Arbitrum — Strengthening Its Position As a Leader in Layer 2

Delving into the Reasons Behind Arbitrum’s Anticipated Success

1. Introduction

1.1. Ethereum Scaling Solution, Rollups

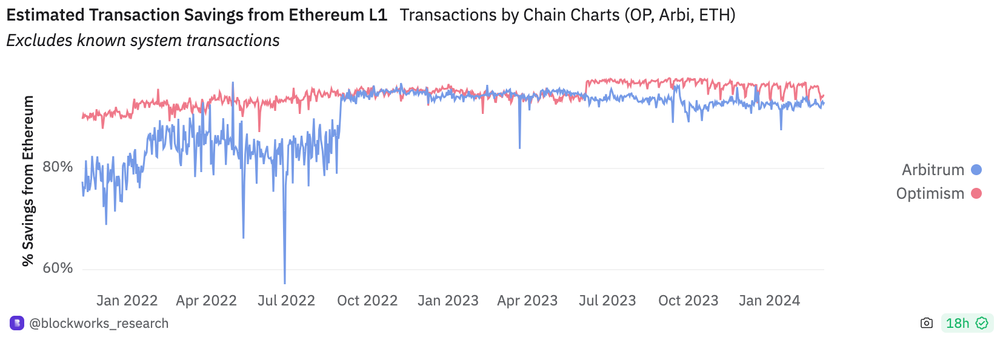

Launched to enhance Ethereum's scalability, rollups have successfully achieved their initial goal of reducing gas fees and accelerating transaction execution through off-chain computations. In particular, Arbitrum and Optimism, which together account for 65% of the TVL across all rollups, have recorded transaction fees (gas fees) that are approximately 10 to 20 times lower than those on Ethereum. As a result, the costs paid by users have decreased by more than 90% compared to Ethereum.

The significant reduction in transaction costs has attracted many users and developers who were struggling with Ethereum's high fees. Rollup TVL has grown remarkably, increasing approximately 74 times from $460 million in March 2021 to $34.5 billion by March 2024, according to the data from L2Beat. This remarkable growth has established rollups as a core pillar within the blockchain industry, boasting a daily transaction volume that is 8 to 10 times higher than that of Ethereum itself, thereby attracting substantial capital and user engagement.

1.2. Cambrian Explosion of Rollups

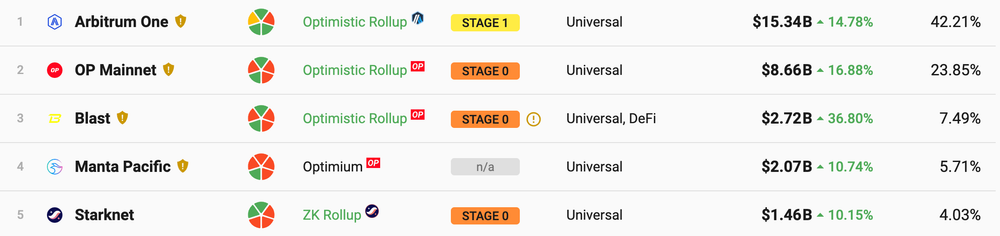

As of early March 2024, 45 rollups have been launched, and an additional 34 projects are preparing for launch. Among these, Arbitrum and Optimism hold market shares of 42% and 24%, respectively, with Starknet, Base, and zkSync following behind.

The development landscape for rollups has become more accessible due to the emergence of Data Availability (DA) layers like Celestia, as well as open-source rollup frameworks such as OP Stack, Orbit, and Polygon CDK. This trend has lowered the technical barriers to rollup development, leading to the launch of numerous new rollups. Furthermore, the increased anticipation for token airdrops has spurred active capital inflow into new rollups. Notably, Blast, Manta, and Mode, which launched their mainnets on February 29, 2024, September 12, 2023, and January 31, 2024, respectively, are now ranked 3rd, 4th, and 15th in terms of TVL.

1.3. Arbitrum, Consolidating its Lead

Despite the existence of nearly 90 rollups and the continuous launch of numerous new layer 2 solutions intensifying competition, Arbitrum stands out for its remarkable achievements compared to other layer 2 solutions. As mentioned earlier, Arbitrum holds over 42% of the TVL in rollups, securing the top spot, and the number of dApps onboarded on its network is 560, which is about 2.5 times more than that of Base, the second-ranked platform.

With its rich ecosystem, Arbitrum also maintains a dominant place in terms of the TVL in dApps, with approximately $3.4 billion, more than three times that of the second-placed Optimism. Arbitrum's ecosystem is particularly impressive, as it hosts a range of projects, from DeFi OGs like Aave and Uniswap to recent market favorites such as Pendle, Hyperliquid, and Vertex.

