IVS2024 Recap — A Glimpse into the Present and Future of Web3 in Japan

The Progress and Potential of Japan's Web3 Industry

1. Introduction

It's been over a year since Japan's Web3 industry began attracting significant attention. Under the Kishida administration, Japan has been making vigorous efforts to revive its economy from the "the Lost Decades" and re-establish itself as a major player in the current market. As part of this effort, developing the Web3 industry has been a key focus. Notable strides include establishing clear regulations for virtual assets, promoting various Web3 activities across government departments, and seeing major financial institutions enter the stablecoin and security token markets.

Throughout 2023, I have authored articles covering various aspects of Japan's Web3 landscape, including security token offering (STO), regulatory trends, strategies of Japanese financial institutions in the stablecoin sector, and the current state of blockchain gaming in Japan. My participation in WebX Tokyo 2023 and IVS2024 Kyoto allowed me to experience firsthand the intense enthusiasm for Web3 in Japan.

1.1 What is IVS?

The IVS is Japan's largest startup conference, which began in 2007. In 2022, IVS Crypto was introduced to cater specifically to Web3 companies, making it one of Japan's largest blockchain events. Following the 2022 event in Naha and the 2023 event in Kyoto, IVS2024 Crypto was held again in Kyoto from July 4th to 6th, attracting over 12,000 participants from various sectors, including venture capital, projects, media, and students. This year, DeSpread participated in IVS2024 Kyoto as a partner, continuing our involvement from the previous year.

Under the theme "Cross Boundaries," IVS2024 saw the participation of numerous companies and projects from both Web2 and Web3. Despite being branded as a startup conference, the event also featured prominent Japanese corporations such as Sony, SBI, and KDDI.

The conference layout featured Web2 and Web3 booths equally divided around the central main stage, allowing participants to easily explore new initiatives in both sectors. Notably, several trendsetting projects utilizing blockchain for mobile payments and various AI-driven services stood out, contrasting sharply with Japan's traditional industry image. These innovations reflect the strong push for digital transformation (DX) by the Kishida administration.

This article will cover the current state and trends of Japan's Web3 industry as observed at IVS2024 Kyoto. Also, it will examine the changes and advancements in the Web3 space over the past year and highlight noteworthy projects to watch in the future.

