Elixir — The Magic Potion for Orderbook DEX Liquidity Provision

Focusing on Elixir's Architecture and Features

1. Introduction

1.1. Liquidity Provision Issues in On-Chain Environments

Liquidity refers to the ease with which a particular asset can be exchanged for its counter asset without causing a significant price impact. In trading environments with insufficient liquidity, two primary issues arise: 1) Transactions take longer to execute satisfactorily, and 2) Quick trades may require accepting substantial price concessions. This lack of liquidity can lead to increased price volatility and higher transaction costs.

To facilitate smooth trading environments, modern financial exchanges—dealing in stocks, bonds, commodities, and cryptocurrencies—often contract with market makers. These market makers continually place buy and sell orders in the exchange’s order book, thereby supplying liquidity. They earn profits through the spread, the difference between the buying and selling prices.

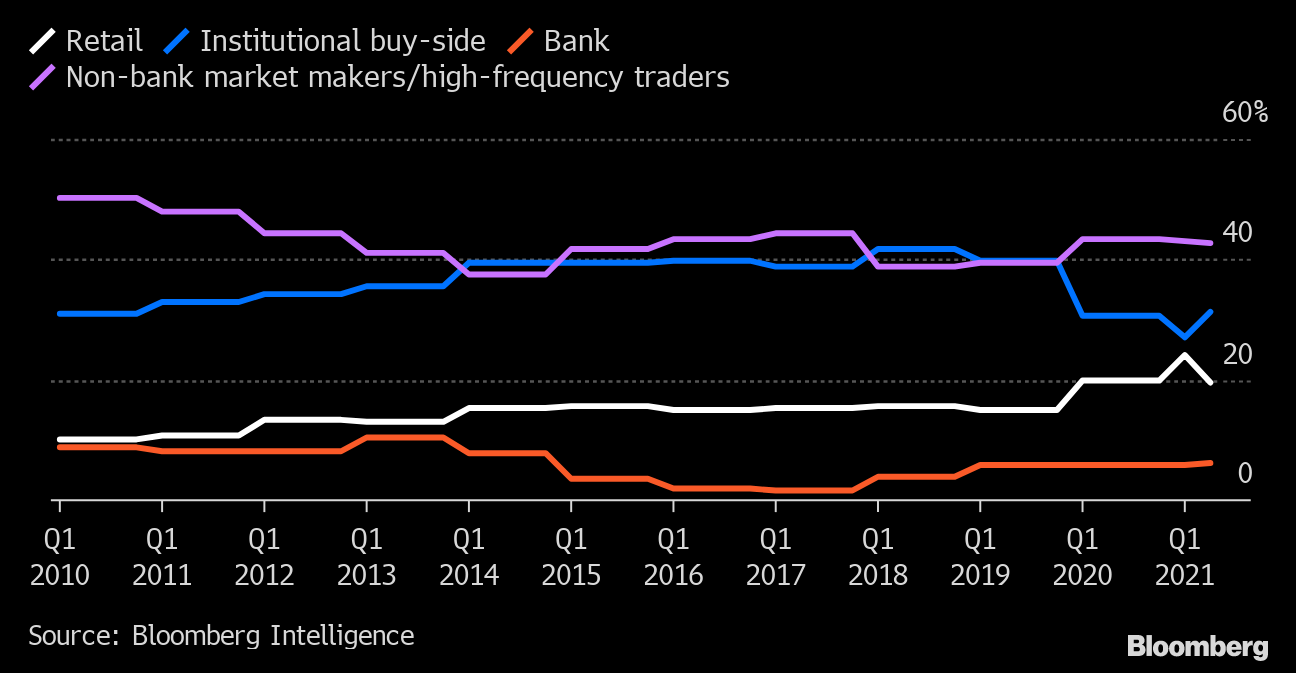

In the traditional markets, such as those in the United States, over 40% of stock market volume is attributed to orders placed by market makers, highlighting their significant influence.

