Dive into Hyperliquid Ecosystem dApp: Harmonix Finance

Hyperliquid, HyperEVM, Harmonix

Thanks to @harmonixfi team for their insights and support during the writing of this article.

1. Introduction

- @HyperliquidX is rapidly emerging as a leading platform in the perpetual futures market, thanks to its high-speed on-chain orderbook infrastructure.

- As of June 4, 2025, Hyperliquid's Open Interest (OI) reached levels equivalent to 22% of Binance, 29% of Bybit, and 48% of OKX - an exceptional achievement for a decentralized derivatives exchange.

- In perpetual markets, a structural mechanism known as the funding fee ensures that traders on the more aggressive side of the market (long or short) pay a recurring fee to those on the less aggressive side.

- Notably, Hyperliquid offers some of the highest funding fees in the market compared to centralized platforms, creating a strong incentive for delta-neutral strategies.

- Annualized funding fee rates (as of June 4, 2025) illustrate this:

- BTC: Hyperliquid (10.95%) / Binance (3.43%) / Bybit (-7.9%)

- ETH: Hyperliquid (10.95%) / Binance (9.1%) / Bybit (9.65%)

- HYPE: Hyperliquid (10.95%)

- Such conditions significantly increase the appeal of strategies that profit from funding without taking price exposure. These opportunities are being captured by a growing number of dApps offering automated delta-neutral strategies.

- Among them, Harmonix Finance has attracted attention as a protocol leveraging Hyperliquid’s funding markets in a structured, composable way.

- More than just harvesting funding yield, Harmonix is building interconnected products across the HyperEVM ecosystem to amplify returns. A notable example includes their upcoming HYPE HyperEVM Vault and haHYPE token, which will utilize feUSD issued by @felixprotocol.

2. Harmonix Overview

Harmonix Finance is a decentralized finance (DeFi) protocol aiming to maximize user returns by implementing hedge fund-grade structured investment strategies entirely on-chain. Founded in 2023, Harmonix is led by founders with deep expertise in both traditional finance and decentralized finance.

- CEO Frank Dang has six years of experience at a traditional investment bank, followed by four years in the DeFi space, during which he built a CeDeFi aggregator that reached $50M in TVL.

- CTO Bean Nguyen brings over a decade of experience in algorithm development and quantitative systems engineering, with a track record of building models for major firms based in Singapore.

The two co-founders have collaborated since 2020, working together on Deribit options trading and researching strategies like the options wheel in 2022. Drawing from these experiences, they launched Harmonix with the vision of building sustainable and structured revenue models in DeFi.

Harmonix’s core strategy revolves around a delta-neutral structure. This involves simultaneously taking long positions in spot markets and short positions in futures to neutralize price volatility, while consistently capturing funding fee income from the futures market. While the concept is simple in theory, it demands precise automation and execution, as constant rebalancing and real-time response to funding and price dislocations are required.