2. IVS2024 Recap

2.1. Speech Session Analysis

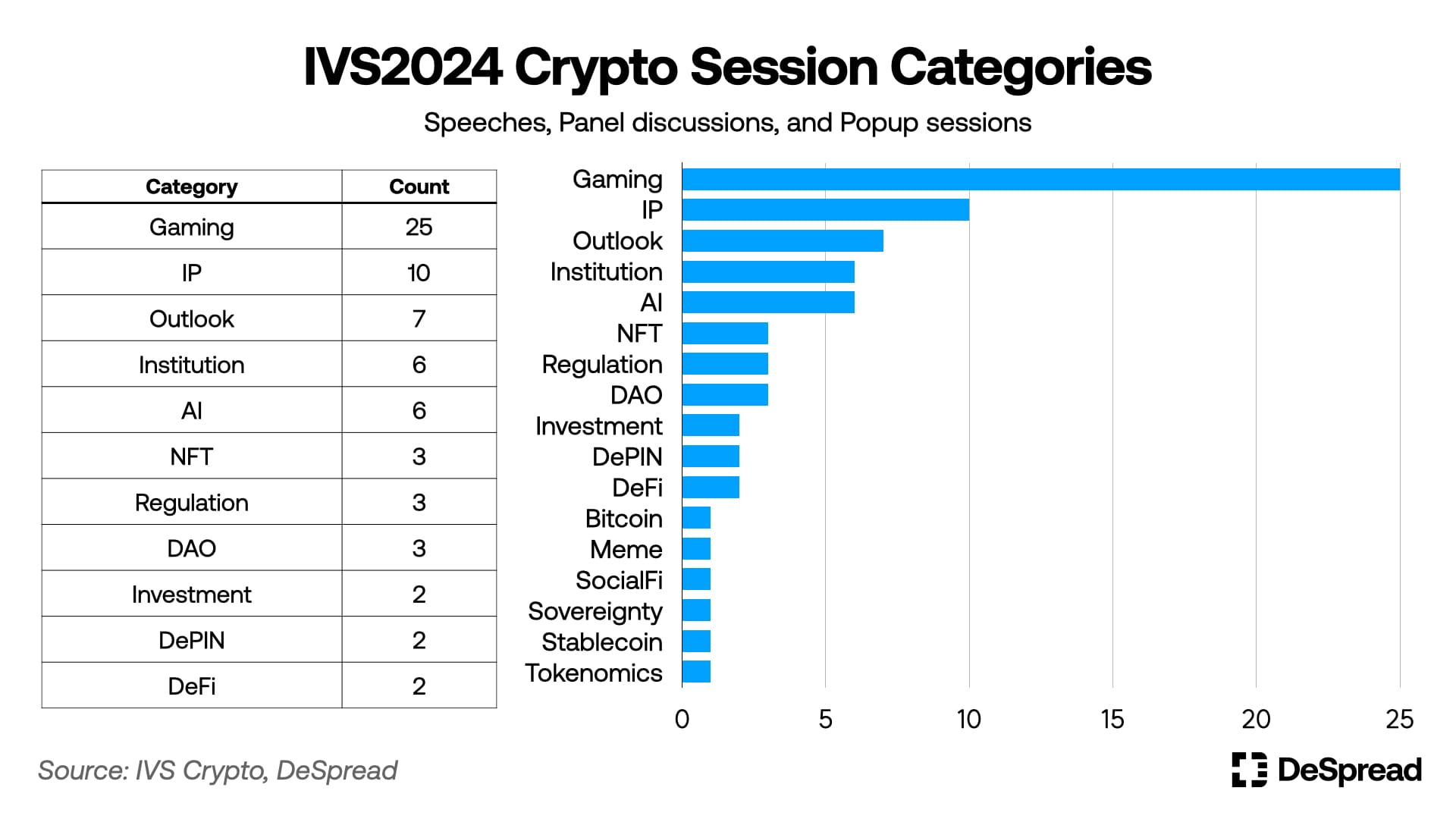

From July 4th to 7th, IVS2024 Crypto featured a total of 75 sessions across five venues: the IVS Crypto Main Stage, Web3 Stage, Web3 Entertainment Zone, Crypto Village, and Pitch Park. These sessions included speeches, panel discussions (fireside chats), interactive pop-up sessions, and hackathons. Excluding the opening session, community meetups in the Crypto Village, and the hackathon held at Pitch Park, a category analysis was conducted on the remaining 63 sessions. It's important to note that some sessions fell into multiple categories, so the total number of sessions mentioned below exceeds 63.

2.1.1. Gaming Continues to Dominate

Gaming and Intellectual Property (IP) ranked first and second with 25 and 10 sessions, respectively. Even before Japan fully ventured into the Web3 industry, gaming and NFTs, driven by Japan's rich IP resources, were seen as the primary engines for the country's blockchain industry. Numerous startups and major corporations have been actively pursuing Web3 through gaming and NFT-related projects.

This trend continued at IVS2024 Crypto. Approximately 40% of the 63 sessions were gaming-related, underscoring that gaming remains the most vibrant and heavily discussed sector within Japan's Web3 industry.

Out of 20 sessions on the Main Stage, 40% focused on gaming. On the Web3 Stage, 17.4% of the 23 sessions were gaming-related. A significant 65% of the 20 sessions in the Entertainment Zone centered around gaming. The substantial number of gaming sessions on the Main Stage and the dedicated Entertainment Zone for sessions related to NFTs, IP, and gaming all underline the importance of gaming within Japan's Web3 sector.

