Disclaimer: The authors of this report did not purchase or sell any of the relevant tokens using material non-public information during the research or drafting of this report. The contents of each report reflect the opinions of the respective authors and are provided for informational purposes only and are not intended to be a recommendation to buy or sell any token or use any protocol. Nothing contained in this report is investment advice and should not be construed as such.

Introduction

Part 2 Recap

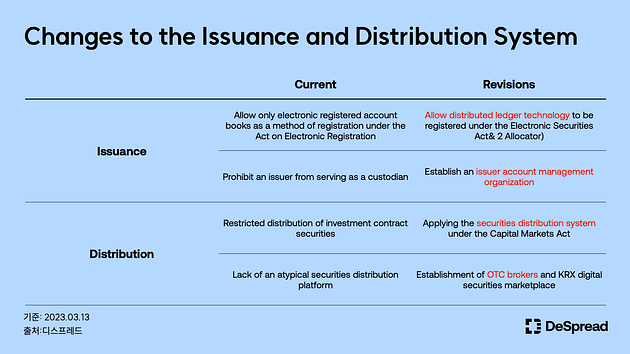

In the last two parts, we looked at the issuance and distribution structure of the Korean security token market. In Korea, token securities are defined as “digitized securities under the Capital Markets Act using distributed ledger technology”. Here, distributed ledger refers to a private or consortium blockchain network where only special entities authorized by the Korean Financial Services Commission(FSC) can participate as nodes, rather than a general public blockchain, which seems to reflect the limitations of security tokens that are not yet technically and institutionally mature. The structure of the security token market is expected to follow basically the same form as that of the traditional securities market, but with changes in the details. For example, there is an attempt to resolve the inefficient structure of having to go through an intermediary to register existing securities through the introduction of an ‘issuer account management organization’, which is authorized to directly register securities with the Korean Securities Depository. In addition, there is a noticeable effort to establish an ‘OTC broker’ in the secondary market to form a market where atypical securities (non-monetary trust beneficiary certificates and investment contract securities) that cannot be freely traded under the current system can be actively traded.

Japanese Security Token Market

Last month, the FSC released guidelines for issuing and distributing security tokens, signaling the beginning of a security token market in Korea. At this point, the country is still in its infancy, with no specific regulatory framework or technical infrastructure in place. Therefore, I think it would be helpful to look at the cases of other countries that have introduced token securities ahead of Korea to get a hint of how the Korean token securities market will develop. Among the various countries that have raised funds using token securities, as mentioned in the first part, I would like to look at the security token market in Japan. In this article, I will look at the security token market in Japan, which has been regulating the security token market for many years ahead of Korea through legislative amendments and is currently steadily utilizing security tokens mainly by securities firms, focusing on the issuance and distribution structure and related laws, and compare it with Korea to see where the Korean security token market should go.

Main Content

The Japanese View of Security Tokens

What are Security Tokens?

Japan’s second amendment, published in May 2019, defines security tokens as “rights deemed to be securities under Article 2, paragraph 2 of the Financial Instruments and Exchange Act(FIEA) that are recorded using an electronic information processing organization. More intuitively, it can be understood as the tokenization of any property value using distributed ledger technology. Based on the above definition, it can be seen that Japan classifies security tokens as securities, just like the definition of token securities in Korea, by stating that only the form of issuance(electronic information processing organization) changes, but the essence(securities under the FIEA) follows the existing law.

Types of Security Tokens

Japan’s FIEA categorizes securities into two types. Securities that are primarily liquid, such as government bonds, corporate bonds, and stocks, are classified as Class 1 securities, and securities that are primarily illiquid, such as beneficiary’s rights and collective investment contracts, are classified as Class 2 securities. Security tokens are divided into three categories depending on which of the above two types of securities are tokenized.

- Tokenized Securities Display Rights: Tokenization of Class 1 securities

- Electronic Records Transfer Rights: Tokenization of Class 2 securities

- Excluded Electronic Records Transfer Rights: Tokenization of Class 2 securities under specific conditions(*)

*Specific condition: Implement technical measures to ensure that tokens cannot be transferred without the permission of the issuer and qualified investment entities.

In Korea, guidelines have been issued focusing on the tokenization of atypical securities (non-monetary trust beneficiary certificates and investment contract securities), which are classified as Class 2 securities in Japan, while in Japan, regulations on the tokenization of Class 1 securities(bonds, stocks), which are classified as typical securities, have also been developed. In Japan, we often see security tokens utilized not only in the form of fractional real estate investments serviced by innovative financial services but also in capital increases common in traditional finance(more details in Part 1).

The Structure of the Primary Market

The table above is a diagram of the structure of the security token primary market in Japan. Since Japan considers security tokens to be securities, they are regulated by the Japanese Financial Services Agency(FSA) under the FIEA, the same as conventional securities. Therefore, the issuance structure of security tokens is basically the same as that of conventional securities: when an issuer issues security tokens with securities as the underlying asset, it receives investment through an underwriter such as a securities firm or bank. However, by using distributed ledger technology, there is a distinct difference from the existing securities issuance system, which is that the management of the bond registry is handled by the blockchain platform instead of the Japan Securities Depository Center(JASDEC).

