Astar Network — Introducing zkEVM to Extend to the Ethereum Ecosystem

Focusing on Astar zkEVM's Architecture and Features

1. Introduction

Last September, Astar, a blockchain platform focused on interoperability between the Polkadot and Ethereum ecosystems, announced Astar Supernova.

A key part of the announcement was the launch of the Astar zkEVM in partnership with Polygon. This signaled Astar's aspirations to evolve from a mere EVM-compatible chain into an EVM-equivalent one, as a Layer 2 solution on Ethereum.

1.1. Story Behind the Launch of Astar zkEVM

Astar plans to launch the Astar zkEVM utilizing Polygon CDK (Chain Development Kit). Polygon CDK is a program that enables the creation of ZK-rollup solutions. But what are Astar’s true intentions to release a zkEVM, as a smart contract platform already encompassing EVM and WASM development environments?

For the purpose of revitalizing the ecosystem, connecting with Ethereum, which is currently the first blockchain ecosystem, is the most important task. However, with so many rollup projects on Ethereum, there is little to no incentives for market participants to onboard with Astar's existing EVM compatibility alone.

Meanwhile, Polygon is a public blockchain that offers low gas costs and high scalability compared to Ethereum, making it actively adopted by various projects in Japan, especially by gaming projects. In addition, Polygon has collaborated with KDDI, one of Japan's three largest telecommunications companies, to allow NFTs from their metaverse platform "αU" to be traded on Polygon. In addition, Polygon has directly and indirectly helped various companies in Japan enter the blockchain industry, including Double Jump Tokyo, Square Enix, and others, across Web2 and Web3.

In this regard, the launch of zkEVM with Polygon CDK could provide a springboard for Astar, which aims to become Japan's leading blockchain network, led by founder Sota Watanabe, to kill two birds with one stone: achieve EVM equivalence and strengthen its influence in Japan.

1.2. Architecture of Astar Network

Astar started as Astar Substrate, a parachain in the Polkadot ecosystem, to become a cross-chain smart contract platform that provides a more convenient environment for enterprise and dApp developers. As an independent network, a parachain can have its own native token, and block generation and verification is performed by validators in the relay chain. After the launch of Astar zkEVM, an Ethereum layer 2, both networks will be bridged, thus extending the Astar ecosystem beyond the Polkadot ecosystem to Ethereum as shown in the diagram above.

2. Features of Astar zkEVM

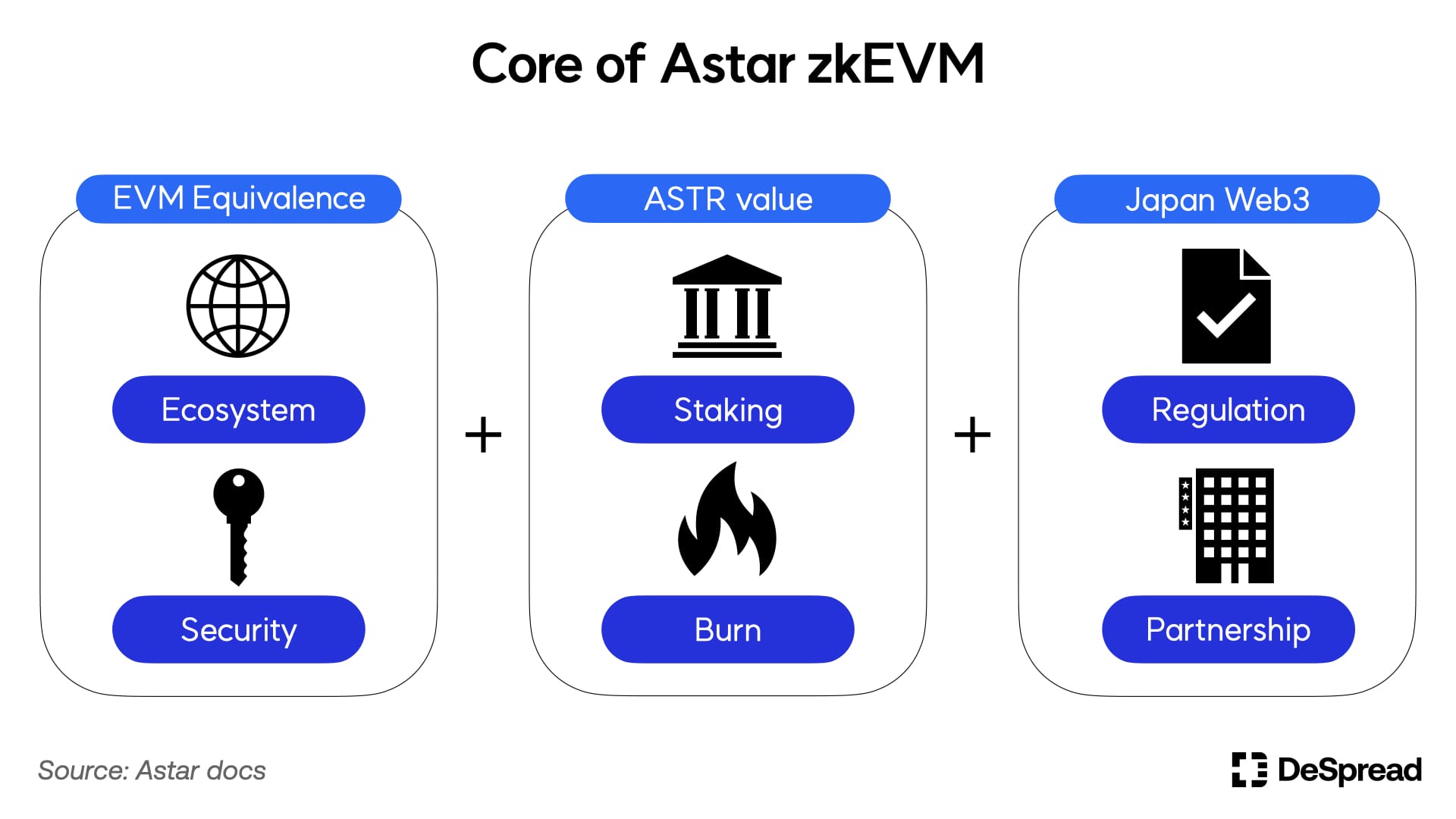

By adding Astar zkEVM, a layer 2 that interacts directly with the Ethereum mainnet, Astar aims to broaden the options for enterprises and developers, ultimately attracting more ecosystem builders to Astar network. In this chapter, we'll discuss the key features of Astar zkEVM.

