Japan Web3 Bible Part 1

Focusing on Japanese Government and Financial Institutions

Abstract: This article aims to provide information on the overall structure and recent trends of the Japanese web3 market. We will look at the major changes taking place in various aspects of web3 in Japan, including legal regulations, stablecoins, and security tokens, and explore whether Japan could become the new cradle of Web3.

1. Introduction

Originally at the forefront of cryptocurrency adoption, Japan gradually emerged as a significant player in the crypto industry since the early 2010s. With a remarkable 43.6% share of the global Bitcoin trading volume in 2017, Japan surpassed the United States and China. However, a series of unfortunate events, including the hacking incidents of major Japanese exchanges like Mt.Gox in 2014 and Coincheck in 2018, caused Japan to lose its central position and influence in the cryptocurrency industry. Moreover, the combination of a worldwide downturn in crypto markets and increasing interest rates in the United States led to the decline of Japan's once-vibrant crypto market.

But as the saying goes, the ground hardens after the rain. Japan has focused on laying the groundwork for its crypto industry after the exchange hack. While the world is buzzing about cryptocurrency regulation, Japan has learned from experience and is now actively working to get back to the center of the industry.

Currently, Japan is attempting to become a crypto powerhouse on multiple fronts, including aggressive government regulation, the development of a security token market, various activities related to web3, and a change in perception within the country. In this article, we'll take a look at the changes taking place in the crypto industry at the national and traditional financial levels in Japan and see if they have the potential to become a market leader.

