Can Protocol-Owned Liquidity be DeFi 2.0?

Limitations of liquidity mining and liquidity bondage

1. Double-edged Sword of Liquidity mining

The cryptocurrency market and trends change very rapidly. Many projects come and go, and among them, we can find projects that pioneer new and meaningful attempts.

Let’s think about Compound that brought about ‘DeFi Summer’ in last year. Compound rewarded protocol contributors with ‘Liquidity Mining’, which allowed Compound to quickly bootstrap its protocol in its early stages.

Since then, projects modeled on liquidity mining have begun to emerge, giving rise to an era of open financial platform led by Uniswap, Aave, and Yearn Finance. People began to rush into projects that boast high annual percentage rate(APY) and became a ‘Yield Farmer’ earning profits from DeFi.

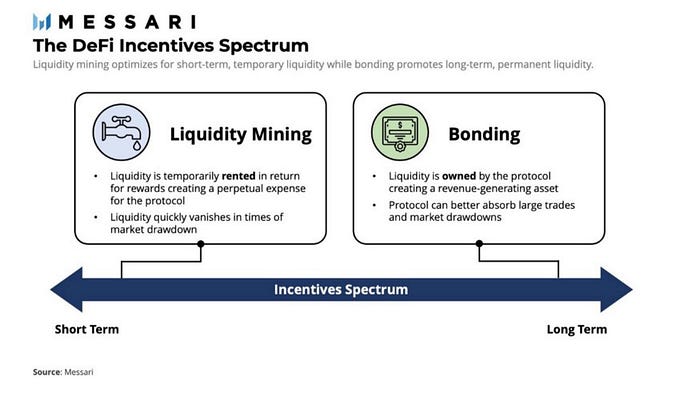

However, this liquidity mining model can be a double-edged sword. Although liquidity mining can help bootstrap protocols in the early stages with community building and user acquisition, the downside was apparent. As the compensation for liquidity supply is continuously released, there exists a selling pressure, making the model not sustainable in the long-term.

In order to compensate for liquidity mining, DeFi services attracted users with high APY, and high inflation of circulating tokens eventually resulted in a drop of token prices.

2. Call Option and Put Option

There have been several attempts to mitigate these shortcomings of liquidity mining. One interesting idea was to use ‘Option’, setting the execution price and expiration date for tokens to reduce immediate selling pressure coming from liquidity mining compensation.

2.1. Range Token

Synthetic assets and derivatives protocol UMA has launched Range Token. It sets a certain range of token prices by combining put and call options to control the number of tokens and price that can be received at the time of option execution.

2.2. Call option

Andre Cronje, founder of Yearn Finance, technical advisor of Fantom, also proposed compensation using call options. The compensation is paid out with call option that can be purchased after a certain number of months at an X% discount from the current token price. Adding these additional conditions lowers the token selling pressure and prevents the possibility of an X% drop during that period.

3. Protocol-Owned Liquidity, POL

3.1. OlympusDAO

OlympusDAO is a decentralized reserve currency protocol operated by algorithms and governance. OHM’s value is determined by several assets deposited in Olympus DAO Treasury. Olympus’ governance is operated by game theory with unique structure of ‘Staking’ and ‘Bond’.

Users can create LP tokens such as OHM-DAI and OHM-FRAX to issue ‘Bond’ and purchase OHM at a discounted price for a certain period of time (currently, 5 days due, ~7% discount rate). So when you purchase OHM with discount, the LP token you made is exchanged with the protocol.

Unlike existing methods where liquidity providers can stop supplying liquidity at any time and protocols receive liquidity, the Olympus’ staking and bond structure can create ‘Protocol Owned Liquidity (POL)’ by tying LP tokens into a protocol in the form of bonds to maintain liquidity.

In addition, the protocol itself, not the user, own the LP tokens, thereby generating transaction fees from the liquidity pool and at the same time preventing immediate selling pressure from liquidity providers.

OlympusDAO has also launched ‘Olympus Pro’ so that other protocols can make use of this mechanism.

3.2. Abracadabra.Money

Abracadabra Money is a protocol that allows users to borrow stablecoins called MIM (Magic Internet Money) by collateralizing staking liquidity assets such as yvUSDT and xSUSHI.

Collateralized loan stablecoins such as MakerDAO issued stablecoins with assets such as Ethereum, USDC, and USDT as collateral. However, if people use yvUSDT obtained by staking USDT in Yearn or xSUSHI in Sushi as collateral they can receive deposit or staking rewards, and also take a loan. In other words, the liquidity and efficiency of assets are maximized.

