1. Introduction

Contrary to the trend of traditional businesses entering the Web3 industry, there is a trend of DeFi providing financial services to traditional businesses.

In the past, assets available on DeFi platforms were limited to cryptocurrencies. As a result, even if decentralized financial services such as borrow & lending were available, capital was only circulated within the on-chain environment, limiting the potential for maximizing capital efficiency.

Therefore, there have been ongoing efforts on DeFi platforms to provide financial services to real world assets (RWA) and traditional companies, and there have even been cases where DeFi protocols and financial institutions have collaborated to expand their business.

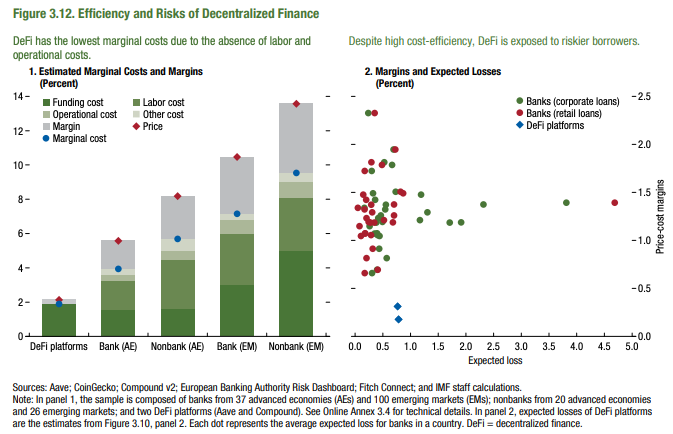

One of the main benefits that traditional companies can expect to gain from using DeFi is cost. DeFi can offer favorable capital costs to consumers for the following reasons:

- (1) It is open to anyone, including those who are unbanked or underbanked and cannot create or use a bank account due to borders, (2) It can expand the scope of financial services targets and investors beyond institutions, thanks to its high accessibility, making it easier to secure economies of scale.

- Smart contracts based on the blockchain minimize the occurrence of asymmetry of information, making it easier to minimize personnel and operational costs.

Services that can minimize auxiliary costs by optimizing systems have always been popular, and users are always proactive in reducing such costs.

The reduction of auxiliary costs is primarily achieved through the use of distributed ledger technology, which eliminates the need for intermediaries and allows for easy peer-to-peer transactions, which is the most well-known aspect of DeFi.

Of course, financial services are related to “assets” that are as important as people’s lives in a capitalism market, so regulatory authorities always try to prepare various procedures and systems to reduce risks. The auxiliary costs also arises as a side effect of this intention, and capital costs and capital risks have always had a trade-off relationship.

At this stage, it is unlikely that multinational unregulated financial services based on smart contracts will completely eliminate this trade-off relationship as it relates to RWA, which actually exists in the real world. However, with a high probability, as various types of RWA are standardized and DeFi security is established, and as the infrastructure is established, regulatory requirements will be reasonably balanced, enabling reduced capital costs and sufficient stability to be achieved.

Of course, financial services are always subject to regulations from authorities to reduce risks, as they are related to “assets” that are vital to people in capitalist markets. Auxiliary costs are also side effects arising from these intentions, and capital costs and capital risks have always had a trade-off relationship.

At this stage, it is unlikely that multinational, permisionless financial services based on smart contracts will completely resolve this trade-off relationship, as they are related to real world assets (RWA). However, it is highly likely that various types of RWA on-chain standards will be established and DeFi’s security will be established as the infrastructure for handling real world assets becomes more mature.

At this stage, it is unlikely that multinational permissionless financial services based on smart contracts will completely eliminate this trade-off as it relates to RWA, which actually exists in the real world. However, with a high probability, as various types of RWA are standardized and DeFi security is established, and as the infrastructure is established, regulatory requirements will be reasonably balanced, enabling reduced capital costs and sufficient stability to be achieved.