2. Establishing Regulations

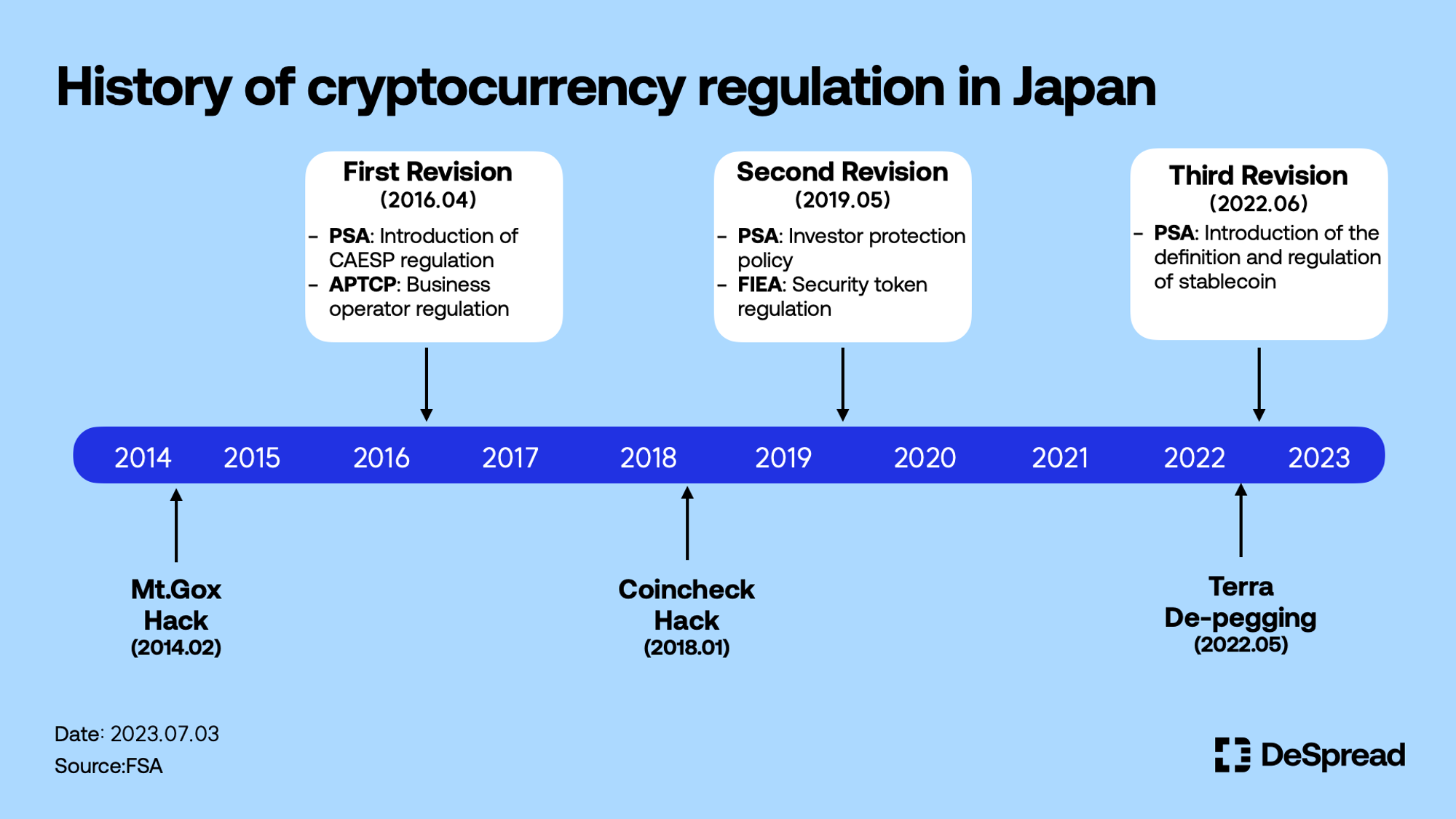

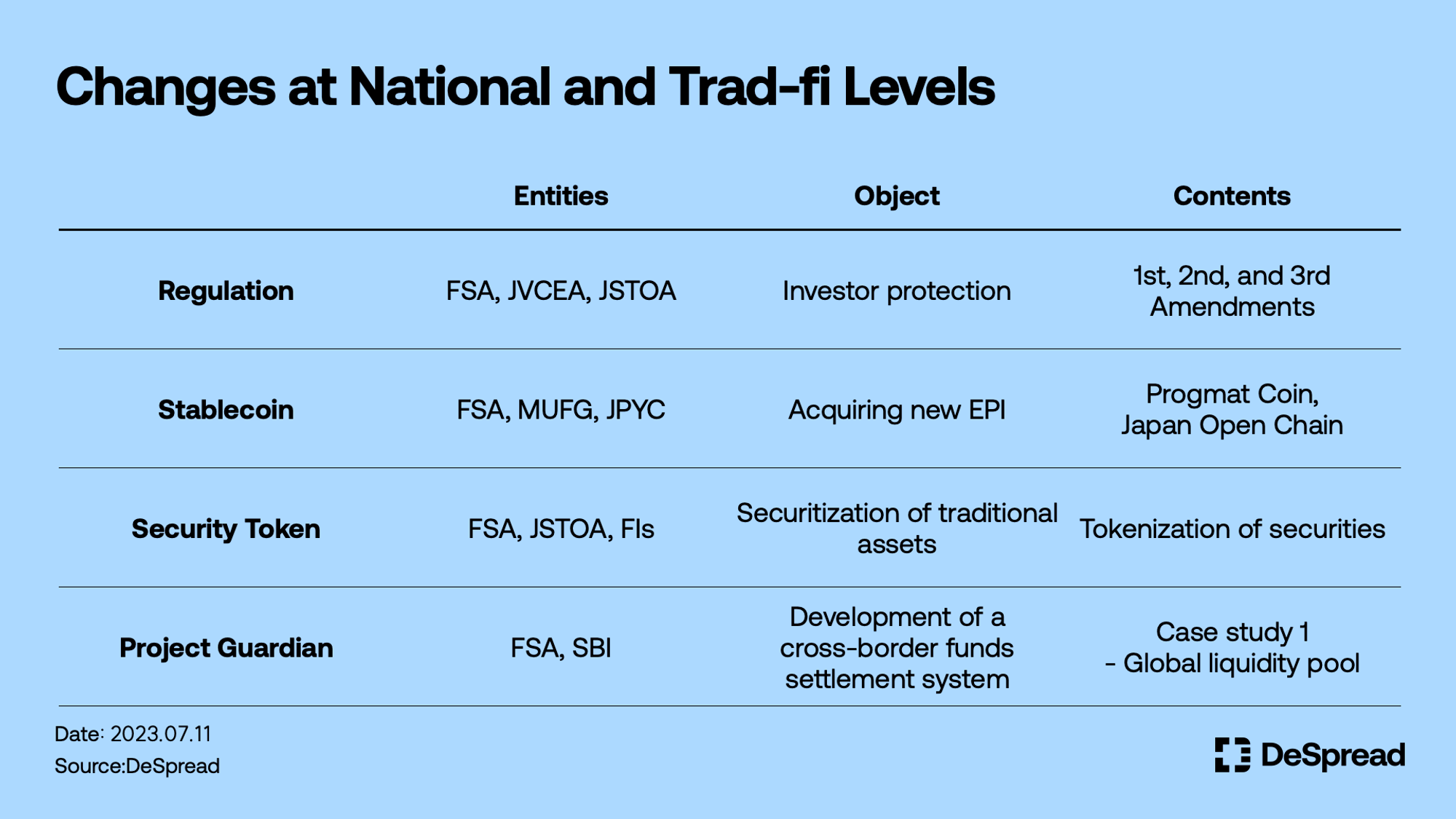

One of the most prominent features of Japan compared to other countries is its solid regulatory foundation for the cryptocurrency industry. After suffering a series of large-scale hacks earlier, Japan opted to create a legal framework for the industry to develop safely rather than ban crypto investments altogether. As a result, there were three rounds of revisions between 2016 and 2022.

2.1. Key Authorities and Key Regulations, FSA and PSA

- FSA(Financial Services Agency): An organization responsible for the overall regulation and supervision of Japan's financial markets. Sometimes referred to as the JFSA.

- PSA(Payment Services Act): Laws governing the transfer and settlement of funds.

Japan has been actively shaping its cryptocurrency regulations under the oversight of the FSA(Financial Services Agency), which plays a similar role to Korea's Financial Services Commission. Over time, there have been three major revisions to these regulations. The PSA(Payment Services Act) has been a primary focus in all three amendments, encompassing the broader Japanese cryptocurrency industry. Alongside the PSA, other laws like the APTCP(Act for Prevention of Transfer of Criminal Proceeds), ensuring transparent fund transfers, and the FIEA(Financial Instruments and Exchange Act), akin to South Korea's capital market law and governing security tokens, have also been subject to the first and second revisions. These laws collectively regulate cryptocurrencies. However, the PSA covers the majority of core regulations, including the cryptocurrency definition, exchange fund management, and requirements for cryptocurrency issuers and intermediaries. Hence, it can be broadly regarded as Japan's primary legislation governing cryptocurrencies, referred to as the "PSA" or "Japan's Cryptocurrency Law.”

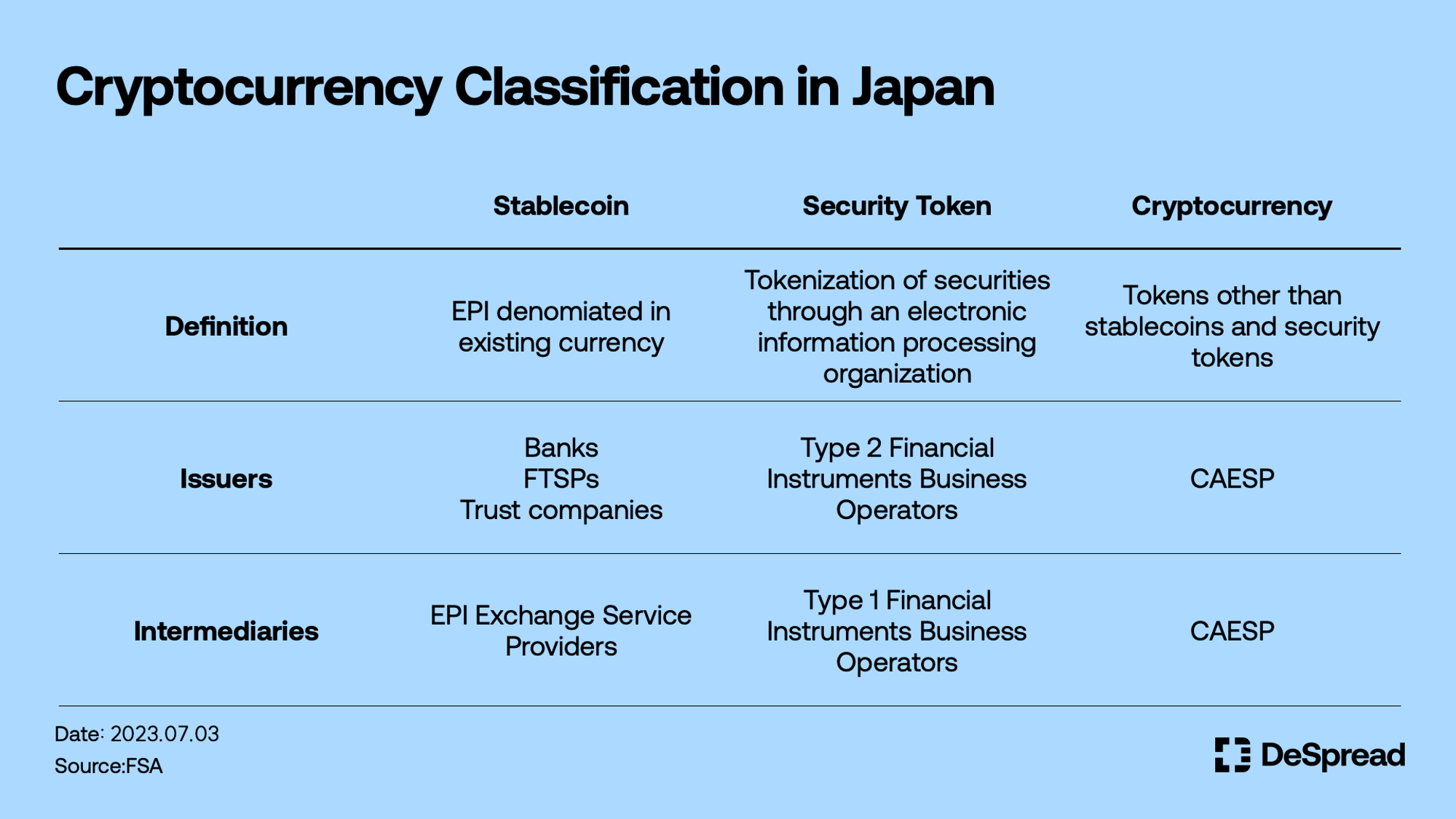

Through these three revisions, Japan has been able to establish a framework for the entire cryptocurrency industry. First of all, they categorized cryptocurrencies into three types: stablecoins, security tokens, and general cryptocurrencies, with issuers and intermediaries for each type as shown in the table below.

