Radiant Capital — Reformer of Lending Protocols

A Deep Dive on Tokenomics

1. DeFi Primitives

In November 2020, Multicoin Capital published “The DeFi Stack” to explain how decentralized finance, or DeFi, protocols create network effects, introducing six layers of DeFi, which include the following.

1.1. Get to Know the DeFi Stack

Source: The DeFi Stack

Layer 1: Atomic Units of Value

- Tokens that hold value and are used as collateral, such as DAI, ETH, USDT, etc.

Layer 2: The Transaction Layer

- Transaction features that utilize tokens to track and store collateral balances, measure collateralization rates, process oracle pricing, execute liquidations, distribute staking rewards, and issue margin and leverage, etc.

Layer 3: Price Oracles

- Oracle’s ability to make secure, verifiable market price data available to DeFi protocols

Layer 4: DeFi Primitives

- Layer of DeFi apps that interact with users, such as lending, AMMs, order book exchanges, derivatives, and asset management platforms.

Layer 5: Protocol Aggregators

- A layer that leverages the composability of DeFi primitives to create and deliver revenue-maximizing or cost-minimizing products to users.

Layer 6: Wallets and Front Ends

- Wallets like Metamask and DeFi front ends like Zerion that aim to improve the user experience of DeFi users through design, usability, localization, and more to win customers.

2. Importance and Limitations of Lending Protocols

Layers 1–3 above are the core infrastructure that makes DeFi activities possible, so the most recognizable layer from a user perspective is the DeFi primitive layer.

Among them, lending protocols function as the basic infrastructure for DeFi activities by forming a money market for lending and borrowing cryptocurrencies to maximize the efficiency of funding. Lending protocols allow DeFi users to access additional funds without having to sell their holdings, and can be used to build on-chain leveraged positions (long or short), leverage the connectivity between DeFi apps, engage in yield farming strategies, and more.

2.1. About the Limitations

Compound, one of the leading lending protocols during the DeFi summer in 2020, was able to successfully raise liquidity and grow by offering its native token, COMP, to crypto lenders and borrowers on the protocol.

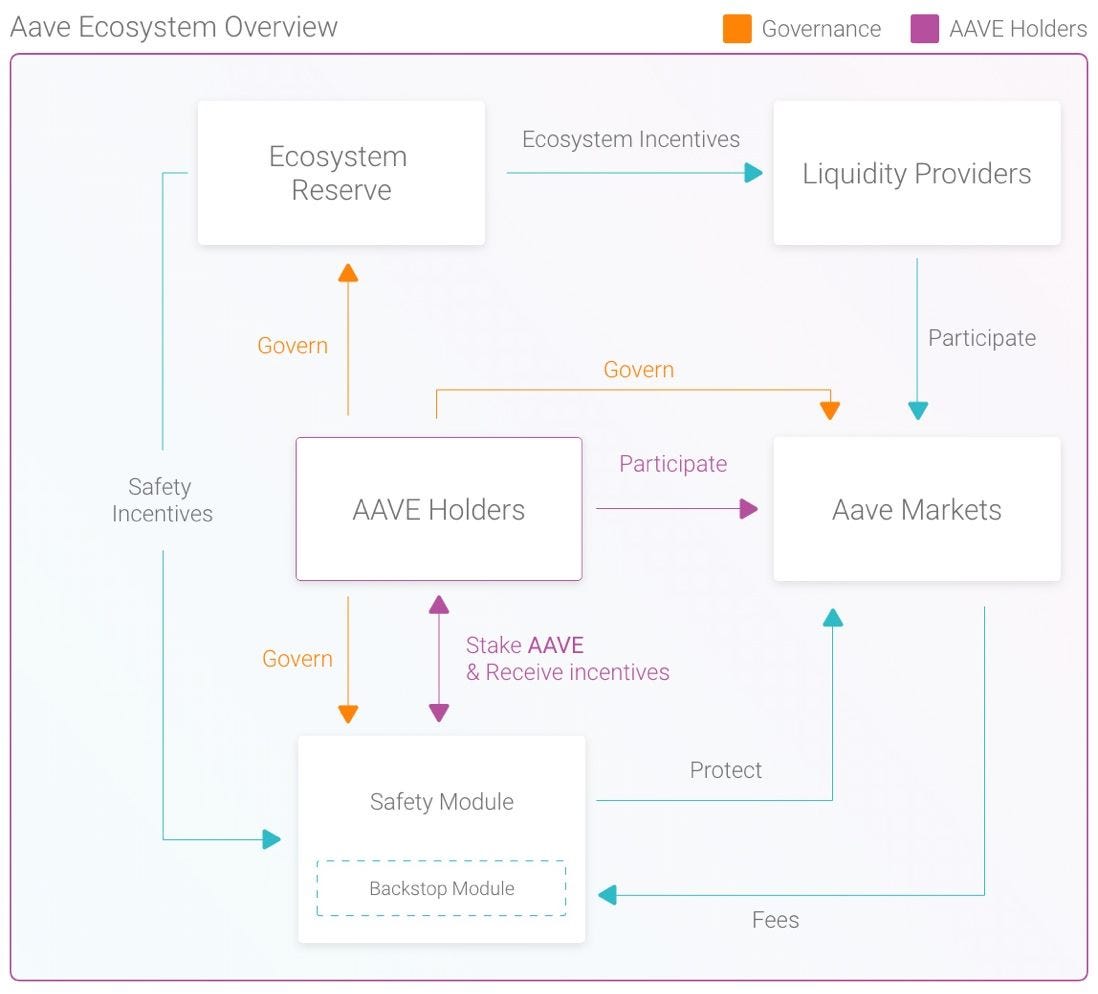

However, this approach — granting governance tokens as a form of interest to protocol participants — is unlikely to be sustainable without establishing sufficient utility for users to demand the tokens. In the case of Aave and Compound, two of the leading lending protocols today, it’s safe to say that utility is limited to voting in protocol governance.