2.1. Beyond Compatibility to Equivalence

Astar zkEVM provides greater Ethereum compatibility than Astar EVM, which originally supported the Ethereum development environment. Like Polygon PoS, Astar EVM is an EVM-based network separate from Ethereum and has its own consensus mechanism. However, Astar zkEVM is a ZK-rollup solution that interacts directly with Ethereum during transaction processing as a layer 2 on top of the Ethereum mainnet, meaning that it has a vertical relationship instead of a horizontal relationship.

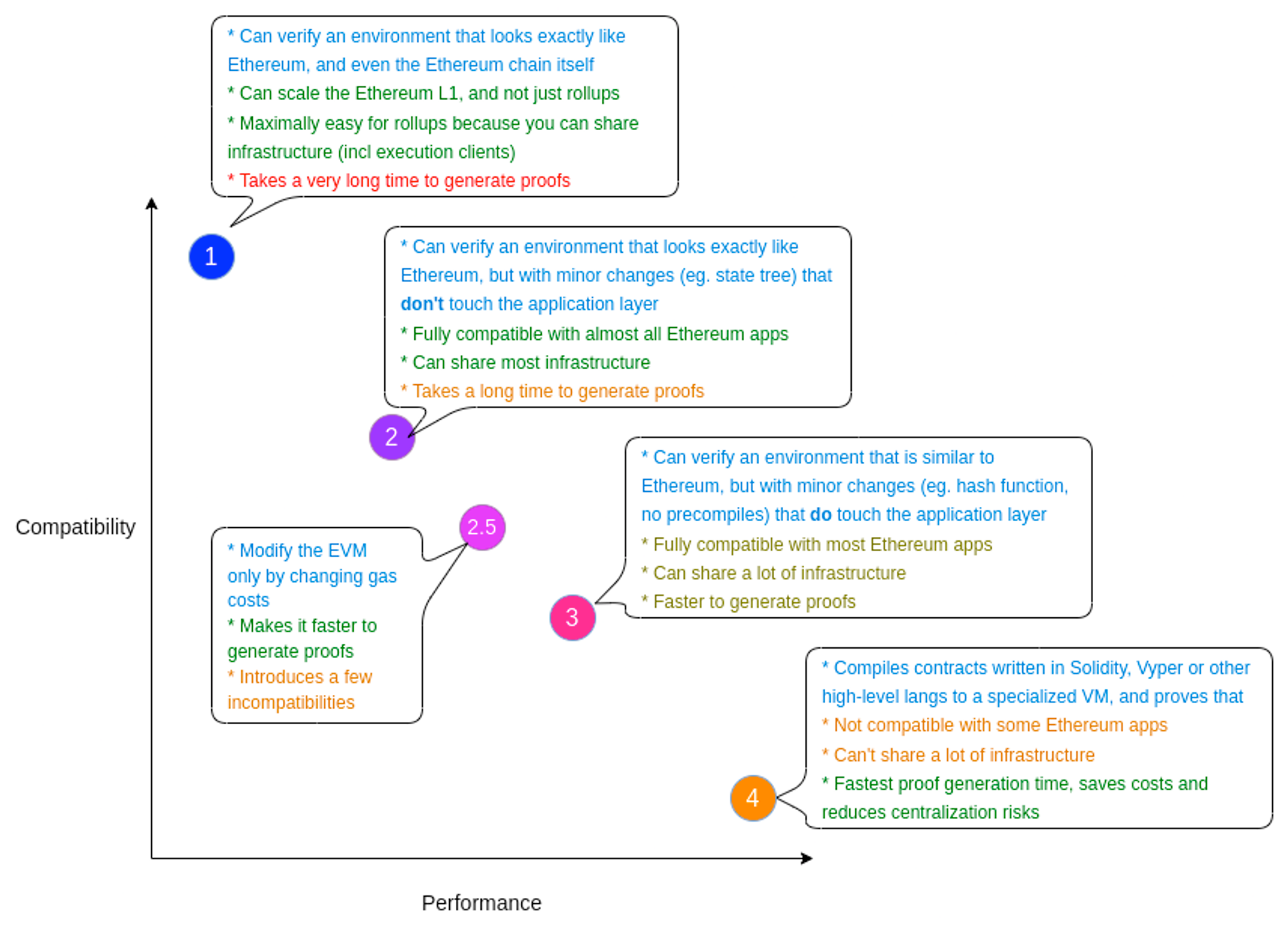

Astar describes this as a process of securing EVM equivalence beyond compatibility. Both compatibility and equivalence have in common that they support EVM-based development environments, but there is a difference in the degree. When moving code from the Ethereum mainnet to a ZK-rollup, a rollup solution that achieves compatibility can use the existing code in most cases, but sometimes requires code changes to ensure smooth operation. However, EVM equivalence means that dApps, tools, and infrastructure on the Ethereum mainnet can be moved without any code changes. Vitalik categorizes ZK-rollups into five types of EVM equivalence, as follows.

Currently, Astar zkEVM has achieved Type 3 EVM equivalence, which means it is fully compatible with most Ethereum dApps, but some changes are required to make it compatible with dApps that use pre-compiles that Astar zkEVM removes. Astar has stated that it plans to reach Type 2, meaning full EVM equivalence, once all pre-compiles are supported. Once Astar zkEVM achieves Type 2 EVM equivalence according to their roadmap, developers will be able to move smart contracts deployed on top of the Ethereum mainnet onto Astar zkEVM without any changes.

In addition to EVM equivalence, Astar zkEVM will benefit from lower transaction fees and faster transaction processing times compared to the Ethereum mainnet, the high interoperability and security inherited from Ethereum, and the largest and most diverse pool of capital and developers in the Ethereum ecosystem today, as it extends to a rollup solution on top of the Ethereum mainnet.

2.2. Sustainable ASTR Value Maintenance Model

ASTR is the native token of Astar network and is used for staker and developer rewards, *transaction fees, and to fund the Astar treasury and community.

