Growth 0 to 1: Hyperliquid

User-Centered New Philosophy: The Growth Story of Hyperliquid

As of May 2025, Hyperliquid has achieved a daily trading volume of $22B and open interest of $10.1B, ranking 3rd among all cryptocurrency exchanges globally. Hyperliquid's success stems from a combination of differentiated strategic positioning and a community-centric growth model. This article examines the growth trajectory from the testnet launch in November 2022 to the TGE.

1. From Centralization to Decentralization: FTX's Collapse and Hyperliquid's Genesis

In Jeff's interview "Hyperliquid Founder: How to Win in Crypto," we learn that Hyperliquid's birth is deeply connected to the industry's turning point - FTX's bankruptcy in 2022. Founder Jeff Yan, a former Google Brain and OpenAI engineer, founded Chameleon Trading from 2020 to 2022, developing CEX-based high-frequency trading systems and operating as a top-tier market maker across multiple centralized exchanges, accumulating real market experience. The FTX collapse provided him with decisive inspiration for founding Hyperliquid. Thinking "suddenly people had a real reason not to trust centralized exchanges" and "the world was finally ready to embrace DeFi," Jeff and his team began focusing on building Hyperliquid.

He established a unique philosophy by questioning the fundamental VC-centric growth model of existing Web3. His approach of rejecting VC investment and adopting user-first principles was based on the belief that "to succeed, you must prioritize long-term user value over short-term profits" and "the key to success is building products that real users love and use for a long time, not VC-centric ones." This philosophy became the foundation for all of Hyperliquid's future strategic decisions and the starting point for a unique growth model that simultaneously pursued trust with the community, transparency, and technical excellence.

