Market Commentary | 01.24.

Trump's Bold Moves and the Fluctuating Cryptocurrency Market.

Market Commentary provides a recap of the week's key events and offers insights from DeSpread Research on future points of interest. In the January 24th edition of Market Commentary, we will cover Trump's bold moves and the fluctuating cryptocurrency market.

1. Trump Memecoin, Inauguration, and SBR... The World is All About Trump!

1.1. The Launch and Surge of the Trump Memecoin, and the Controversy

On the evening of January 17 (local time), President-elect Donald Trump (current president) launched a memecoin named after himself, $TRUMP. The news was first announced through Trump's Truth Social account, followed by the same post on his X account, which led to its rapid spread.

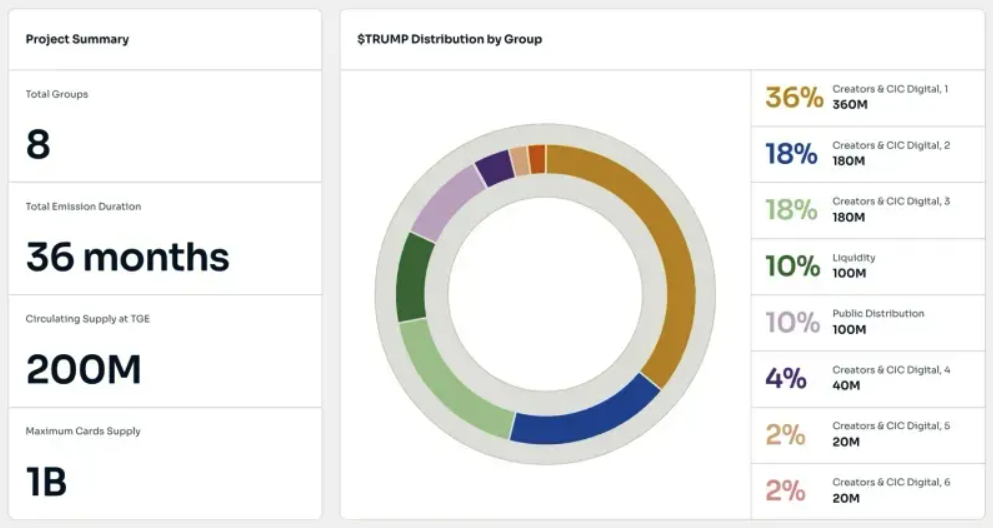

$TRUMP was issued on the Solana network with a total supply of 1 billion tokens. Of this total, 80% was allocated to subsidiaries of the Trump Group, including CIC Digital LLC and Fight Fight Fight LLC, setting the initial circulating supply at 200 million tokens.

Following its launch, $TRUMP garnered explosive interest, leading to a sharp price surge. Initially priced below $0.20, the token skyrocketed by over 16,000% within a day, reaching $33.60. On its second day, January 19, the price peaked at approximately $75, demonstrating a steep upward trajectory. As a result, its market capitalization soared to nearly $15 billion at its highest point, while the fully diluted valuation (FDV) reached around $75 billion, placing it close to the top 10 global cryptocurrencies in terms of market cap.

Riding on this momentum, major cryptocurrency exchanges quickly moved to list $TRUMP. The listing schedules for major exchanges, including those in Korea, were as follows:

- Coinbase: January 19 – Added to the listing roadmap

- Binance: January 19

- Robinhood: January 20

- Coinone: January 20

- Bithumb: January 21

However, on January 19 (local time), the announcement of the issuance of the $MELANIA dramatically shifted the situation. As soon as $MELANIA was launched, the price of $TRUMP plummeted from $75 to a low of $35, wiping out approximately $7 billion in market capitalization almost instantly.

Various speculations have emerged regarding the cause of this sharp decline. Personally, I believe that unlike $TRUMP, $MELANIA lacks a clear issuance basis. This may have led investors to perceive that President Trump is leveraging the crypto industry for personal gain rather than taking it seriously, which resulted in widespread disappointment among them.

