Market Commentary | 11.22.

Federal Reserve's potential rate cuts and the narrative surrounding Decentralized Science (DeSci)

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the November 22 edition, we examine the Federal Reserve's potential rate cuts and the narrative surrounding Decentralized Science (DeSci).

1. Powell Hints at Rate Pause: Will It Leave the Markets Unaffected?

On November 15 (KST), Federal Reserve Chair Jerome Powell delivered remarks during a lecture hosted by the Dallas Regional Chamber (DRC) that created uncertainty regarding the direction of December’s Federal Open Market Committee (FOMC) decision on Federal Funds Rate. While Powell touched on various topics such as the U.S. economy, the Fed’s role, and fiscal policy, his statements on inflation and interest rate policy captured the most attention.

Powell stated:

“The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we're currently seeing in the economy gives us the ability to approach our decisions carefully. Ultimately the path of the policy rate will depend on having incoming data and the economic outlook evolve.”

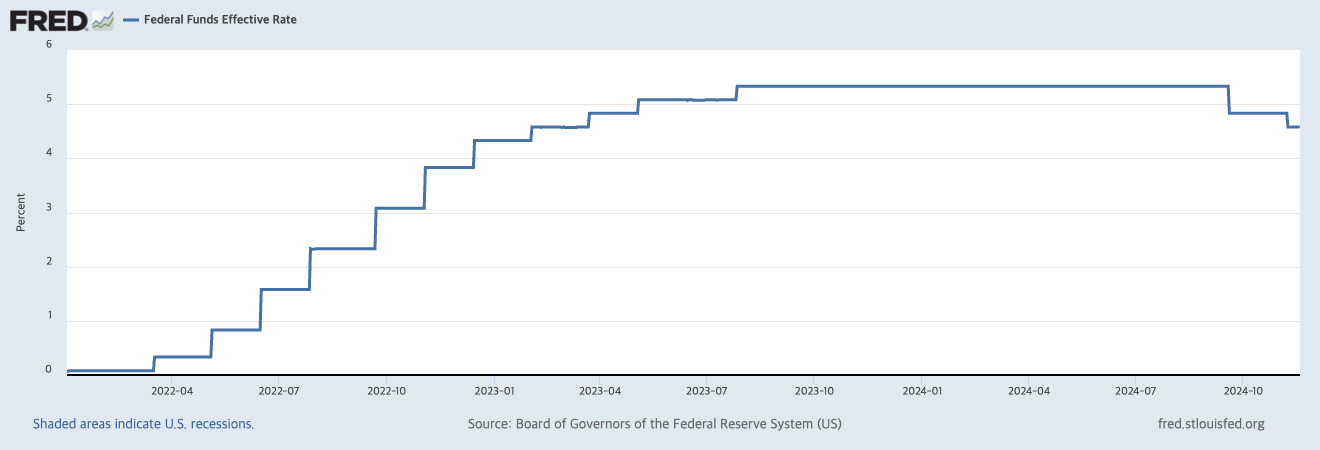

Powell’s statement have significantly increased the likelihood of the Federal Funds Rate being held steady at the December 18 FOMC meeting, where the decision on whether to lower rates will be made. According to CME FedWatch*, predictions for a 25-basis-point rate cut in December, which had surged to approximately 82.5% on November 13, dropped sharply after Powell’s remarks, standing at about 59.1% as of November 20. This data suggests that, compared to before Powell's comments, market participants now view a rate hold as more likely at the December FOMC meeting.

*The image above shows data provided by CME FedWatch, which is based on Federal Funds Futures. It indicates investor expectations regarding the Federal Reserve’s monetary policy decisions.

In addition, Powell stated:

“We know that reducing policy restraint too quickly could hinder progress on inflation. At the same time reducing policy restraint too slowly could unduly weaken economic activity and employment.”

This comment signals that future rate decisions will continue to be approached cautiously.

