An Overview of Japanese Stablecoin Regulation

Focusing on the Issuance and Intermediation Structure

1. Introduction

The crypto industry has become one of the leading industries globally. While this has had a positive impact such as increasing the size of the industry and bringing a variety of new opportunities, there are also negative aspects such as a lack of investor protection and crimes. Therefore, countries are trying to regulate cryptocurrencies to maximize the potential of blockchain technology while minimizing the risks and uncertainties. Among them, stablecoins, whose token value is backed by fiat currencies, have emerged as one of the most important sectors of the crypto industry due to their low volatility, high versatility, and strong linkage to traditional finance. Many countries have been discussing the regulation of stablecoins, especially in the wake of the devastating Terra-Luna depegging event in May 2022. This has prompted authorities in various jurisdictions, including the United States and Europe, to develop regulatory frameworks.

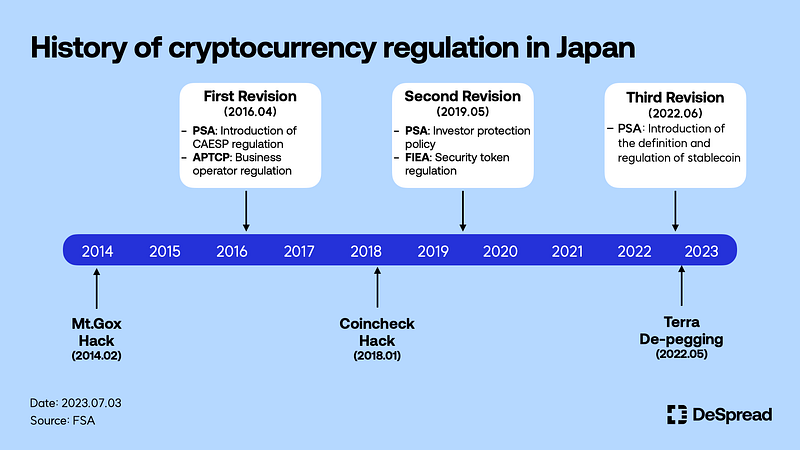

Among them, Japan recognized the need for regulation relatively early, after the Mt. Gox crisis in 2014 and the Coincheck hack in 2018. Since 2016, the Payment Services Act (*PSA), which regulates the transfer and settlement of funds, has been revised three times.

The third revision, completed in June 2022, addressed the legal framework for the issuance and intermediation of stablecoins. With the official implementation of the revisions this June, Japan became the first country in the world to have clear regulatory guidelines for stablecoins. In addition, Mitsubishi UFJ Financial Group (MUFG), one of Japan's largest financial holding companies, announced that stablecoins will be available for use in the country starting in June 2024, when companies engaged in the intermediation of stablecoins are expected to obtain the relevant licenses.

As the global movement to establish regulatory frameworks for stablecoins continues to accelerate, it may be helpful to take a look at Japan as a precedent to anticipate changes in the cryptocurrency industry. As the Korean financial authorities have stated that they will refer to the regulatory frameworks of the United States, Japan, and the EU’s Markets in Crypto-Assets Regulation(MiCA), it will be helpful to look at the legal framework for stablecoins in Japan, where stablecoin issuance is already regulated and authorized, to see where Korean regulations will be headed. In this article, we will analyze the details of Japan's stablecoin regulation, the key players, and the impact of the regulation.

2. Introduction to Stablecoin Regulations

The third amendment to the PSA, which was revised in June 2022 and officially entered into force this June, focuses on the issuance and intermediation. These amendments reflect the Financial Stability Board's "Proposal for the Regulation, Supervision and Oversight of Global Stablecoin Arrangements" published in October 2020 to align with regulatory developments in the US and EU.

The significance of the third amendment is to establish clear regulations around the definition, issuance, and intermediation of stablecoins, ensuring predictability for institutions and stability for investors, thereby expanding the status of stablecoins as a payment method.