Reflecting this sentiment, Bitcoin also experienced a downturn following the issuance of $MELANIA, dropping from around $106,000 to below $100,000.

1.2. Trump's Inauguration: Where Did the Crypto Mentions Go?

Even before the controversy surrounding the issuance of Trump-themed coins had settled, Donald Trump’s inauguration as the 47th President of the United States took place at the U.S. Capitol on January 20 (local time). In the lead-up to the inauguration, Bitcoin surged to an all-time high of $109,360, fueled by heightened expectations for Trump's potential impact on the crypto sector. However, the absence of any mention of cryptocurrency or blockchain in his inaugural address left the market disappointed, triggering a sharp downturn.

Within just 24 hours after the speech, Bitcoin's price plummeted by over 7%, reaching a low of $100,087. This starkly contrasts with Trump's campaign promises to make the U.S. the "world capital of crypto" and his hints at integrating Bitcoin into strategic national assets. The market's enthusiasm quickly turned into disappointment, reflecting dashed hopes for a crypto-friendly administration.

1.3. Two Disappointments in a Day—Isn't That Too Much?

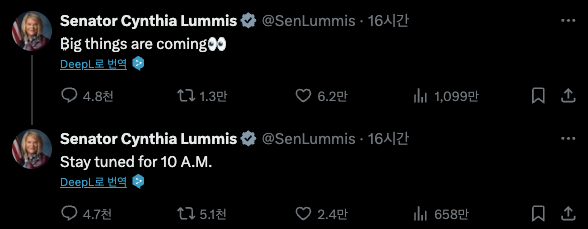

On January 23, Senator Cynthia Lummis posted a cryptic tweet on her X account stating, “₿ig things are coming👀.” Given Lummis's previous proposal of the “BITCOIN Act,” which outlined a plan for the U.S. government to acquire and hold 1 million bitcoins over five years, and the inclusion of the Bitcoin symbol (₿) in her tweet, the market speculated that a major announcement related to the U.S. Strategic Bitcoin Reserve (SBR) was imminent. However, it was later revealed that the tweet merely referred to Lummis's appointment as Chair of the Senate Digital Assets Subcommittee, leaving the market disappointed.

Adding to the market’s disillusionment, President Trump’s executive order, announced on the same day, also fell short of expectations. The order included the establishment of a Cryptocurrency Working Group and outlined two key initiatives: ① developing a regulatory framework for managing digital assets, including stablecoins and ② assessing and setting targets for a national digital asset stockpile focused on Bitcoin.

However, the market perceived the executive order as underwhelming, leading to an 8.5% decline in Bitcoin’s price within 24 hours. The key reasons behind this downturn include: ① the term "stockpile" does not imply an immediate government purchase of Bitcoin, contrary to market expectations and ② the market's anticipation of swift action on the SBR right after Trump's inauguration was unmet, leading to disappointment. In essence, the lack of a concrete policy implementation plan and the administration’s focus on long-term strategic direction have been identified as major factors behind the decline in investor confidence.