- Utility of AAVE: governance voting rights, earn AAVE token incentives after staking Safety Module

- Utility of COMP: governance voting rights, COMP token incentives for users who perform activities such as lending and borrowing crypto on the protocol

Moreover, given that the main source of revenue for lending protocols is yield margin (the difference between lending and borrowing rates), it is not easy for a particular lending protocol to differentiate itself from its competitors by guaranteeing users a particularly high yield. As a result, the lack of utility of native tokens and the difficulty of differentiating revenue streams among protocols make it difficult for new projects to emerge in the lending protocol sector.

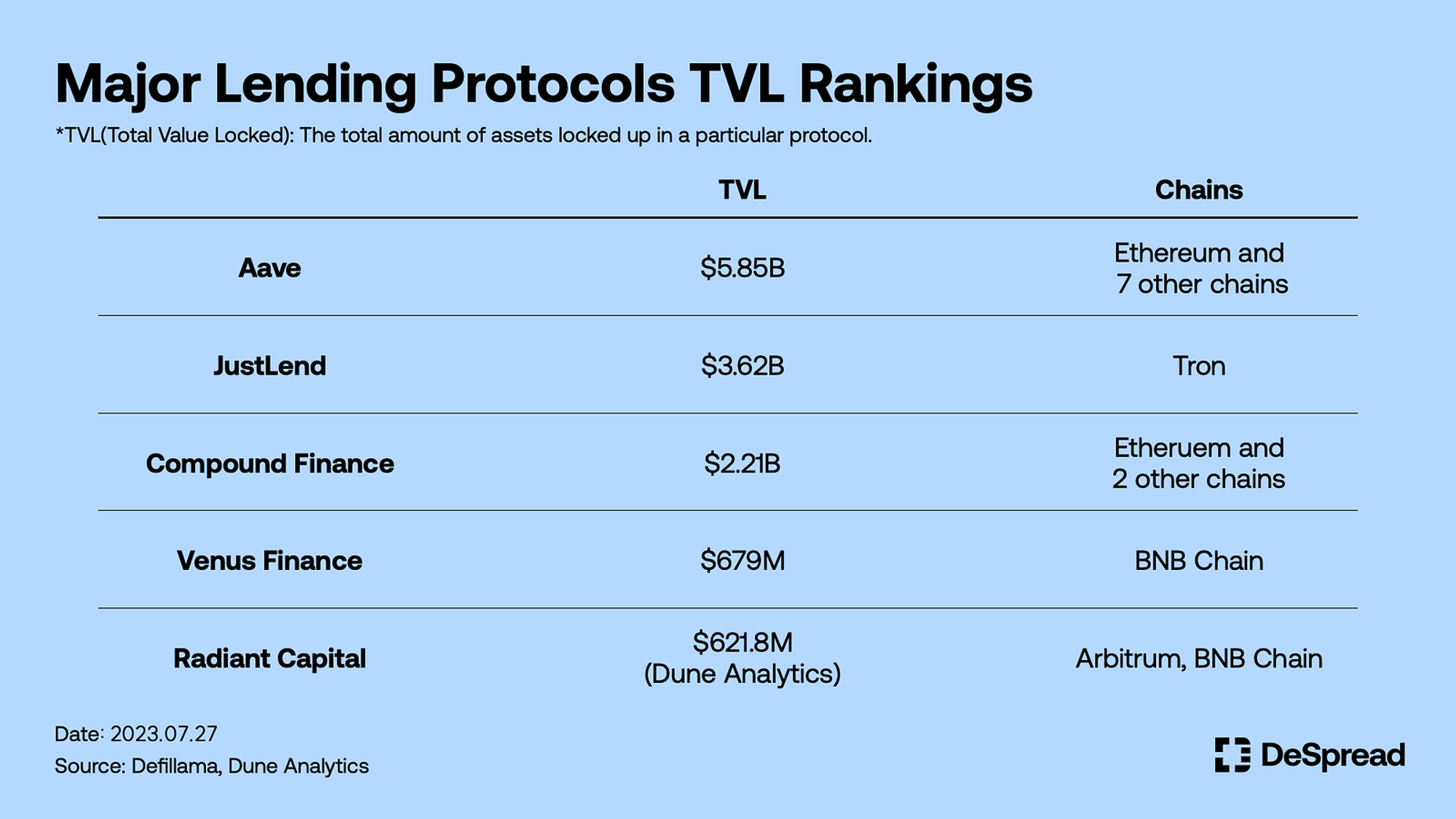

For this reason, demand for lending protocols is bound to be concentrated by a few protocols that have taken first-mover advantage on major chains, with the top four protocols (Aave, JustLend, Compound Finance, and Venus Finance) accounting for 83.7% (~$12.5b out of ~$15b) of the total TVL in the lending sector as of July 2023 according to Defillama.