*Astar Substrate and Astar EVM use ASTR as the transaction fee, while Astar zkEVM uses ETH.

ASTR has an infinite maximum supply and is currently experiencing an inflation rate of 9.5%. Inflation, which refers to the rate at which the number of tokens increases, is one of the key metrics in evaluating the value of a token. Tokens with an infinite maximum supply, such as ASTR, are more affected by inflation than other tokens with a limited maximum supply. ASTR's high inflation has come to the forefront as ASTR has experienced a steady decline in price over the past year and a half, and has been unable to meaningfully compensate its users, developers, and other participants in the Astar ecosystem.

Astar's high inflation rate stems from the 253.08 new ASTR tokens that are created every 12 seconds. To reduce inflation, Astar will introduce "Tokenomics 2.0", which will set new inflation rates annually based on the total supply at the time of the adjustment rather than a fixed value, and "dApp Staking 3.0" which will encourage users to stake ASTR to help reduce the circulating supply of ASTR in the market.

In addition, Astar announced plans to reduce ASTR inflation by buying and burning ASTR during transaction processing on Astar zkEVM. With these changes in place, Astar estimates that the current inflation rate of 9.5% will be reduced to 5.8% or less. In this chapter, we will discuss the sustainable ASTR value maintenance model that Astar zkEVM aims to achieve with its improved dApp staking and ASTR buyback-and-burn structure.

2.3. dApp Staking

dApp staking is a unique funding mechanism that allows developers to earn incentives and users to receive rewards by staking ASTR on Astar dApps. By providing direct revenue to all participants in the Astar ecosystem, including developers, enterprises, and users, it incentivizes users to buy ASTR and make long-term investments, while providing developers and enterprises with incentives to build dApps and infrastructure, and solving fundraising challenges. dApp Staking is currently in version 2.0 and will be updated to 3.0 in phases.

- dApp Staking 1.0: Building a mechanism to provide passive income

- dApp Staking 2.0 (current): Strengthening the connection of the reward system between projects, developers, and users

- dApp Staking 3.0 (upcoming): Differentiating tiers for each dApp

2.3.1. Problems with dApp Staking 2.0

Rewards for dApp staking are paid out of the ASTR block rewards generated by each block on Astar network. Then the rewards are divided between dApp developer rewards and user (staker) rewards. Developers are rewarded based on the percentage of total TVL their project contributes to dApp staking, while users earn an average of 10.7% (APY) regardless of the project.

The problem with the current system is that the rewards for developers are designed to be fixed, meaning that the more dApps that are staked, the less each dApp receives, creating a zero-sum game. Furthermore, Astar Core Contributors and Community Treasury, which are managed by Astar, are the first and second largest in TVL among dApp staking projects, with a combined TVL of over 54% of the total dApp staking TVL (approximately 3.6B ASTR).

In a zero-sum game like this, where Astar gets the majority of the pie, it's difficult for new onboarding projects and developers to be meaningfully rewarded, and this high entry barrier could be a huge obstacle to attract more dApps on Ethereum to Astar dApp staking after the launch of Astar zkEVM.

Therefore, Astar announced plans to introduce dApp staking 3.0 to mitigate competition in this zero-sum game, facilitate the onboarding of new dApps, and ultimately allow more users to stake ASTR in the enriched dApp staking ecosystem thereby regulating circulating supply and maintaining the value of ASTR.