2. Community and Testing (November 2022 ~ August 2023)

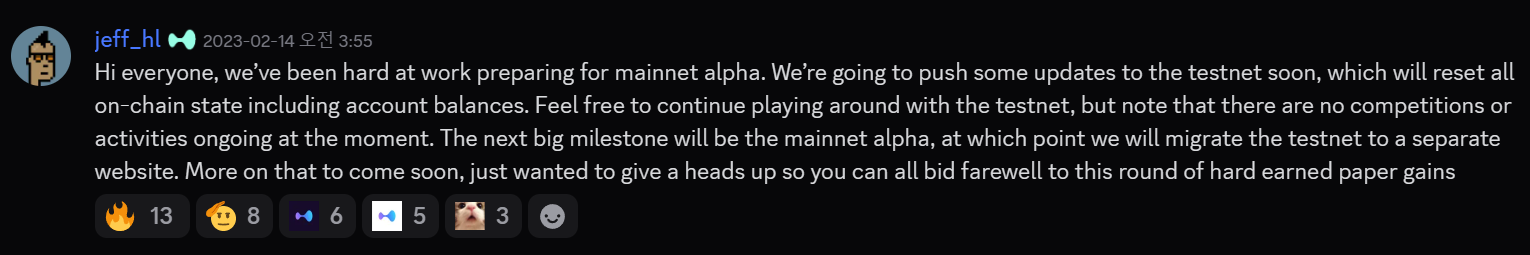

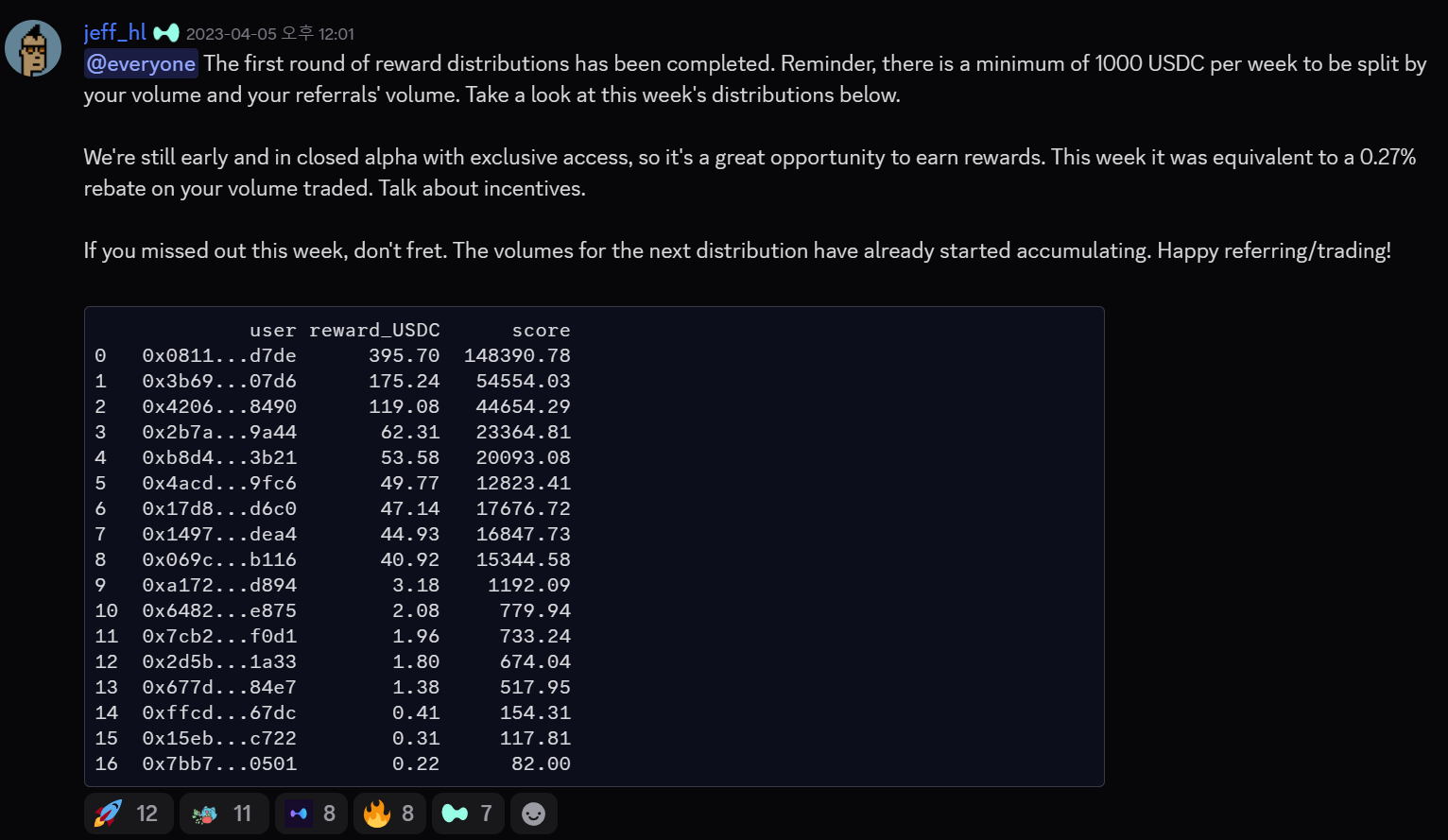

In November 2022, Hyperliquid launched the "Futures paper trading competition" event on Arbitrum Goerli testnet. From the first event, the Hyperliquid team made transparent communication with the community a core value. The team shared all event progress in real-time through Discord and honestly disclosed unexpected technical issues such as Arbitrum testnet's block generation problems.

