Market Commentary | 12.13.

Korean crypto market trends with tax deferral news, Ethereum ETF net inflows and the Trump family's love of crypto

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the December 13 edition, we examine Korean crypto market trends with tax deferral news, Ethereum ETF net inflows and the Trump family's love of crypto.

1. Will Tax Deferral Be a Catalyst for the Booming Korean Crypto Market?

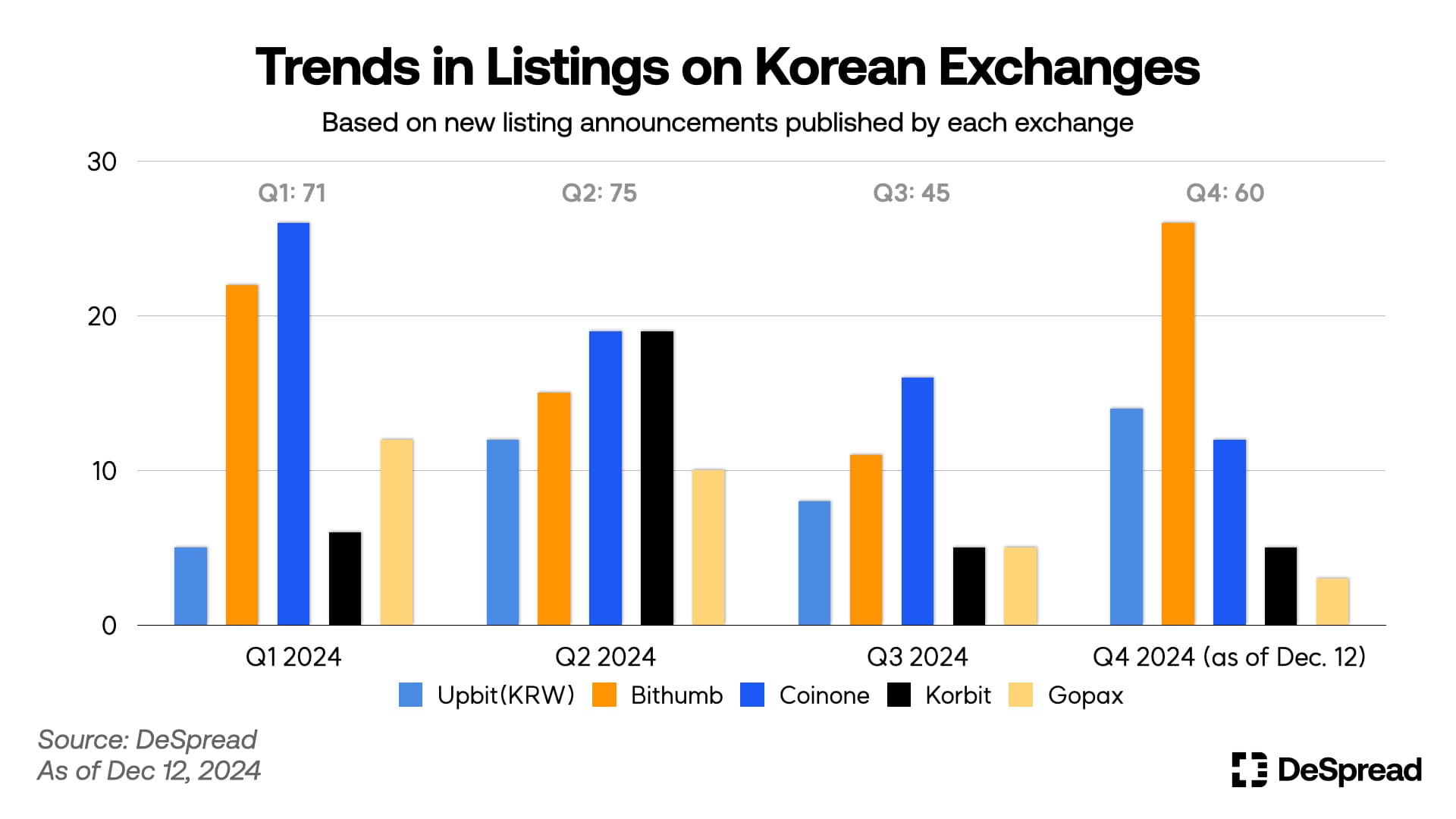

The number of listings on Korean exchanges dropped significantly to 45 in Q3, compared to over 70 listings in Q1 and Q2. This decline can be attributed to both the extended correction period in the crypto market following substantial gains in the first half of 2024, and the implementation of the Virtual Asset User Protection Act on July 19, as mentioned in ‘Market Commentary | 10.18.’

