1. Introduction

Two questions came to mind after publishing a series of articles about SBT (Soulbound Token). The First was “Why should it be SBT anyway?” and the second was “What would the governance mechanism that utilizes SBT look like?”. This article aims to answer these questions and describe my opinion on how SBT can be used for governance.

2. Let’s start from the bottom.

To understand why SBT is necessary and how it can be used, I would like to first discuss a problem existing token-based governance faces.

2.1. A problem of token-based governance.

Generally, DAO governance shows the process of proposal approval by token voting, with winning proposal having more token quantity voted on. This mechanism is the same as corporate governance, which assigns one voting right to each share based on the principle of equality of shareholders, meaning a decision selected by larger shares wins.

Also, with easy transferrability of voting rights, there’s a tendency of a monopoly of powers being created as a negative effect. Vitalik Buterin’s paper ‘Soulbound’ points out that the following problems are proned to happen by allowing transfer of the governance rights.

- If the goal is for governance power to be widely distributed, then transferability is counterproductive as concentrated interests are more likely to buy the governance rights up from everyone else.

- If the goal is for governance power to go to the competent, then transferability is counterproductive because nothing stops the governance rights from being bought up by the determined but incompetent.

As a result, the token-based governance cannot achieve decentralization in the governance, and the governance is easily controlled and swayed by a small number of whale holders. This situation is frequently found on on-chain governances of famous DeFi protocols such as Aave, Curve Finance, etc.

The discussion around SBT starts from here. How should the token-based governance be improved, and what would be the most appropriate way to improve it?

2.2. ‘One person, one vote’ is not an answer.

Instead of granting voting right in proportion to the number of tokens, granting one voting right to an account one account, one vote can be a way to improve token-based governance. The followings are the conditions that can be set in this regard.

- Through proof of personhood that maintains Sybil resistance (ex. Worldcoin, BrightID) or verifiable attestations (ex. SBT (Soulbound Token), VC(Verifiable Credentials)), one on-chain account gets to represent a unique single-person entity.

- The voting right distributed to each account is not transferrable.

Despite implementing one person one vote on on-chain governance through the condition mentioned above, there is another problem. One person’s one-vote system cannot properly reflect one’s degree of preference and only distributes the voting right with the same degree of influence without considering each person’s preference for the proposal. This problem is discussed in the following part of SBT(Soulbound Token) 논문 톺아보기 ①

Making a decision based on the contribution to the production of public goods, the preference of an individual who owns large capital can be disproportionately reflected. In contrast, in the case of one person’s one-vote system, it cannot reflect the degree of preference, meaning the decision of a person with much less preference toward public goods may be disproportionately reflected. DAO governance also has this problem. If the number of tokens determines the governance system, an individual with a large capital would have too much voting power over the decision. Furthermore, if the decision-making based on the address of wallet that has participated in the voting cannot properly take into account one’s preference to the decision, meaning a voting right of an individual who has less preference to cast a vote on the proposal being taken into account inadequately or there is a risk of Sybil attack. — SBT(Soulbound Token) 논문 톺아보기 ①

As seen from the above statement, the voting right irrelevant to the agenda can be reflected when a person with fewer preferences votes. A player with a strong interest in adopting the proposal could purchase the accounts to get more voting powers. In this regard, ‘one person, one voting’ system is not a perfect way to improve governance.

3. Selective distribution of voting rights is needed.

3.1. A reputation system should be adopted.

In order to overcome the shortcoming of the one person, one vote system, it is necessary to establish a way to show a person’s preference for the agenda, meaning one’s qualification should be assessed to selectively distribute the voting right. In SBT(Soulbound Token) 논문 톺아보기 ①, a quadratic voting system where the cost of votes is set to increase by the square of the number of votes has been suggested as a possible solution. However, this system also increases the number of voting rights as the cost of voting increases, meaning the decision-making is affected by the amount of capital.

As a result, a criterion to assess one’s qualification other than a transferable asset to distribute voting right is needed, which brings the need for reputation. Reputation in governance can be used as a criterion to give more voting power to a person with a substantial degree of preference for an issue or a person who appears to be able to make a wise decision.

3.2. A need for the Verifiable Attestation

As a result of the discussion about reputation, reputation is added as another condition to improve governance.