Despite the lower numbers recorded for NFT-related sessions in the analysis, it is essential to consider that many gaming projects that conducted sessions utilized NFTs. Additionally, discussions about NFT adoption strategies frequently occurred in sessions categorized under different topics. This highlights the continued importance of NFTs in Japan beyond the raw numbers.

2.1.2. Active Discussions on Institutions and Regulations

The global attention on Japan's Web3 sector since last year can be attributed to the active participation of the government and institutions in Web3, underpinned by the establishment of virtual asset regulations. Following major exchange hacks like Mt.Gox in 2014 and Coincheck in 2018, the Japanese government amended the Payment Services Act (PSA) and the Financial Instruments and Exchange Act (FIEA), establishing itself as a leading country in virtual asset regulation. Major traditional financial institutions such as SBI and MUFG, along with large corporations from various industries like Sony, NTT, and Bandai Namco, are either providing or preparing to offer Web3 services.

Institutions and regulations were hot topics at the IVS2024 Crypto sessions. High-ranking executives from globally recognized corporations and the Chief Fintech Officer of the Japan Financial Services Agency (FSA) participated as panelists. Sessions related to institutions primarily covered the Web3 industry entry strategies of major corporations, while regulatory sessions saw heated discussions on tax policies and stablecoins.

Japan implemented stablecoin regulations in June last year, and many financial institutions had already ventured into the stablecoin issuance and distribution business prior to that. Although there was only one session specifically about stablecoins, the topic frequently surfaced in sessions related to institutions, regulations, and outlooks.

In the "Web3 and Crypto Outlook into 2024 and 2025" session on the Main Stage, Akio Tanaka, partner at Headline Asia and IVC emphasized the importance of the stablecoin industry for Japan to regain its competitive edge lost in Web2. This sentiment was echoed by the high attendance and enthusiastic response in the "Current Status and Outlook for Stablecoins" session, which featured panelists from JPYC, Sony Bank, and the Bank of Japan.

2.1.3. High Interest in AI

AI-related sessions totaled six, tying with institutions for fourth place. Notably, while discussions about AI applications in the blockchain industry have previously focused on infrastructure like DePIN, IVS2024 Crypto highlighted AI as a tool to revitalize the gaming and IP industries. This emphasis reaffirms that gaming and IP remain the primary areas of interest within Japan's Web3 space.

[The list of AI sessions related to gaming and IP]

- AI application: Acceleration and revolution of gaming

- Animechain.ai's Vision for a Creator-First Generative AI × Blockchain Ecosystem