With the advent of smart contracts, discussions about decentralized finance (DeFi) on the Ethereum network began, particularly focusing on order book DEXes (decentralized exchanges). These platforms required users to pay gas fees to place orders, which meant that repeatedly placing and canceling orders to provide liquidity involved significant capital costs. Early Ethereum-based order book-based DEXes like EtherDelta faced substantial challenges in attracting market makers and thus struggled to provide adequate liquidity, failing to achieve widespread success.

1.2. Automated Market Making (AMM)

Since the introduction of Uniswap in 2018, the Ethereum mainnet has seen the emergence of DEXes that use the Automated Market Maker (AMM) model to set prices and execute trades automatically, without the need for traditional order books.

AMM-based exchanges operate using liquidity pools that contain pairs of tokens. When a trader wishes to sell one token from a pair, they deposit it into the liquidity pool and receive the corresponding amount of the other token, as determined by an algorithm.

This method allows anyone to provide liquidity by depositing a pair of tokens into the pool, and in return, liquidity providers earn a portion of the transaction fees paid by traders. This model significantly lowers the barriers to liquidity provision that were previously dependent on a few large market makers, thereby facilitating smoother on-chain transactions with ample liquidity.

Additionally, AMM DEXes have incentivized early liquidity providers by distributing their own protocol tokens through liquidity mining campaigns. This has not only promoted their products but also helped bootstrap liquidity, making the AMM model a typical choice for most DEXes and allowing it to evolve in multiple ways.

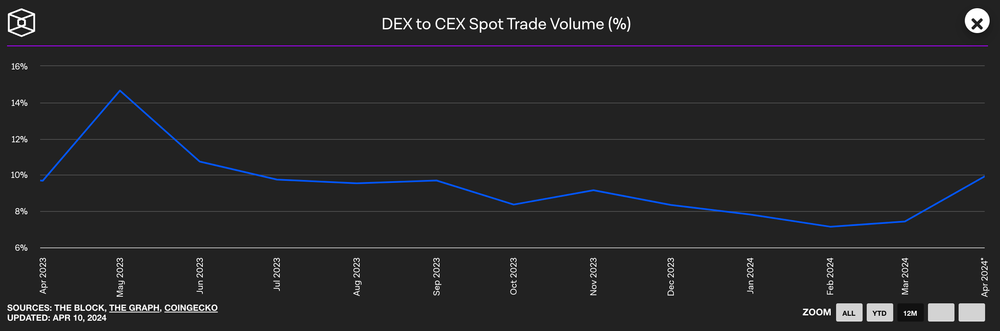

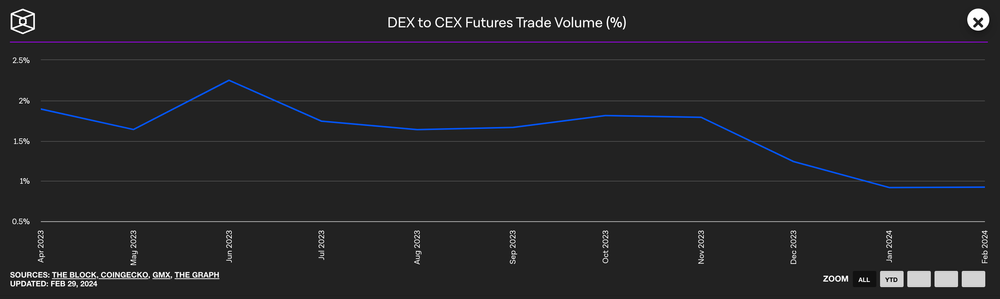

However, the AMM model has its limitations; 1) the high gas fees on the Ethereum network make it unsuitable for high-frequency trading that requires frequent transactions, and 2) the focus of AMM DEXes on token exchange imposes constraints that make them less appealing to traders accustomed to the features and interfaces of traditional order book exchanges. Due to these factors, AMM DEXes have struggled to attract high-frequency traders, and the high entry barriers of on-chain platforms have limited the influx of retail users from centralized exchanges (CEXes). Consequently, DEXes currently account for only about 10% of the total trading volume compared to CEXes.

