MakerDAO Endgame — Dreaming of a Complete Rebranding

Highlighting the Five Phases of Pregame

1. MakerDAO Endgame Revealing Itself

On May 12, MakerDAO co-founder Rune Christensen(Rune) posted a proposal called “The 5 phases of Endgame” on the Maker Forum.

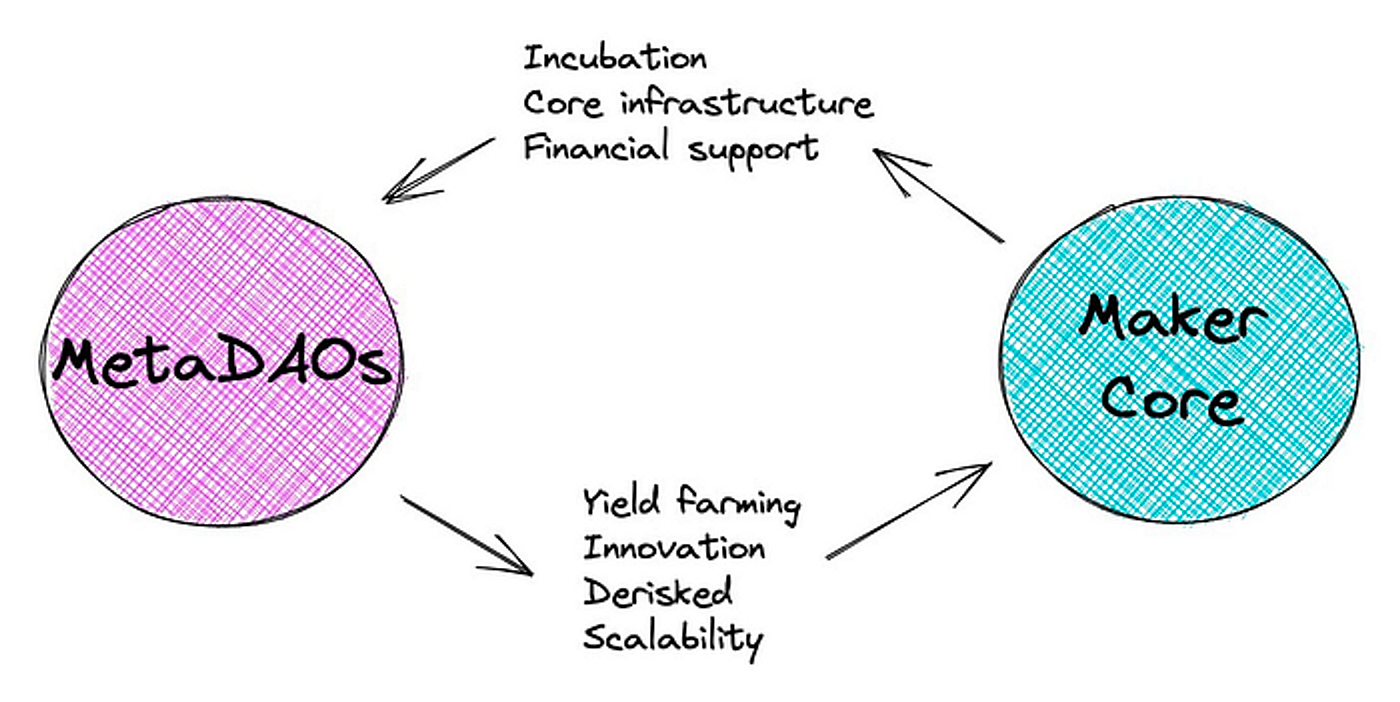

Rune’s Endgame proposal is aimed at resolving the internal and external challenges that MakerDAO is currently facing. This proposal has been thoroughly discussed within the community since June of last year and has gained attention in Korea after the vote to implement Endgame was approved in October. The proposal seeks to bring about significant transformations to the structure of MakerDAO, a prominent player in the DeFi ecosystem. It introduces a new component called metaDAO and suggests detaching the stablecoin DAI from its peg. Consequently, the debate surrounding Endgame has been intense. Given the comprehensive nature of the changes involved in Endgame, if you desire a more detailed explanation, I recommend checking out the endgame series provided below.

