Market Commentary | 01.17.

Continuing Market Volatility With the End of Inflation Fears, and Virtuals Protocol’s Controversial Buyback Plan Announcement

Market Commentary provides a recap of the week's key events and offers insights from DeSpread Research on future points of interest. In the January 17th edition of Market Commentary, we will cover continuing market volatility with the end of inflation fears, and Virtuals Protocol's controversial buyback plan announcement.

1. Continuing Market Volatility: Is This the Real Bottom?

In the second week of January, the market experienced sharp volatility due to rising inflation concerns in the U.S. economy and a surge in long-term Treasury yields (Market Commentary | 01.10.). This week, the volatile market conditions continued as inflation and employment indicators, directly related to inflation concerns, were released in succession.

Bitcoin, continuing its downward trend from last week, recorded a low of $89.2K on January 13th but quickly recovered to the $100K range through a sharp rebound.

The key economic indicators released this week are as follows:

January 14 (Tuesday)

- PPI* (Month-over-Month) - Expected: 0.4% / Actual: 0.2%

- Core PPI (Month-over-Month) - Expected: 0.2% / Actual: 0.0%

*PPI (Producer Price Index): A figure surveyed and reported by the U.S. Bureau of Labor Statistics (BLS) that shows changes in prices received by producers for goods and services, indicating price fluctuations from the producer's perspective.

January 15 (Wednesday)

- CPI** (Month-over-Month) - Expected: 0.4% / Actual: 0.4%

- Core CPI (Month-over-Month) - Expected: 0.3% / Actual: 0.2%

- CPI (Year-over-Year) - Expected: 2.9% / Actual: 2.9%

**CPI (Consumer Price Index): A figure surveyed and reported by the U.S. Bureau of Labor Statistics (BLS) that shows price changes in goods and services actually purchased by consumers, indicating price fluctuations from the consumer's perspective.

January 16 (Thursday)

- Retail Sales*** (Month-over-Month) - Expected: 0.6% / Actual: 0.4%

- Core Retail Sales (Month-over-Month) - Expected: 0.5% / Actual: 0.4%

- Initial Jobless Claims**** - Expected: 210K / Actual: 217K

***Retail Sales: An indicator measuring changes in sales at retail stores and restaurants, showing changes in the amount consumers actually spend on goods and services.

****Initial Jobless Claims: An indicator released by the U.S. Department of Labor (DoL) showing the number of people filing for unemployment benefits for the first time, serving as an indicator of employment market conditions.

With inflation indicators (PPI, CPI) coming in below expectations and retail sales also reporting lower than anticipated figures, this has temporarily put an end to recent market inflation concerns. Notably, when the CPI figures—considered a watershed moment for inflation concerns—were released, Bitcoin prices temporarily rose by approximately 2.3%, indicating that some of the market uncertainty had been resolved.

Following the CPI release, the closely watched 10-year Treasury yield fell significantly. The yield, which had reached as high as 4.8%, has continued to decline and currently stands at 4.6% as of the writing date (January 17).

As inflation concerns subside, market attention is now shifting to President-elect Trump's inauguration scheduled for January 20 and the launch of his new administration. As mentioned in Market Commentary | 01.10., key points of interest include what economic stimulus measures Trump will implement in a somewhat restrictive economic environment, and the extent of deregulation in the virtual asset industry under his administration.

Expectations of deregulation are already being reflected in some assets. Notably, Ripple ($XRP) has been showing consistently positive price movement, seemingly driven by President-elect Trump's mention of potentially holding strategic positions in U.S.-based virtual assets like Solana and Ripple, as well as increased expectations of winning the SEC lawsuit following SEC Chairman Gary Gensler's retirement.

Bitcoin has been in a correction phase for about a month since forming its peak in mid-December. With the inauguration of President-elect Trump—the driving force and protagonist of this cycle—just around the corner, the market is expected to continue experiencing significant fluctuations in response to his statements even after the inauguration. We advise caution during this period of sustained market volatility and recommend paying close attention to market trends unfolding in this political era.