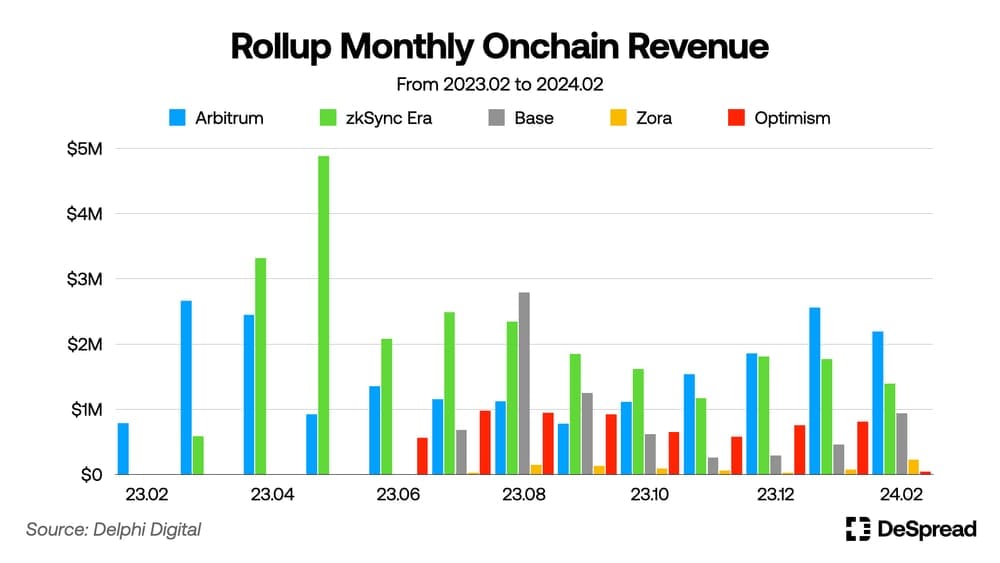

Furthermore, in terms of revenue, Arbitrum demonstrates superior performance compared to other rollups. Examining the graph showing onchain revenue by rollup from February 2023 to February 2024, Arbitrum recorded a rise in revenue for four consecutive months from September 2023 to January 2024. During this period, it surpassed zkSync Era, establishing itself as the top revenue-earning chain among the five listed.

In the current landscape where numerous rollups are in competition, this article aims to highlight the reasons behind Arbitrum's notable success and why it is expected to continue showing high performance.

2. What is Arbitrum?

Before diving deeper, let's first examine the Arbitrum network and its native token, ARB. Arbitrum is an Ethereum layer 2 solution developed by Offchain Labs, utilizing Optimistic Rollup technology. Optimistic rollup refers to a layer 2 technology that assumes the results of transactions processed on layer 2 and stored on the mainnet (Ethereum) are valid. To prevent malicious attacks, this technology includes a dispute period of one to two weeks, during which the validity of transaction execution can be contested.

2.1. Arbitrum One

Arbitrum One is the main rollup solution provided by Arbitrum, commonly referred to as the "Arbitrum network." As an Optimistic rollup, batches of transaction data processed on Arbitrum One are stored on the Ethereum network by a sequencer. This process allows Arbitrum One to fully inherit Ethereum's high level of security.

The implementation of Arbitrum Nitro in August 2022 marks a significant development in Arbitrum's technology, distinguishing the period before its application as Arbitrum Classic and after as Arbitrum Nitro. Nitro represents the latest phase in the evolution of Arbitrum's technology. With Nitro, Arbitrum One has achieved lower fees and higher EVM compatibility than before.

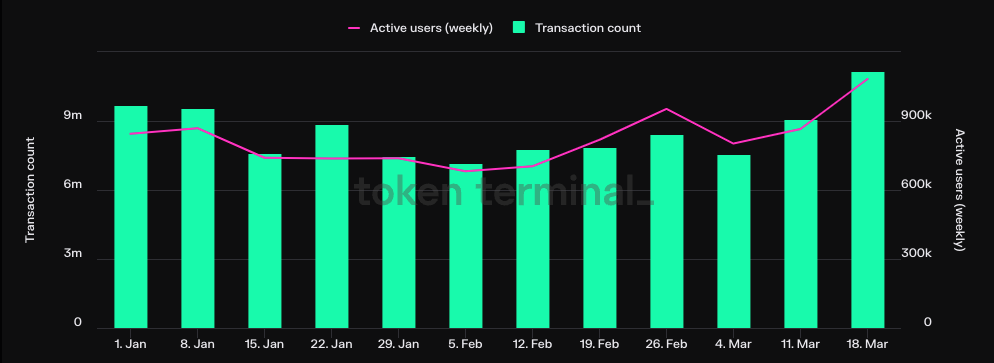

The previously discussed metrics, including the high TVL, the quantity of integrated dApps, and the onchain revenue, are all attributes of Arbitrum One. Furthermore, as illustrated in the subsequent chart, Arbitrum One has shown an upward trend in active users and the number of transactions since 2024, with a consistent increase in TVL, thereby maintaining steady and impressive performance.

2.2. Arbitrum Nova

Arbitrum Nova is another network within the Arbitrum ecosystem, established on the AnyTrust technology, which is a modified version of Nitro. This network emphasizes gaming and social applications, leading with its high scalability and usability. Distinct from Arbitrum One in the way it stores transaction data, Arbitrum Nova leverages this difference to assert enhancements in security while reducing costs.

While Arbitrum One saves transaction data on the Ethereum mainnet in calldata, Arbitrum Nova takes a different approach by storing this data with an external Data Availability Committee (DAC). The DAC consists of N members, and AnyTrust assumes that at least two of these members are honest. When the sequencer sends transaction data to the DAC, members are expected to sign and return it to the sequencer. If the sequencer cannot gather enough signatures within a few minutes, it shifts from the DAC storage method to a traditional rollup method. This "fallback to rollup" strategy ensures that under the assumption of at least two honest DAC members, the validity of signatures from up to N-1 members can always be established.

Arbitrum Nova is particularly well-regarded for gaming or social projects that require frequent transactions. By substituting the significant costs associated with submitting transaction data to the mainnet with an external DAC, Arbitrum Nova effectively lowers operational expenses. This cost-effective approach makes it an ideal platform for high-frequency transaction environments. Indeed, notable examples include the launch of Reddit's community point tokens, MOON and BRICK on the Arbitrum Nova network.

MOON is a token distributed based on Karma, a community point earned through activities such as posting, commenting, and recommending contents on Reddit's "r/CryptoCurrency" subreddit. Similarly, BRICK is a community token allocated based on Karma, which users can earn by participating in the "r/FortNiteBR" subreddit, associated with Fortnite: Battle Royale. Holders of these tokens gain access to exclusive services, including badges, the ability to use gifs in comments, and custom emojis. Additionally, BRICK serves a dual purpose within its subreddit, acting both as a governance token and a means to tip other users, thereby integrating a unique utility that enhances community interaction and governance.

