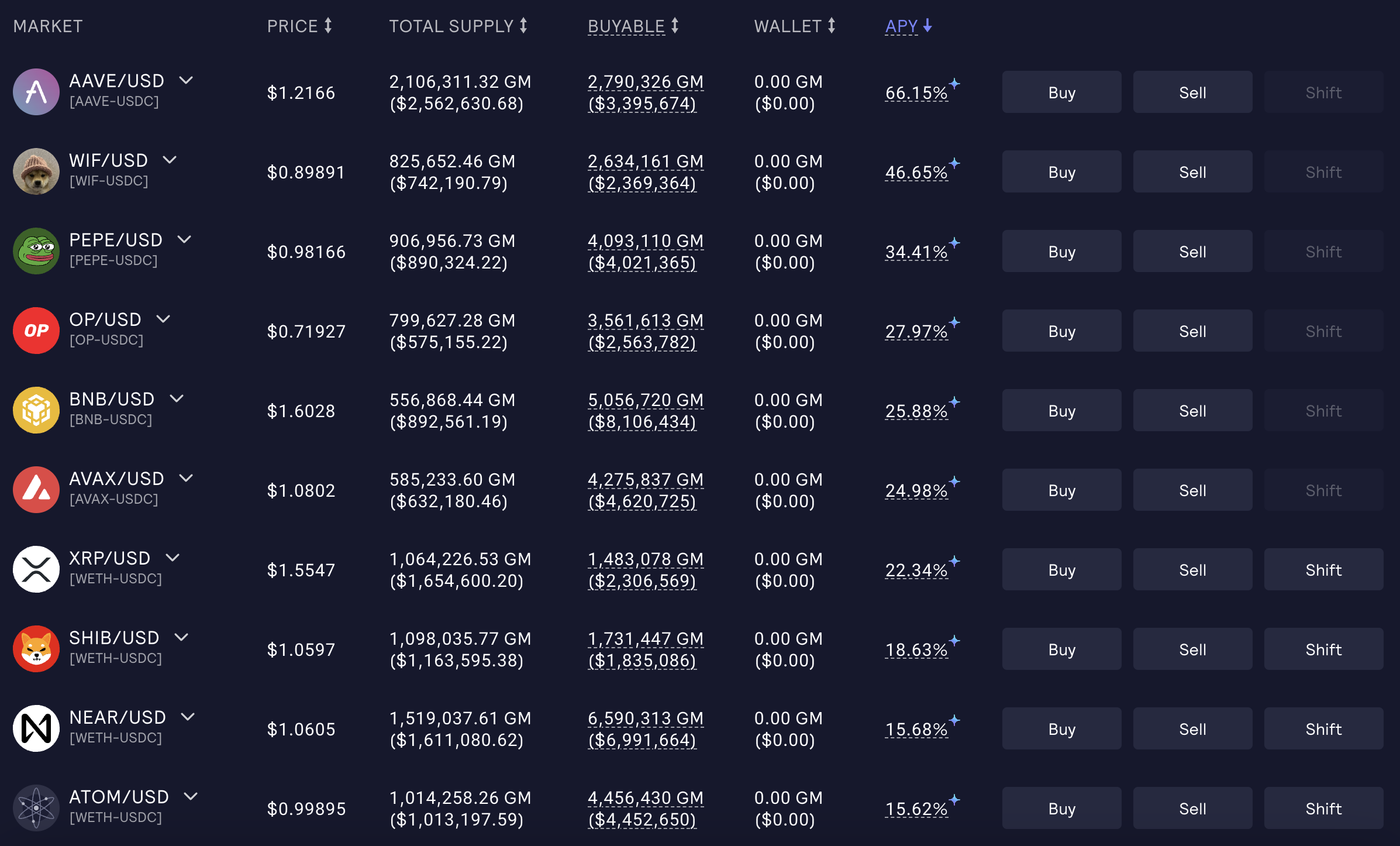

- Theseus: A vault that generates yield using various volatile assets, and depositors are issued MOZ-THE-LP tokens as liquidity tokens

- Assets deposited by users in the vault are deposited in the GM Pool of the GMX protocol, a decentralized perpetual futures exchange, providing trading liquidity to traders and earning incentives. At this time, liquidity is deployed considering the volatility and interest rates of each GM pool trading asset, and depending on market conditions, the proportion of stablecoins may be increased and deposited in Stargate to generate additional interest

- Perseus: A vault that actively utilizes the PoL (Proof of Liquidity) consensus mechanism to receive network rewards by providing liquidity to ecosystem protocols of Berachain, which is about to launch its mainnet. The Mozaic Finance team is currently developing and preparing to launch strategies using Berachain's testnet. Detailed information will be disclosed later

Unlike Fyde Treasury, which builds token basket funds, Mozaic Finance is a protocol that optimizes liquidity supply strategies and processes through AI when depositing user assets into DeFi protocols and manages risks.