Meanwhile, there is a project that is disrupting the oligopolistic lending protocol market with a unique protocol design. One such project is Radiant Capital, which has raised over $600M in TVL since launching V2 in March 2023 and is ranked #5 in the lending sector by size.

3. The Rise of Radiant Capital

Radiant Capital is a lending protocol that was launched in July 2022 and currently has a TVL of around $621.8M ($260M on DeFiLlama, but the actual size of deposits on the protocol is same with this), making it the 5th largest in the overall lending sector. The project, which originated on Arbitrum, continues to march under the banner of DeFi’s Most Profitable Protocol.

In July 22, the project realized that there were some problems with the design of tokenomics after the product was launched, and in March 23, the project reorganized as Radiant V2. In the reorganization, they said it was necessary to realize sustainability centered on Real Yield, and cited the following problems of existing DeFi projects, including Radiant (V1).

- Lack of utility provided by governance tokens

- Unable to control short-term speculative capital infiltration due to low entry barrier of token farming

Due to the problems above, existing DeFi protocols were unable to increase the value of native tokens proportionally to their growth, and were exposed to the side effect of exponentially increasing selling pressure on the tokens due to short-term capital for token farming. With this in mind, Radiant Capital improved its tokenomics through several governance changes and built a differentiated tokenomics compared to existing lending protocols. In the following, we will analyze Radiant Capital with a focus on its tokenomics.

4. Exploring the Tokenomics

In their vision, one of the goals set forth by Radiant Capital is to minimize the impact of short-term speculative capital through various mechanisms to prevent pump-and-dumps. Given that the RDNT token is essentially given away as a reward for participating in the protocol (primarily depositing funds), similar to the native token use cases of existing DeFi protocols, a tokenomics design will be required to achieve their goal.

4.1. Governance History

To start, here’s a summary of Radiant Capital’s governance history around improving tokenomics.

(As used in the following, RFP stands for Radiant Foundation Proposal, a term that refers to Radiant Capital’s governance agenda).

- RFP-4: Dynamic Liquidity Provisioning

⁃ Mandates users to deposit LP tokens in an amount equal to 5% of their deposit to enable RDNT farming. - RFP-5: Exit Penalties in v2

⁃ RDNT farming claims will be available on a linear vesting schedule from the time RDNT farming claims are enabled, with a 25% to 90% penalty for users who want to claim before vesting is complete.

⁃ 90% of the tokens not claimed by the user due to the exit penalty will be returned to the RDNT DAO’s reserve, and 10% will be burned from circulation. - RFP-6: v2 Vesting and Locking

⁃ Disqualify locked LPs from receiving protocol fees when they expire

⁃ Set the vesting period for RDNT tokens to 90 days - RFP-7: Protocol Fee Distribution

⁃ In the V1 design, 50% of the protocol fees were previously awarded to RDNT lockup and vesting users and 50% to depositors (lenders).

⁃ In the V2 design, 60% of the protocol fees are transferred to dLP depositors, 25% to lenders, and 15% to the DAO wallet, which the DAO uses for operating expenses. - RFP-8: Extending the Emissions Runway

⁃ Adjusted the token distribution schedule from 2 years (ending July 2024) to a total of 5 years(ending July 2027).

5. Features of Tokenomics

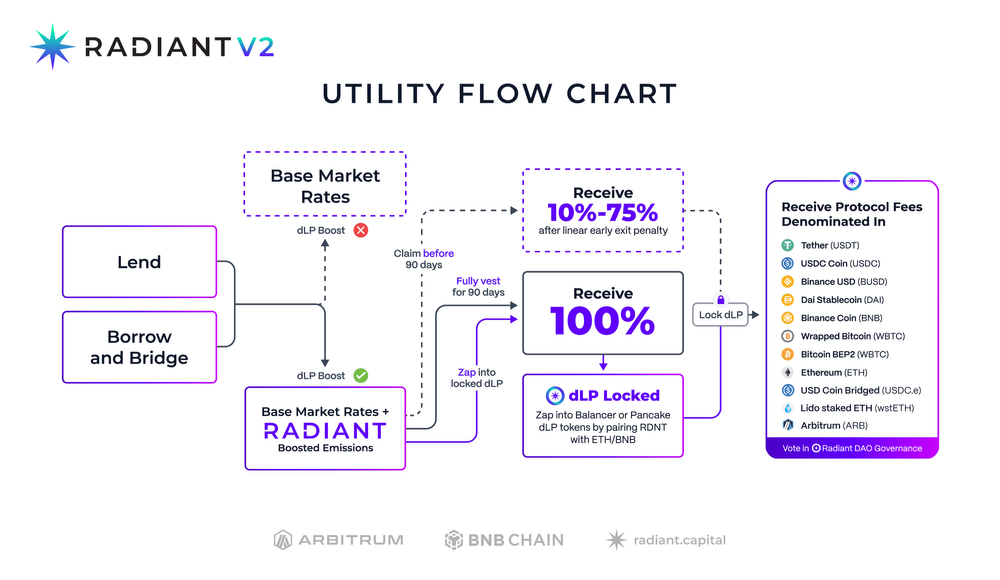

After going through the above governance, the overall tokenomics of Radiant Capital V2 is as follows:

- Those who deposit funds into the protocol will receive Base Market Rates offered by Radiant, with the Base Market Rates amounting to 25% of the total protocol fees (RFP-7).