1.1. DeSpread’s Comments

In September, the U.S. Federal Reserve ended its prolonged rate hike cycle, which had begun in 2022, and transitioned into a rate-cutting cycle. Defying expectations of a 25-basis-point reduction, the Fed implemented a 50-basis-point "big cut," marking the first rate cut in four years since 2020.

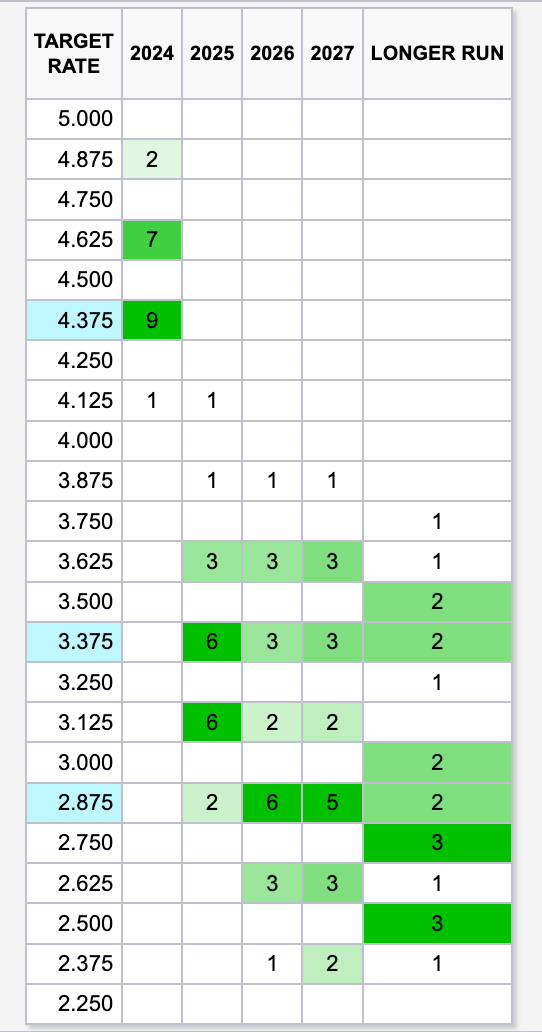

This decision is part of what is being referred to as a "rate-cutting cycle," reflecting a longer-term plan for monetary easing. According to the Federal Reserve's dot plot, the Federal Funds Rate is projected to decrease to a median of 437.5 basis points (425–450 bps range) in 2024 and further to 312.5 basis points (300–325 bps range) in 2025.

Even if the December FOMC meeting results in a decision to hold rates steady, it is unlikely to disrupt the broader trend of monetary easing. However, since a 25-basis-point rate cut had been the prevailing expectation, a decision to pause could lead to unavoidable short-term market volatility.

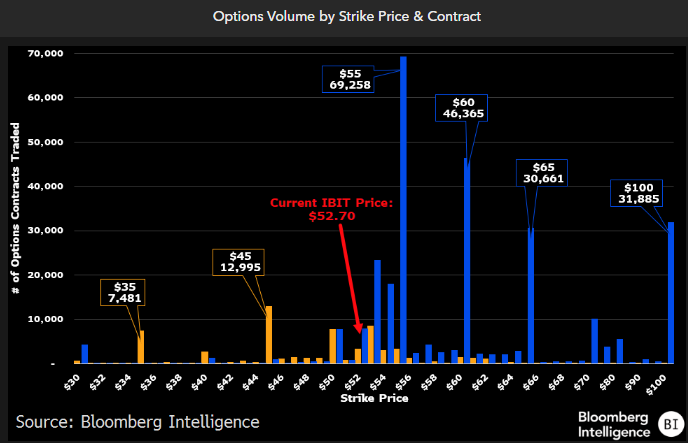

Meanwhile, the market appears to maintain a positive outlook on Bitcoin and the cryptocurrency industry. According to a tweet by Bloomberg ETF analyst Eric Balchunas, options trading for the Bitcoin ETF "IBIT," which began trading on November 19 (local time), saw a significant number of call options* at prices higher than IBIT's current level.

