Aptos — Beyond Technical Excellence to a New Era of Ecosystem Expansion

Focusing on Strategies for Enhancing Scalability and Bootstrapping the Ecosystem

1. Introduction

The concept of the "Blockchain Trilemma," which posits the challenge of a single blockchain network achieving scalability, security, and decentralization simultaneously, has served as a significant driving force for the growth of the blockchain industry by motivating the emergence of numerous networks aimed at solving this dilemma.

The importance of "scalability," which refers to a network's ability to handle a large number of transactions reliably, has become increasingly pronounced as more users and funds flow into blockchain networks. In the industry's early days, Ethereum, where most on-chain activities were conducted, faced difficulties in processing the growing number of transaction requests due to its limited scalability, leading to network congestion and surging gas fees. To address these issues, new Layer 1 solutions boasting high scalability emerged, creating a competitive stance against Ethereum, while within the Ethereum camp, discussions about scalability improvements through sidechains and Layer 2 solutions took place.

The approaches to solving the Trilemma have evolved into debates over Monolithic vs. Modular architectures, EVM (Ethereum Virtual Machine) vs. non-EVM compatibility, and Layer 1 vs. Layer 2 solutions. Notably, Monolithic and Modular blockchains propose different methods for addressing the Trilemma, each offering unique solutions to overcome these inherent challenges.

Monolithic blockchains, which perform all four fundamental tasks of a blockchain (execution, settlement, consensus, and data availability) within a single network, has proposed the development of unique consensus mechanisms and transaction processing structures as their primary solution. On the other hand, modular blockchains, which divide tasks across various networks, have offered solutions through the organic integration of networks that specialize in specific tasks, such as Layer 2 solutions like Arbitrum and Optimism, and data availability-focused layers like Celestia.

Aptos, utilizing the Move language and being a non-EVM Layer 1, stands as one of the prominent representatives of monolithic blockchains. Since its mainnet launch in October 2022, Aptos has received significant attention and has shown an active expansion in the Asia-Pacific (APAC) region, including South Korea.

1.1. What is Aptos?

Aptos is a Delegated Proof of Stake (DPoS) Layer 1 blockchain created by developers from Meta's blockchain-based payment network, Diem. DPoS is a consensus mechanism where delegates stake tokens to validators in exchange for rewards. The staking rewards for delegates are weighted based on the validator's reputation, incentivizing delegates to choose high-performing validators and motivating validators to maintain a good reputation to attract more APT from delegates. Although Aptos initially adopted a Proof of Stake (PoS) consensus mechanism at its mainnet launch in October 2022, it switched to DPoS on April 20, 2023. Currently, there are 126 validators across 27 countries, with each validator offering an average annual yield of about 6.5%.