- AI x Web3 short animation contest 「Prince JAM!」

- The future of AI utilization in anime and game production sites

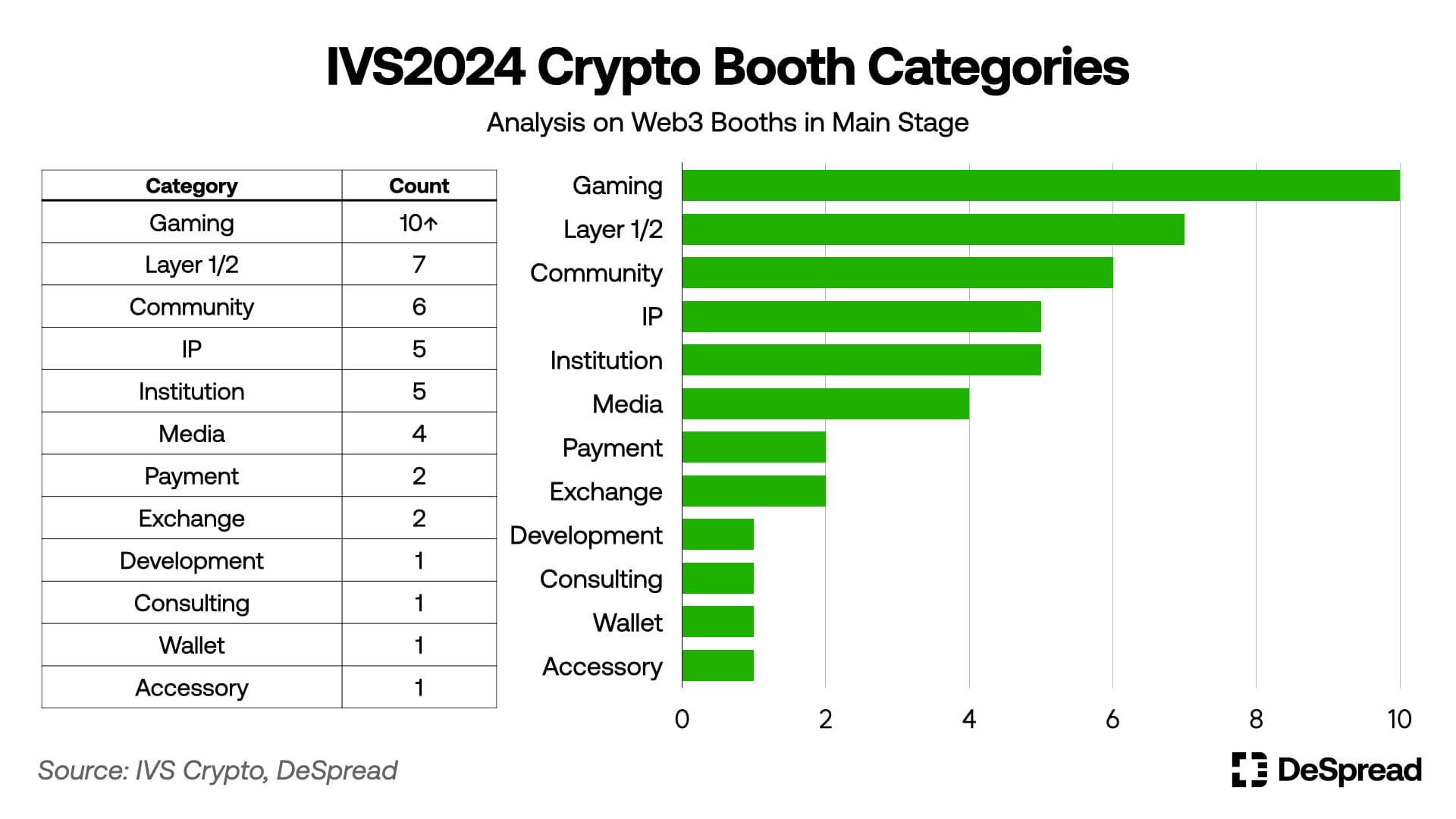

2.2. Booth Analysis

At IVS2024, the main stage on the first floor was divided into two sections: the left side for Web2-related booths and the right side for Web3-related booths. A total of 34 Web3 booths were analyzed, and to prevent excessive fragmentation, similar categories were defined as follows:

Gaming: Web3 Entertainment Zone SHAKE! gaming projects

IP: Projects related to IP, NFTs, and gaming

Community: Memes, DAOs, Web3 studios, etc.

Institution: B2B services like custody and cloud solutions

2.2.1. Absence of Major Enterprise Booths

One of the noticeable aspects of IVS2024 Crypto was the absence of Web3 booths from Japan's major financial institutions such as SBI, Mitsubishi UFJ Financial Group (MUFG), and Sumitomo Mitsui Trust Bank (SMTB).These institutions have been key players in Japan's Web3 landscape, starting with STOs in 2020, moving into stablecoins in 2023, and more recently, exploring wallets and NFTs. Despite their significant involvement, no Web3 booths from these institutions were present at the conference. The only notable participation was SBI Holdings as a silver sponsor of IVS2024 Crypto. Additionally, sessions featuring senior executives from large corporations like Sony and NTT did not provide a clear vision of their Web3 strategies. Considering the size and decision-making structures of these companies, it is understandable that they may not exhibit the rapid, bottom-up decision-making seen in Web3 startups. This situation warrants patience and ongoing observation.