- Ensure predictability for institutions through issuer-specific regulation

- Ensure safety for investors by introducing an intermediary license system

3. Definition and Types of Stablecoin

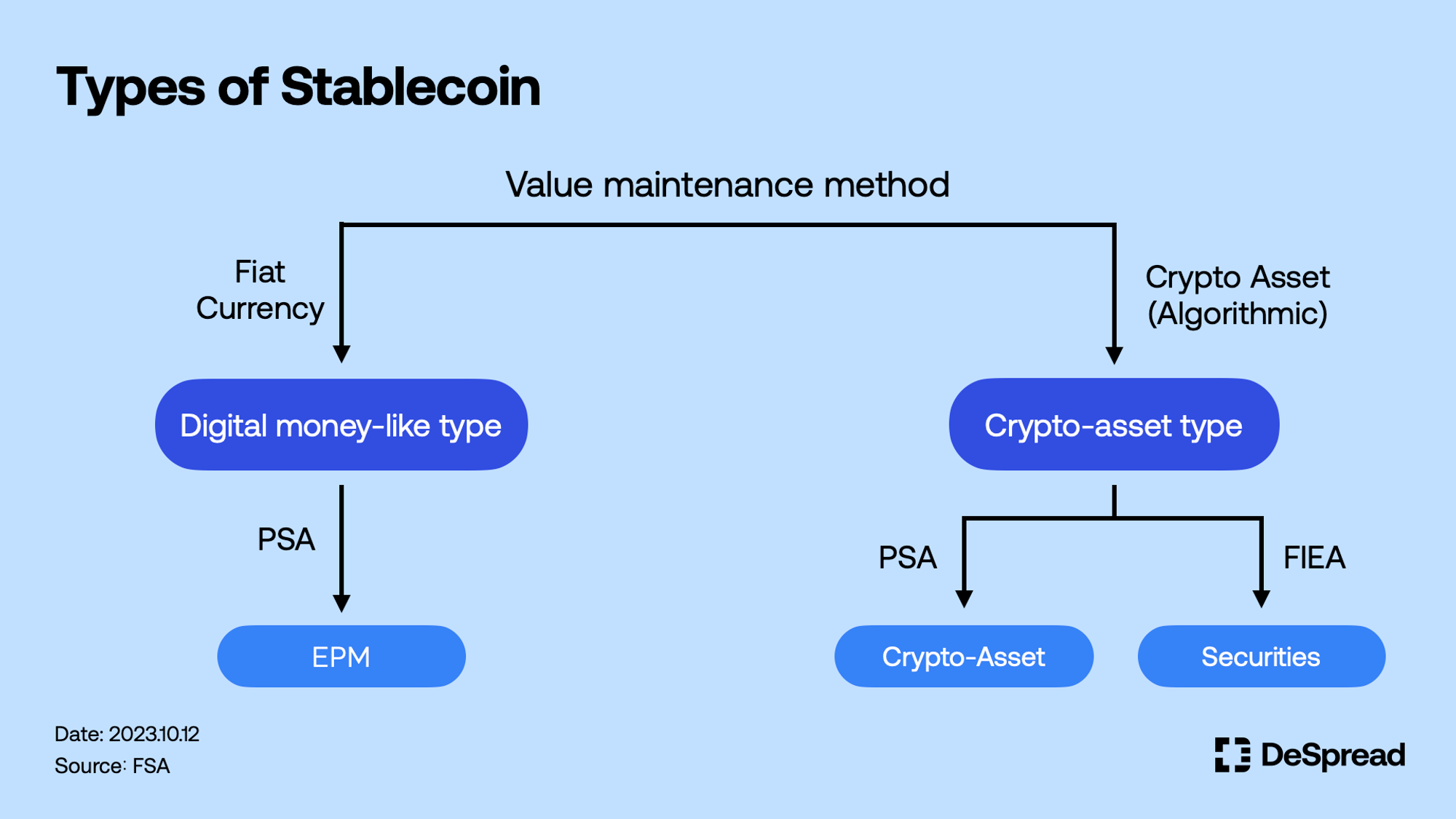

Prior to the implementation of this amendment, the laws governing stablecoins differed depending on the type, which led to legal confusion for issuers. Therefore, the Japanese Financial Services Agency(FSA) categorized stablecoins according to their value maintenance method as follows, and stipulated the corresponding laws for each type.

Digital money-like type is a stablecoin that is backed by cash and cash equivalents. One token has the same value as one Yen. For example, Tether's USDT and Circle's USDC are typical digital money-like types. On the other hand, crypto-asset type is a stablecoin whose value is backed by crypto-assets by an algorithm rather than fiat currency. MakerDAO's DAI is a typical example of that.

It is important to note that the laws applicable to each type of stablecoin differ: digital money-like type stablecoins are defined as Electronic Payment Methods(EPM) by the PSA, while crypto-asset type stablecoins can be categorized as either crypto-assets under the PSA or securities under the Financial Instruments and Exchange Act(FIEA). Among them, stablecoins for which the third amendment provides regulations for issuance and intermediation are limited to EPM. This means that under current Japanese law, there are clear regulations only for stablecoins that maintain their value with fiat currency as collateral. Accordingly, related organizations are conducting business only with digital money-like type stablecoins.

4. Definition and Types of EPM

Digital money-like type, or EPM must meet the following three conditions.

- Must be able to be paid to unspecified parties in exchange for goods, services, work, etc.

- Must be able to transfer using an electronic information processing organization(e.g., electronic payment system, blockchain, etc.)

- Must have a property value that can be exchanged with unspecified parties

In the above conditions, the term “unspecified parties” constantly appears. This is the intention to utilize stablecoins as a practical payment method by ensuring transactions through electronic information processing organizations by anyone without the issuer's consent in EPM transactions.