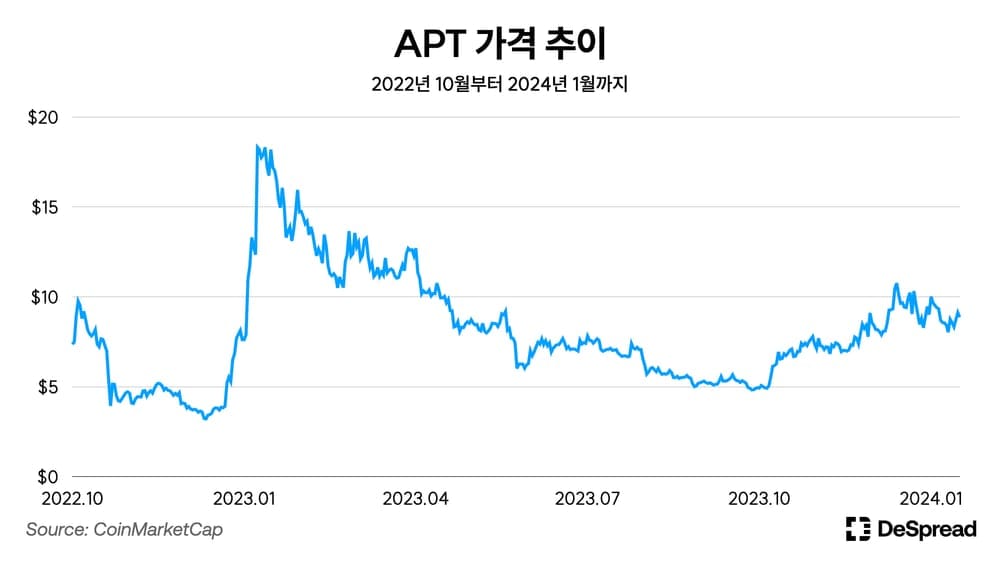

The debut of Aptos' mainnet captured worldwide interest for several key reasons: first, its innovative approach as a non-EVM network utilizing the Move programming language; second, its remarkable potential for scalability, aiming to support up to 160,000 transactions per second (TPS); and third, its substantial financial backing, securing $400 million from esteemed venture capital entities such as Andreessen Horowitz (A16Z), Multicoin Capital, and Binance Labs. Nevertheless, Aptos was not immune to the broader cryptocurrency market decline that started in 2022, experiencing a decrease in the value of its token, APT, by around 63% from its highest point.

Despite the market downturn, Aptos has continued to develop through network upgrades, governance activities, collaborations with global companies, and community building. This article will explore the key features of Aptos that are beginning to regain market attention, dividing the analysis into technical and ecosystem aspects.

2. Design for High Scalability

Layer 1 blockchains that have positioned themselves as 'Ethereum killers' have gained market attention by high scalability, including low gas fees and fast transaction processing speeds. Aptos, too, has been in the spotlight for its high scalability, centered on efficient consensus and transaction processing, and is applying various technical upgrades to achieve its ultimate goal of reaching 1 million TPS.

2.1. AptosBFT v4, the unique consensus mechanism

Aptos adopts DPoS with AptosBFT v4 as its consensus mechanism. AptosBFT v4 is an improved consensus algorithm based on the widely used practical BFT (pBFT) in networks such as Cosmos and Ripple. It offers lower network latency and faster consensus speeds over pBFT based on the following features:

- Improved transaction processing speed through Linear Communication and Chaining.

- Enhanced synchronization speed among validators is achieved through the introduction of a 'Pacemaker' and 'Timeout' mechanism, which helps in adjusting block creation times.

- An efficient selection process for the leader node (the validator proposing a new block) through the introduction of a validator reputation system.

Alongside AptosBFT v4, Quorum Store, introduced with the Aptos v1.5.0 upgrade in July 2023, also contributes to efficient transaction processing. Quorum Store is an upgrade that improves throughput by implementing Narwhal, which separates transaction distribution and consensus stages.

Before the introduction of Quorum Store, transaction processing was divided into two stages: mempool (distribution) and consensus. In the mempool stage, all transactions were sent to all validators. During the consensus stage, the leader node sent all transactions of the block it created to all other validators, who then sent signed block metadata to vote on the block. This process had two main issues: 1. All transactions were distributed twice, and 2. The leader node, which had to process raw transactions, was overloaded.

Quorum Store introduces an intermediate stage between the mempool and consensus stages, whereby transactions are not directly sent to all validators but pass through Quorum Store and are batched. For batches signed by more than two-thirds of the validators, Quorum Store generates a Proof-of-Availability, ensuring the uniqueness and availability of the batch. This stage efficiently addresses the problem of transaction redundancy and significantly reduces the workload on the leader node by allowing it to distribute only the validated batches alongside their Proofs-of-Availability during the consensus phase.

2.2. Parallelized non-EVM

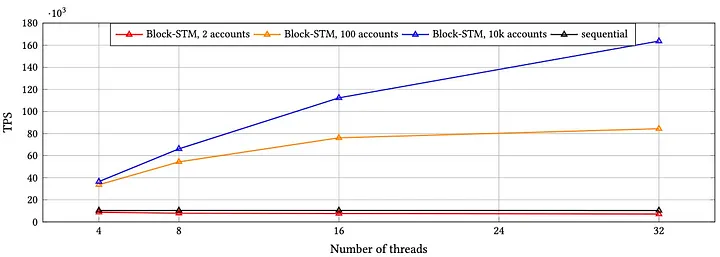

Aptos enables efficient transaction execution through a smart contract parallel execution engine called Block-STM. Traditional transaction execution in EVM-based systems must occur sequentially according to block order, leading to bottlenecks when there's a high volume of transaction requests, resulting in increased network congestion and gas fees. However, Block-STM facilitates parallel transaction execution by splitting transactions that have independent outcomes across multiple threads for simultaneous execution. This approach promises increased transaction throughput, reduced network congestion, and improved user experience with the following features:

- Optimistic Concurrency Control: Transactions run optimistically in parallel and resolve conflicts after execution.