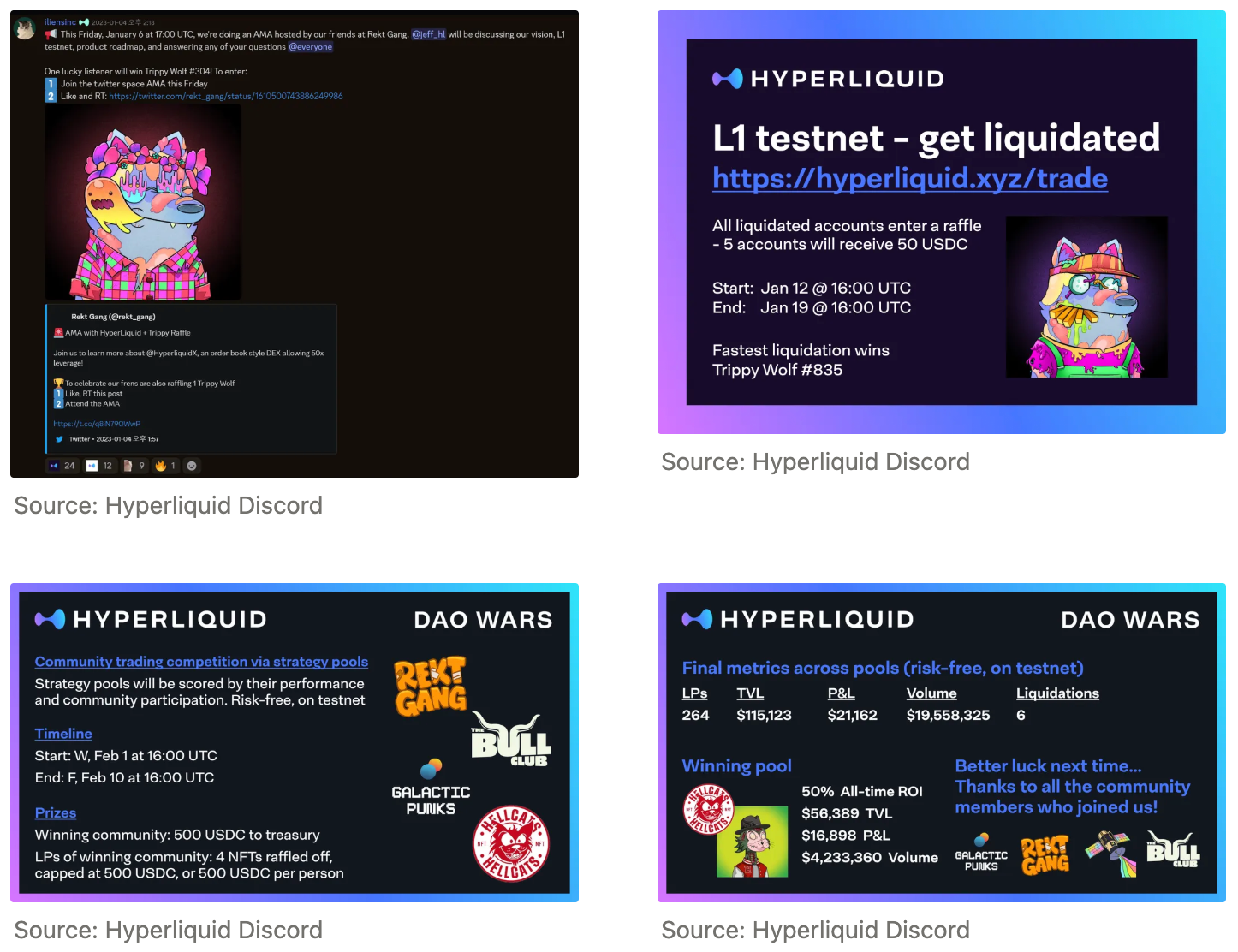

After a month of testing, Hyperliquid announced its own testnet in December 2022, embarking on building an independent ecosystem. The team first shared their vision and roadmap with the community through an AMA with Rekt Gang and encouraged continuous participation from early users through events like "get liquidated" and "DAO WARS.”

In February 2023, with the announcement of mainnet alpha closed alpha testing, the Hyperliquid team began focusing simultaneously on product development and branding.

In March, they introduced referral codes for user expansion, and from April, they established their overall visual identity including branding colors and fonts through mascot marketing via the Hyperintern Twitter account. They created educational blog content to inform users about Hyperliquid and consistently produced content on the HyperIntern Twitter to increase SNS exposure.