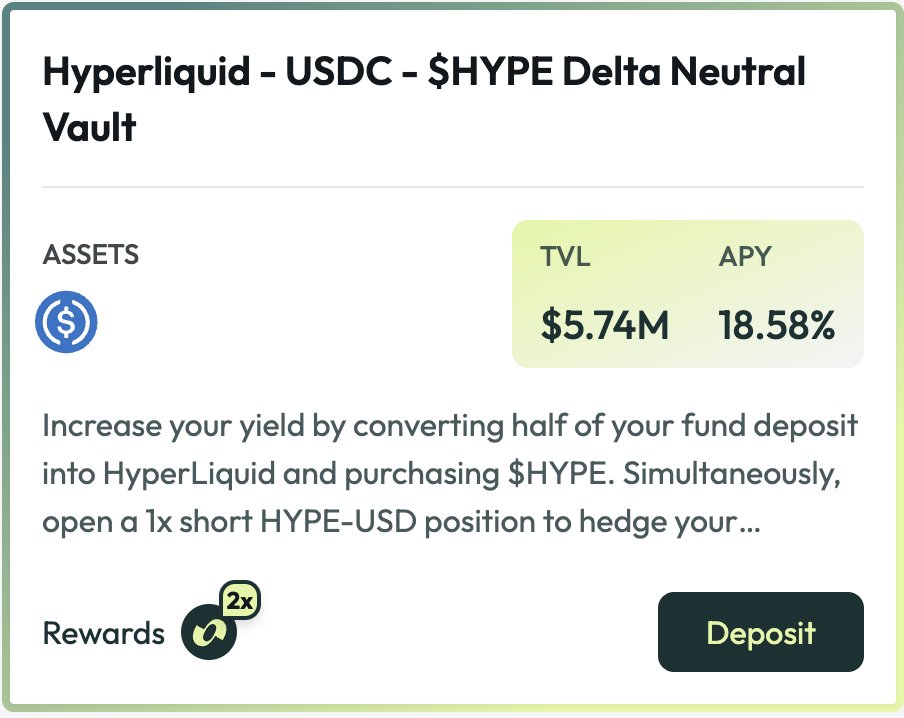

Currently, over 82% of assets deposited in Harmonix are concentrated in the $HYPE delta-neutral strategy vault, making it the protocol’s central strategy. The vault architecture and Harmonix’s future roadmap offer deeper insights into the protocol’s distinct approach.

3. Core Structure of Harmonix

Harmonix’s flagship strategy is the HYPE Delta-Neutral Vault, which operates through the following sequence:

- User deposits are made in $USDC on the Arbitrum chain.

- The deposited USDC is bridged to the Hyperliquid exchange (HypeCore).

- A 1x long position in $HYPE spot and a 1x short position in perpetual futures are established simultaneously. These positions are automatically rebalanced by Harmonix’s automation system.

- Users receive roUSD, a Yield Bearing Token (YBT) that represents their share in the delta-neutral position. Yield is accrued directly to this token.

- Withdrawals require a 3-day unbonding period, and funds are returned based on the exchange ratio between roUSD and USDC at the time of redemption.

In addition to its currently active HYPE-based delta-neutral strategy, Harmonix is planning to launch a range of delta-neutral vaults built on various stablecoins available on HyperCore and HyperEVM - including USR, USDe, feUSD, and USDT.

These strategies are scheduled to be integrated after the mainnet deployment of Hyperliquid’s Write Precompile functionality, which is expected to significantly expand the flexibility of asset flows on the EVM layer.

Looking ahead, the strategy lineup will extend beyond stablecoins to include major assets such as BTC, ETH, and Fartcoin, as well as meme tokens native to the Hyperliquid ecosystem, such as PURR. Through this expansion, Harmonix aims to offer a diverse suite of vaults covering a broad range of risk profiles and yield structures.