*Although the tweet did not explicitly label these as call options, the statement, “Basically everything to the right of the right line is betting that BTC will be higher in future. Left of it is betting lower,” implies call option trades. Additionally, related reports confirm that most of the trades involved call options.

In conclusion, Powell's relatively hawkish remarks, as well as a potential decision to hold rates steady at the December FOMC meeting, are expected to have only temporary effects. Powell’s acknowledgment of positive economic indicators such as growth rates and labor market conditions, alongside his emphasis on maintaining stability, reflects a deliberate effort to sustain the current favorable economic trajectory without causing market disruption.

As macroeconomic stability and optimistic market sentiment grow, where should we direct our attention? It is likely that participants will focus on figures or assets that represent market trends, with their influence gradually increasing.

Lastly, to illustrate the strong institutional interest in cryptocurrencies, it is worth noting that MicroStrategy (MSTR) announced on November 18 a significant purchase of Bitcoin worth $4.6 billion.

MicroStrategy has acquired 51,780 BTC for ~$4.6 billion at ~$88,627 per #bitcoin and has achieved BTC Yield of 20.4% QTD and 41.8% YTD. As of 11/17/2024, we hodl 331,200 $BTC acquired for ~$16.5 billion at ~$49,874 per bitcoin. $MSTR https://t.co/SRRtRrB2jO

— Michael Saylor⚡️ (@saylor) November 18, 2024

2. Is DeSci Emerging as a Narrative Following AI?

Recently, the crypto market has been swept by the DeSci (Decentralized Science) narrative, which focuses on building public infrastructure for scientific research using blockchain technology. This trend was initiated on November 8th when Bio Protocol, which decentralizes funding, commercialization, and incentive distribution for bioscience research through blockchain, secured investment from Binance Labs. The DeSci narrative gained even more market attention when Binance Labs hosted 'DESCI DAY' on November 13th at their Web3 event 'BUIDLer House' in Bangkok, Thailand, where key figures from the DeSci sector gathered for speeches and networking.