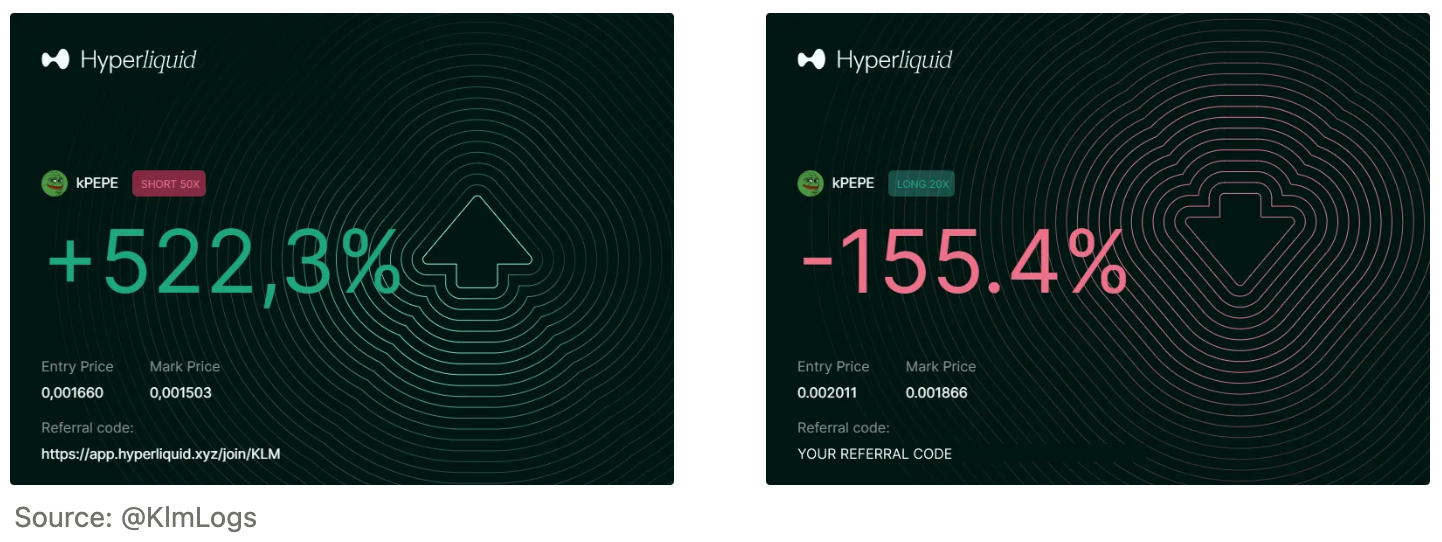

To increase SNS exposure, they held mini-events sharing P&L images and attracted user inflow through referral codes, gradually becoming known to more people.

In June 2023, Hyperliquid held its first community call, followed by a second community call in July, helping onboard users who joined after aggressive initial marketing.

During Q2 2023, Hyperliquid grew into a platform supporting trading of 28 assets, achieving over 4,000 users and over $200 million in non-HLP trading volume. During this period, they introduced protocol vaults (liquidator vault, HLP) that allowed the community to participate in liquidation and market-making strategies, began API support, and implemented a fee structure of 2.5 bps taker and 0.2 bps maker rebate in June. They also strengthened communication with users through community calls and research channels while laying the foundation as a fully on-chain, trustworthy, transparent, and scalable trading platform through advanced trading feature improvements, statistics page launch, referral program expansion, and unverified node testnet operation for decentralization.

The Hyperliquid team didn't just focus on marketing but consistently proceeded with product development. They received bug and error reports from users through the Detective program and improved UX/UI for better mobile experience.