2.3.2. dApp Staking 3.0

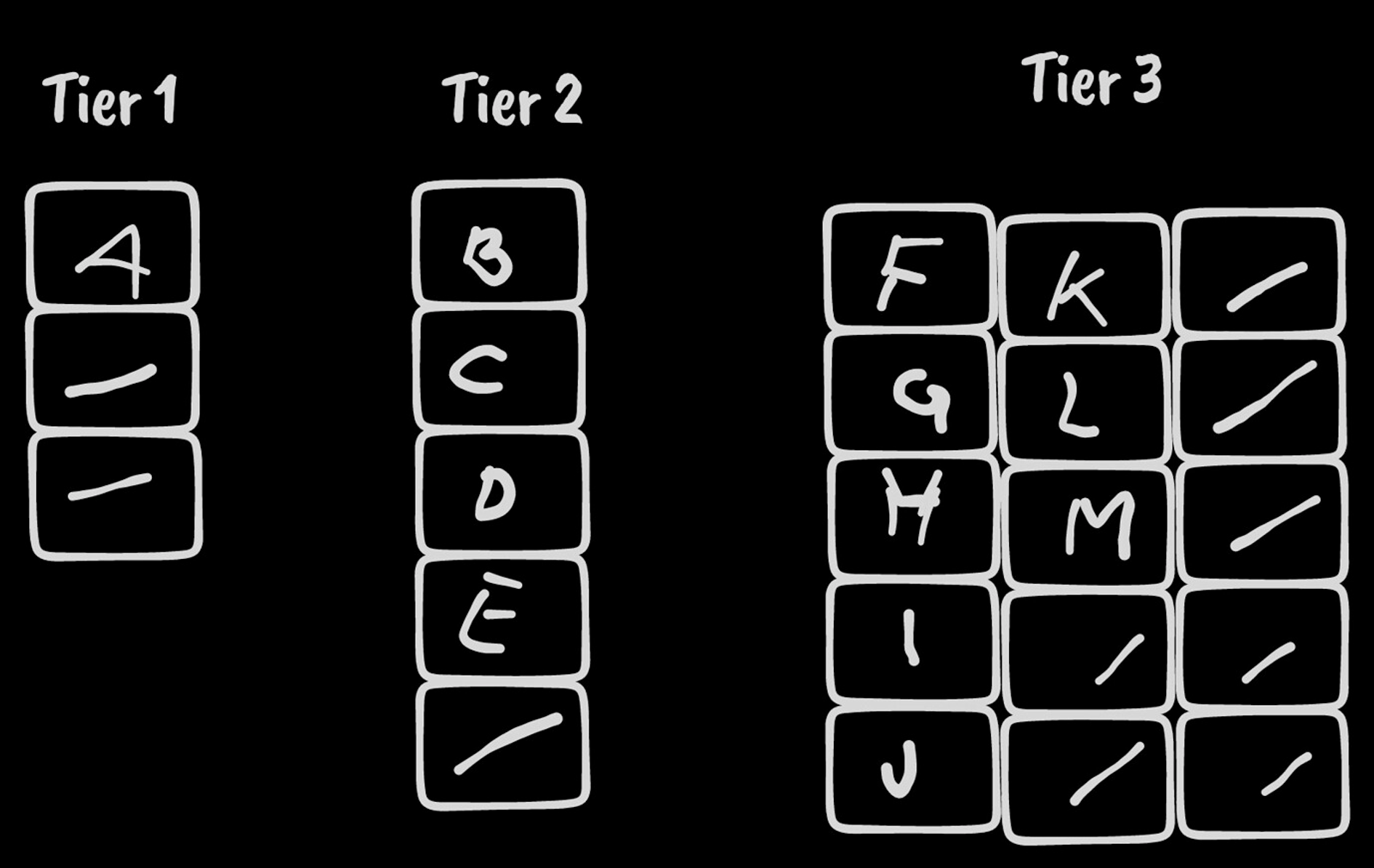

The core of dApp Staking 3.0 is the establishment of tiers. In 2.0, each dApp's rewards grew linearly with its individual staking TVL, but in 3.0, each tier has a limit on the block rewards it can earn, and the rewards cascade based on its tier, not TVL.

For example, let's assume that dApp staking 3.0 has three tiers, as shown in the figure above: 23 dApps can be onboarded, but only 13 (A through M) are actually on dApp staking, and each tier requires certain criteria (e.g. minimum TVL) to be met to enter that tier. Even if a tier slot is available, if there are no DApps that meet the criteria for that tier, it will remain vacant. All dApps within the same tier will receive the same amount of rewards, regardless of their respective TVL sizes. Therefore, Astar is introducing an "absolute rating" system to dApp staking to mitigate the zero-sum game that was a problem in 2.0.

In addition, they announced that they will introduce a system called "Forced Tier". The Forced Tier is a system that arbitrarily places a certain dApp in a specific tier for a certain period of time, regardless of whether it fulfills the tier requirements. It is mainly expected to be utilized as a kind of protection system for newly onboarded dApps to smoothly settle into the Astar ecosystem and grow their influence during that period based on guaranteed staking rewards. However, it can also be used as a blacklist for dApps that have negatively impacted the ecosystem, which may raise concerns about centralization.

Finally, Astar plans to burn ASTR staking rewards of users who have not claimed for a long period of time, as well as undistributed dApp rewards due to vacancies in tiers, to encourage more active participation in the ecosystem and reduce ASTR inflation.

2.4. Transaction Processing Structure

Astar zkEVM is a zero-knowledge rollup on the Ethereum mainnet that offloads transactions from the Ethereum mainnet like typical rollup solutions and processes user-requested transactions at a lower cost and faster speed through off-chain operations. The following entities participate in transaction processing on Astar zkEVM and their roles are described below.

- User: Creating transactions on Astar zkEVM (Layer 2)

- Sequencer: Sending a batch of transactions to the Ethereum mainnet

- Aggregator: Running Prover to generate a ZK-proof that verifies the batch and submitting it to the Ethereum mainnet

Transaction processing structure on Astar zkEVM

- A transaction is created in the user's wallet.

- The transaction is sent to a transaction pending pool.

- Sequencer selects multiple transactions, puts them in a batch, and submits it to the Ethereum mainnet.

- Aggregator validates the batch, generates a zero-knowledge proof, and submits it to the Ethereum mainnet.

- The batch and zero-knowledge proof are validated and recorded on Ethereum.