Against this background, as various attempts have been made continuously from the relationship between traditional companies and DeFi, we can see cases where DeFi protocols have actually had an impact on the real world, surpassing the wall of on-chain.

One such start was made by MakerDAO, AAVE and Goldfinch.

2. MakerDAO: RWA Vaults

MakerDAO is a protocol that allows users to deposit cryptocurrencies such as Ethereum and issue stablecoin called $DAI as collateral. It can be described as a decentralized version of a central bank issuing currency backed by gold, as seen in the gold standard. MakerDAO is the first generation DeFi protocol that established the foundation for the decentralized financial infrastructure.

Users on the blockchain can deposit their cryptocurrencies in MakerDAO and issue $DAI without selling their assets, providing them liquidity as a basic financial service so that they can pay for expenses or purchase other assets.

MakerDAO earns revenue through fees proportional to the amount of $DAI issued. However, after the end of 2021, the value of the collateral assets has become more volatile due to the overall market downturn, causing the $DAI repayment amount to increase and the demand for asset liquidity to decrease, resulting in a continuous decline in MakerDAO’s revenues.

On the other hand, MakerDAO has been operating RWA Vaults, which issue $DAI backed by RWA (Real World Assets) instead of cryptocurrencies like Ethereum, since mid-2021.

As the graph below shows, the amount of RWA being boarded on MakerDAO has consistently increased. By bringing in RWA as collateral, MakerDAO has not only dramatically expanded the scale of finance, but also gained a revenue structure with low correlation to the cycle of the crypto market.

Currently, MakerDAO has 8 RWA vaults, which can be classified into several categories based on their characteristics.

2.1. Tokenized RWA Vaults

This category includes 6S Capital, ConsolFreight, FortunaFi, Harbor Trade Cred, New Silver, and previously represented the group of RWA Vaults until July 2022, before the introduction of HVBank and MIP65 Vaults.

The process of depositing physical assets in MakerDAO involves the following infrastructure:

- Tinlake, a killer app on the Centrifuge chain that specializes in onboarding RWA to DeFi, tokenizes RWA by issuing documents containing the legal contract terms of the assets as NFTs.

- Tinlake then collateralizes the NFTs and issues ERC-20 tokens in the form of Senior/Junior (Drop Token/Tin Token) tranches.

So, the process is RWA -> NFT -> ERC-20.

MakerDAO has equipped a vault with five types of RWA tokens, including four types of Tinlake-based RWA tokens and one separate RWA token based on 6S Capital. Therefore, entities that want to liquefy illiquid RWA can deposit tokenized RWA assets with Tinlake, etc. in MakerDAO, which enables them to issue DAI.

- ConsolFreight: collateralized loan for freight shipment invoices

- FortuneaFi: Tokenized real assets that generate cash flow

- Habor Trade Credit: Export sales receivables

- New Silver: collateralized loan for residential real estate development projects and mortgage pools

- 6S Capital: Secured loan for commercial real estate development projects

As above, the RWA vaults that accept deposits of tokenized real assets are currently dominated by collateralized loans and loan receivables. Therefore, these non-liquid assets provide liquidity to the holders, while on-chain investors can invest in the desired tranche (Senior/Junior) of the vault through the Tinlake UI and earn a profit. In other words, this RWA-DeFi integration not only liquefies RWA, but also has the significance of implementing traditional financial product CDO (Collateralized Debt Obligation) on the DeFi platform.

2.2. Direct Bank Vault

HVBank vault, which appeared in July 2022, is a joint venture between Huntingdon Valley Bank (HVB), located in Pennsylvania, USA, and MakerDAO. HVB, which offers a variety of loan products, can deposit the loan assets with MakerDAO and issue DAI to secure liquidity instead of selling the loan to a third party. At the same time, MakerDAO can not only increase the issuance of DAI and diversify the collateral assets, but also receive MakerDAO’s long-standing know-how on risk management and legal and regulatory procedures for the tangible assets held by HVB, which will help to secure the evaluation criteria for accepting even more diverse RWA in the future.