2. Bull or Bear? Virtuals Protocol Buyback Controversy

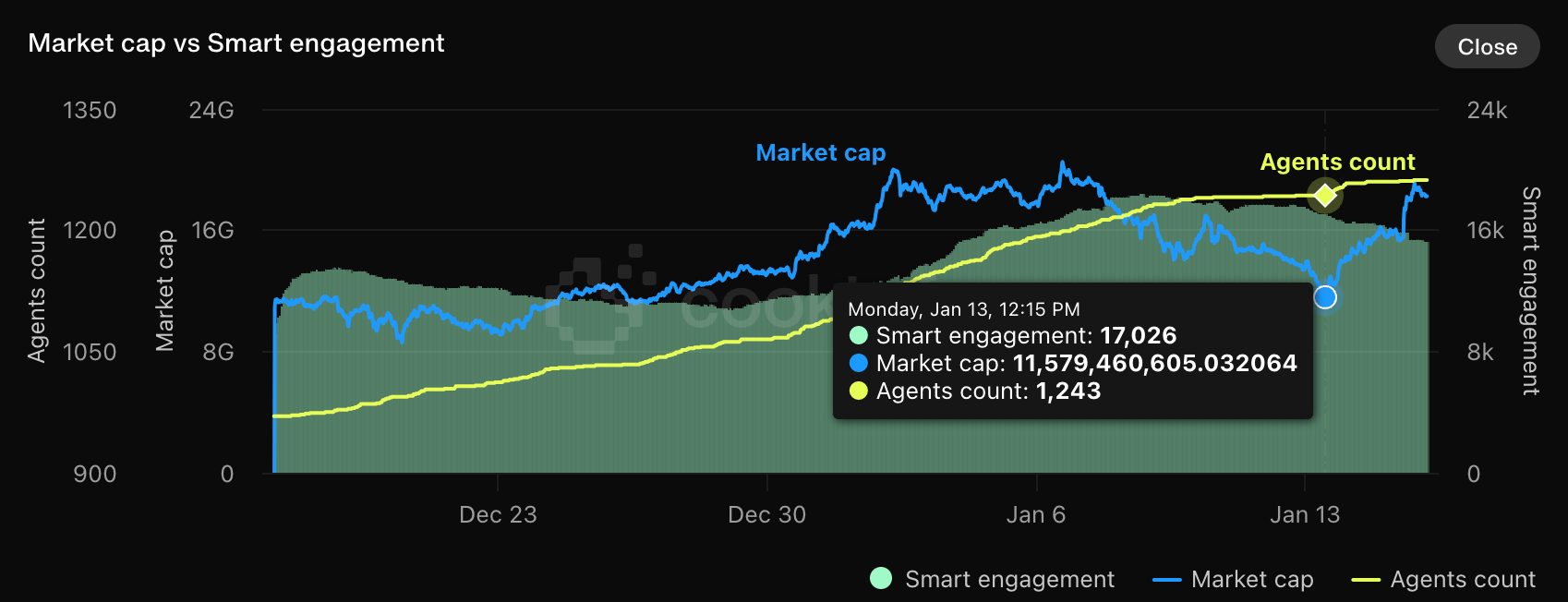

According to Cookie.fun, an AI agent data platform, the total market capitalization of AI-related virtual assets, which had decreased to approximately $11b as of January 13th, has recovered to nearly $18b, approaching its previous all-time high. Recent positive indicator releases have led to renewed liquidity flowing into the AI agent-related virtual asset sector.

On January 15th, Virtuals Protocol, which is leading the AI agent narrative on the Base network, attracted significant market attention by announcing new tokenomics through their X account. The new system would redistribute the 1% fee collected from Agent transactions back into the ecosystem. The platform token $VIRTUAL's closing price on that day increased by approximately 26% compared to its opening price.