- Endgame Series Part 1: The Introduction and Impact of MetaDAO

- Endgame Series Part 2: The True Decentralization of DAI

- Endgame Series Part 3: Various opinions surrounding Endgame

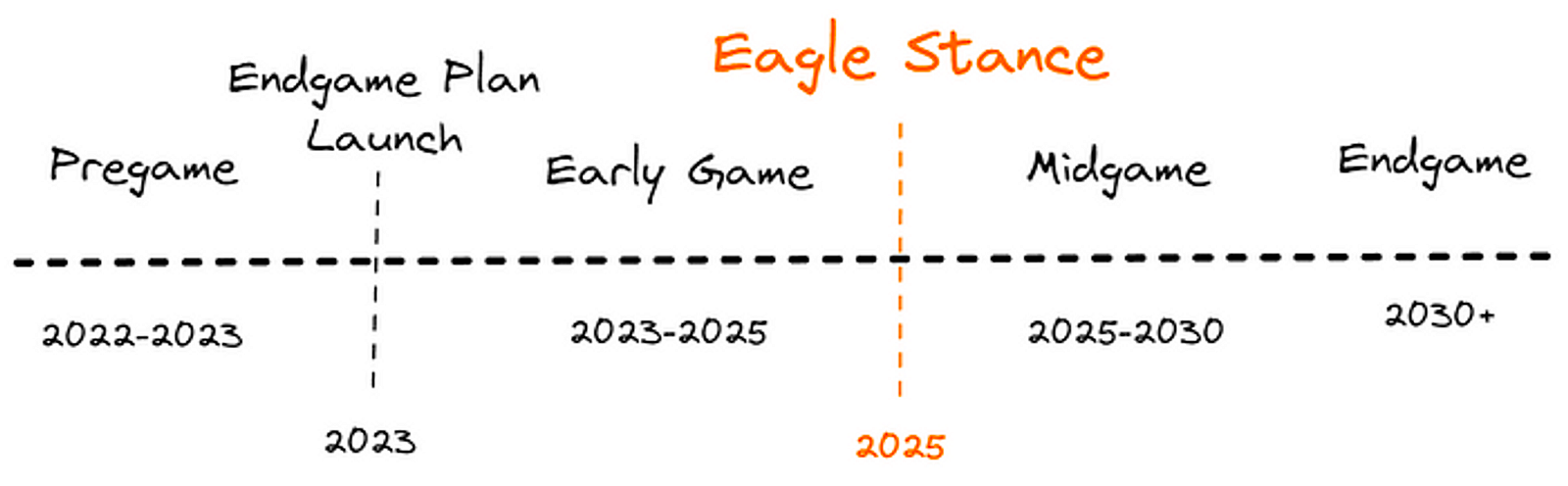

Simply put, the objective of Endgame is to extensively overhaul various aspects of MakerDAO in order to establish a “complete and sustainable decentralized organization” that is immune to external factors. This comprehensive reform plan encompasses all components of the MakerDAO ecosystem, including tokenomics, governance, and the reward system. It is designed as a long-term strategy, divided into four distinct phases: Pregame, Early Game, Midgame, and Endgame. Each phase is accompanied by specific Key Performance Indicators (KPIs) presented by Rune to track progress and achievements.

Rune’s “The 5 phases of Endgame” proposition aligns with the initial stage known as “Pregame,” which involves the preparation of essential products required to transition into the complete Endgame state. The proposal outlines a breakdown of Pregame into five distinct phases, each specifying the products that need to be developed and accomplished within them. This article will primarily concentrate on the modifications occurring in each phase, delving into the anticipated structure of the new ecosystem before MakerDAO reaches the full Endgame state.

2. Phase 1: Beta Launch

Phase 1 revolves around a comprehensive rebranding effort for MakerDAO, which involves introducing a fresh stablecoin and governance token. The primary objective of Endgame is to ensure the successful launch of the new stablecoin, called “newStable,” and the governance token, referred to as “newGovToken,” while still maintaining connectivity with the current ecosystem. This entails providing a range of rewards and incentives to support the establishment of these new tokens. Now, let’s delve into the distinctive features of both newStable and newGovToken.

2.1. newStable

First and foremost, it’s important to clarify that the introduction of newStable does not imply the disappearance of DAI, which is MakerDAO’s current stablecoin. Even after Phase 1 is implemented, individuals holding DAI will still have the option to retain it. However, for those who wish to possess newStable, they will have the freedom to exchange it for DAI at a one-to-one ratio without incurring any fees or encountering quantity limitations.