As of January 2024, the Hercules and Theseus vaults were showing good performance with high expected APYs of about 11% and 50%, respectively. However, due to a fund theft incident in Mozaic Finance's vaults, both vaults are currently suspended.

2.2.2. Fund Theft Incident and Mozaic 2.0

The fund theft incident at Mozaic Finance occurred on March 15, 2024, while transitioning to a new security solution developed by Hypernative to enhance on-chain risk and security.

Before the security update was completed, an internal developer discovered that the vault's funds could be stolen using a core team member's private key. They hacked the core team member's PC to obtain the private key. Then, using the stolen key, they stole about $2M worth of assets tied up in the vaults and moved them to centralized exchanges for liquidation.

Due to this incident, the Mozaic Finance team suspended the operation of the Hercules and Theseus vaults, and the value of $MOZ, the governance and protocol fee collection token, dropped by about 80%. Immediately after the theft incident, the Mozaic Finance team transparently disclosed the progress of the incident and, in collaboration with security firms, tracked the flow of stolen assets and applied for freezing and return of stolen funds to the exchanges where the developer deposited the stolen assets, making efforts to resume protocol operations.

Fortunately, the return of all stolen funds is currently in progress, and while waiting for the return of stolen funds from centralized exchanges, the team is preparing to launch Mozaic 2.0, which includes the following improvements:

- Enhanced Security: Conducting code audits and security enhancements through security specialist firms such as Trust Security, Testmachine, and Hypernative

- AI Model Improvement: Comprehensively upgrading the existing Archimedes model, as well as predicting and learning black swan scenarios that have not occurred so far due to lack of data based on expert knowledge. Also, detecting abnormal decisions and setting flags for human review and model improvement

- Improved User Experience: Improving the UI/UX of the Dapp and enhancing user accessibility to the Dapp in various chain environments through account abstraction and bridging service integration

Thus, although Mozaic Finance experienced a major crisis with the fund theft incident, they are preparing to launch Mozaic 2.0 and striving to provide users with a safer and more efficient asset management service.

3. Challenge: AI's Decentralization and Scalability Dilemma

So far, we have looked at how Intelligent DeFi protocols utilize AI as a core component of DeFi applications through the cases of Fyde Treasury and Mozaic Finance. The benefits that Intelligent DeFi protocols can gain by utilizing AI can be summarized as follows:

- Establishing new types of DeFi protocol models through autonomy

- Enhancing capital efficiency through analysis and optimization of fund operation methods

- Real-time analysis and response to risks such as abnormal transactions

Currently, the integration of blockchain and AI is mostly taking place in the direction of building blockchain infrastructure to solve the limitations of AI. However, we expect that attempts to introduce AI into DeFi protocols will increase due to the benefits mentioned above. Of course, there are also challenges to be solved in the process of combining these two fields.

AI requires an environment that can process large amounts of data quickly, but the current blockchain infrastructure cannot meet the level of data processing speed required by AI. For example, the ChatGPT-3 model is estimated to require trillions of data processes per second to generate answers to questions, which is about ten million times faster than Solana's maximum TPS (Transactions Per Second) of 65,000.

Furthermore, even if blockchain infrastructure develops to the point where AI computations become possible, the transparency of public blockchains could potentially expose the training data and decision weights of AI models to the public. This presents a limitation where the transactions generated by AI could become predictable, potentially exposing them to various external attacks.

For these reasons, DeFi protocols that want to utilize AI, including Fyde Treasury and Mozaic Finance introduced above, are currently running AI on centralized servers and interacting with the blockchain based on the results.

However, this approach creates a situation where users who have deposited assets in the protocol must trust the honesty of the team managing the AI, which undermines the principle of DeFi to provide a trustless trading environment by eliminating the need for trusted third parties through smart contracts. This dilemma of decentralization and scalability that arises in the process of utilizing AI in blockchain is considered a challenge that DeFi applications must solve in the process of utilizing AI, and zkML (Zero Knowledge Machine Learning) technology is gaining attention as an alternative to this.

3.1. zkML (Zero Knowledge Machine Learning)

zkML is a technology that combines Zero-Knowledge Proofs (ZKP) and Machine Learning (ML). Zero-knowledge proofs are a cryptographic technique that can prove the content of certain data without disclosing it, enabling both privacy protection and data integrity verification. zkML applies these characteristics of zero-knowledge proofs to machine learning, making it possible to prove that the output of the model was correctly calculated without disclosing the input, parameters, and internal workings of the AI model.

Moreover, by constructing the smart contract of the DeFi protocol to verify the zero-knowledge proof and generate on-chain transactions only when the AI model has operated honestly as intended without external interference, AI can be safely integrated into the DeFi protocol.