- Lenders can earn RDNT token emission and additional protocol fee rewards(60% of total fees) for Dynamic Liquidity Provisioning (dLP) deposits (above 5% of deposited funds) (RFP-4, RFP-7).

- dLP is the LP token that backs the RDNT value on each chain, meaning the 8:2 ratio of $RDNT-$WETH LP tokens supplied to the Balancer protocol for the Arbitrum chain and the 5:5 ratio of $RDNT-$WBNB tokens supplied to the Pancakeswap protocol for the BNB chain.

In other words, the more users of Radiant Capital want to benefit from the value generated by the protocol, the more they need to deposit (or lock up) dLP in proportion to their deposited assets, which entails the conversion of their funds into RDNT tokens, so participation in the protocol is directly linked to the increase in RDNT token value. Radiant Capital’s tokenomics is designed to 1)encourage long-term contributions from users, and 2)minimize selling pressure on the RDNT token.

5.1. Encourage Long-Term User Contributions

The existence of dLPs in RDNT tokenomics ensures that users participating in the protocol make long-term contributions to the protocol. The mechanism of dLPs can be summarized as follows:

- Depositors of dLPs after depositing will receive increased platform fee rewards and RDNT emission rewards

- Simple deposit depositors earn 25% of the platform fee, while dLP complex depositors can earn 60% of the platform fee

- When depositing dLP, you need to set a lockup period of 1/3/6/12 months, and the longer the period, the larger the reward you receive.

These mechanisms have following two effects.

- Align users’ interests with that of the protocol

⁃ Reward distribution is proportional to contribution, as the more capital you lock up, and the longer you lock it up, the larger the reward you can receive, rather than simply depositing it into the protocol.

⁃ Can be seen as a mechanism to align user expectations of reward or profit maximization with the protocol’s expectations of promoting sustainability. - Connect protocol contributions to increase in native token value

⁃ Since dLP is an LP token that bundles RDNT and other assets, on-chain liquidity for RDNT is also expanded when dLP is created and locked up, killing two birds with one stone as the growth of the protocol leads to an increase in token value.

⁃ Minimizing the depreciation of RDNT used as a reward for contributing to the protocol, which leads to minimal dLP value fluctuations, lowering the entry barrier for dLP lockups.

This can also be seen in a similar way to veTokenomics, where Curve Finance was able to differentiate who would benefit from the emission of its native token, the CRV token. Even on veTokenomics, where users could lock up CRV tokens for up to four years, the more CRV tokens they locked into the protocol for a longer period of time, the more fees and governance rights they were entitled to receive. In this way, users competed to lock up tokens in order to receive more protocol rewards, and the value of protocol and user rewards naturally grew together.

However, while veTokenomics simply locks CRV tokens, Radiant Capital’s dLP mechanism locks LP tokens that are bundled with RDNT and other assets, making it a more aggressive way to increase the token value.

5.2. Minimize Selling Pressures on RDNT Tokens

The process of distributing protocol value to users, including protocol fees and RDNT emissions, also demonstrates an effort to minimize selling pressure on the RDNT token. The design features that create this effect are as follows

- Platform fees awarded as dLP rewards are claimable upon receiving, but are comprised of assets treated as collateral by protocols such as DAI, USDC, wBTC, ETH, ARB, and others, not RDNT.

- RDNT token rewards can only be claimed in full after a 90-day vesting period, with a 25% to 90% loss if rewards are claimed before the 90-day period.

- Before vesting, or at any time during vesting, ‘Zap’ feature can be utilized to deposit additional dLP along with the appropriate amount of pair assets (WETH, WBNB).

With these features, Radiant Capital has created a virtuous cycle by providing users with the ability to easily convert their RDNT token emissions into dLP as a reward, while minimizing the depreciation of the native token, RDNT, and allowing them to once again contribute to the protocol’s value.

6. Conclusion

Radiant Capital’s tokenomics above is designed to ensure that RDNT token value appreciation is proportional to the increase in RDNT liquidity due to the growth of the protocol, i.e., the increase in protocol TVL due to the increase in deposited funds and the amount of dLP locked up.

However, users who want to participate in the protocol and share in its growth must lock up their dLP for a long period of time, which means they have to bear the risk of fluctuations in the value of their input capital, which acts as an entry barrier to participate in the protocol. In addition, there is no incentive to demand RDNT tokens without depositing dLP, so there may be a lack of factors to promote demand for the tokens other than participation in the protocol, such as Buy&Hold.

Despite these concerns, Radiant Capital deserves a lot of credit for the design as it achieves the intended goal of minimizing the impact of short-term speculative capital through various mechanisms to prevent pump and dump. It also provides UI/UX conveniences such as “Zap,” “Auto-compound,” and “Auto-relock” features that make it convenient for existing stakers to re-contribute their rewards so that they can continue to participate in the protocol’s growth.

