Market Commentary | 11.01.

Bitcoin’s surge past 100 million KRW with "Trump trading," Japan's political climate and rate hike fears, and virtual protocol's hype and the AI meme narrative

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the November 1 edition, the following topics are covered: Bitcoin’s surge past 100 million KRW with "Trump trading," Japan's political climate and rate hike fears, and virtual protocol's hype and the AI meme narrative.

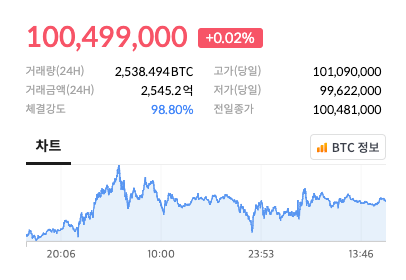

1. Bitcoin Surpasses 100 Million KRW: Is the Market Reflecting the “Trump Trading”?

Since October 28, Bitcoin has shown a significant upward trend, surpassing $72,000 and reaching over 100 million KRW per coin, continuing its steady rise since September. Bitcoin’s impressive performance contrasts with the relatively stagnant U.S. stock market, prompting speculation that this rally may be a form of "Trump trading"—a market response reflecting the increasing likelihood of Trump, known for his crypto-friendly stance, winning the presidential election.

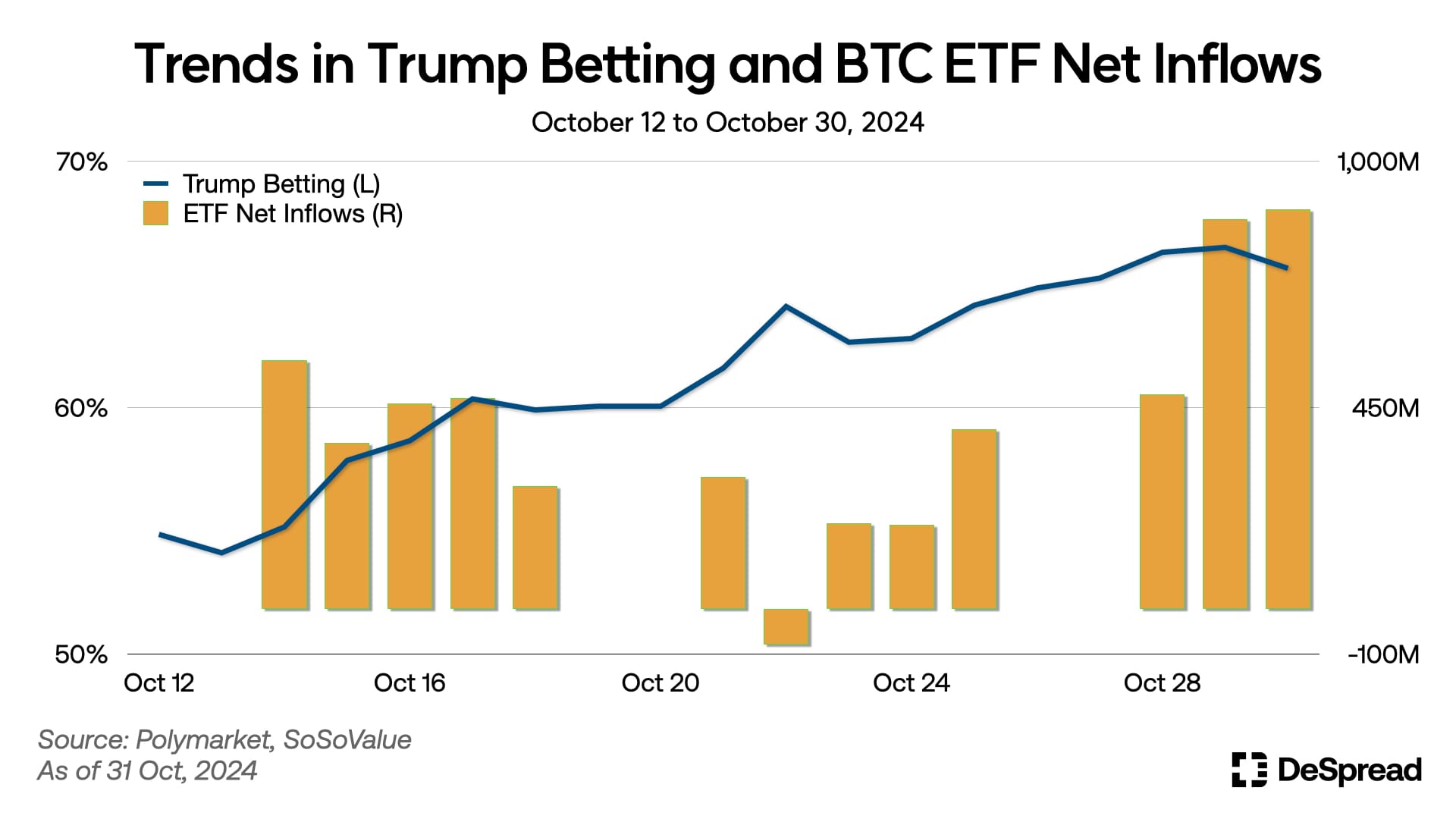

Further insight can be gleaned from various sources. On the prediction market platform Polymarket, betting for Trump have steadily risen, reaching approximately 65% as of October 31. This upward trend aligns with substantial capital inflows into Bitcoin ETFs, with net inflows reaching approximately $870 million and $890 million on October 29 and 30, respectively.