The future fee distribution plan for Virtuals Protocol is as follows:

- Agent Creators: 30%

- Agent Affiliates: 20%

- Agent SubDAO Treasury: 50%

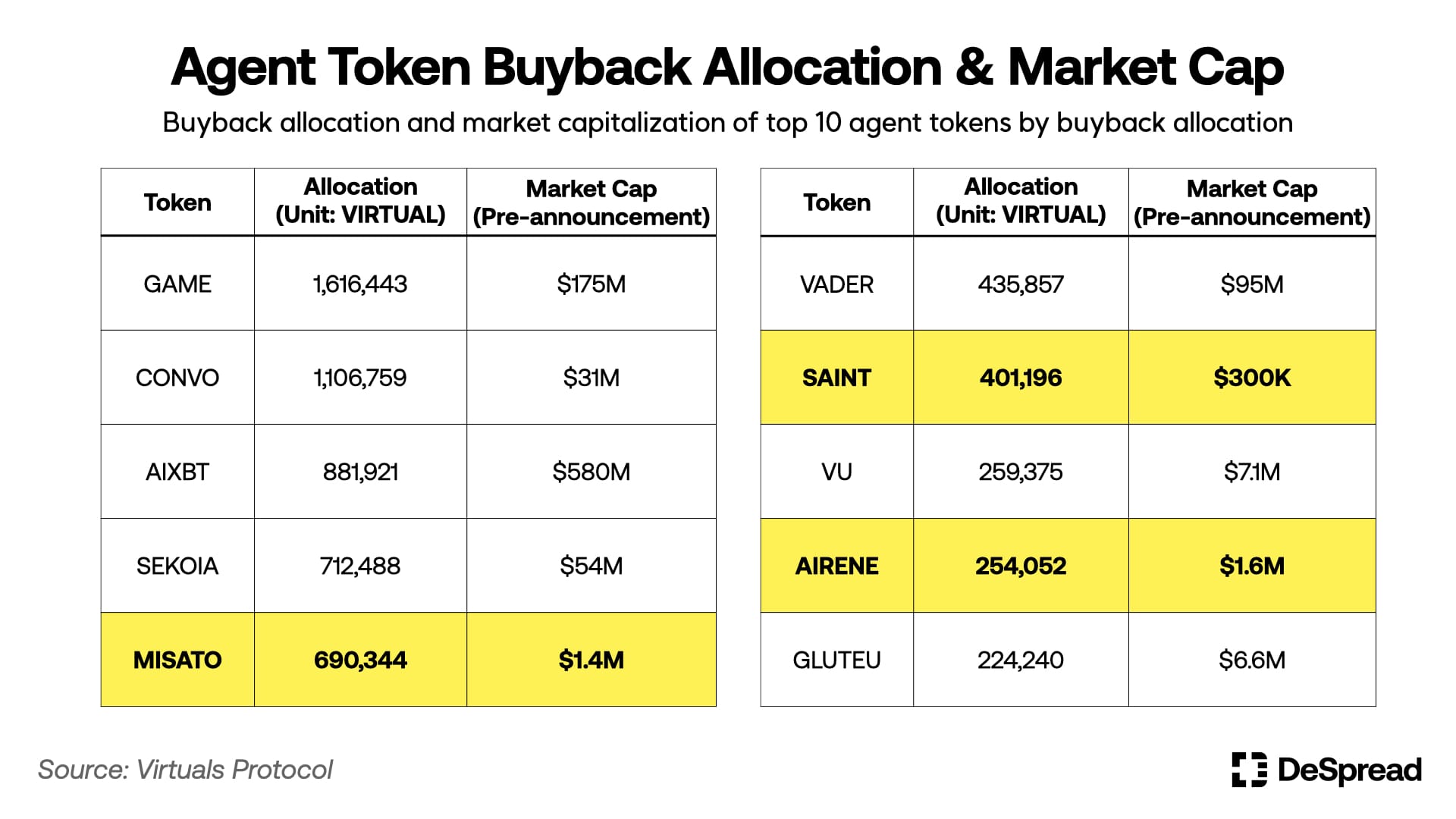

Along with this tokenomics reform, Virtuals Protocol announced plans to buy back approximately 520 agent tokens from their ecosystem using about 12 million $VIRTUAL tokens collected as fees since October 16th, 2024. The agent token buyback will be weighted proportionally to the trading volume generated by each agent token during this period and will be distributed over 30 days.