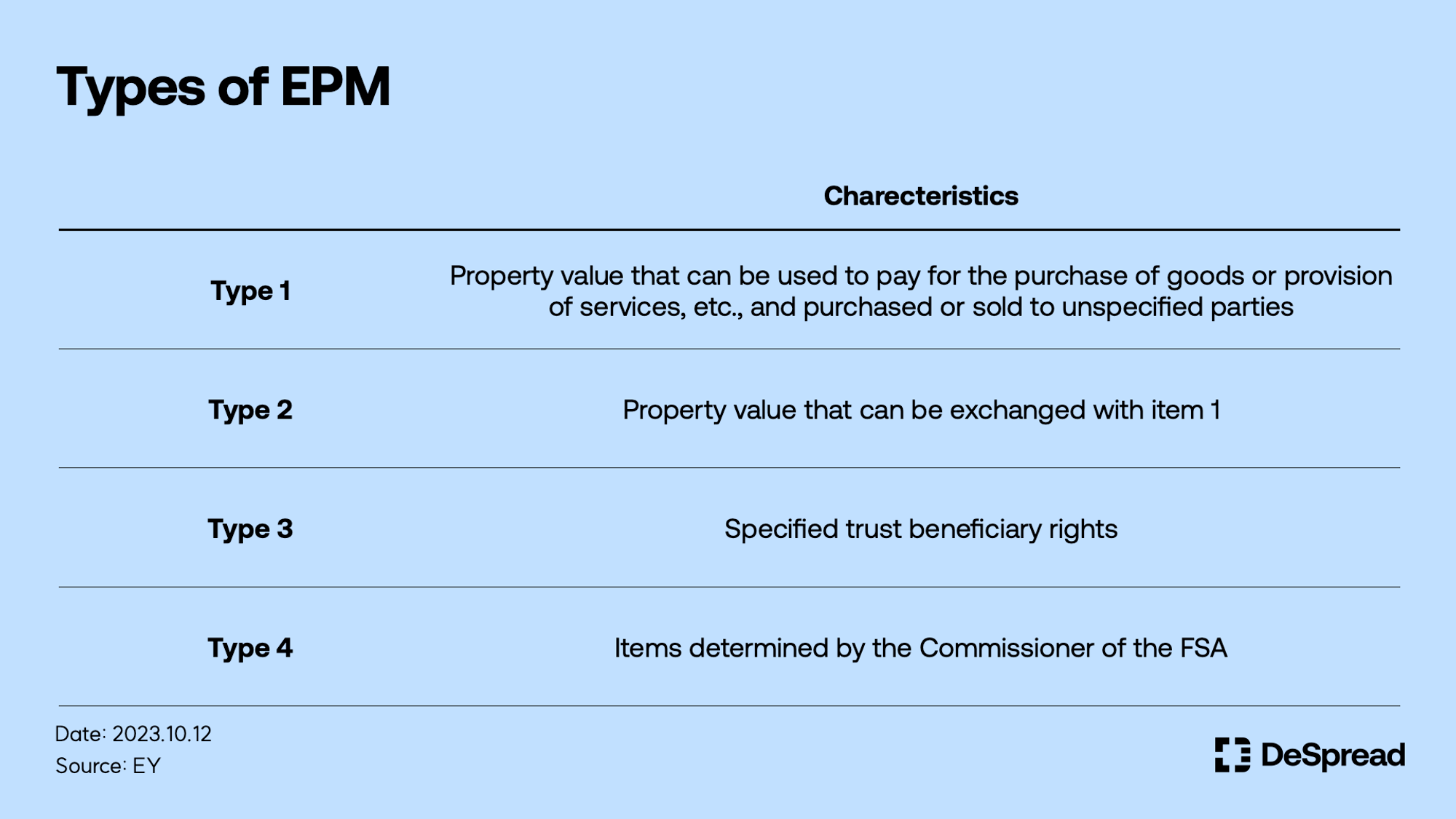

There are four types of EPMs, from 1 to 4, depending on their characteristics. Let's take a closer look at the type 1 which is the representative type and the type 3 which seems to be the one that issuers will choose the most.

4.1. Type 1 EPM

Type 1 EPM must meet the following four conditions.

- Be able to be used to reimburse unspecified parties for consideration

- Be able to be exchanged with unspecified parties

- Currency-denominated assets recorded and transferred electronically

- Not fall under securities, electronically recorded monetary claims, prepaid instruments, etc.

The third condition above is similar to the definition of Type 1 crypto-asset in the PSA. But the difference is the existence of the term "currency-denominated asset". A currency-denominated asset is an obligation, refund, or other equivalent of an obligation in a national or foreign currency that gives the issuer the obligation to refund the same amount in fiat currency.

Type 1 EPM is the most common type of stablecoin issued by securing its value with cash and cash equivalents. This type of stablecoin does not necessarily need to be issued on the blockchain, but is also allowed to be issued and managed on electronic information processing organizations such as servers. It is expected that the Type 1 EPM will be issued by banks that mainly manage demand deposits.

In addition, local legal experts have suggested that crypto-asset type stablecoins may fall under the fourth category of EPM. As the requirements to be met for the fourth category are almost identical to the first category, but there is no stipulation that the assets must be currency-denominated. However, since there is no asset designated as a Type 4 EPM yet and the current law focuses on only digital money-like type stablecoins, it is expected that it will take some time before crypto-asset type stablecoins, which have more regulatory needs than the former, are actually recognized as one of the types of EPM.

4.2. Type 3 EPM

Type 3 EPM means a digital money-like type stablecoin issued based on “specified trust beneficiary rights”. A trust beneficiary right becomes a “specified trust beneficiary right” when it meets the following two conditions:

- A trust beneficiary right that can be recorded and transferred electronically

- A trust beneficiary right that a trustee manages the entirety of the money held in trust under a trust agreement as a deposit or savings account.

In the case of tokenizing existing trust beneficiary rights, it is considered a security token and is therefore classified as a Type 2 security under the FIEA. However, in the case of specific trust beneficiary rights, it is considered an EPM and not a security under the PSA.

For a detailed explanation of security tokens, see Part 3 of the STO series.

Type 3 EPM is expected to be issued primarily by trust companies, and as we will see in more detail below, MUFG, which is currently at the forefront of the Japanese stablecoin market is also building its business on the basis of Type 3 EPM, as it enjoys the greatest regulatory freedom.

5. Issuer Types and Regulations

Next, let's take a look at the types of EPM issuers and their regulations. Currently, there are three types of institutions authorized to issue electronic payment instruments in Japan: banks, funds transfer companies, and trust companies. They are responsible for issuing, redeeming, and stabilizing the value of EPMs and must obtain the following licenses for each type:

