Japan Web3 Bible Part 2

Focusing on Japanese Web3 Market Development

1. Introduction

In recent months, there has been a lot of interest in the Japanese web3 market, particularly within Korea. Media reports suggest that Japan is positioning itself to become a leader in the web3 space, bolstered by the government’s supportive stance on cryptocurrency and related technologies.Since the beginning of this year, I’ve been closely following the Japanese web3 market, starting my research with a focus on the STO(Security Token Offering). From there, I broadened my analysis to include other significant areas, and in ‘Japan Web3 Bible Part 1’, I explored the numerous progresses made by the Japanese government. These include advancements in regulation, stablecoins, and security tokens, all significant strides since the massive exchange hack in the past

While government efforts and policies have a great impact on the development of the industry, equally or even more important are the efforts of the actual participants who drive web3: web3 firms and users. In the same way that a restaurant with a beautiful interior and a delicious meal is wasted if there are no customers, it is necessary to look at the current situation from the perspective of the actual players to discuss the true development of the Japanese web3 market. This idea was reinforced when I personally attended Web X Tokyo.

Web X Tokyo is the largest web3 event held in Tokyo this past July, and DeSpread was a Gold Partner of Web X Tokyo. The Prime Minister of Japan, Mr. Kishida, as well as well-known domestic and international projects participated as speakers at the event. I attended Web X Tokyo and had the opportunity to speak with various Japanese web3 project teams, which gave me a deeper understanding of the Japanese market on the ground.

In this article, I will discuss my expectations and concerns about the Japanese web3 market from the field, as well as the essential conditions that must be met to address current challenges and foster further growth in the industry.

2.Japanese Web3 Investment Trends

Since Prime Minister Mr.Kishida took office in 2021, Japan has been proactive in fostering the web3 industry, with the government issuing a web3 white paper, reforming taxation, and attracting investments. Major events like IVS2023 Kyoto and Web X Tokyo have featured key government figures, including Mr. Kishida, as speakers. In addition, the government announced a five-year startup development policy to increase the number of startups in Japan to 100,000, 10 times the current level, within five years, and to invest approximately 10 trillion yen to create 100 unicorn companies.

Investments in Japan’s web3 industry tend to be led by existing web2 giants such as securities firms, telecommunications companies, and distributors rather than venture capitalists(VCs), and existing local VCs that specialize in web3 investments are rare.

Major investments in the Japanese web3 industry

- Animoca Brands Japan raises US$45 million from MUFG and Animoca Brands to grow Web3 business(2022.08.26)

- Japan Mobile-Phone Operator NTT Docomo to Invest $4B Into Web3(2022.11.09)

- Established Decima Fund with SBI Holdings, Animoca Brands, MZ Cryptos, and Gumi with $50M to advance the web3 industry(2022.12.22)

- Skyland Ventures launches $38m SV4 fund with SBI Group to invest in Web3 startups(2023.04.14)

- Startale and Sony Network Communications Form Capital Alliance to Build Global Web3 Infrastructure(2023.06.28)

2.1. Web2 Giants Entering Web3 Industry

Japan’s web2 giants are increasingly participating in the web3 industry, often through joint ventures or subsidiaries, and SBI Group stands out as a notable example.

SBI Group’s web3 subsidiaries

- SBI Digital Asset Holdings: Security token service

- SBI VC Trade: Cryptocurrency trading service

- SBINFT: NFT business

Among them, SBINFT is the rebranding of “SmartApp,” Japan’s first integrated NFT marketplace, which was acquired by SBI Holdings in September 2021, and will launch its NFT customer management platform “Mits” at the end of this September. According to the developers of SBINFT, SBI is not focusing on a specific area, but is actively investing and making mergers and acquisitions in various areas of web3 to increase its influence on the industry as a whole.

In addition to the SBI Group, some of Japan’s biggest traditional companies are making inroads into the web3 industry by establishing and developing subsidiaries and joint ventures dedicated to the web3 industry.