- Dynamic Dependency Estimation: Utilizes transaction order to minimize aborts by marking failed transaction outputs as estimates. This helps manage dependencies, allowing transactions to wait for resolution instead of proceeding and likely failing, thus improving efficiency and reducing unnecessary work.

- Collaborative Scheduler: Streamlines transaction processing by smartly organizing tasks based on their complexity, using a counting method to address multi-core scaling challenges effectively.

Compared to traditional transaction execution(black line), Block-STM achieves higher TPS as the number of threads increases, mitigating the rise in gas fees or delays in transaction execution during high network congestion. The inscription craze last December highlighted the importance of parallel execution, as transaction requests surged across many networks centered around inscriptions, significantly increasing network congestion and gas fees.

Especially for EVM-based networks that process transactions sequentially, the gas fees for inscriptions hit a record high of $8.3M, with networks like Arbitrum experiencing operational issues for 78 minutes due to the spike in transaction requests. In contrast, networks like Aptos and Sui, which are Move-based and focused on parallel execution from the design phase, along with parallel EVM networks like Sei, showed relatively stable performance under high congestion and drawed attention.

2.3. Towards 1 Million TPS

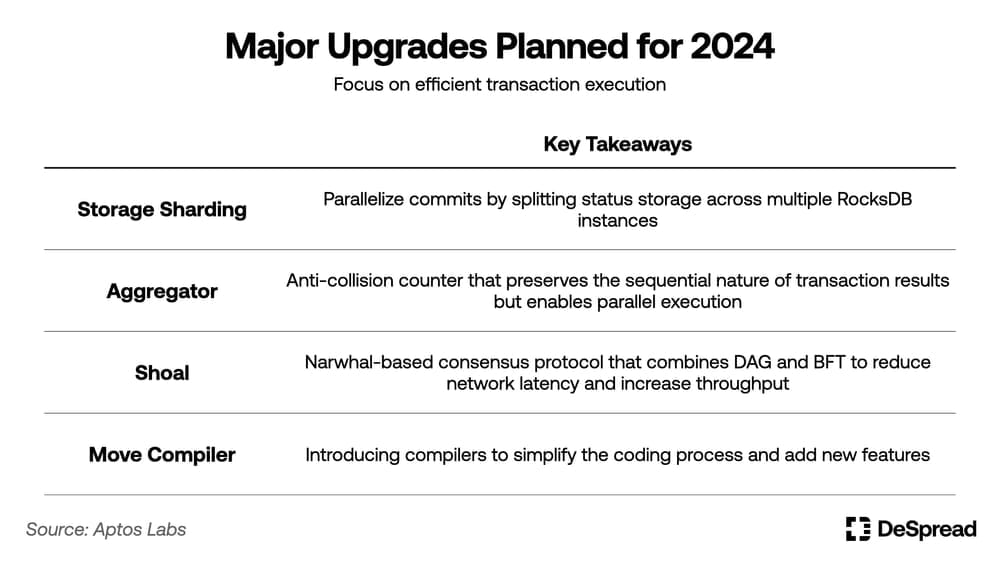

Aptos is undergoing upgrades through Previewnet, a testbed mirroring the mainnet environment, allowing experimentation before mainnet application. From November 6th to 21st, it conducted a focused test on TPS improvement, successfully processing over 9 billion transactions during this two-week period. The test achievements include:

- Processing 2 billion transactions in 24 hours.

- Achieving a maximum of 30,000 TPS and confirming the ability to maintain 25,000 TPS.

- Issuing over 1 million NFTs in 90 seconds.

When compared to Visa, the world's largest electronic funds transfer company, which processes 150 million transactions a day, Aptos's achievements are impressive, even considering the Previewnet environment. Aptos has announced plans to reach 100,000 TPS in the next phase, ultimately aiming for 1 million TPS. It has completed Previewnet tests for upcoming upgrades, planning to implement most of them in the mainnet by the first half of 2024.

3. Ecosystem Bootstrapping Strategy Utilizing Increased APT for Growth

After launching its mainnet in October 2022 with an initial circulating supply of 100 million APT, Aptos has conducted token unlocks every 12th of the month. Until October 2023, Aptos distributed 4.84 million APT monthly, constituting 0.42% of the total issuance of 1 billion APT. However, from November 2023 to April 2024, the distribution will include individual investors, with about 25 million APT being distributed each month, amounting to 2.31% of the total issuance. During this period, a total of 149 million APT will be distributed, leading to an anticipated increase in APT's circulating supply from 185 million to 334 million, an approximately 80% rise.