- Bank: Banking business

- Funds transfer company: Funds transfer business

- Trust companies: Trust business + Specified Funds Transfer Business

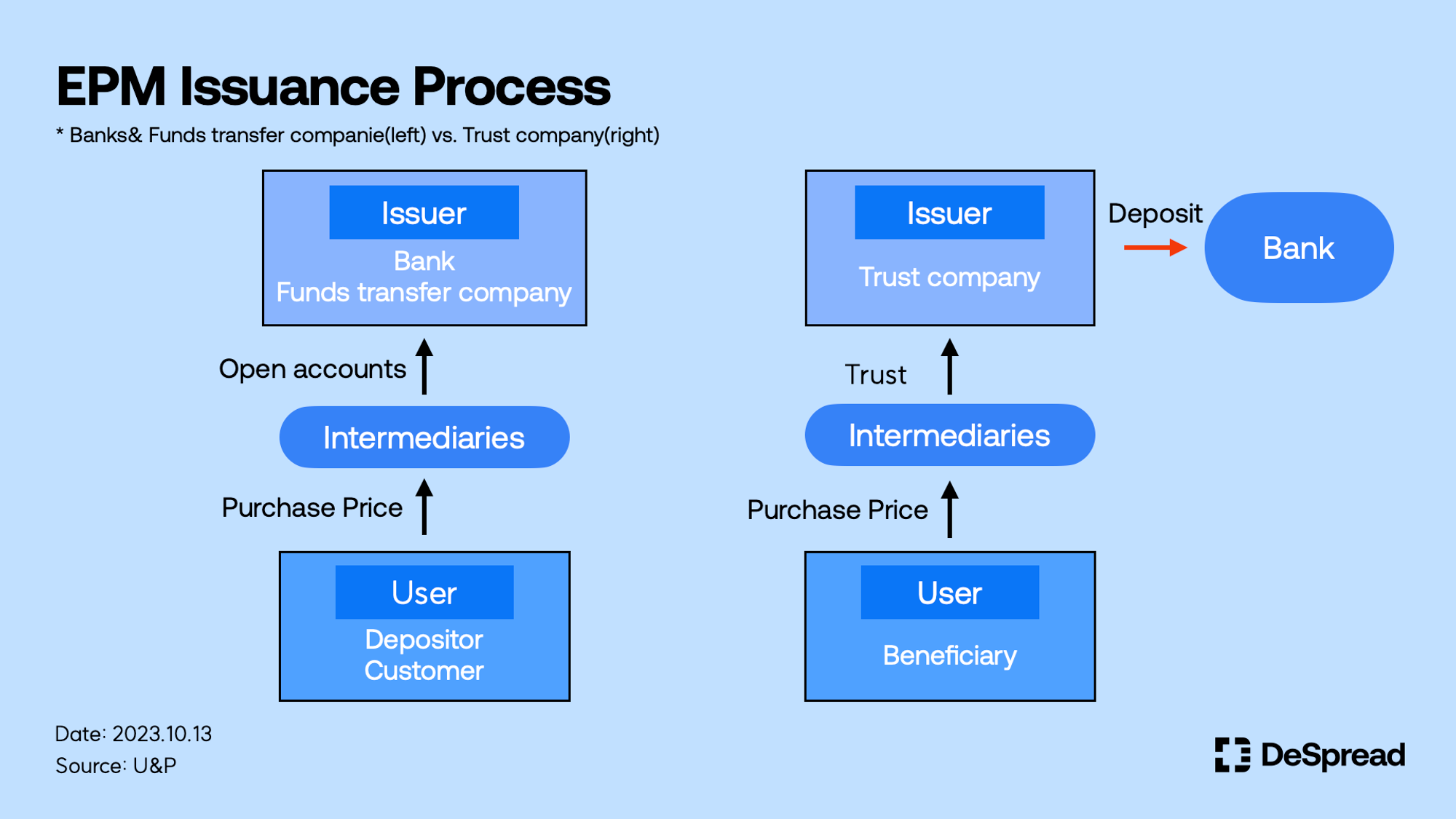

Currently, the issuance and redemption of EPM in Japan are considered foreign exchanges according to a Supreme Court ruling. Therefore, issuers are basically required to register as a banking or funds transfer business, but the licenses required for trust companies who issue Type 3 EPM based on specified trust beneficiary rights are different from the other two types of issuers.

In addition to the trust business, trust companies are required to obtain an additional license for the specified funds transfer business. Specified funds transfer business refers to the business of trading only in specified trust beneficiary rights, and institutions that have obtained such a license and are recognized as a specificied trust company can only transfer funds related to specified trust beneficiary rights. It is worth noting that banks that are already licensed to engage in the trust business can issue EPM based on specified trust beneficiary rights without registering as a specified trust company. Therefore, from a financial institution's perspective, it may be more attractive to issue Type 3 EPM based on specified Trust beneficiary rights through a trust company than to obtain an additional license to issue EPM based on bank deposits. This can be better understood by looking at the issuance process by issuer type below.

In the figure above, we can see that there is a difference between the EPM issuance process by a bank or funds transfer company(left) and a trust company(right). On the right, the funds held in trust by the trust company are all deposited with the bank participating in the issuance(red arrow). The key point is that the account is opened in the name of the trust company, not in the name of the bank. Therefore, as mentioned above, banks do not need to obtain additional licenses. In addition, banks participating in the issuance of EPM through trust banks are free from the redemption obligations required by issuers and intermediaries. This makes Type 3 EPM through specified trust beneficiary rights an even more attractive option for issuers.

6. Intermediary Types and Regulations

This PSA revision includes the regulation regarding EPM intermediaries. Like issuers, EPM intermediaries are required to obtain certain licenses to conduct their business. Intermediary licenses are broadly divided into trading and handling businesses. Intermediaries are required to obtain the corresponding license depending on the type of issuer of the EPM.

6.1. EPM Trading Business

Under the revised PSA, intermediaries must obtain a trading business license if they do any of the following.

- Purchase or exchange of EPM

- Intemediation of EPM

- EPM management for others

- Funds management received from users on behalf of funds transfer company

Based on the above conditions, it can be seen that a trading business license is required to intermediate EPM issued by funds transfer companies. In addition, since the transfer of specified trust beneficiary rights arising from the issuance of EPM by a trust company is also considered a transfer of funds, intermediaries of EPM issued by trust companies must also obtain a trading business license.

When obtaining the trading business license, in addition to EPM issued in Japan, the institution can also accept EPM issued abroad. However, the following conditions must be met for foreign-issued EPM to be accepted.

- Issued by an entity that has obtained a qualified license under a law that is equivalent to the PSA or banking law in a foreign jurisdiction

- Have a thorough audit of the assets required for redemption

- If an issued EPM has been involved in criminal activity, the entity has taken appropriate action, including suspension of transactions.

Given the above, the first foreign-issued EPM that comes to mind is probably USDC issued by Circle. Circle is a representative regulatory-compliant stablecoin issuer, currently supervised by the Financial Crimes Enforcement Network(FinCEN) division of the U.S. Department of the Treasury. It also has obtained a money transmitter license in several U.S. states such as Colorado and California. In addition, Circle publishes audited reports on its reserves on its official website every month, and it froze 44 addresses linked to the cryptocurrency mixing protocol Tornado Cash in August last year. Moreover, as the world's second-largest stablecoin, USDC's tremendous versatility and user pool could be very attractive to issuers and intermediaries looking to expand their EPM acceptance in Japan. In fact, Jeremy Allaire, CEO of Circle, said in an interview that the company is considering entering the regulated Japanese market.

6.2. EPM Handling Business

EPM handling business licenses are required for intermediation of EPM issued by banks, details of which are as follows:

- A depositor who opens a deposit account with a bank on behalf of the bank.

- A person who manages funds related to an account and funds received through foreign exchanges using an electronic information processing system.

To summarize, in order to conduct a intermediation business, you need to obtain EPM handling business license if the issuer is a bank, or EPM trading business license if the issuer is a funds transfer company or trust company. It is important to note that the two licenses are not interchangeable, so for example, if an institution wants to intermediate EPMs issued by both banks and funds transfer companies, it will need to obtain both licenses.

7. Key Player: Mitsubishi UFJ Trust Bank

7.1. What is Progmat?

In Japan Web3 Bible Part 1, the overview of EPM issuers in Japan was covered, and in this article, we will take a closer look at the EPM issuance and intermediation process of MUFG's Mitsubishi UFJ Trust Bank(hereinafter referred to as Mitsubishi), which is consolidating its leading position.

Mitsubishi’s EPM issuance will take place on Progmat, its token issuance platform. Progmat was officially unveiled in February 2022 and became a joint venture of seven companies, including Sumitomo Mitsui Banking Corporation(SMBC), SBI Holdings, and Japan Exchange Group(JPX), following its independence from MUFG in October 2023. Progmat is now one of the key players in Japan's web3 industry, developing not only stablecoins but also security tokens and RWA(Real World Asset) token businesses.