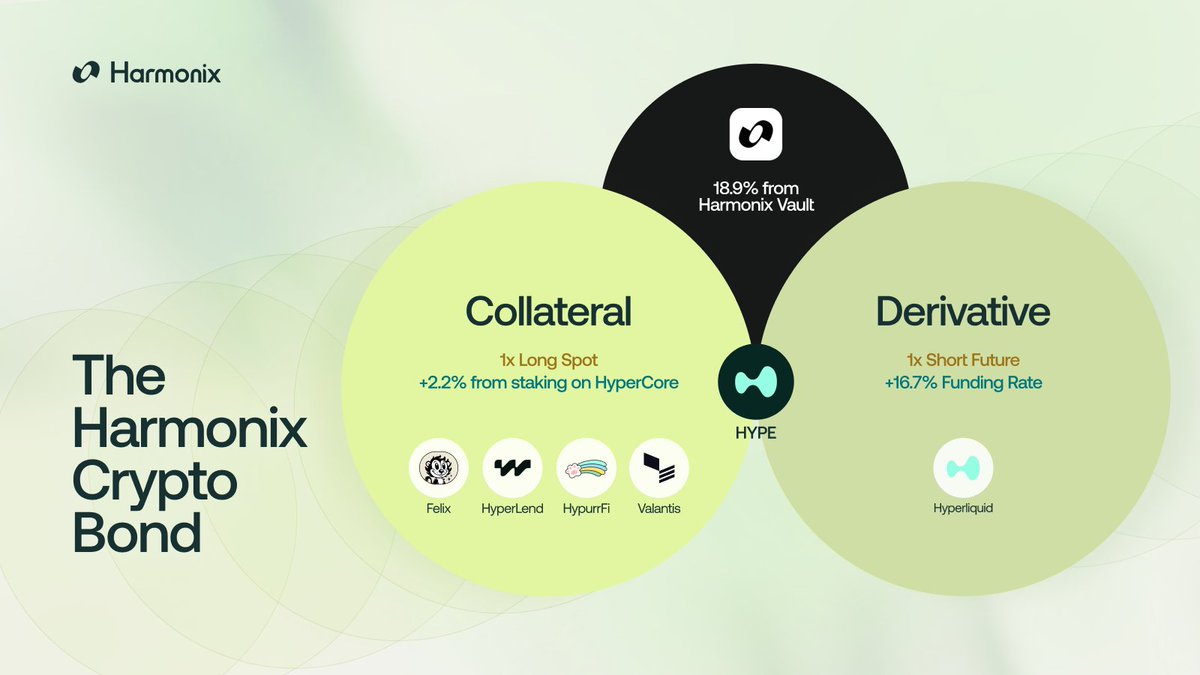

4. HYPE HyperEVM Vault and haHYPE Token: A Strategy for Structured Expansion

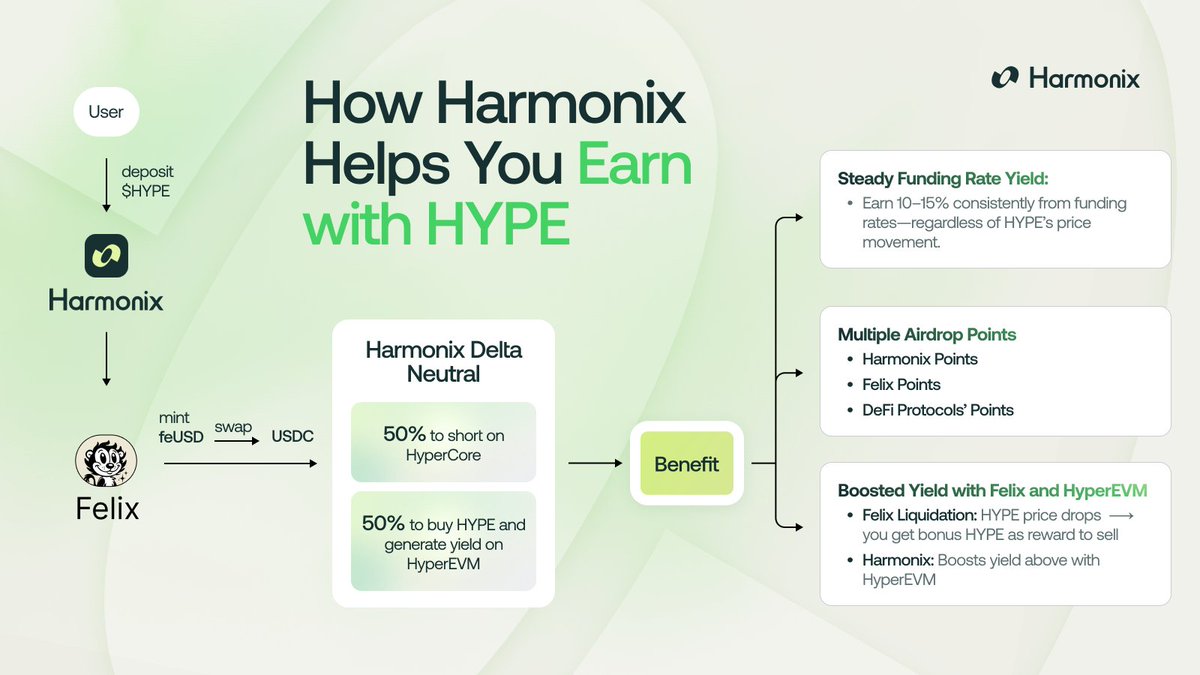

The profitability of delta-neutral strategies can vary significantly depending on whether the underlying spot assets are further utilized across the ecosystem. Harmonix aims to enhance returns by leveraging its spot exposure - namely $HYPE - across various DeFi protocols within the Hyperliquid ecosystem.To this end, Harmonix is designing the HYPE HyperEVM Vault, which operates as follows:

- Users deposit $HYPE into the HYPE HyperEVM Vault and receive haHYPE tokens in return.

- The vault deposits the received $HYPE into Felix Protocol to be used as collateral.

It then mints feUSD against the collateral and swaps the feUSD for USDC via HyperCore. - The acquired USDC is used to open a short perpetual position on $HYPE, equal in size to the original HYPE value - thus maintaining a delta-neutral position.

- Strategy profits accrue to the haHYPE token, which functions as a Yield Bearing Token (YBT).

- Upon redemption (haHYPE → HYPE), the user receives $HYPE at a yield-adjusted conversion rate. To ensure system stability, a 3-4 day withdrawal delay and exit fee apply.

- The vault may generate additional gains when the price of HYPE rises, as the value of the collateral increases. Even when the price declines, losses are generally limited due to the delta-neutral structure.