- Zap: A dLP deposit convenience feature that allows users to create, deposit, and lock up dLPs in a single click, depending on the size of the asset (ETH, BNB) they wish to deposit, utilizing money markets if necessary (Link)

- Auto-compound: automatic lockup of protocol fees received by users by converting them to dLPs at regular intervals (Link)

- Auto-relock: If enabled, automatically re-lock user-locked dLPs when they expire (Link)

As a result of the efforts above, Radiant Capital has seen growth in its metrics since the launch of V2, with consistent high protocol fees. Below, we’ll take a look at the protocol growth metrics that Radiant Capital has been recording.

7. Protocol Growth Metrics

With a vision of being the DeFi’s Most Profitable Protocol, the most important factors for Radiant Capital will be 1)whether it actually generates high yields and 2)whether users stay engaged with the protocol. To analyze these factors, here are the metrics to look for.

- Do they really generate high returns — protocol fee trends

- Are users consistently participating in the protocol — liquidity trends in dLP pools

7.1. Protocol Fee Trends

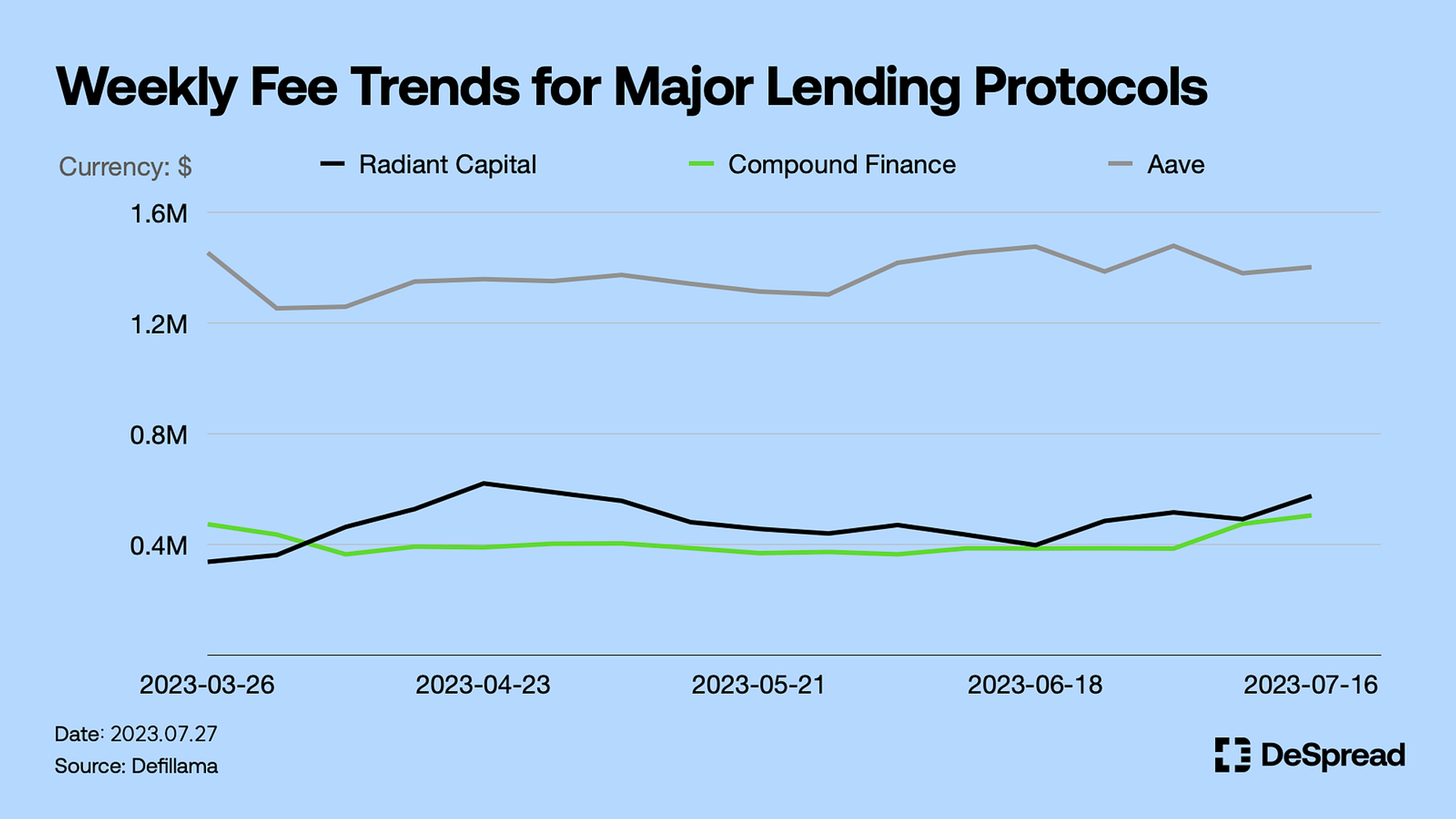

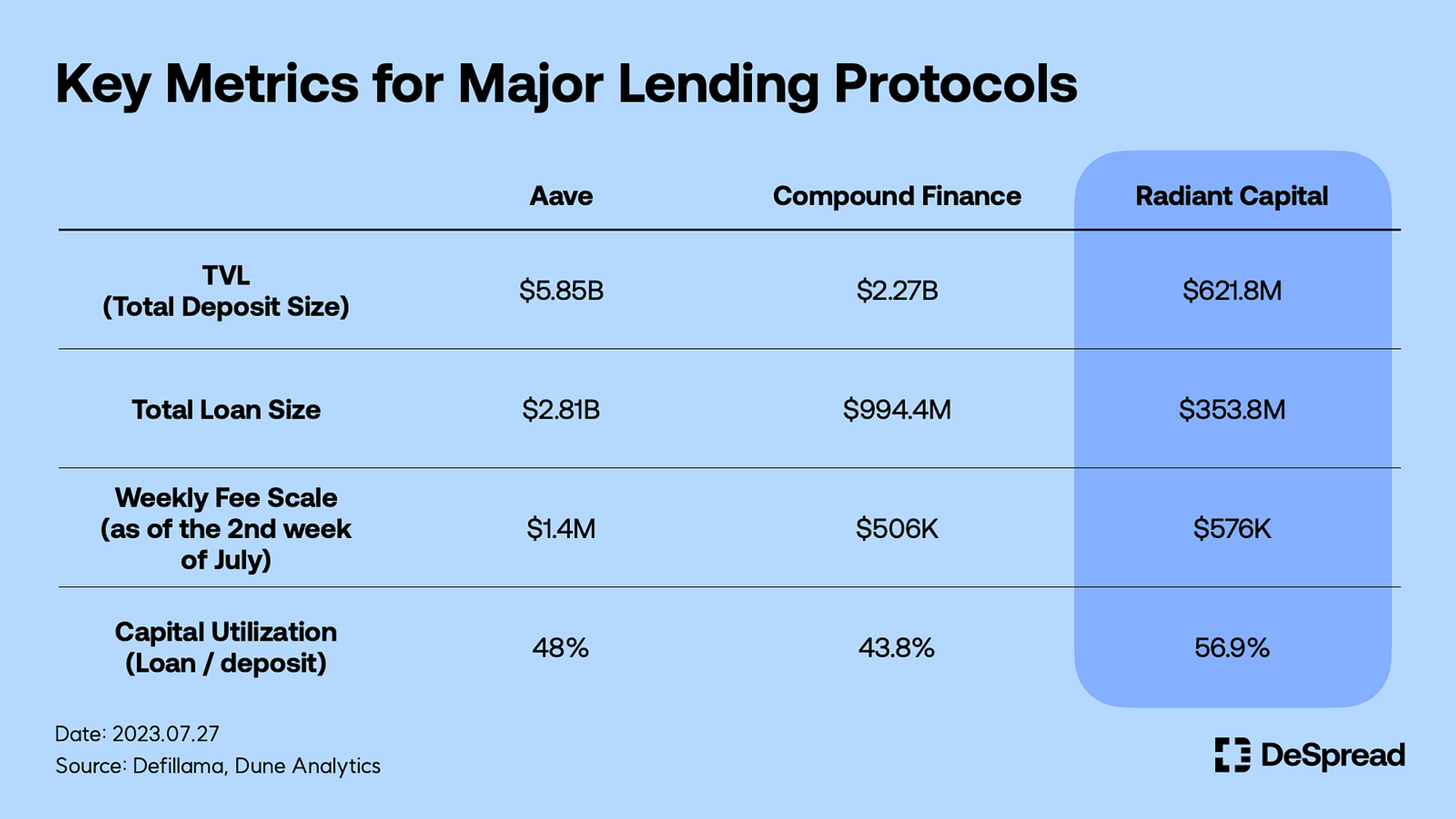

As of the second week of July, Radiant Capital’s weekly fees were around $576K, similar to that of Compound Finance (around $506K), and a third of AAVE (around $1.4M). Since Radiant V2 was launched in March 2023, it has consistently maintained a similar fee scale, which is quite encouraging given the TVL that indicates the size of the protocol. As of July 27, 2023, the TVL for the three lending protocols shown above are as follows.

- AAVE: $5.85B

- Compound Finance: $2.27B

- Radiant Capital: $621.8M

Despite the relatively small size of the protocol compared to competing projects, Radiant Capital is generating fees that are comparable to Compound finance, suggesting that it is generating relatively high returns. Here are some key metrics, including protocol fees.