7.2. Issuance and Intermediation Structure

Progmat chose to issue a Type 3 EPM based on specified trust beneficiary rights. This decision was made because issuing a Type 3 EPM as a trust company provides the most regulatory freedom, and this feature is an advantage in attracting potential partners, including intermediaries.

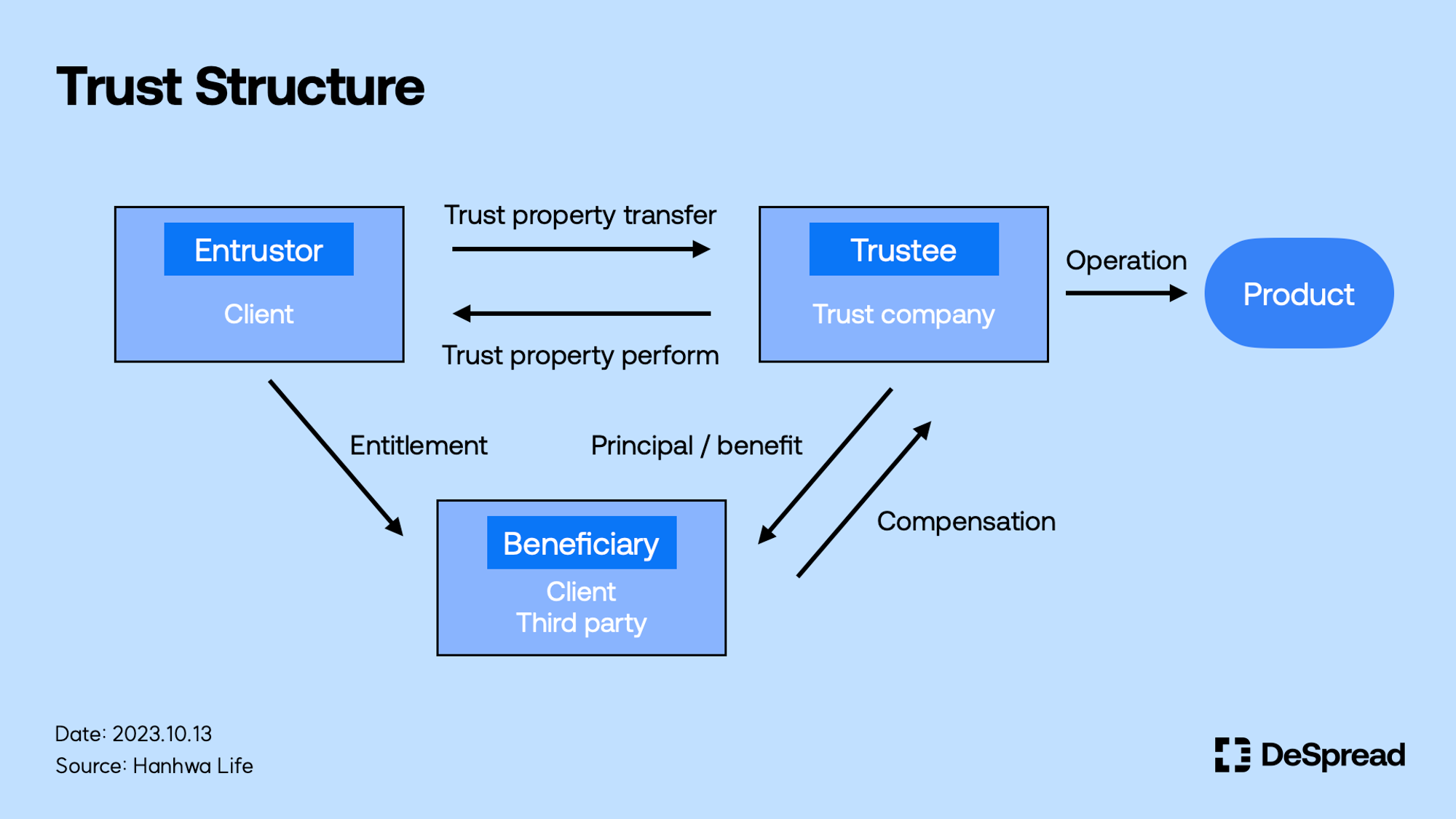

To understand the structure of Progmat's EPM issuance and intermediation, it is first necessary to check the trust structure in traditional finance. A trust consists of three main entities: Entrustor, Trustee, and Beneficiary, and the role of each entity is as follows.

- Entrustor(Client): Creates a trust structure that entrusts the management and operation of the trust property.

- Trustee(Trust Company): Manages and disposes of trust property in accordance with the purposes of the trust.

- Beneficiary(Client or Third party): The entity designated by the trustee to receive the principal or benefit of the trust property.