- However, if HYPE experiences a sharp price drop over a short period, losses may occur.

a. In order to mitigate such risks and prevent potential losses, comprehensive audits were conducted by Verichains.

As of June 2025, the expected returns from this strategy are:

- feUSD minting yield from Felix Protocol: 12.38%

- Loan-to-Value (LTV): 58.8% → implies a 7.28% cost per unit of deposited HYPE

- 15-day average APY from the HYPE Delta-Neutral Vault: 20.87%

Projected Net APY: 13.59%

In addition to baseline yields, Harmonix seeks to capitalize on pricing inefficiencies within the Felix Protocol, stemming from the dynamics of feUSD’s market peg.

- When feUSD trades above $1, Harmonix can mint and sell feUSD at a premium to realize arbitrage gains.

- When feUSD trades below $1, Harmonix can repurchase discounted feUSD from the market and redeem it within Felix to reclaim collateral at a discount.

This type of peg arbitrage serves a dual function: it contributes to the overall peg stability of feUSD, while simultaneously creating an additional yield stream for Harmonix Vaults.

The haHYPE Vault and its associated token are currently operating on the testnet, with a mainnet launch planned following user feedback. Moreover, this structure is not limited to Felix Protocol - additional vault strategies integrating with other lending protocols such as HyperLend are also under development.