To address these challenges, there is ongoing discussion about integrating traditional order book methods into DEXes to attract high-frequency traders from the traditional financial markets to the DeFi ecosystem. This approach is considered crucial for the growth and expansion of the DeFi market as it seeks to attract more users and increase liquidity.

1.3. Orderbook DEXs: Confronting the Recurring Challenge of Liquidity Provision

While AMM DEXes have evolved to more effectively utilize the liquidity provided in their pools, order book DEXes have developed by implementing off-chain order books and recording matched orders on-chain, aiming for quick and efficient transaction processing. The advancement of order book DEXes has been further accelerated by the emergence of blockchain network infrastructures that offer fast and cost-effective transactions, such as Layer 2 solutions and Cosmos app chains.

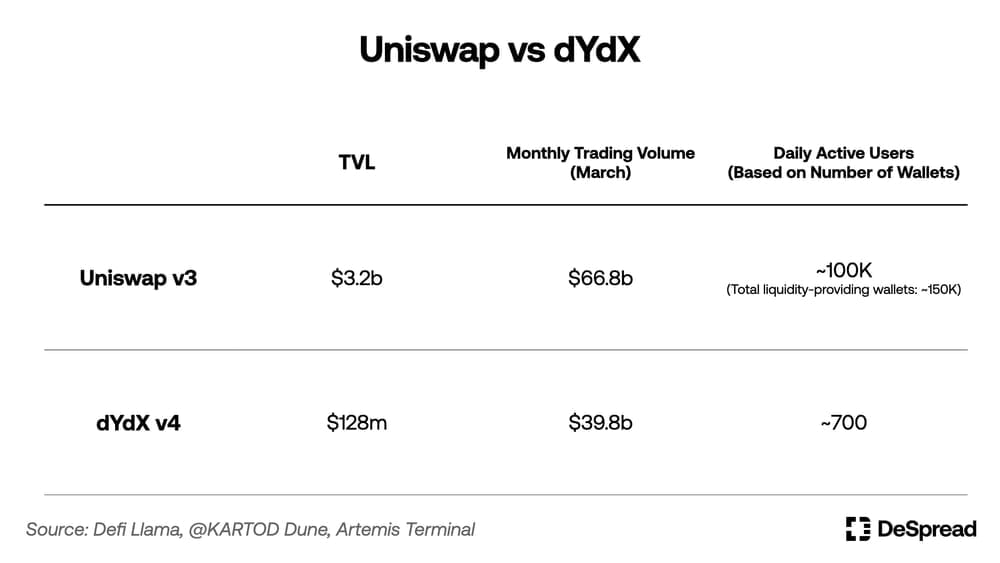

dYdX, a leading order book-based perpetual and futures DEX, adopted a model in its version 3 where trades are processed off-chain, and the validity of transactions is certified through the StarkWare network before being recorded on the Ethereum mainnet. This model has enabled dYdX to provide a rapid and efficient trading environment. Subsequently, dYdX introduced its own app chain using the Cosmos SDK in version 4, which fully brings all trading processes on-chain. As of March 2024, dYdX v4 has achieved a total value locked (TVL) that is about 5% of Uniswap v3's, while capturing 60% of Uniswap's trading volume.

In the realm of order book DEXes, liquidity providers must continuously submit and adjust orders within the order book, contrasting sharply with the AMM DEX model that relies on liquidity pools. This requirement makes order book DEXes dependent on a limited number of technically skilled market participants for their liquidity supply.

To mitigate this limitation, most order book DEXes have adopted incentive models from AMM DEXes, launching campaigns that reward users with their own protocol tokens for placing and executing orders. However, these incentives are not an ideal solution. General users without the necessary skills to constantly populate the order book find it difficult to participate in these campaigns. Furthermore, skilled traders, who are capable of fulfilling these requirements, can easily switch to other order book DEXes offering better conditions. Thus, order book DEXes face structural challenges in securing liquidity, resembling a zero-sum game over the limited liquidity available.

Amid these challenges, a new protocol named Elixir has emerged, offering solutions to the liquidity issues faced by order book DEXes. This protocol aims to alleviate the reliance on a few skilled participants by broadening the accessibility and appeal of liquidity provision through innovative mechanisms.