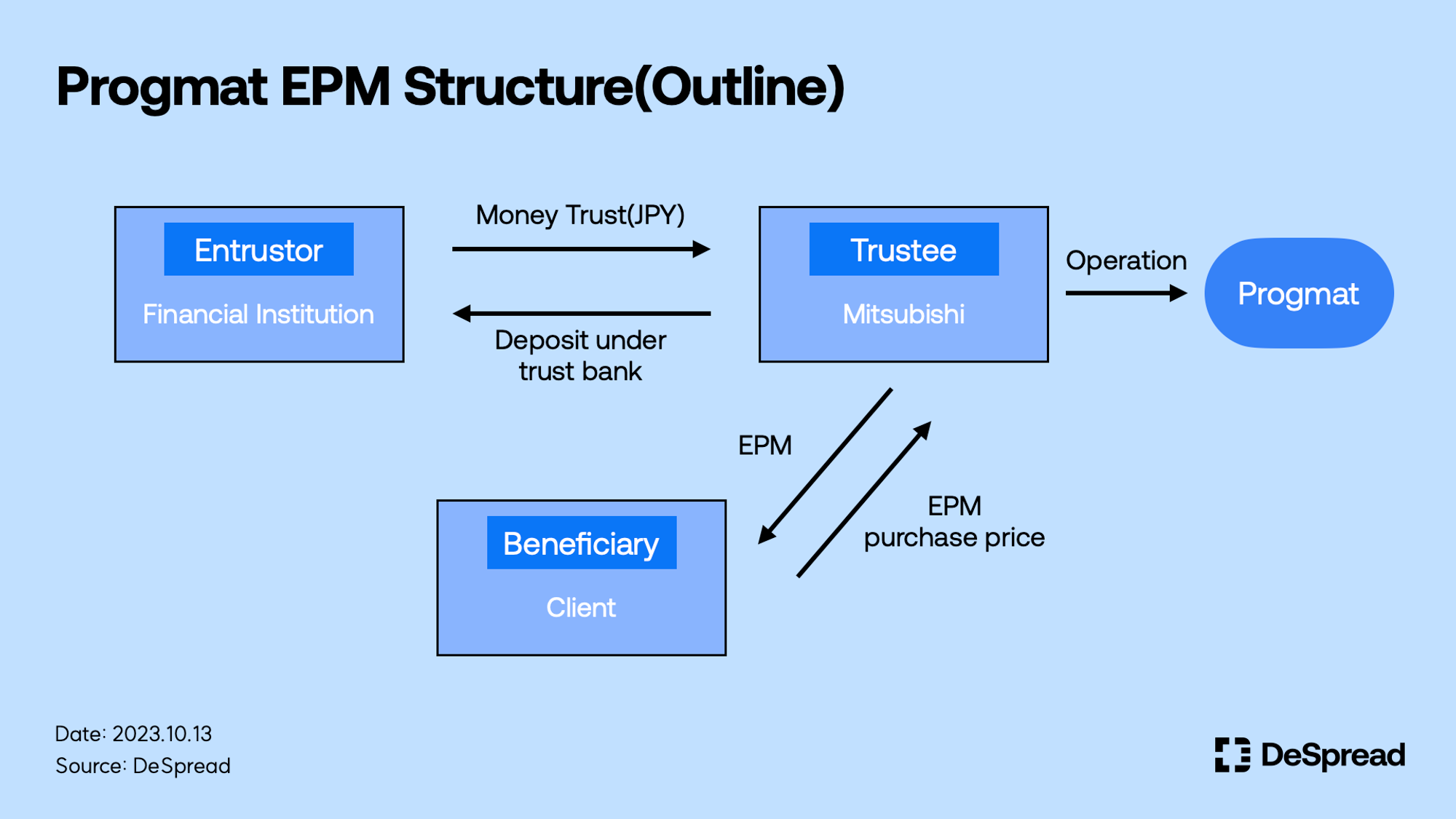

Based on the above traditional trust structure, the entities participating in Progmat's EPM issuance are as follows, and the chart below depicts the outline issuance structure of the EPM.

- Entrustor(Issuance Applicant): Entrust the management and operation of JPY or foreign currency to a trustee(FI)

- Trustee(Issuer): Manage entrusted money as a deposit and issue EPM on Progmat(Mitsubishi)

- Beneficiary: Pay the price and receive the EPM issued by Progmat(Client)

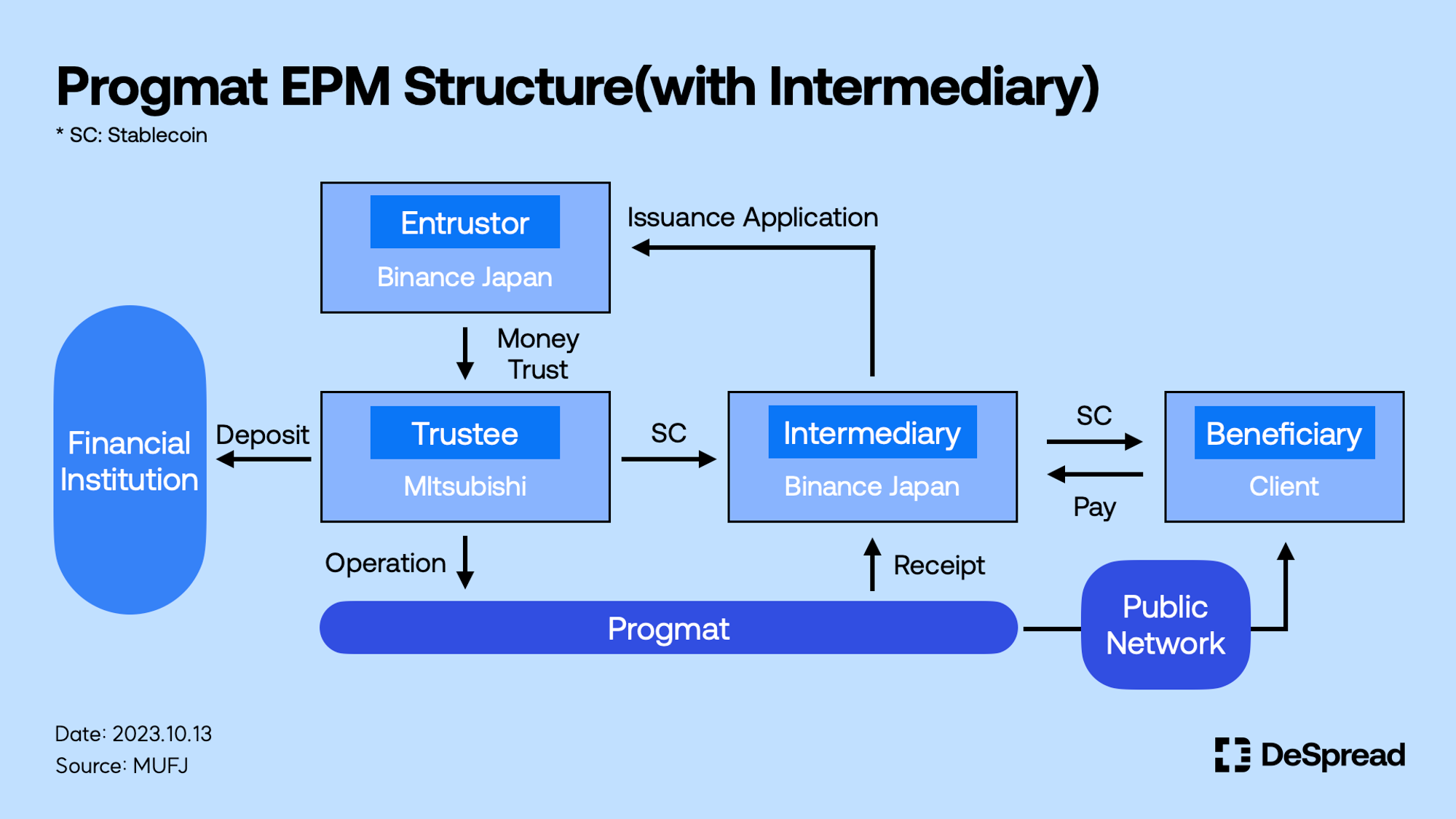

In addition to the custodian, trustee, and beneficiary, the actual Progmat EPM structure also includes an intermediary, which is responsible for the distribution of EPMs among the three entities. In particular, the intermediary acts as a window for retail customers to actually purchase EPMs.