The entity that proposed HVBank Vault to MakerDAO governance and promoted the business is RWA Company, which plays a bridging role between HVB and MakerDAO governance, among other things, by communicating and transmitting off-chain data to the Maker community. The CEO of RWA Company is Greg Di Prisco, who previously served as Head of BD for Maker Foundation, and is currently involved in the development of various DeFi projects as a consultant.

To establish a direct vault between the real and on-chain, MakerDAO launched MBPTrust (MakerDAO Bank Participation Trust), a Delaware Statutory Trust form of trust.

MBPTrust represents MakerDAO and is responsible for the legal subject of HVB creditors, and supervises the contract with HVB. The trust is composed of a committee elected by MakerDAO and monitors commercial issues including the relationship between the assets deposited by HVB and the issued DAI.

MakerDAO has agreed to provide a total credit limit of $100m to HVB for a period of two years starting in July, 2022. Considering that the total assets deposited in the MakerDAO RWA vault prior to the HVB participation was only around $40m, it is clear how much of a contribution this collaboration with HVB has made to DeFi going out into the real world.

As can be seen from the data below, as of December 2022, the entire credit limit of $100m set has been used and $100m of DAI has been issued. However, currently the HVBank vault does not charge a Stability Fee for the issued DAI on-chain, but rather has a form where the revenues are generated off-chain and transferred to MakerDAO’s Surplus Buffer.

If this collaboration is recognized as a representative success case, the DeFi protocol will open the door to providing financial services to traditional financial markets worth several billion dollars, not just the crypto market. By working with the traditional bank HVB, which has a wealth of know-how, there will be a significant improvement in the infrastructure for legal issues, collateral asset risk assessment procedures, and settlement related issues between RWA and the DeFi protocol, and based on this, other DeFi protocols will also be able to easily challenge this market, resulting in a synergy between traditional finance and decentralized finance that will grow even more.

This also means that traditional financial markets will gain a new outlet for capital efficiency, not just the growth of the DeFi protocol. For example, HVB has gained a new outlet for liquidity through this collaboration, and the maximum loan limit that can be lent to a single entity has actually increased.

2.3. MIP65 Vaults (Menetalis Clydesdale)

MIP65 is different from the other two types of vaults mentioned above. While previous vaults have been used to issue $DAI by using RWA as collateral, MIP65 is a vault that is intended to be used to purchase RWA rather than just holding stablecoins like $USDC that MakerDAO has held to maintain the stability of the $DAI price.

The target assets for purchase are US short-term government bonds (80%) and investment-grade corporate bonds (20%), which may have relatively lower liquidity compared to holding stablecoin directly, but can sufficiently play the role of collateral assets to maintain the price of $DAI and receive sufficient interest rates. Given Circle use highly liquid investment-grade bonds as collateral for $USDC, MakerDAO aims to create a structure in which it can directly operate the vault to maintain the stability of $DAI and gain interest rates at the same time.

Technically, MIP65 vault is a system in which MakerDAO issues $DAI as collateral for $USDC held by MakerDAO itself, and then uses the $DAI to purchase iShares ETF from BlackRock through the Swiss digital asset bank Sygnum.

The significance of this vault is that it not only enables MakerDAO to provide financial services to real-world companies, but also allows decentralized protocols to own a large amount of RWA. As of now, MIP65 vault has issued approximately $500m worth of DAI for bond purchases.

As described above, various assets are being transferred into MakerDAO from different sources, and currently, the revenue generated from businesses related to RWA accounts for more than half of MakerDAO’s total revenue. Of course, it must be considered that the revenue from $DAI Stability Fee, which was collateralized by cryptocurrencies, has been heavily impacted by the recent continuous downtrend in the market, but there is no doubt that DeFi’s entry into the real world not only treads on the land of opportunity but also promotes the stabilization of the business model.