- NTT DoCoMo(Japan’s largest telecommunications company): NTT Digital

- Sony(a leader of electronics and entertainment industry): Sony Network Communications

- SoftBank and Line: Z Venture Capital

In addition to existing major companies entering the industry through joint ventures and subsidiaries, new local VCs specializing in web3 investments are also emerging. Besides Skyland Ventures already mentioned above, Emoote founded by Akatsuki, a game company, Gumi Cryptos founded by Gumi, also a game company, and MZ Fund founded by MZ DAO, Japan’s largest Web3 community, are some of the representative Web3 VCs in Japan.

Many of the latest projects and investments are targeting gaming and NFTs. Considering that Japan’s web3 industry is currently in its infancy, focusing on blockchain games and NFTs with a wealth of IP(Intellectual Property) and a solid gaming industry base is a logical choice for initial market expansion.

3. The Current State of Blockchain Gaming in Japan

In the previous chapter, we saw that blockchain games are currently receiving significant funding and are being developed and launched at a rapid pace in Japan. This influx of capital and firms is undoubtedly enriching the ecosystem and playing a crucial role in the industry’s growth. However, the active participation of users who actually play games and make on-chain transactions are equally essential. Therefore, in this chapter, we will examine the performance of the blockchain gaming industry in Japan, a key segment of the nation’s web3 market, and analyze how effectively it is attracting and retaining users.

3.1. Japanese Blockchain Gaming Industry

The Japanese blockchain gaming sector is considered a promising market based on the following three characteristics.

- A robust content and customer base, stemming from a rich history in the gaming industry

- Higher unit costs, driven by customer preferences for high-quality products.

- Market trends that favor mobile gaming over PC or console gaming

In fact, according to data provider “Globaldata”, the Japanese video game market was valued at $29 billion in 2021, ranking third in the world, with mobile games accounting for 78% of the market. It is also at the top of the list in terms of revenue to market size, making it a very promising country for the development of the blockchain gaming industry, and there have been various attempts to launch blockchain games since 2018.

Notable Japanese blockchain games include My Crypto Heroes, the first homegrown game, Crypto Spells, and GGGGG.

However, contrary to the expectation that the Japanese blockchain gaming industry will receive high user interest based on the solid infrastructure and customer base of the Japanese gaming industry, their performance so far has been relatively weak. In this article, we will examine the on-chain metrics such as DAUs(Daily Active Users) and new user acquisition to understand the actual user engagement of the above games, as well as the perceptions of Japanese gamers about blockchain games.