With the introduction of joint listing review guidelines under this law, exchanges like Coinone, Korbit, and Gopax, which had previously relied on independent listing policies, faced significant challenges. In fact, following the regulatory changes, Coinone listed only 8 assets, Korbit listed none, and Gopax listed 2, with only Coinone maintaining a similar level of listings to Upbit and Bithumb in the third quarter. — Excerpt from 'Market Commentary | 10.18.'

Meanwhile, as of December 12, the total number of listings across Korea's top 5 exchanges in Q4 has reached approximately 60, showing a 33% increase from Q3 even before December ends. This increase can be attributed to the overall crypto market boom, catalyzed by potential Trump candidacy, which led to significantly increased trading volumes in Korea and motivated exchanges to pursue more aggressive listing policies.

Looking at individual exchange listings, Upbit and Bithumb accounted for two-thirds of total listings with 14 and 26 listings respectively. Including Coinone's 12 listings, the top three exchanges by trading volume (Upbit, Bithumb, Coinone) represented over 85% of total listings, indicating increased concentration among major exchanges.

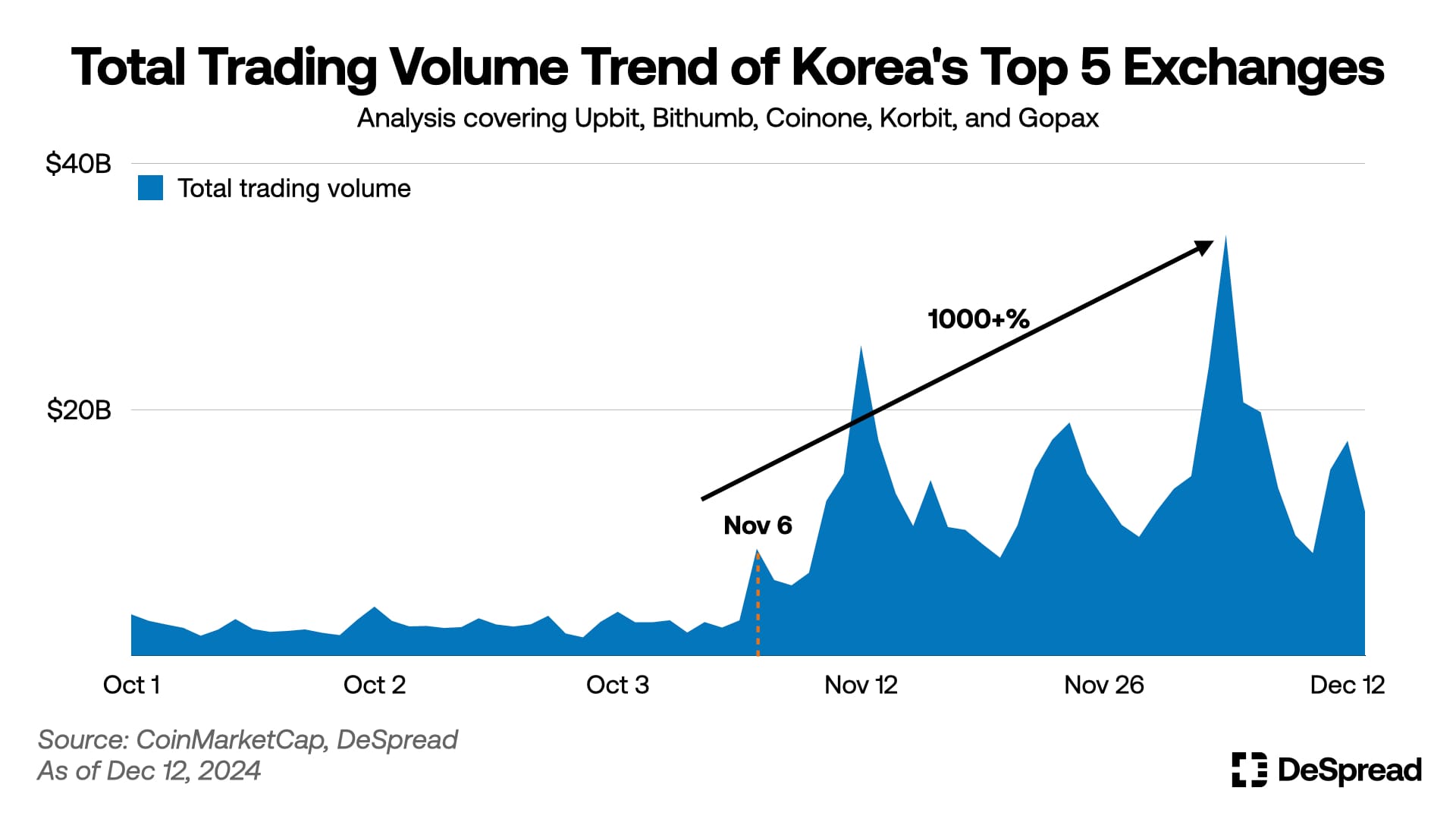

Examining the trend in total trading volume across Korean exchanges, there was a sharp increase starting November 6, right after the U.S. election speculation. While daily average trading volume was under $3B before November 5, it jumped to $8.6B on November 6, and reached a peak of approximately $34.2B on December 3 - more than 11 times higher than pre-U.S. election levels.

Looking at monthly exchange market share, while Bithumb temporarily increased its share to 36% in October, Upbit's dominance returned in November during the market boom, capturing over 70% of domestic trading volume. This differs from the market dynamics in January and February 2024, when Bithumb maintained a 30-40% higher market share (source: ‘DI - 07: Market Commentary | 09. 20.’). Considering Bithumb's Q4 listings (26) were almost double that of second-place Upbit (14), it appears Upbit successfully maintained and expanded its trading volume market share despite Bithumb's aggressive listing strategy.