2. Elixir, a Decentralized Market Maker

Elixir is a decentralized market making protocol that supplies liquidity to order book DEXes across multiple networks. It leverages automated market making algorithms and operates through its own network with the goal of enabling a wider array of participants to contribute to the liquidity of order book DEXes in a decentralized setting.

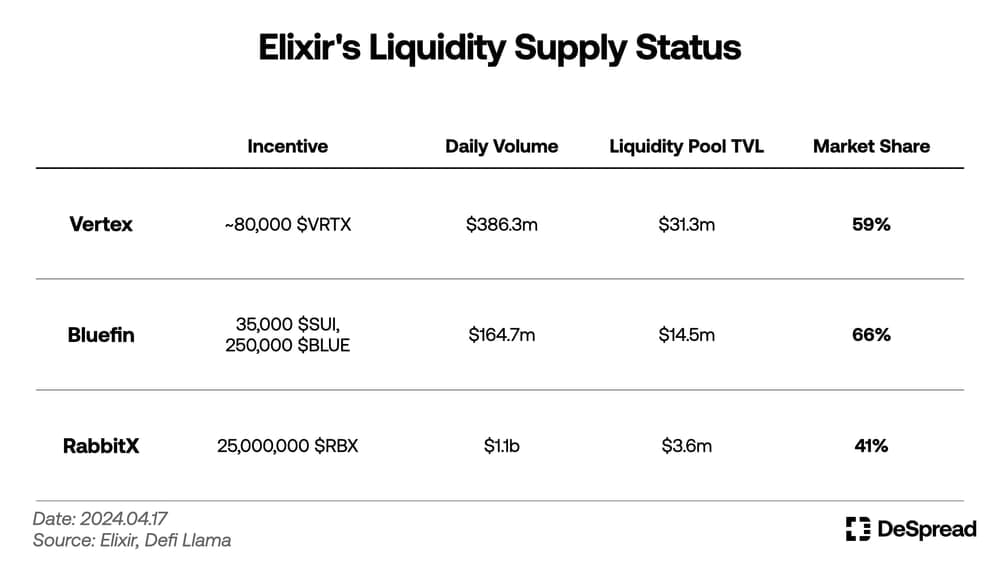

Users can deposit assets into Elixir and choose trading pairs from partnered order book DEXes to supply liquidity. Through this mechanism, users can participate in incentive campaigns of each order book DEX and generate earnings. Currently, Elixir has established partnerships with several order book spot and futures exchanges, including Vertex, Bluefin, and RabbitX, providing liquidity and supporting their operations.

The current status of collaboration is as follows:

In addition to its existing partnerships, Elixir is also preparing collaborations with other order book DEXes such as Hyperliquid, dYdX v4, and Orderly Network. The protocol plans to continuously expand its network of partnerships with order book DEXes to further enhance liquidity provisions across multiple platforms.

By depositing assets into the Elixir protocol, users can earn rewards proportional to their deposited assets through participation in each order book DEX's incentive campaigns. Additionally, users can acquire Elixir's points, known as Potions, which can also be earned through social activities conducted on Elixir's community channels. Elixir has plans to distribute its native token, $ELX, based on the number of Potions a user holds following the mainnet launch. The $ELX token is intended for use in various functions within the Elixir protocol, including governance, validator staking, and fee distribution.

Next, we will delve deeper into the core technology of Elixir, focusing on its market making algorithm and network architecture.

2.1. Liquidity Provision Mechanism

Elixir utilizes its proprietary market making algorithm to submit orders to order book DEXes, designed to achieve liquidity provision effects comparable to those of Uniswap v2's AMM. Before delving deeper into Elixir’s liquidity supply mechanism, let’s first understand the working principle of the Constant Product Market Maker (CPMM) model, exemplified by Uniswap v2.