Of course, according to MakerDAO’s current endgame plan, it is emphasized that real world assets can bring a fatal risk to the foundation of the protocol, as they are vulnerable to government asset freezing and seizure. While bringing financial assets from the real world into DeFi is still under the jurisdiction of regulatory institutions, it is a process of finding a point of agreement between various regulatory authorities and DeFi infrastructure on efficiency, innovation, risk, and regulation.

As a result, it is expected to find a cost-effective point of stability, and it is thought that the moment of the birth of the second digital financial innovation based on smart contracts will be seen.

3. AAVE: On-chain transactions with Muti-national Mega Banks initiated by Singapore

The government also encourages the use of DeFi by traditional businesses. This can be seen in the Digital Asset and Decentralized Finance-Based Wholesale Foreign Exchange Trading Pilot Project launched by the Monetary Authority of Singapore (MAS).

The pilot project included participation from DBS Bank, the largest banks in Singapore, SBI Digital Asset Holdings (a subsidiary of SBI Bank), and JP Morgan Chase. The pilot project consists of (1) FX trading between JPY (Japanese yen) and SGD (Singapore dollar) and (2) trading Japanese and Singaporean government bonds on a liquidity pool on a blockchain.

All the real world assets were tokenized and traded in real-time on a blockchain, and the trade was successfully completed on the AAVE ARC (AAVE’s Permissioned Pool fork) of the public blockchain Polygon.

AAVE ARC used the same interest rate and exchange rate parameters built by AAVE, and JP Morgan Chase and SBI respectively handled the tokenization and custody of SGD and JPY on AAVE ARC.

You can check the custody transaction of a token based on RWA generated by a bank for the first time in history at the link below.

https://polygonscan.com/token/0x5E85C16A31284cCa21d3eD0f8d86002B00D73142

“DeFi enables financial transactions to be performed by entities directly with one another using smart contracts, without financial intermediaries. The live transactions executed under the first pilot demonstrate that cross currency transactions of tokenised assets can be traded, cleared and settled instantaneously among direct participants. This frees up costs involved in executing trades through clearing and settlement intermediaries, and the management of bilateral counterparty trading relationships as required in today’s over-the-counter (OTC) markets”, from the media release of the pilot project by MAS

However, there is also a community that expresses skepticism about the fact that the trade was conducted on a Permissioned Pool, which can only be used with the permission of financial regulatory authorities, even though the trade occurred between traditional financial institutions on a public blockchain.

While this does not fit the true DeFi spirit of providing permissionless on-chain financial services, it is understandable that a traditional financial institution, which is subject to regulatory oversight and holds other people’s capital, would need to have safety measures in place when attempting to venture into new territory. At the very least, this outcome has likely helped the general public to understand the cost, time efficiency, scalability, and transparency of utilizing DeFi, and as more efforts to bridge the gap between the real world and DeFi continue to be made, it is hard to deny the potential for growth and development between the two.

The improvement of inefficiency and cost reduction is always welcome demand, and demand always creates innovation. Protocols that transparently follow a predetermined sequence based on smart contracts show the potential for creating a system that allows for safe and efficient wholesale trading. This alone provides enough room for various existing businesses to recognize the value of DeFi platforms and contribute to the development of this field.

4. Goldfinch: On-chain capital -> Real-world company with Unsecured Loans

What DeFi protocols currently offer to real companies is not just a service, but also a form of investment that provides unsecured loans to companies and actually lends them money. One of the protocols that particularly stands out in this model is Goldfinch.

Goldfinch is a platform that provides funding to global real entities in the form of debt investments, and the funding and liquidity for these loans is raised through $USDC from investors on the blockchain.

The various pools in the DeFi system have different themes or sectors that they target for lending.

Investors can deposit $USDC into the Senior Pool for lower risk and lower returns through a diversified position in the branches of the Senior Pool. Alternatively, investors can target specific sectors in the Borrower Pool and invest in the lower priority, concentrated positions. The choice depends on the investor’s risk tolerance.