3.2. User Engagement Analytics

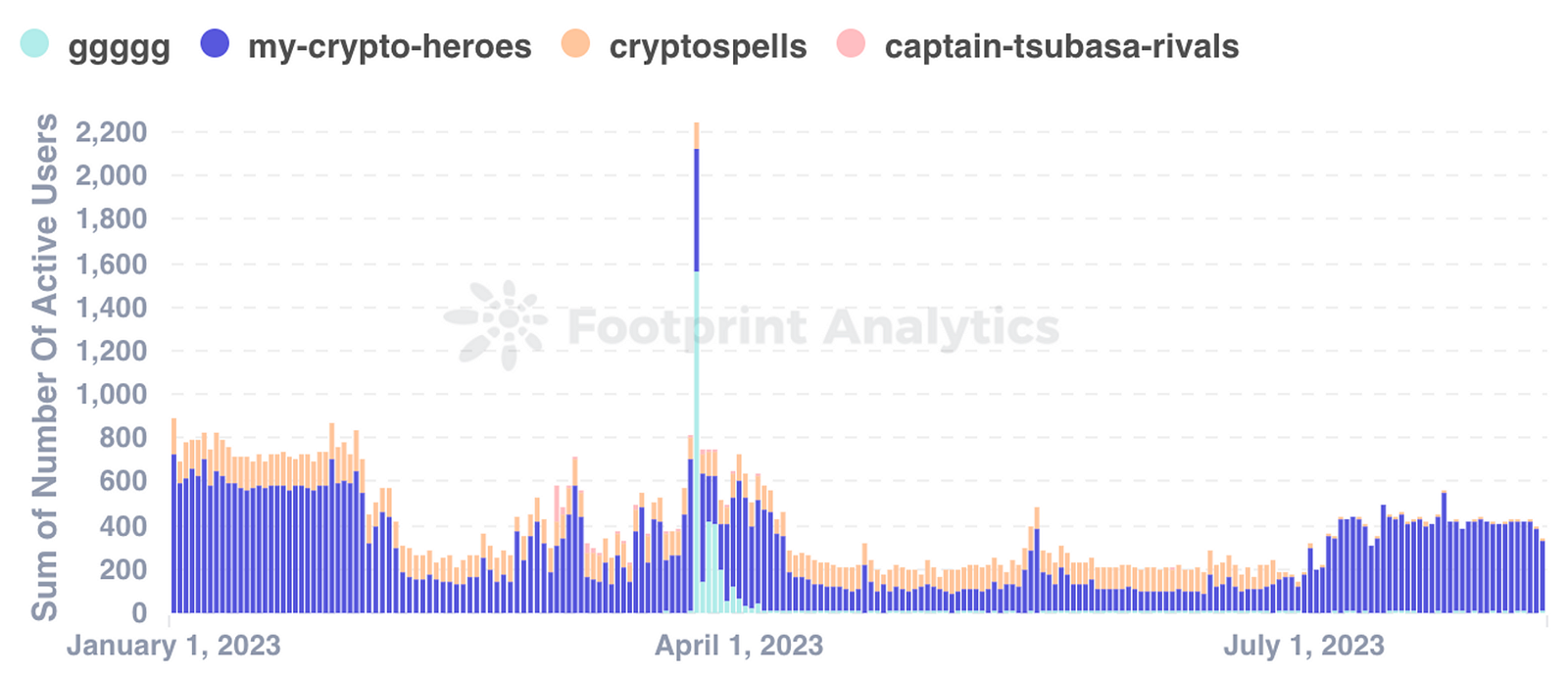

The chart above shows the DAUs of the above games from January 2023 to the present. In the case of Crypto Spells, the game has consistently recorded more than 100 DAUs until June, but then it plummeted to almost zero in July. In addition, GGGGG, which was released in this March, recorded more DAUs than My Crypto Heroes and Crypto Spells combined immediately after its launch, but then disappeared after about two weeks. My Crypto Heroes, on the other hand, has been relatively steady. With the exception of the second quarter of this year, when it was around 140 DAUs, My Crypto Heroes has consistently reached 400 DAUs, a trend that has been maintained to date.

While My Crypto Heroes has shown relatively steady user engagement, this is only in Japan, and when looking globally, it’s a bit of a struggle. When ranked by Unique Active Wallets(UAW), which is the number of addresses interacting with the project, My Crypto Heroes is ranked 121st, with a rather low number of transactions and transaction values compared to other similarly ranked games, as shown in the figure below.