Equipped with a technological foundation capable of accommodating numerous users through parallel execution, Aptos is entering a key stage where it seeks to boost its dApps by leveraging the growing liquidity of APT. Aptos developer Zachtos.apt highlighted that Aptos has transitioned from the first Infrastructure Stage to the Protocol Stage and must now progress to the Composability Stage, underlining the significance of ecosystem bootstrapping.

- Infrastructure Stage: Building internal and external processes for achieving high scalability.

- Protocol Stage: Emergence of various applications within the Aptos ecosystem.

- Composability Stage: Organic integration and competition among applications to expand the ecosystem.

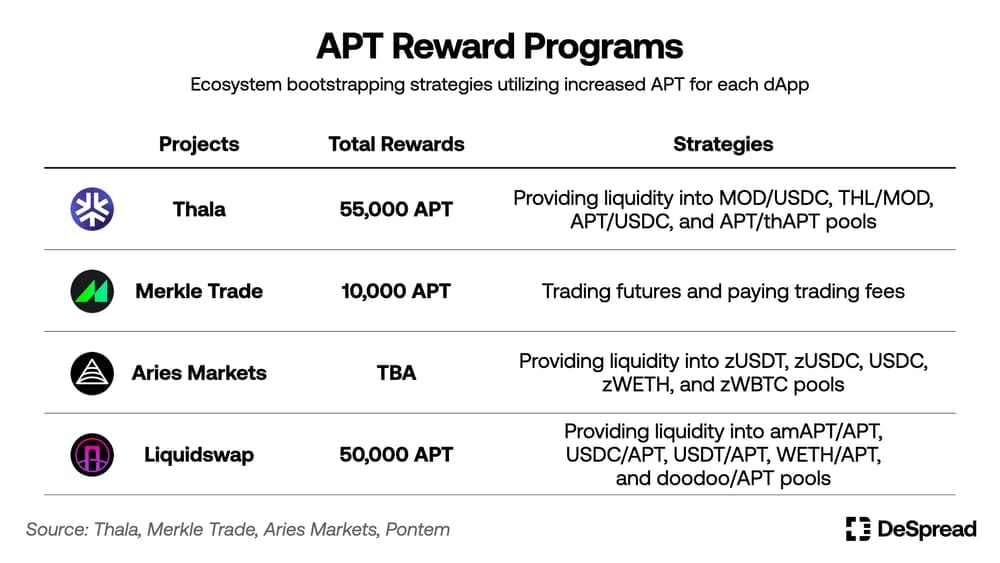

Moreover, several dApps on Aptos announced the launch of APT reward programs at the beginning of this year, demonstrating the ecosystem's intention to actively utilize the increased APT liquidity to attract funds and users. This chapter will explore the Aptos DeFi ecosystem, focusing on the reward strategies of four representative dApps that launched APT reward programs.