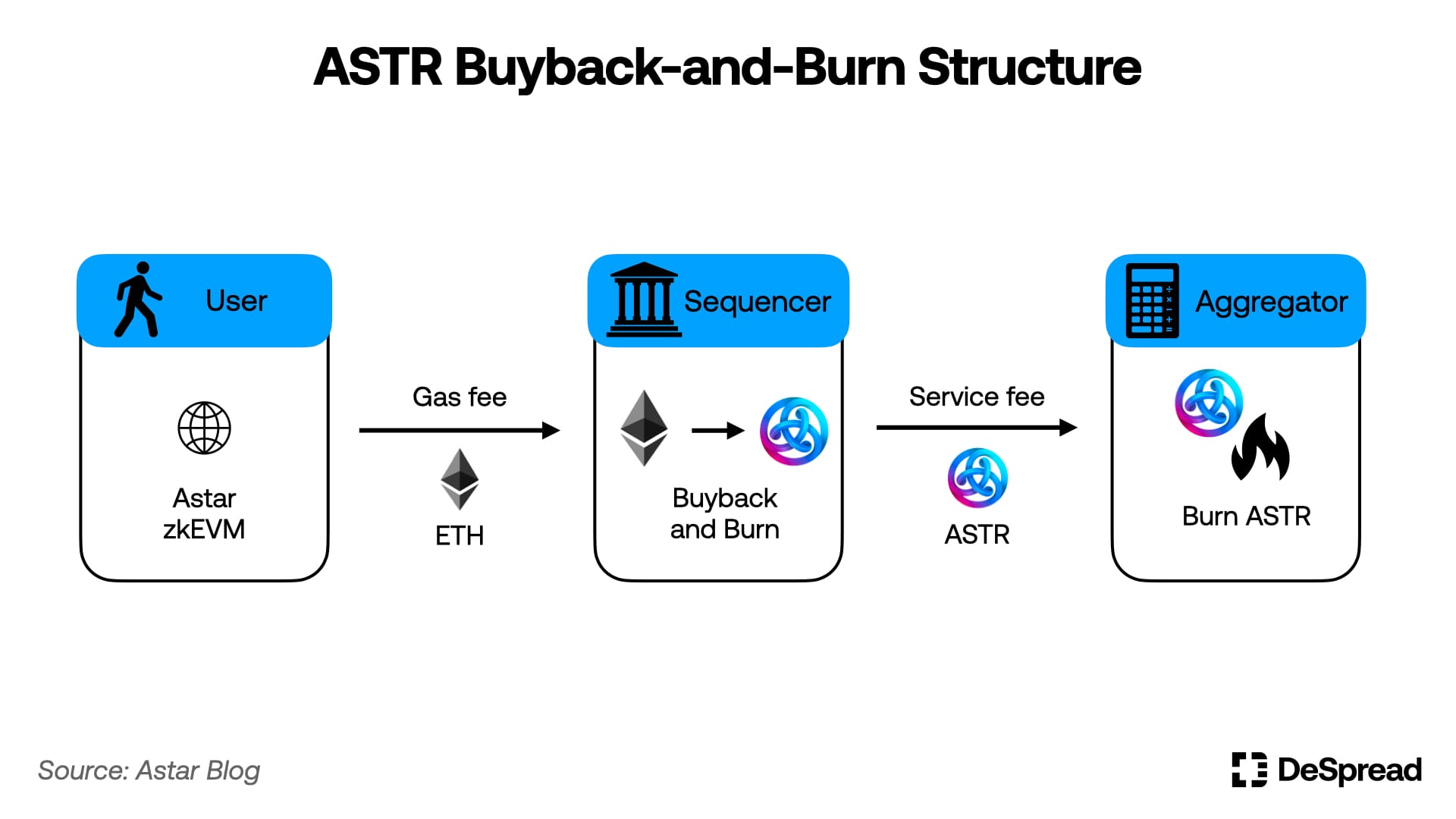

During the above process, the sequencer can earn fees from the transactions contained within the batch if the batch submitted is valid. Thus, the more transactions that are executed on Astar zkEVM, the more revenue the sequencer earns. As long as that revenue exceeds the cost (ETH) for the sequencer to submit the batch to the Ethereum mainnet, the sequencer earns a net profit.

To reduce the inflation of ASTR, Astar zkEVM introduces a structure in which ASTR is bought and burned by the sequencer and the aggregator during transaction processing. First, the sequencer buys and burns ASTR as a percentage of the transaction fees (ETH) received from Astar zkEVM users. In addition, the sequencer will submit ASTR to the aggregator as a service fee (generating zero-knowledge proofs), and all ASTR paid out will be burned.

The percentage of ETH received by the sequencer that will be purchased for ASTR and the amount of ASTR provided to the aggregator as service fees have not yet been determined and are subject to change. In addition, the buyback and burn process will initially be conducted through a trusted third party, as Astar has a centralized structure for managing sequencers and aggregators.

To summarize, the launch of Astar zkEVM has made it easier for Ethereum-based dApps to onboard to Astar network. This enriched ecosystem will increase the number of transactions by users, which in turn will increase the amount of ASTR purchased and burned by the sequencer and aggregator, thus reducing ASTR inflation.

3. Concerns and Possibilities

Currently only zKatana, the testnet of Astar zkEVM, is open to the public, and the mainnet is expected to be launched early next year. Based on the information available to date, Astar zkEVM has the following challenges to address.

3.1. Centralized Sequencer and Aggregator

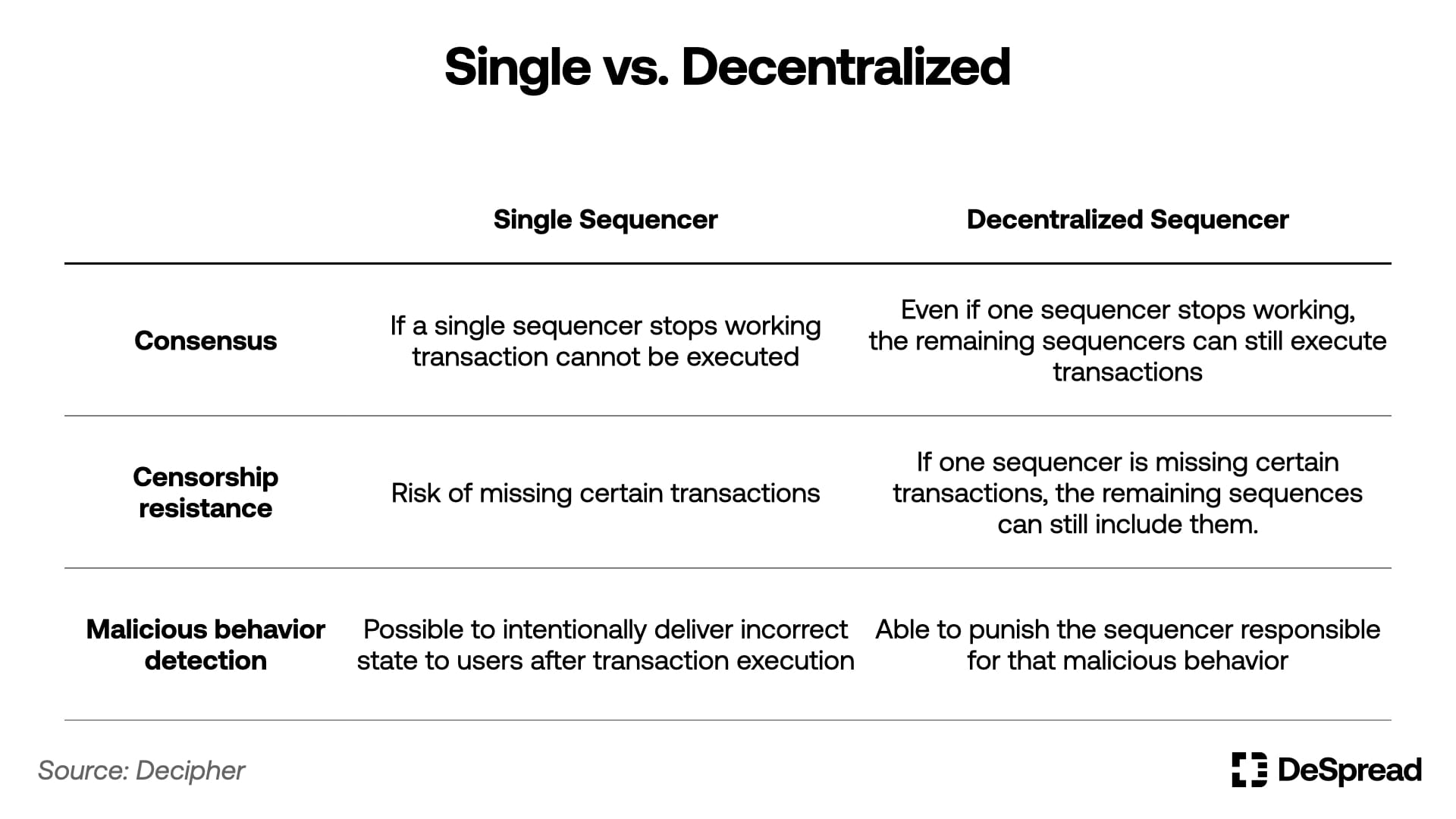

As we saw in the previous section, the sequencer and aggregator of Astar zkEVM are centralized in a single structure managed by the Astar Foundation. Centralized sequencer have differences in consensus, censorship resistance, and malicious behavior detection compared to decentralized sequencers, which are detailed below.