2.3. Native Token, ARB

ARB, an ERC-20 native token of the Arbitrum network, primarily serves governance purposes and provides grants to dApps within its ecosystem. ARB holders have the privilege to vote on significant ecosystem changes, including grant programs, committee selections, and network upgrades. The Arbitrum Foundation plays a pivotal role by disbursing ARB as grants in accordance with community-established rules. This mechanism is designed to assist dApps in acquiring users and funds, thereby fostering the growth and sustainability of the ecosystem. The details and impact of these grants are further explored in the section titled "5. Expanding the Ecosystem Through Grants."

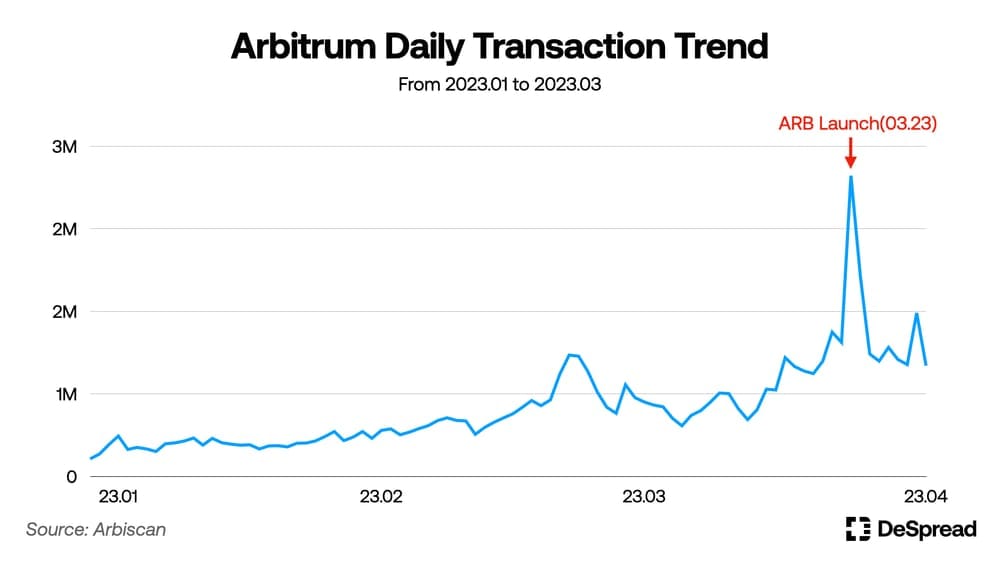

Optimism, which has been a traditional rival of Arbitrum launched its native token in March 2021, only after 3 months from its mainnet launch. In contrast, Arbitrum did not release its native token for about a year and a half after its mainnet launch in August 2021. The Arbitrum Foundation eventually announced ARB airdrop targeted at ecosystem participants on March 16, 2023, and subsequently distributed over 1 billion ARB tokens to more than 500,000 wallets on March 23. The efforts to qualify for the airdrop criteria and the subsequent explosive increase in daily transactions following actual ARB claims vividly illustrate the high anticipation and impact of the ARB token release at that time.

3. Cost Reduction Following EIP-4844

The Dencun Upgrade, particularly the implementation of EIP-4844, is a pivotal change within the Ethereum ecosystem eagerly anticipated by rollup solutions, including Arbitrum. Following successful applications across three testnets (Goerli, Sepolia, and Holesky) during January and February, the Dencun Upgrade was successfully deployed to the Ethereum mainnet on March 13.

3.1. EIP-4844, the Core of the Dencun Upgrade

Known as Proto-Danksharding, EIP-4844 is a key component among the nine EIPs included in the Dencun Upgrade and is a primary reason for the anticipation of Ethereum rollups towards this upgrade. The essence of EIP-4844 is to introduce "blobs," aimed at reducing costs for rollup solutions by cutting down on gas fees. Ultimately, this seeks to enhance the scalability of Ethereum's layer 2, offering a significant leap forward in terms of efficiency and cost-effectiveness.

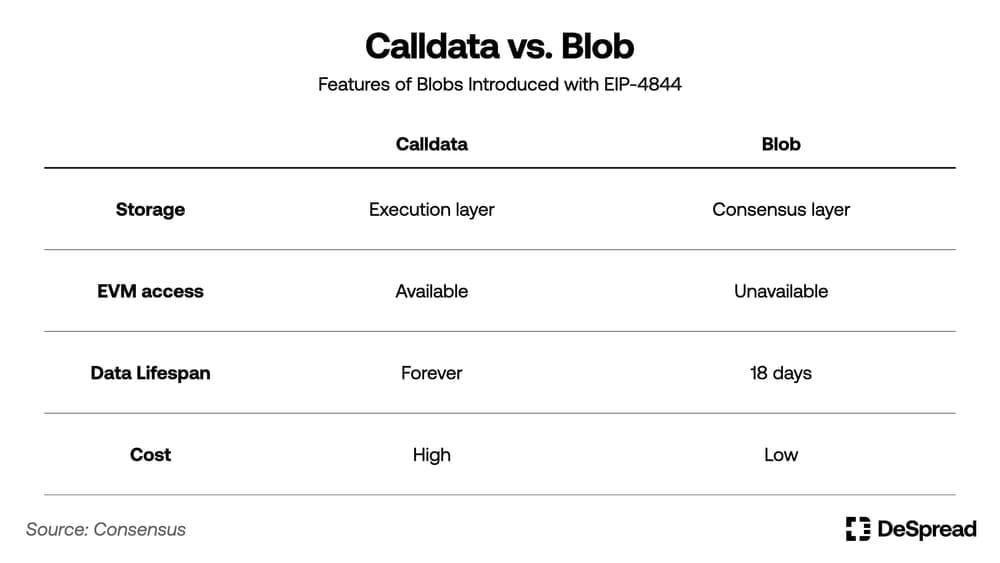

A blob is a new type of data storage that is exclusively stored in the Ethereum consensus layer. Before the implementation of EIP-4844, rollup solutions had their sequencers bundle the outcomes of transactions into batches, which were then submitted to the Ethereum mainnet execution layer in the form of calldata. This process incurred high gas fees, accounting for as much as 90% of the total operational costs for layer 2 solutions, leading to increased transaction fees for users of layer 2. The introduction of blobs is an upgrade aimed at addressing the scalability limitations of rollup solutions caused by these high costs. By creating a separate data storage space distinct from calldata, the upgrade seeks to free up space on the Ethereum mainnet and significantly reduce the data submission costs (DA costs).