3.1. Thala

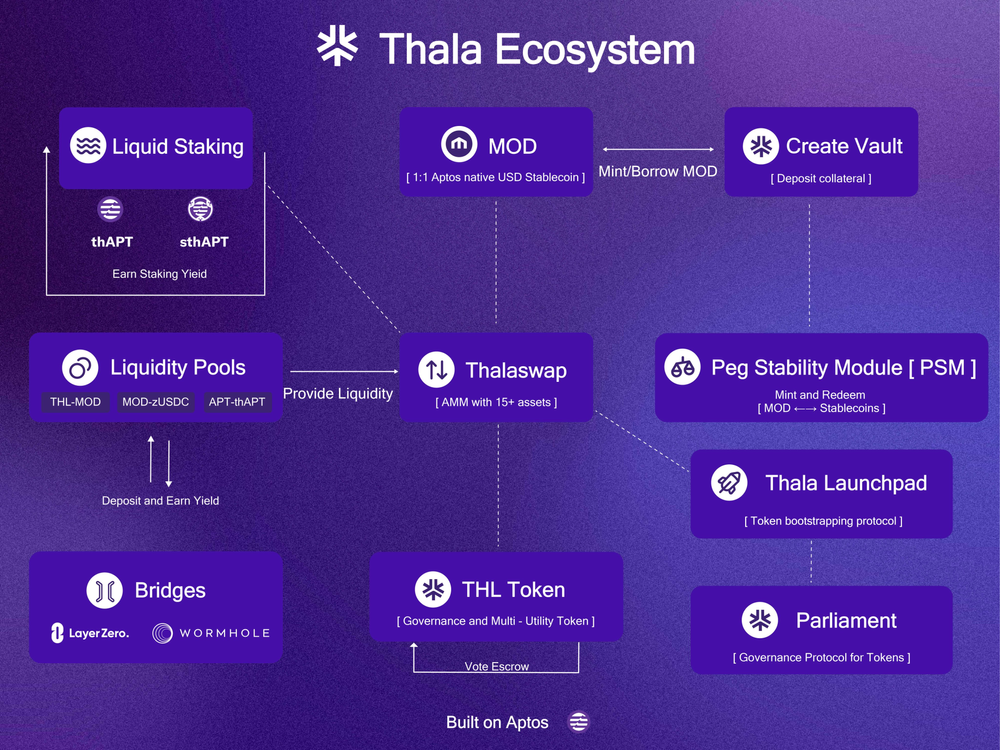

Thala is an all-in-one DeFi project offering a variety of functions such as swaps, bridges, and liquidity staking, holding over 40% of the total TVL (Total Value Locked) of the Aptos ecosystem with approximately $53.5M(excluding liquidity staking). The products offered by Thala include:

- Vault: CDP (Collateralized Debt Position) where users can mint Thala’s stablecoin, MOD, using various tokens like APT, USDC, USDT, and WETH as collateral

- TSP (Thala Stability Pool): A liquidation system that operates through MOD deposits, maintaining MOD’s peg and rewarding depositors.

- Peg: Divided into PSM (Peg Stability Module) and Redemption, where PSM allows 1:1 exchange between USDC and MOD, and Redemption enables swapping MOD for various tokens like APT, USDC, USDT, and WETH.

- Swap: Supports token swaps using an Automated Market Maker (AMM).

- Pool: Users can deposit in various token pools to receive LP (Liquidity Provider) rewards. Pools are categorized into Stable Pools, where two tokens have equal value, and Weighted Pools, where tokens have different values.

- Liquid Staking: Liquid staking is divided into Minting and Staking. Minting involves issuing thAPT by staking APT, with thAPT maintaining APT's value. While in the Staking, depositing thAPT results in the issuance of a rebasing token named sthAPT.

- Vote Escrow: Depositing native token THL to obtain ThalaDAO's governance token, veTHL.

- Launchpad: A platform for issuing new tokens through a LBP (Liquidity Bootstrapping Pool), with THL's LBP conducted in March 2023.

- Bridge: Utilizes LayerZero and Wormhole for token transfers across various networks, serving as a main gateway for stablecoins (zUSDC, whUSDC, zUSDT) to enter the ecosystem.

Thala announced an APT rewards program on January 12th, with rewards set to be distributed in February 2024, totaling 55,000 APT, making it the largest APT rewards program revealed to date. Users can earn additional APT rewards on top of the existing swap fees and THL rewards (esTHL) by providing liquidity to ThalaSwap. The pools eligible for this program include MOD/USDC, THL/MOD, APT/USDC, and APT/thAPT, totaling four pools.

Following the announcement of the rewards program, these four pools recorded significant increases in TVL: 108%, 8%, 60%, and 70%, respectively. This surge contributed to ThalaSwap's overall TVL rising from $21.36M to a peak of $33.3M during the same period, indicating a growth rate of over 55%.

Comparing Thala to other protocols offering APT rewards, depositing liquidity into ThalaSwap to earn APT rewards is considered the safest, with the least volatility and risk associated with the dApp itself since Thala holds the highest TVL and has the most liquidity concentrated in the stablecoin pool (MOD/USDC) among the four reward-offering pools. However, it's important to note that over half of the yield (APR) from the pools providing APT rewards originates from the APT rewards themselves, meaning the liquidity supply rewards are highly susceptible to APT price fluctuations.

Furthermore, on January 16th, Thala introduced a new policy called "THL Gated Emissions" aimed at converting the funds attracted by the APT rewards program into long-term liquidity. The essence of this policy is that to receive esTHL reward, liquidity providers must hold at least 2.5% of their LP position in veTHL. In other words, to fully benefit from the indicated yields, liquidity providers need to have deposited Thala’s native token, THL, within Thala. Through this policy, Thala aims to increase the demand for THL and ultimately enhance overall liquidity within the Thala ecosystem.