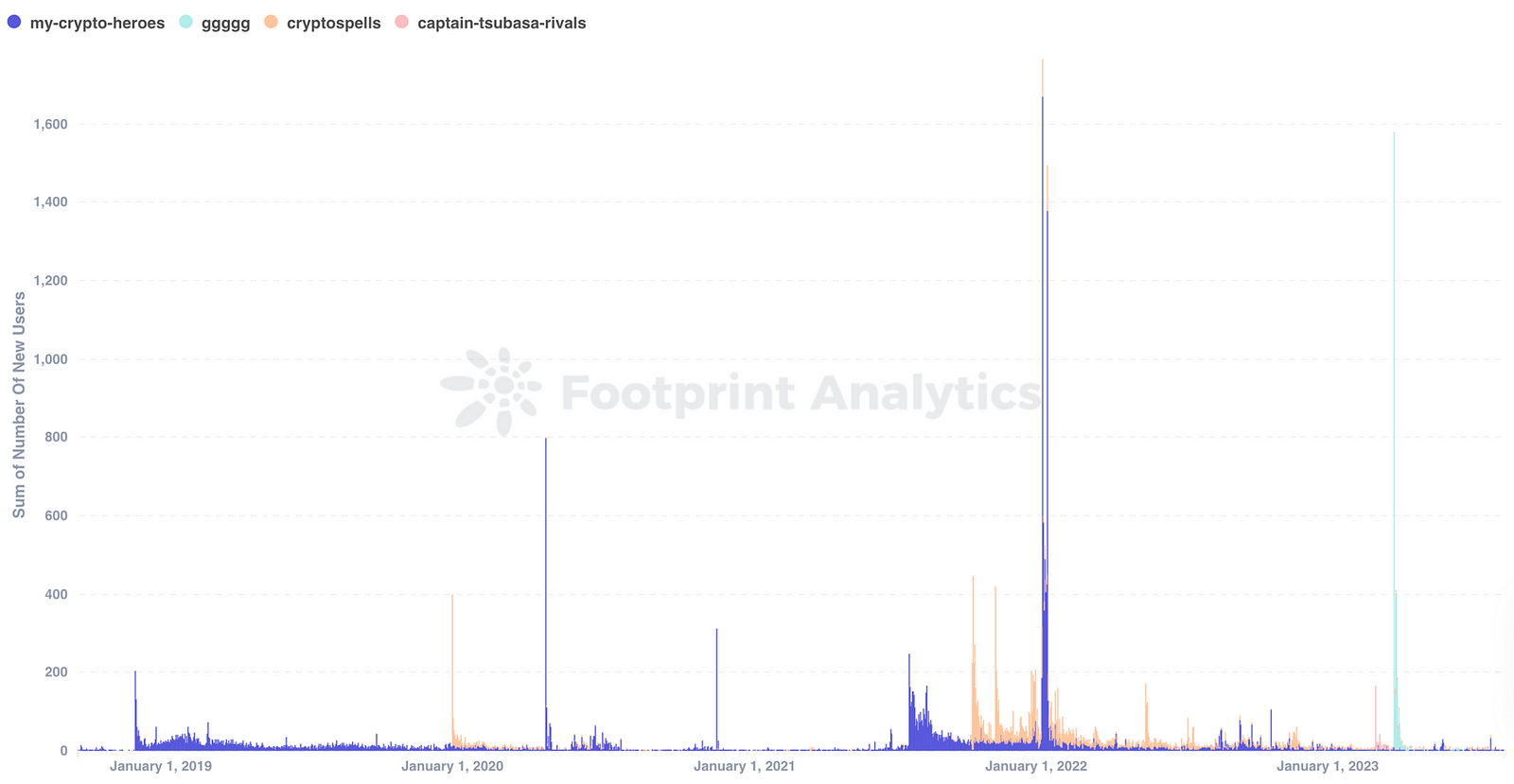

The influx of new users has also been slow. The chart below shows the influx of new users for each game since 2019, and you can see that all of the games had a high number of new users right after launch, and then a sharp decline. Although the numbers are small, My Crypto Heroes is the only game that has seen a steady stream of new users to date. It’s worth noting that My Crypto Heroes had a relatively high number of users(over 1,600) in January 2022, three years after its release. This is likely due to the fact that My Crypto Heroes announced a collaboration with Polygon and released new tokenomics, including “My Crypto-Rays Mining” at the time.