While DAI will continue to exist, the aim of Endgame is to enhance the liquidity of newStable compared to DAI, establishing newStable as the dominant stablecoin within the MakerDAO ecosystem. In pursuit of this objective, various rewards will be provided to holders of newStable. Here is a breakdown of the rewards for each phase:

- Phase 1: A total of 10 million NewGovToken (equivalent to approximately 8,333 MKR) as rewards per year from the NewGovToken farm.

- Phase 2: Rewards will include a total of 35 million *SubDAO token rewards per year from each SubDAO farm.

- Additionally, Accessibility Rewards will be granted to protocols that integrate and adopt newStable.

*SubDAO refers to a specific segment within the MakerDAO ecosystem that possesses its own distinct domain and holds a significant role in the overall structure of MakerDAO. However, it should be noted that the nature of *SubDAO is subject to transformation as part of the Endgame initiative. Initially, the proposal referred to this entity as metaDAO.

Furthermore, MakerDAO is introducing a novel system known as the “Allocator Vault” to facilitate the provision of substantial amounts of newStable and DAI collateral to prominent decentralized exchanges (DEXs), such as Uniswap, during the initial launch of newStable. This initiative aims to enhance the liquidity of newStable and foster a seamless transition for DAI holders towards newStable. By offering greater liquidity and a wider range of yield farming possibilities for newStable compared to DAI, MakerDAO intends to encourage a natural shift from DAI to newStable.

2.2. newGovToken

newGovToken represents a redenomination of MKR, which involves changing the face value of the currency. It can be exchanged for MKR at a ratio of 1200:1, meaning that 1 MKR is equivalent to 1200 newGovTokens. The conversion process from MKR to newGovToken is designed to facilitate rapid adoption, and as such, no fees or quantity limits are imposed.

The primary objective of introducing newGovToken is to enhance the issuance and utility of the governance token. Throughout phases 3 and 4, newGovToken holders will receive various governance token utilities. Here are the specific utilities that will be granted:

- Phase 3: Access to governance AI tools, which will simplify and streamline participation in the governance process, making it more intuitive for newGovToken holders.

- Phase 4: The ability to stake newGovToken in the Sagittarius Lockstake Engine (SLE) in order to receive rewards in the form of newStable or SubDAO tokens.

It is worth noting that access to all the aforementioned yield farming opportunities for newStable and newGovToken was restricted for users from the USA and those accessing via VPN. This measure was likely implemented to mitigate potential legal risks arising from the unclear standards set by the U.S. Securities and Exchange Commission (SEC) when determining securities.