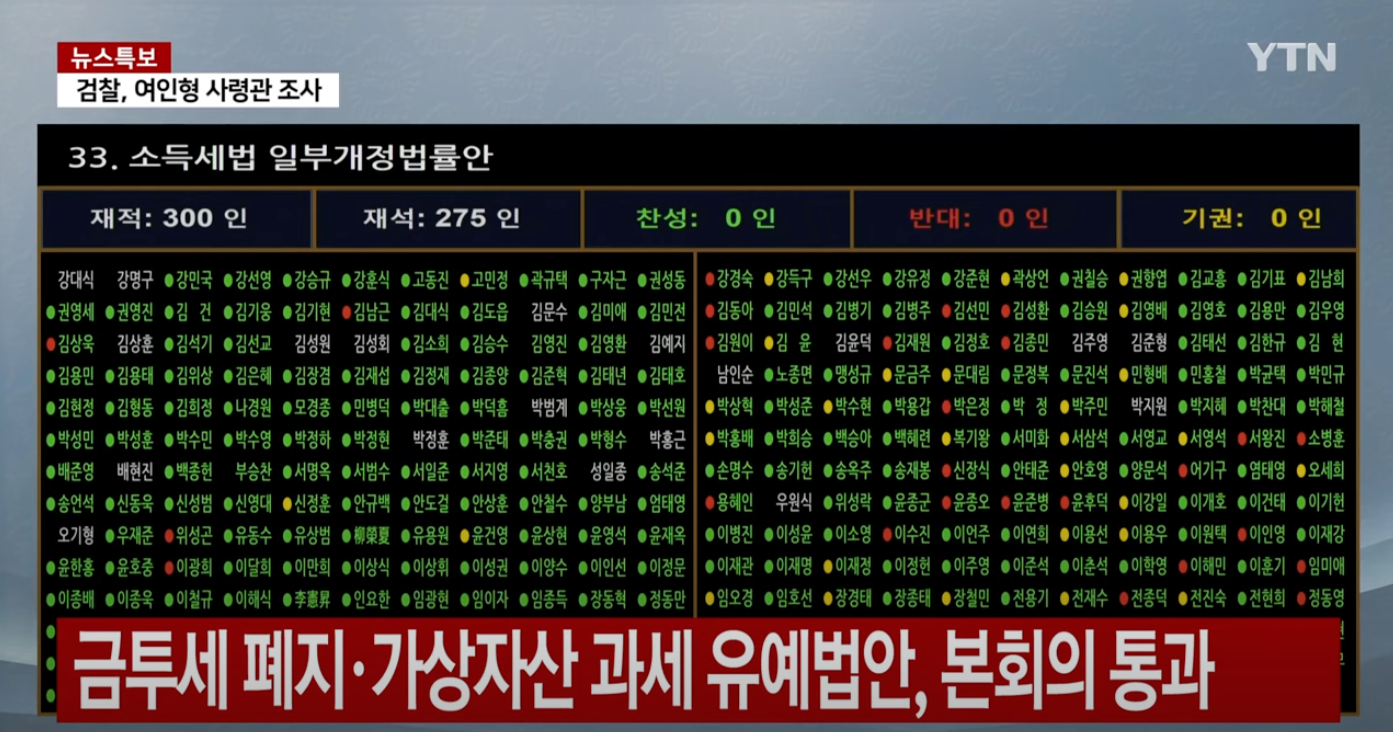

On Tuesday, December 10, the National Assembly passed a partial amendment to the Income Tax Act, which included both the abolition of the Financial Investment Income Tax and a two-year deferral of crypto taxation. The ruling and opposition parties had maintained opposing positions on crypto tax deferral. While the People Power Party consistently supported the tax deferral, the Democratic Party initially advocated for taxation under the principle of "taxation where income exists." However, the Democratic Party eventually shifted its position to support the deferral on December 1, considering factors such as nearly 80,000 signatures on a national petition supporting tax deferral, equity issues regarding the abolition of financial investment tax while maintaining crypto tax, and practical challenges in tracking personal wallets and establishing clear taxation standards.

After the Democratic Party's official announcement supporting the two-year crypto tax deferral, Korean crypto trading volume increased sharply. While the total trading volume across the top 5 Korean exchanges was around $14.6B on December 1, it surged to $23.4B on December 2 and $34.2B on December 3, representing a 2.34-fold increase over two days. As discussed in Market Commentary | 12.06., Ripple ($XRP) attracted the most attention from Korean investors during this period.

However, after this temporary surge in trading volume, the total trading volume in the Korean crypto market has returned to pre-tax deferral announcement levels. It remains to be seen whether this tax deferral news will serve as a catalyst for further growth in the Korean crypto market, which has already entered a boom phase.