3.2. Cost Changes with the Introduction of Blobs

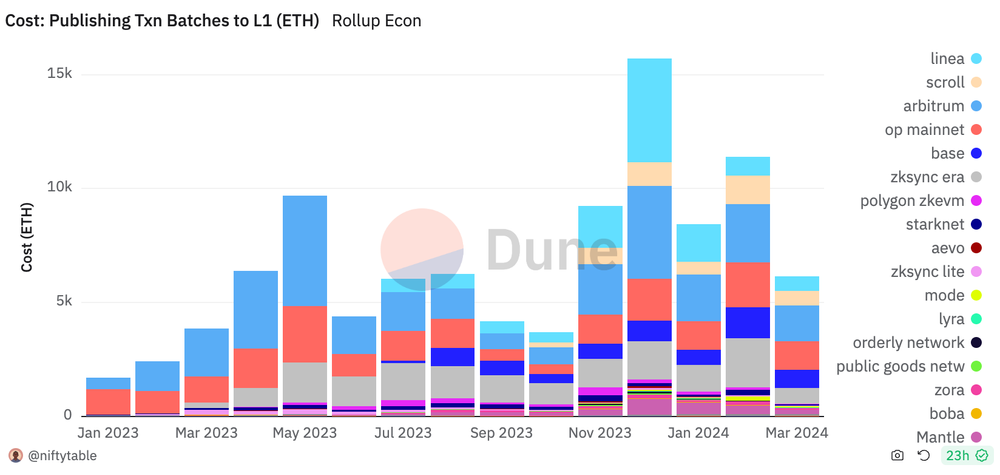

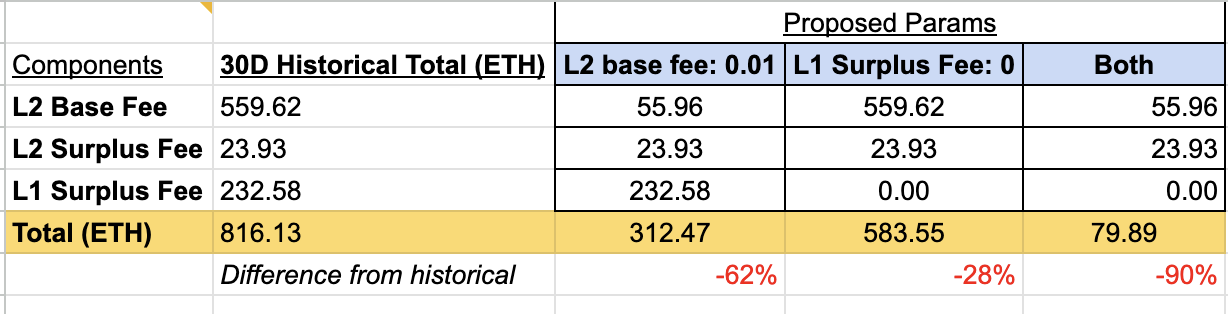

The referenced chart illustrates the monthly costs incurred by various rollups for transmitting transaction batches to the Ethereum mainnet, with Arbitrum alone paying approximately 24,617 ETH in such fees over the course of 2023. The significant portion of rollup operational costs stemming from batch submission is attributed to the high data storage cost of calldata, which is 16 gas per byte. In contrast, according to the Ethereum official GitHub, the cost for blobs is only 1 gas per byte, making it 16 times cheaper than calldata. Moreover, the pricing of blob costs is determined in a market independent from the calldata fee market, meaning that blob costs remain unaffected by surges in calldata demand. This separation potentially stabilizes the costs associated with blob storage, providing a more predictable and scalable cost structure for rollup operations on Ethereum.

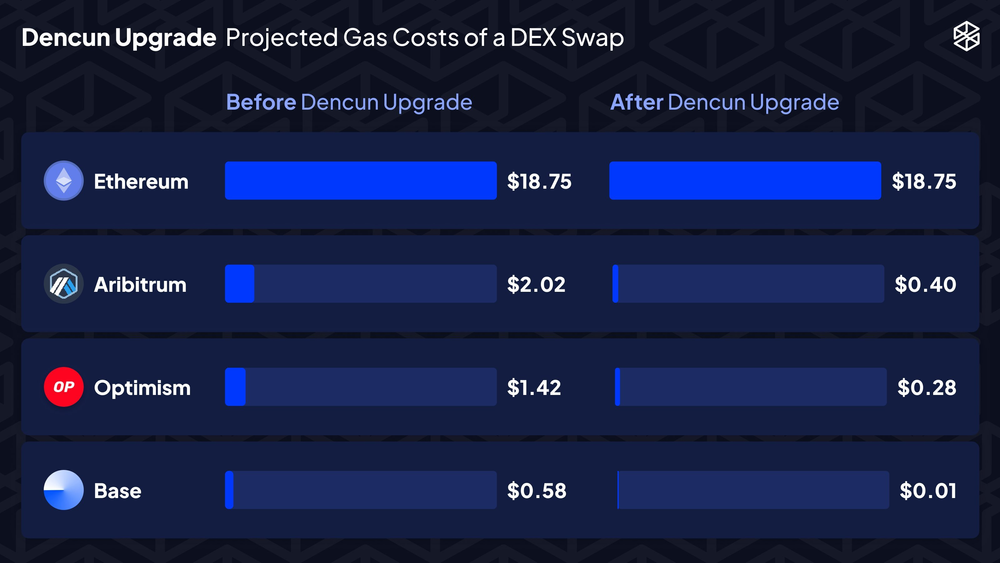

The introduction of blobs and the consequent reduction in rollup operational costs can significantly impact users, primarily through reduced transaction fees. Since the bulk of rollup expenses are tied to the batch submission fees to the Ethereum mainnet, a substantial reduction in these costs should proportionally lower the fees rollups charge their users, namely the gas fees. By examining the formula for calculating gas fees on Arbitrum, this relationship becomes more evident.