3. Crisis and Transparent Response, Then Rapid Growth (August 2023 ~ May 2024)

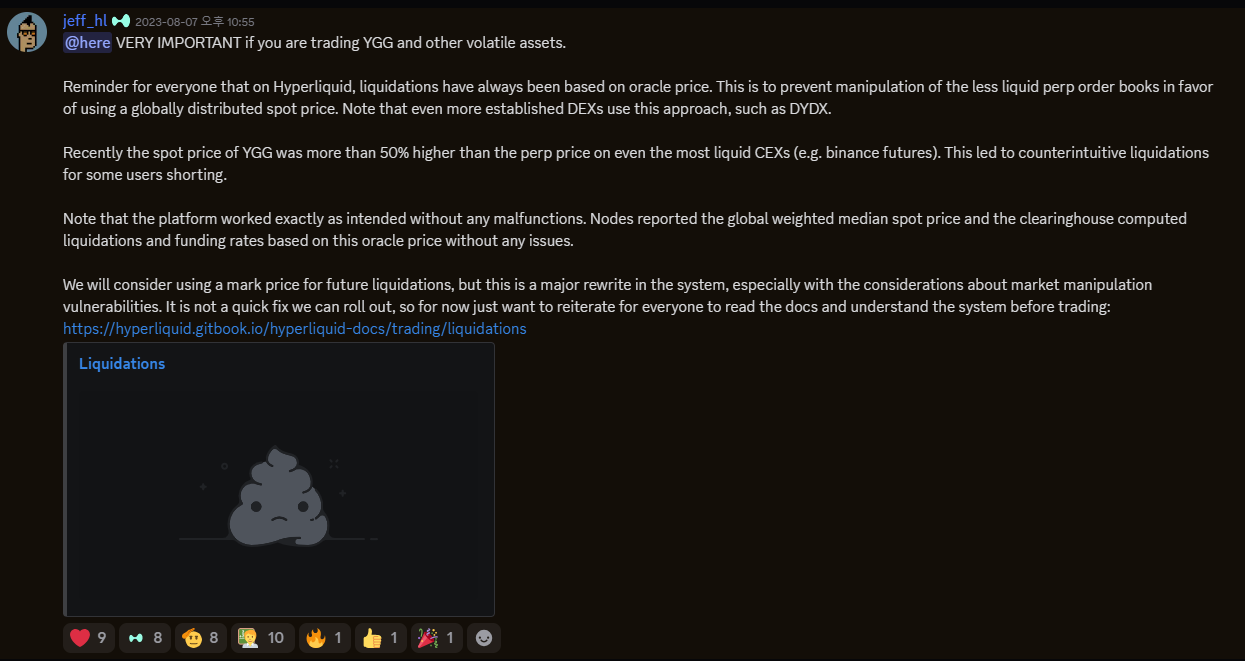

The Hyperliquid team faced two major oracle-related trials in the second half of 2023. In the August YGG incident, during extreme market volatility, a divergence of over 50% occurred between oracle price and mark price, causing short position liquidations to be executed more aggressively than expected, leading to user confusion. While the platform argued the technical legitimacy of oracle-based liquidation according to existing DEX standards like DYDX, they acknowledged damage from vault imbalances caused by the protocol's oracle system and deteriorated user experience, introducing a compensation system through insurance funds.

The FRIEND-USD incident further revealed structural vulnerabilities of the oracle itself. When the manipulability of TVL-based indices was discovered by white hat hackers, a serious security risk was confirmed where attackers could induce liquidations through artificial TVL inflation at minimal cost. Building on lessons from the YGG incident, the Hyperliquid team responded more swiftly and proactively this time, implementing emergency oracle changes without prior notice while simultaneously providing immediate margin refunds to affected users, demonstrating mature crisis management capabilities that pursued both technical security and user protection.

Through these crisis experiences, Hyperliquid evolved into a mature platform that simultaneously pursued fundamental system improvements and user-centric approaches. Immediately after the YGG incident on August 19, the platform announced a transition to mark price-based liquidation systems. They also improved the liquidation process by treating liquidations as market orders and allowing users to retain remaining collateral, significantly reducing user losses in most liquidations. Alongside this, HLP's TVL surged from $1.5 million to $6 million in three months, with cumulative profits exceeding $1 million, showing substantial results.

