ALEX — The Core Financial Layer for Next-Generation Bitcoin Infrastructure

A Protocol to Unlock the Potential Value of Bitcoin

1. The Core of the Modern Financial System: Leverage Effect

The modern financial system is designed to enable the utilization of assets without liquidating them. Such a structure allows individuals or corporations to leverage the value of their assets, like real estate or stocks, without selling them. This is made possible through the support of financial institutions when needed.

Financial institutions lend money by taking personal or corporate assets as collateral, thereby earning interest. Conversely, the recipients of these funds are enabled to explore other investment opportunities. This process, where investments are made with capital borrowed from others or financial institutions, is termed the ‘leverage effect.’

A typical example of the leverage effect is in the real estate market. For instance, a homeowner may obtain a loan by using one’s house as collateral, which can then be used for various investment or consumption purposes. Such secured loans offer capital efficiency to the homeowner while providing a supplementary source of income for the financial institution.

2. The Limitations and Emerging Technical Challenges of Bitcoin

2.1. The Financial Standing and Constraints of Bitcoin

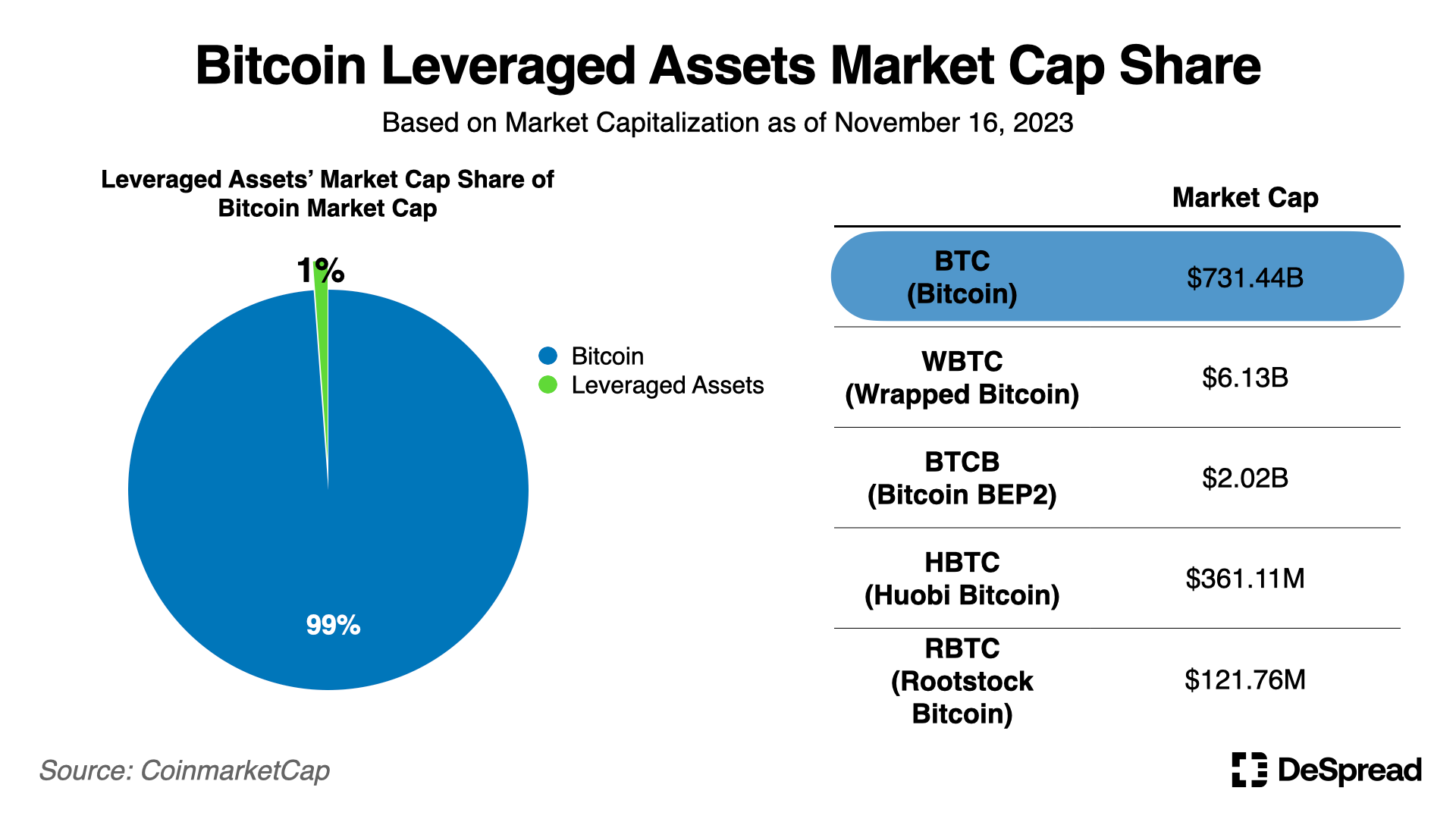

Financial products have been developed to maximize the use of assets that are recognized for their value. For instance, there are derivatives like futures and options on commodities such as gold and oil. In this context, it appears unusual that Bitcoin, with its massive market capitalization of over 700 billion dollars, is underutilized as a financial product.

Although products like WBTC (Wrapped Bitcoin) have somewhat alleviated this issue, only about 1% of the total Bitcoin market cap is utilized in the form of WBTC, indicating its still limited role. This is particularly striking when compared to Ethereum, where about 200 billion dollars of its market cap, from a total of approximately 2 trillion dollars, is being used in decentralized finance (DeFi).