Binance Japan is one of the most notable intermediaries for Progmat's EPM. On September 26th, Binance Japan announced an agreement with Mitsubishi to issue JPY and USD stablecoins, marking the world's largest exchange's entry into the Japanese stablecoin market. According to the announcement, Binance Japan will act as an entrustor and intermediary for Progmat EPM and will be responsible for processing Mitsubishi stablecoin transactions with customers via the Progmat network and public blockchain. Adding Binance Japan to the above outlined Progmat structure reveals a more specific issuance and brokerage structure, as shown below.

7.2.1. Issuance and Intermediation Process

- Binance Japan, as entrustor will apply for the issuance of EPM, and the corresponding funds will be held in trust in Mitsubishi.

- Mitsubishi, as trustee, will manage the money trust as a specified trust beneficiary rights by placing it on deposit under Mitsubishi's name at a financial institutions in the partnership.

- Mitsubishi will issue Type 3 EPM through the Progmat network based on the specified trust beneficiary rights.

- Binance Japan, as an intermediary, will receive such EPM through the Progmat network.

- Customers pay in JPY or foreign currency through Binance, an intermediary, and purchase EPM.

This agreement between Mitsubishi and Binance Japan is a win-win for both parties. For Mitsubishi, working with Binance Japan, which supports the largest number of tokens in Japan(34 as of early October 2023) and is backed by the world's largest exchange, Binance, will allow them to rapidly expand their presence in the domestic electornic payment market. Especially since various financial institutions, such as ORIX Bank, have announced plans to implement EPM after 2024, collaborating with Binance, which has a large user pool, will help them get a lead in the market. Furthermore, as Binance is currently focusing on global expansion due to regulatory pressure from the U.S. government, a partnership with MUFG, one of the largest financial institutions in Japan, will make it easier for Binance to enter the Japanese market.