Arbitrum Transaction Fee

= L1 Cost + L2 Cost

= (Calldata size * Cost per byte) + (Gas demand * base fee)

Arbitrum transaction fees are divided into two main categories: the cost of storing calldata on the Ethereum mainnet (L1 cost) and the cost of executing contracts on Arbitrum (L2 cost). The L1 cost is determined by multiplying the size of the calldata stored on Ethereum by the cost per byte, while the L2 cost is calculated by multiplying the gas required for contract execution by the base gas fee. The introduction of blobs directly impacts the L1 cost by reducing the cost per byte for data storage on Ethereum. Therefore, mathematically, it is clear that the overall fees that Arbitrum users are required to pay decrease with the implementation of blobs.

Arbitrum introduced blobs later than other chains, but now that the implementation is complete, its average gas fee has significantly dropped to a very low level of $0.01, which is about 20 times lower than before. However, the current situation can change at any time. For example, Base experienced a suuden rise in L2 costs following surge in transactions prompted by memecoin trading —which initially led to a reduction in gas fees to $0.0005, over 100 times lower, right after the introduction of blobs. Arbitrum, too, may experience increases in gas fees resulted from a spike in transaction processing that raises L2 costs, as well as from an increase in the demand for blobs, which would affect L1 costs.

4. Expanding the Ecosystem Through Technical Upgrade

Beyond the implementation of EIP-4844, which affects the entire Ethereum ecosystem, Arbitrum is also making concerted efforts to expand its own ecosystem. These efforts can be broadly categorized into two types: expansion through technical development and expansion through grants. In this chapter, we will first explore examples of ecosystem expansion achieved through technological development.

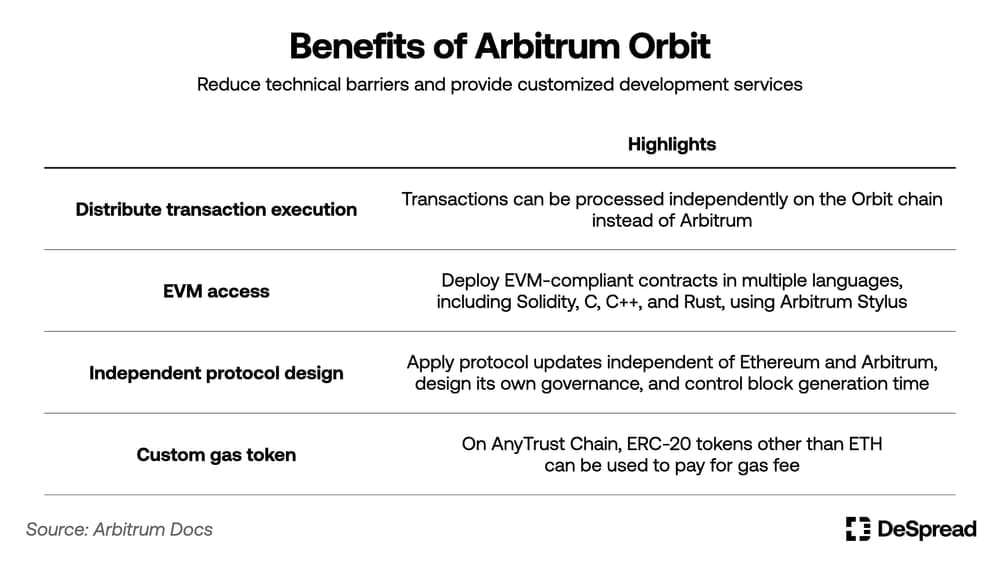

As mentioned above, the rollup space is currently experiencing a Cambrian Explosion, with numerous existing and upcoming rollups vying to onboard users, developers, and projects. Despite maintaining a leading position in terms of TVL, transaction throughput, and onboarded projects, Arbitrum is actively developing its tech stacks to ensure flexible ecosystem expansion. The key players in this development are Arbitrum Orbit for vertical expansion and Arbitrum Stylus for horizontal expansion. Through these upgrades, Arbitrum is striving to attract more projects and developers, facilitating their smooth transition into its ecosystem.

4.1. Arbitrum Orbit

Arbitrum Orbit is a permissionless service that leverages Arbitrum Nitro, allowing users to create layer 2 or layer 3 solutions according to their needs. A comparable service is Optimism's OP Stack. With Orbit, users can freely choose between Arbitrum rollup (Arbitrum One) and AnyTrust (Arbitrum Nova) to easily create a custom chain tailored to the application they wish to develop.

To date, approximately 20 projects have announced plans to create chains using Arbitrum Orbit, with five of those projects having already launched their mainnets. Prominent examples of Orbit chains that have launched or plan to launch their mainnets include Xai, TreasureDAO, and Yuga Labs. Notably, the decision for Yuga Labs' ApeChain to use Arbitrum Orbit made through a community vote garnered significant attention outpacing other layer 2 solutions like Optimism, Polygon, and zkSync in the community vote.

In addition to onboarding various projects onto the Arbitrum ecosystem through Orbit, Arbitrum is actively collaborating with renowned infrastructure service providers including Caldera, Conduit, Altlayer, and Gelato Network, as well as with data availability protocols like Celestia and EigenDA, to enhance its influence within the modular blockchain ecosystem.

Such proactive partnerships by Arbitrum offer potential clients considering their own chain development a wider range of options, thus providing a solid foundation for gaining an advantage in the intensifying competition for ecosystem expansion among rollups. For instance, users can look forward to freely choosing the optimal services based on their preferences and chain characteristics, such as using Arbitrum Orbit as a rollup framework, Base as a settlement layer utilizing Conduit, and Celestia for a data availability (DA) layer.