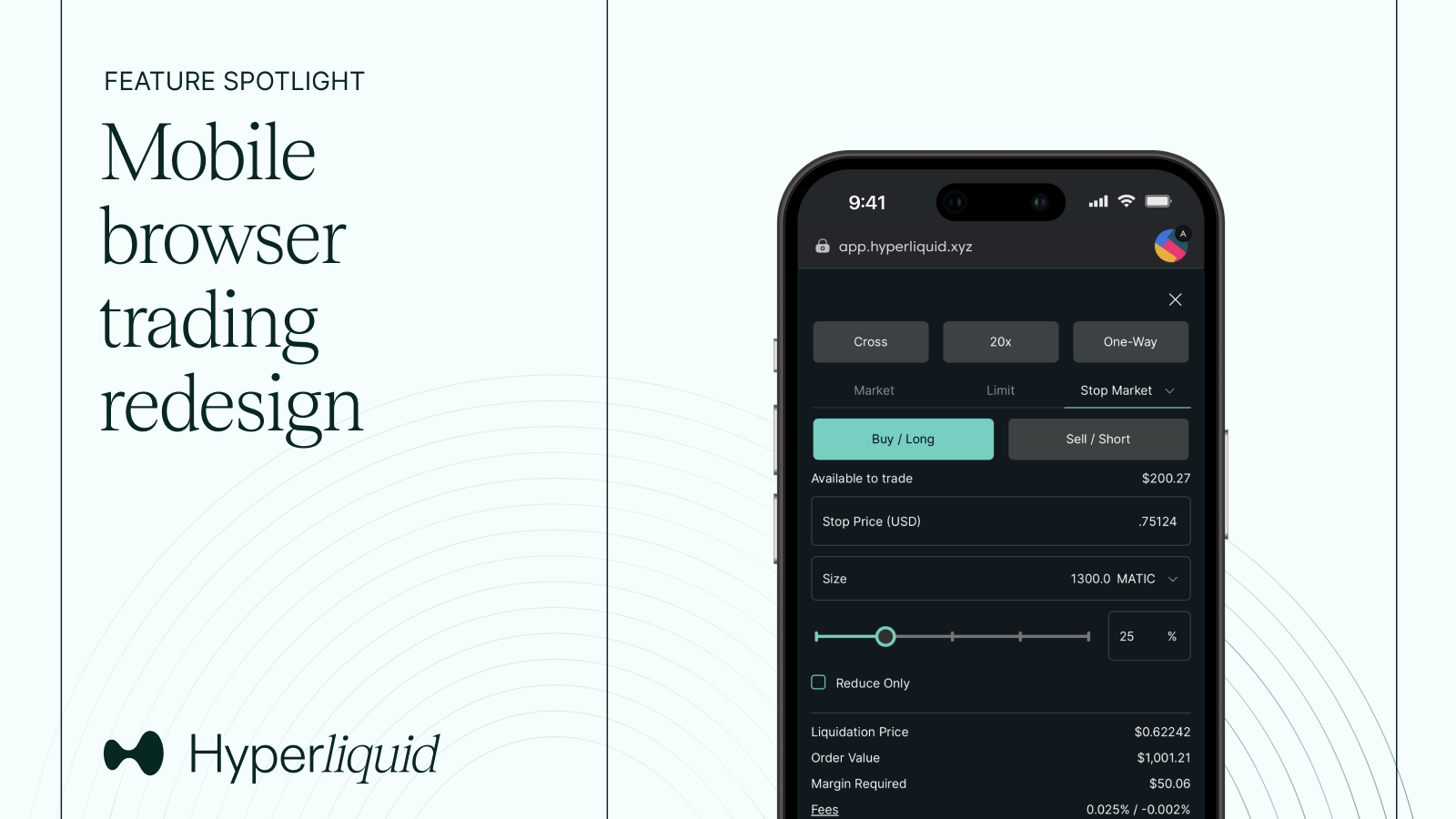

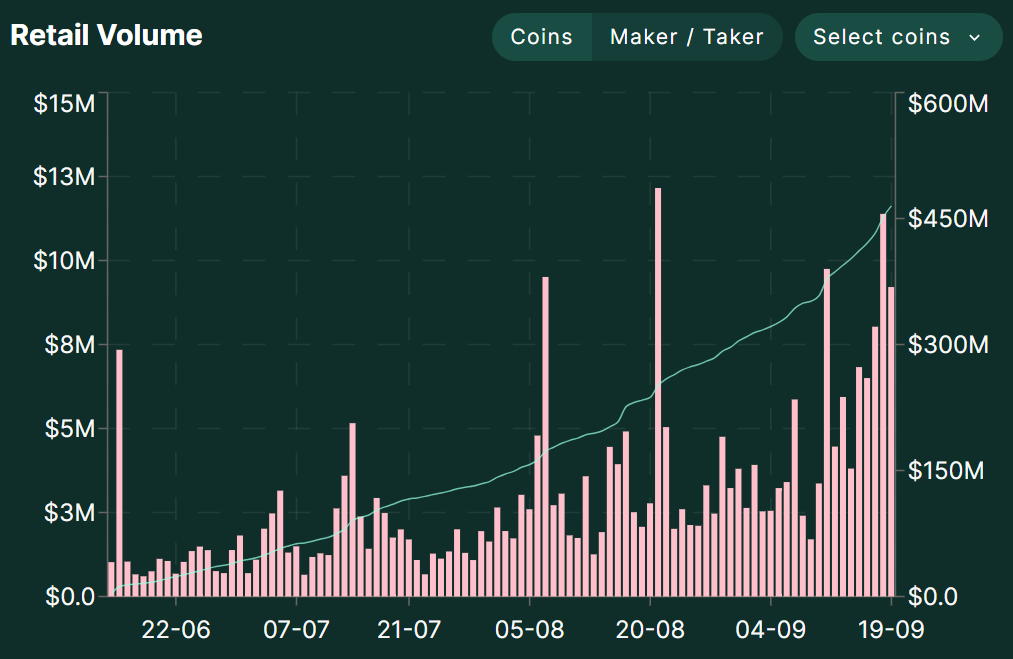

After the YGG incident, over several months, Hyperliquid expanded total assets to 60 and achieved a new record of $20 million daily retail trading volume. They continuously improved user convenience through API infrastructure improvements, scale order feature additions, various wallet integrations, and mobile experience enhancements. Particularly through the open interest reward program that returned part of trading fees to users and continuous user-centric product development through active community calls and feedback collection, they demonstrated excellent crisis management capabilities by turning crisis into a growth catalyst.