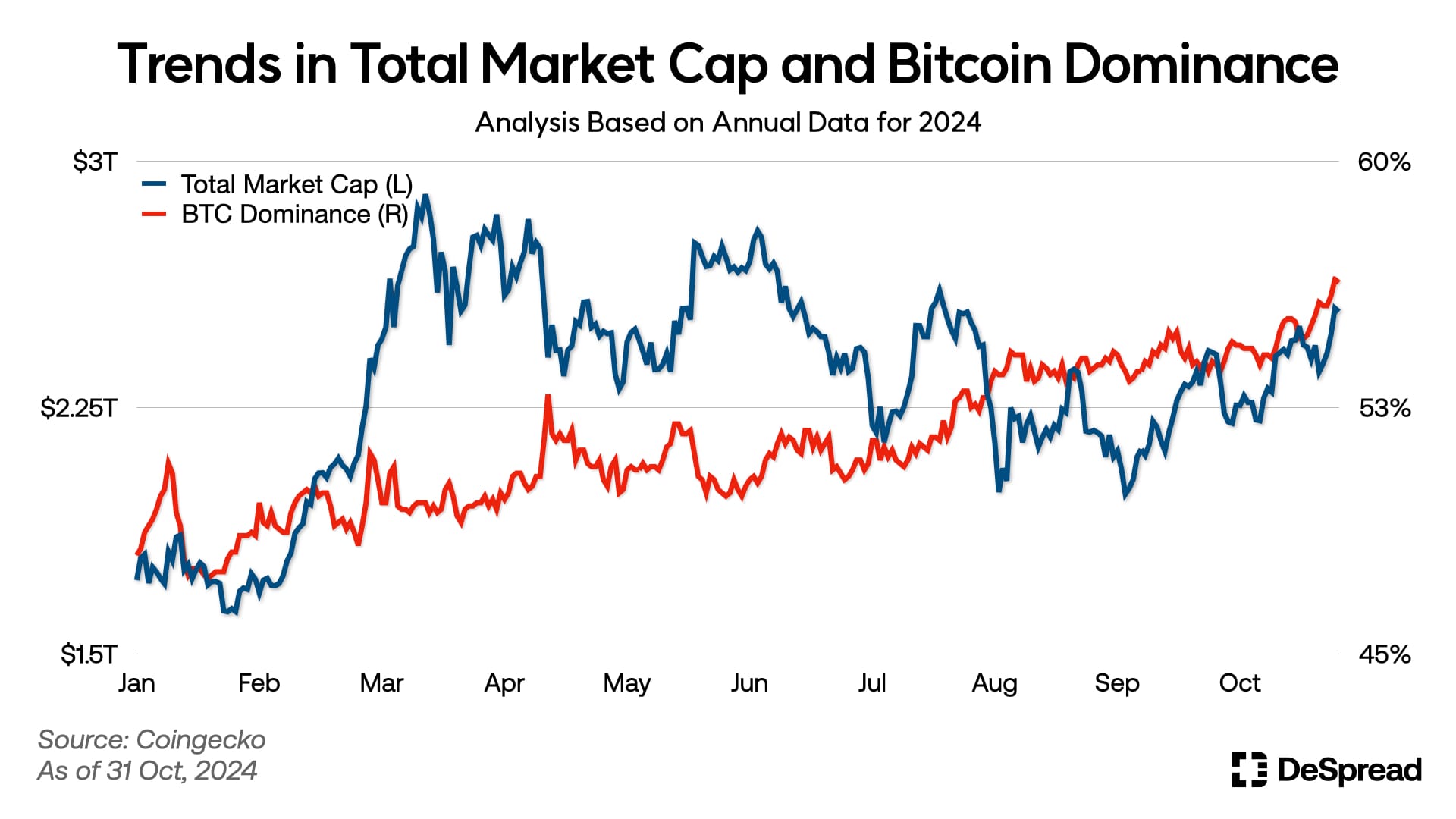

However, questions remain as to whether this influx of capital will spread across the entire crypto industry. Bitcoin, which briefly exceeded $73,000, has shown high volatility, dropping below $70,000 as of November 1. Despite this, Bitcoin dominance has actually increased, rising from about 56% on October 30 to around 58% currently, highlighting the continued sluggish performance of the altcoin market in comparison.

1.1. DeSpread’s Comments

The October 25 market commentary addressed the growing polarization in the market, with an intensified focus on Bitcoin and DEX meme trading. This article aims to highlight the view that Bitcoin's capital concentration might not necessarily signal a broader revival of the crypto industry in the short term.

A commentator known as The Giver, an individual with a background in Investment Banking (IBD), shared his perspective in a Twitter thread, summarized as follows:

What you must believe:

1) The direction of the election does not drive a price-dependent outcome; rather, Bitcoin is currently being used as a liquid proxy to hedge a Trump win.

2) "Easing conditions" present today for manufacturing a new TOTAL-high is insufficient. The correlation of rates and other popular heuristics to faction liquidity is much weaker than popular rhetoric suggests, with signs pointing toward price ultimately being suppressed rather than price discovery.

In summary, The Giver argues, first, that the election’s outcome—namely, a Trump victory—is not directly influencing Bitcoin’s price. Instead, Bitcoin is being bought as a hedge against the volatility that a Trump win could bring to the market. Second, he argues that the current financial conditions do not sufficiently support a new all-time high for the broader crypto industry, suggesting that liquidity and rate correlations do not align as closely with price growth as is often assumed.

The detailed arguments in the thread offer a counterbalance to the prevailing optimism in the market and serve as a useful perspective.

DeSpread Research finds some validity in The Giver's view. A significant portion of capital from traditional finance—largely through ETFs—has been confined to Bitcoin holdings without extending to other crypto assets. This pattern supports the notion that this capital may serve as “mercenary capital,” directed solely toward hedging political event risk.