Companies aiming to engage in cryptocurrency-related activities, including cryptocurrency issuance, brokerage, and custody, are obligated to register with the FSA as Crypto Asset Exchange Service Providers(CAESP) and fulfill the following criteria.

- Protection of user assets: To store at least 95% of client assets in cold wallets, only handle authorized assets, etc.

- Provision of sufficient information: To disclose contractual information, balance sheet and income statement, etc.

- Market integrity: To prohibit unfair trading and implement measures to prevent conflicts of interest, etc.

As the main objective of this article is to offer a comprehensive understanding of cryptocurrency regulation in Japan, please consult the previous article titled "STO Series Part 1: History and Current Status of Japan's Security Token Market" for specific information regarding the historical background of Japanese cryptocurrency regulation and the details of each amendment.

2.2. Various Regulators

2.2.1. JVCEA

The Japan Virtual and Crypto assets Exchange Association(JVCEA) is a self-regulatory organization formed in April 2018 by 16 cryptocurrency exchanges in Japan. Its primary role is to conduct screening procedures for cryptocurrencies before their registration. In comparison to the Digital Asset Exchange Joint Association(DAXA), established by five major exchanges in Korea in June 2022, the formation of this self-regulatory organization occurred relatively swiftly. The JVCEA maintains a close relationship with the FSA and assumes responsibility for overseeing exchange operations and cryptocurrency listings in Japan. As of 2023, it boasts a total of 40 registered members.

While the JVCEA's screening process has provided a safe environment for investors to trade cryptocurrencies, the problem is that it takes a very long time for a new cryptocurrency to pass the screening and actually be listed on an exchange, requiring a minimum of six months. To address this, the JVCEA has relaxed its screening criteria and introduced new systems, including the Green List and the Crypto Asset Self Check(CASC). The Green List was introduced in March 2022, and CAESPs can handle tokens included in the Green List through self-assessment without JVCEA's evaluation. At the time of launch, a total of 18 tokens were included, including BTC and ETH, and as of July 2023, 24 tokens are currently on the Green List. CASC is a system introduced in December 2022 that allows CAESPs that meet certain conditions to be exempted from JVCEA's review. With the introduction of this new system, Japan is actively working to reduce the time it takes to review cryptocurrencies.

2.2.2. JSTOA

The Japan Security Token Offering Association(JSTOA) is an organization founded in October 2019 by six prominent Japanese securities firms, including SBI, Nomura, and Rakuten Securities. Its primary objective is to facilitate the systematic introduction and advancement of security tokens within Japan. In May 2020, upon the implementation of the second amendment, the JSTOA was officially recognized by the FSA as a self-regulatory organization under Article 78(1) of the FIEA. The association is responsible for various key tasks, such as safeguarding investor interests, developing the security token market infrastructure, managing seller registrations, and engaging in communication with relevant entities within the financial instrument trading industry. Since its inception in 2019, the JSTOA has demonstrated transparency by annually disclosing internal information such as business plans, business reports, and balance sheets.

The essence of the JSTOA lies in its identity as a self-regulatory organization composed of industry practitioners. It encompasses a broad spectrum of financial, legal, and accounting firms as regular, supporting, and sponsoring members. As of July 2023, the JSTOA boasts 73 members who actively contribute their practical expertise to establish regulations that promote the healthy development of the security token market. Notably, CEOs or other key figures from each member organization actively participate in various committees within the JSTOA, including the ST Market Revitalization Committee, ST Market Business Committee, and ST Taxation Business Committee. These committees engage in regular consultations to address and disclose the challenges and progress associated with the security token market.

2.2.3. JSTA

The Japan Security Token Association(JSTA) is an additional non-profit organization established in September 2018 with the aim of advancing the security token ecosystem in Japan. Its membership comprises fintech companies, blockchain startups, real estate firms, and others. Distinct from the previously mentioned organizations, the JSTA's focus lies in educational initiatives, including hosting various seminars and conducting research on the ecosystem. While the JSTOA concentrates on regulatory development and market establishment pertaining to security token issuance and distribution by securities firms, the JSTA's emphasis is on educational efforts. However, it is important to note that the JSTA and JSTOA are not separate entities; rather, they operate in conjunction with one another. The JSTA serves as a supporting member of the JSTOA, and the JSTOA acts as a partner to the JSTA. Both organizations collaborate with a shared objective of cultivating a robust and healthy security token market in Japan.

2.3. Tax Reform

According to "The web3 White Paper" released by the Liberal Democratic Party of Japan in April, the Japanese government is actively working to relax tax policies for both businesses and individuals in the context of web3. Previously, tokens held by companies in Japan were subject to year-end fair value assessment tax, requiring companies to pay corporate taxes on unrealized gains and losses. However, the "2023 Tax Reform Policy" announced by the Liberal Democratic Party and the Komeito Party in December 2022 included a provision to exempt tokens issued and continuously held by companies from such year-end taxation. This policy change took effect on June 26, allowing companies to avoid paying corporate taxes of approximately 30%. Nonetheless, long-term holdings of tokens issued by other companies still remain subject to taxation. While proposals have been put forth to eliminate corporate taxes on tokens issued by other companies, these suggestions have not yet been formally adopted.

Regarding individuals, Japan currently treats income from cryptocurrencies as other income and imposes a relatively high tax rate, reaching up to 55%, which includes income tax and residence tax. The perception is that this high tax rate has contributed to the outflow of funds from Japan. Responding to public sentiment, the LDP Headquarters for the Promotion of Digital Society proposed in November 2022 to reduce the tax rate on transactions between cryptocurrencies and fiat currencies to 20%, aligning it with the tax rate for income from stocks, and to eliminate taxes on transactions between cryptocurrencies altogether. If approved, this proposal is expected to lower entry barriers to the cryptocurrency industry for businesses and consumers alike.

3. Yen Stablecoin

The third amendment, which was passed on June 3 of the previous year, primarily concentrated on providing clear definitions for stablecoins and establishing a legal framework governing their issuance and distribution. Subsequently, on June 1, the amendment was officially enforced, marking the commencement of yen-denominated stablecoin issuance in Japan. Banks, fund transfer service providers, and trust companies within the country took active steps to engage in the issuance of these stablecoins.

3.1. Backgrounds

Japan stands out as one of the few countries that has successfully maintained a quantitative easing(QE) strategy despite a prolonged decline in interest rates. Since the early 2000s, interest rates in Japan have remained relatively stable, with the exception of 2006. In fact, interest rates have continuously fallen since the early 1990s, starting at 6% and eventually reaching negative territory in January 2016. While many other countries, such as the United States, South Korea, and Europe, have been raising rates in 2022, Japan has continued to maintain negative rates.

However, the intended effects of QE, which aimed to combat deflation and stimulate the economy, have not been fully realized in Japan. Instead, Japanese corporations and commercial banks have been accumulating cash and depositing funds with the central bank(BoJ), or investing in government bonds, rather than actively engaging in lending and investment activities. Additionally, the cultural emphasis on frugality among the Japanese public has also hindered the effectiveness of QE as a stimulus measure. In response, the Japanese government has implemented various policies, including tax reforms, Yield Curve Control(YCC), and interest rate cuts, but there is ongoing debate about the success of these measures.

Against this backdrop, the active introduction of yen-denominated stablecoins at the national level can be seen as an effort to create a new channel to address the increasing volume of currency. The decision to establish state oversight of stablecoin issuance and distribution systems was largely influenced by the bank run that occurred in May 2022 due to the de-pegging of Terra. However, it is challenging to consider yen stablecoins as a tool for regulating the expanding money supply in the market. Nevertheless, it is noteworthy that Japan, which has been making various attempts to revive its economy over the past decade, is now beginning to develop infrastructure that can leverage emerging technologies like blockchain for conducting financial policies at the national level.