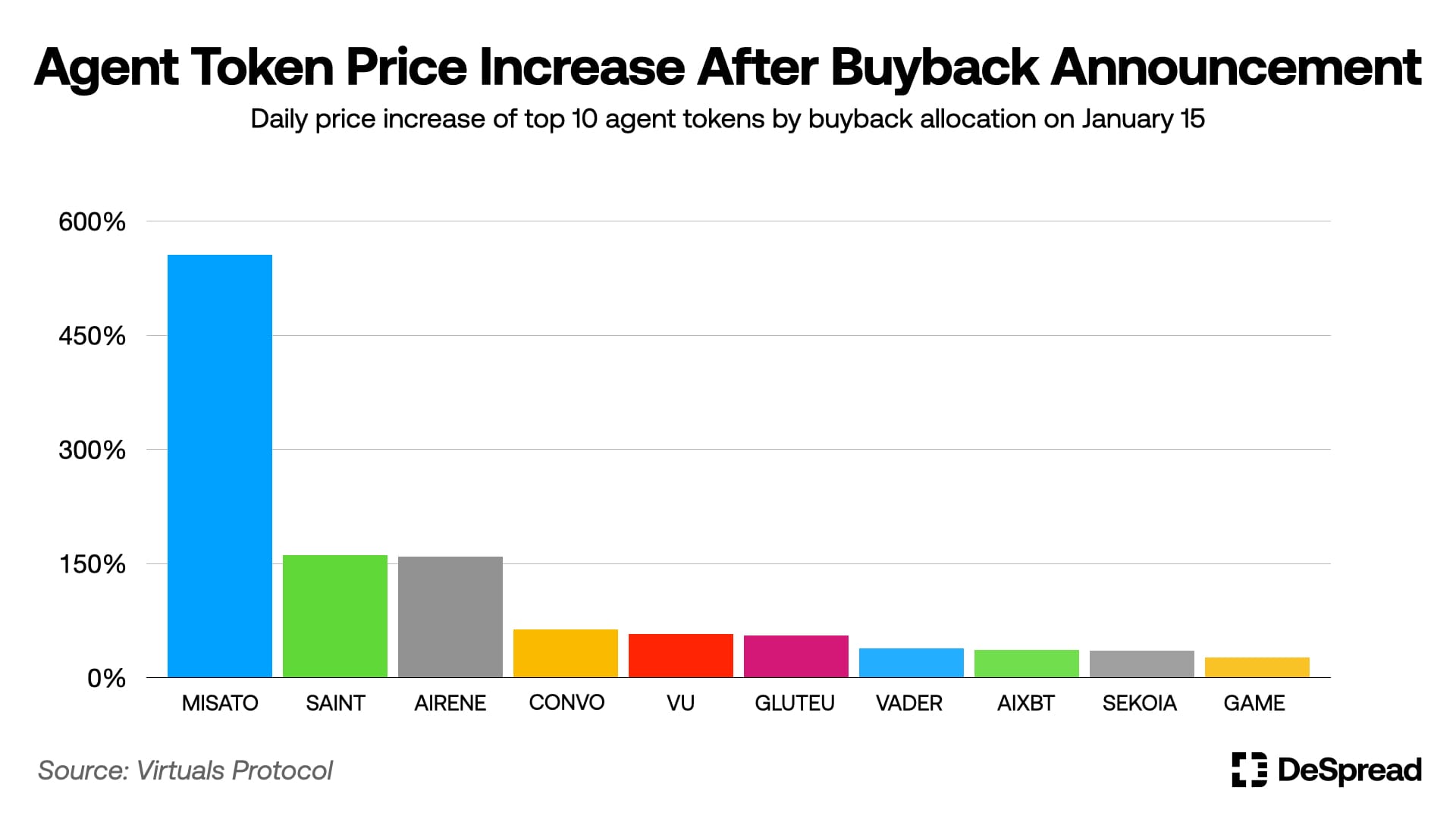

In the buyback allocation table released by the team, tokens that were launched early in Virtuals Protocol's history and had been trading for extended periods dominated the top positions. These tokens showed sharp increases immediately after the team's buyback announcement. In particular, tokens with relatively lower market capitalizations like $MISATO, $SAINT, and $AIRENE recorded significant price increases. $MISATO, for instance, showed a 556% price increase in just one day, with its market capitalization surging from $1.4M to as high as $11.7M.