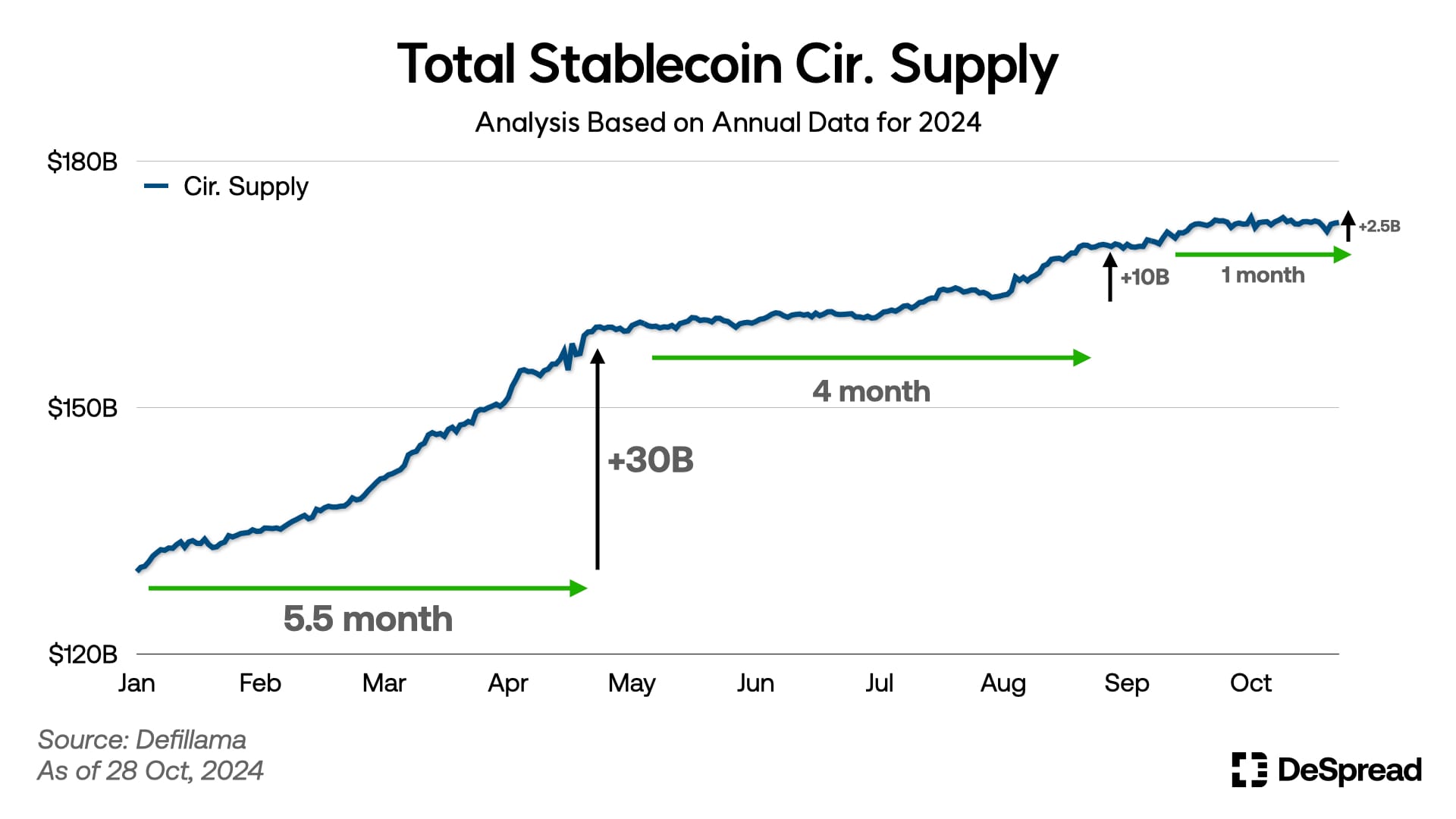

The Giver also notes that easing financial conditions remain insufficient for broader industry growth. In the crypto context, this can be partially observed through the stablecoin circulation trend. In 2024, the total stablecoin supply rose from approximately $130 billion in January to around $172 billion currently, reflecting a $42 billion increase, or 32.3% growth. However, this growth has slowed significantly, exhibiting a plateau over the past two months.

While these observations are not radical enough to overturn the current optimism in the industry, they are valuable for fine-tuning scenario projections. For instance, following a Trump victory, it may be more prudent to consider potential volatility arising from the dissipation of political event-driven dynamics, rather than expecting a prolonged rally. Observing U.S. and global financial conditions post-election, particularly any accompanying increase in stablecoin circulation, could also offer insight into future industry outlooks and help refine investment scenarios accordingly.

2. Eased Concerns Over Japan's Rate Hike, But It's Too Early to Relax

In the 50th general election of the House of Representatives held on October 27, the ruling Liberal Democratic Party (LDP) fell short of securing a majority, winning only 191 out of 465 seats. This marks the first time the LDP has failed to secure a majority since 2012. Additionally, the main opposition party, the Constitutional Democratic Party, secured over 140 seats, marking the first time this has happened since 2003.

The primary reasons for the LDP’s election defeat include concerns over rising prices, declining wages, and a falling stock market. Another significant factor was the newly appointed Prime Minister Ishiba's failure to hold LDP faction members tied to former Prime Minister Abe accountable for their alleged involvement in political funding scandals, despite his promises to do so.

Meanwhile, on October 31, the Bank of Japan (BoJ) held its short-term interest rate steady at 0.25% as expected. The BoJ stated that it would consider gradual rate hikes if inflation remains at its target level of 2%, in line with the stance outlined in the previous market commentary. Although Japan’s domestic political uncertainty and the volatility expected from the upcoming U.S. presidential election make it more challenging for the BoJ to increase rates, there is still speculation that a rate hike in December is not entirely off the table.

