Market Commentary | 12.21.

Powell's Hawkish Rate Cut and $PENGU Airdrop

The Market Commentary provides a weekly review of major issues, along with DeSpread Research's insights on key points to watch moving forward. In the December 13 edition, we examine Powell's Hawkish Rate Cut and $PENGU Airdrop.

1. Powell's Hawkish Rate Cut: What Does It Mean?

At the Federal Reserve's FOMC meeting held at 4 AM Korean time on December 19, the benchmark interest rate was cut by 25bp as expected. However, despite the rate cut decision, the S&P 500 index, representing the U.S. stock market, fell by -3.25% as of writing, while Bitcoin recorded a dramatic decline of -11.7%, sending shockwaves through the market. The market's sensitive reaction wasn't due to the rate cut itself, but rather to the Fed's detailed economic outlook revealed during Powell's press conference following the FOMC.

First, as discussed in 'Market Commentary | 11.22.', Fed Chairman Powell had been taking a cautious stance on the economic outlook since November. The following statement temporarily led to a surge in the possibility of a rate hold at the December FOMC:

We know that reducing policy restraint too quickly could hinder progress on inflation. At the same time reducing policy restraint too slowly could unduly weaken economic activity and employment

This stance from Powell was similarly reflected in the latest FOMC statement (Source: Yonhap Infomax), which included the following:

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

These statements confirm that the Fed maintains a cautious yet more hawkish stance than before. In particular, it seems they are somewhat wary of the potential inflationary risks that could arise from the policies proposed by Trump following his election.