4.2. Arbitrum Stylus

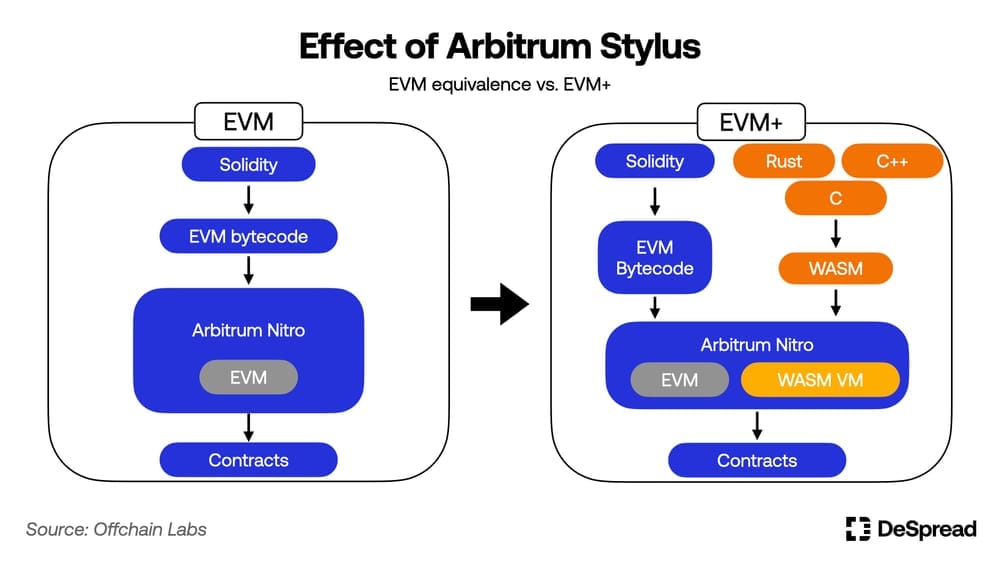

Arbitrum Stylus, an upgrade from Nitro, is a technical enhancement aimed at attracting more developers in conjunction with Arbitrum Orbit. A significant improvement is the addition of WASM VM alongside EVM to Arbitrum One and Nova, enabling the deployment of contracts written in various languages such as Rust, C, and C++ on top of Arbitrum, thus surpassing the existing EVM equivalence to achieve an 'EVM+'. There is anticipation within the Arbitrum community that the Stylus implementation could enhance Arbitrum's scalability to the same extent as, or even more than, the Dencun Upgrade.

The introduction of Stylus is expected to have two major effects. First, by supporting languages used by a broader developer base than Solidity, such as Rust, C++, etc., it can secure a wider pool of developers. According to statistics from Statista for the year 2023, while only 1.33% of developers used Solidity, while Rust was used by 13.05%, C by 19.34%, and C++ by 22.42%. Secondly, WASM can significantly reduce gas fees and increase transaction execution speed. Arbitrum has stated that by leveraging Nitro's unique fraud-proof technology, transaction execution through WASM could be over ten times faster and cost between 100 to 500 times less.

5. Expanding the Ecosystem Through Grants

In this chapter, we explore Arbitrum's efforts to expand its ecosystem through grants such as STIP, LTIPP, and GCP. While Arbitrum Orbit and Stylus aim to lower technical barriers and onboard new projects, grant programs like STIP and GCP are designed to increase onchain activity within the Arbitrum ecosystem and attract more users.

5.1. STIP and LTIPP

5.1.1. STIP

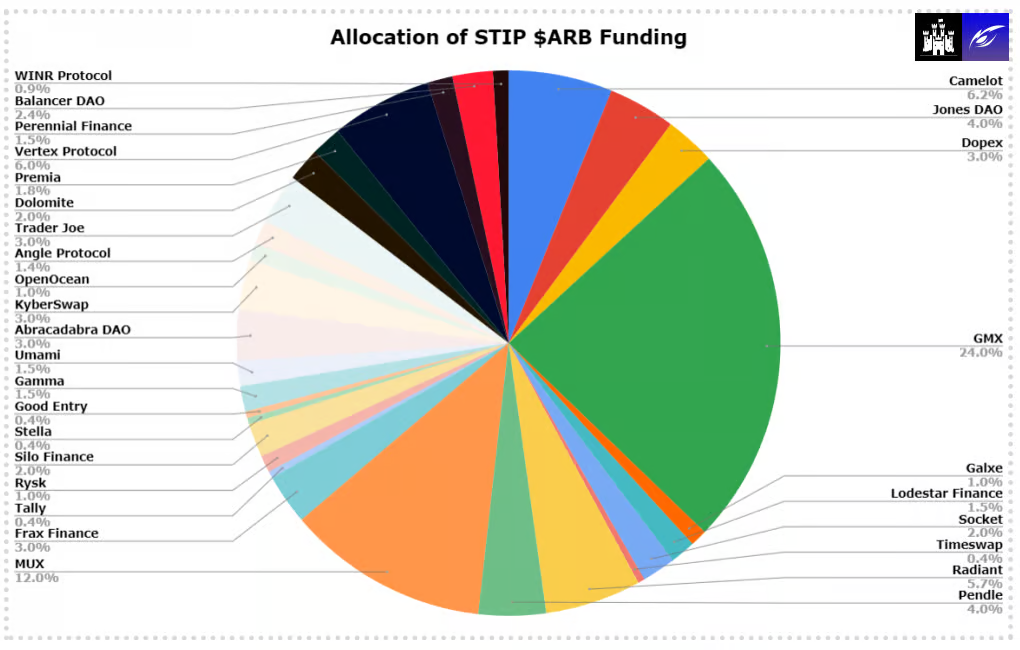

The Short Term Incentive Program (STIP) is a grant program that distributes 50 million ARB to 30 projects selected through community voting. The goal of this program is to distribute ARB tokens to projects within Arbitrum, providing them with a foundation to design incentive structures that attract users and funds and maintain them sustainably.