7.2. Liquidity Trends in dLP Pools

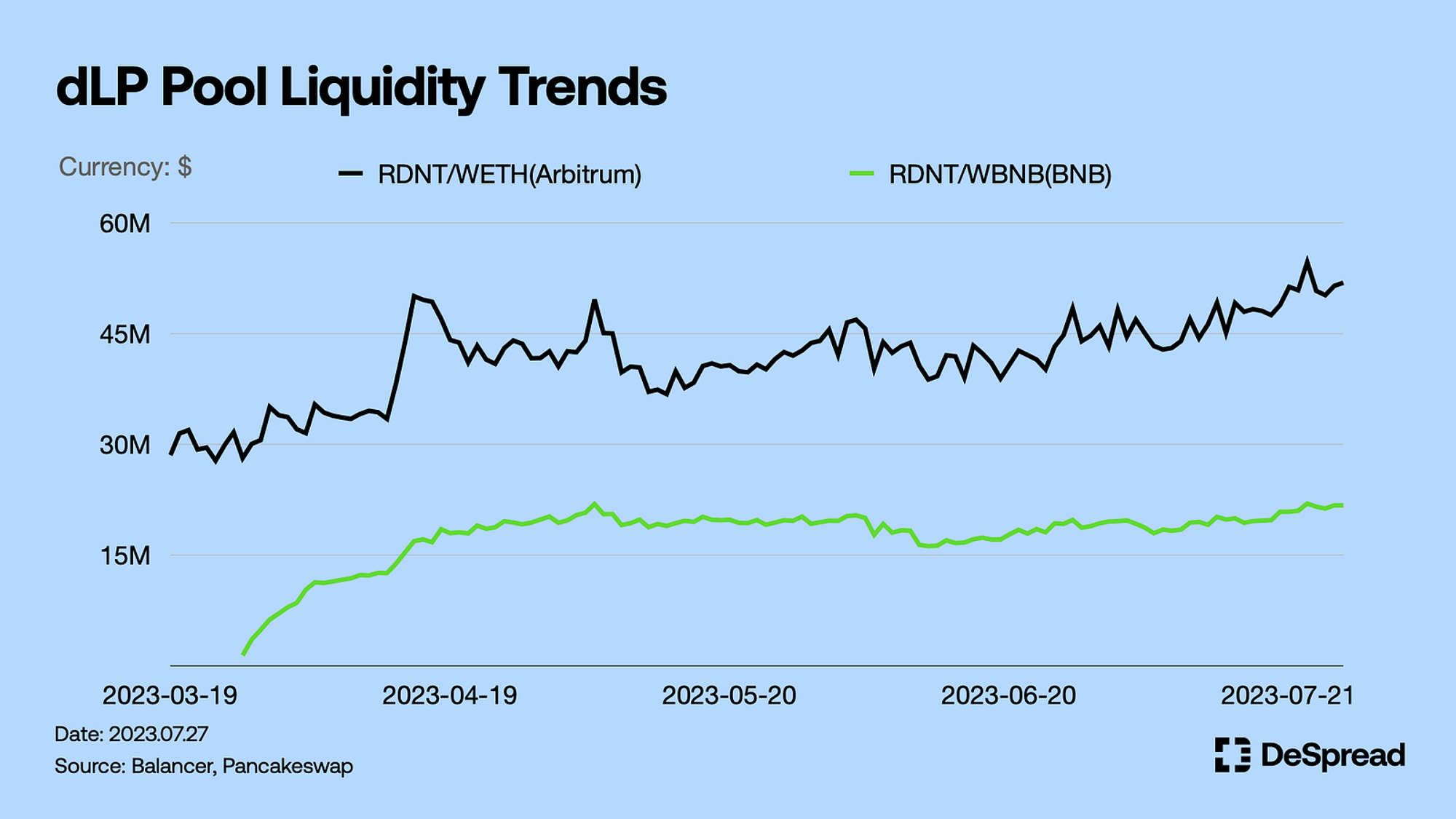

Depositing dLP is essential for users to contribute to the growth of the protocol and receive RDNT and protocol rewards on the tokenomics built by Radiant Capital. As mentioned above, dLP is the LP token that backs the value of RDNT, which for the Arbitrum chain is an 8:2 ratio of $RDNT-$WETH LP tokens supplied to the Balancer protocol, and for the BNB chain is a 5:5 ratio of $RDNT-$WBNB tokens supplied to the Pancakeswap protocol. When depositing dLP, users’ funds are converted into LP tokens for each chain and added to the corresponding pool liquidity.

Therefore, the growth of the dLP deposit pool liquidity can be interpreted as an indicator of whether users continue to participate in the protocol. The liquidity trend of the dLP pool is shown below.

As you can see in the chart above, the liquidity size of the dLP pools on each chain has been growing gradually since the pools were created(Arbitrum: March 18 / BNB Chain: March 27). As of July 27, 2023, the liquidity size of dLP pools on each chain is as follows.

- Arbitrum Balancer RDNT/WETH pool liquidity volume: around $52.4M

- BNB Chain Pancakeswap RDNT/WBNB pool liquidity volume: around $21.92M

Therefore, we can say that users have been participating in the protocol since the launch of Radiant V2 and it’s still growing in scale.

As a result, it’s safe to say that the project is executing the right strategy to realize Radiant Capital’s vision of being the DeFi’s Most Profitable Protocol, and the metrics we’ve seen so far indicate that it’s moving in a positive direction.

8. Closing Thoughts: Concerns and Expectations

Even with sound tokenomics in place and actual metrics confirming the protocol’s growth, there is no guarantee that Radiant Capital will continue to grow. While we’ve seen significant growth since the V2 upgrade, it will take continuous efforts on the part of the project to ensure that users’ capital stays with the protocol rather than leaving it.