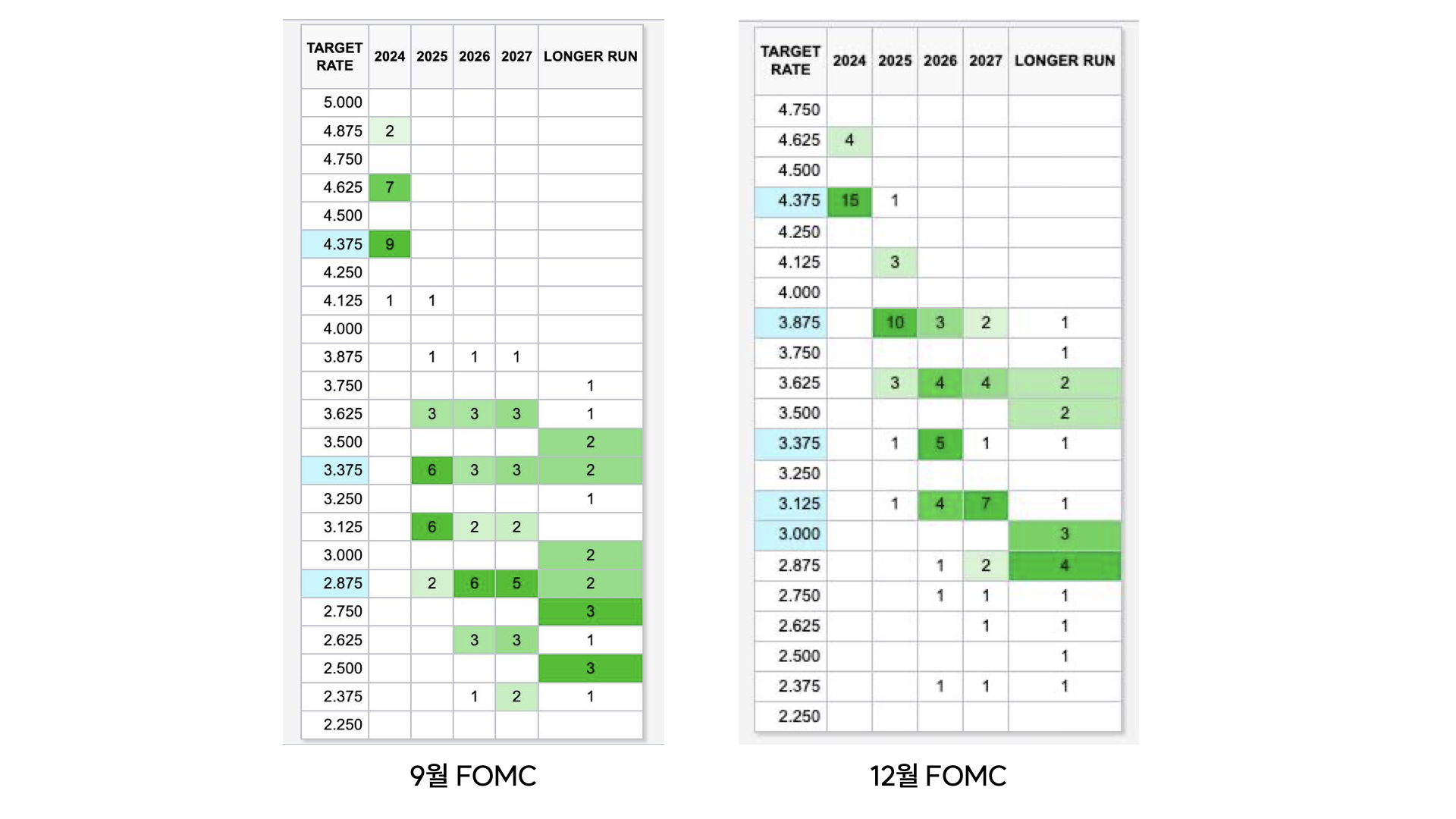

This Fed attitude is also evident in the changes to the dot plot of the target federal funds rate (FFR). The dot plot released after the September FOMC (left) projected rate cuts to a maximum of 4.375 (425-450bp range) in 2024, then to 3.375 or 3.125 in 2025, and to 2.875 in 2026.

However, these projections were adjusted in the December FOMC dot plot (right). The target rate for 2025 was revised upward to 3.875, suggesting 50-75bp less in cuts than previously expected, and the 2026 projection was modified to 3.375, indicating 50bp less in cuts than the earlier forecast.

The dot plot changes show that the market is reacting more sensitively to the adjustment in long-term rate cut plans for 2025-2026 rather than the December rate cut itself.

Additionally, during the post-FOMC press conference, Powell stated:

With today’s action, we have lowered our policy rate by a Page 2 of 4 December 18, 2024 Chair Powell’s Press Conference PRELIMINARY full percentage point from its peak, and our policy stance is now significantly less restrictive. We can therefore be more cautious as we consider further adjustments to our policy rate.

He indicated that with policy rates now 1%p lower than their peak and the policy stance becoming significantly less restrictive, there's no need to maintain an unconditional rate-cutting stance.

Furthermore, during the Q&A session, he mentioned "We're significantly closer to neutral," suggesting that the policy rate is approaching the neutral rate level, which implies there might not be much room left for additional rate cuts.

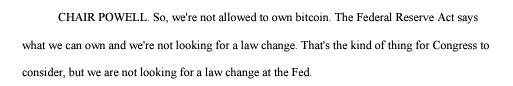

As a side note, when asked by a reporter about Trump's consideration of Bitcoin as a strategic reserve asset, Powell avoided expressing the Fed's opinion on Bitcoin with the above statement.

With the adjustment to the Fed's rate cut cycle plan, the market is likely to face negative pressure in the short term from a liquidity perspective. As we approach President-elect Trump's inauguration, and given that the Fed has entered a phase of serious discussion about potential inflationary risks from his proposed policies, the market will inevitably go through a process of absorbing this uncertainty.

However, this FOMC decision should not be interpreted as signaling the end of the cryptocurrency market boom that began after Trump's election. Rather, I believe it's necessary to continuously monitor how the outline of relevant policies that could affect the market will take shape before and after Trump's inauguration.

2. $PENGU Airdrop: Success or Failure?

Pudgy Penguins is an Ethereum-based penguin NFT project launched in July 2021. The initial collection of 8,888 Pudgy Penguin NFTs, priced at 0.03 ETH each, sold out in just 19 minutes after launch. By August of the same year, it achieved significant popularity with a floor price reaching 3.4 ETH on OpenSea. However, its initial success was short-lived due to delays in roadmap implementation and misappropriation of funds by the project team in late 2021.