STIP was proposed in October 2023 and passed in December 2023 with 99% approval. The proposal attracted over 100 project applications within a week of its announcement, highlighting the community's high interest. Of the 50 million ARB distributed, about 44% was allocated to perp DEX protocols, with GMX receiving the largest grant of 12 million ARB. Decentralized exchanges followed, receiving 12% of the total grant allocation.

Additionally, Arbitrum proposed the Backfund program in November, extending an additional support of 21.4 million ARB to 26 projects that did not receive grant from STIP. In this program, the Perp DEX protocol Gains Network received the largest allocation of 4.5 million ARB. Unlike STIP, this round included bridge protocols such as Stargate, Synapse, and Wormhole, which were not part of the original STIP allocations.

Projects selected for the STIP and Backfund programs must complete the distribution of ARB incentives to users by March 29, 2024. The original deadline for incentive distribution was January 31, 2024, but it was extended to March 15 for the Arbitrum Foundation's ARB distribution and March 29 for projects to distribute ARB incentives to their users, especially for those included in the Backfund to facilitate the design of effective incentive structures. Moreover, projects which received ARB incentive are required to update their progress biweekly on the Arbitrum forum, including details such as the amount of ARB received from the foundation, how much of this was used, details of the incentives, trends in TVL and transaction increases, and plans for the next two weeks.

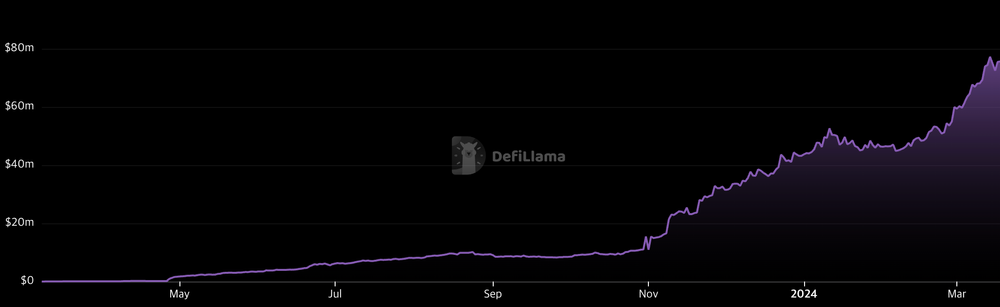

Approximately four months after the initiation of STIP, 82.1% of the total allocated 62.68M ARB has been distributed to the projects, with 75.47% of that being used for user incentives. It has been observed that the majority of the top 20 projects by ARB allocation, where over 90% of ARB distribution has been completed, have seen an increase in TVL since the start of STIP. Notably, the Perp DEX protocol Vertex, which received an allocation of 3 million ARB, experienced a TVL increase from 6,000 ETH to 22,000 ETH during the incentive program period, a roughly 3.67-fold increase, demonstrating significant fund inflows beyond mere ETH price appreciation.

Vertex launched its native token, VRTX, concurrently with the start of STIP and announced a VRTX and ARB incentive program. This program was designed to enable users to earn ARB and VRTX rewards through trading and staking in liquidity pools, aiming to increase the number of transactions executed, boost the protocol's revenue, and secure long-term user liquidity within the protocol. The rapid success of Vertex can be considered a prime example of effectively utilizing the anticipation of a protocol token airdrop to design an incentive structure that benefits the protocol, its users, and the Arbitrum ecosystem, fulfilling the objectives of the grant program most effectively.

5.1.2. LTIPP

The Long Term Incentive Pilot Program (LTIPP) is a 12-week test program that bridges the gap between STIP and LTIP, with a total support of 45 million ARB, approved on January 17th. According to the Arbitrum DAO, STIP identified three major issues, and Arbitrum aims to address these problems within LTIPP, using the solutions as a foundation to enhance the outcomes of future grant programs.

The Issue and Solution for STIP

- Issue 1: The challenge of reviewing and voting on over 100 project proposals through direct elections.

- Solution 1: Transition to an indirect voting method by electing a 5 council members.

- Issue 2: Lack of appropriate feedback for projects that were not selected.

- Solution 2: Introduction of Application Advisors to provide guidance and feedback.

- Issue 3: The strict limitations on ARB incentive structure design led to a scarcity of innovative examples.

- Solution 3: Relaxation of restrictions through the introduction of Application Advisors.

The election for the 5 council members was completed on January 24th, selecting GFX Labs, 404 DAO, Wintermute, GMX, and Karel Vuong. The application period for LTIPP ended on March 17th at 23:59 EST, followed by a two-week feedback period, one week of council evaluation, and one week of voting. After this process, the selected projects will participate in LTIPP for 12 weeks. Projects that applied for LTIPP can be found on the Arbitrum forum.

5.2. Gaming Catalyze Program

The Gaming Catalyze Program (GCP) is a grant program designed to expand the Arbitrum gaming ecosystem with an allocation of 200 million ARB tokens. Unlike the STIP and LTIPP, which focus on DeFi projects that leverage Arbitrum's strengths, the GCP targets Web3 gaming projects—a sector previously considered a weakness within the Arbitrum ecosystem.

As the largest and longest initiative of its kind, spanning two years, Arbitrum aims for the successful implementation of the GCP through rigorous vetting by the Arbitrum Foundation, a 5 council member, and a Venture Team. The council, elected through community voting similar to the LTIPP process, will oversee the hiring and firing of the Venture Team members—a subsidiary of the Arbitrum Foundation—and manage the whitelisting of projects wishing to participate in the GCP.

Out of the total 200 million ARB allocated to the GCP, 160 million ARB will be used for builder onboarding and development, while the remaining 40 million ARB will be distributed for the construction of infrastructure to support game development.

- Builder Onboarding and Development Funds (160 million ARB): These funds are allocated to onboard promising projects onto Arbitrum, aiming to facilitate their development within the ecosystem.

- Infrastructure Development (40 million ARB): This portion of the funds is dedicated to the development of technology and infrastructure crucial for game development, such as account abstraction, game engine SDKs, and more.