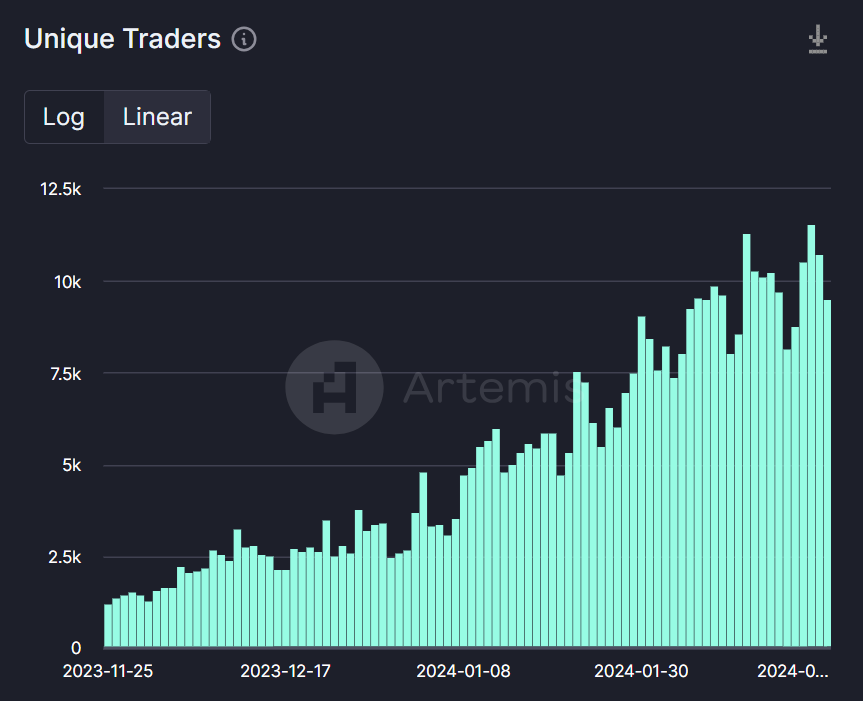

Hyperliquid, having turned crisis into a growth catalyst, embarked on full-scale ecosystem expansion through the introduction of a points program in November 2023. This program, distributing 1 million points weekly for 6 months, became a core driver of the platform's explosive growth beyond a simple reward system. With the start of the points program, daily active traders surged from 5,000 to 30,000, total trading volume surpassed $10 billion, and TVL grew over 120-fold from $2.8 million to $340 million. Particularly, HLP's cumulative profits reached $19 million, providing substantial value to users through successful protocol vault operations.

