Millions of Koreans own crypto but the government is retarded

The Kimchi Premium #7: Recap of Korean crypto community trends for week 5 in October

The Kimchi Premium is a weekly series that looks back at the hottest topics in the Korean crypto community

A few days ago we got a new report from the the Financial Services Commission (FSA) packed with some interesting stats. Here’s a breakdown:

- Average daily trading volume in of crypto assets in Korea: $4,381,044,000 (+67% YoY)

- Total market cap of crypto assets in Korea: $40,378,622,200 (+27% YoY)

- Total Korean Won deposited in in Korea: $3,650,870,000 (+2.9% YoY)

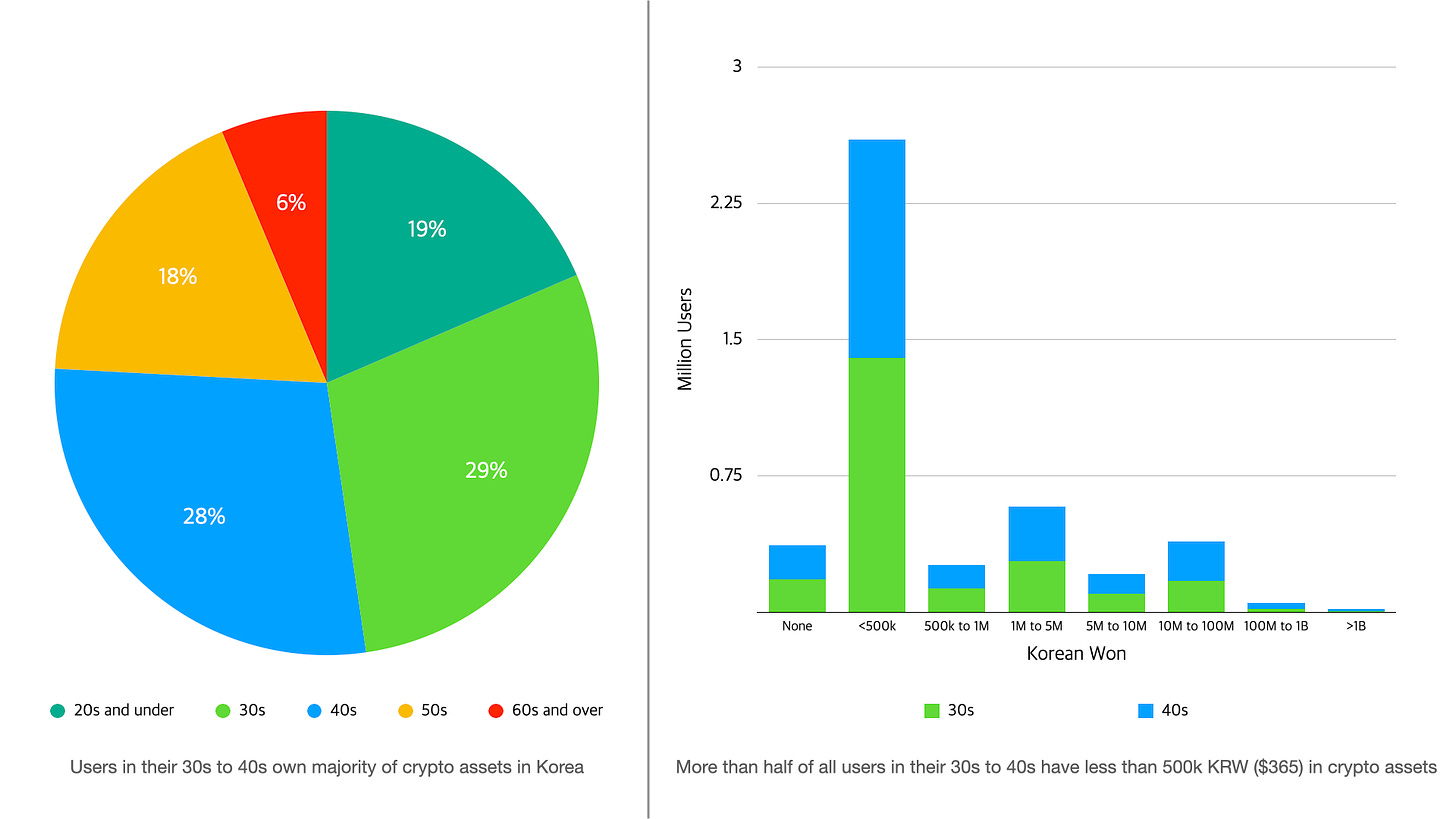

- Total number of approved users: 7.78 million (+21% YoY)

- Users who own less than 1M KRW (around $365): 5.67 million (+24% YoY)

- Age group with most users: 30s

- For the full report go to this link

To put it in a sentence it would be something like, “Since November 2023, the Korean crypto market showed strong growth, with an overall increase of volume and market cap while the user base also expanded”

But one thing that really stood out to me was the amount of people who owned less then 1M KRW; a staggering 5.67 million! To put that in perspective, Korea’s current population is 51.75 million. More than 10% of the nation has some exposure to crypto.