2. Growing ETH ETF Net Inflows and Trump Family's Love of Crypto

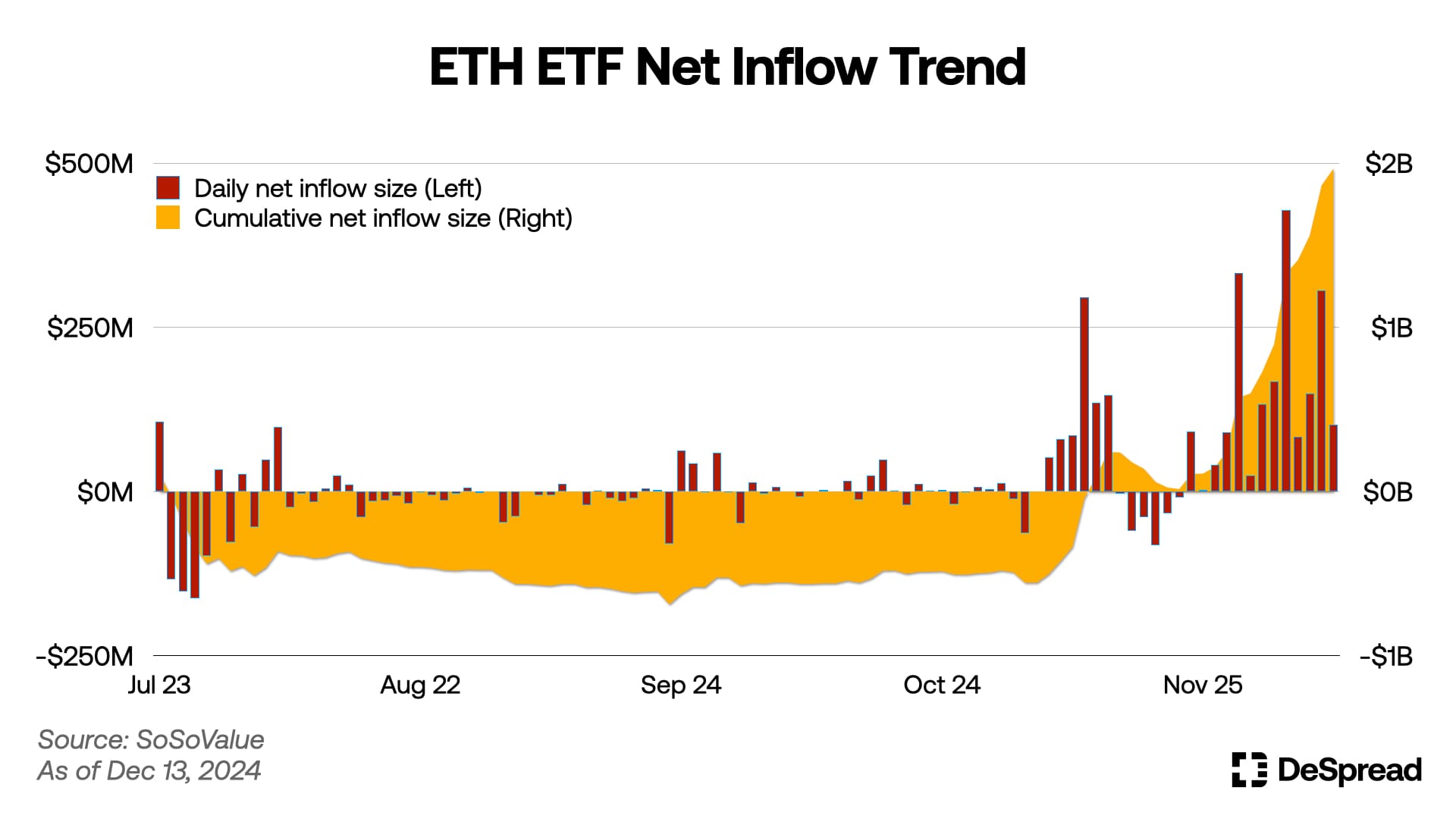

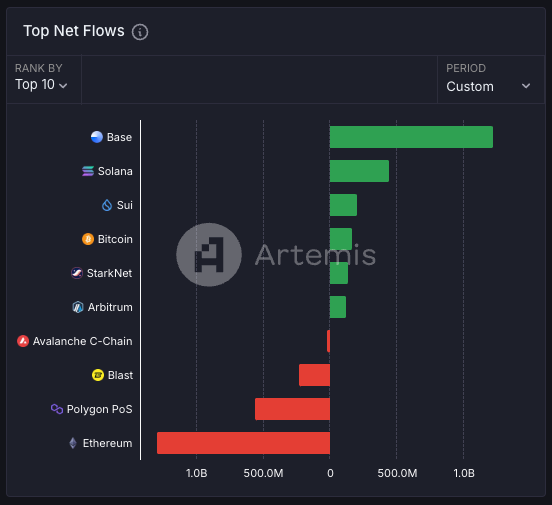

Ethereum ETF, which had been experiencing consistent net outflows since its approval and trading commencement on July 23, reversed to net inflows starting November 6 following Trump's potential candidacy. After a large net inflow of $330M on November 29, it has shown rapid expansion with average daily net inflows of approximately $190M up to the date of writing.

[ETH ETF Average Daily Net Inflows]

- November 6 - November 27: $49.7M

- November 29 - December 11: $192M

Additionally, Ethereum's price began a significant upward trend coinciding with the ETF net inflow reversal, rising approximately 67% from $2,400 on November 5 to a peak of $4,000 on December 8.