BoJ Governor Ueda also maintained a balanced approach, stating that the BoJ will carefully assess Japan’s domestic political and economic conditions, as well as the U.S. economic outlook, before implementing any policy changes (source).

2.1. DeSpread’s Comments

Prime Minister Ishiba and BoJ are considering a rate hike. However, they remain cautious due to Japan’s domestic and international conditions. Domestically, factors such as political uncertainty following the LDP’s recent election loss, a continued decline in real wages since June, a drop in household consumption, and the burden of government bonds issued to combat deflation are constraining a rate increase. Externally, the interest rate gap with the United States and market volatility tied to the U.S. presidential election are key variables.

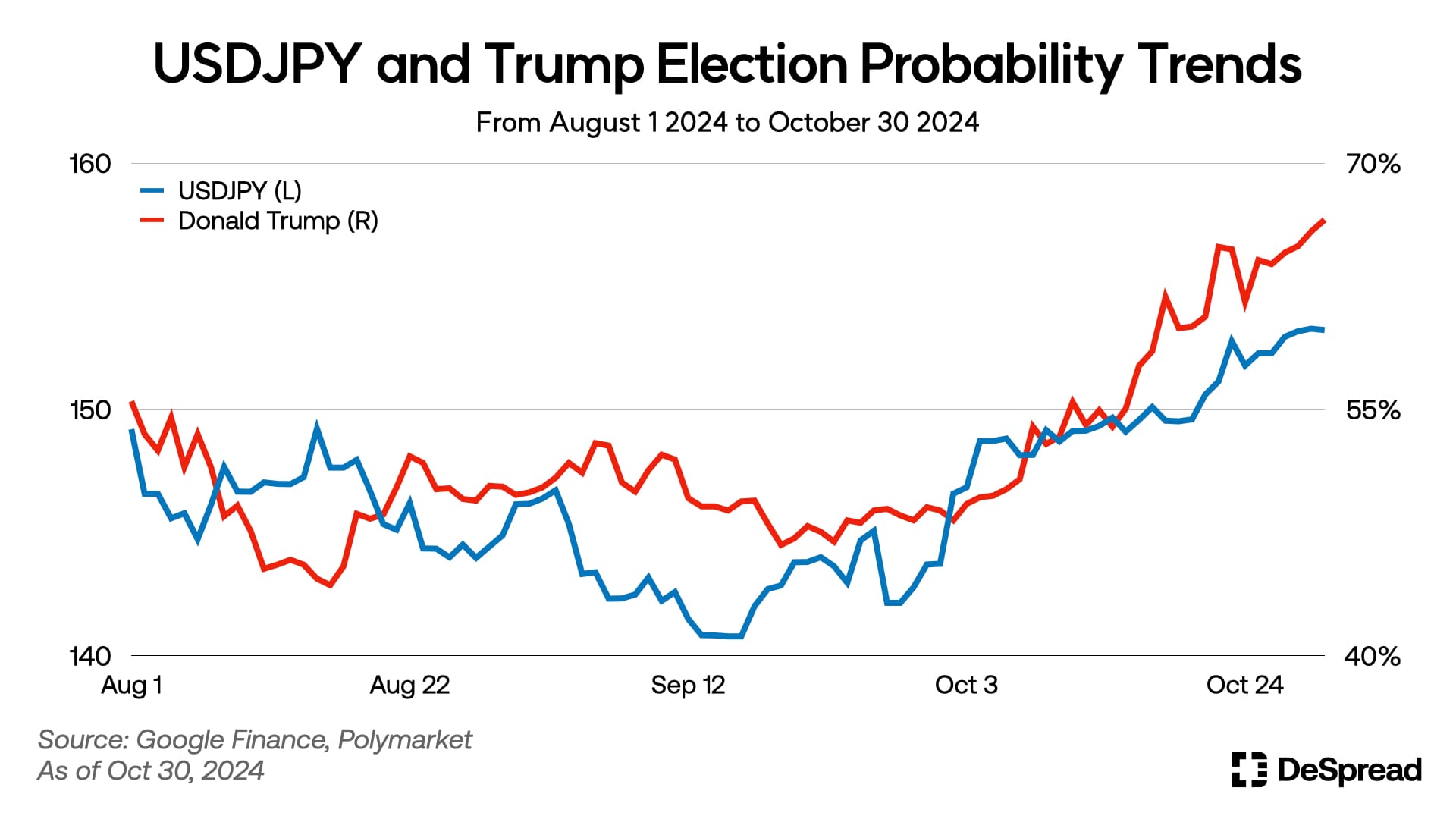

The chart above illustrates the USDJPY rate and Trump’s election probability on Polymarket from August 1 to October 30, 2024. Both show an upward trend, with USDJPY reaching a three-month high following August’s Black Monday. This movement likely reflects market expectations that Trump’s tariff policies could strengthen the dollar.

With Japan’s government and BoJ expected to defend the 160 level for USDJPY, there is still a considerable chance of an unexpected rate hike in December. If Trump wins the upcoming U.S. election, and USDJPY surges past 160, BoJ may implement a rate increase despite the adverse impact on Japanese households.

3. Virtuals Protocol: Carrying Forward the AI Meme Narrative

The AI narrative memecoin market, which was centered around $GOAT as discussed in our previous market commentary, maintained its momentum this week, with Virtuals Protocol and its AI agents taking center stage. The protocol allows anyone to create and deploy AI agents while enabling revenue sharing through tokens that represent ownership of these agents.

Following the launch of Virtuals Protocol, the team unveiled a YouTube live streaming feature for their proprietary AI agent, Luna. During the stream, Luna demonstrated capabilities such as real-time user interaction through chat and displaying various reactions when users showed support using $LUNA tokens, which represent ownership in Luna. Through these intuitive demonstrations of the AI narrative, Luna successfully captured significant market attention.

After the live stream launch, the protocol added autonomous virtual asset transfer and management features using Coinbase Wallet, garnering support from key figures in the Coinbase/Base network including Jesse Pollak and Brian Armstrong. Combined with other positive developments such as listing on Moonshot, a crypto credit card payment platform, these events drove $LUNA token's market capitalization up by approximately 400% to $230M in just three days.