However, the problem of using a centralized sequencer is not unique to Astar zkEVM, but is a common problem among other layer 2 solutions. The top four rollup solutions in TVL according to L2Beat - Arbitrum, Optimism, Base, and zkSync Era - all plan to eventually decentralize their sequencers, but for now, transactions are processed by a centralized sequencer operated by the team. Astar has also stated that it will gradually decentralize its sequencers and aggregators.

3.2. Lack of Killer dApps

A killer dApp is an application that has the influence to revitalize a network by bringing in a lot of assets and users. The most recent example is Base's friend.tech. Since its debut on August 10, friend.tech has seen tremendous growth, with TVL increasing 10x from $5M to $50M in the month of September. With a this killer dApp, Base has seen steady network growth since then and is now the 3rd largest rollup ecosystem by TVL and 10th largest network overall.

However, Astar still lacks a killer dApp. Of the 62 dApps listed on the dApp staking, the project with the highest TVL (excluding Astar Core Contributors, Community Treasury) is the decentralized exchange Arthswap. Arthswap has a TVL of $16.1M as of DefiLlama, which is less than a third of the $48.45M of SyncSwap, the largest TVL project in the same zk rollup, zkSync Era.

Astar founder Sota Watanabe agrees, and Astar has been aggressively signing up projects and companies recently. It's worth noting that instead of trying to onboard Web3 native projects to solve this problem, Astar and Sota are focusing on partnering with Web2 companies. The joint project with Sony, a leading Japanese entertainment and technology company, is a typical example. Sony and Astar will be working to develop new applications through mentorship and exploring new technologies.

3.3. Still Early for ZK-Rollups

Astar had two options to become an Ethereum rollup solution, optimistic or ZK-rollups, and as we saw in the introduction, Astar chose the ZK-rollup, where there is no clear dominant player, over the already overloaded optimistic rollup market. However, the lack of a clear dominant player can also be thought of as a lack of a rich ecosystem and a lack of a network that can take a leader role and drive users to the ZK-rollup ecosystem. Moreover, if the sector is expanded to rollups overall, it will inevitably face competition with Arbitrum, Optimism, and other strong optimistic rollups. It remains unclear whether Astar zkEVM will be able to gain an advantage in this competition.

Indeed, the scale gap between the optimistic and ZK-Rollup ecosystems is very wide. The top three networks in the optimistic rollup sphere (Arbitrum, Optimism, and Base) have a combined TVL of approximately $11.56B, while the top three ZK-rollup (zkSync Era, dYdX, and Starknet) networks have a combined TVL of approximately $0.97B, making the optimistic Rollup sector more than 12x larger.