- One account on the on-chain represents one unique entity

- A voting right distributed to each account is not transferrable

- A voting right is distributed according to the reputation of the governance participant

In accordance with the above condition, the proof of personhood mechanism that verifies the uniqueness of an account via iris scan (Worldcoin) or KYC is insufficient. Instead, it is necessary to express self-sovereign identity in the form of a verifiable attestation that shows reputation by incorporating the account’s experiences and qualifications, etc. (Refer SBT 시리즈 3편). In other words, on-chain governance requires identification, such as a real-world certification of contents, to inform the recipient that the sender has ‘when’ sent the document of ‘what content’.

4. Why SBT?

4.1. How is SBT different from Verifiable Credential (VC)?

SBT and verifiable credential (hereinafter referred to as VC), which are examples of verifiable attestation, share commonality as they both are about an issuer providing arbitrary content proof to a recipient. Below are the examples of content proof that SBT and VC can provide, as discussed in SBT 시리즈 3편.

- Credentials such as university degree, ID number, driver’s license, the status of employment, etc.

- Proof of experience such as concert attendance, church membership, game quest completion, confirmation of product purchase, etc.

Read “How Exactly Are Verifiable Credentials Making the World Better?”, an article by Stepan Gershuni, which provides detailed examples of VC as below to help understand a use case better.

4. Meet Josh. Josh is a fresh graduate from Technische Universität Berlin and he’s looking for a data science job in startups. He applied for 10 different positions and all of those employers are asking him to complete very similar case studies. Those companies understandably want to make sure that he’s a good fit for their positions by verifying competencies, hard and soft skills. Josh acquires a number of verifiable credentials from his peers, his university, his internship company. In addition, he completes typical data science challenges and receives verifiable credential from the challenges platform with detailed definition of his score and competencies. Recruiters of each company save hours because they are presented with actionable data on the candidate and don’t need to do multiple checks. — Source: How Exactly Are Verifiable Credentials Making the World Better?

One might think SBT and VC are two very similar concepts, but there are some significant differences. The first is related to the consent of a recipient upon issuance. VC cannot be issued without a recipient’s consent, but SBT can be published as a tag without a recipient’s permission. Looking at how SBT is issued, an issuer issues a tag that contains arbitrary content, which is then agreed upon by a recipient so that the content is confirmed as SBT. Please see the following thread for more details.

2/ It’s overinclusive because not all claims are SBTs, which are *consented*.

— Puja Ohlhaver (@pujaohlhaver) June 7, 2022

*Consented* SBTs are different from unconsented claims (I call "tags")—the former minted by you, the latter not.

This is to be innovated, as you said.

The second is a possibility of a negative reputation. According to “Where to use a blockchain in non-financial applications?”, a recent article by Vitalik Buterin, SBT, unlike VC, is designed to contain a negative reputation. A negative reputation is created by creating proof of content whose evidence is not wanted by a user (or a recipient). Proving a user’s wrong behavior, such as a criminal record, etc., is an example of a negative reputation.

The third is programmability. Unlike VC, SBT can be programmed to grant a specific credential upon holding SBT. In particular, it is expected that splitting a property right into three rights of use, change, and profit and selectively choosing, if necessary, to combine it with SBT will be possible (please see SBT(Soulbound Token) 논문 톺아보기 ①). An article by Puja Ohlhaver introduced in part 2 of the series also discusses this below. As for the VC, it is uncertain whether it can be programmed, but we have deemed VC as unprogrammable as a document related to VC of w3c did not mention its programmability.

8/ Another piece of the puzzle is missing though. But why even make such commitments memorialized in SBTs?

— Puja Ohlhaver (@pujaohlhaver) June 7, 2022

What does consenting to a claim *do* for you?

4.2. A simple thought experiment: A governance mechanism using SBT

Based on the characteristics of SBT discussed, let’s do a simple thought experiment on how governance can operate using SBT. The following form can be considered as a governance mechanism with SBT.

- The mechanism distributes more voting rights to a person with an SBT that is more relevant to the governance issue, and the voting right cannot be transferred to another person.

- There are regular (or irregular) governance rounds, and the participant’s activity history per each round can be assessed to issue an SBT.

- The number of voting rights for the next governance round changes on the content of SBT, and as it is possible to create a negative reputation, the voting rights can be reduced too.

- A participant, who hasn’t consented for the SBT issuance from the previous round, cannot participate in future governance rounds.

- Changing the number of voting rights through adjusting SBT’s contents, may include organizers’ assessment, community assessment, peer assessment, etc.

- Each participant receives certain rewards following performance results at each governance round.

The form of SBT issued after each round is completed can be created as follows.

Title: nth governance round of AAA project

Issuer: AAA project

Recipient: participant B

Contents: The score of participant B in the nth governance round is 92/100, which provides 100 C tokens as rewards. The participants are given three additional voting rights to exercise in the future governance round.