2.1.1. How CPMM Works

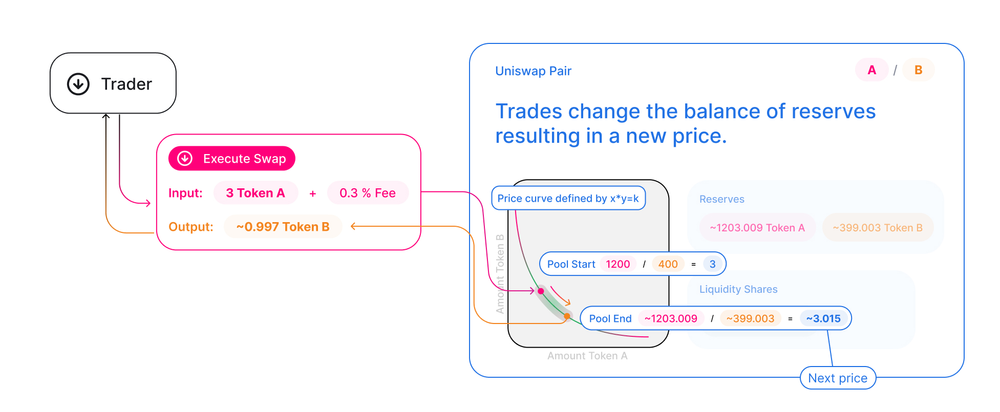

Uniswap v2 employs the CPMM model, which operates on the formula X*Y=K. In this equation, X and Y represent the quantities of the respective tokens, while K is a constant value.

In the CPMM model, every trade ensures that the product of the two token quantities in the liquidity pool remains constant. For instance, if a trader wants to exchange token X for token Y, the pool automatically calculates the exchange rate based on the X*Y=K formula to determine the amount of Y to provide to the trader, and vice versa.

Additionally, anyone can supply liquidity by adding both tokens in proportion to the current pool ratio, and the withdrawal of liquidity follows the same principle, allowing simultaneous withdrawal of both tokens in accordance with the existing pool ratio. This structure can lead to liquidity providers experiencing losses compared to simply holding the tokens, due to market price fluctuations of the tokens affecting the pool ratio.

For example, if the market price of token X significantly increases after a provider has deposited X and Y at a 1:1 ratio, the provider will receive fewer X tokens and more Y tokens when withdrawing liquidity, potentially valuing the total tokens received less than if they had retained their tokens outside the pool. However, such a loss is not realized until the liquidity is withdrawn and is referred to as impermanent loss.

Thus, the CPMM uses the formula X*Y=K to automatically execute market making by clearly defining the exchange rates and liquidity ratios of the pool.

2.1.2. Elixir's Liquidity Provision Mechanism

In contrast to AMMs, order book exchanges consist of numerous buy and sell orders proposed by various participants, each based on individual judgments and strategies. This results in prices and liquidity being irregularly dispersed, complicating the implementation of a uniform automated liquidity provision system like the Constant Product Market Maker (CPMM) model.