3.2. The Third Amendment

On June 1 this year, the third amendment to the PSA was implemented, encompassing the definition of stablecoins and the regulatory requirements imposed on issuers and intermediaries involved with them. Japan revised the PSA to classify stablecoins as "Electronic Payment Instruments(EPIs)". As the PSA governs entities offering electronic payment services like credit cards and prepaid payment methods, categorizing stablecoins as EPIs reflects the Japanese government's aim to leverage stablecoins for money transfers and payments in diverse domains in the coming years.

Under the regulations outlined in the third amendment, the entities responsible for issuing stablecoins are termed "EPI business operators." These operators fall into several categories, including banks, fund transfer service providers, and trust companies. The third amendment not only introduces changes to the PSA but also amends the Banking Law and the Trust Business Law to enhance oversight and regulation of stablecoin issuers and intermediaries.

- Bank: Issues EPIs with deposits as the underlying asset and protects users' funds in the same way as traditional bank deposits.

- Fund Transfer Servie Provider: Issues EPIs with claims on outstanding debt as the underlying asset, and the institution backs the debt with safe assets such as deposits and government bonds.

- Trust Companies: Issues EPIs with trust beneficial interests as the underlying asset, and the institution holds all assets in the form of bank deposits.

Individuals or organizations desiring to engage in stablecoin transactions must undergo registration as EPI business operators before commencing operations. Foreign entities that are not Japanese joint-stock companies are unable to register unless they appoint a representative residing in Japan. EPI business operators who successfully register are obligated to adhere to five specific requirements outlined in the PSA. These requirements reflect the Japanese government's dedication to applying rigorous investor protection measures to stablecoins, a commitment that has been in effect since the first amendment to the PSA.

EPI Business Operator Regulations under the PSA

- the obligation to take measures to manage the security of information related to EPI's business

- the obligation to provide users with information related to EPI's business

- the obligation not to accept deposits of property interests from users in connection with EPI business

- the obligation to strictly separate company funds from customer funds and perform periodic accounting audits

- the obligation to compensate customers for any losses caused by the operation of the EPI business

3.3. Recent Trends

With the recent implementation of amendments, numerous companies now have the opportunity to become stablecoin issuers and intermediaries in Japan. As long as they satisfy the requirements set for EPI business operators outlined in the PSA, a range of entities, including fintech startups and traditional financial institutions like banks and securities firms, are either planning or already executing yen stablecoin ventures. Moreover, Jeremy Allaire, the CEO of Circle, the issuer of USDC, the world's second-largest stablecoin, has shown interest in entering the Japanese market. This development has raised expectations and generated excitement surrounding the Japanese stablecoin market.

3.3.1. Progmat Coin

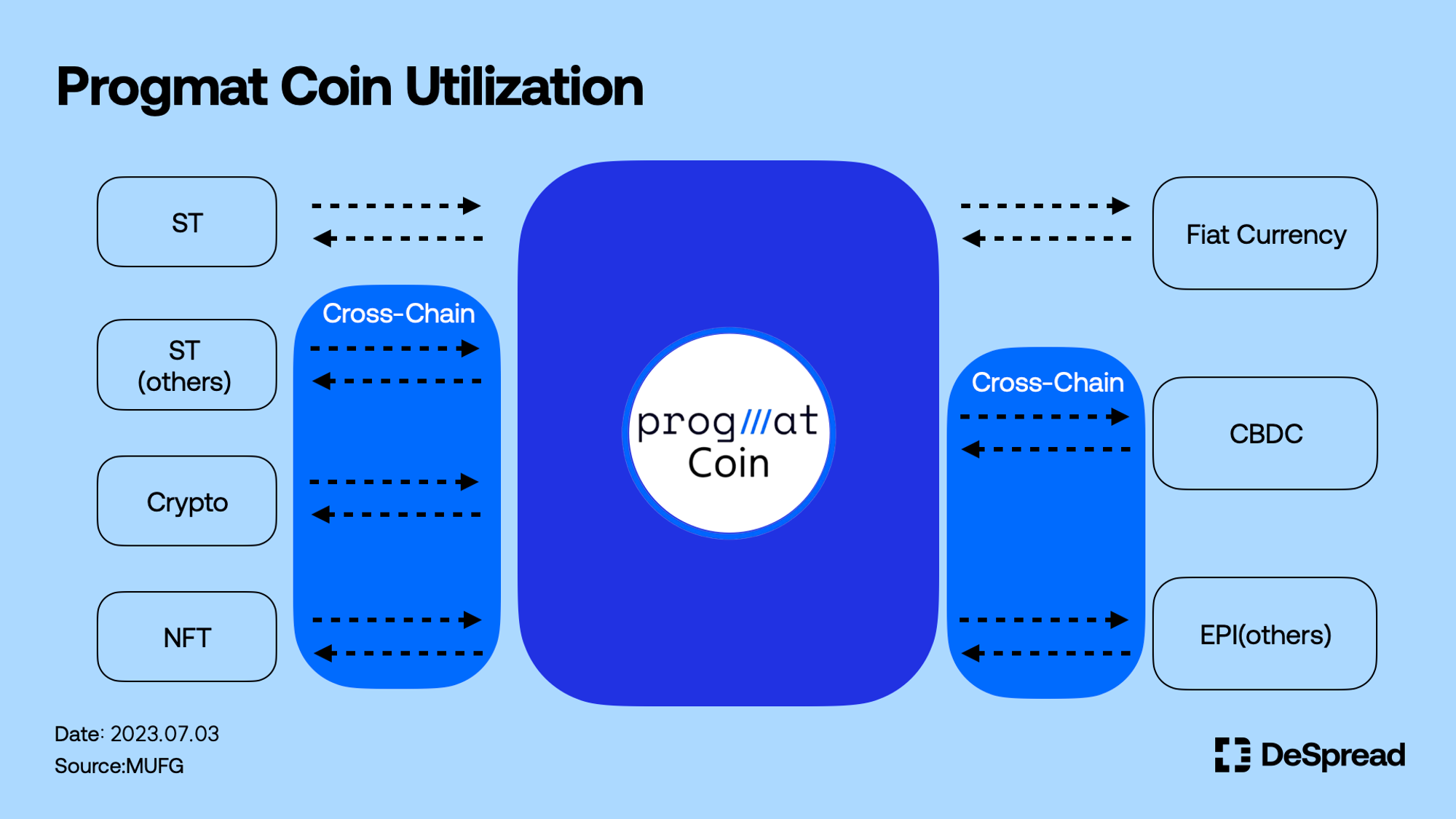

Progmat Coin operates as a stablecoin issuance network integrated into the token issuance platform called "Progmat," which was launched by Mitsubishi UFJ Financial Group(MUFG), one of Japan's largest financial institutions. Alongside MUFG, various other financial institutions participate as nodes within the network. Progmat Coin made its official debut in February of the previous year, aiming to provide universal payment methods within the digital asset space. This includes facilitating payments for security tokens and Central Bank Digital Currency(CBDC) transactions. Notably, all fiat currencies backing Progmat Coin are held in trust, mitigating the risks associated with stablecoin issuance and the potential bankruptcy of intermediaries. Users have the freedom to request full redemption of their holdings at any given time.