To understand this issue, one must comprehend the core characteristics of Bitcoin. Since the creation of its genesis block in 2009, the Bitcoin network has continuously produced blocks without any hacking incidents, proving its stability. However, to maintain decentralization and stability, the Bitcoin network was designed to limit complex functions and implement only simple features. This has restricted its ability to execute complex smart contracts and process large-scale transactions, hindering the full potential of Bitcoin.

Despite these limitations, there have been several attempts to leverage Bitcoin’s high potential. For instance, wrapping methods like WBTC, where coins of equivalent value to Bitcoin are issued on other chains with more developed financial ecosystems; ‘Ordinals’, which involves storing data directly on Bitcoin; and methods like ‘BRC-20’, which create a token standard based on the Bitcoin network. Particularly, methods like Ordinals and BRC-20 have recently gained significant attention, presenting new milestones in Bitcoin utility.

2.2. The Emergence of Ordinals and BRC-20

Several technical challenges and ideas have been proposed to utilize Bitcoin, but most have not progressed beyond the initial experimental stage. However, in January 2023, ‘Ordinals’ emerged as the first case of adoption. The Ordinals technology involves engraving data into the smallest unit of Bitcoin, the satoshi, recording information such as images or text directly onto the blockchain ledger. This data, being recorded on-chain, is immutable, making it a popular method for data storage that leverages Bitcoin’s security.

The BRC-20 standard extends the concept of Ordinals by incorporating text containing token-related information into Bitcoin scripts, storing this information in satoshis. Based on this text information, the deployment, minting, and transfer of tokens become possible, leading to the creation of a Bitcoin-based fungible token ecosystem. However, BRC-20 is a script that does not run directly on the Bitcoin network, and Bitcoin miners do not directly verify its validity. As such, BRC-20 tokens could be considered just “text” but have triggered an unprecedented activation of the Bitcoin network.