3.3. Blockchain Games Perceptions

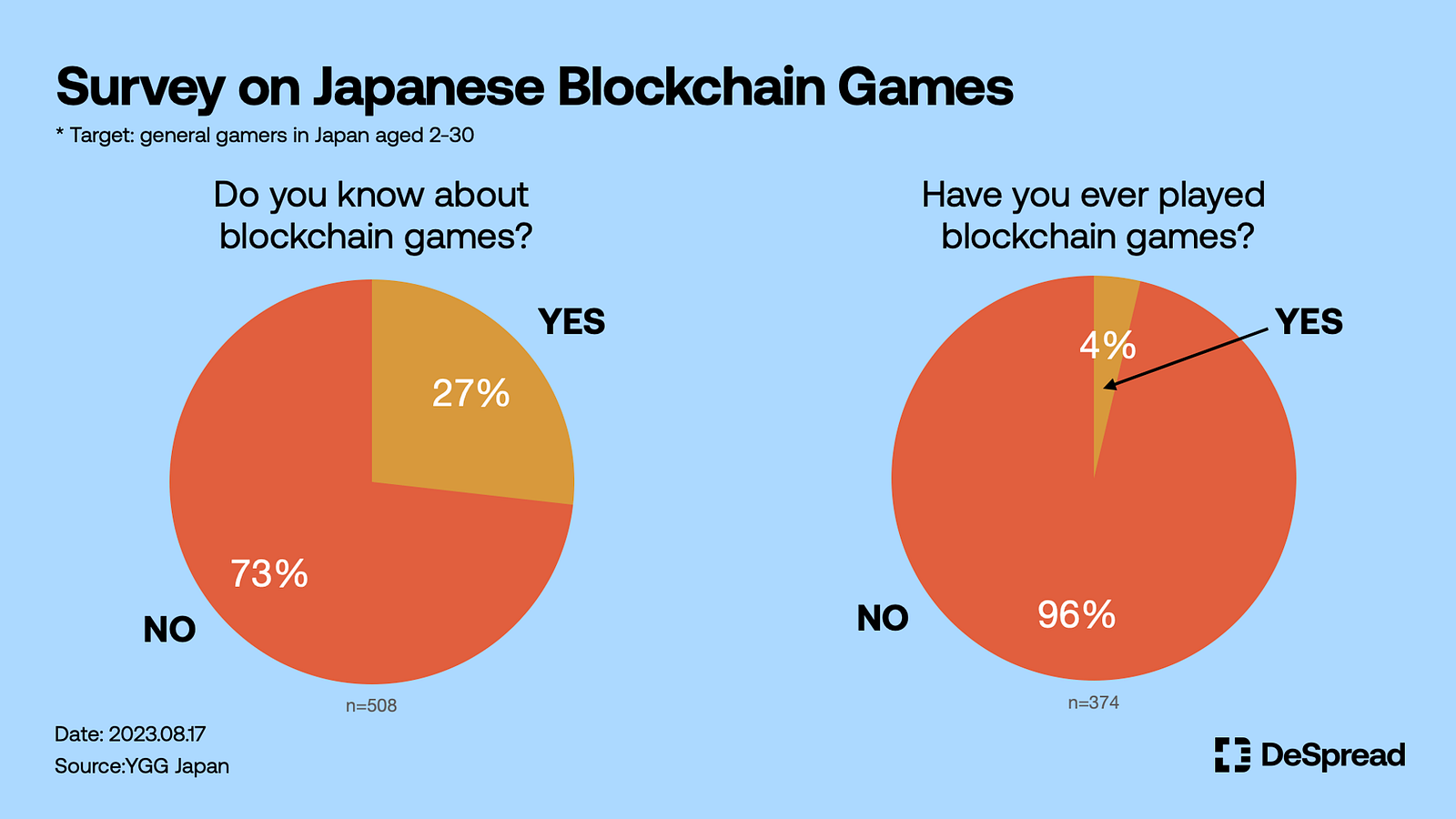

In May, YGG Japan, a leading Japanese blockchain gaming community, conducted a survey of over 500 Japanese 20–30 year old gamers on user perceptions of blockchain games. The conclusion was that even though Japanese blockchain games have been around for five years, they are still somewhat unfamiliar and inaccessible to the general public, even among those who love games.