3.2. Merkle Trade

Merkle Trade, a decentralized perpetual futures exchange launched at the end of 2023, has quickly become one of the most notable emerging projects in the Aptos ecosystem. Its standout feature is the gamification of the decentralized exchange (DEX). Gamification involves incorporating game-like elements such as items, experience points (XP), and quest rewards into non-game applications to encourage usage. Merkle Trade employs the following game elements to enhance user engagement, competition, and long-term retention, much like leveling up a character in an RPG game:

- Experience Points (XP): Granted in proportion to the trade volume, allowing users to level up and receive better items as they gain more XP.

- Weekly Missions: Offer a variety of missions based on trade volume, market types, profit margins, and consecutive trades, rewarding mission points (MP) upon completion.

- Loot Boxes: Reward boxes given for accumulating certain mission points or level up, randomly containing experience boosts, items, or pMKL.

- Items: Obtainable from loot boxes, offering various benefits like fee discounts, XP boosts, or pMKL boosts. Users must regularly repair their items to keep using them.

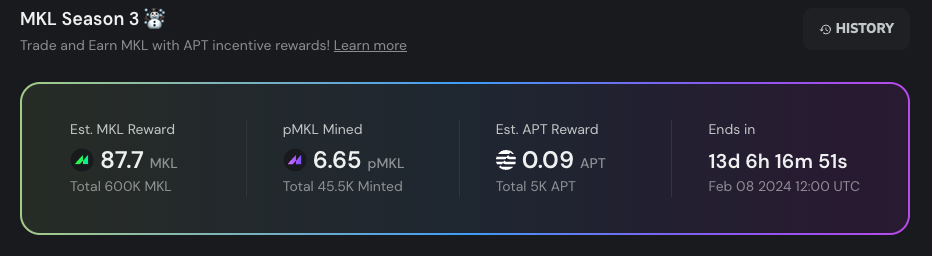

Beyond the gamification strategy, Merkle Trade provides pMKL rewards each season. The seasonal system was introduced following the launch of V2 in December 2023, with each season lasting two weeks. As of January 26, 2024, Season 3 is underway. Token rewards available during the season include pMKL and APT.

pMKL serves as a points system for obtaining Merkle Trade's native token, MKL, scheduled for release in Q1 2024. It's awarded in proportion to trade volume and fees paid, automatically converting into MKL at the end of the season. Out of a total issuance of 100 million MKL, 5.3% is allocated for total rewards, with 1.5 million MKL distributed in Season 1, and 600,000 MKL each in Seasons 2 and 3.

Additionally, for Seasons 2 and 3, running from January 12 to February 8, Merkle Trade is offering 5,000 APT rewards per season. Similar to pMKL, APT rewards are proportional to trade volume and fees paid, but to prevent bot trading, there's a cap where only up to 90% of the fees paid can be converted into APT rewards.

Merkle Trade enhances user experience through features like EVM wallet support, gas fee sponsorship, and fast transactions, offering a more user-friendly UX and comfortable application use. Merkle Trade supports not only Aptos-based wallets but also EVM-compatible wallets such as MetaMask and Rainbow, eliminating the need for users to manually bridge assets from EVM networks to Aptos. This integration is achieved through the LayerZero bridge, closely associated with Aptos, allowing users to deposit USDC from Ethereum, Arbitrum, and Polygon networks directly into Merkle Trade. The transferred USDC is sent to a new Aptos wallet created by Merkle Trade, which is then used by users to receive MKL and APT rewards, with the protocol covering the gas fees.

With its gamification strategy, diverse token rewards, and seamless UX, Merkle Trade has garnered significant attention within the Aptos ecosystem. This focus has led to substantial achievements in less than three months post-launch, including an over eightfold increase in TVL, a cumulative trading volume of $1.4 billion, and a total of 68,000 traders.

3.3. Aries Markets

Aries Markets, the first decentralized lending protocol on Aptos, launched in October 2022 and currently boasts a TVL (Total Value Locked) of $33M, ranking it third among all protocols on Aptos by TVL. Aries Markets provides a suite of services including lending, swaps, bridging, and trading, detailed as follows:

- Lending: Allows depositing various assets such as USDC, USDT, APT, and stAPT to earn interest and borrow assets.

- Swap: Supports swapping between different tokens using an AMM.

- Bridge: Utilizes Wormhole to support token transfers between Aptos, Ethereum, BSC, Polygon, and Fantom networks.

- Trading: Offers APT/USDC and WETH/USDC order book trading using the on-chain order book engine Econia.