On June 2, just one day after the PSA revisions came into effect, MUFG announced plans with Progmat Coin for Japanese banks to launch stablecoins on public blockchains such as Ethereum, Polygon, Avalnche, and Cosmos by April 2024. The announcement also highlighted MUFG's active collaboration with fintech startups, including a collaboration with DataChain, a blockchain interoperability startup, and Toki, a cross-chain bridge solution. By collaborating with these two startups, MUFG aims to develop Progmat Coin into a platform that can be used by various financial institutions for public blockchain cross-chain swaps, lending, and trading.

3.3.2. Japan Open Chain

Japan Open Chain is an Ethereum-compatible public blockchain developed by GU Technology in collaboration with Dentsu Tokyo and Kyoto University of Arts, providing a solution for companies looking to launch web3 businesses. In March, Japan Open Chain announced that it was conducting stablecoin issuance and remittance tests in compliance with the PSA amendments. Various local banks, including Tokyo Kiraboshi Financial Group, Minna no Bank, and Shikoku Bank, participated in the test. Like Progmat Coin, Japan Open Chain aims to establish itself as a legally compliant means of issuing stablecoins and using those assets for various trading activities in Japan.

3.3.3. JPYC

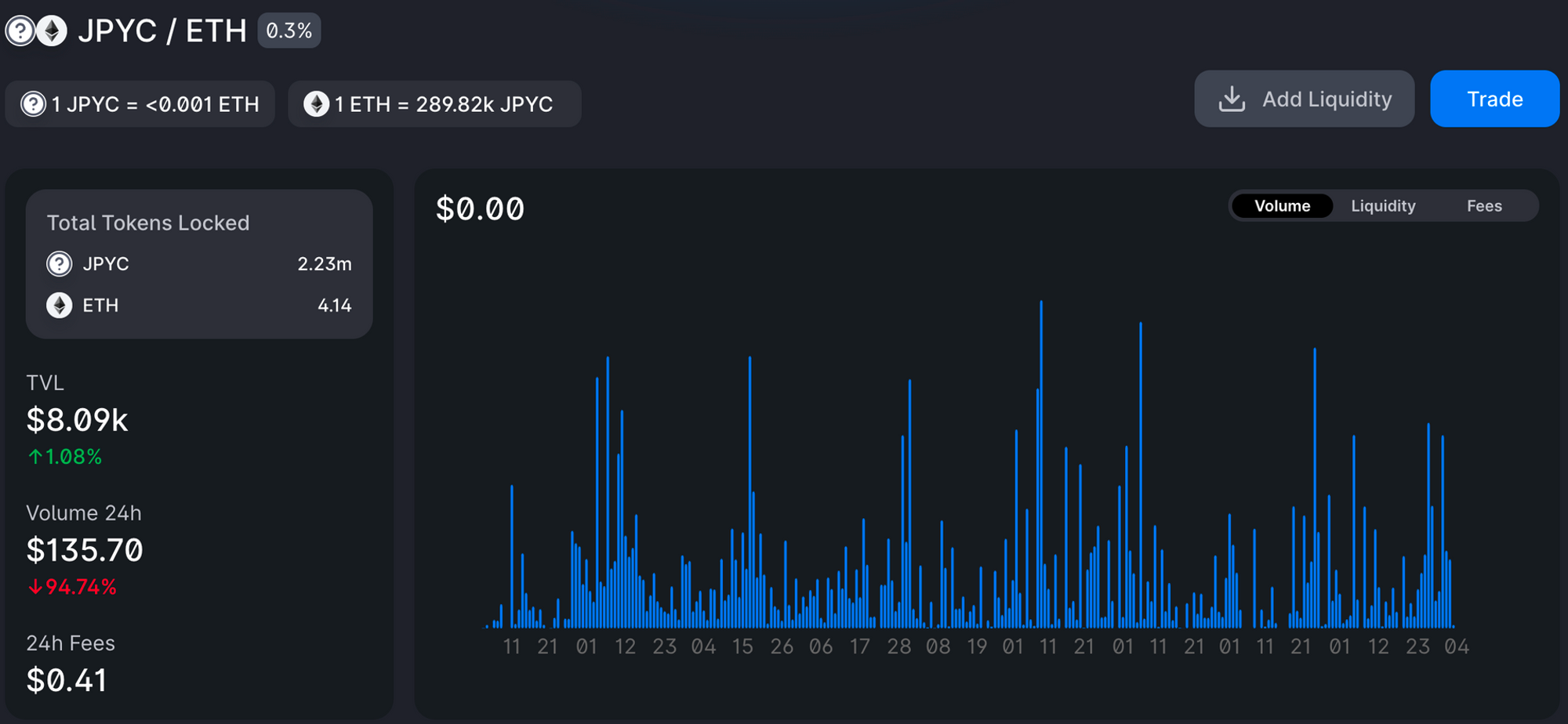

JPYC is making a number of efforts to stay ahead of the curve during the golden time before the Japanese government and traditional financial institutions enter the stablecoin market. The upgrade to v2 in April brought JPYC to networks such as Ethereum, Polygon, Avalanche, and Japan's leading blockchain Astar. It also has business agreements with companies such as the Taranzaka tax corporation and Yield Gaming Games(YGG) Japan.

4. Security Token

This part summarizes the key takeaways from parts 1 and 3 of the STO series to give you a better understanding of the article.

In Japan, the serious discussions surrounding security tokens commenced in 2019 with the implementation of the second amendment. The purpose of this amendment was to establish national-level regulations and oversight for security tokens. This initiative was prompted by the emergence of security tokens as an alternative fundraising method, in response to the concerns and doubts surrounding Initial Coin Offerings(ICOs) during that period. The aim was to ensure proper regulation and management of security tokens within the country.

ICOs have experienced explosive growth in Japan since January 2018, raising $16.7 billion in capital by October of that year. However, due to the lack of clear regulations and investor protection measures, investment fraud occurred frequently and shareholders' rights were often not guaranteed. In response, the FSA defined a new funding method called STO(Security Token Offering) through the FIEA amendment to bring the advantages of ICO's blockchain technology and tokens, but apply securities to apply clear issuance rules and further protect investors.

In the May 2019 release of the second amendment, security tokens were defined as "rights deemed to be securities under Article 2, paragraph 2 of the Financial Instruments and Exchange Act(FIEA) that are recorded using an electronic information processing organization." Japan's FIEA classifies securities into two categories: Class 1 securities, which include highly liquid assets like government bonds, corporate bonds, and stocks, and Class 2 securities, encompassing lower liquidity assets such as trust interests and collective investment contracts. Security tokens are further classified into three categories, based on whether they represent tokenized Class 1 or Class 2 securities. Notably, what sets Japan's regulations on token securities apart from those of other countries is that it covers not only the tokenization of Class 2 securities but also the tokenization of structured securities(Class 1 securities).

- Tokenized Securities Display Rights: Tokenization of Class 1 securities

- Electronic Records Transfer Rights: Tokenization of Class 2 securities

- Excluded Electronic Records Transfer Rights: Tokenization of Class 2 securities under specific conditions(*)

*Specific condition: Implement technical measures to ensure that tokens cannot be transferred without the permission of the issuer and qualified investment entities.