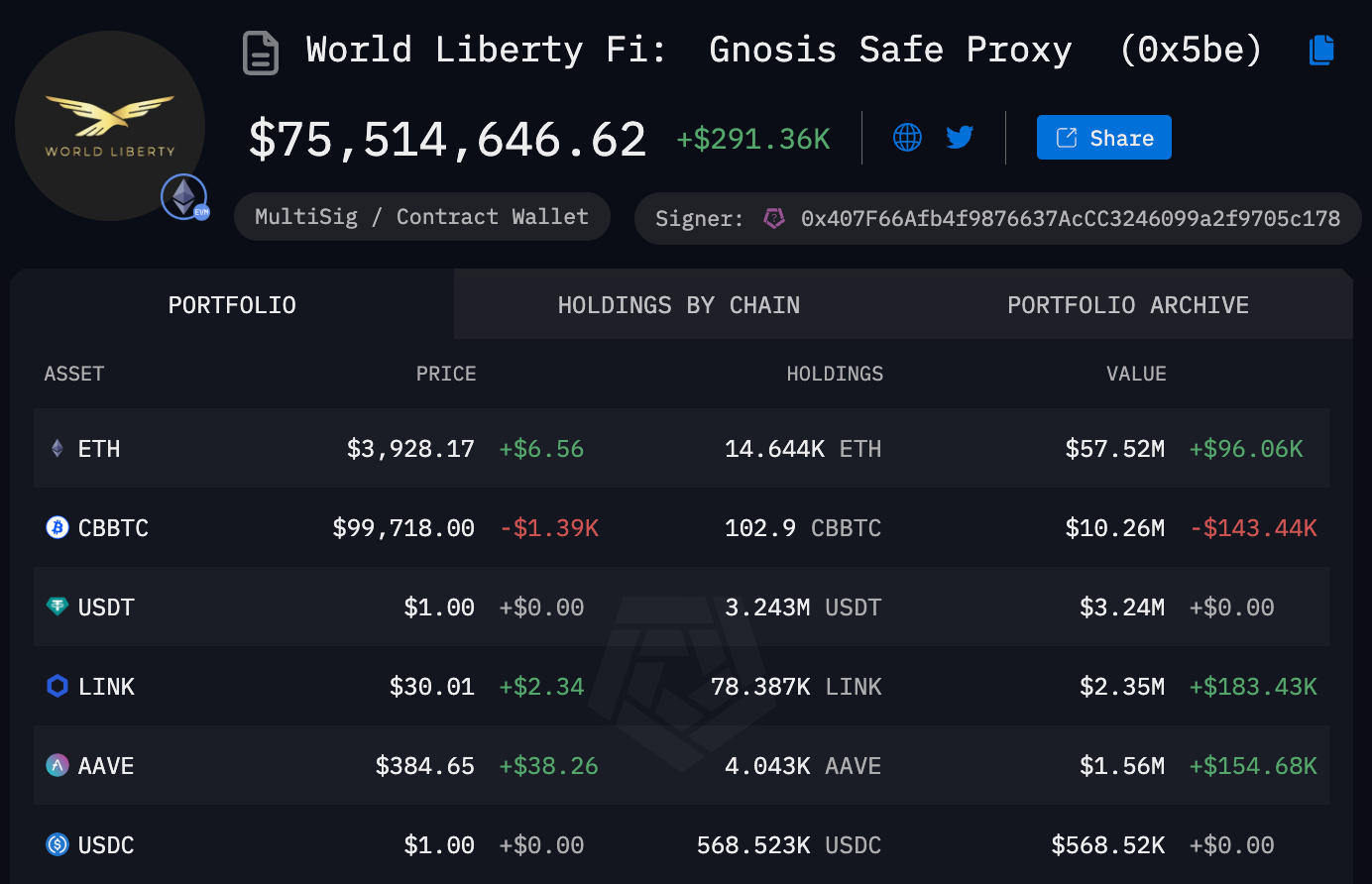

Meanwhile, one of the wallet addresses identified as belonging to World Liberty Financial, a DeFi platform closely associated with the Trump family (as discussed in the October 18 Market Commentary), has been consistently purchasing Ethereum through the decentralized exchange CowSwap using stablecoins since November 29, and currently holds approximately $57M worth of Ethereum.