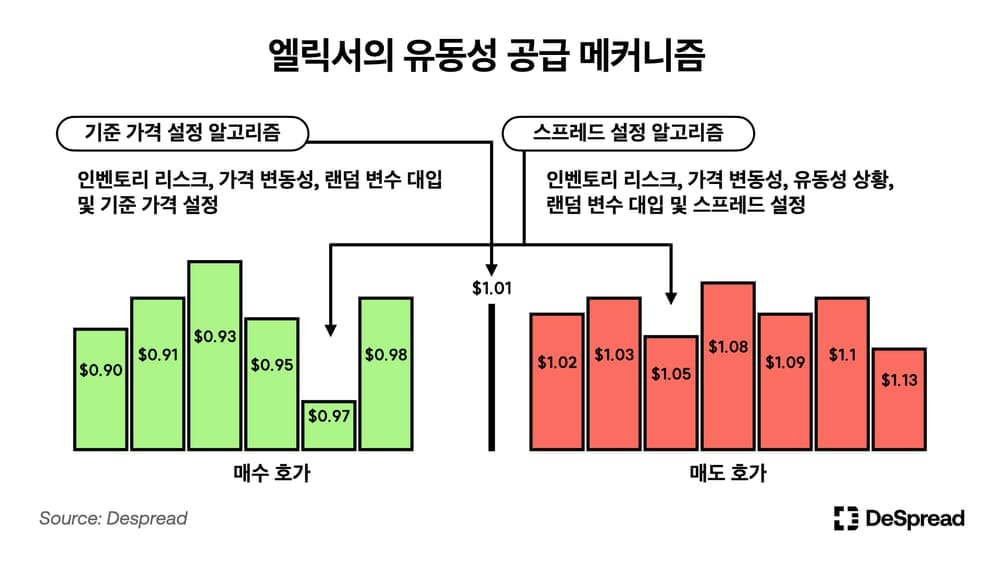

To overcome these structural limitations and provide liquidity providers in the order book with a risk and reward profile similar to that of a CPMM, Elixir measures real-time variables such as the price volatility of trading pairs, the state of the order book, and the inventory risk, which is the discrepancy between the ideal token exchange rate and the actual ratio of assets held. Based on these measurements, Elixir uses two algorithms to generate and submit orders: 1) the Benchmark Price Setting Algorithm and 2) the Spread Setting Algorithm.

The Benchmark Price Setting Algorithm sets an appropriate base price for the token pairs Elixir is providing liquidity for, taking into account its current inventory risk and the volatility of that trading pair. For instance, if the market exchange rate between tokens X and Y is 1:1, but Elixir’s inventory ratio of these tokens is 1:2, the algorithm will set the base price of Y tokens lower than the market price to reduce the Y token inventory, adjusting the ask price downwards. In this scenario, during periods of high volatility, the focus shifts from reducing inventory risk to offering a fair market price. Thus, it is deemed more critical to maintain trading volume by offering a suitable price in the market, even if it means accepting some level of inventory risk when volatility is high.

Once the benchmark price is set, the Spread Setting Algorithm is employed to establish the spread between buy and sell prices by considering the inventory risk, price volatility, and the current bids and asks submitted by other users in the order book. The spread is wider when the values for inventory risk and volatility are higher and when the order book’s liquidity depth is shallow, resulting in a conservative approach to liquidity provision.

Moreover, to protect liquidity providers from malicious attacks designed to exploit the algorithms, Elixir includes a variable that randomizes the timing of order submissions in both algorithms. This prevents users with malicious intent from predicting when Elixir’s orders will be placed, thus making it difficult for them to misuse the algorithms for unfair gain.

Through these methods, Elixir performs market making in the order book with a level of liquidity provision similar to CPMM, ensuring a stable supply of liquidity even in a decentralized and transparent trading environment. However, like CPMM, it is also exposed to impermanent loss. Unlike CPMM, which earns a portion of the fees generated from trading, Elixir compensates through arbitrage profits from the difference between buying and selling prices and through the incentive system of the order book DEX.