Goldfinch is driven by three types of participants:

1. Borrowers are customers who want to borrow from Goldfinch’s Borrower Pool, and they must follow the terms of the loan (such as interest rate and repayment schedule) defined in the smart contract of the Borrower Pool.

2. Investors are those who provide crypto capital to the protocol, and they are divided into two categories: backers and liquidity providers.

- Backers directly invest in the Borrower Pool and serve as first-loss capital, earning higher returns in exchange. They are also the party responsible for conducting due diligence on the Borrower and investment decisions.

- Liquidity providers invest in the Senior Pool, which holds a diversified position in the Borrower Pool. They are protected by priority in the event of a default, but receive lower returns. The proportion of each Borrower Pool is determined by the assets of the backers deposited in each pool.

3. Auditors are responsible for filtering Borrowers before they are proposed to the Backers. Auditors are selected from a pool of nine randomly chosen $GFI stake holders who have completed KYC certification. They are rewarded or punished through slashing for manually reviewing and accurately assessing Borrowers to prevent fraud and ensure the proper functioning of the system.

After the filtering by Auditors, actual due diligence and loan decisions for Borrowers are made by the Backers. They may also delegate credit evaluator/analyst roles to each other and create contracts for asset liquidation in the event of default. After due diligence is completed and a loan is approved, the pool’s $USDC is converted to fiat currency and provided to the borrowing party.

In this way, Goldfinch strives to achieve its mission of building a platform that provides financial services based on decentralized decision-making for the benefit of all participants, while also operating as a business model similar to a traditional bank.

Smaller companies often face high barriers to accessing direct financing due to a lack of demand for their bonds, complicated procedures, and high floating costs. Alternatively, emerging markets may not have accessibility to capital markets at all. Therefore, borrowing from banks may be the only means of debt financing, but if a diverse pool of funding is created through the use of cryptocurrencies, which can be accessed by anyone and not just institutions, and allows entities around the world to access funding, it will create a more efficient capital market. Additionally, the ability to cut down on additional costs through DeFi can significantly reduce issuance costs, creating a platform that can provide the most efficient capital transactions between borrowers and investors.

5. DAO Treasury: Another reason for the adoption of RWA by on-chain

If the DeFi protocol infrastructure can bridge the gap between the on-chain world and the real world capital market by providing financial services to real world businesses, it is possible to consider the reverse direction in which the DAO, which exists in the on-chain world, can benefit from the real world market.

DAOs generally hold treasuries, which are like the DAO’s safe where necessary costs are covered or revenues are stored to sustain and expand the business. Therefore, the treasury must be safe and efficiently operated.

Today’s DAO treasury are composed of cyptocurrency such as ETH, stablecoin, and DAO native tokens, and have a high level of unsystematic risk while not generating profits due to inefficient asset management.

If the tokenization technology of RWA is widely adopted, it will be possible for DAOs to allocate assets to safe and liquid real world assets that generate interest, such as US Treasuries. Therefore, in the future, we can see a picture where a huge demand for RWA is created in order to more efficiently and safely manage the important capital of the treasury with lower risk.

In this way, real world assets will be onboarded to the on-chain world in various ways, and in the future, DeFi will confidently take on a role as a major industry in the financial market.

6. Lastly

So far, we have looked at a few examples of the integration between real assets, real companies, and DeFi protocols. Of course, this trend is not the result of a one-day effort, but rather an industry that has been built up over the years through various trial and error experiences. And now, with the infrastructure becoming more solid than ever before, successful integration cases are emerging one after another, leading to even more diverse attempts.

Of course, there are still many challenges to be addressed in the future. Clearly, there is the possibility of accidents caused by flaws found between DeFi and the real market, and there will be many battles with regulatory authorities. However, the fact that there is a limitless synergy between DeFi and the real world market is self-evident, and we will find a way. We always have.