3. Phase 2: SubDAO Launch

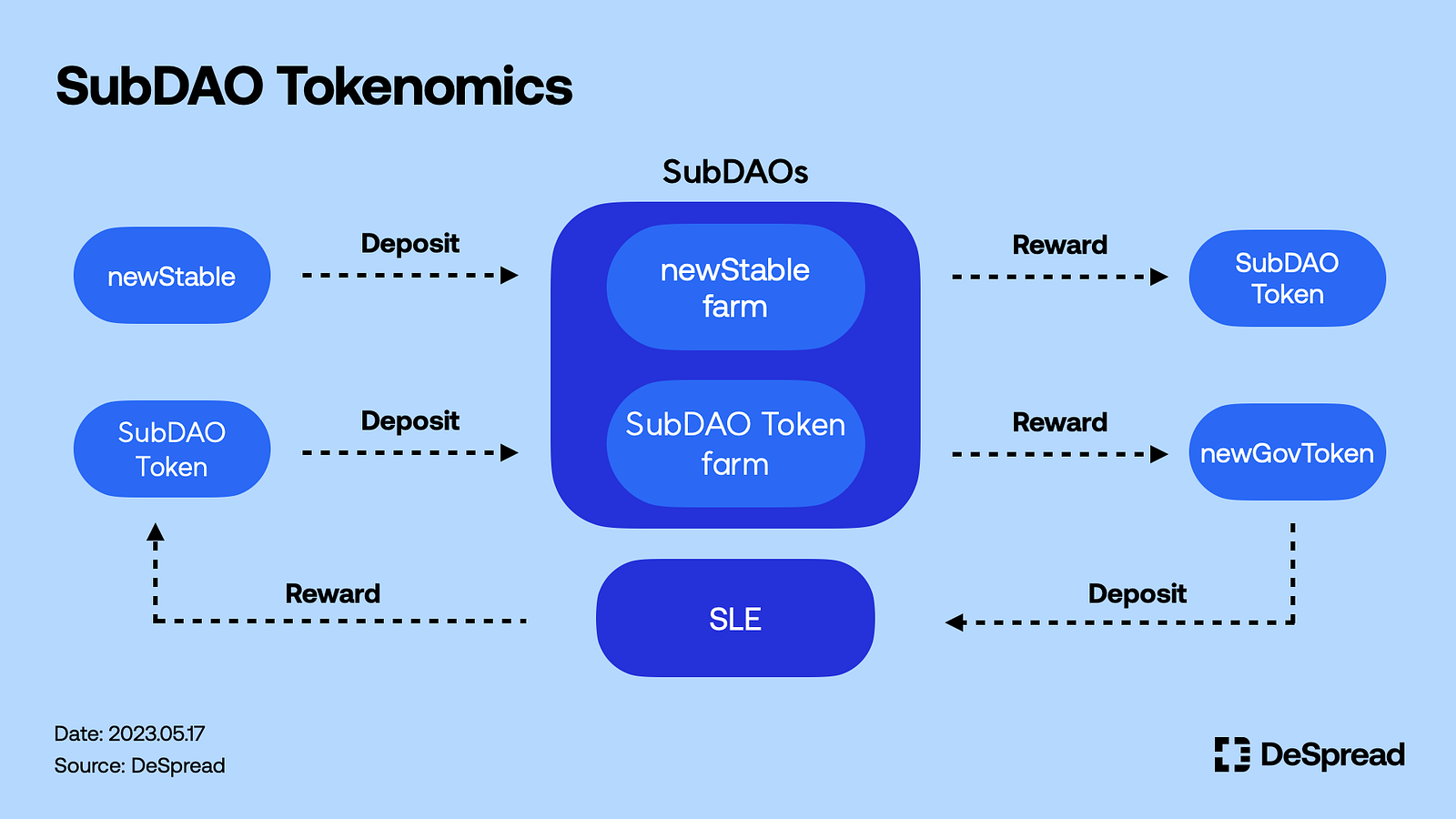

Following the introduction of newStable and newGovToken in Phase 1, Phase 2 aims to launch six distinct SubDAOs along with a dedicated newStable farm for each SubDAO. As previously mentioned, each SubDAO operates with its own governance process and possesses a native governance token known as the SubDAO token. Phase 3 will build upon this foundation, with the primary objective of facilitating rapid horizontal expansion of SubDAOs by attracting users for each SubDAO and maintaining decentralized frontends for their operations.

The MakerDAO ecosystem, which will undergo transformation through Endgame, can be understood as a network composed of subsets called SubDAOs. Each SubDAO operates on its own system while being based on the underlying principle of the MakerDAO protocol. SubDAOs can be categorized into two types: FacilitatorDAOs and AllocatorDAOs, based on their specific roles. Among the initially established six SubDAOs, two will be designated as FacilitatorDAOs, while the remaining four will serve as AllocatorDAOs.

3.1. FacilitatorDAO

FacilitatorDAOs play a crucial role in governing the operations of the DAO and are subject to potential rewards or penalties based on their performance. The genesis tokens of FacilitatorDAOs, which will be created at the beginning of Phase 2, will be distributed via the newStable farm. Consequently, users have the opportunity to acquire the newly generated tokens of FacilitatorDAOs by depositing newStable into the farm. This mechanism allows FacilitatorDAOs to enhance the stability of the SubDAO by attracting a significant amount of newStable tokens.

3.2. AllocatorDAO

AllocatorDAOs have a wide range of responsibilities related to newStable, including managing collateral, oracles, and handling legal fees. Once AllocatorDAOs are established, MakerDAO will relinquish its role in issuing stablecoins such as DAI and newStable, transferring all relevant authority to the AllocatorDAOs. However, for large-scale, long-term collateral allocation, AllocatorDAOs will utilize the MakerDAO protocol to issue newStable and subsequently allocate the generated stablecoins as collateral to various DeFi protocols and Real World Assets (RWA).

AllocatorDAOs bear the responsibility of covering all costs associated with the stablecoin and will be the first to bear losses in the event of liquidation. In exchange for assuming these risks and costs, AllocatorDAOs are empowered to offset them by requiring issuers to pay a premium to the Base Rate.

The six initially established SubDAOs will be assigned codenames from ZERO to FIVE. FacilitatorDAOs will be designated as ZERO and ONE, while AllocatorDAOs will be assigned from TWO to FIVE. MakerForum has created dedicated communities for each codename, serving as platforms for discussions on the upcoming tokens and governance processes.