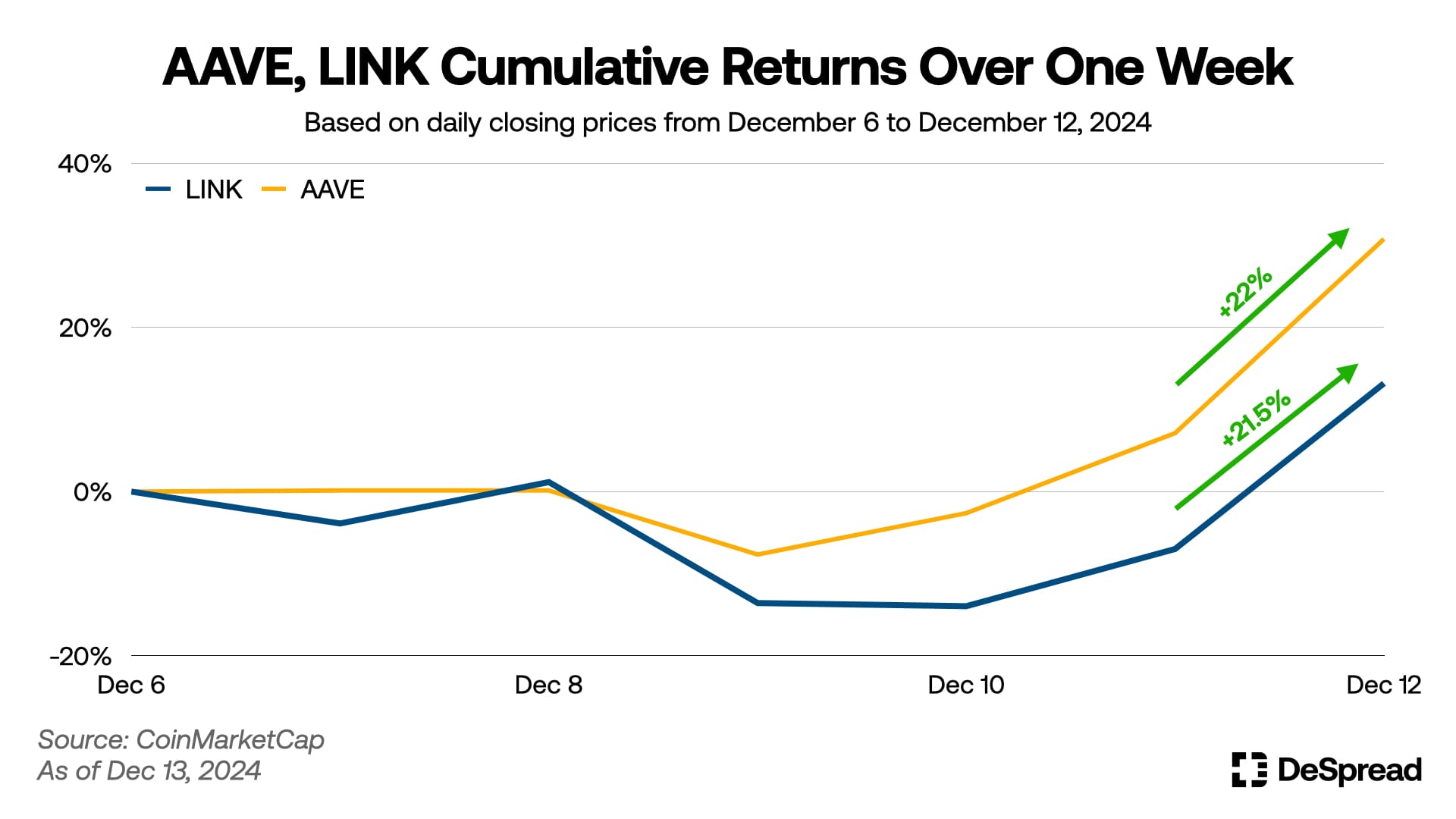

Furthermore, on December 12, this wallet address purchased not only Ethereum and cbBTC but also $AAVE, the governance token of lending protocol Aave, and $LINK, the network token of oracle protocol Chainlink, through CowSwap. As these on-chain records spread on X, both $AAVE and $LINK recorded sharp price increases of about 22% in just one day.