5. Key Considerations

5.1. Points Program

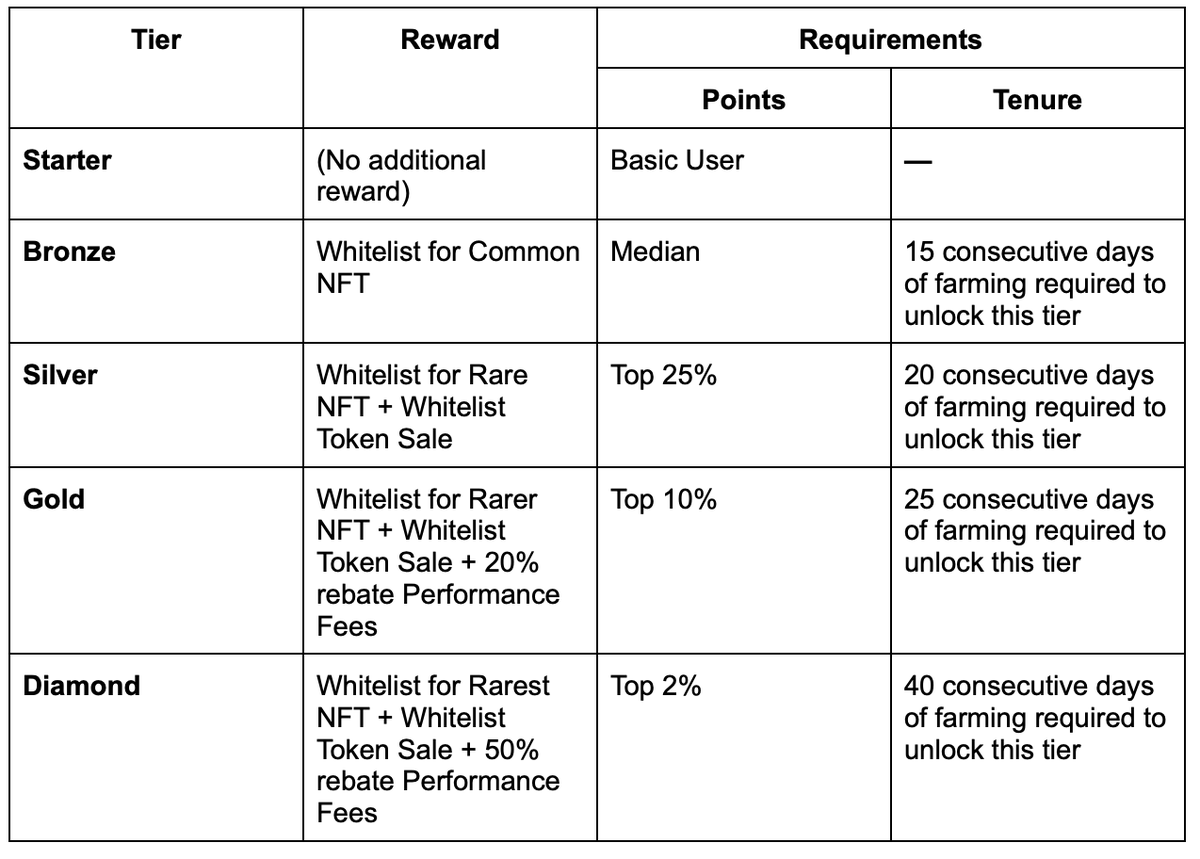

Depositing into Harmonix Vaults offers not only yield opportunities but also eligibility for the $HAR token airdrop through participation in the points program. Since the HYPE-based delta-neutral strategy and haHYPE Vault are Harmonix’s flagship products, these vaults are expected to receive higher multipliers in the program.

- Season 1: Mid-2024 to January 2025, 8 million points distributed

- Season 2: Ongoing since March 4, 2025

The point calculation method for Season 2, which began on March 4, is as follows:

- Base Rate: Automatically adjusts based on changes in TVL (Rate of Change, or ROC)

- Deposit: Actual amount deposited by the user

- Vault Multiplier: Displayed on the Harmonix UI

- Loyalty Bonus: Additional weight for Season 1 participants

- Time Factor: Increases based on the duration of deposit

For example, depositing $50,000 into a vault with a 4x multiplier for 90 days would yield approximately 20,000 points:

Based on the number of points earned, users are assigned to different tier levels, which determine the scope and size of future reward allocations. Notably, the whitelist opportunity for the $HAR token sale is only available to users in Silver tier or above, making it strategically valuable to accumulate a sufficient point balance.

As of June 2025, the Diamond tier starts at approximately 36,000 points, placing users in the top 84 rankings. This suggests that entry into the Silver tier may be achievable without exceptionally large deposits.

Additionally, staking $HYPE via Harmonix is also included in the points calculation.