2.2.2. Dominance of Layer-Related Booths

Among the 34 Web3 booths, layer-related booths were the most prevalent, with seven booths. These ranged from new, noteworthy projects like Zeus Network to established projects like Avalanche and Japan Open Chain, which caters to Japanese companies.

2.2.3. Enthusiasm for Gaming in the Web3 Entertainment Zone 'SHAKE!'

The 'SHAKE!' gaming booth, operated by YGG Japan, the main sponsor of IVS2024 Crypto, featured gaming projects supported by YGG, such as Genopet, Heroes of Mavia, and Moonveil.gg. At 'SHAKE!', visitors could actively participate by playing games or entering simple events, offering a more engaging experience beyond just listening to presentations.

3. Insights from IVS2024

3.1. The Potential of Avalanche Subnets

One of the notable insights from IVS2024 was the rising attractiveness of Avalanche subnets for companies offering Web3 services in Japan.

Avalanche subnets are solutions designed to enhance the scalability of the Avalanche network. They are essentially independent networks operated by a subset of Avalanche validators. Each subnet can autonomously determine its network structure, including rules and tokenomics, providing high flexibility and scalability, similar to an app-chain.

Avalanche subnets have been gaining attention by meeting the needs of Web2 companies that want to create their own network structure while still utilizing a public network. For instance, in September 2023, data marketing company Loyalty Marketing introduced a subnet for its point payment platform Ponta. In June 2024, Konami announced plans to use a subnet for its NFT solution Resella. Additionally, the Avalanche Japan booth at IVS2024 showcased its subnet.

SARAH, a food review application with 2 million monthly users, has established its own network called the Onigiri Chain, based on the Avalanche subnet, following its success in the Web2 space. SARAH aims to evolve into a protocol encompassing food and healthcare by sharing review information recorded on the network with other applications and offering targeted marketing through restaurant membership NFTs (NOREN NFTs).

While there have not been many significant success stories involving Web3 services from Japanese companies using subnets like Onigiri Chain, the trend could gain traction given Japan's Web3 market focus on nurturing the industry through existing Web2 companies. Avalanche subnets provide the benefits of a public chain while offering high autonomy, which could make them a rising trend.

3.2. Stablecoin Business Still in Preparation Phase

In June 2023, Japan implemented a revised stablecoin law, allowing banks, money transmitter, and trust companies to issue yen and dollar-based stablecoins. However, despite the high expectations when the law was enacted, the issuance and distribution of these stablecoins remain in the preparation stage more than a year later.

[Updates on Japan's Stablecoin Sector (Post-November 2023)]

- Ginco (issuer) and MUFG (trustee) initiated joint research on issuing yen and dollar stablecoins (Nov 7, 2023).

- Market makers DRW Cumberland, Bitbank, and Mercoin participated.

- SBI Holdings and Circle signed an agreement to distribute USDC in Japan (Nov 27, 2023).

- SBI Shinsei Bank will provide banking services to Circle, and SBI Group will adopt Circle’s Web3 services.

- MUFG, Progmat, and JPYC entered into an agreement related to stablecoin issuance (Nov 29, 2023).

- JPYC will be issued on the Progmat.

- MUFG, Progmat, Ginco, and Standage signed an agreement for cross-border stablecoin payments (Jan 31, 2024).

- Exploring the use of stablecoins for Japanese trade settlements, focusing on emerging markets.

- Sony Bank began experimenting with issuing yen stablecoins on the Polygon network (Apr 5, 2024).

- Aiming to explore the use of stablecoins in Sony Group's content, including games.

- MUFG and KlimaDAO signed an agreement for trading carbon credits using stablecoins (May 21, 2024).