Aries Markets announced on January 12th and 15th that it would apply an APT rewards program to the USDC, USDT, and zWETH pools in addition to the existing yields. However, the yield from pools paying APT rewards, such as zUSDT, zUSDC, USDC, zWETH, and zWBTC, is heavily dependent on APT rewards, ranging from 80% to 99% of the total yield, indicating a higher dependency on APT prices compared to Thala. Moreover, when compared with Thala from the perspective of depositing funds to earn APT rewards, the TVL and yield of the pools are significantly lower, resulting in a less than 7% increase in the protocol's overall TVL in the week following the announcement of the APT rewards program.

Despite its relatively low TVL growth and yields, it's important to note Aries Markets's proactive efforts in establishing collaborations across various dApps within the Aptos ecosystem. Aries Markets is not only partnering with other DeFi sector dApps but also engaging in collaborations with bridges, oracles, and wallets, positioning itself as a frontrunner in advancing the "composability" that Aptos emphasizes.

Key Collaborations of Aries Market

- Pontem: Enables lending and borrowing within the Pontem wallet interface

- Pyth: Utilize Pyth’s price feeds, ensuring accurate and reliable asset pricing

- Econia: Mentioned earlier in “Trading”

- PancakeSwap: Accept PancakeSwap’s CAKE as a collateral

- Amnis Finance: Accept stAPT, Amnis Finance’s rebasing LST as a collateral

3.4. Liquidswap

Liquidswap, established by the wallet project Pontem, is the first AMM-based DEX within the Aptos ecosystem, featuring token swap, liquidity farming, staking, and bridging. Currently, with a TVL of approximately $23M, it ranks fourth in the Aptos ecosystem by TVL.

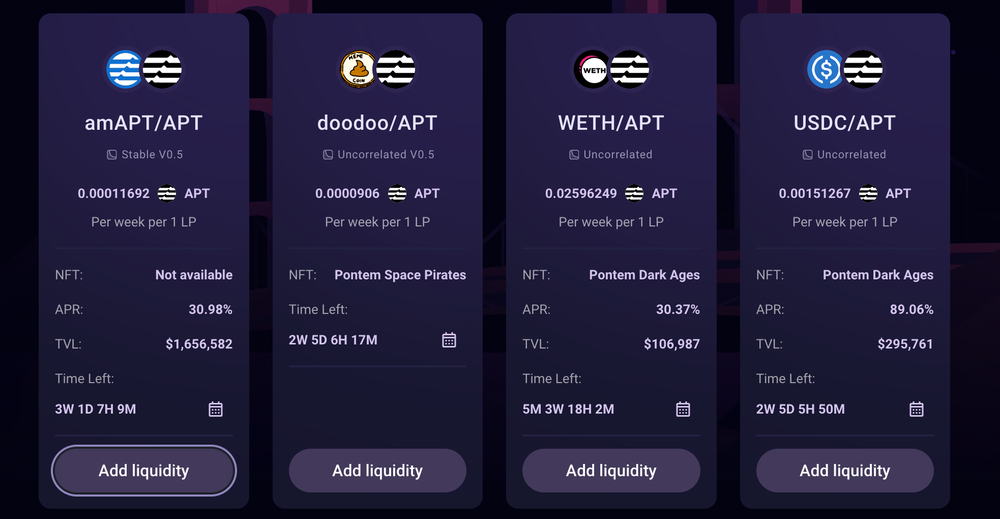

On January 16th, Liquidswap launched a reward program totaling 50,000 APT. This program includes pools such as amAPT/APT, USDC/APT, USDT/APT, WETH/APT, and doodoo/APT, offering APT rewards on top of the existing swap fee rewards to LP token holders on a weekly basis.

A notable aspect of Liquidswap’s APT rewards program is its collaboration with other Aptos DeFi projects. For example, one of the reward-eligible pools, amAPT/APT, involves amAPT, which is the LST of Amnis Finance, a new liquid staking protocol on Aptos. Within approximately three months of its launch, Amnis Finance has surpassed previous Aptos liquidity staking projects like Tortuga, Ditto, and Thala LSD in TVL, ranking second in the entire Aptos ecosystem. Liquidswap collaborates with Amnis Finance to offer APT rewards for the amAPT/APT pool, which currently holds the most liquidity among Liquidswap’s reward-eligible pools. Additionally, they are planning to distribute extra rewards to holders of specific NFTs issued by Pontem, targeting further expansion within the Pontem ecosystem.