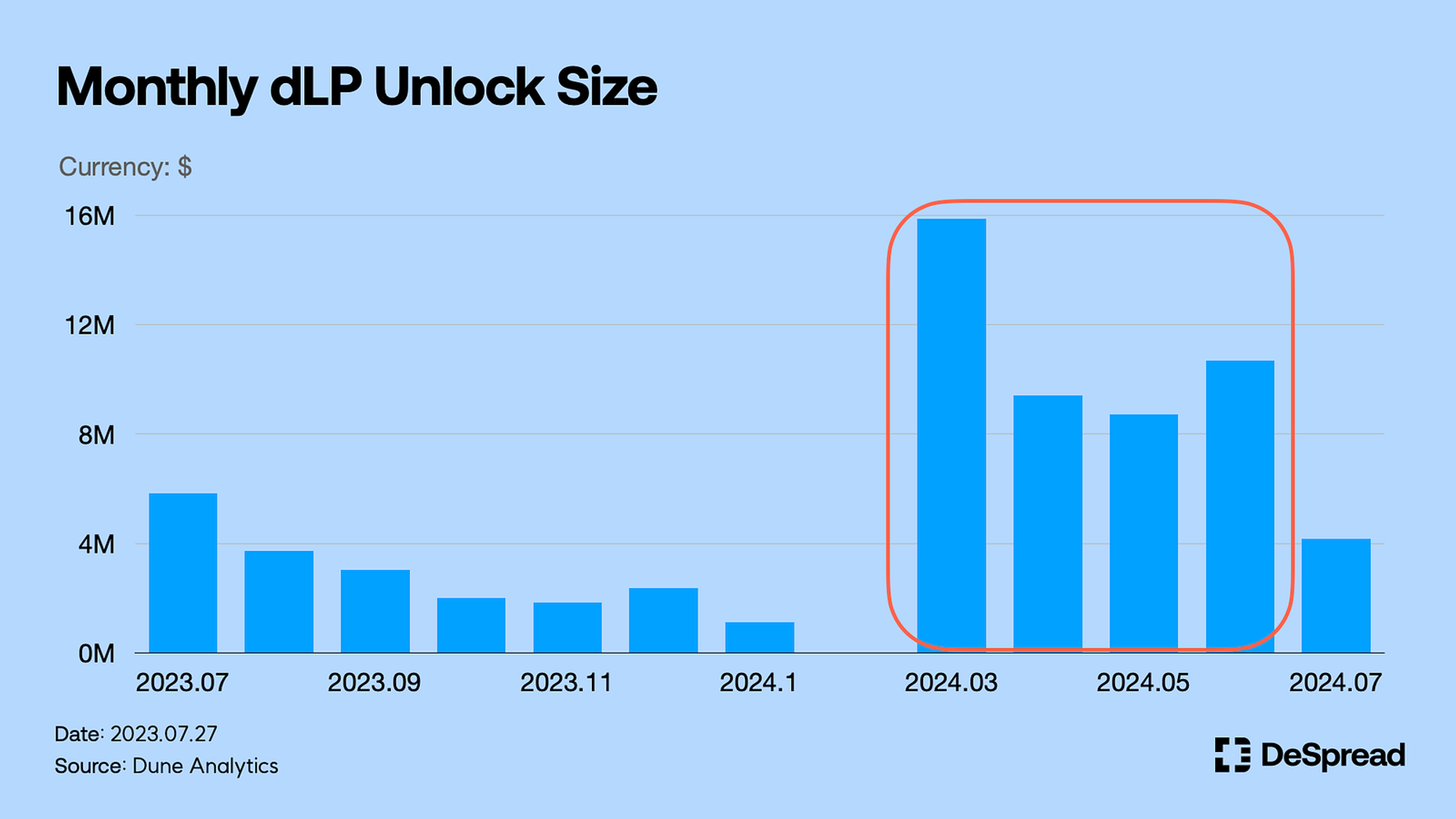

Perhaps the biggest concern facing the protocol is the approaching large-scale unlock of dLP. Approximately $44.67M of dLP is scheduled to be unlocked in the roughly four months following March 2024, representing 60% of the total DLP liquidity of $74.3M that currently exists across the Arbitrum and BNB chain. As a result, protocols will need to work to secure additional liquidity until that large unlock is reached, which is a significant challenge for the protocol sustainability.

8.1. Actions and Strategies

Radiant Capital is now taking steps to become a leading omnichain money market. First, they migrated the existing ERC-20-based RDNT token to a Layerzero-based Omnichain Fungible Token(OFT) format to facilitate the expansion into multiple chains, while allowing users to seamlessly share protocol value regardless of chain.

Since the launch of Radiant V2 on Arbitrum, they have successfully expanded the protocol to the BNB chain in late March. In addition, a governance proposal (RFP-19) to expand to the Ethereum chain was passed in late June, and another chain expansion is also planned. It would be exciting to see if expanding to the Ethereum chain, which is home to the largest DeFi market, including LSD and stablecoins, can serve as a new growth engine for Radiant Capital.

Meanwhile, Radiant Capital is a beneficiary of the ARB token airdrop, holding approximately 3.34M ARB tokens in its treasury, and is also working to attract additional liquidity by holding two governance rounds (RFP-16, RFP-18) to distribute tokens to new and existing dLP depositors.

With a tokenomics design that minimizes the impact of short-term speculative capital through various mechanisms to prevent pump-and-dumps and a strategy to position itself as a representative of omnichain money markets, can Radiant Capital continue on its path to becoming DeFi’s Most Profitable Protocol? It’s worth keeping an eye on the tectonic shifts in the lending sector that are taking place around them.