In April 2022, the project reached a turning point when current CEO Luca Netz acquired it for 750 ETH (approximately $2.5 million at the time). He presented a vision of strengthening the Pudgy Penguins IP and developing it into a brand, leading to the production and sale of various merchandise including clothing and toys. Notably, Pudgy Penguins plush toys not only secured placement in about 3,000 Walmart stores but also achieved the top sales ranking in three Amazon categories. Building on these successes, the project recorded cumulative sales of approximately $13M as of October 2024, marking its second golden age.

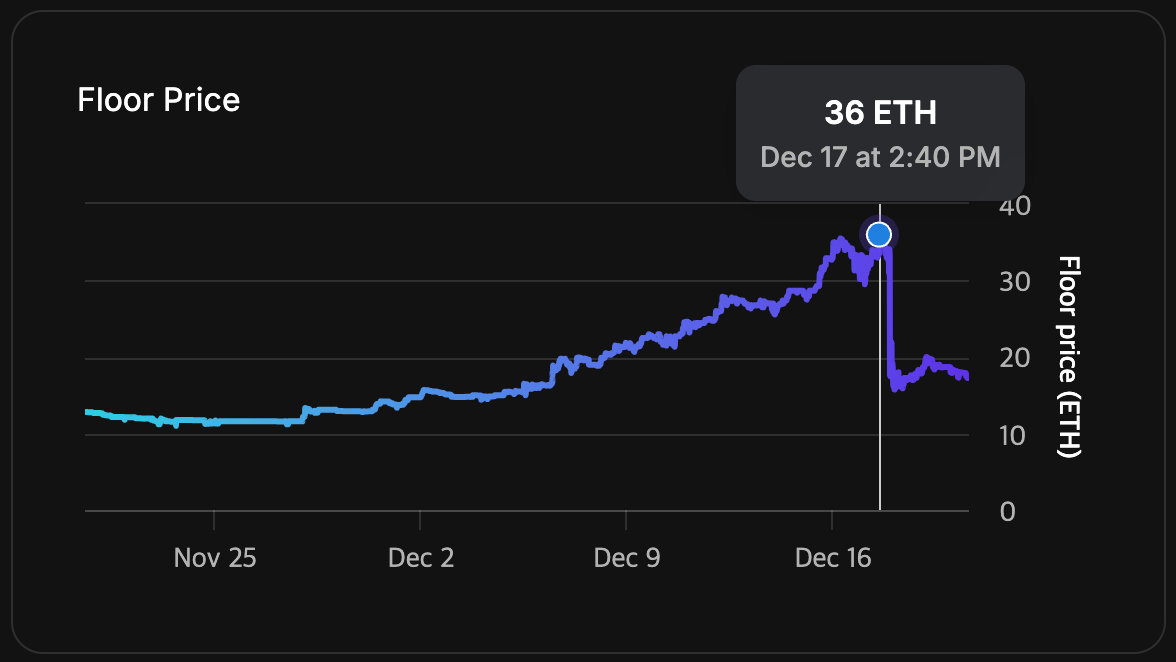

On December 6, amid this growth trajectory, the Pudgy Penguins project announced the issuance of memecoin $PENGU through CoinDesk and their official X account. According to the token allocation plan released simultaneously, 25.9% of the total supply of approximately 88.8B tokens was scheduled for distribution to the Pudgy Penguins community. This news heightened airdrop expectations within the community, causing the floor price of Pudgy Penguin NFTs to surge from 16 ETH to 20 ETH in just one day after the announcement. On the airdrop day, December 17, it reached a peak of 36 ETH, demonstrating the market's enthusiastic response.

On the airdrop day, December 17, a total of 40.2B $PENGU tokens were allocated not only to the Pudgy Penguins community but also to most Ethereum and Solana on-chain activity users. At 22:00 Korean Standard Time when the airdrop began, approximately 4.7 million users accessed the $PENGU claim website, with over 100,000 claim requests submitted, temporarily causing the website to crash. This became one of the most extensive airdrops ever conducted for on-chain users.