During the same period, in terms of product development, they continuously invested in user experience optimization. They provided the same onboarding experience as CEX without wallets through email login support, added sophisticated trading tools like TWAP orders, scale orders, and subaccount features, and significantly improved global user accessibility through mobile optimization and multi-language support. They also facilitated algorithmic trader inflow through continuous API infrastructure improvements and integration with major trading frameworks like CCXT and Hummingbot.

The community-centric growth strategy became Hyperliquid's greatest differentiating factor. Through regular community calls, consistent communication through Discord, and rapid product reflection of user feedback, they realized a true community-first philosophy. Particularly, community-driven ecosystem tools like purrburn.fun, Telegram bots, and various analytical tools emerged organically, laying the foundation for a healthy developer ecosystem.

By the end of the points program in May 2024, Hyperliquid had grown into the largest perp DEX by trading volume, open interest, and daily active users, realizing their vision of evolving beyond a simple exchange into an L1 capable of supporting an entire financial system.

4. Hyperliquid Ecosystem Launch and $HYPE TGE (May 24 ~ November 24)

Hyperliquid's vision expanded to new dimensions with the groundbreaking HyperEVM announcement in May 2024. Particularly, through transfer functionality between HIP-1 assets and ERC-20 contracts, they created an environment where developers could deploy smart contracts with familiar EVM tooling and immediately connect to CEX-grade trading experiences, concretizing their goal as the ultimate financial platform where "users no longer need centralized exchanges or other blockchains.”

With the successful implementation of the permissionless spot token deployment system, they embarked on ecosystem expansion through the L1 points program. The new points season starting in May 2024 distributed 700,000 points weekly for 4 months. By reintroducing the points system that had been successful on testnet, they continued rapid growth.

Growth momentum accelerated further through community-centric organic expansion and strategic partnerships. The first community event held at Token2049 Singapore became a valuable opportunity to collect product improvement feedback through actual user meetings, with Hypurr dolls serving as elements that increased brand affinity.

Successive integrations with major trading infrastructure and tools like CCXT, Hummingbot, Rage Trade, Insilico Terminal, and Tradestream facilitated the inflow of algorithmic traders and institutional investors, while various ecosystem tools voluntarily built by community builders like purrburn.fun, HypurrScan, Telegram bots, and cross-chain bridges became the foundation for a healthy developer ecosystem.

This growth culminated in the establishment of Hyper Foundation and the HYPE token genesis event in November 2024. They provided fair compensation to genuine users, recognizing community contributions through the final distribution of 57.9 million points. The staking system introduced with the genesis event established a structure where HYPE holders could directly participate in network security, and through consecutive all-time highs including $150 billion trading volume, $4.3 billion open interest, and $1 billion daily liquidation volume, they solidified their position as the undisputed largest on-chain exchange.

5. Conclusion

Hyperliquid's growth represents an important case study of what sustainable growth means in the Web3 industry. The approach that prioritized user value without relying on VC capital, transparent and responsible responses in crisis situations, and genuine communication with the community became the platform's core DNA rather than simple marketing strategies.

From the journey that began with a small number of early adopters at the testnet launch in 2022 to growing into the world's 3rd largest exchange in 2025, Hyperliquid has proven the possibility of a new growth model that simultaneously pursues technical excellence and community trust. Built on this philosophical foundation, Hyperliquid introduced an innovative value distribution system after TGE. As of 2025, the platform records approximately $587.5 million in annual revenue, investing 54% of total trading fees into HYPE token buybacks. As of May 2025, a total of 22 million HYPE tokens (worth approximately $556 million) have been bought back through the Assistance Fund, with 226,000 tokens directly burned, operating an aggressive deflationary mechanism.

While centralization and privacy issues continue to emerge after TGE, Hyperliquid is simultaneously growing even faster through HyperEVM. What process will Hyperliquid's next chapter undergo?

Hyperliquid.