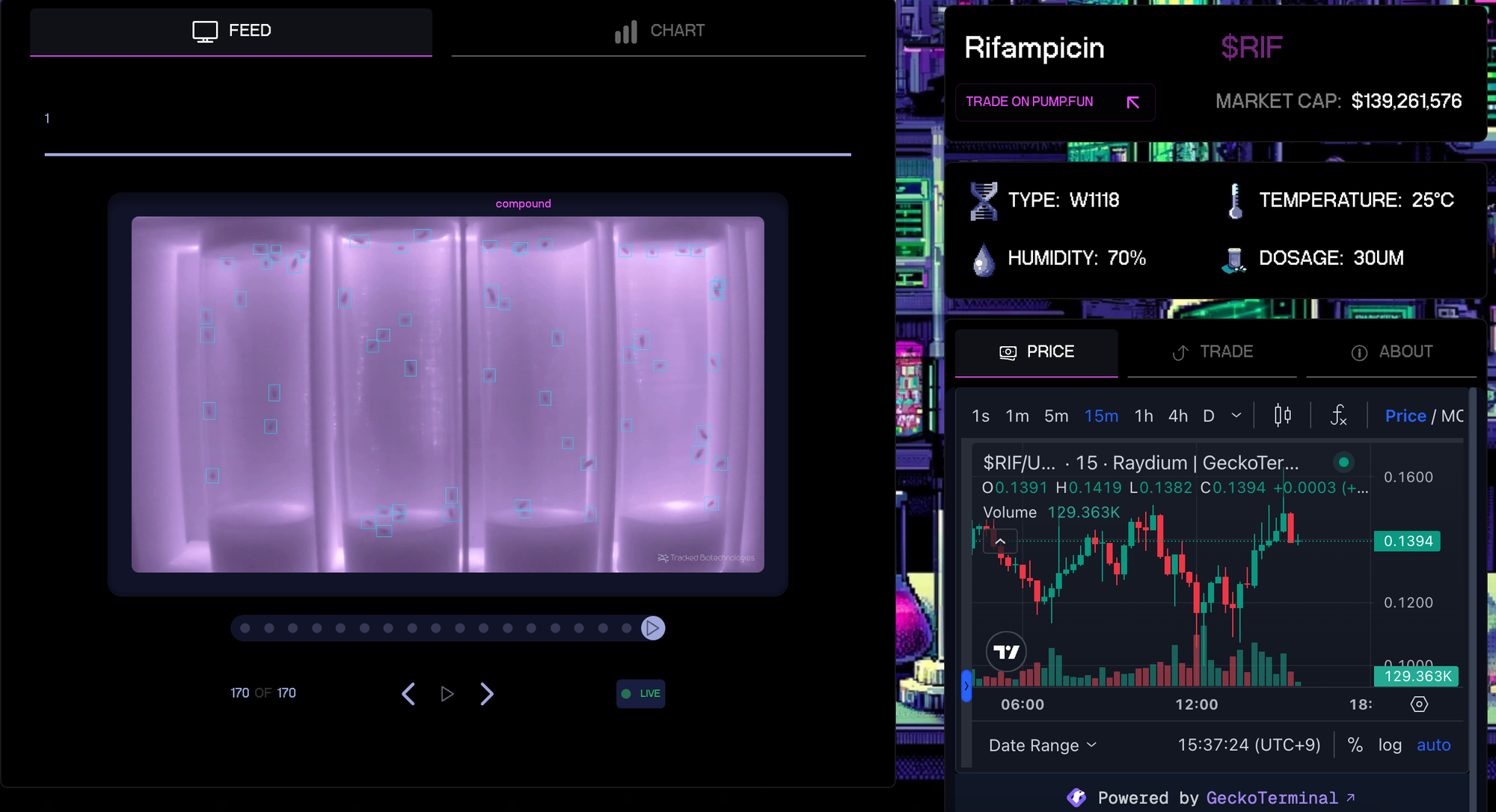

At the center of the DeSci narrative, the most notable project has been Pump Science, a memecoin launchpad combined with scientific experiments, which was unveiled by the Bio Protocol team at Solana Breakpoint in September. This project conducts life extension experiments by administering compounds to organisms like worms, flies, and mice, streaming the results in real-time. Participants can evaluate the compounds' effectiveness through these streams and own tokens representing shares in these compounds. Currently, Pump Science is conducting experiments testing two compounds: Rifampicin and Urolithin A on flies.

Notably, $RIF, the token representing Rifampicin shares on Pump Science, achieved the milestone of futures trading listing on Bybit exchange and saw its price surge approximately 260 times over five days following DESCI DAY on November 13th, reaching a market cap of $270M.