A bond registry is a company’s account book that contains information about bonds and bondholders. Currently, in Japan, when a company issues bonds such as general bonds and short-term bonds under the FIEA, the bond registry for those bonds is electronically registered and managed by the JASDEC. However, in the case of security tokens, the bond registry is managed by a blockchain platform, allowing issuers to access information about investors through that platform. Under the current FIEA, the transfer of rights in security tokens is done through a blockchain platform, so blockchain platforms play a very important role in the security token ecosystem in Japan. Due to the nature of securities transactions, which must be conducted under strict financial regulations, most blockchain platforms use a consortium format for screening blockchain operating entities(nodes), with issuers, bond ledger managers, brokers, and trustees participating as nodes.

Currently, the leading blockchain platforms in Japan are Mitsubishi UFJ Bank’s “Progmat” and Boostry’s “ibet for Fin”. Various Japanese companies such as Mitsubishi UFJ Bank, SBI Holdings, and Kenedix(a real estate operator) have issued security tokens through these platforms, and various other companies are participating as nodes. Progmat, in particular, has issued its stablecoin, “Progmat Coin,” whose value is fixed at 1 yen, to streamline the trading and management of security tokens.

The Structure of the Secondary Market

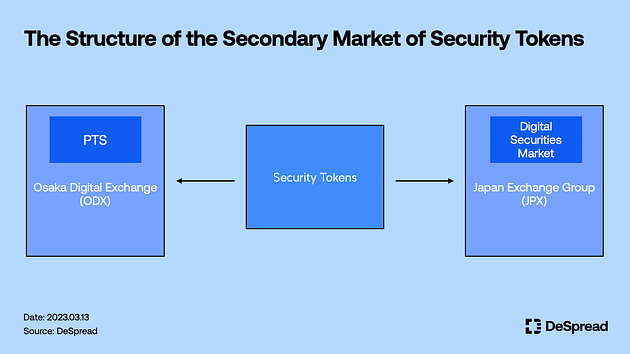

The table above is a diagram of the structure of the security token secondary market in Japan. Due to the nature of token securities, which can be tokenized by various assets using distributed ledger technology, it seems that the key to successful security token regulation is to develop a system that allows newly securitized assets to be traded smoothly in the secondary market. In addition, blockchain platforms, which are responsible for issuing security tokens and managing investors, are structurally incapable of handling securities contracts, so the importance of establishing a new secondary market outside of the platform is increasing.

Japan aims to facilitate smooth secondary trading for investors through the creation of two new secondary markets below:

- PTS(Proprietary Trading System): ODX(Osaka Digital Exchange)

- Digital Securities Market: JPX(Japan Exchange Group)

PTS

PTS stands for Proprietary Trading System and is an over-the-counter market for securities that are conducted by the “Ordinance on Sales and Purchase of Share Certificates, etc. Listed Outside the Financial Instruments Exchange”, etc. set forth by the Japan Securities Dealers Association. PTS allows investors to buy and sell securities without going through a traditional stock exchange and is characterized by longer trading hours and relatively smaller price units compared to exchanges. ODX, a PTS that is expected to support security tokens trading, was established in April 2021 as a joint venture among SBI Holdings, Sumitomo Mitsui Financial Group, Nomura Holdings, and Daiwa Securities. Currently, it only services stock PTS, but has stated its goal to support security token PTS within 2023.

ODX’s security token PTS is expected to play a key role in Japan’s security token distribution market in the future. As we mentioned in Part 2, it is expected that “due to the nature of security tokens that use innovative technologies and use previously illiquid assets as underlying assets, active trading in the OTC market seems to be the key to the security token business” so the flexible trading policy of ODX PTS is expected to lead to the formation of a new capital market with high convenience. The FSA’s Market System WG(Working Group), which researches the system and regulation of financial markets, released an interim report in June 2022, and the FSA’s 2022 Financial Administration Policy Plan, which was published in August of the same year, mentioned the need to overhaul the system related to the handling of security tokens on PTS to establish a market for trading security tokens

Digital Securities Market

A digital securities market is a system that allows the buying and selling of security tokens on a traditional stock exchange. JPX was created when the Tokyo Stock Exchange merged with the Osaka Stock Exchange, and as of 2022, its market capitalization was over $5 trillion, ranking sixth globally. As the centerpiece of securities trading in Japan and one of the top exchanges globally, JPX announced in March 2022 that it would create a digital securities market by the end of 2024 in its Mid-Term Management Plan.

In 2020, JPX conducted a demonstration experiment with 19 financial institutions, including the JASDEC, Nomura Securities, and Mizuho Securities, to apply blockchain technology to investment trust business operations, and in February 2022, JPX issued a Green Bond in collaboration with the blockchain platform “ibet for Fin”. As JPX, which has been focusing on securities market reform using blockchain technology for a long time, has cited the opening of a digital securities market for security token trading as one of its core tasks, the digital securities market is expected to play a key role in Japan’s security token secondary market alongside the PTS.