Through the strategic use of these funds, GCP aims to onboard between 200 to 300 gaming applications and launch over 25 Orbit chains. This initiative is projected to secure over 20% market share of the total gaming projects, positioning Arbitrum to gain a competitive edge over other layer 2 solutions.

The proposal for GCP was introduced on the Arbitrum forum on March 11 and passed a governance vote with approximately 99% approval on March 23. Following this, the GCP council elections and the formation of the Venture Team are scheduled to be completed between April and May, with the program starting to receive project applications soon after. Despite only completing the community vote phase, GCP has already attracted significant interest within the Arbitrum community. This attention is not only due to the program's unprecedented scale and long-term vision but also its timely introduction amidst growing efforts to energize the gaming ecosystem, such as the launch of Arbitrum Arcade. Furthermore, the GCP proposal was authored by Karel Vuong, a co-founder of TreasureDAO and a member of the LTIPP committee, highlighting the strategic involvement of key figures within the Arbitrum ecosystem. Vuong's involvement, along with the expressed enthusiasm from various notable community members, underscores the GCP's potential to drive significant growth and innovation within the Arbitrum gaming sector from its early stages.

6. Conclusion

We've examined the background that could allow Arbitrum to maintain its lead in the intensifying competition among layer 2 solutions, focusing on aspects such as gas fee reduction following the Dencun upgrade, development of the technology upgrade including Orbit and Stylus, and the implementation of grant programs like STIP and GCP. However, while the decrease in gas fees due to the Dencun upgrade is a necessary condition for the revival of the rollup ecosystem, but it is not sufficient on its own. Even if the absolute cost for users to operate on the network significantly decreases, the lack of appealing services or applications to attract users means that the reduction in fees could not only fail to be beneficial but could also negatively impact revenue due to decreased earnings.

From its launch, Arbitrum has onboarded numerous dApps, particularly DeFi projects, thereby establishing itself as the network with the highest TVL and a significant number of transactions among rollup solutions. Furthermore, the steady release and migration of emerging DeFi dApps to Arbitrum highlight its dominant position in the DeFi sector. With the introduction of GCP, Arbitrum is also making concerted efforts to expand into the gaming sector, aiming to solidify its presence and attract a broader user base.

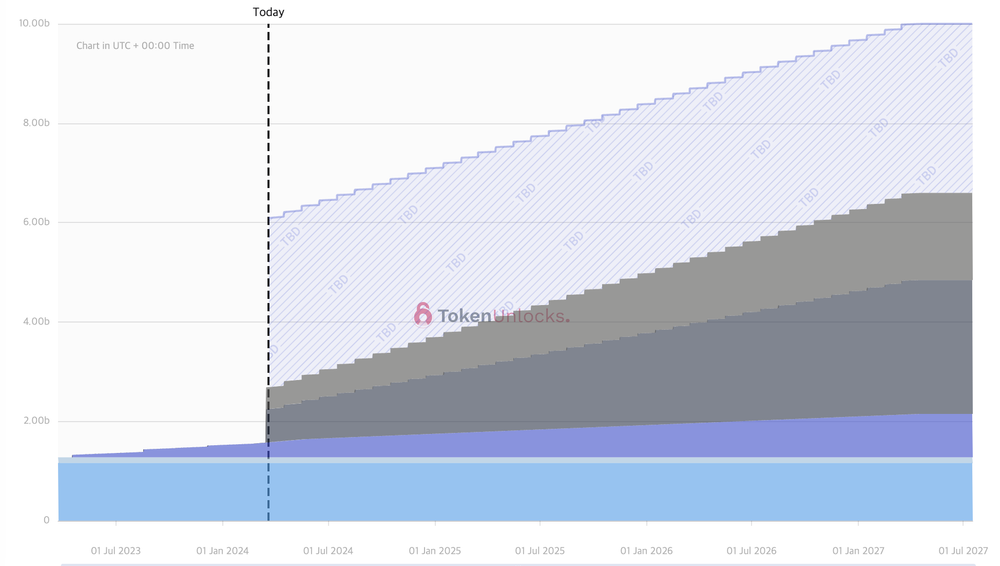

Despite the rich ecosystem of Arbitrum, ongoing concerns about the limited utility of its native token, ARB, remain a challenge that Arbitrum needs to address. Like most Ethereum rollup solutions, the primary use case for ARB is governance, with gas fees still being paid in ETH. This results in a lack of opportunities for ARB's continual utilization within the ecosystem.

Furthermore, a significant unlock event occurred on March 16, with 1.11 billion ARB being released in the largest unlock since ARB's launch. This will be followed by monthly unlocks of 926 million ARB targeted at teams and investors until March 2027. Therefore, to leverage the increased liquidity from these unlocks as a driving force for ecosystem activation rather than a downward pressure on price, Arbitrum must diversify the use cases for ARB.

Having addressed the issue of comparatively high gas fees with the Dencun upgrade, Arbitrum is strengthening its existing advantages while also striving to arm itself with new tools, such as gaming and L3 expansion. As liquidity continues to flow into layer 2 solutions and the technical barriers to network launches are reduced, it will be important to observe whether Arbitrum can solidify its leading position.

References

- Offchain Labs, Understanding Arbitrum: 2-Dimensional Fees, 2022

- Four Pillars, [KBW related Article] 아비트럼 101, 2023

- Offchain Labs, Hello, Stylus, 2023

- Delphi Digital, The Year Ahead for Infrastructure 2024, 2023

- Galaxy Research, How Modularity and Rollups Impact ETH Value, 2023

- Galaxy Research, Proto-danksharding: What It Is and How It Works, 2023

- Consensys, Ethereum Evolved: Dencun Upgrade Part 5, EIP-4844, 2023

- Messari, The Road Ahead for Rollups and EIP4844, 2024

- Zeeve, What’s brewing on Arbitrum Orbit? Navigating the Hottest Projects, 2024

- The Castle Chronicle, The State of Arbitrum, 2024

- Arbitrum Docs, How to estimate gas in Arbitrum