2.2. Network Architecture

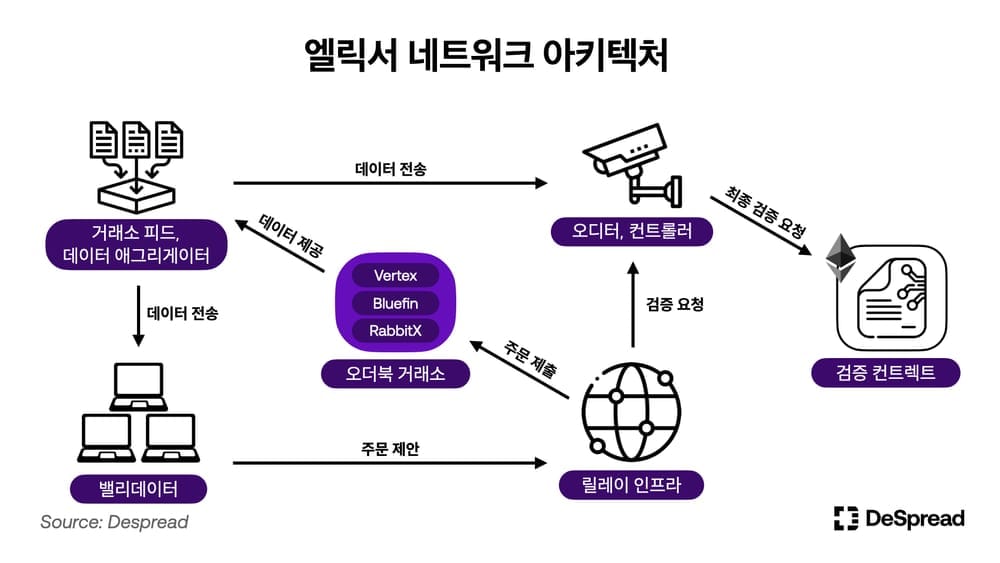

Elixir is building its own network to apply market making algorithms and provide liquidity to order book DEX within a decentralized environment. Although its mainnet has not yet been launched, liquidity provision to the order book DEX is currently being executed through its testnet.

The Elixir network employs the Delegated Proof-of-Stake (DPoS) consensus algorithm. Users can stake the network token, $ELX (or $ELXR on the testnet), to operate validator nodes. Users who do not wish to run validator nodes directly can still participate in network validation indirectly by delegating their $ELX to a validator.

Validators are responsible for collecting data from the order book exchanges within the Elixir network, applying it to the market making algorithm, and creating and proposing orders to be submitted to the order book. Currently, a clear incentive system for validating has not been implemented, but Elixir plans to later collect a portion of the profits from the bid-ask spread as fees to pay to the validators.

2.2.1. Network Operating Mechanism

The detailed architecture and operation mechanism of the Elixir network are as follows:

- Exchange feeds gather data for each trading pair from the exchanges, including price, order book status, order details, and transaction history, and send this data to a data aggregator.

- The data aggregator consolidates the received data and forwards it to validators and auditors.

- Validators input the received data into the market making algorithm formula to generate order proposals for execution on the order book DEX, then transmit these to the relay infrastructure.

- Relay infra verify whether a consensus of 66% has been reached among the validators and submit the order proposals received from the validators to the order book exchange and auditors.

- Auditor compare the consolidated data from the data aggregator with the order proposals from the relay infrastructure to verify them. If any misconduct is found, they report the relayed data to a controller.

- The controller sends the reported misconduct and exchange data to an Ethereum blockchain-based verification smart contract for final verification. If misconduct is confirmed, the validator’s staked $EXL is slashed.

Thus, Elixir operates its order submission process to the order book DEX through its network equipped with a DPoS consensus algorithm, which allows for fast transaction speeds. The process of verifying malicious activities and conducting slashing utilizes the Ethereum mainnet, thereby enhancing the trust and transparency of the Elixir network.

3. Future Plans

Elixir is approaching its final test phase, Testnet v3, before launching the mainnet, with the mainnet launch scheduled for August 15.

In addition, alongside the mainnet launch, Elixir plans to collaborate with cross-chain infrastructures like LayerZero to introduce cross-chain LP tokens that will facilitate liquidity provision across multiple networks. As part of the preparation, Elixir is currently pre-collecting ETH from users to be utilized for liquidity provision on various order book DEXs post-mainnet launch. Those who deposit will receive elxETH proportional to their deposited assets, and a campaign is also underway that offers an additional 50% in Potions—points paid to liquidity providers—to elxETH holders. Following the introduction of cross-chain LP tokens, Elixir also plans to support derivative functions like loans and leverage positions utilizing these tokens

Currently, order book DEXs that wish to receive liquidity from Elixir must collaborate with the Elixir team to integrate their systems. However, in the future, Elixir aims to provide an interface and guidelines that will allow anyone to easily and conveniently connect their order books to Elixir, operating as a permissionless infrastructure. Governance based on its native network token, $ELX, will delegate the authority to decide on various parameters, including protocol fees, to the community.

Elixir is also considering providing liquidity on CEX and plans to establish a dedicated team to continue developing this initiative. However, there are several issues related to account setup and regulations that make providing decentralized liquidity to CEXs less prioritized at the moment.

Thus, Elixir is evolving from a liquidity supply protocol for order book DEXs to a DeFi infrastructure using cross-chain LP tokens, with a vision to become a liquidity layer connecting various liquidity across multiple chains, including CEXs, in the future. However, there are also challenges and limitations that Elixir needs to address to realize this vision.