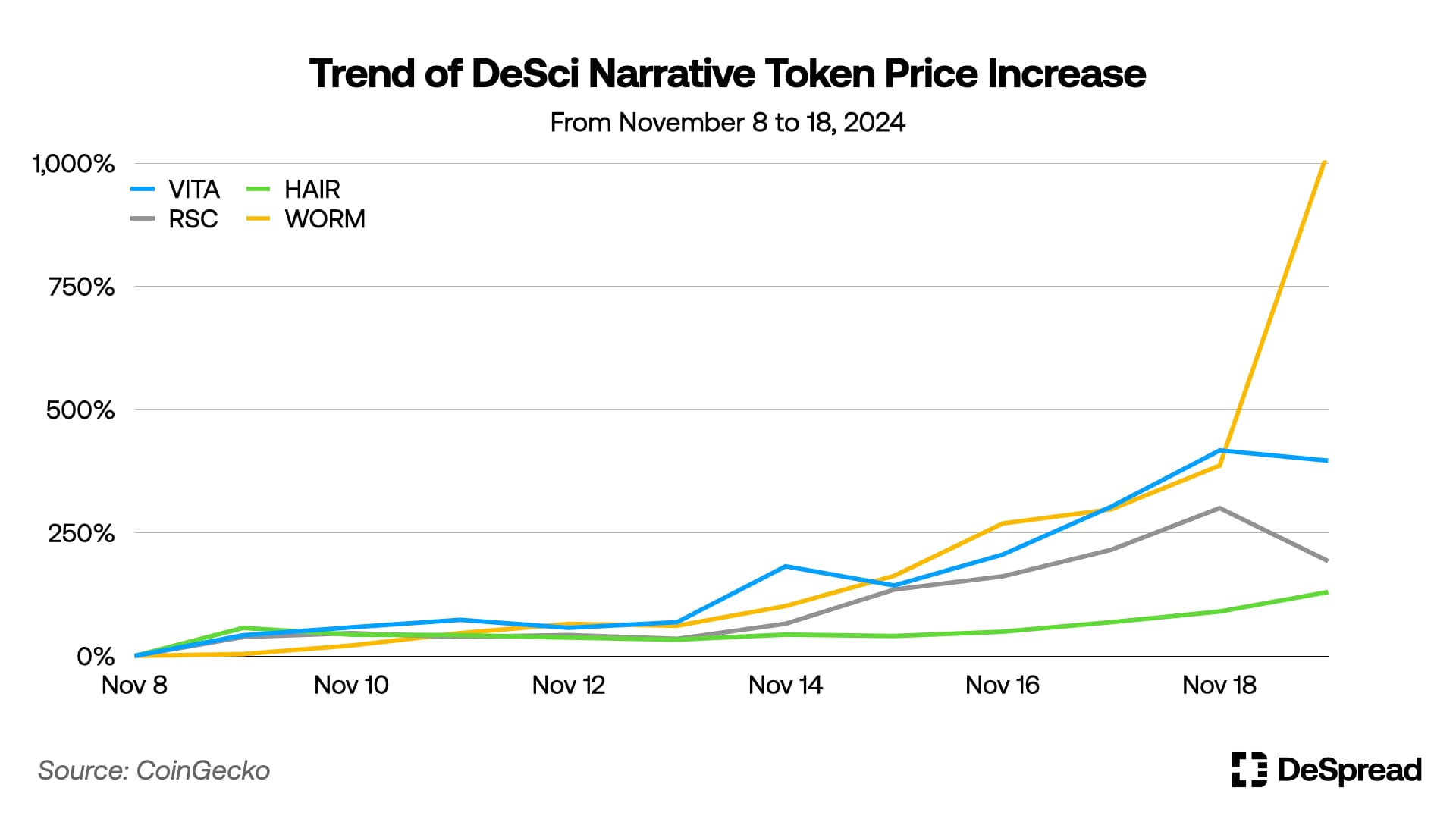

During the same period, ResearchHub's $RSC (co-founded by Coinbase CEO Brian Armstrong), DeepWorm's $WORM (highlighted by Maelstrom Fund founder Arthur Hayes) also gained significant attention, and Bio Protocol-born projects like Vita DAO focusing on human longevity research and Hair DAO conducting hair loss prevention research also received attention and recorded substantial token price increases.