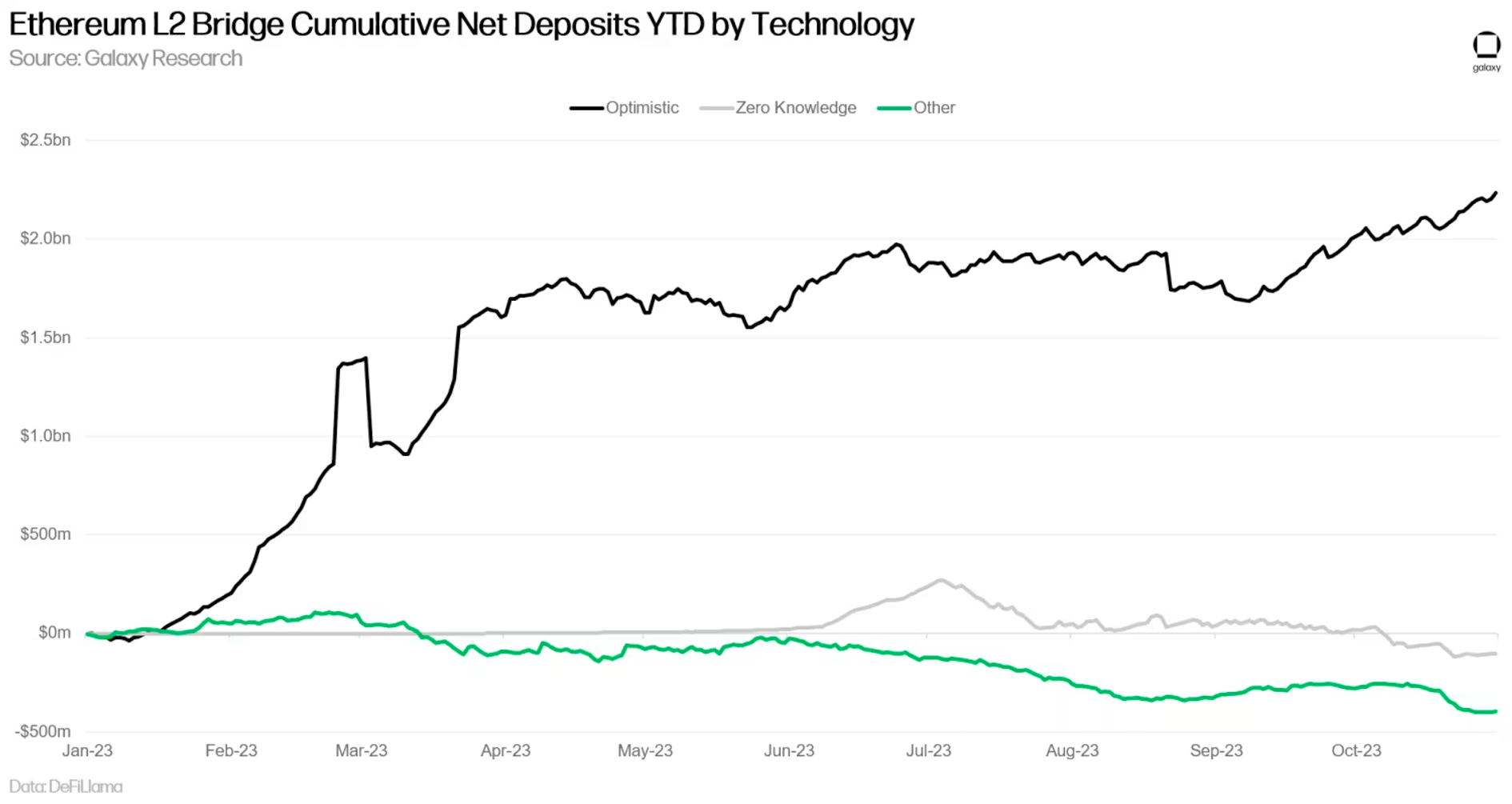

Recent trends in the inflows and outflows of funds into and out of the respective rollup ecosystems also show that ZK-rollups are struggling. According to Galaxy Research, optimistic rollups are the only sector that has seen net inflows of assets in 2023, while ZK-rollups and the rest have seen net outflows.

In order for Astar zkEVM to have a clear competitive advantage, it needs to see significant growth in the ZK-rollup ecosystem, starting with the aforementioned killer dApps, and then have a weapon to compete with optimistic rollups.

4. Astar’s Unique Strength: Japan

Nevertheless, it is worth noting that Astar has a unique strength that could lead to the growth of Astar zkEVM. Astar is currently the leading blockchain network in Japan, extending its presence beyond Web3 to Web2, boasting huge influence in the Japanese market. Rather than adopting a Web3 native strategy in the Japanese market, Astar is more focusing on a so-called Web2.5 strategy, which is a collaboration between Web3 (Astar) and Web2 (large Japanese enterprises) to naturally onboard new users to Astar network.

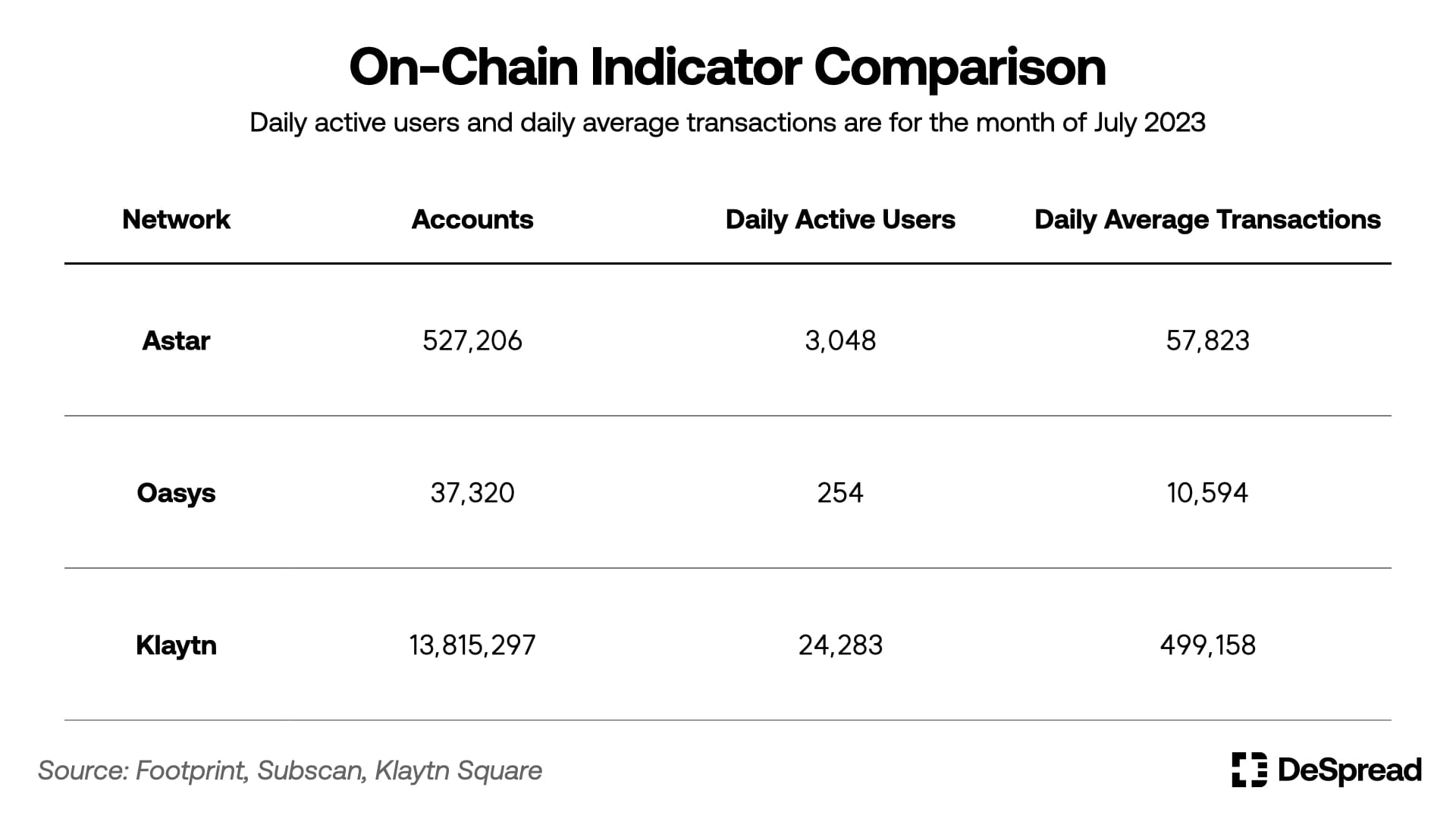

The reason behind Astar's Web2.5 strategy is that Japan's economic and political characteristics make the country unfriendly to investments. Japan had a policy of lowering interest rates since the 1990s, and with the introduction of Abenomics in 2012 along with a negative interest rate policy (NIRP) in 2015, the value of the Yen has continued to depreciate. After decades of quantitative easing, interest in investment has been minimal in Japan, making it difficult for high-risk, high-return projects, such as cryptocurrencies, to gain traction. This lack of interest in investment and crypto naturally resulted in very low levels of on-chain activity that actually participated in Web3, and even two of Japan's leading blockchains, Astar and Oasys, showed a significant gap in on-chain metrics when compared to Klaytn, a South Korea-based network.