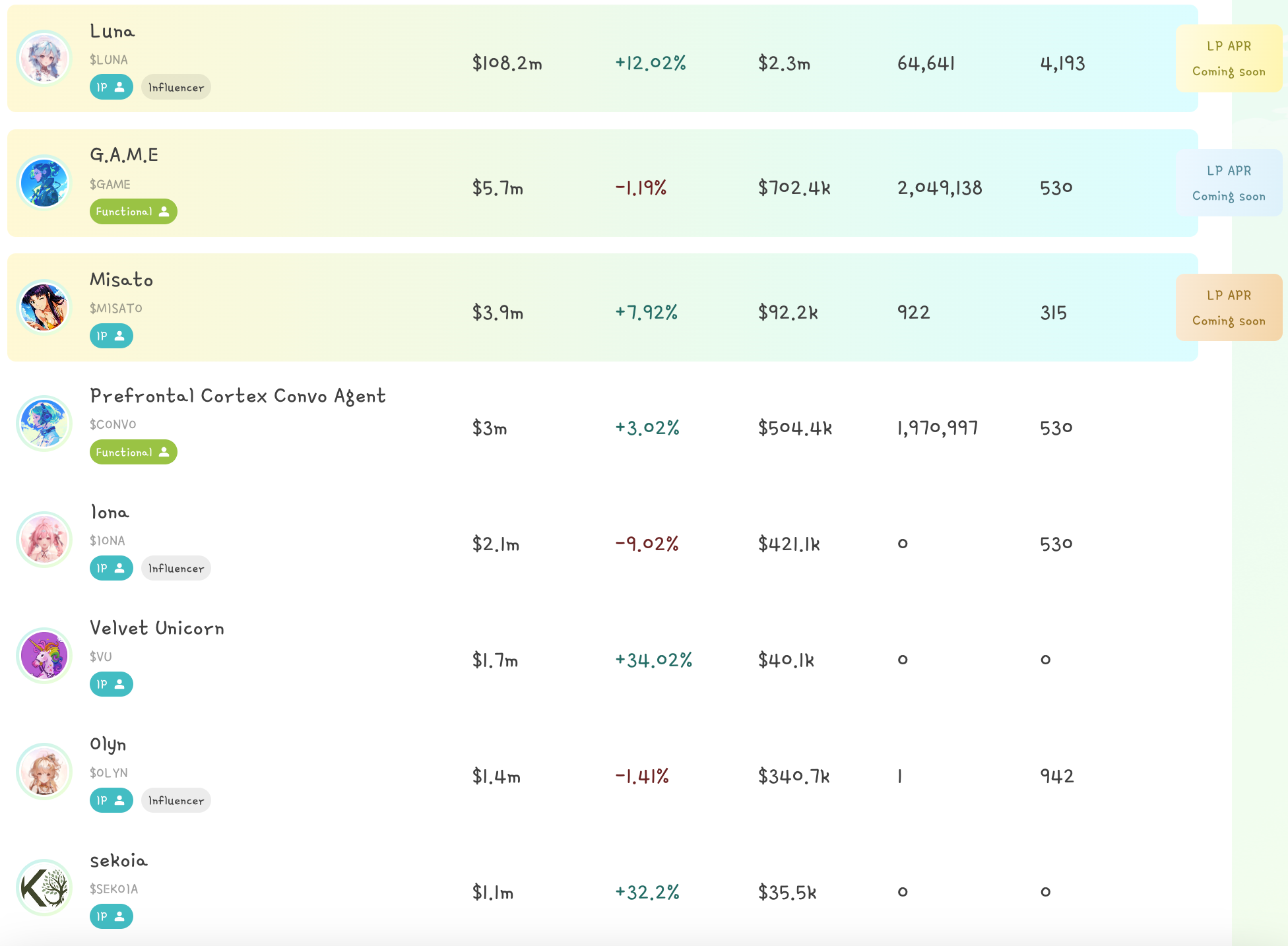

During the same period, around 100 AI agents were deployed and actively traded on Virtuals Protocol. The platform's native $VIRTUAL token, which is used for agent token purchases, agent interactions, and supplied to liquidity pools along with ownership tokens during agent creation, also saw substantial price increases, reaching a market capitalization of $500M. However, as of October 31st, the AI narrative has somewhat cooled down, with the $VIRTUAL token experiencing a 30% correction from its peak and the $LUNA token declining by approximately 58%.

3.1. DeSpread’s Comments

Luna's ability to own and manage personal wallets, provide token incentives to protocol contributors, and interact with users through chat demonstrates new possibilities for AI integration in the crypto industry. This aligns with the convergence of crypto assets and AI as outlined by Ethereum founder Vitalik Buterin in his article 'The promise and challenges of crypto + AI applications’, where he described four key intersection points:

- AI as Players: Utilizing AI as players in blockchain-based systems

- AI as Interfaces: Using AI as intermediaries between users and blockchain/blockchain-based applications

- AI as Rules: Employing AI as on-chain decision makers in smart contract algorithms, DAOs, etc.

- AI as Goals: Building and operating blockchains for AI