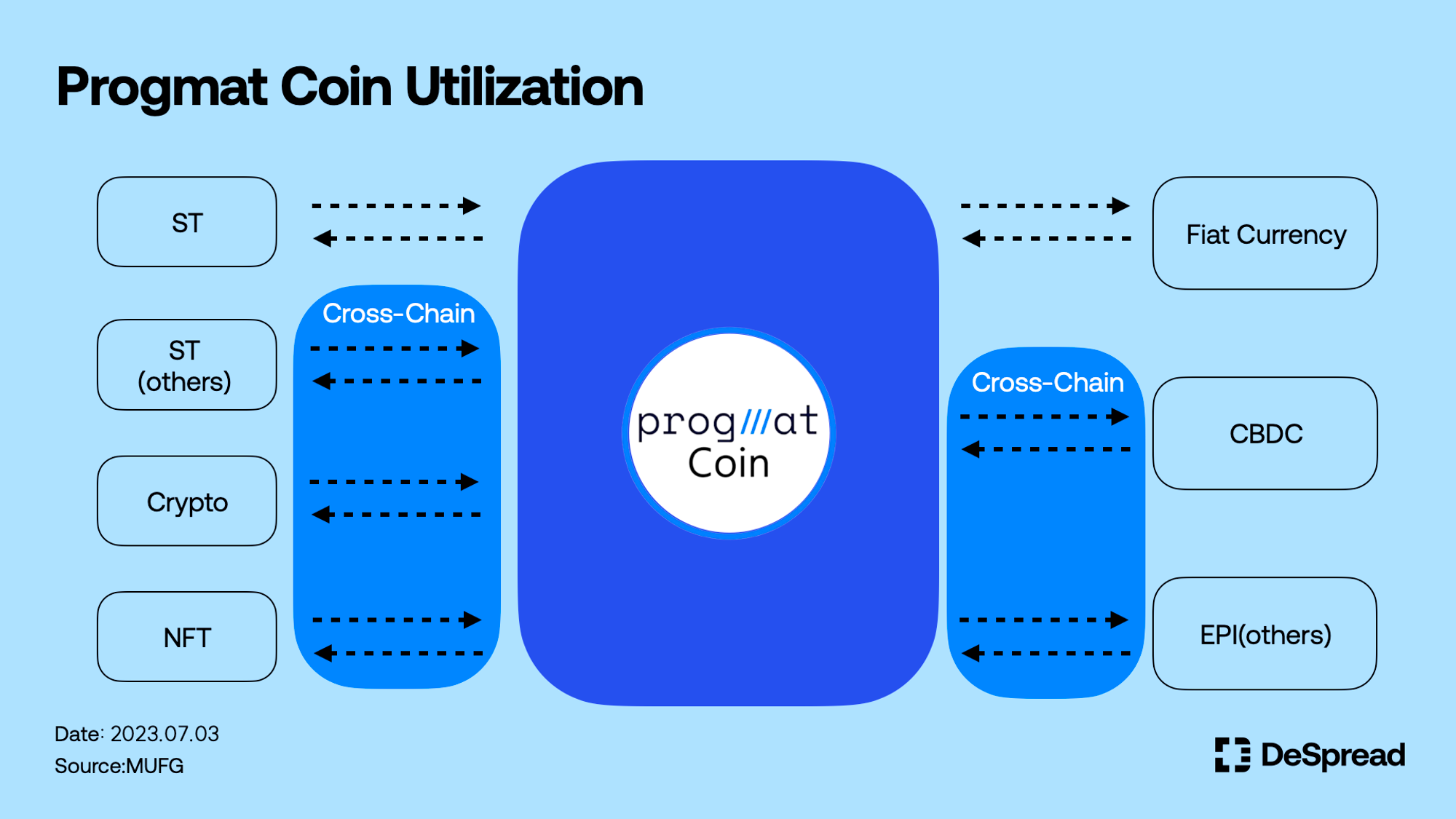

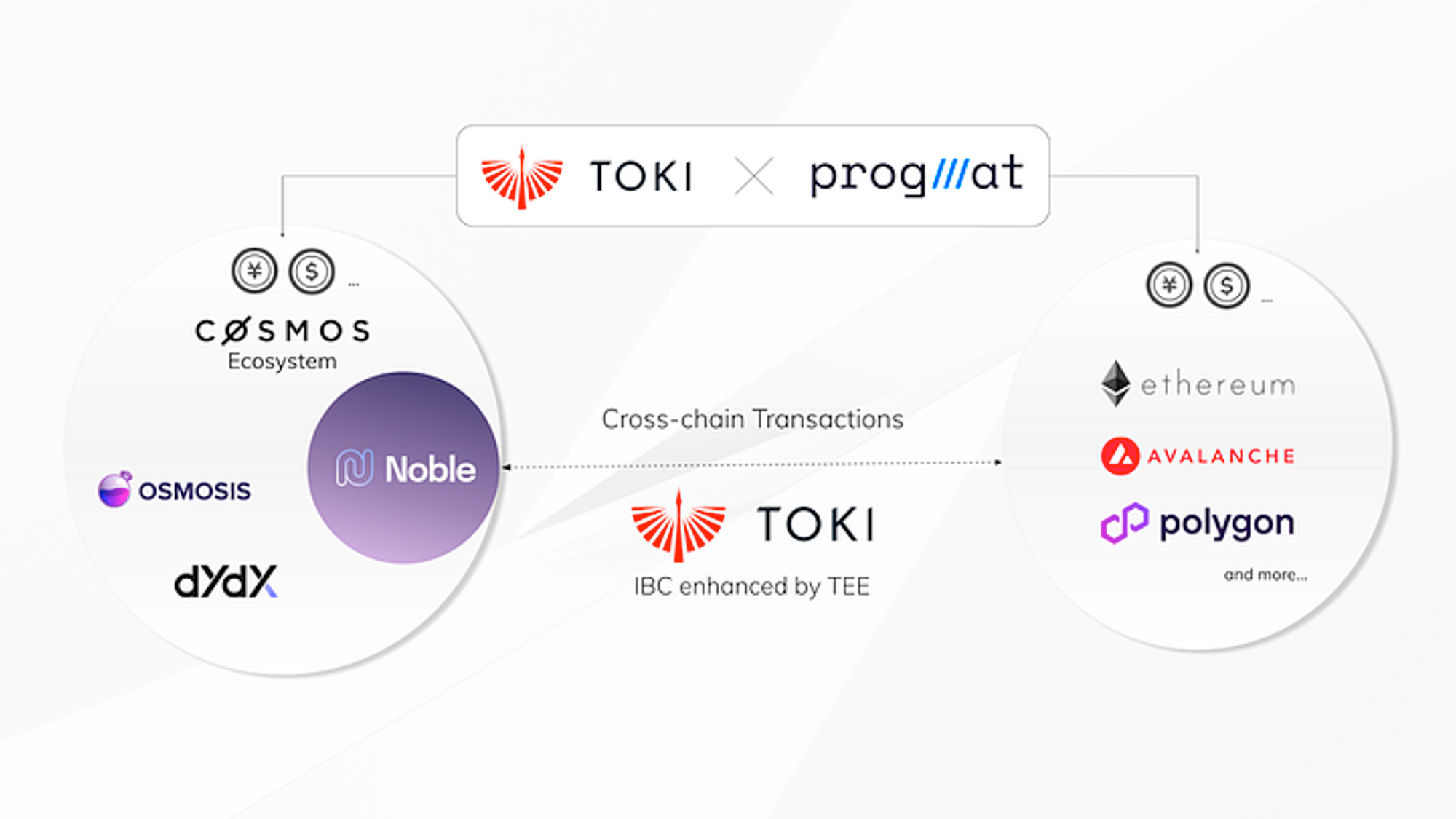

In June, Mitsubishi announced a collaboration with cross-chain solution TOKI and blockchain interoperability solution DataChain, with plans to expand to public blockchains such as Ethereum, Avalanche, and Cosmos. In particular, TOKI is expected to play a key role in Progmat's expansion into the public blockchain, as it has announced plans to support cross-chain swaps and lending between various tokens, including representative dollar stablecoins such as USDT and USDC, and the Yen EPM.

8. Conclusion

Establishing a clear regulatory path for crypto is an inevitable challenge as the industry grows in influence and size. The market has experienced numerous instances of damage over the past few years, including the Terra-Luna depegging and the FTX collapse. While we are still in the early stages of formalized regulation, there is a clear difference between having clear, legally enforceable guidelines to prevent harm and punish criminal behavior and not having them. In particular, the fact that regulation has been established for stablecoins, which are likely to be used by more people, institutions, and even countries than any other sector in the crypto space, is significant. Furthermore, it could be an important foundation for financial system stabilization and financial innovation.

Expectations for Stablecoin Regulation

- Strengthening financial system stability: institutional predictability, investor protection, preventing capital outflows

- Fostering innovation: more collaboration between traditional firms and Web 3, improved payment systems, etc.

- National competitiveness: being at the forefront of international regulatory trends, leading empirical experiments such as Project Gaurdian, etc.

While Japan's stablecoin regulations have been implemented, they are still far from perfect. Determining whether a token issued on a blockchain network is an EPM, a prepaid payment method, a crypto-asset, or a security requires considerable legal expertise. Moreover, due to the nature of crypto-assets, there are difficulties in determining their types based on the same criteria as traditional assets. Therefore, each case will be verified individually, and it will take a long time before the data of such judgments is accumulated for each type of token. In addition, the fact that the overall framework of the regulation needs to ensure stability and clarity while not stifling innovation means that there will be a lot of trial and error in finding the appropriate balance. It will be interesting to see if Japan can meet these challenges and if the government-led promotion of the web3 industry can result in a meaningful influx of on-chain users.

References

- Anderson Mōri & Tomotsune, Introduction of Regulations on Stablecoins, 2022

- Clifford Chance, Japan to have world's first clear regulatory framework for stablecoins, 2022

- EY, Overview and key points of laws and regulations related to stablecoins, 2023

- U&P, Overview of stablecoin regulations, 2023

- Monolith Law Office, Explanation of the Regulation of Stablecoin, 2023

- MUFJ, Launch of Joint Study for Issuance of National Stablecoin with Potential for Global Distribution, 2023

- Ledger Insights, MUFG: Japanese public blockchain stablecoins won’t need KYC if trust bank issuer, 2023