According to the survey, only about 27% of people are aware of blockchain games, and less than 4% have actually played them. The reasons for these rather low numbers include unfamiliarity with blockchain games(43.3%) and a lack of understanding of game content(34.8%), ranking first and second, respectively. In addition, the fact that the majority of participants(67.7%) identified “eliminating initial investment costs” as a necessary condition for lowering the entry barrier to blockchain games also confirms that the characteristics of blockchain games that require the purchase of tokens or NFTs, unlike typical mobile or console games that can be played for free, are also hindering the popularization of blockchain games.

4. Strengths and Challenges in the Japanese Web3 Market

So far, we’ve examined the many efforts made by the Japanese government, businesses, and market participants. In this chapter, we’ll explore the strengths and challenges of Japan’s web3 industry, looking at the weapons that can help Japan become a web3 leader and the enhancements needed to make real progress.

4.1. Challenges

4.1.1. Low On-Chain Activity

The first problem that needs to be solved for the Japanese web3 industry to develop is low on-chain activity. On-chain activity is a key metric for evaluating the success of a project or protocol. We can simply think of many examples of projects that attracted initial market attention with huge investments and community hype, only to fade into oblivion over time due to a lack of real user engagement. Even though Japan is actively fostering various web3 projects with support from the government and large corporations, it’s not enough to say that the Japanese web3 industry is truly developing. Success depends on real users who consistently engage with these technologies.

Japan currently lacks a substantial number of web3 users. According to research firm TechFlow, the number of personal hot wallet holders in Japan, including MetaMask, is estimated to be a minimum of 20,000 and a maximum of 100,000. In contrast, South Korea has an estimated 1.1 million hot wallets. This puts Japan’s current web3 population at only about 10% of South Korea’s maximum.

In addition, the on-chain activities of Japan-based blockchain networks Oasys and Astar have been inactive. Oasys is a gaming-specific Layer 1 network with major Japanese and Korean game companies as validators, and Astar is a parachain with close cooperation with the Japanese government. While they are both highly regarded as Japan’s leading networks, the number of accounts, transactions, and other indicators of the network’s actual activation are somewhat less impressive. The table below compares the on-chain metrics of South Korea-based blockchain network Klaytn with those of Oasys and Astar. Given the current low level of user engagement, it seems that attracting real web3 users and sustaining on-chain interaction will be essential for the Japanese web3 industry to truly flourish.

4.1.2. Passive Centralized Exchanges

The existence of a leading exchange in a country can significantly boost the entire web3 ecosystem. More than just an indicator of a country’s interest in the crypto market, the volume of transactions recorded on an exchange can act as a bridge between crypto and fiat, increasing liquidity and providing an incentive for various international projects to enter.

A prime example of this is South Korea’s Upbit, which has a strong user base and ranked second in global trading volume after Binance, with a trading volume of approximately $30b in July. The existence of Upbit is playing an important role in increasing the interest of overseas projects in entering the Korean market and providing a base for various projects to enter, ultimately enriching the Korean web3 ecosystem.

However, in Japan, the consecutive hacks of large-scale exchanges Mt.Gox and Coincheck in 2014 and 2018, respectively, led to the establishment of a strict exchange regulatory system and stringent token listing standards. Because of this, crypto assets traded on centralized exchanges in Japan lack diversity compared to other countries, and trading volumes also remain low. According to Japan Virtual and Crypto assets Exchange Association(JVCEA), which is in charge of managing virtual asset operators in Japan, the spot trading volume of crypto exchanges registered as members of JVCEA was around $4.6b in June this year. The difference is even more stark when compared to the fact that Upbit alone recorded $35.1b in trading volume during the same period, nearly eight times as much. There is also a significant difference in the number of tokens supported for trading, with Upbit supporting 294 tokens in its KRW and BTC markets combined as of August, compared to 38 tokens on Binance Japan, which supports the largest variety of tokens in Japan.