4. Phase 3: Governance AI Tools Launch

Phase 1 and 2 align closely with the overall direction outlined in Rune’s Endgame roadmap overview released in August of the previous year. However, it is Phase 3 that has garnered significant attention due to its introduction of a completely new concept: the integration of artificial intelligence (AI). This inclusion of AI innovations aims to streamline the progression of MakerDAO towards achieving the Endgame status by reducing both time and costs. The incorporation of AI has been a widely discussed topic in the industry over the past few months, with notable advancements such as OpenAI’s chatGPT generating substantial interest.

4.1. Alignment Artifacts

The introduction of AI aims to streamline and decentralize the governance process within MakerDAO. A critical component of this is the creation of Alignment Artifacts, a comprehensive collection of principles and rules that govern the MakerDAO ecosystem. AI governance tools will play a crucial role in editing, adding, summarizing, and interpreting the vast amount of data contained in the Alignment Artifacts. The objective is to address governance illiteracy by providing easy access to the information within the Alignment Artifacts for all users, regardless of their level of participation or position within the ecosystem. This approach seeks to bridge the information gap between core members and end members, fostering a more decentralized form of governance. Comparing this to the real world, where only a limited number of legal professionals can effectively read, interpret, and utilize law books, this initiative highlights Rune’s vision for utilizing AI governance tools.

Moreover, Rune envisions going beyond the utilization of existing recorded data. Through AI’s learning capabilities, the Alignment Artifacts will evolve into “Ecosystem Intelligence” by incorporating knowledge, experience, and practical examples. The goal is to develop the Alignment Artifacts into a repository of collective knowledge, enabling governance to be carried out without relying solely on a centralized entity or leader to make decisions. This forward-thinking approach has the potential to shape a future where accumulated collective knowledge plays a pivotal role in governance processes.

4.2. Aligned Voter Committee(AVC)

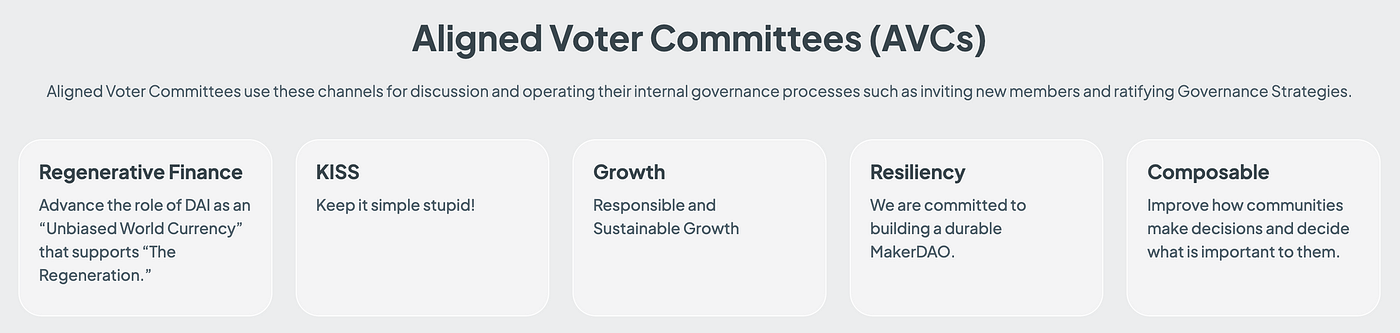

AVCs (Aligned Voter Committees) serve as forums where holders of newGovToken gather to present and aggregate diverse opinions, playing a significant role in guiding the governance of MakerDAO. The figure provided illustrates the existence of five AVCs, each focusing on specific areas with distinct objectives:

- Regenerative Finance: Aims to establish DAI as an impartial global currency, fostering the development of regenerative finance.

- KISS (Keep It Simple, Sybil): Focuses on maintaining DAI’s decentralized nature and rewarding MKR holders.

- Growth: Concentrates on scaling and expanding MakerDAO through continuous research and analysis of proposals.

- Resiliency: Ensures the long-term sustainability of MakerDAO and the resilience of DAI.

- Composable: Strives to establish transparent governance through the exchange of governance mechanisms among SubDAOs.

In an analogy where MakerDAO represents a government, each AVC functions as a governance group responsible for discussing and addressing matters within their respective areas, similar to government departments like the Ministry of Finance, Ministry of Justice, and Ministry of Education. The core decisions reached by each AVC are synthesized into Aligned Governance Strategies (AGS). The announcement includes plans to incorporate AI into this decision-making process.