Conclusion

Comparison of Korean and Japanese security token systems

So far, we’ve looked at the security token issuance and distribution systems in Korea and Japan. When looking at the relevant laws and market reforms, there are some similarities and differences between both countries. The first commonality is that each country has applied the existing laws governing securities (Korea: Capital Markets Act, Japan: FIEA) to security tokens. In the case of Korea, this intention is also evident in the terminology of the security token, which was used to emphasize that security tokens are essentially securities, with only the issuance method being changed to a blockchain*. Before the FSC’s guidelines last month, Korea’s government stated that it used the term security tokens to put security tokens on the same footing as physical and electronic securities and to emphasize that they are essentially the same as traditional securities, with only the issuance method being different. In addition, both countries showed common features such as using a consortium blockchain as a platform for issuing security tokens and establishing an on-exchange and OTC market.

*In Korea, the official terminology for security token is token security(Securities=증권, Token=토큰).

However, there are also areas where the two countries diverge. A comparison of Japan’s second amendment implemented in 2020, and the domestic guidelines released by the FSC last month, reveals distinct differences in the types of securities eligible for tokenization and their detailed classification. In Korea, securities subject to tokenization were limited to previously atypical securities(non-monetary trust beneficiary certificates and investment contract securities), and the criteria for dividing the types of security tokens and the details of the regulatory proposals applied to each type were not established. In Japan, on the other hand, in addition to the new type of atypical securities(Class 2 securities), structured securities(Class 1 securities) are also being tokenized, and the detailed types based on the assets to be tokenized and the regulatory proposals applied to each type have been established. Other differences include the absence of a self-regulatory organization, active adoption of blockchain by exchanges, and active blockchain platforms.

Of course, Japan’s market system and regulations are not perfect or the answer and the lack of market development and related regulations in Korea compared to Japan may be a natural consequence of the length of time each country has been working to institutionalize its security token market. However, we can use Japan’s example as a good model to learn from and adopt what is necessary and reject what is not.

For the Korean token securities market to move forward

The Korean security token market is just getting started. There are only guidelines and no formal legislation yet. But as with all things, the first time is a big deal. How we get off to a good start can determine whether the innovative idea of security token is just a dabbling attempt or a big footprint in changing the paradigm of finance. As we wrap up our STO series, I’d like to reflect on what direction Korea should take in light of the example of Japan, which implemented security tokens four years ahead of Korea.

Based on the official guidelines released to date, two things need to be addressed first before Korean security tokens can become viable.

- Establishing a blockchain platform

- Developing a secondary market

Due to the nature of security tokens, which utilize a new technology called blockchain for issuance, investor management, and transfer of rights, the importance of a blockchain platform is enormous. Therefore, for the security token market to be successfully established, a blockchain platform that can handle technical issues must be established. In Japan, various blockchain platforms exist, such as “Progmat,” which is co-founded by securities firms such as MUFG and SBI, “ibet for Fin,” which was launched by fintech company Boostry, and “Securitize,” which has offices in Japan. Then, issuers can choose the most appropriate platform for their situation to issue security tokens. In Korea, the ecosystem of security tokens will develop more constructively if players closely related to the security tokens ecosystem, such as securities firms and fintech companies, launch their blockchain platforms and compete with each other. Currently, Shinhan Investment & Securities, which is collaborating with APND, and Lambda 256, a subsidiary of Dunamu, are active in launching blockchain platforms, and it is worth paying attention to such cases in the future.

In addition to establishing a blockchain platform, systematic maintenance of the secondary market is also an important point. The secondary market is a market that provides liquidity for issued securities, and the degree of activation of the secondary market is an important indicator of the performance of token securities. However, Japan, which started to develop its secondary market about three years earlier than Korea, has not yet established a system and is still in the process of continuous discussion, so it is necessary to take more time to judge the case of Korea, which has just begun. For the security token market not to be opportunities only for securities firms, banks, and issuers, active trading by individual investors in the secondary market is essential. Therefore, it is worth paying attention to the development of the KRX Digital Securities Market and OTC brokers, which are responsible for brokering multilateral counterparty transactions for retail investors.

In Par 1,2, and 3, we’ve looked at the development of the Japanese security token market, as well as the structure of the security token market in Korea and Japan. As a person interested in traditional finance and blockchain, this is a very interesting and exciting project. I would like to conclude this STO series with the hope that Korean token securities will not end up as one of ordinary new businesses, but will become an innovative industry that can lead the future of domestic finance.

<References>

- Business Lawyers, What is the security token under the revised FIEA, 2020

- Japan Research Institute, Security Token Overview and Trends, 2021

- Japan Research Institute, Security Token Overview and Market Expansion Challenges, 2022

- JSTOA, ST Market WG Interim Consolidation Report, 2022