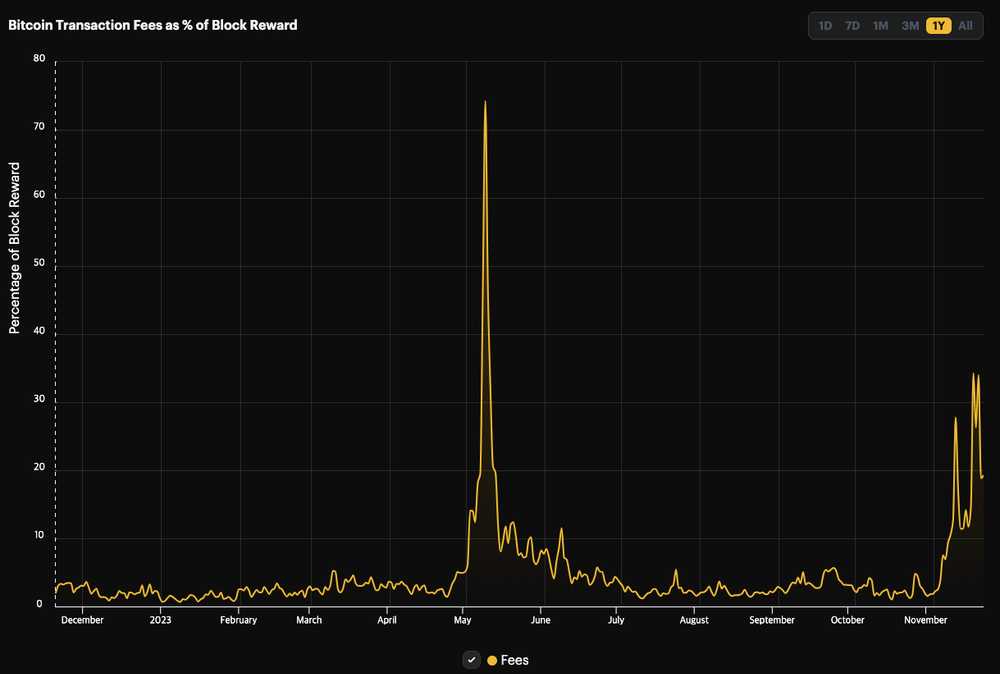

During the peak of on-chain activity related to BRC-20, the total transaction fees occasionally exceeded the $BTC rewards generated by block creation, and simultaneously, hundreds of thousands of transactions were waiting in the mempool, causing significant congestion in the Bitcoin network. Additionally, in May 2023, the market value of BRC-20 reached approximately 1 billion dollars, and by October 2023, there had been 35 million inscriptions on the network. An inscription refers to the process of engraving data into the smallest Bitcoin unit, the satoshi. Domo, the creator of BRC-20, started this as a “fun experiment,” but these outcomes clearly demonstrated the potential for expanding Bitcoin’s utility and indicated high interest in the Bitcoin ecosystem.

Despite this heightened interest, there are several major obstacles to using the Bitcoin network and leveraging the value of Bitcoin assets. For instance, wrapped bitcoins issued by third parties significantly depend on the trustworthiness of the issuing institutions. Additionally, the BRC-20 token system requires considerable technical understanding, making it challenging for average users to easily access and utilize.

To overcome these issues and universally realize Bitcoin utility, the ALEX project was introduced. This project aims to fully leverage the stability of Bitcoin without third-party intervention and adds programming functionality. ALEX aims to act as a layer that integrates Bitcoin-related financial infrastructure, striving to provide an optimal user experience possible.