4.2. Strengths

4.2.1. Abundant IP

Despite the challenges above, Japan has the potential to emerge as a leader in the web3 industry based on its unique strengths. Most notably, Japan has a wealth of game and anime IP that has been developed over many years. Even before the Japanese government began actively promoting the web3 sector, the country’s strong IP served as a key argument for major rationale to support the flourishing of the industry. With an array of game companies, anime producers, and distributors entering the web3 arena, the momentum for developing projects that leverage their IP — especially in gaming and NFTs — is growing.

Among the many powerful IPs in Japan, Pokémon is one of the most notable to watch make its way to web3. In the 26 years since the first episode aired, Pokémon has become a vast IP, encompassing games, cards, movies, and an array of merchandise, and last year’s Pokémon bread scandal in Korea showed how popular the franchise still is among young and old alike. With such a strong fan base and success story, Pokémon became a subject of significant attention in March when the company launched a job posting for Web3 specialists, including blockchain technology and NFTs or metaverses.

In addition to Pokémon, Japan’s leading game companies such as Square Enix, Sony, and Sega have been making inroads. Also Oasys and Astar have announced various MOUs with established corporations, further fueling the trend. While there is still a lack of high-profile projects that have come to fruition through collaboration, it’s worth keeping an eye on their progress given that Japan is still in the early stages of fostering its web3 industry.

4.2.2. Active Government

The last point I’m covering is the Japanese government’s active support of the web3 industry. In June of this year, Japan not only introduced a year-end tax exclusion for self-issued tokens but also launched the Green List, a policy to relax token screening criteria and streamline the listing process. These measures aim to alleviate the strict regulations that have led to the consistent outflow of human and financial resources from the country. It is also encouraging to note that the LDP Headquarters for the Promotion of Digital Society, a dedicated unit within Japan’s ruling Liberal Democratic Party responsible for research and policy recommendations for the web3 industry, released two NFT and Web3 white papers in 2022 and April 2023, respectively.

With the growing influence of the cryptocurrency industry, authorities, including the U.S. Securities and Exchange Commission(SEC), are working to establish appropriate regulations for cryptocurrencies. This has led to a growing number of cases of conflicting interests between the industry and authorities, such as securities issues. This trend is expected to intensify as the industry develops and grows in size. Japan, on the other hand, has already thoroughly established regulations related to cryptocurrencies for a long time, and the government’s active support based on this is also expected. Thus, Japan may enjoy a comparative advantage over other countries, allowing for more refined development within the web3 sector.

For more information on the Japanese government, check out the part 1.

5. Conclusion

In the part 1 of this series, we looked at the Japanese web3 market from the perspective of the government and financial institutions, and in this part 2, from the perspective of businesses and users. There are many positive aspects of the market, such as the government’s active initiatives based on solid regulations, large financial firms actively expanding their web3 businesses, and the potential to develop a variety of projects based on strong IP. Nevertheless, there are also problems, such as the fact that most projects are still focused on gaming and NFTs, the absence of large-scale exchanges, and the lack of real web3 activity among users.

Although it is still in the early stages with many obstacles to overcome, Japan is attracting a lot of attention from many countries based on the strengths mentioned above. If Japanese projects can successfully expand globally or overseas projects can actively enter Japan,the country could be well-positioned to advance to the next step.

References

- Footprint Analytics X CryptoTimes, Crypto in Japan, 2023

- TechFlow, Exploring the Real Japanese Crypto Market, 2023

- Tiger Research, Deep Dive into Japanese Blockchain Games, 2023

- Hashed, Japan, the emerging Mecca of digital innovation, 2023