Caution: If the participant does not consent to the said tag and therefore SBT is not issued, they cannot participate in the future governance round.

Creating an SBT in the said format can encourage participants to consistently participate in the governance through rewards, and it is expected to build sustainable governance by using various mechanisms such as adjusting the level of prizes and voting rights upon the level of governance participation (reducing the number of voting rights can be considered in the case of low participation score).

5. Sustainable governance mechanism

5.1. Based on two kinds of assets

Though not expressly stated, the thought above experiment shows a governance mechanism based on two kinds of assets: non-transferrable “voting rights” and transferrable “tokens,” which are given as rewards. The said mechanism was mentioned in “A Novel Framework for Reputation-Based Systems”, an article by Jad Esber and Scott Kominers and published on future.com, which is an insight platform of a16z. The article argues that a reputation system should be built based on two assets which are (non-transferrable) “point” that represent the degree of contribution or reputation and (transferrable) “coin” that represents rewards or dividends. According to them, the number of Coins given as rewards correlates with the point. In order to maintain a reputation system, it is necessary to create a structure where the more points held, the bigger the coin rewards become.

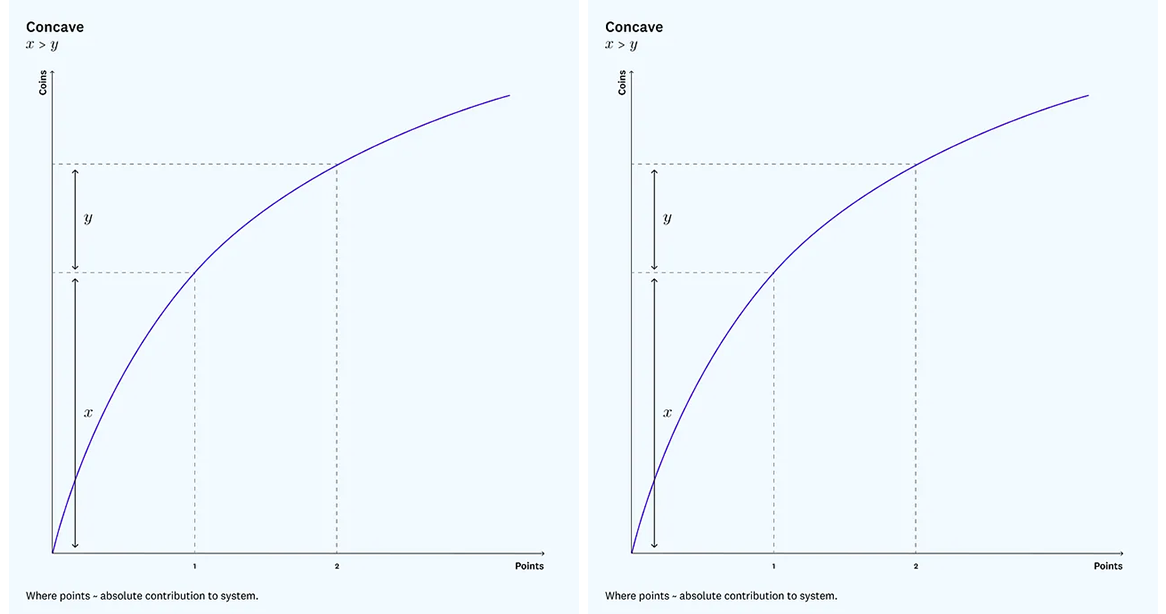

For example, setting a convex graph for origin, means the longer you participate in governance, the greater the size of the coin reward, has the effect of encouraging participants’ long-term governance activities. Conversely, concave graphs for origin means rewarding new governance activities a lot, which has the effect of inducing new governance participants to enter.

Yet, how can one predict the possibility of success of the governance mechanism that is characterized by:

- Based on two kinds of assets.

- Implementing (non) regular governance round.

- Distributing rewards differentially depending on the governance activities

Some of you would have already noticed that we have witnessed that a governance mechanism similar to the above has been successfully operating in the market.

5.2. Gauge Weights of Curve Finance

Gauge Weights system of Curve Finance holds all governance characteristics mentioned above, which are as follows.