3. ALEX: Bitcoin Utility Infrastructure Expansion Project

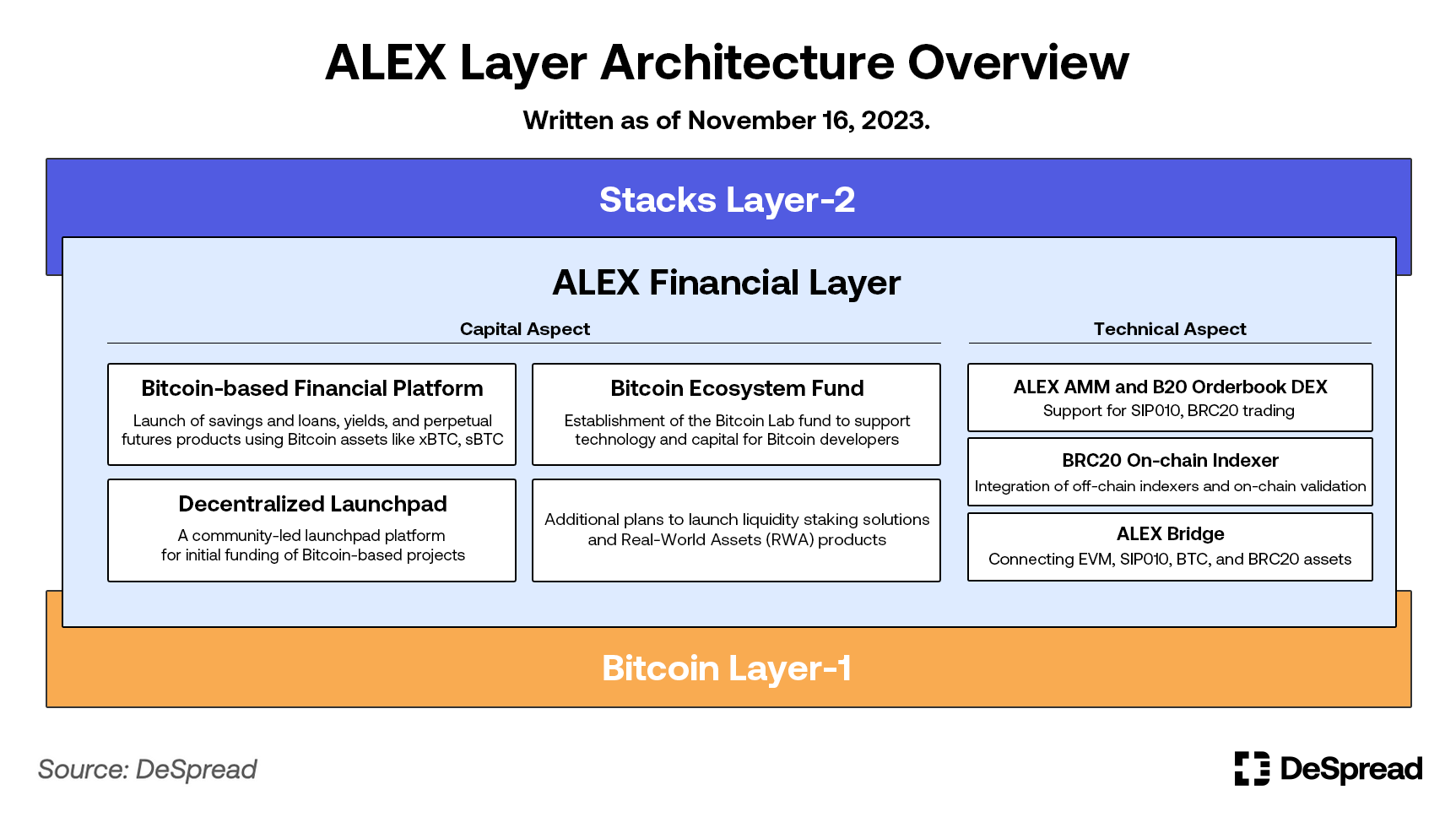

The ALEX project is dedicated to providing users with an exceptional experience and high security, implementing two primary strategies to achieve these objectives:

- Capital Aspect — Researching and offering a range of financial products and solutions, such as Bitcoin-based lending and borrowing services.

- Technical Aspect — Expansion and integration of the Bitcoin ecosystem through technical solutions like on-chain indexers.

3.1. Capital Aspect: Establishing the Safest Financial Infrastructure Using Bitcoin

3.1.1. Adopting Stacks as the Main Chain

Stacks serves as a Bitcoin Layer 2 solution, enabling the implementation of programmable contracts like DeFi and NFTs on the Bitcoin network. ALEX, leveraging Stacks, maintains the security and decentralization of the Bitcoin network while offering programming capabilities. This strategy aims to evolves Bitcoin into a more versatile and functional platform, where users can generate diverse values through Bitcoin-based decentralized applications (dApps).

3.1.2. Launching a Bitcoin Financial Platform with sBTC

Furthermore, ALEX plans to develop financial products utilizing Bitcoin assets directly through the ‘Nakamoto Release’, a major upcoming upgrade of Stacks slated for the next quarter. The Nakamoto Release will utilize Stacks’ feature of directly reading Bitcoin state to issue sBTC assets, pegged 1:1 with native Bitcoin, using smart contracts exclusively, eliminating the need for intermediaries. This innovative method marks a clear distinction from traditional intermediary-based asset pegging. Users will be able to directly access the Bitcoin base layer using sBTC and use pegged assets on the Stacks chain, fully protected by the Bitcoin network. ALEX aims to launch a platform providing foundational elements of financial infrastructure like lending, borrowing, yield products, and perpetual futures using sBTC.

Prior to the sBTC launch, ALEX has developed and finalized several protocols to effectively link the Stacks layer with the Bitcoin layer, ensuring an optimal environment for users. To facilitate easy onboarding and liquidity provision to ALEX, the ALEX Bridge, connecting Ethereum/BNB chains with the Stacks chain, has been developed and deployed on the mainnet. Future developments include creating bridges between the Bitcoin chain and the Stacks chain, fostering a seamless asset transfer environment between Bitcoin Layer 1 and Layer 2.

3.1.3. Decentralized Launchpad for Bitcoin Assets

ALEX operates a decentralized launchpad platform aimed at energizing the Bitcoin ecosystem. This platform supports the growth of new BRC-20 projects by providing opportunities for initial funding, community building, and project promotion.

The application for the launchpad is open to all projects related to BRC-20. However, the final selection of projects for the launchpad is determined through voting by ALEX governance token holders.