For example, Mozaic Finance, introduced earlier, plans to introduce zero-knowledge proof technology to the protocol in the future, and has stated in their docs that this will complement the ability to prove in real-time that Archimedes makes decisions honestly and manages vaults.

However, zero-knowledge proof technology has not been around for long, and much discussion and development is needed for it to be actually adopted. In particular, generating zero-knowledge proofs for complex AI models, while more efficient than directly implementing AI models on the blockchain, still requires more computational costs and storage capacity than the current blockchain infrastructure can provide. Therefore, for zkML to be practical, further technological advancement and optimization of zero-knowledge proofs and blockchain infrastructure are needed.

4. Agent-Based Economy and Proof of Personhood

I expect that as blockchain and AI technologies continue to develop, they will gradually achieve the challenges necessary for the two fields to converge. Furthermore, based on this progress, I anticipate that in the near future, most DeFi protocols will integrate AI as part of their operating mechanisms.

Moreover, with the emergence and sophistication of AI agent deployment and trading platforms such as SingularityNET and Autonolas, an environment is being created where not only can AI be integrated at the protocol level, but individual users can easily utilize AI agents. In other words, every 'human' participating in the blockchain ecosystem will be able to build and utilize Intelligent DeFi protocols optimized for individuals.

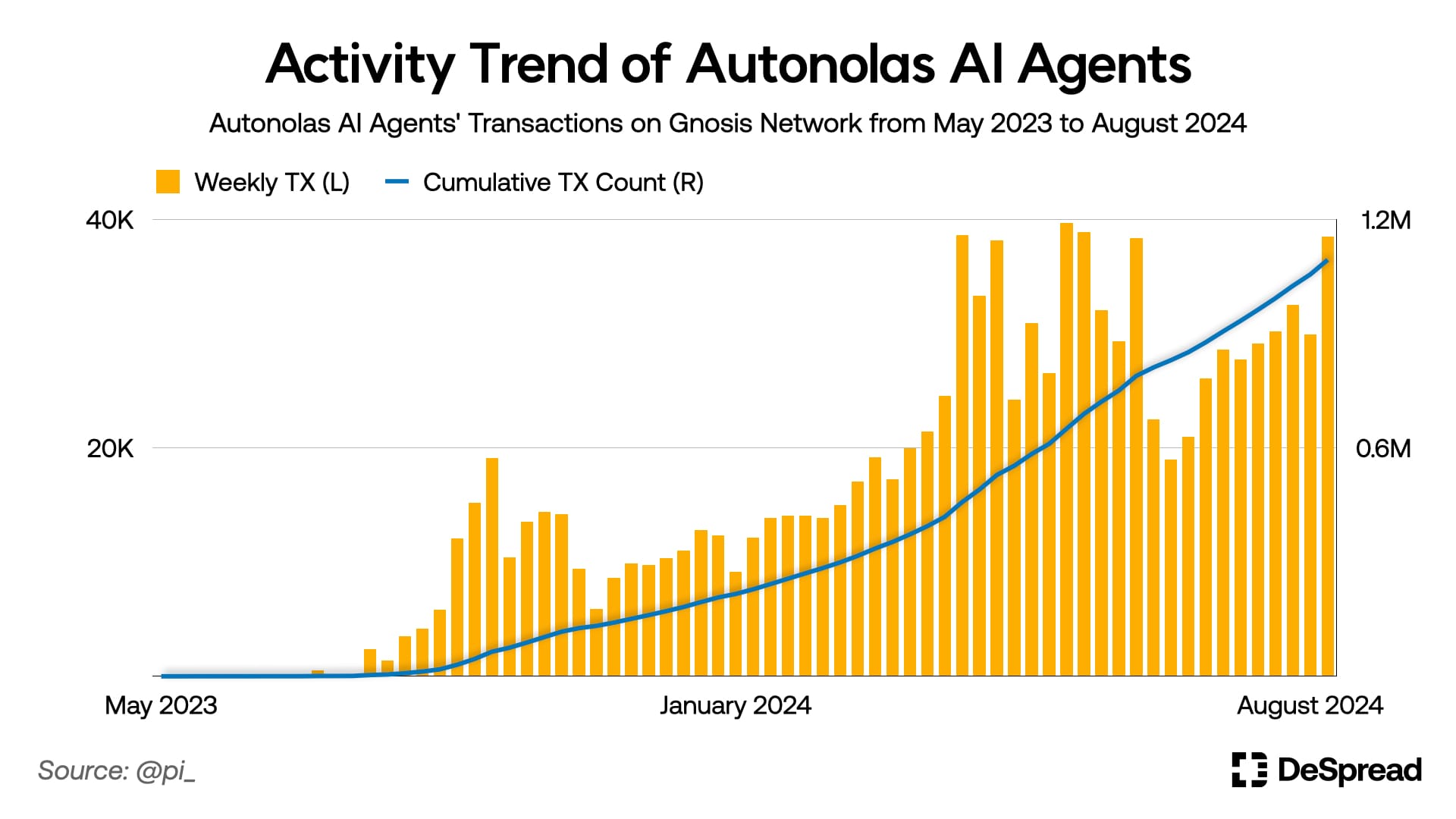

For example, the number and activity of Autonolas' AI agents executing bets by analyzing on-chain and off-chain data on Omen, the prediction market platform of the Gnosis network, have steadily increased, generating over a million transactions in about a year from July 2023.