Therefore, in order to strengthen its influence in Japan and attract new users to Astar network, Astar is focusing on building an ecosystem utilizing influential companies in Japan as gateways for Web2 users to naturally join Astar without even realizing it, rather than Web3 native projects, which are unfamiliar to Japanese people.

4.1. Government's Pro-Web3 Stance

The Kishida Cabinet's favorable stance on Web3 could also boost Astar. Astar has been one of the most vocal advocates for regulatory reform in Japan and is expected to be one of the most active players in the revamped regulations. Japan has been aggressively pursuing pro-Web3 policies, including regulatory reform, since 2022 in an effort to build on its Web2 failures and become a global leader in the Web3 market. Here are some of the key steps the Japanese government has taken to create favorable conditions for Web3 companies, venture capitalists, and crypto investors.

- Established a 10 trillion Yen fund with a 5-year startup incubation policy (2022.10)

- First global stablecoin regulation officially enforced (2023.06)

- Excluded year-end taxation of unrealized gains on virtual assets issued and held by companies (2023.06)

- Allowed startups to raise funds by issuing virtual assets (2023.09)

*For a detailed explanation of Japanese crypto regulations, see the articles below.Japan Web3 Bible Part 1An Overview of Japanese Stablecoin Regulation

4.2. Astar's Position

Some of Astar's most notable collaborations include its partnerships with Sony and KDDI. In June, Astar established a 500 million yen Web3 infrastructure fund with Sony to support an incubation program for new projects to be onboarded to Astar network. Sony also formed a joint venture with tech startup Startale Labs, which has close ties to Astar, to develop the Sony blockchain network, targeting its public launch in January 2024. The collaboration with KDDI is relatively recent, with the two companies signing a MOU (Memorandum of Understanding) in October to consider bringing KDDI's wallet service "αU wallet" and NFT marketplace "αU market" to Astar zkEVM.

In addition, Astar has created Astar Japan Lab, a community dedicated to the Japanese market, and provides a variety of services to its members, including business collaboration, international VC brokerage, and collaborative research. Astar Japan Lab has grown to a large community with 143 members, including companies in Japan and overseas, such as Anderson Mori & Tomotsune (AMT), Microsoft, and Double Jump Tokyo, across legal, tech, and gaming sectors.

Astar's growing influence in Japan is also due in large part to the fact that it has a clear rallying point; Sota Watanabe, the founder of Astar and Startale Labs. Through his personal blog and interviews, Sota has consistently called for the Japanese government to reform Web3 regulations to stop the outflow of Web3 human resources and capital from Japan. He has also taken the initiative to showcase Japan's ambition to become a global leader in the Web3 industry, running an advertisement in the Nikkei newspaper titled "Japan as No.1 Again" featuring the logos of a total of 329 Japanese companies.

4.3. Astar, a Bridge Between Japan and the Global Crypto

Japan has been described as the "Galapagos Islands" because companies have not actively expanded overseas, nor have they felt the need to. This is especially highlighted in the borderless Web3 industry, and in addition, strong attachment to traditional business models and culture, negative perceptions of cryptocurrencies, and language barriers have hindered the development of the Japanese blockchain industry.

But Japan is changing. The government is actively supporting Web3 startups, and it's not uncommon to find examples of major government agencies and organizations entering the Web3. With a strong foundation in both Japan and blockchain industry, Astar is well-positioned to serve as a bridgehead for Japanese companies to enter the global market of Web3. The launch of Astar zkEVM also provides access to the abundant pool of capital and developers in the Ethereum ecosystem, making it a more attractive option for enterprises looking to enter the public chain. In the ideal scenario where there are significant success stories between large Japanese enterprises and Astar, and other corporations are encouraged to utilize Astar to enter Web3, it could be the basis for Astar to reach 1 billion users by 2030, as Sota hopes.

5. Conclusion

So far, we've covered the features, concerns, possibilities, and strengths of Astar zkEVM. While there are a number of changes Astar zkEVM aims to accomplish, including entering the Ethereum ecosystem with full EVM equivalence, maintaining a sustainable ASTR value, and expanding its influence in the Japanese market, they all have the same ultimate goal; to bring more and more participants into the Astar ecosystem.

5.1. Astar, the Platform for Builders

Developers and enterprises play a role in enriching the ecosystem by providing dApps to Astar ecosystem. As Astar's foremr CTO Hoon said, Astar is a platform that aims to provide developers with a more convenient, easy, and diverse development environment since its beginning. In other words, they chose the chicken in the chicken-and-egg game, providing a convenient environment for enterprises and developers, and if they create high-quality products, users will naturally flow in.

The main purpose of Astar zkEVM is to attract capital and participants in the Ethereum ecosystem, thereby leveraging the expanded ecosystem to attract more developers and enterprises. To this end, Astar zkEVM strengthens the linkage to Ethereum based on EVM equivalence, and satisfies the needs of existing Ethereum ecosystem participants by providing more efficient security and maintenance costs than the Ethereum mainnet. Furthermore, they aim to secure competitiveness by strengthening their influence in the Japanese market, including active cooperation with Japanese companies.

Recently, Astar has been actively expanding its presence also in Korea by participating in UDC, hosting networking parties, and conducting interviews with local media, and the interest in Astar in Korea is also growing. It will be interesting to see whether Astar can achieve significant results in Japan, Korea, and even the global market with its new weapon, zkEVM.

References

- Astar Docs

- Astar Blog, How the ASTR Token Brings Utility and Value to the Astar Ecosystem, 2023

- Astar Blog, Introduction to Zero Knowledge Proofs, 2023

- 100y, [Polygon 시리즈]#4: Polygon Hermez — 탈중앙 zk롤업 및 zkEVM, 2022

- Vitalik, The different types of ZK-EVMs, 2022

- Earl, 아스타 네트워크 근황, 2023

- Maarten, Astar Tokenomics 2.0: A Dynamically Adjusted Inflation, 2023

- Dino, dApps Staking v3 - proposal, 2023

- 온체인야쿠자, 아스타가 일본 웹3 시장 주도하는 이유. 2023