4.1. Japanese Security Token Market

Apart from regulation by the FSA, the Japanese security token market is subject to oversight by self-regulatory organizations like JSTOA and JSTA. Multiple organizations are actively involved in maintaining the issuance and distribution markets. In the issuance market, token securities are regulated by the FSA in accordance with the FIEA, which treats security tokens as securities. Consequently, when an issuer issues security tokens backed by securities, the process generally follows the established structure for issuing traditional securities. This entails raising investments through an underwriter such as a securities firm or bank. However, there is a distinction in that the management of underlying assets, investors, and the transfer of securities rights are handled by blockchain platforms rather than the Japan Securities Depository Center. Given the requirement for securities transactions to comply with stringent financial regulations, most blockchain platforms adopt a consortium format to screen and validate the participating blockchain operating entities(nodes). Nodes in this context can include issuers, bond principal managers, brokers, and trustees. Prominent platforms in this domain include MUFG's Progmat and Boostry's ibet for Fin.

In the secondary market, Japan is currently focusing on facilitating seamless trading for investors through the introduction of a Proprietary Trading System(PTS) and a digital securities market. The PTS is represented by ODX(Osaka Digital Exchange), while the digital securities market is represented by JPX(Japan Exchange Group). As security tokens have the ability to securitize a wide range of assets, it is essential to establish a system that enables efficient trading of newly securitized assets in the secondary market. This becomes particularly important due to the structural limitations faced by blockchain platforms that issue security tokens and manage investors, which are unable to directly handle securities contracts. The successful development of the security token market relies on the establishment of a system that allows for smooth trading of newly securitized assets in the secondary market.

4.2. Recent Trends

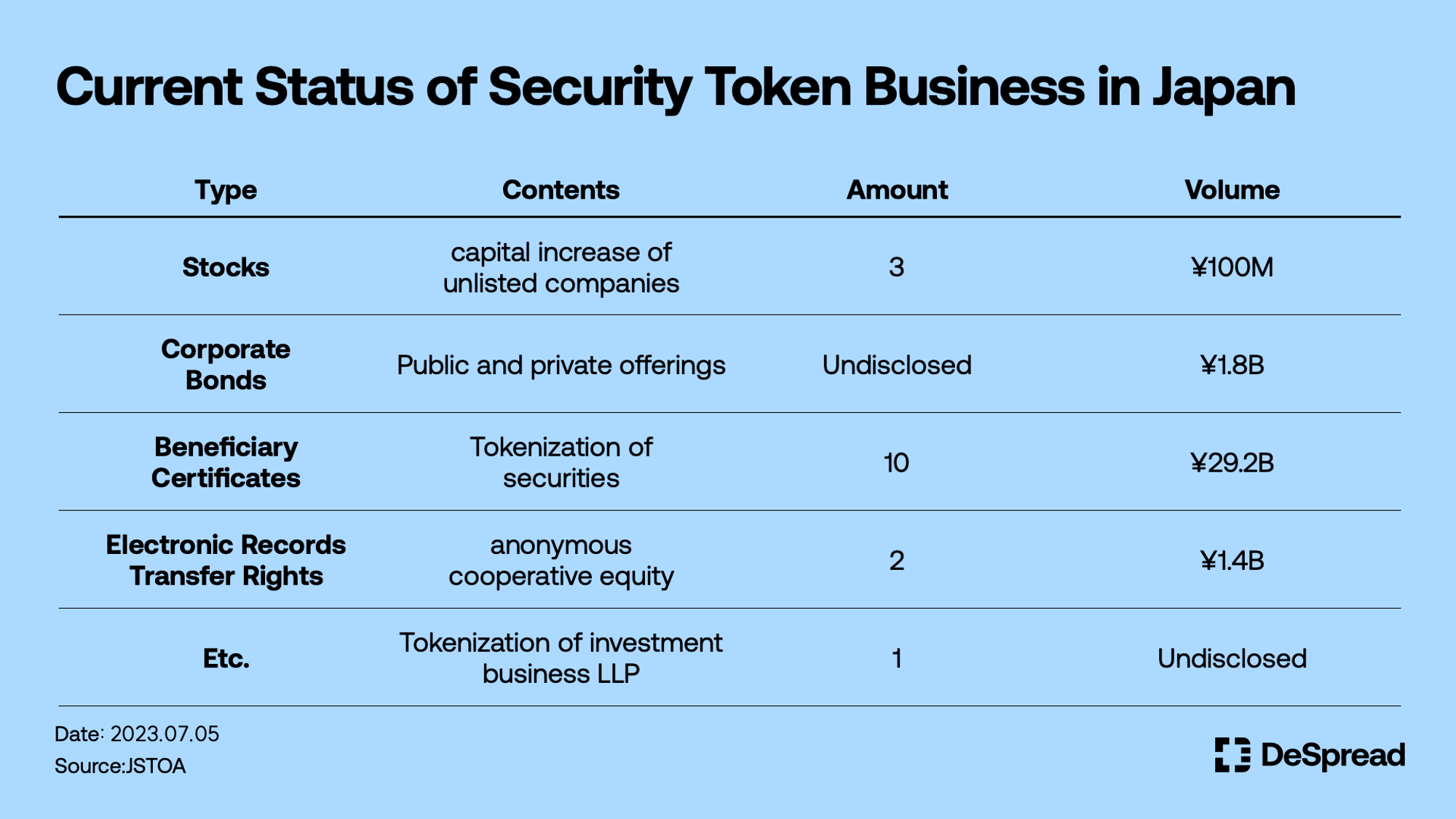

As per the "Status of Token Securities" report published by the JSTOA in June of this year, the total value of issued security tokens amounts to approximately 32.5 billion yen, excluding the tokenization of investment business limited partnerships for which the size remains undisclosed. Among the issued security tokens, beneficiary certificate-issuing trusts make up the largest portion, accounting for 29.2 billion yen. Corporate bond issuance follows at 1.8 billion yen, while the tokenization of anonymous cooperative investment shares amounts to 1.4 billion yen. Lastly, capital increase for unlisted companies represents 100 million yen of the total value.

Since the practical utilization of security tokens began in Japan in 2020, the number of use cases has steadily increased throughout 2021 and up to the present. Security tokens have found applications in various sectors such as real estate, digital points systems, and hot spring facilities. For bond tokenization, platforms like ibet for Fin and Securitize are commonly employed, while anonymous cooperative equity utilizes ADDX. Progmat, on the other hand, is widely utilized in other fields. Notably, when it comes to tokenizing beneficiary certificates with the involvement of securities firms as intermediaries, Progmat is extensively used in collaboration with major Japanese securities firms. For further information on other Japanese security token use cases and more comprehensive explanations, please refer to the first and third parts of the STO series.