It is expected that personalized AI agents capable of efficient 24-hour capital management will increase and actively participate in the blockchain ecosystem in the future. This will lead to the utilization of idle liquidity and more efficient capital operation, greatly increasing the overall liquidity of the ecosystem. Ultimately, transactions between AI agents are expected to become the main activity of the ecosystem, forming a new agent-based economic ecosystem.

Furthermore, as the models of personalized AI agents become more intelligent in the future, personal AI agents are likely to expand their range of activities to areas designed for 'humans' with agency to perform, including on-chain asset management tailored to individual tendencies, capturing and participating in airdrop opportunities, and participating in governance.

Therefore, as AI agents increasingly mimic human behavior precisely, it will become more difficult to distinguish between "real" human users and AI agents in the future. Accordingly, the importance of Proof of Personhood, a mechanism for proving a user's humanity and uniqueness, is expected to be highlighted, centering around protocols that value human value and agency.

4.1. Proof of Personhood

Proof of Personhood is a mechanism that allows proving an individual's humanity and uniqueness by linking characteristics that only humans can have with personal accounts on the network. The methodologies currently being discussed and emerging can be broadly classified into two categories:

- Physical Authentication-based: Utilizes unique biometric information such as face, fingerprint, iris, etc., through hardware

- Behavior Analysis-based: Determines humanity and uniqueness based on a user's social graph and reputation, network activity patterns, etc., based on the network activity of a specific account and its interactions with other accounts

The behavior analysis-based Proof of Personhood method relatively well protects user privacy and has the advantage of being accessible without special hardware for identifying the body, but it requires a large amount of network data to increase the accuracy and reliability of the proof. As AI agents become more sophisticated, its discernment may decrease, so it is expected that physical-based Proof of Personhood will be more widely adopted in the future.

A representative protocol that has introduced physical authentication-based Proof of Personhood is Worldcoin, co-founded by Sam Altman, the founder of OpenAI, which created ChatGPT. Worldcoin is a project that conducts research and experiments to implement Universal Basic Income by assigning unique digital IDs to all people in the world through Proof of Personhood and distributing $WLD tokens to all people with IDs, in preparation for a future situation where people lose jobs due to the development of AI.

4.1.1. Worldcoin

Worldcoin is a physical authentication-based Proof of Personhood project that recognizes human irises using special hardware called the Orb. After iris recognition, a World ID is issued for that iris on the Worldcoin network, and a private key that can access that World ID is generated on the user's personal device.

At this time, the Worldcoin network only stores the hash value of the scanned iris data so that the user's iris cannot be reconstructed or identified, and whenever authentication for the World ID is required, the user's device generates a zero-knowledge proof and sends it to the network, protecting the data privacy of individual on-chain activities.

However, due to the system of recognizing the iris only when issuing the World ID, challenges such as World ID transfer through the trading of devices holding private keys and AI agents' access to private keys still exist. Worldcoin is making efforts to solve these problems by discussing the introduction of a biometric authentication system when using World ID and developing behavior analysis-based AI detection algorithms.

5. Conclusion

In this article, we have looked at protocols providing new types of services emerging as AI is incorporated into the blockchain ecosystem, the challenges faced by these protocols, and the future of the blockchain ecosystem based on AI agents.

In the future, AI and blockchain technologies will continue to develop and converge, complementing each other's limitations, and through this, it is expected that an environment will be provided where individuals can access and utilize AI and blockchain more conveniently.

Especially in the future on-chain economic ecosystem centered on AI agents, anyone will be able to use and provide financial services easily without a high level of financial knowledge. This is expected to contribute greatly to improving the liquidity of the on-chain ecosystem and expanding the inclusiveness of the 'financial' industry.

Furthermore, AI and blockchain have the potential to be used as infrastructure for various industries beyond simply influencing each other, and as a result, the development of these two technologies will bring about widespread changes to human society as a whole, beyond their impact on individual industries.

However, institutional regulations related to AI, such as data privacy protection and AI accountability issues, and institutional regulations on blockchain, such as the securities nature of tokens, will greatly influence the future development direction and industry structure of these technologies. Therefore, it is necessary to closely observe the content of industry regulations for AI and blockchain that will be established in the future.

Ultimately, we hope that the development of these technologies will provide a better environment for humanity and contribute to solving various problems in our society.