- JPYC will be used as the payment stablecoin.

In previous articles on STOs, the Japan Web3 Bible, and Japanese stablecoin regulations, MUFG and Progmat have been highlighted as key players leading the Japanese stablecoin industry. Recent trends in the Japanese stablecoin market show their proactive efforts, with additional prominence given to SBI Holdings' efforts to distribute USDC in Japan and JPYC's growth as a leading Japanese stablecoin.

Notably, JPYC has experienced remarkable growth. Launched in March 2021, even before the revision of the stablecoin law in Japan, JPYC faced initial challenges as a stablecoin issued by a fintech startup rather than a major financial institution, with a TVL of only $8K in the Uniswap v3 pool. However, national efforts to revive the stablecoin industry and the infrastructure established by Progmat have helped JPYC become a leading stablecoin in Japan. Since major corporations like MUFG and Sony Bank have not yet launched their own stablecoins, the absence of clear competitors presents an opportune moment for JPYC to solidify its position.

4. Conclusion

Continuously following the Japanese market, IVS2024 Crypto was a meaningful opportunity to observe the latest trends in Japan's Web3 sector and feel the enthusiasm of market participants firsthand. Reflecting on the conference, several strong impressions remain:

- Interest in gaming and IP remains strong and is expected to grow even further.

- Both institutions and individuals recognize the importance of stablecoins, which will likely become a cornerstone of Japan's Web3 industry.

- While a year in crypto can bring significant changes, a year is a short time for government-led Web3 efforts in Japan.

4.1. My Number Card, Cashless Policy, and Web3

The My Number Card is an IC card containing a personal identification number and various electronic certificates, serving a role similar to South Korea's resident registration number and public certification. Although the My Number Card system was implemented in October 2015, widespread distribution only began 4-5 years later, driven by the limitations of analog administrative processes realized during the COVID-19 pandemic and the push for digital transformation.

Initially, the adoption of the My Number Card faced challenges due to Japanese sensitivity to personal information, entrenched analog administrative practices, and numerous errors found in the cards. By 2019, four years after the policy's implementation, the penetration rate was only 14.3%.

However, the Japanese government made various efforts to promote the My Number Card, such as providing incentives (MyNaPoints), integrating it with health insurance, establishing a comprehensive information inspection headquarters, and conducting regular system checks to restore trust. As a result, issuance rates steadily increased: 23% in 2020, 39.9% in 2021, 51.1% in 2022, and 76.1% in 2023.

The rapid increase in cashless payments is another indicator of Japan's digital transformation. The proportion of cashless payments (credit cards, QR pay, etc.) in Japan was relatively low compared to other major countries, with figures at 13.2% in 2010, 18% in 2015, and 24.2% in 2018. However, the introduction of a point rebate system for cashless payments following the consumption tax increase in October 2019, active cashback events by major companies like Line and Yahoo Japan, and the rise in demand for contactless payments during the COVID-19 pandemic contributed to a significant increase. The cashless payment ratio rose to 26.8% in 2019, 36% in 2022, and 39.3% in 2023.

The cases of My Number Card adoption and the increasing rate of cashless payments suggest that, although it may take time, the government's and companies' active efforts can overcome distrust and entrenched practices, leading to meaningful outcomes in digital transformation initiatives.

And currently, the Japanese government's digital transformation policy is focusing on Web3. Although Japan's Web3 industry is experiencing growing pains in its early stages, it is expected that with continuous support from the government and companies, Web3 will soon grow into a key pillar driving Japan's digital transformation.

References

- 한국은행, 일본의 마이넘버제도 추진 현황

- KOTRA, 일본, 캐시리스 결제 비중 39.3%(3.30 니혼게이자이신문)

- KOTRA, 2019년 일본 법개정으로 본 세 가지 키워드

- SARAH, なぜグルメアプリ「SARAH」がブロックチェーン活用を決めたのか

- Avalanche Docs, Subnets