Market reaction to these moves by Virtuals Protocol has been mixed. Some support the new tokenomics, expecting ecosystem revitalization, while others express concern about increased selling pressure on $VIRTUAL due to the buyback of currently underperforming agent tokens and the tokenomics reform.

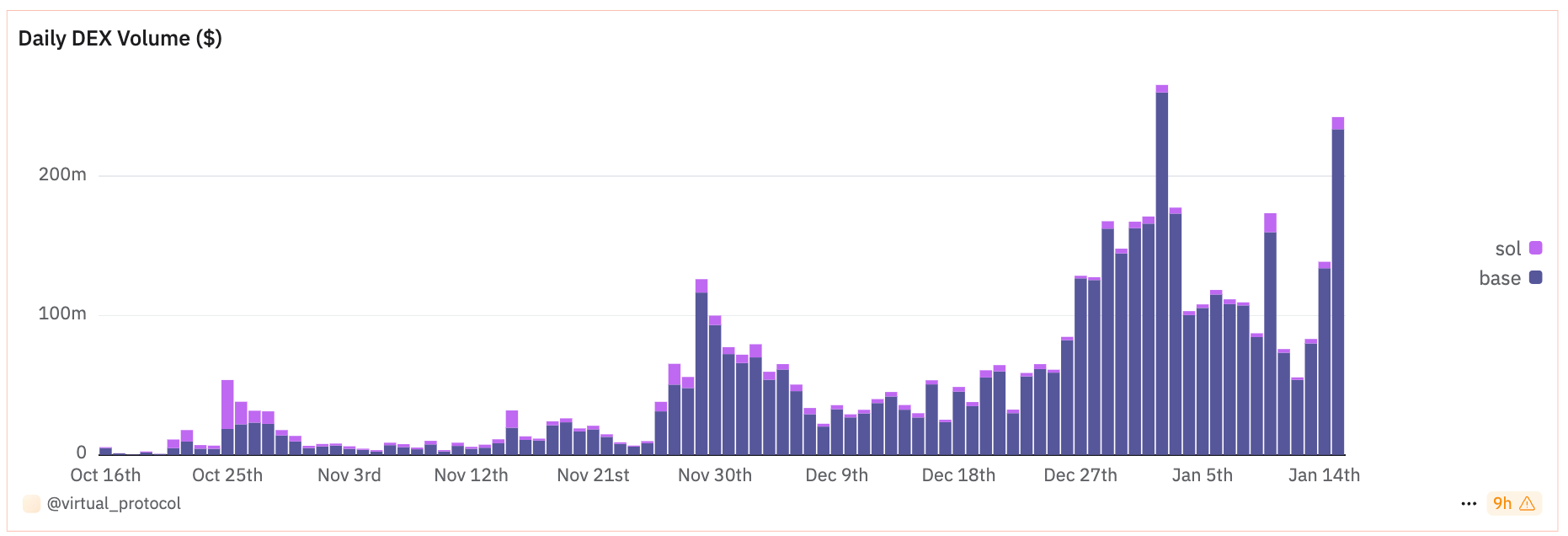

While these concerns are valid - the agent token buyback and tokenomics reform do create selling pressure on $VIRTUAL tokens - the January 15th buyback announcement contributed to securing liquidity flowing into the on-chain market, coinciding with positive CPI announcements. This also helped quickly recover the trading volume of Virtuals Protocol-based agents, which had been showing a declining trend in recent days.

The market attention and liquidity secured through these measures, combined with ecosystem-friendly tokenomics, could promote the influx of AI agent developers. If more developers deploy agents through Virtuals Protocol, this could naturally lead to increased demand for $VIRTUAL for providing liquidity for both agent tokens and $VIRTUAL.

Therefore, it's currently difficult to definitively assess the success of Virtuals Protocol's agent token buyback. It would be prudent to wait and observe whether Virtuals Protocol can maintain the user traffic and liquidity attracted through this buyback mechanism and establish a positive feedback loop before making a final judgment.