Meanwhile, the Pudgy Penguins team implemented a system allowing users to connect all their wallets and claim their airdrop allocations simultaneously. However, some raised concerns that this claim method, combined with the team's close relationship with on-chain data analysis platform Nansen, might actually be aimed at mapping relationships between users' on-chain wallet addresses.

After initial selling pressure from airdrop recipients subsided, $PENGU's price rose to a market cap of $2.5B over two days. However, following the December FOMC, it declined and stabilized around $1.5B, showing somewhat disappointing price performance. In this context, how the Pudgy Penguins team utilizes $PENGU as a project element to boost prices and how they healthily utilize the collected user data will ultimately determine the success of the $PENGU airdrop.

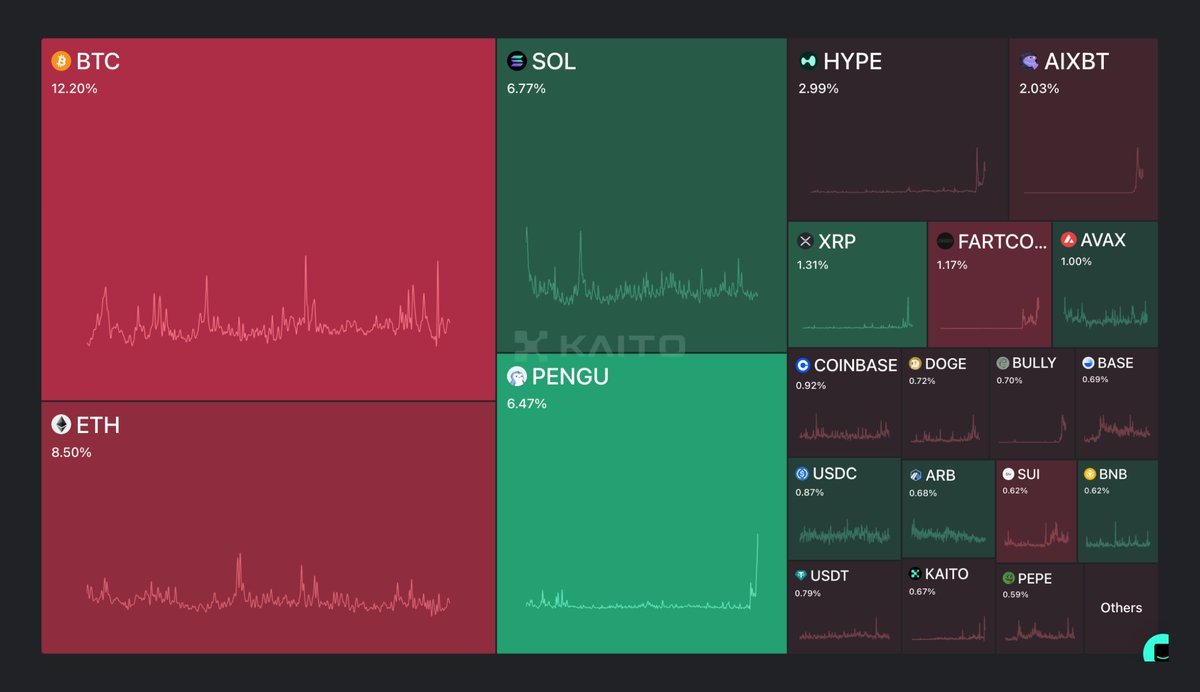

Nevertheless, $PENGU token achieved an encouraging 6.47% on the mindshare index of data analysis platform Kaito.ai on the airdrop day. This widespread token distribution approach by Pudgy Penguins is likely to serve as an important reference case for NFT/meme projects in how to gain market attention when issuing project-based tokens and leverage it as a driving force for project development.

References

- 연합인포맥스, 12월 FOMC 성명 전문 번역

- Federal Reserve Board, Transcript of Char Powell’s Press Conference December 18, 2024

- Forbes, Penguins: How Pudgy Secured Walgreens And $13 Million In Sales