Moreover, the most active age range of users were in their 30s, with users in their 40s coming in second. Probably because of the amount of disposable income they can throw on crypto assets. But again, that didn’t really change the overall trend where the majority of users will have less than 500k KRW in crypto assets.

To me, this kinda took away the appeal from the phrase “the Korean bid” because it looks like just a bunch of people gambling their pocket money on exchanges. Of course who’s creating the most volume is another question but just by looking at these stats, I couldn’t help to think that the amount crypto owned by users was lower than expected.

But is that the whole story? I don’t think so.

From my experience most serious users move their funds to foreign exchanges to trade on leverage or onchain. While there are a significant amount of users in Korean platforms, the report doesn’t count onchain and foreign exchange users. To assess the true market size of Korea would require some serious onchain sleuthing and cooperation from foreign exchanges.

However, even before conducting any meaningful research, creating consumer protection schemes, or even having anyone competent in office, some folks at the parliament are discussing about KYCing private wallets. They want to track down our wallets to tax them.

According to the National Assembly on the 30th, Democratic Party Representative Ahn Do-geol and others have proposed amendments to the Inheritance and Gift Tax Act. The amendments would require Virtual Asset Service Providers (VASPs) to submit transaction data and mandate annual reporting for private wallet users.

Specifically, individuals and corporations holding crypto wallets must report to tax authorities by June of the following year if their wallet balance exceeds a certain threshold. Failure to report or underreporting will result in penalties of up to 20% of the unreported amount. Cryptocurrency exchanges will also be required to submit transaction records to tax offices.

Previously, People Power Party Representative Choi Eun-seok proposed similar amendments to the Framework Act on National Taxes. While current law applies a 40% additional tax rate for unreported cryptocurrency gifts made overseas, the amendment would increase this to 60%.

The push for stricter reporting requirements stems from the difficulty in tracking cryptocurrency transactions. This is particularly challenging when users utilize overseas exchanges or private wallets that aren't subject to the "Travel Rule" - a regulation designed to track virtual asset movements.

Taking advantage of these tracking difficulties, overseas cryptocurrency account reporting has declined. According to National Tax Service data, the number of individuals reporting overseas crypto accounts dropped from 1,432 last year to 1,043 this year. During the same period, the reported amount plummeted by over 90%, from 103.8 trillion won to 10.4 trillion won.

Representative Choi pointed out that "It's virtually impossible to crack down on irregular inheritance through cryptocurrencies since there's no way to verify unreported transfers."

The Korean government is freaking out on crypto for a good reason. Like I posted last week, the cornerstone of the Korean economy is crumbling. And two weeks before that, I posted about stablecoins and the Korean economic model.

To simply put, I believe that authorities are worried about rampant capital flight due to crypto and stablecoins the Korean economy if it were to go through another macro-driven recession. Moreover, we are running out of taxable meatbags. However, reading on the series of discussions coming from the parliament tells me that they want to lock up domestic capital, but are not competent enough to actually execute on any talking points.

In my latest podcast with Steve from Four Pillars, we talked about this extensively. These so-called expert types with outdated perspectives are the main drivers when it comes to crypto discourse upstairs. The reality is, these professors are still stuck in 2017. They are still talking about trillemas and decentralization. Not saying these are irrelevant, but the industry has evolved to a point where it is not wise to focus on these things anymore.

We are seeing a huge wave of speculation-as-a-service type of apps like pump dot fun dominating mindshare in crypto. This didn’t come out of nowhere because since inception, speculation has been the most interesting and profitable part of crypto. It’s time to embrace it.

But NOoOoooOoOoOOOoOO.

Speculation is immoral! Speculation is unfair! Speculation kills! We like blockchain as a technology! These type of people are in the “blockchain industry, not the crypto industry” because they are in the likes of immutable, decentralized networks but not in for the permissionless money aspect.

They are also a safe bet for major broadcast stations to feature when introducing crypto to the public. In reality, most people in crypto are in it for the money. Even Bitcoin maximalists are in it for the money. I mean, crypto was about money all the time.

Crypto’s perceived value to legislators, the public, the “experts”, and real users has such a wide gap but I don’t know how to fix it.