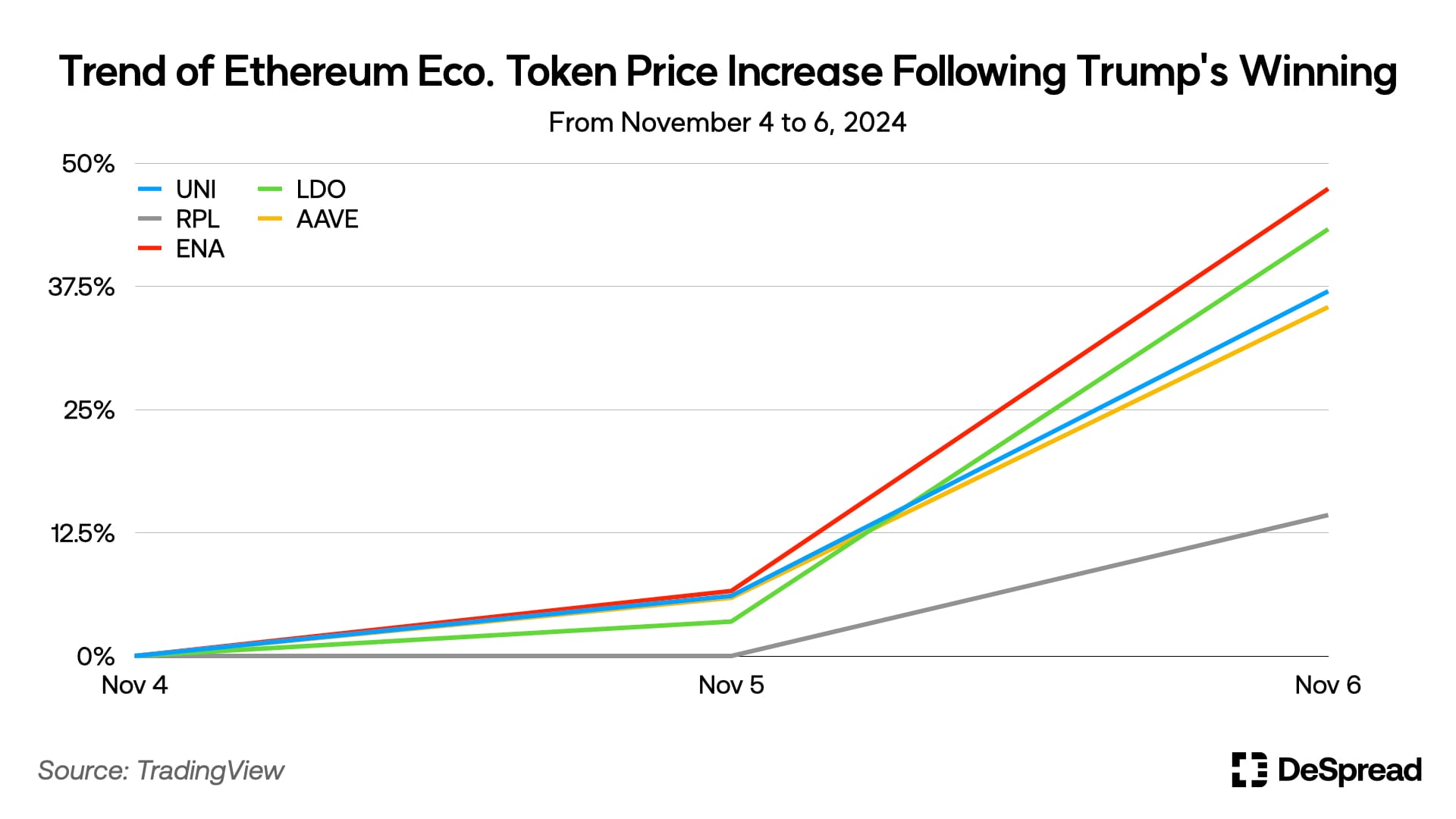

As mentioned in Market Commentary | 11.08., DeFi tokens in the Ethereum ecosystem experienced sharp price increases due to expectations of Gary Gensler's dismissal and changes in SEC's stance following Trump's potential election. It's worth monitoring whether the Trump family's continued participation in the Ethereum ecosystem could function as a catalyst for the ecosystem's revival and capital inflows in the future.

References

- KBS, 민주 “가상자산 과세 2년 유예”…결국 ‘금투세 시즌2’

- BizFACT, 금투세 폐지·가상화폐세 유예 확정···불안한 주주 희망될까

- YTN 유튜브, 금투세 폐지·가상자산 과세 유예법안, 국회 본회의 통과 / YTN

- SoSoValue, US ETH Spot ETF Dashboard