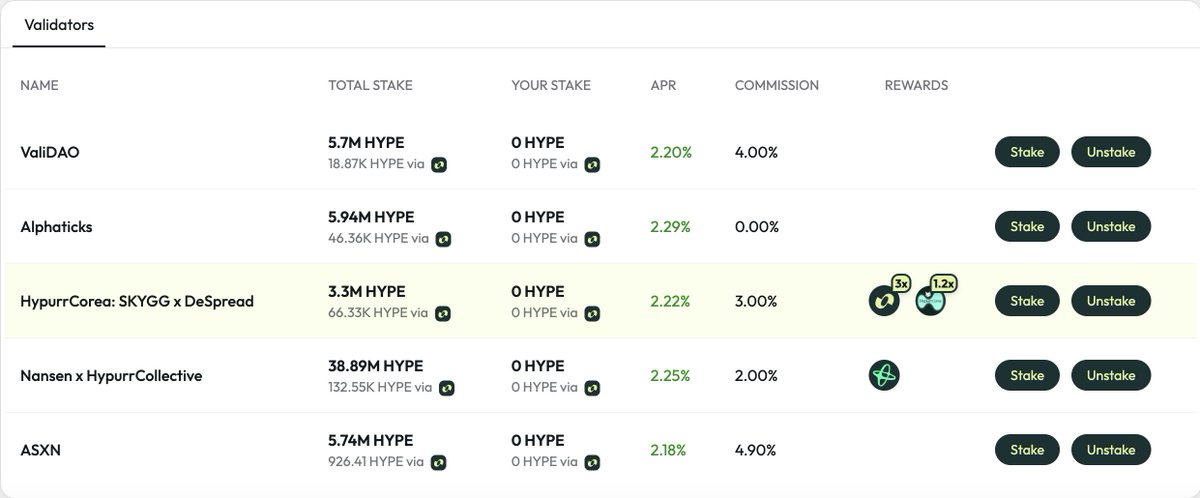

Specifically, staking to the HypurrCorea: SKYGG x DeSpread validator grants 3x base points, along with an extra 1.2x bonus from the validator’s own incentive program.

5.2. Security and Risk Management

5.2.1. Liquidation and Funding Fee Risk

The haHYPE Vault strategy offers structurally enhanced yields, but it also introduces certain risk factors tied to $HYPE’s price volatility.

- If $HYPE surges sharply:

The short perpetual position may face forced liquidation, and borrowing rates on Felix Protocol may rise due to higher demand. - If $HYPE drops sharply:

The value of the HYPE collateral falls, worsening the collateral ratio on Felix and potentially triggering CDP liquidations.

Additionally, if funding fees decrease or turn negative at this time, the overall profitability of the strategy may deteriorate. - Over the past three months, Harmonix has collaborated with Felix to refine its liquidation mechanisms with substantial capital at stake - resulting in highly efficient position management.

In summary, while the haHYPE Vault can outperform traditional delta-neutral strategies in terms of yield, it is more sensitive to market conditions and requires tighter risk management.

5.2.2. Smart Contract Security and Mitigation Systems

To enhance smart contract security, Harmonix has undergone multiple external audits. To date, it has completed:

- 2 audits by Verichains

- 1 audit by Shieldify

- Additional audits by Zenith and Code4Arena are planned ahead of the token generation event (TGE).

Security of integrated external protocols (DEXs, lending platforms, etc.) is also considered a high priority. Harmonix minimizes risk exposure by collaborating exclusively with verified and reputable partners.

As part of this effort, Harmonix has partnered with Hypernative to enable real-time security monitoring across its own vaults as well as Hyperliquid, stakedHYPE, and other external protocols. This includes an automated response system for detecting malicious wallets and potential hacks, thereby helping mitigate operational risk for the Harmonix dApp.

The core logic of the current vault is designed to be upgradable, but once the product is fully stabilized, the team plans to remove the smart contract’s owner privileges and transition the vault to an immutable structure.

This transition would fundamentally block the operator from unilaterally modifying or altering the strategy logic, which is generally viewed positively from a user perspective—enhancing predictability, trust, and governance transparency.

However, once the vault becomes immutable, it may limit the protocol’s ability to respond quickly to changing market conditions or adjust strategies as needed. Therefore, it is essential to embed sufficient strategic flexibility and parameterization during the initial design phase to accommodate future developments.