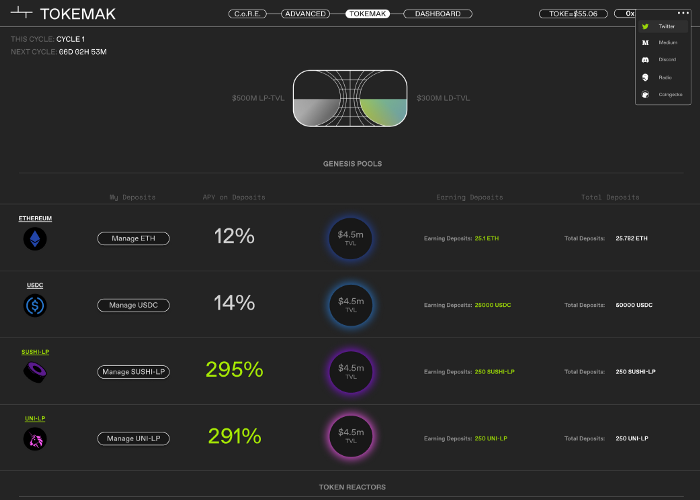

3.3. Tokemak

Tokemak is a decentralized market maker and liquidity provider operated by DAO. Users deposit assets in Token Reactor and get TOKE tokens for liquidity supply. Liquidity Director(LD) becomes Tokemak DAO by staking its TOKE. Liquidity directors have the authority to analyze protocols to supply liquidity and send deposited assets to the protocol.

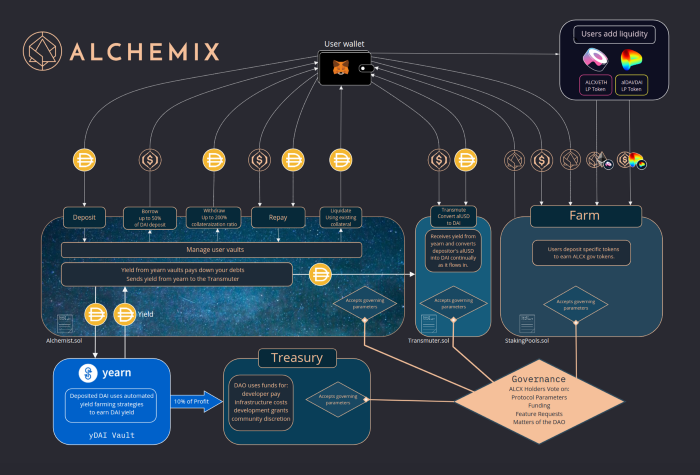

3.4. Alchemix

Alchemix is a collateralized stable loan platform using Yearn Vault that automatically repays loans while collateral deposited in Vault generates deposit compensation. 1 alUSD corresponding to 1 DAI is used as a stablecoin, and the interest is generated by Yearn Vault and the ‘Transmuter’ algorithm function maintain the price of alUSD.

4. So, Is it Defi 2.0?

So far, the existing DeFi projects were not too different from traditional financial services such as swaps, farm, collateral loans, and leverage. And they used liquidity mining and gave high APY to attract users. However, it failed to serve as a long-term operable model.

OlympusDAO proposed a new idea of ‘Protocol Owned Liquidity’. In the existing DeFi, liquidity was supplied by users and was subject to the users, whereas in OlympusDAO, the protocol itself can take liquidity and control.

Liquidity is issued as bonds so that liquidity is bound to the protocol in the long term. This reduces inefficiency and does not require indiscriminate reward of tokens as liquidity supply compensation.

In addition to OlympusDAO, many projects have emerged wanting to improve liquidity and capital efficiency, such as Alchemix and Tokemak. This is definitely a new and interesting attempt. All these protocols aim to maximize liquidity and improve capital efficiency.

However, the symbolism and meaning of early DeFi projects such as Uniswap’s AMM, Compound’s liquidity mining, and Yearn Finance’s aggregator cannot be ignored.

Currently, OlympusDao is pushing it’s narrative as ‘DeFi 2.0’ on Twitter. So far, It seems that ‘DeFi 2.0’ is still Buzz Word for marketing, but we should keep an eye on whether it actually will be Defi 2.0 game changer for DeFi or simply a top compatible version of DeFi 1.1. Time will tell.