It’s important to note that the aforementioned five AVCs were initially formed as Constitutional Voter Committees (CVCs) before Rune’s new plan was unveiled. Consequently, the details created within each AVC forum, based on DAI and MKR, are subject to change as newStable and newGovToken are introduced into the ecosystem.

5. Phase 4: Governance Participation Incentive Launch

5.1. Sagittarius Lockstake Engine(SLE)

The SLE serves as a vault that has been specifically designed to motivate active participation in governance among newGovToken holders. It enables users to engage in voting on the Aligned Governance Strategies (AGS) and offers additional rewards for staking newGovToken based on the amount they deposit into the SLE.

By staking their newGovToken, users can receive staking rewards in the form of either NewStable or SubDAO tokens, which are derived from two sources: 30% of the protocol surplus and a distribution of 15 million SubDAO tokens. To further encourage ongoing participation, the SLE imposes a higher withdrawal fee of 15% for users who choose to withdraw their newGovToken. This is to motivate newGovToken holders to remain engaged in the governance process. Notably, the withdrawal fee is immediately burned to help maintain the value of newGovToken over time.

5.2. SubDAO Token Farm

In addition to the SLE, a SubDAO token farm will be established on each of the 6 SubDAOs. Participants in each SubDAO can earn a yearly total of 4m newGovToken by depositing their SubDAO tokens into the farm. Furthermore, by depositing newGovTokens into the SLE, users will receive SubDAO tokens as a reward. These SubDAO tokens can then be deposited back into the respective SubDAO’s farm, allowing users to earn newGovToken as staking rewards. This integration of governance and economic reward systems enables users to engage in ecosystem governance using either newGovToken or SubDAO tokens.

6. Phase 5: NewChain Launch and final Endgame State

Phase 5, the final stage of the pregame, marks the transition to the Endgame state. Its objective is to establish a new network called NewChain, which will host the backend logic for SubDAO tokenomics and MakerDAO governance. Certain elements of MakerDAO, such as newStable, newGovToken, DAI, and MKR, will remain on the Ethereum network but will be governed by the governance system operating on the newly created NewChain network. This setup mirrors the relationship between Ethereum and Ethereum L2, as explained in the first part of the Endgame series.

“It is difficult to perfectly describe the relationship between Maker Core and MetaDAO, but it can be intuitively compared to the relationship between L1 and L2. Maker Core, which has a rich infrastructure and security, but is slow, can be likened to L1, while MetaDAO, which derives from Maker Core and has its own functions, can be likened to L2.” — Part 1 of the Endgame series

*In the above quote and diagram, Maker Core refers to MakerDao and MetaDAO to SubDAO.

One crucial aspect of the NewChain is its capability to utilize hard forking as a governance mechanism, serving as a safeguard in case of a severe governance attack by an attacker wielding significant voting power, posing a threat to MakerDAO’s vision. By retaining the option of a hard fork as a last resort, Rune emphasized the protocol’s ability to maintain security while minimizing disruptions for DAI and newStable holders and other protocols. MakerDAO also intends to incorporate additional features into the NewChain, such as employing AI to create smart contracts and capturing MEV (Maximal Extractable Value) within the protocol.

7. The Direction of MakerDAO

Here’s a summary of the products and the goals at each phase of the Pregame before entering the full Endgame state.

MakerDAO recently introduced Spark Protocol, a new lending platform aimed at promoting broader adoption of DAI. With its advantages of lower borrowing costs compared to the existing Oasis platform and higher loan-to-value ratios for assets sharing a common underlying asset (e.g., DAI-USDC-USDT), Spark Protocol is anticipated to attract an increasing number of DAI holders as it gains stability. Detailed information about the current status and future vision of the Spark Protocol can be found on the TWO forum, which is associated with the FacilitatorDAOs.

Notably, Spark Protocol has implemented restrictions on access from US IP addresses, demonstrating a strong commitment to mitigating regulatory risks, particularly those associated with the SEC. In an environment characterized by growing concerns and regulatory uncertainties surrounding the securitization and oversight of cryptocurrencies, MakerDAO is proactively ensuring the equilibrium of the entire MakerDAO ecosystem, including its stablecoin DAI, irrespective of external pressures. This strategic direction, known as the “Endgame,” offers one of several potential pathways for the crypto industry to progress amid the ongoing balancing act between regulation and freedom. It is worth paying close attention to MakerDAO’s initiatives in this regard.

References

- Rune, The 5 phases of Endgame, 2023

- Spark Protocol, Spark FAQ, 2023