2.1. DeSpread's Comments

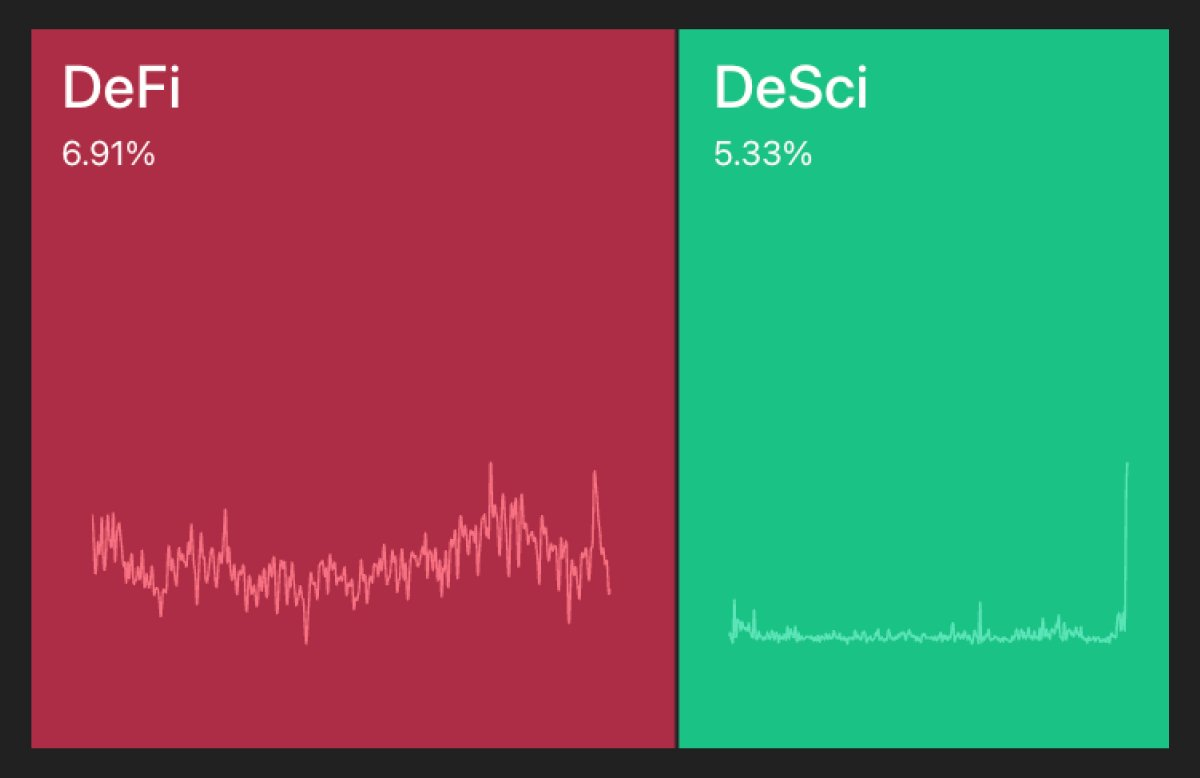

The attention received by DeSci narrative tokens over the past week has been remarkable. Despite the significant market cap difference between DeSci ($1B) and DeFi ($90B) categories on Coingecko, Kaito AI's mindshare analysis shows that DeSci narrative's mindshare surged to 5.3% as of November 17th, approaching levels comparable to DeFi narrative.

We believe the DeSci narrative gained substantial market attention due to the absence of new narratives following the AI agent trend, combined with the emergence of Pump Science and Binance's DeSci-friendly initiatives, which attracted traders seeking high-volatility, low-cap trading opportunities. Furthermore, with the current market's rapid narrative rotation, as of November 20th, TikTok narrative memecoins including $CHILLGUY are gaining prominence while DeSci narrative-based tokens have already entered a correction phase.

However, the essence of the DeSci narrative lies in solving traditional scientific community challenges through blockchain technology, including inefficient funding mechanisms, limited access to research outputs, and complex administrative procedures. Pump Science, which recently gained attention, emerged as a protocol aiming to solve the chronic problem of the scientific community that requires significant time and cost in converting basic science to clinical science using blockchain technology.

Currently, investor attention seems more focused on short-term profits available through DeSci narrative tokens based on the attention economy, rather than the problem-solving aspects and visions proposed by DeSci projects. Additionally, in the current market where Bitcoin's price and dominance continue to rise, we expect more frequent narrative and liquidity rotation among low-cap memecoins. In an environment where investor attention shifts rapidly, we believe it's essential to examine the specific solution proposals and feasibility of new projects that present high ideals and fresh ideas, and to monitor their implementation process.