3.1.4. Establishing a Fund for Bitcoin Builders

Given the nascent stage of the Bitcoin ecosystem and its immense potential for growth, ALEX has established a fund known as the “Bitcoin Lab Fund.” This fund not only provides financial support to Bitcoin builders but also offers comprehensive development infrastructure, including various tools and technologies owned by ALEX. Particularly, ALEX offers its API and software development kits (SDKs) to other projects, leveraging its extensive experience in developing on the Stacks layer, to facilitate their development process.

3.2. Technical Aspect: Building Bitcoin-Based Applications for Optimal User Experience

3.2.1. Launching the World’s First Order Book-Based BRC-20 DEX

Following the AMM(Automated Market Maker) methods used in DEXs (Decentralized Exchanges) for token exchanges, ALEX has launched the world’s first order book-based DEX for BRC-20 tokens, named B20. Executing tasks like minting or transferring BRC-20 tokens requires a deep understanding of Bitcoin’s on-chain structure and scripting, posing a significant barrier to entry for average users. Consequently, most had to rely on centralized exchanges due to this complexity. However, with the introduction of the B20 DEX by ALEX, users can now trade BRC-20 tokens more securely through an order book-based UI, similar to centralized exchanges. All transactions on B20 are securely settled on the Bitcoin chain using roll-up technology.

3.2.2. Development of BRC-20 On-Chain Indexer

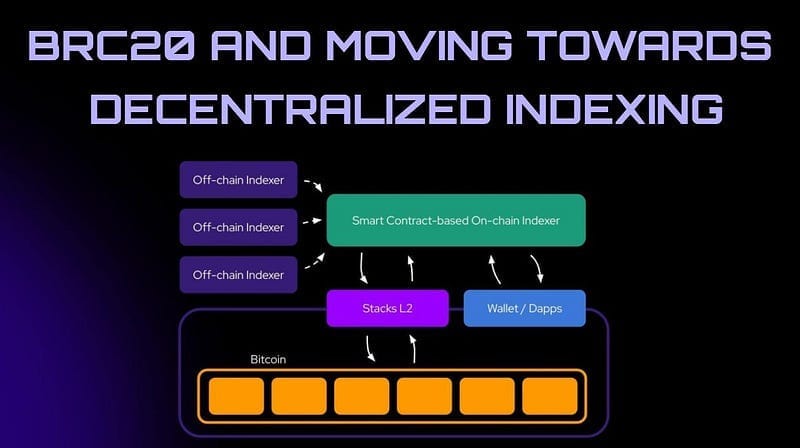

BRC-20 tokens are not deployed through smart contracts like the commonly known ERC-20 tokens. Additionally, as mentioned earlier, the token information files embedded in Bitcoin do not execute and are not verified by Bitcoin miners. In essence, BRC-20 tokens are a type of virtual token created based on simple text files within the Bitcoin network. Although these text files stored on the highly secure Bitcoin chain are immune to tampering, the issuance and circulation of tokens created from this text rely on external indexers for tracking.

Currently, centralized entities like Unisat, a leading wallet platform for BRC-20 and Ordinals, manage these indexers and are building vast databases. It can be seen as a contradiction that the BRC-20 ecosystem, which capitalizes on the advantages of using the most decentralized Bitcoin, relies on centralized entities.

I would be careful trading BRC20’s at the moment.

— Sanj 😶🌫️ (@SanjFomojis) October 22, 2023

There’s currently a risk of double spending due to a recent issue in ord.

Currently different marketplaces are using different versions of ord which are indexing different inscription numbers.

Until @MEonBTC @okx and…

Centralized indexers can distort data. In fact, due to version differences in Ordinals indexers, a problem arose where marketplaces indexed different inscription numbers, exposing users to the risk of double spending. This issue significantly undermined the trust in the BRC-20 ecosystem and emerged as a critical problem that must be resolved for the expansion of the Bitcoin ecosystem.

To address this issue, ALEX, in collaboration with Domo, the creator of the BRC-20 token standard, is developing a decentralized on-chain indexer utilizing the Stacks layer, which can directly read the state of Bitcoin. This development will enable a token ecosystem where Bitcoin-based tokens are fully protected by the power of Bitcoin, independent of any specific entity.

4. Role and Utilization of $ALEX

$ALEX is the governance token of ALEX. Holding this token grants voting rights to decide on proposals in the ALEX governance forum. $ALEX is distributed as a reward to those who stake their LP tokens, obtained by providing liquidity to the ALEX platform, and to participants in $ALEX staking. The total supply of $ALEX is 1 billion, with over 630 million tokens circulating in the market as of November 2023.