This chapter has reviewed projects such as Thala, Merkle Trade, Aries Market, and Liquidswap, all of which have announced APT reward programs. Thala, as Aptos' leading all-in-one dApp, focuses on its own ecosystem expansion. Merkle Trade, a highly regarded new project, emphasizes rapid growth through unique features. Both Aries Market and Liquidswap, as original Aptos projects, aim to enhance the interoperability and composability among dApps within the ecosystem through various collaborations.

5. Conclusion

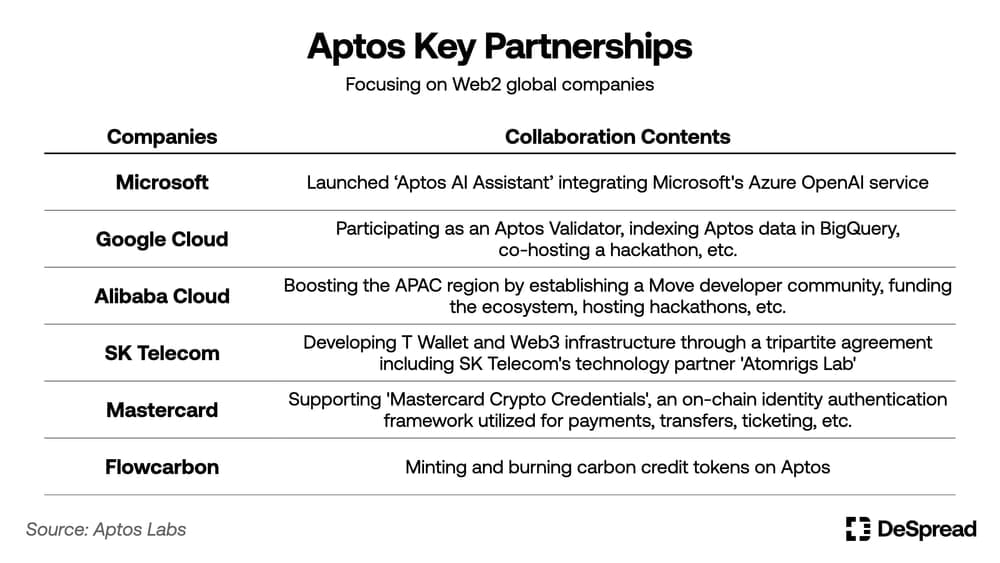

Aptos is striving for not only its internal ecosystem development but external expansion particularly aiming to connect with Web2 companies. Leveraging the networks and experience of its co-founders, Mohammad Shaikh and Avery Ching, both of whom are former Meta (previously Facebook) employees, Aptos is actively forming partnerships with major global Web2 companies. Given the increasing number of corporations entering or planning to enter the blockchain industry, Aptos's high network stability and TPS capabilities are well-positioned to facilitate a smooth and reliable onboarding of numerous users from Web2 to Web3.

Aptos is also showing a strong commitment to expanding its influence within the APAC region. Beyond strategic collaborations with Asian giants like Alibaba Cloud and SK Telecom, Aptos has initiated various projects such as the Asia region grant program launched with ABCDE Highlight, a world tour hackathon, and country-specific community management efforts. Co-founder Mohammad Shaikh highlighted Korea's potential, noting its well-established developer community and Web3 culture as capable of leading blockchain technology's mass adoption.

Aptos has formed partnerships with Korean companies such as SK Telecom, Netmarble, and Seoul Land. These collaborations highlight its focus on the gaming and entertainment sectors. Furthermore, Aptos anticipates expanding into the financial sector, including ventures into Security Token Offerings (STO). With its ambitions of serving as a bridge between Web3 and Web2, Aptos leverages its stable network, developer-friendly language, and global corporate connections. Currently, its efforts are concentrated on the APAC market, positioning it as a key player aiming to attract billions of potential customers worldwide. It is essential to observe whether it can achieve this ambition.

References

- Messari, Understanding Aptos: A Comprehensive Overview, 2023

- CoinBureau, Aptos Review 2024: The Next Solana Killer?, 2023

- Aptos Labs, Previewnet — and setting new industry milestones!, 2023

- Merkle Trade, Merkle Trade Incentives Overview. Trading Seasons, 2023

- Merkle Trade, Merkle Trade V2. Did Someone Say Trading RPG?, 2023

- Xangle, Aptos’ Ariadne's Thread: Untangling the Crypto Maze, 2023

- Aslan Research, 1. What is Aptos & Why?, 2023