A particularly noteworthy aspect of Virtuals Protocol and Luna's success is how Luna demonstrated the feasibility of 'AI as Players' and 'AI as Rules' to the market by introducing AI into the creator and user incentive structures—a core challenge that has driven Web3's evolution and remains central to all projects—through its capacity to own and manage personal wallets, distribute token incentives to protocol contributors, and interact with users via chat. However, as the AI narrative meta has currently entered a cooling period, for this meta to regain market attention, it needs more practical success cases that go beyond Luna's demonstrated potential of AI as market 'players' and 'rules'.

Reflecting this trend, we can observe that AI agents focused on 'financial services', such as Velvet Unicorn which plans and executes DeFi strategies and Sekoia which invests in other AI agents, are currently ranking high on the Virtuals Protocol dashboard alongside influential AI agents that gained attention during this meta. Looking ahead, these AI agents—which go beyond simple wallet interactions to provide efficient and distinctive financial services that were previously impossible—are likely to lead the next AI narrative meta.

References

- SoSoValue

- Polymarket

- The Giver, tweet thread

- Daily Sabah, Political shift in Japan: Implications for BOJ, fiscal policy outlook

- Reuters, BOJ Governor Ueda's comments at news conference

- Trading Economics

- Vitalik Buterin, The promise and challenges of crypto + AI applications

- Four Pillars, Virtuals Protocol: Worship me, Kittens!