4.1. $AutoALEX: A Token for Automated Compound Staking

When users stake $ALEX, they receive $ALEX as a reward. Utilizing the AutoALEX feature provided by ALEX automates the process of claiming and redepositing $ALEX, enabling users to enjoy the benefits of compounding interest. $AutoALEX is a token that converges to the value of compounding $ALEX without the need for lockup. For instance, initially, $AutoALEX and $ALEX are valued at 1:1, but over time, the value of $AutoALEX increases by the amount of the compounding interest generated. In the ALEX pool, there is an $AutoALEX-$ALEX pair supported by soft pegging from the ALEX Foundation, allowing users to liquidate their assets when needed.

4.2. $Apower: Ticket for Launchpad Access

$Apower is a unique token used to access ALEX’s decentralized launchpad. It can't be traded or transferred, creating an exclusive ticket system for participation. This token is distributed to contributors in the ALEX ecosystem and plays a role in maintaining a virtuous cycle among ALEX, launchpad projects, and ALEX users through the following roles:

- Reward for ALEX Staking Participants: Participants who provide liquidity to the ALEX pool and having LP tokens, or those staking $ALEX, can receive APower in addition to $ALEX rewards. As the Bitcoin ecosystem grows and more quality projects enter the ALEX launchpad, the demand for APower may increase, leading to more liquidity for the ALEX protocol.

- Securing Potential Participants for Decentralized Launchpad: Since APower is non-tradable and non-transferable, and has limited utility for participating in the ALEX launchpad, it encourages holders to actively consider participating in ALEX’s launchpad. This provides motivation for Bitcoin projects to conduct their launchpads on the ALEX platform.

- Resource for User Acquisition: Utilizing APower can activate ALEX’s own products. For example, during the launch of $ORDD on ALEX’s launchpad, an event was held offering APower to users of ALEX Bridging, resulting in a roughly 20% increase in the total amount transferred to the Stacks chain via the bridge during the event period.

4.3. Maximizing Capital Efficiency with Collateralized Loans

Arkadiko Finance, a Stacks-based DeFi protocol, offers a feature to mint USDA, a stable coin pegged to 1 dollar, as a loan against cryptocurrency collateral. Users can mint the stablecoin USDA using $AutoALEX as collateral in Arkadiko Finance for additional investment opportunities. Notably, in collaboration with Arkadiko Finance, ALEX is rewarding those providing liquidity to the $ALEX/$USDA pool with Arkadiko Finance’s governance token $DIKO, in addition to $ALEX. Through this process, $ALEX holders can convert to $AutoALEX to earn interest from the compounding effect and maximize capital efficiency by minting stablecoins using $AutoALEX as collateral.

5. Conclusion

ALEX is establishing itself as a financial layer for the Bitcoin infrastructure, creating an ecosystem that leverages Bitcoin’s abundant capital and the network’s superior security. For this purpose, ALEX has set up a Bitcoin fund to build the Bitcoin infrastructure and is in the process of developing and has already developed the world’s first order book-based BRC-20 DEX, a bridge connecting EVM (Ethereum Virtual Machine) based chains and Stacks chain, and an essential on-chain indexer for securely trading BRC-20 tokens.

Within ALEX, The entry barrier to Bitcoin for developers is lowered with financial and technical support, and users can quickly and safely use Bitcoin-based dApps. However, features that directly utilize Bitcoin have not yet been officially launched in ALEX, and liquidity is still not sufficient. Despite this, ALEX has been pursuing its roadmap continuously. In case it successfully launches Bitcoin financial products using sBTC, it has the potential to become a key protocol to bootstrap the Bitcoin ecosystem, making it a crucial infrastructure that can’t be ignored.

References

- ALEX, Why Bitcoin does not need DeFi, but DeFi needs Bitcoin, 2022

- ALEX, AutoALEX: The Power of Compound Interest, 2022

- ALEX, BRC20 and Moving Towards Decentralized Indexing, 2023

- ALEX, Decentralizing ALEX Launchpad: A Step Forward in Community Governance, 2023

- ALEX, Bitcoin Oracle: Building an On-Chain BRC20 “Indexer of Indexers”, 2023

- ALEX, ALEX’s Bold Ambition: Re-inventing Bitcoin’s Role in DeFi, 2023

- ALEX, From the Co-Founders: Launch of Bitcoin Lab, 2023

- Trustmachine, What is the BRC-20 Token Standard and How Has it Impacted Bitcoin?, 2023

- Sanj’s tweet