- Two types of assets based ➡️ non-transferrable “voting right” veCRV / transferrable “reward” CRV

- (Non) regular governance round implementation ➡️ Gauge Weights voting of Curve Finance regularly takes place every 10 days

- Differential distribution of rewards by the governance activity ➡️ For each round, a certain amount of CRV tokens is distributed to the LP pool that participates in the Gauge, and CRV tokens are differentially distributed as per the Gauge Weights due to veCRV voting

Gauge Weights system operates on a single objective of being “a system of competition to distribute CRV token inflation.” Therefore it might be exaggerating to say that this case indicates a success of the governance after the SBT adoption. Nevertheless, the successful functioning of the governance mechanisms that are likely to be available after the adoption of SBT in the market, is significant in terms of the potential for future governance improvements.

6. Food for thought

I believe the said examples of governance mechanisms show that adopting and implementing SBT could sustainably improve Web3 governance. However, the issue of sustainability is complex and cannot be improved all at once just by enhancing the base mechanism structure. We need to answer the following questions to determine how the governance should transform after the SBT adoption to be sustainable.

6.1. What is the right decision-making system?

Evaluating a reputation through SBT will identify which participant is adequate for the decision-making in the governance and differentially distribute the voting rights to those determined as adequate to lead them to decide more appropriately. This leads us to think that the governance will be formed as a representative system. For example, looking at Gauge Weight voting at Curve Finance, voters (veCRV holders) use bribing platforms such as bribe.crv.finance, Votium, etc., to sell and delegate their voting rights, similar to a representative system. In the same context, Joseph Delong, a former CTO of SushiSwap, once mentioned that this representative system of delegating voting rights to experts and operating the governance is efficient and desirable (Refer to the Tweet thread below).

11/n 거버넌스는 위임하는 방식이 보다 합리적이라 생각. 모든 사람들이 매번 투표한다는 것은 매우 비효율적인 일. 매번 투표를 하려면 모든 사건을 계속 팔로우업 해야함. 때문에 특정 분야를 깊게 파보들고 보다 전문적인 사람들에게 위임하는 것이 효율적.

— Jasonyeah. KR. (Giga Rekt) (@JasonyeahKr) July 12, 2022

The above discussion leads to the following question.

- Is the move to this representative system can be justified? Then, how so, and if not, what would be the alternative?

- If the representative system is adopted, how should the participation of the general participants be designed?

- Isn’t the shift to the representative system against the decentralization that blockchain aims to achieve?

6.2. How should Tokenomics be designed?

The sustainability of governance based on two kinds of assets (Point and Coin) directly leads to the issue of designing tokenomics. “A Novel Framework for Reputation-Based Systems”, an article mentioned earlier, points out that there are primarily three problems to the tokenomics of ‘Coin’, which is given as rewards:

- ‘The problem of size’ questions how big the rewards should be, meaning it is about the total amount of token supply and the reward amount for each round.

- ‘The problem of supply’ questions how often the rewards should be given.

- ‘The problem of distribution’ questions the correlation between how much reward should be distributed depending on the amount of points.

Meanwhile, there are many things to be considered regarding the point, an asset representing a voting right. How the cumulative mechanism for points be designed, and who should get more points in terms of qualification? For instance, in Curve Finance, one can get more veCRV as they lock up more CRVs given as rewards for more extended periods at the protocol, and the amount of veCRV is amortized over time.

7. Conclusion

The adoption of SBT and the governance mechanism enabled by it implies that it is possible to build sustainable governance as it is similar to the veTokenomics of Curve Finance, which has successfully established itself in the market. However, questions other than those mentioned above should also be addressed to complete the whole picture. What are your thoughts about these questions? What else can be considered to achieve sustainable governance or tokenomics? I hope my writing could be the start your thought on “SBT and Web3 Sustainability”.

<References>

- Do Dive, SBT(Soulbound Token) 논문 톺아보기 ①

- Do Dive, SBT(Soulbound Token) 논문 톺아보기 ②

- Do Dive, SBT 시리즈 1편: Kate Sills의 SBTs Should Be Signed Claims

- Do Dive, SBT 시리즈 2편: Kate Sills의 지적에 대한 Puja Ohlhaver(SBT 논문 공동 저자)의 답변

- Do Dive, [아티클 번역] SBT 시리즈 3편: Molly White의 Is “acceptably non-dystopian” self-sovereign identity even possible?

- Do Dive, The Great Curve War: 커브 전쟁, 그 경과와 전망

- Stepan Gershuni, How Exactly Are Verifiable Credentials Making the World Better?

- Jad Esber, Scott Kominers, A Novel Framework for Reputation-Based Systems

- jay, [거버넌스에 대한 오래된 생각 #3]: 평판 시스템은 활용해볼만하다.

- W3C, Verifiable Credentials Data Model v1.1

- Jasonyeah, tweet thread related with Joseph Delong podcast