4. Limitations and Challenges

4.1. Technical and Regulatory Constraints in the On-Chain Trading Environment

Even if Elixir resolves the liquidity issues of order book DEXs, problems such as slower transaction speeds compared to CEXs, higher fees, and the lack of on/off-ramp facilities continue to prevent it from providing an optimal user experience for high-frequency traders. Consequently, the trading volume on DEXs is still less than 1% of that on CEXs, particularly in futures markets where high-frequency trading is more common.

To address these issues, two main improvements are necessary: 1) Continued development and enhancement of blockchain infrastructure and order book DEXs to provide on-chain trading infrastructure comparable to current CEXs, and 2) Development of smooth capital transfer infrastructures between fiat and cryptocurrencies through on/off-ramps based on collaboration with regulatory authorities and financial institutions.

However, actively leading the advancement of this infrastructure is challenging for Elixir, and delays in this area could stifle the growth of the on-chain trading market, adversely affecting the realization of Elixir's ultimate vision.

4.2. Limitations of the Liquidity Supply Algorithm and Developments in AMM

Elixir’s market making algorithm, intended to implement a CPMM style in order books, does not distribute liquidity evenly across all price ranges, which can be seen as suboptimal in terms of capital efficiency. Elixir's founder, Phillip, mentioned in an interview with 0xResearch that Elixir’s goal is not to compete directly with sophisticated market makers but to provide stable and reliable liquidity to order book DEXs. Therefore, if market makers using advanced strategies begin to actively enter the order book DEX market, Elixir could lose its market share to these market makers, and its role might be limited to merely bootstrapping initial liquidity for order book DEXs.

On the other hand, Uniswap, a leader in the AMM space, introduced the Concentrated Liquidity feature in version 3 to address the inefficiencies in liquidity distribution observed in the previous CPMM version. This feature allows liquidity providers to supply liquidity intensively within a specific price range. Moreover, the upcoming Uniswap version 4 will introduce a Hook feature that allows setting triggers in the liquidity pool to activate during certain events. This feature enables the implementation of advanced functionalities like limit orders and the use of liquidity outside the supplied range for lending.

Recently, the Uniswap team updated their interface to include a limit order feature, and projects like TONDEX that aim to combine the advantages of AMM and order book DEXs are emerging. As AMM DEXs begin to integrate features traditionally associated with order book DEXs and attract high-frequency traders, Elixir needs to go beyond its role as a liquidity provider for order book DEXs. It appears essential for Elixir to secure a competitive edge by focusing on its functions as a DeFi infrastructure using cross-chain LP tokens and as a cross-chain liquidity layer.

5. Conclusion

Elixir is a protocol that aims to solve the liquidity supply issues faced by order book DEXs using its proprietary market making algorithm and a decentralized network architecture. It strives to democratize the participation in liquidity provision for order book DEXs, which has traditionally been concentrated among a few market makers, thereby expanding the market and providing more opportunities to a greater number of participants.

Elixir is preparing to supply liquidity in earnest by forming partnerships with multiple order book DEXs. Moreover, in collaboration with cross-chain infrastructure protocols, Elixir plans to introduce LP tokens and utilize these for various DeFi services.

However, the path ahead is not without its challenges. Elixir must overcome issues such as the slow speeds and high fees typical of on-chain trading environments, the efficiency of its own algorithms, and competition from other protocols.

As the competition between AMMs and order book DEXs intensifies, and indeed between CEXs and DEXs, it will be interesting to observe how Elixir establishes its niche in this evolving competitive landscape.

References

- Market-makers: The Recluses through Cycles

- The History of dYdX

- Elixir

- Elixir docs

- Uniswap docs

- Optimal High-Frequency Market Making

- The Dominoes of Centralized Risk - Solving for the Right DEX

- Trustless & Permissionless Liquidity Vision for Order Book Exchanges

- Elixir's innovative decentralization approach

- Our Vision for Uniswap v4

- TONDEX, Orderbook style DEX using Uniswap V4