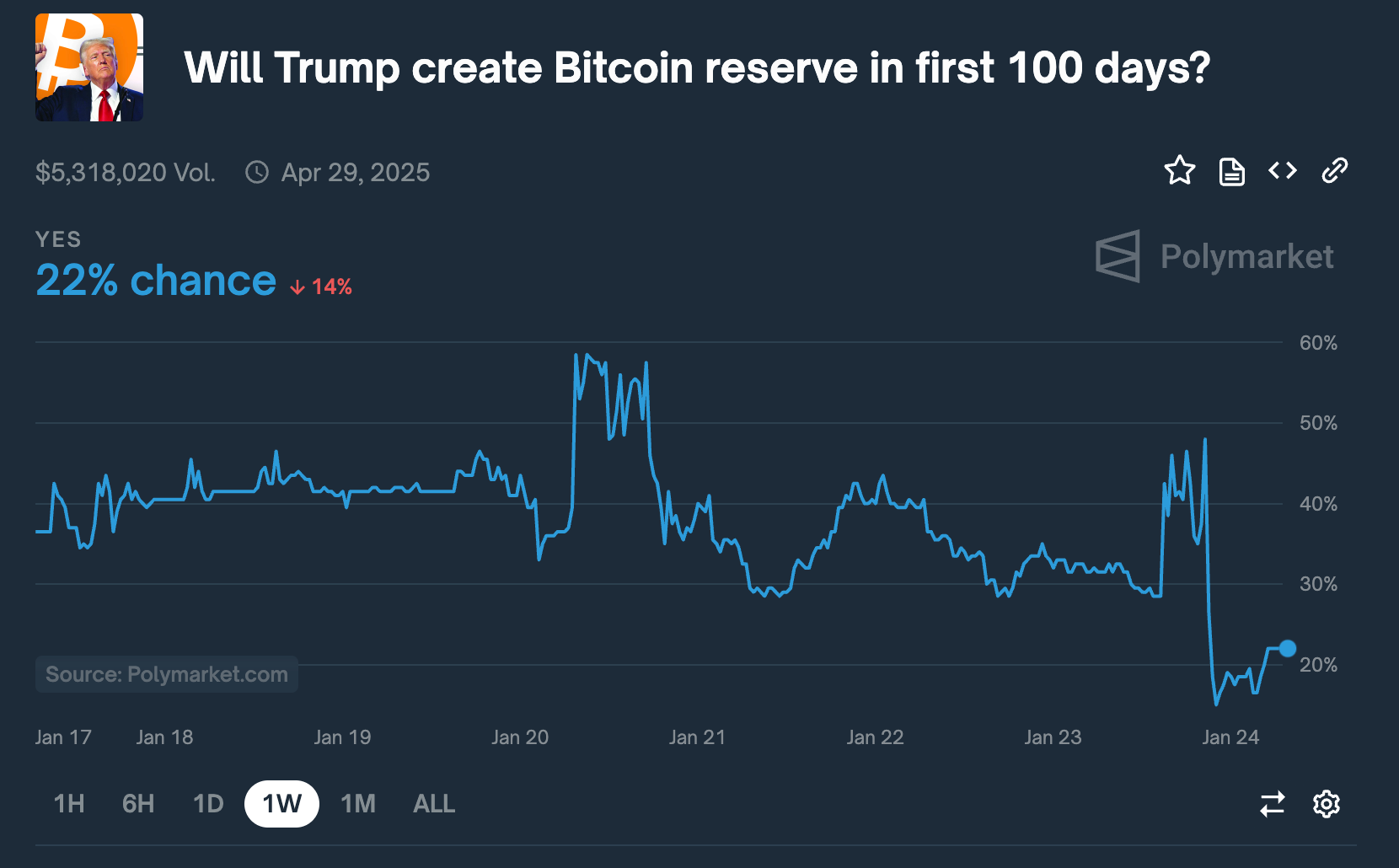

As a result, the global prediction market Polymarket saw a significant decline in the probability of a positive outcome for the bet titled “Will Trump create Bitcoin reserve in first 100 days?”

With the lack of tangible policy direction, the initial excitement surrounding Trump's presidency is gradually fading, and this sentiment is directly mirrored in the changing probabilities within prediction markets.

During the fourth week of January, leading up to the Lunar New Year holiday, the market exhibited heightened volatility, reacting sensitively to each of Trump’s moves. Overall, there is a growing sense of disappointment as the administration’s actual policy execution falls short of the pro-crypto stance Trump projected during his election campaign. Consequently, the market remains uncertain and volatile.

Looking ahead, the cryptocurrency market is expected to remain highly reactive to Trump's actions, and investors should closely monitor whether the administration delivers on their expectations with concrete and timely crypto-related policies.