5. Project Guardian

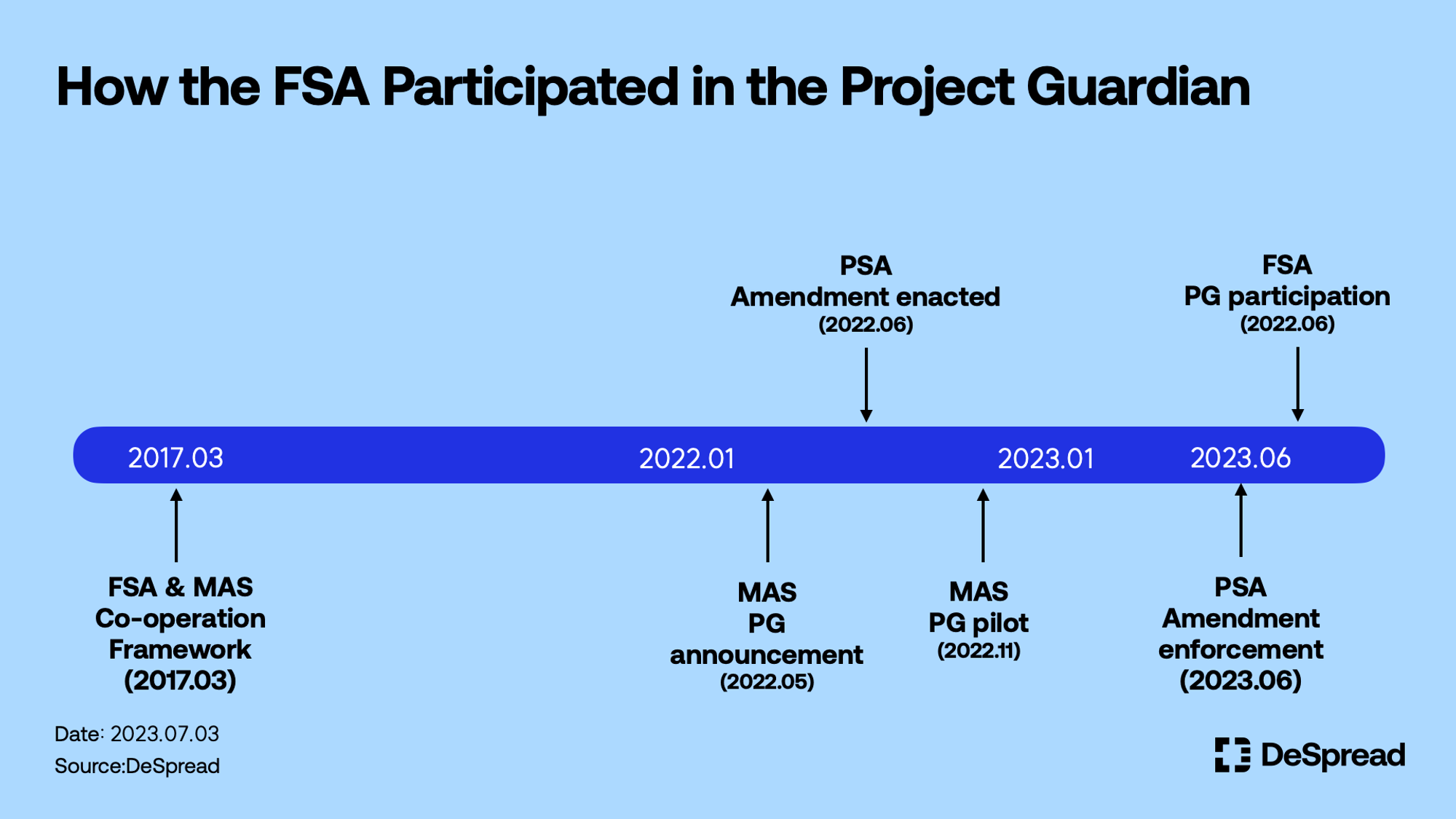

As of June 26, it was officially disclosed that the FSA would become the first international financial regulator to join "Project Guardian." This collaborative project, led by the Monetary Authority of Singapore(MAS), aims to bring together established financial institutions and fintech startups to explore the reliable utilization of Decentralized Finance(DeFi) and asset tokenization in cross-border payment systems.

The launch of Project Guardian was formally announced in May 2022 during a speech by Singapore's Deputy Prime Minister at the Asia Tech x Singapore Summit. The participation of JP Morgan in November of the previous year garnered significant attention and publicity in Korea.

5.1. FSA's Ambitions

What led the FSA to express its interest in joining a project led by the MAS? The collaboration between the FSA and MAS traces back to 2017. In March of that year, the FSA and MAS announced the "Co-operation Framework to enhance FinTech," which aimed to establish a closer financial exchange agreement in the fintech domain between Japan and Singapore. However, no specific development plans were disclosed at that time, and blockchain technology was not initially included in the framework. It was not until five years later, in November 2022, that full-scale blockchain financial cooperation between Japan and Singapore commenced with the implementation of the Project Guardian pilot program mentioned earlier. The pilot program involved DBS Bank, Singapore's largest bank, and SBI Digital Asset Holdings, a subsidiary of a prominent Japanese bank. Leveraging a fork of the Aave protocol deployed on the Polygon Network, they successfully executed forex and government bond trades between the Japanese yen(JPY) and Singapore dollar(SGD).

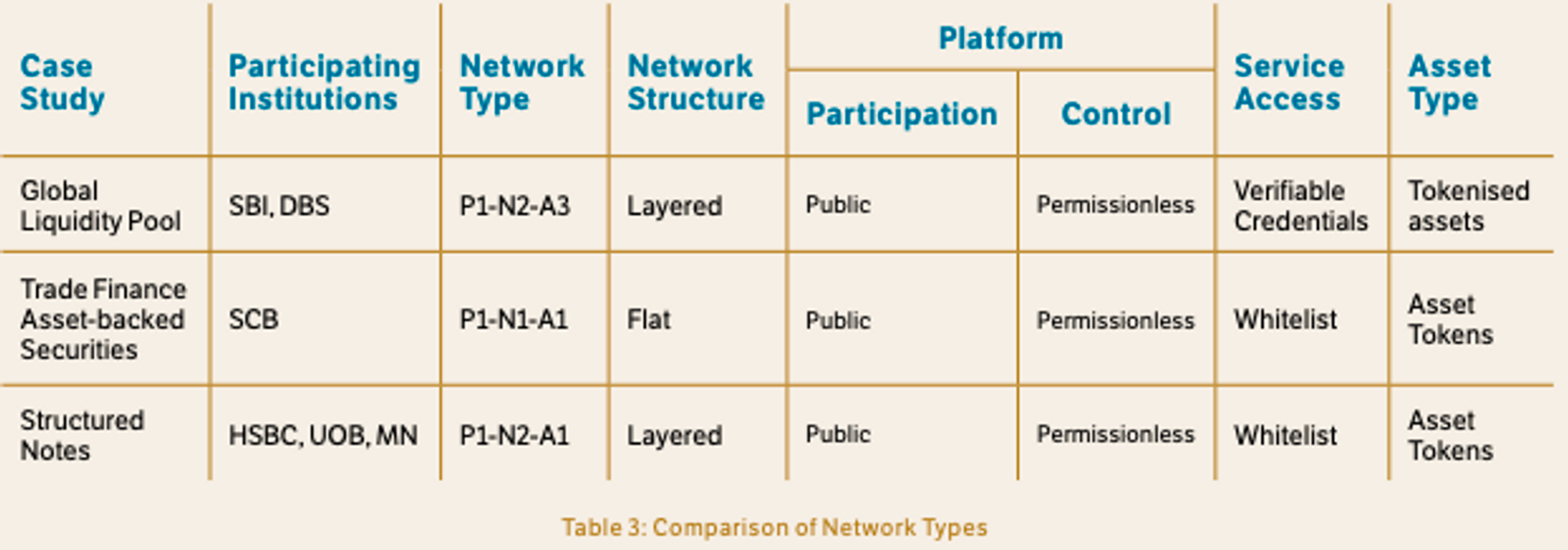

Following the success of the previous year, MAS, in collaboration with the Bank for International Settlements(BIS), released the Project Guardian report on June 26. The report categorizes existing blockchain platforms, asset classes, networks, and service approaches into three distinct categories. It also presents three case studies highlighting the use of blockchain technology in traditional finance. The first case study, known as the "Global Liquidity Pool," sheds light on why the FSA decided to join Project Guardian.

5.2. Case Study - Global Liquidity Pool

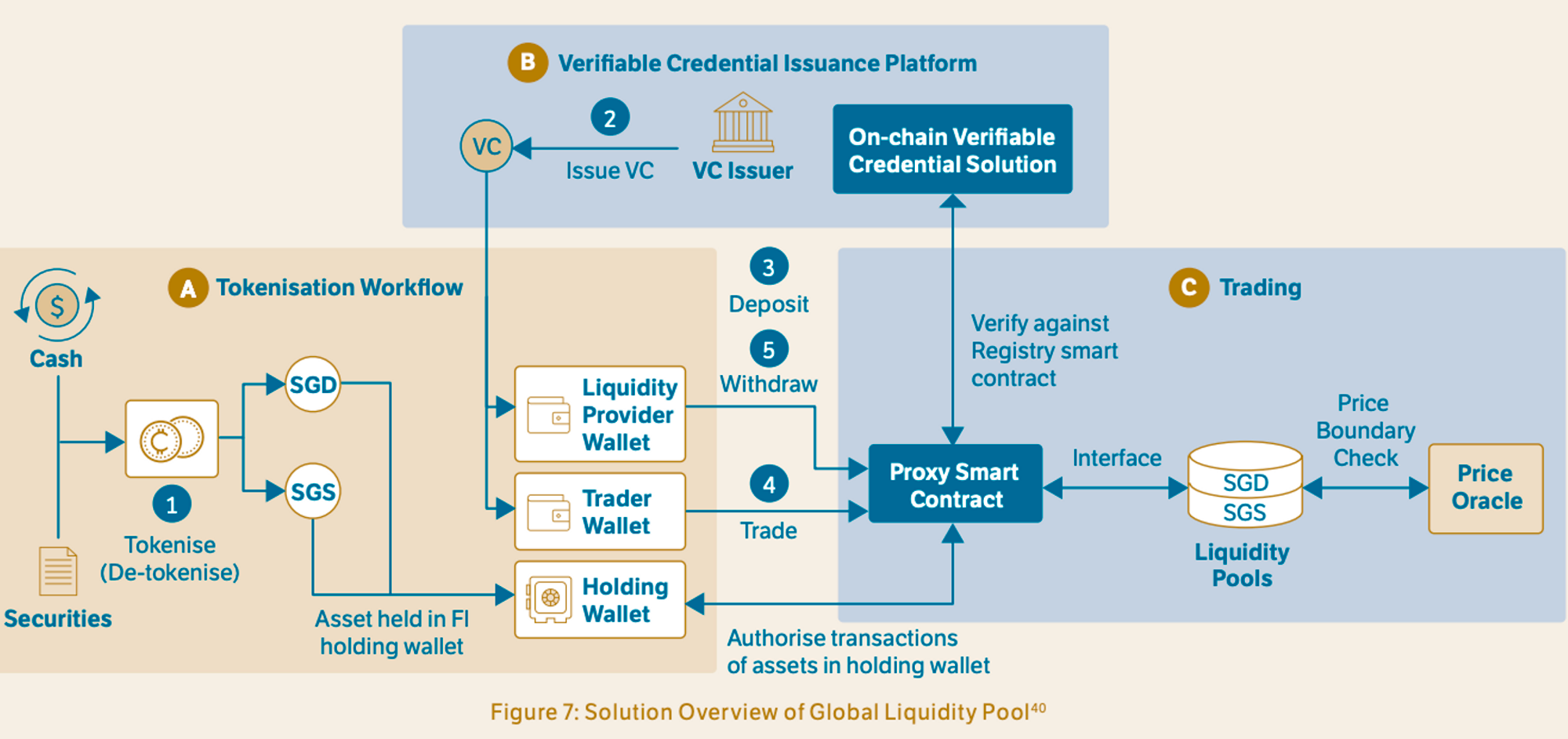

The concept of the global liquidity pool was introduced to address inefficiencies within the foreign exchange(FX) market. According to MAS, the FX trading market is substantial, with a daily turnover reaching approximately $7.5 trillion as of April 2022. However, these transactions typically occur in the over-the-counter market, which often faces challenges like friction between intermediaries, prolonged settlement processing times, and high costs. In an effort to mitigate counterparty risk and enhance the efficiency of transactions, Project Guardian proposes the use of liquidity pools, employing Automated Market Makers(AMMs) similar to those utilized by decentralized exchanges(DEXs) like Uniswap and Curve. This approach aims to streamline forex trades, reduce settlement time, and lower transaction costs.

In this context, DBS Bank from Singapore and SBI Bank from Japan fulfill the role of issuing stablecoins and security tokens tied to fiat currencies to supply liquidity to the pool. Specifically, DBS Bank issues stablecoins and security tokens representing the SGD and Singapore Government Securities(SGS), while SBI Bank issues stablecoins and security tokens representing the JPY and Japanese government bonds(JGB), respectively. Therefore, any entity participating in Case Study 1 must possess the capability to tokenize real-world assets such as bonds and seamlessly issue and distribute stablecoins with their values pegged to fiat currencies.

The FSA's announcement regarding its involvement in Project Guardian signifies Japan's intention to expand the use of yen-denominated stablecoins and Japanese security tokens in cross-border payment markets beyond its borders. The FSA's active engagement in regulatory developments since 2016, along with numerous demonstration experiments involving banks and securities firms, has laid a strong foundation for exploring external applications for yen stablecoins. Notably, the recent amendments to the PSA, which came into effect on June 1, specifically address regulations pertaining to stablecoins, further supporting Japan's preparedness to officially explore the external use of yen stablecoins. With the domestic stablecoin industry poised for growth, Japan's participation in Project Guardian aims to investigate the external utility of yen stablecoins and establish a prominent position in the cross-border payments market as these technologies mature.

6. Conclusion

This article examined the efforts of the Japanese government and traditional financial institutions to advance the country's crypto industry, with a focus on regulation, stablecoins, security tokens, and Project Guardian. It is encouraging to see that the Japanese crypto industry, which experienced setbacks due to major hacks, is undergoing changes in various domains as part of the Kishida cabinet's digital transformation initiative. Notably, there is a relaxation of regulations to some extent, which were previously perceived as both advantageous and disadvantageous. Of particular interest is the government's exploration of practical use cases for cryptocurrencies. Internally, stablecoins and token securities are generating demand for fiat currencies and illiquid assets, respectively. Externally, the government's participation in Project Guardian aims to identify opportunities for utilizing cryptocurrencies in cross-border transactions.

Furthermore, Japan has been proactively working to attract global attention to its blockchain market, evidenced by hosting three prominent blockchain conferences this year: ETHGlobal Tokyo in April, IVS2023 Kyoto in June, and WebX Tokyo in July. The upcoming WebX Tokyo event, in particular, has garnered significant interest, as Japanese Prime Minister Kishida is scheduled to participate as a speaker. In the subsequent Japanese Web3 Bible Part 2, we will delve into the current status of the cryptocurrency industry in Japan, focusing on web2 companies and blockchain startups operating in the retail sector.

References

- FSA, Regulating the crypto assets landscape in Japan, 2022

- Yasuyuki Kuribayashi and Takashi Saito, Changes ahead for electronic payment instruments in Japan, 2022

- MAS, Project Guardian, 2023

- LDP Headquarters for the Promotion of Digital Society, The web3 White Paper, 2023

- Earl | DeSpread Twitter, 2023

- Four Pillars, Understanding Crypto Regulations In Japan, 2023